| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Book Paper Market Size 2024 |

USD 313.27 Million |

| India Book Paper Market, CAGR |

6.37% |

| India Book Paper Market Size 2032 |

USD 513.55 Million |

Market Overview:

The India Book Paper Market is projected to grow from USD 313.27 million in 2024 to an estimated USD 513.55 million by 2032, with a compound annual growth rate (CAGR) of 6.37% from 2024 to 2032.

Several factors are propelling the growth of the India book paper market. Foremost is the country’s emphasis on education, with increasing enrollment rates and government initiatives boosting the demand for textbooks and educational materials. The rise in literacy rates and a growing middle class have also led to a surge in demand for various genres of books, including fiction, non-fiction, and children’s literature. Furthermore, the Indian trade book market is experiencing a vibrant transformation, driven by evolving reader preferences and the influence of social media. These dynamics collectively contribute to the heightened demand for quality book paper in the country. The rapid growth of edtech platforms and hybrid learning models is further strengthening the need for both printed and supplementary learning materials. In addition, state-level policy incentives supporting domestic paper manufacturing are also contributing to supply chain resilience and market expansion.

The demand for book paper in India exhibits regional variations, influenced by factors such as population density, literacy rates, and the presence of educational institutions. North India, with states like Uttar Pradesh and Delhi, has a high concentration of schools, colleges, and universities, leading to significant consumption of educational books and, consequently, book paper. South India, particularly Tamil Nadu and Karnataka, boasts a strong publishing industry and a culture that values literature, further driving the demand for book paper. East India, with its rich literary heritage, and West India, with commercial hubs like Mumbai, also contribute notably to the market. Overall, the diverse linguistic and cultural landscape of India ensures a widespread and growing demand for book paper across all regions. Urban centers are witnessing a rise in independent bookstores and literary festivals, further stimulating regional publishing activity. Meanwhile, rural outreach initiatives and vernacular publishing trends are enhancing book paper usage beyond metropolitan zones.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Book Paper Market is projected to grow from USD 313.27 million in 2024 to USD 513.55 million by 2032, registering a CAGR of 6.37% during the forecast period.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- Rising investments in India’s educational infrastructure and supportive government initiatives are significantly increasing the demand for printed educational materials.

- Growing literacy rates and expanding middle-class readership, especially in Tier 2 and Tier 3 cities, are boosting consumption across both academic and trade book segments.

- Hybrid learning models and the continued rise of edtech platforms are sustaining the relevance of printed textbooks and supplementary materials.

- The resurgence of vernacular publishing is driving demand for book paper tailored to regional languages and local educational boards.

- Challenges such as volatile raw material prices, digital content substitution, and stringent environmental regulations may impact cost structures and adoption rates.

- Regionally, North India holds the largest market share due to dense student populations, while South India follows with strong publishing infrastructure and cultural literacy demand.

Market Drivers:

Educational Expansion and Government Support

The consistent expansion of India’s educational infrastructure plays a pivotal role in driving the demand for book paper. With growing investments in primary, secondary, and higher education, there has been a parallel increase in the requirement for printed educational content. Government programs like the Sarva Shiksha Abhiyan and National Education Policy (NEP) 2020 emphasize inclusive, quality education, which directly fuels the consumption of textbooks and learning materials. Public and private sector efforts to improve literacy and school enrollment, especially in rural and semi-urban areas, are significantly boosting the domestic book paper demand. For instance, Macmillan Education India, a leading educational publisher, partners with over 20,000 schools and reaches more than 15 million learners across the country, supplying curriculum resources in both print and digital formats.

Rising Literacy and Middle-Class Consumption

India’s rising literacy rate, now exceeding 77%, has expanded the readership base, particularly in Tier 2 and Tier 3 cities. This growth, combined with the rise of a young, aspirational middle class, has led to a surge in demand for printed books across genres including fiction, non-fiction, self-help, and children’s literature. These readers increasingly value physical books for educational, recreational, and cultural purposes. As more Indian households gain access to disposable income, spending on educational and leisure books has become more frequent, translating into steady growth for the book paper market.

Technological Shifts and Hybrid Learning Models

While digital education has grown significantly, hybrid learning models are reinforcing the relevance of printed educational content. A large segment of India’s student population continues to rely on printed textbooks for accessibility, retention, and offline learning. The rise of edtech platforms has not eliminated print usage; rather, it has contributed to the parallel demand for printed supplements, reference materials, and study guides. Publishers are responding by offering multi-format content, integrating print with digital offerings, which sustains the volume of book paper consumption despite the digital shift.

