| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Electrophysiology Devices Market Size 2024 |

USD 378.66 million |

| India Electrophysiology Devices Market, CAGR |

17.07% |

| India Electrophysiology Devices Market Size 2032 |

USD 1,336.33 million |

Market Overview

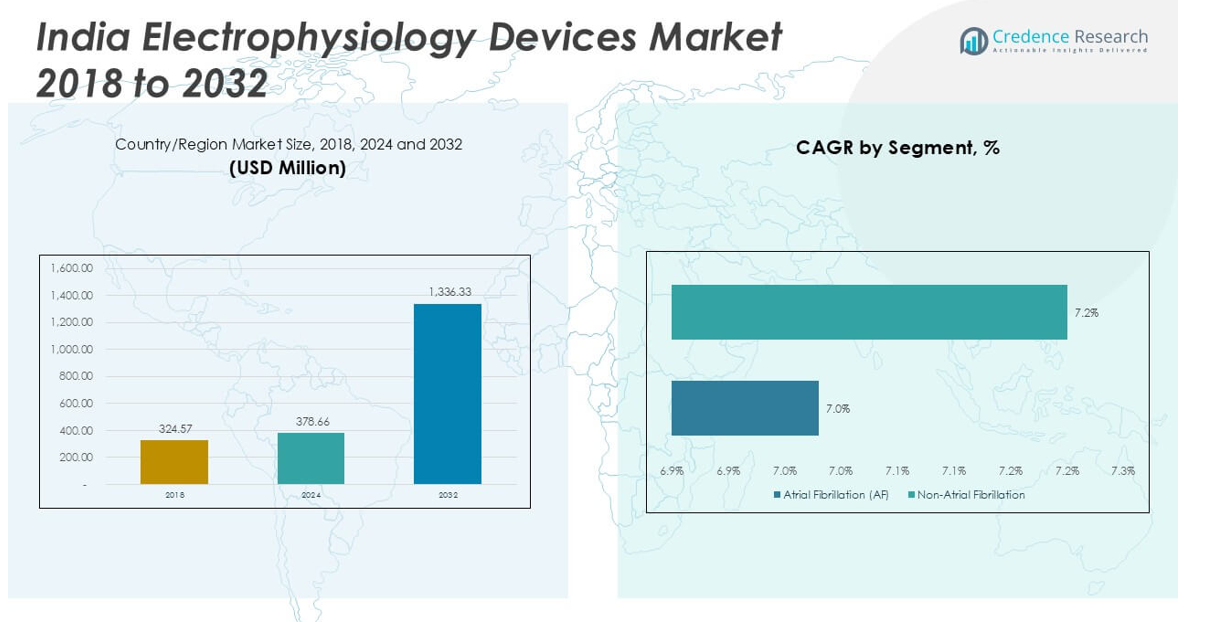

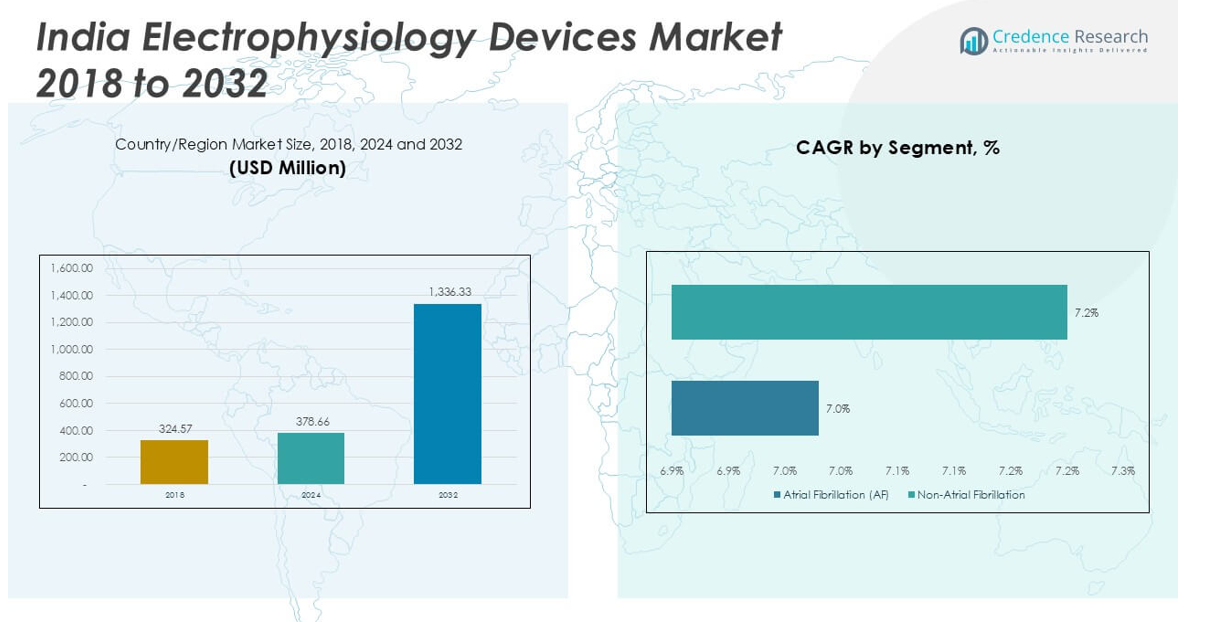

India Electrophysiology Devices Market size was valued at USD 324.57 million in 2018 to USD 378.66 million in 2024 and is anticipated to reach USD 1,336.33 million by 2032, at a CAGR of 17.07% during the forecast period.

The India Electrophysiology Devices Market is experiencing strong growth, propelled by the rising incidence of cardiac arrhythmias, increased healthcare spending, and greater awareness of early diagnosis and treatment options. The expansion of hospital infrastructure and the adoption of minimally invasive procedures drive higher demand for advanced electrophysiology systems and ablation catheters. Technological advancements, such as improved mapping and navigation tools, support more precise interventions and better patient outcomes. Favorable government policies and strategic investments by leading medical device manufacturers further stimulate market growth, while the integration of digital health platforms enhances procedure efficiency and remote monitoring capabilities. Collaborations between domestic healthcare providers and global industry leaders are accelerating the introduction of innovative solutions tailored to the needs of the Indian population. These trends, combined with a growing focus on continuous medical education and training for healthcare professionals, position the India Electrophysiology Devices Market for sustained expansion in the coming years.

