| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Electrical Market Size 2024 |

USD 65.90 Million |

| India Electrical Market, CAGR |

8.4% |

| India Electrical Market Size 2032 |

USD 131.49 Million |

Market Overview:

The India Electrical Market size was valued at USD 40.35 million in 2018 to USD 65.90 million in 2024 and is anticipated to reach USD 131.49 million by 2032, at a CAGR of 8.4% during the forecast period.

The India electrical market growth is primarily driven by rapid infrastructure development, rising urbanization, and a strong focus on renewable energy adoption. The government’s ambitious programs such as Smart Cities Mission and the National Electric Mobility Mission have created substantial demand for electrical equipment and services. Additionally, India’s commitment to achieving 500 GW of renewable energy capacity by 2030 is accelerating investments in solar, wind, and other green power projects, boosting the electrical sector significantly. Technological advancements, including the integration of automation and artificial intelligence in manufacturing and power distribution, are enhancing operational efficiency and reducing costs, further stimulating market expansion. Moreover, the increasing electrification of rural areas and expanding industrial base contribute to sustained demand growth for electrical infrastructure and equipment across the country.

The electrical market in India shows diverse regional dynamics shaped by local industrial activities and infrastructure projects. In North India, states like Delhi, Uttar Pradesh, and Haryana benefit from rapid urbanization and industrial growth, driving demand for electrical installations and equipment. South India, with Tamil Nadu, Karnataka, and Andhra Pradesh as key players, leads in electronics manufacturing and renewable energy initiatives, fostering market growth in this region. Western states such as Maharashtra and Gujarat maintain strong industrial and power generation sectors, fueling demand for electrical infrastructure. Meanwhile, Eastern and Central India, including Odisha and Madhya Pradesh, are focused on expanding power generation and grid modernization to meet rising energy needs. These regional variations highlight the importance of tailored strategies to capitalize on local market opportunities effectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Electrical Market was valued at USD 65.90 million in 2024 and is projected to reach USD 131.49 million by 2032, growing at a CAGR of 8.4%.

- Rapid infrastructure development and urbanization drive strong demand for electrical equipment across residential, commercial, and industrial sectors.

- Government initiatives like the Smart Cities Mission and National Electric Mobility Mission boost investments in electrical infrastructure and services.

- India’s commitment to 500 GW renewable energy capacity by 2030 accelerates demand for specialized electrical components and grid modernization.

- Technological advancements such as automation, artificial intelligence, and IoT improve operational efficiency and reduce costs in manufacturing and power distribution.

- Expansion of industrial hubs and rural electrification programs widen the customer base, promoting energy-efficient solutions and market diversification.

- Challenges include infrastructure bottlenecks, regulatory complexities, raw material price volatility, and a shortage of skilled labor, which affect market stability and growth.

Market Drivers:

Market Drivers:

Rapid Infrastructure Development and Urbanization Fuel Demand for Electrical Equipment

India experiences significant infrastructure growth driven by government initiatives aimed at modernizing cities and rural areas. The push to develop smart cities and upgrade transportation networks creates widespread demand for electrical equipment and power distribution solutions. Urban population growth increases residential and commercial electricity consumption, necessitating expansion of electrical installations and grid capacity. Governments at central and state levels invest heavily in power infrastructure projects, including transmission lines, substations, and renewable energy integration. This development creates continuous opportunities for manufacturers and service providers in the electrical sector. It also encourages private sector participation and foreign investments, which further stimulate market growth.

For instance, in Budget 2025, the government allocated ₹11.5 lakh crore for capital expenditure, with ₹253,424.65 crore directed to Indian Railways and ₹278,192.07 crores to highways, while an Urban Challenge Fund of ₹1 lakh crore supports urban projects.