Vernacular Publishing and Cultural Influence

The resurgence of vernacular publishing has opened new avenues for book paper demand across regional markets. Indian publishing houses are increasingly catering to local language readers, producing books in Hindi, Tamil, Bengali, Marathi, and other languages to serve culturally diverse audiences. Regional literature festivals, state education board curricula, and cultural heritage preservation initiatives are supporting this trend. For instance, Penguin Random House India highlights that literature festivals in smaller cities and towns have become critical for market expansion, bringing first-time readers into literary conversations and increasing demand for regional and bilingual books. Additionally, the growing popularity of printed materials in regional markets has compelled printers and paper manufacturers to scale up production and tailor quality standards for regional needs, further stimulating growth in the book paper segment.

Market Trends:

Growth of Domestic Paper Manufacturing

The India book paper market is witnessing a notable shift toward increased domestic manufacturing capabilities. In response to the rising demand and import challenges, Indian paper mills are scaling up operations to produce high-quality book paper locally. Recent investments in advanced machinery and sustainable production practices are enhancing the capacity and competitiveness of local manufacturers. The push for self-reliance under initiatives like ‘Make in India’ has encouraged paper producers to reduce dependence on imports, ensuring a steady supply of book-grade paper. As of 2024, the Indian paper manufacturing sector accounts for more than 90% of domestic consumption, including for publishing needs.

Sustainability and Eco-Friendly Paper Adoption

Sustainability has emerged as a key trend across the paper value chain. Publishers and printing companies are increasingly opting for FSC-certified and recycled paper to meet the expectations of environmentally conscious readers and institutions. For instance, companies such as ITC and BILT Graphic Paper Products Ltd have adopted FSC (Forest Stewardship Council) Chain of Custody certification, ensuring responsible sourcing of wood fiber and promoting FSC-certified products. This trend is reinforced by procurement policies in schools and universities that favor sustainable materials. Manufacturers are investing in cleaner technologies and adopting alternative raw materials such as agri-residues and bagasse to reduce the environmental impact of book paper production. This eco-conscious shift not only aligns with global environmental standards but also appeals to India’s growing base of socially aware consumers.

Rise in Self-Publishing and Independent Authors

India’s book market is experiencing an uptick in self-publishing activity, which is positively influencing the demand for book paper. A growing number of independent authors and small publishing houses are releasing printed editions of their works to cater to niche audiences. With platforms like Notion Press, Pothi.com, and BlueRose offering easy access to publishing tools, print-on-demand (POD) services are becoming increasingly popular. For instance, Notion Press, India’s most popular and fastest-growing self-publishing house, published 20,000 titles in 2021 alone, with its books available in 150 countries. This trend has contributed to diversified printing volumes, especially for small batches, leading to flexible demand cycles in the book paper industry. Independent publishing has helped sustain physical book sales despite the digital transition.

Influence of Regional Literature and Academic Research

The renewed focus on regional literature and academic research publications is adding depth to the book paper market. Universities and academic institutions are increasingly publishing journals, theses, and curriculum-based texts in printed form to support structured learning and archival. Simultaneously, the regional publishing sector has grown significantly, with literary works in local languages gaining traction across India. States such as Kerala, West Bengal, and Maharashtra have seen a rise in regional literary events and funding support for local writers. This cultural and academic emphasis sustains the need for quality printing material, thereby reinforcing long-term demand for book paper in diverse formats.

Market Challenges Analysis:

Volatility in Raw Material Prices

One of the primary challenges facing the India book paper market is the volatility in raw material prices, particularly pulp and chemicals required for paper production. For instance, Bilt Graphic Paper Products Limited (BGPPL) reported in February 2025 that hardwood pulp prices had climbed to $620+ per tonne and softwood pulp to $890+ per tonne, marking the third consecutive increase within 60 days. India continues to depend heavily on imports for wood pulp due to limited domestic availability, making the industry vulnerable to fluctuations in global commodity markets. Sharp increases in input costs affect the profitability of paper manufacturers and often result in higher prices for book publishers. This cost escalation can impact pricing strategies for educational books and trade publications, potentially restricting demand in price-sensitive markets.

Digital Disruption and E-Learning Proliferation

The rapid adoption of digital learning platforms poses a long-term restraint for the book paper segment. With the increasing penetration of smartphones, tablets, and affordable internet access, more students and readers are shifting toward e-books, online content, and virtual classrooms. While hybrid learning models still rely on printed materials, the growing preference for digital resources among younger generations could erode demand for traditional print formats over time. This digital shift, particularly in urban centers, challenges the sustained growth of the book paper market and calls for adaptation by publishers and paper producers.