The geographical landscape of the India Electrophysiology Devices Market reflects strong growth in metropolitan regions such as North, West, and South India, where advanced healthcare infrastructure and a high concentration of specialized cardiac centers support rapid technology adoption. These regions benefit from well-established hospital networks, experienced electrophysiologists, and ongoing investments in diagnostic and treatment capabilities, driving wider availability of innovative devices. Key players shaping the competitive environment include Biosense Webster Inc., Medtronic PLC, and Abbott Laboratories. These companies maintain a robust presence by offering comprehensive product portfolios, continuous product development, and extensive training for healthcare professionals. Their focus on research, local partnerships, and tailored solutions enables them to address the evolving clinical needs of the Indian market. The collaborative efforts of industry leaders and healthcare providers continue to enhance access to advanced electrophysiology care across diverse regions, supporting market expansion and improved patient outcomes.

Market Insights

- The India Electrophysiology Devices Market is projected to grow from USD 378.66 million in 2024 to USD 1,336.33 million by 2032, registering a CAGR of 17.07%.

- Growing incidence of cardiac arrhythmias, increasing adoption of minimally invasive procedures, and rising awareness about early diagnosis are primary drivers supporting market growth.

- Adoption of advanced mapping technologies, integration of digital health solutions, and the rising role of artificial intelligence are key trends transforming electrophysiology care in India.

- Key players such as Biosense Webster Inc., Medtronic PLC, Abbott Laboratories, and Boston Scientific Corp maintain a strong competitive presence through robust product portfolios, innovation, and strategic collaborations.

- High costs of devices, regulatory complexities, and limited access to advanced healthcare infrastructure, especially in rural areas, continue to restrain overall market expansion.

- North India leads in market development due to superior hospital infrastructure and clinical expertise, while West and South India experience steady growth from urbanization and medical tourism; East and Northeast regions are focusing on infrastructure upgrades and access.

- Continued investments by global and local manufacturers, expansion into tier-II and tier-III cities, and increasing collaborations between hospitals and technology providers are expected to unlock new opportunities for market growth in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Cardiac Arrhythmias and Expanding Patient Base

The increasing prevalence of cardiac arrhythmias drives significant demand for electrophysiology devices across India. With a growing incidence of conditions such as atrial fibrillation and ventricular tachycardia, hospitals and clinics require advanced diagnostic and treatment tools to address a rising patient base. Aging demographics and a surge in lifestyle-related cardiovascular disorders have intensified the need for efficient arrhythmia management. The India Electrophysiology Devices Market benefits from heightened public awareness regarding the risks of untreated heart rhythm disorders. Early detection initiatives and regular screening programs further fuel market growth. Patient education campaigns have encouraged more individuals to seek timely medical attention, supporting greater device adoption.

- For instance, it has been estimated that around 30 million people in India suffer from heart rhythm disorders annually, highlighting the urgent need for advanced electrophysiology solutions.

Technological Advancements and Adoption of Minimally Invasive Procedures

Continuous technological advancements play a central role in driving the India Electrophysiology Devices Market. Next-generation mapping systems, advanced ablation catheters, and integration of digital technologies have transformed electrophysiological procedures, offering improved precision and safety. Hospitals increasingly invest in state-of-the-art equipment to enhance procedural outcomes and minimize complications. The trend toward minimally invasive procedures has gained momentum, with patients and providers favoring shorter recovery times and reduced risks. The market responds to demand for compact, user-friendly devices that support outpatient and day-care settings. Technological improvements position the market for rapid growth by addressing clinical needs and operational efficiency.

- For instance, innovations in 3D mapping and high-density catheters are improving procedural accuracy and patient outcomes.

Government Initiatives and Healthcare Infrastructure Development

Government support and investment in healthcare infrastructure have accelerated the expansion of the India Electrophysiology Devices Market. Policymakers prioritize cardiovascular health through public health programs, subsidized treatments, and improved insurance coverage. Infrastructure upgrades in both urban and rural healthcare facilities enable broader access to advanced electrophysiology solutions. Public-private partnerships facilitate the procurement of innovative devices and support physician training initiatives. National campaigns focused on early detection and arrhythmia management reinforce the importance of timely interventions. Such efforts increase market penetration in regions previously underserved by advanced cardiac care.

Strategic Investments by Industry Leaders and Collaborations with Healthcare Providers

Strategic investments by leading medical device manufacturers strengthen the India Electrophysiology Devices Market. Companies allocate resources for research and development, product launches, and local manufacturing capabilities. Collaborations between global manufacturers and domestic healthcare providers drive the introduction of tailored solutions suited to local clinical requirements. Training programs and educational workshops ensure healthcare professionals remain skilled in using the latest technologies. Partnerships extend to clinical trials and pilot programs that validate device effectiveness in Indian patient populations. The market benefits from knowledge transfer and increased access to innovative products, supporting sustained long-term growth.

Market Trends

Integration of Advanced Mapping Technologies and Digital Solutions

The adoption of advanced mapping systems represents a major trend shaping the India Electrophysiology Devices Market. Enhanced three-dimensional mapping and real-time navigation tools now support greater procedural accuracy and efficiency in arrhythmia diagnosis and treatment. Digital health integration, including remote monitoring and data analytics, allows clinicians to track patient progress beyond the hospital environment. The market shows a clear shift toward interoperable platforms that combine imaging, diagnostics, and therapeutic planning. This approach empowers physicians to customize interventions and optimize patient outcomes. Hospitals seek technologies that streamline workflow and facilitate information sharing across care teams.

- For instance, AI-powered predictive models are being used to assess arrhythmia risks and optimize procedural strategies.