Environmental Regulations and Compliance Pressures

Tightening environmental regulations also present operational hurdles for paper manufacturers. The industry is subject to stringent norms regarding effluent treatment, air quality management, and sustainable forestry practices. Compliance with these standards requires continuous investment in green technologies and process upgrades. Smaller manufacturers, especially in the unorganized sector, often struggle to meet these requirements, limiting their competitiveness. As sustainability becomes central to procurement policies in education and publishing, failure to adhere to these expectations may restrict market participation for non-compliant suppliers.

Market Opportunities:

The India book paper market presents significant growth potential driven by the rising emphasis on regional language publishing and localized educational content. As India’s linguistic diversity continues to shape its reading habits, there is a growing need for printed books in regional languages across educational and literary segments. Government-led initiatives to develop curriculum content in native languages, along with the National Education Policy’s multilingual focus, are likely to stimulate long-term demand for region-specific book paper. This trend opens up opportunities for paper manufacturers and publishers to diversify offerings and tap into underserved regional markets with tailored print solutions.

Moreover, the increasing export potential of India’s publishing industry creates new avenues for growth in the book paper segment. With competitive manufacturing costs and a large pool of skilled professionals, Indian publishers and printers are well-positioned to serve international markets, especially in Asia, Africa, and the Middle East. Demand for affordable educational books from emerging economies offers a strategic export opportunity for India-based book paper producers. In addition, the rise of small publishers and print-on-demand models presents a scalable, flexible growth path for local paper suppliers catering to diverse book formats and shorter print runs. These developments, combined with investments in sustainable paper production and digital integration, position the India book paper market to capitalize on both domestic and international opportunities in the years ahead.