Focus on Minimally Invasive Techniques and Outpatient Care Models

A marked preference for minimally invasive electrophysiology procedures continues to define the India Electrophysiology Devices Market. Demand for ablation catheters and compact, user-friendly devices aligns with the growing appeal of outpatient and same-day procedures. Patients increasingly choose minimally invasive options due to shorter recovery periods, reduced procedural risk, and faster return to daily activities. Healthcare providers invest in training to expand their minimally invasive capabilities and improve procedural success rates. The trend also prompts device manufacturers to develop solutions suitable for both large hospitals and smaller specialty clinics. The outpatient care model enables broader patient access to electrophysiology treatments.

- For instance, hospitals are expanding their capabilities for outpatient electrophysiology procedures to optimize resource utilization and improve patient access.

Rising Role of Artificial Intelligence and Machine Learning Applications

Artificial intelligence and machine learning have begun to transform the India Electrophysiology Devices Market. Advanced algorithms help automate arrhythmia detection, predict procedural outcomes, and assist in complex decision-making for clinicians. AI-driven data analysis enhances diagnostic accuracy and supports personalized treatment planning. The market sees growth in wearable and remote cardiac monitoring devices that leverage smart technologies for continuous patient evaluation. Hospitals and research institutions collaborate with technology firms to pilot and validate new AI applications. The expanding use of intelligent systems sets a new standard for efficiency and clinical excellence in electrophysiology care.

Collaborative Ecosystems and Strategic Partnerships for Innovation

A collaborative approach between hospitals, research organizations, and industry leaders now characterizes the India Electrophysiology Devices Market. Partnerships facilitate knowledge exchange, rapid adoption of innovative solutions, and streamlined clinical trials. Manufacturers join forces with healthcare providers to co-develop devices suited for the unique needs of the Indian population. Joint training initiatives and educational programs ensure clinical teams stay abreast of emerging trends and best practices. Collaborative ecosystems foster local manufacturing and supply chain resilience, reducing dependence on imports. The market advances through shared innovation, responsiveness to clinical feedback, and commitment to continuous improvement.

Market Challenges Analysis

Limited Access to Advanced Healthcare and Regional Disparities

Limited access to advanced healthcare facilities and regional disparities present significant challenges for the India Electrophysiology Devices Market. Many rural and semi-urban areas lack the specialized infrastructure and skilled professionals required for electrophysiology procedures, restricting patient access to timely diagnosis and treatment. Hospitals in tier-II and tier-III cities often operate with outdated equipment, while logistical hurdles complicate the distribution of advanced devices. Awareness about electrophysiology solutions remains lower outside major metropolitan centers, resulting in delayed or missed interventions. The market must address these disparities to ensure broader adoption of innovative cardiac care technologies. Bridging the urban-rural divide is critical to achieving sustainable market growth.

- For instance, rural and semi-urban areas lack specialized infrastructure and skilled professionals, restricting patient access to timely diagnosis and treatment.

High Costs and Regulatory Complexities Impact Market Penetration

The high cost of electrophysiology devices and regulatory complexities impact the India Electrophysiology Devices Market. Import duties, strict certification requirements, and frequent policy changes create barriers for international and domestic manufacturers. Device prices remain out of reach for many patients, even in urban areas, due to limited insurance coverage and reimbursement constraints. Healthcare providers face challenges in justifying the investment for advanced systems without guaranteed patient volume or funding support. The lengthy approval process delays the introduction of next-generation products, hindering the pace of technological adoption. Market participants must navigate these financial and regulatory hurdles to expand their presence across India.\

Market Opportunities

Expansion of Healthcare Infrastructure and Focus on Tier-II and Tier-III Cities

Significant opportunities exist in expanding healthcare infrastructure and increasing the reach of electrophysiology services to tier-II and tier-III cities. The India Electrophysiology Devices Market can benefit from targeted investments in cardiac care facilities, specialized training for healthcare professionals, and the deployment of modern diagnostic equipment in under-served regions. Government initiatives and public-private partnerships support these efforts, promoting equitable access to advanced treatments. Hospitals that upgrade their capabilities stand to attract a broader patient base seeking quality cardiac care. Expanding into new regions allows manufacturers and service providers to unlock untapped demand and foster sustained growth. It creates an environment where timely intervention and effective arrhythmia management become accessible to a wider population.