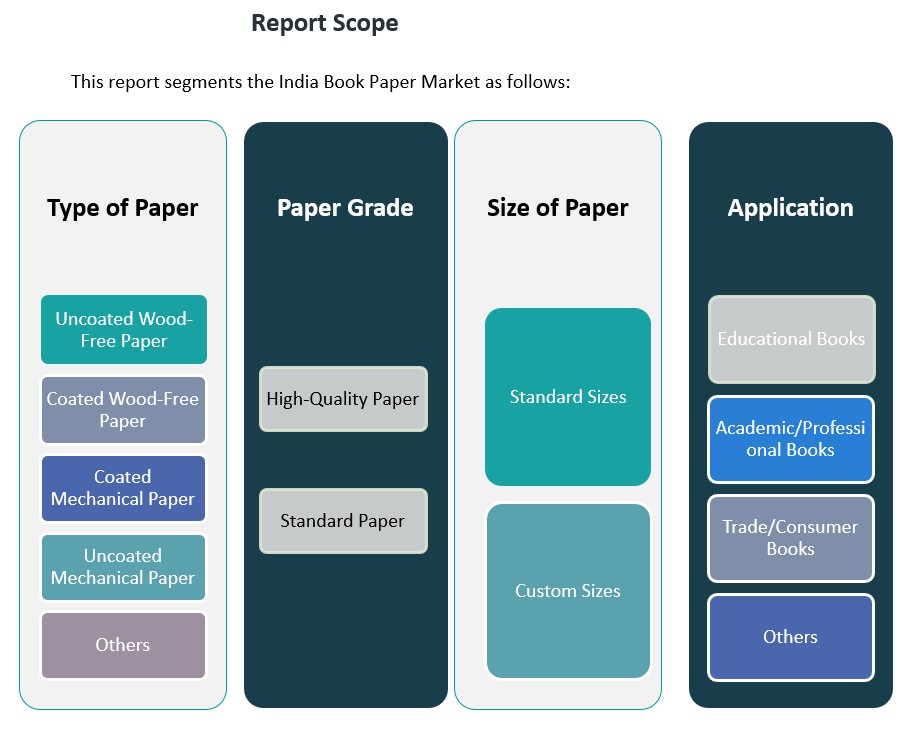

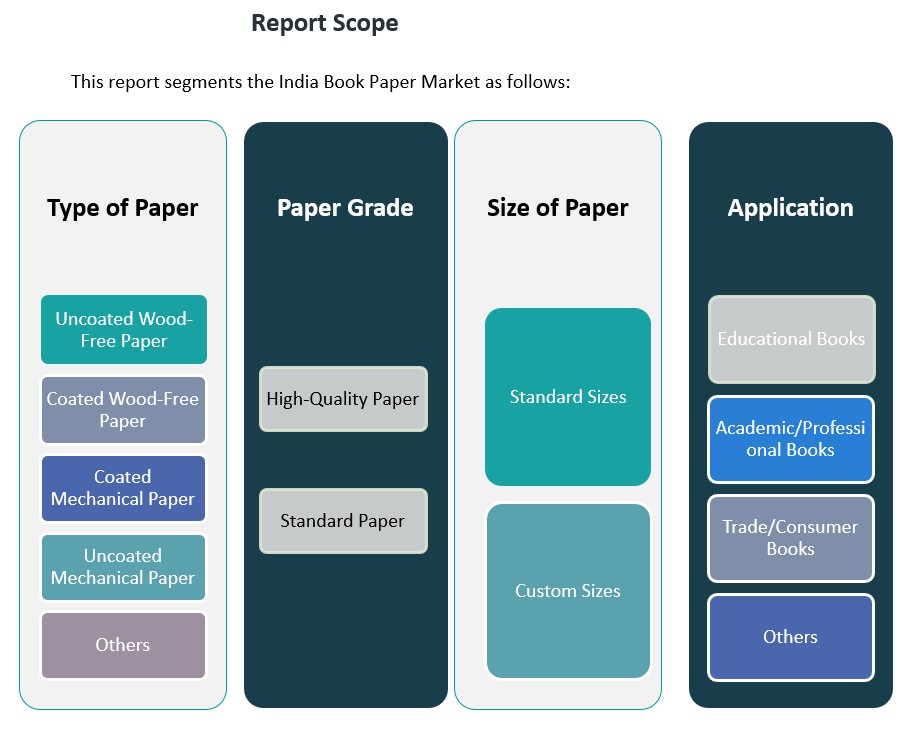

Market Segmentation Analysis:

The India book paper market is segmented based on

By type of paper, paper grade, paper size, and application, each contributing uniquely to the overall demand landscape. Among the types of paper, uncoated wood-free paper holds a significant share due to its widespread use in educational and academic books, offering good readability and print quality. Coated wood-free and mechanical papers are primarily used for high-quality print jobs, such as coffee table books, illustrated publications, and select trade books. Uncoated mechanical paper, being cost-effective, finds use in mass-market publishing where affordability is prioritized.

By paper grade, the market is categorized into high-quality and standard paper. High-quality paper is preferred for premium publications, academic references, and visually rich content, while standard paper dominates educational and trade book printing due to its balance of quality and cost-efficiency.

By paper size, standard sizes remain the most commonly used due to ease of processing and compatibility with conventional printing equipment. However, demand for custom-sized paper is gradually increasing, particularly in self-publishing, children’s books, and design-centric publications.

By Application-wise, educational books constitute the largest segment, fueled by India’s vast school and university networks. Academic and professional books also represent a robust market, supported by higher education and research institutions. Trade and consumer books, including fiction and non-fiction, are witnessing steady growth driven by lifestyle changes and evolving reading habits. The “others” category includes niche publications, religious texts, and regional literature, which collectively contribute to the expanding and diversified demand for book paper in India.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The India book paper market demonstrates strong regional diversity, shaped by varying literacy levels, publishing infrastructure, educational penetration, and language preferences. The four major regions North, South, East, and West India each contribute distinctively to the market’s overall dynamics. As of 2024, North India accounts for the largest share of the market, contributing 34% of the total book paper consumption. The region is home to densely populated states such as Uttar Pradesh, Delhi, Punjab, and Haryana, which host a vast number of educational institutions, government printing presses, and central board schools. The widespread demand for textbooks and competitive exam materials in Hindi and English fuels significant volumes in book paper usage.

South India holds the second-largest market share, representing 28% of the overall demand. States such as Tamil Nadu, Karnataka, Telangana, and Kerala are known for their strong publishing ecosystems, robust academic infrastructure, and high literacy rates. The prevalence of English-medium schools and regional language publishing, particularly in Tamil and Telugu, drives consistent demand for both standard and high-quality book paper. The presence of major printing hubs and publishing houses further strengthens the region’s influence in the national book paper supply chain.

West India contributes approximately 22% of the market share, led by Maharashtra and Gujarat. Mumbai, as the commercial and publishing capital, supports a vibrant trade book market and hosts numerous educational publishers. Gujarat’s growing education sector and its increasing use of Gujarati-language textbooks and literature also support regional paper demand. The region’s publishing sector is diversified, spanning schoolbooks, competitive exam guides, and lifestyle publications.