Emergence of Telehealth, Remote Monitoring, and Digital Health Integration

The growing adoption of telehealth, remote monitoring, and digital health platforms presents strong opportunities for the India Electrophysiology Devices Market. These technologies enable efficient long-term patient management and continuous data collection, improving clinical decision-making and patient outcomes. Device manufacturers that integrate connectivity features and data analytics into their product offerings stand to differentiate themselves in a competitive landscape. Collaboration between technology companies and healthcare providers accelerates the rollout of smart solutions designed for both urban and rural populations. It positions the market to address rising demand for convenient, patient-centric care models while supporting large-scale screening and follow-up programs. The shift toward digital health integration signals a new era of innovation and efficiency in electrophysiology care.

Market Segmentation Analysis:

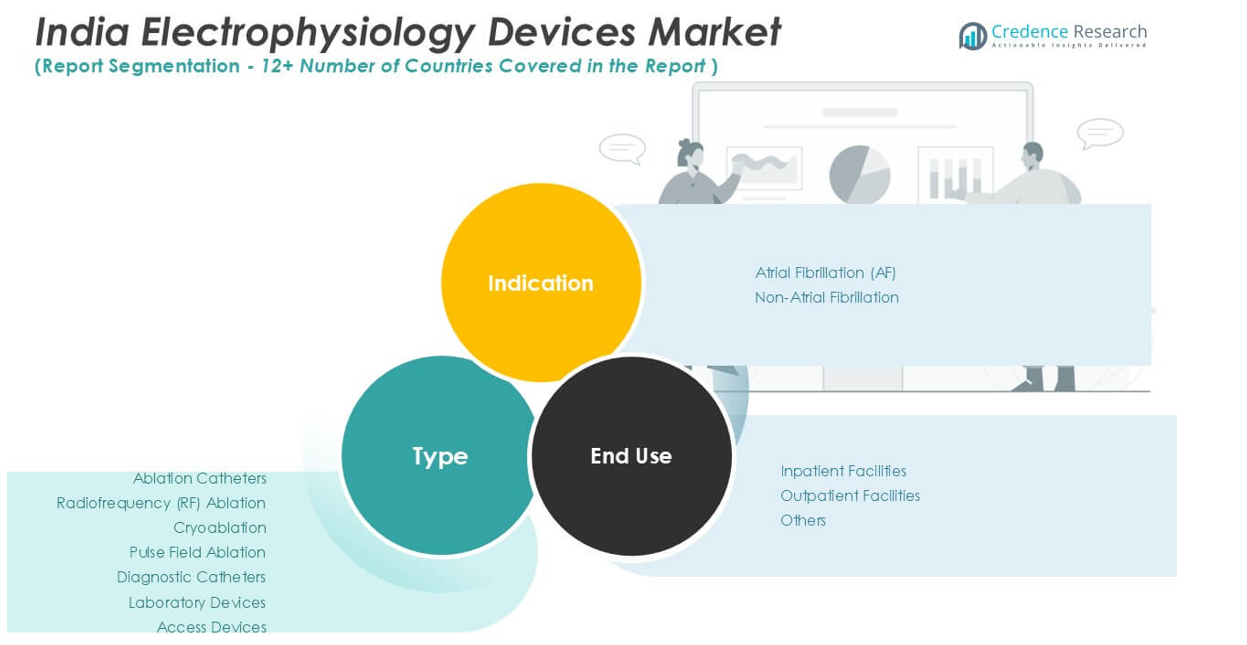

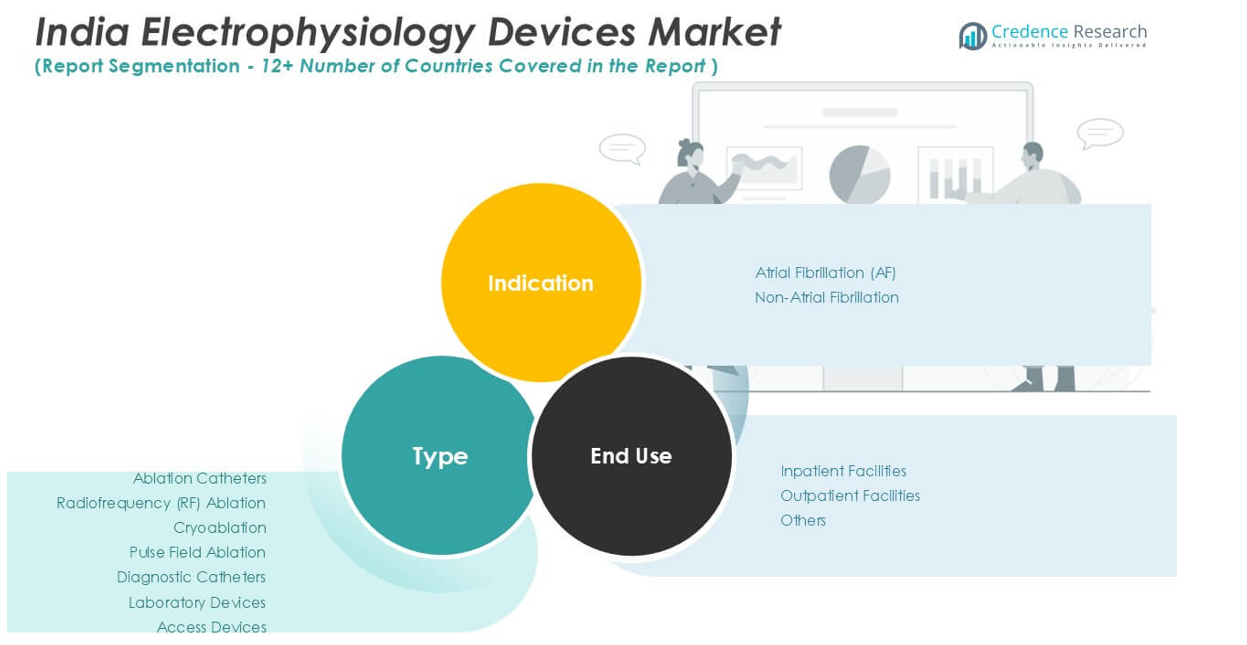

By Type:

The India Electrophysiology Devices Market exhibits diverse growth opportunities across its key segments. By type, ablation catheters represent a dominant category, driven by the rising demand for effective arrhythmia treatments. Within ablation catheters, radiofrequency (RF) ablation remains the most widely adopted technique, offering precision and safety for various cardiac arrhythmias. Cryoablation is gaining momentum due to its ability to reduce collateral tissue damage and provide favorable clinical outcomes. Pulse field ablation, an emerging technology, attracts interest for its non-thermal mechanism and potential to shorten procedure times. Diagnostic catheters play a critical role in accurate arrhythmia mapping and have seen consistent uptake among electrophysiologists seeking to enhance procedural success. Laboratory devices and access devices support seamless workflow and safe vascular entry during electrophysiology procedures, contributing to the comprehensive nature of this segment.

By Indication:

Atrial fibrillation (AF) accounts for a substantial share of the India Electrophysiology Devices Market. The increasing incidence of AF among India’s aging and high-risk population drives demand for advanced ablation and diagnostic technologies. Non-atrial fibrillation indications, such as ventricular tachycardia and supraventricular tachycardia, also require specialized electrophysiology solutions to support effective diagnosis and management. Device manufacturers have developed segment-specific products to cater to the distinct clinical needs associated with each arrhythmia type.

By End-Use:

Inpatient facilities hold the largest market share, reflecting the complexity and resource requirements of electrophysiology procedures. Major hospitals and tertiary care centers invest in state-of-the-art electrophysiology labs and multidisciplinary teams to provide comprehensive cardiac care. Outpatient facilities are experiencing steady growth due to the shift toward minimally invasive procedures and the increasing feasibility of same-day treatments. The “others” segment, which includes specialty clinics and diagnostic centers, is expanding as awareness and access to electrophysiology services improve across the country. Each end-use category offers unique opportunities for stakeholders to align their strategies with evolving patient preferences and healthcare delivery models. The India Electrophysiology Devices Market benefits from this multi-segment approach, supporting broader adoption and clinical innovation across the cardiac care continuum.

Segments:

Based on Type:

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

Based on Indication:

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

Based on End-Use:

- Inpatient Facilities

- Outpatient Facilities

- Others

Based on the Geography:

- North India

- West India

- South India

- East and Northeast India

Regional Analysis

North India

North India stands as the leading region in the India Electrophysiology Devices Market, holding a substantial market share of 36%. The region’s dominance is underpinned by its concentration of advanced healthcare infrastructure, prominent multi-specialty hospitals, and a high volume of cardiac centers equipped with state-of-the-art electrophysiology labs. Major metropolitan cities such as Delhi, Chandigarh, Lucknow, and Jaipur anchor the region’s growth, providing a robust network of tertiary care institutions and specialist cardiologists. Government and private sector investment in cardiac care facilities remain strong, supporting the rapid adoption of the latest ablation catheters, mapping systems, and remote monitoring solutions. Academic partnerships and the presence of major medical colleges ensure a steady flow of trained electrophysiologists, further elevating care standards. North India’s large population base, combined with rising awareness about arrhythmia treatments and preventive cardiology, continues to drive high patient volumes and ongoing demand for electrophysiology devices. As the preferred destination for complex cardiac procedures, North India sets the benchmark for clinical innovation and operational efficiency in the national market.

West India

West India commands a market share of 29%, establishing itself as the second-largest region in the India Electrophysiology Devices Market. Cities such as Mumbai, Pune, Ahmedabad, and Surat have emerged as major centers for cardiac care and medical technology advancements. Rapid urbanization, rising disposable incomes, and proactive healthcare investments have created an environment favorable for the adoption of advanced electrophysiology technologies. Leading private hospital chains and specialty cardiac centers in this region frequently upgrade their infrastructure, offering access to next-generation ablation and diagnostic systems. West India’s cosmopolitan demographics and a well-developed insurance ecosystem support higher penetration rates of innovative cardiac therapies. The presence of regional medical device distributors and collaborations with global manufacturers ensure a consistent supply of cutting-edge devices. Continuous professional development and international partnerships enable local physicians to stay updated on global best practices, enhancing overall patient outcomes. West India’s growth trajectory is supported by both demand from urban populations and strategic investments targeting future healthcare needs.

South India

South India accounts for 24% of the India Electrophysiology Devices Market, leveraging its reputation as a hub for medical tourism, research, and advanced healthcare delivery. Chennai, Bengaluru, Hyderabad, and Kochi house some of India’s most prestigious hospitals, academic medical centers, and cardiac institutes. The region’s focus on research-driven medicine fosters early adoption of emerging electrophysiology technologies, such as pulse field ablation and integrated digital mapping platforms. South India benefits from a collaborative healthcare ecosystem where hospitals, research institutes, and device manufacturers work closely to pilot new technologies and clinical protocols. The region’s skilled healthcare workforce, patient-centric care models, and strong emphasis on continuing medical education drive superior procedural outcomes. The medical tourism industry draws patients from across India and neighboring countries, increasing the region’s patient volumes and boosting device utilization rates. South India’s progressive approach positions it as a leader in implementing international standards and promoting clinical excellence in electrophysiology care.