East India, while currently holding a smaller share at 16%, shows promising growth potential. States like West Bengal, Bihar, Assam, and Odisha are witnessing rising literacy rates and increased investment in education. West Bengal, in particular, has a rich literary tradition and an active market for Bengali publications, which supports localized demand for book paper. The growth of regional language publishing and state board curriculum reforms are expected to further stimulate demand in this region.

Key Player Analysis:

- Ballarpur Industries Limited (BILT)

- Khanna Paper Mills

- Orient Paper & Industries Limited

- Kuantum Papers Limited

- Chand Group

Competitive Analysis:

The India book paper market is moderately consolidated, with a mix of large-scale manufacturers and regional paper mills competing to meet growing demand. Key players such as JK Paper Ltd., West Coast Paper Mills Ltd., Tamil Nadu Newsprint and Papers Ltd. (TNPL), and Ballarpur Industries Ltd. dominate the landscape, offering a wide range of paper grades suitable for educational, academic, and trade publishing. These companies leverage integrated manufacturing capabilities, extensive distribution networks, and investments in sustainable production technologies to maintain a competitive edge. Simultaneously, smaller regional players cater to niche segments with cost-effective and customized solutions. Intense competition has prompted continuous innovation in paper quality, environmental compliance, and production efficiency. Strategic partnerships with publishers and printers, along with expansion into export markets, have become key focus areas for leading firms. The competitive environment is expected to intensify as demand grows for premium, eco-friendly, and region-specific book paper products.

Recent Developments:

- In April 2025, Ballarpur Industries Limited announced the launch of a new product line, signaling its focus on innovation and market expansion within the Indian paper sector.

- At its board meeting on February 7, 2025, S. Chand Group approved the acquisition of the remaining 49% equity interest in BPI (India) Private Limited, making it a wholly-owned subsidiary. This acquisition aligns with S. Chand’s strategy to enhance its portfolio of value-added products and strengthen its position in the publishing and educational content market.

- In September 2024, Orient Paper introduced a new alternative hardwood raw material for pulping sourced locally at lower costs, alongside launching 11 new SKUs across its product categories. New product developments include eco-friendly carry bag paper, drawing book cartridge paper, and thermal coating base paper, reinforcing Orient Paper’s commitment to innovation and sustainability.

Market Concentration & Characteristics:

The India book paper market is characterized by a moderately consolidated structure, where a few large players dominate the industry alongside numerous regional and niche manufacturers. Leading companies such as JK Paper Ltd., West Coast Paper Mills Ltd., Tamil Nadu Newsprint and Papers Ltd. (TNPL), and Ballarpur Industries Ltd. hold significant market shares, leveraging integrated operations and extensive distribution networks to meet the diverse demands of educational, academic, and trade publishing sectors. These firms benefit from economies of scale, advanced manufacturing technologies, and established relationships with major publishers and institutional buyers. Despite the presence of dominant players, the market retains a dynamic character due to the active participation of small and medium-sized enterprises (SMEs) that cater to localized needs and specialized segments. These SMEs often focus on producing customized paper grades and sizes, serving regional language publishers and self-publishing authors. The coexistence of large-scale manufacturers and agile SMEs fosters a competitive environment that encourages innovation, adaptability, and responsiveness to market trends. Additionally, the increasing emphasis on sustainable and eco-friendly paper production has prompted both large and small players to invest in environmentally responsible practices, further shaping the market’s evolution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising literacy rates and expanding educational infrastructure will sustain long-term demand for book paper across all regions.

- Government initiatives promoting regional language education will drive growth in vernacular publishing and localized paper requirements.

- Increased adoption of sustainable and FSC-certified paper will reshape production standards and consumer preferences.

- Growth in self-publishing and independent authorship will boost demand for small-batch and custom-sized paper formats.

- Export opportunities to emerging markets in Asia and Africa will enhance the global competitiveness of Indian paper producers.

- Technological advancements in paper manufacturing will improve quality, reduce costs, and support scale efficiency.

- Urbanization and rising middle-class consumption will expand the trade book segment, increasing diversified paper demand.

- Hybrid learning models in schools and higher education will maintain the relevance of printed educational content.

- Expansion of e-commerce channels will improve accessibility to printed books, indirectly supporting book paper sales.

- Policy incentives under ‘Make in India’ and industry collaborations will promote domestic paper production and reduce import dependency.