East and Northeast India

East and Northeast India represent 11% of the India Electrophysiology Devices Market. The region is witnessing gradual growth as state governments and healthcare organizations prioritize the expansion of cardiac care infrastructure in cities such as Kolkata, Bhubaneswar, Guwahati, and Ranchi. Historically, these areas faced challenges including limited access to advanced devices and a shortage of trained electrophysiologists. Targeted investments in public and private sector healthcare, as well as new initiatives to train local medical professionals, are beginning to bridge the gap. Outreach programs and mobile health units help raise awareness about arrhythmia treatments in semi-urban and rural communities. Strategic collaborations with larger hospitals in other regions support knowledge transfer and referral networks. Although East and Northeast India lag behind in device penetration, continued focus on infrastructure development and access improvement presents a strong opportunity for accelerated market growth. As the region modernizes its healthcare offerings, it will play a more prominent role in shaping the future landscape of the India Electrophysiology Devices Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Biosense Webster Inc.

- Medtronic PLC

- Abbott Laboratories

- Boston Scientific Corp

- Biotronik AG

- Siemens Healthcare AG

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

Competitive Analysis

The competitive landscape of the India Electrophysiology Devices Market is defined by the strategic activities of leading players such as Biosense Webster Inc., Medtronic PLC, Abbott Laboratories, Boston Scientific Corp, Biotronik AG, Siemens Healthcare AG, MicroPort Scientific Corporation, and Koninklijke Philips N.V. These companies maintain their leadership positions through robust research and development, extensive product portfolios, and a focus on technological innovation. They actively introduce next-generation ablation catheters, advanced mapping systems, and integrated digital health platforms tailored to the evolving needs of Indian healthcare providers. Strategic collaborations with hospitals, academic centers, and government bodies enhance their market penetration and support local skill development. Training programs and educational initiatives ensure that clinicians are proficient in the latest procedures and device technologies, promoting adoption across both metropolitan and emerging regions. By investing in local manufacturing and supply chains, these players also address cost sensitivity and regulatory requirements, making advanced solutions more accessible. Their commitment to clinical excellence, local partnerships, and patient-centric innovation positions them at the forefront of India’s dynamic electrophysiology devices sector.

Recent Developments

- In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

- In August 2023, Boston Scientific Corporation (US) launched the POLARx cryoablation system. This system is used to treat patients with paroxysmal atrial fibrillation.

- In May 2023 Abbott Laboratories launched the Tactiflex ablation catheter which is sensor-enabled and it is used to treat the most common abnormal heart rhythm.

- In September 2022, Johnson & Johnson (US) launched OCTARAY MAPPING SYSTEM which is used to treat cardiac arrhythmias.

Market Concentration & Characteristics

The India Electrophysiology Devices Market exhibits a moderate to high level of market concentration, with a few multinational corporations controlling a significant share of total revenues. It is characterized by strong competition among global leaders who leverage technological advancements, comprehensive product lines, and local partnerships to maintain their positions. The market emphasizes clinical innovation, continuous product upgrades, and specialized training for healthcare professionals, reflecting a focus on quality and procedural outcomes. Companies frequently introduce advanced mapping technologies, minimally invasive devices, and integrated digital health solutions to meet evolving clinical needs. Regulatory requirements and cost sensitivity influence market strategies, driving investment in local manufacturing and distribution channels. The market also shows increasing collaboration between device manufacturers and healthcare providers, supporting knowledge transfer and clinical adoption across diverse regions. This competitive yet collaborative environment ensures rapid dissemination of new technologies and contributes to sustained market growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India electrophysiology devices market is expected to witness steady growth driven by the increasing prevalence of cardiac arrhythmias.

- Rising awareness about early diagnosis and advanced cardiac care is likely to support market expansion.

- Technological advancements in electrophysiology mapping and ablation systems will enhance procedural efficiency and outcomes.

- Growing investments in healthcare infrastructure across tier-II and tier-III cities will expand patient access to electrophysiology services.

- The increasing adoption of minimally invasive procedures will continue to fuel demand for advanced electrophysiology devices.

- Strategic collaborations between global medical device companies and Indian healthcare providers will improve product availability and expertise.

- Rising geriatric population and associated cardiac conditions will remain a major demand driver in the coming years.

- Regulatory reforms and fast-track approvals for medical devices will support quicker market entry and product innovation.

- The expansion of private multispecialty hospitals will boost procurement of advanced electrophysiology systems.

- Training programs and workshops for cardiologists and electrophysiologists will improve procedural adoption across the country.