Strong Government Focus on Renewable Energy Accelerates Market Expansion

India’s ambitious targets for renewable energy capacity significantly impact the electrical market. The government’s plan to achieve 500 GW of non-fossil fuel-based power by 2030 pushes adoption of solar, wind, and hydropower projects nationwide. This shift requires specialized electrical components, such as inverters, transformers, and smart meters, tailored for renewable energy integration. Policy support through subsidies, tax incentives, and favorable regulatory frameworks attracts large-scale investments. It also drives innovation and adoption of advanced technologies in power generation and distribution. The growing renewable sector reduces dependence on traditional fossil fuels and creates sustained demand for electrical equipment and services.

Technological Advancements Enhance Efficiency and Lower Operational Costs

Technological innovation plays a crucial role in shaping the India Electrical Market. The integration of automation, artificial intelligence, and Internet of Things (IoT) technologies optimizes manufacturing processes and power grid management. These advancements improve reliability, reduce energy losses, and enable predictive maintenance. Electrical equipment manufacturers benefit from enhanced production capabilities and reduced downtime. Smart grid deployments increase energy efficiency and allow better load management across urban and rural areas. It drives demand for advanced electrical products that support digital control and real-time monitoring. This technology-driven transformation attracts new customers and increases market competitiveness.

Expansion of Industrial and Rural Electrification Broadens Market Reach

Industrial growth and rural electrification efforts create a broader customer base for electrical products and services. The expansion of manufacturing hubs in states like Maharashtra, Gujarat, and Tamil Nadu raises demand for high-quality electrical components and systems. Simultaneously, government schemes targeting rural electrification improve access to electricity in remote regions. This development requires new transmission infrastructure, transformers, and wiring solutions. It also promotes the use of energy-efficient lighting and appliances, which stimulates market diversification. The combination of industrial and rural demand ensures steady growth and drives innovation in the electrical market.

For instance, the government’s Saubhagya scheme brought electricity to over 25 million households, significantly improving grid access in rural areas.

Market Trends:

Increasing Adoption of Smart Grid Technologies Drives Modernization in Power Distribution

The India Electrical Market is witnessing a growing shift towards smart grid implementation to enhance power reliability and efficiency. Utilities and government agencies prioritize integrating advanced metering infrastructure, automated control systems, and real-time data analytics. These technologies improve demand response management and reduce transmission losses across urban and rural networks. Smart grids enable better monitoring and faster fault detection, which minimizes downtime and operational costs. Manufacturers develop electrical components that support interoperability and digital communication protocols. The trend encourages investments in grid modernization projects and fosters collaboration between technology providers and energy companies.

For example, Energy Efficiency Services Limited (EESL) completed the installation of 3 million (30 lakh) smart meters across India under the Smart Meter National Programme by October 2022, with a target to install over 47,000 additional smart meters by December 2023.

Rising Demand for Energy-Efficient Electrical Products Boosts Sustainable Market Growth

Energy efficiency gains prominence in India’s electrical sector as consumers and industries seek to lower power consumption and costs. The adoption of LED lighting, energy-efficient transformers, and variable frequency drives accelerates across commercial and residential segments. Government regulations and incentive programs promote energy-saving technologies to reduce carbon footprint and comply with environmental standards. It drives manufacturers to innovate products that meet stringent efficiency criteria while maintaining affordability. The India Electrical Market benefits from growing awareness among end-users about long-term savings and sustainability. This shift supports broader environmental goals and strengthens the market’s future outlook.

For instance, under the Unnat Jyoti by Affordable LED for All (UJALA) programme, nearly 370 million LED bulbs have been distributed across India since 2015, significantly reducing national energy use.

Integration of Renewable Energy Sources Transforms Electrical Equipment Demand

The rapid expansion of solar and wind power installations significantly influences product requirements in the India Electrical Market. Renewable energy projects need specialized equipment like power converters, inverters, and grid synchronization devices. Increasing off-grid and microgrid solutions create opportunities for flexible and scalable electrical systems. It drives the development of hybrid power setups combining conventional and renewable sources. Electrical manufacturers focus on producing durable, weather-resistant, and low-maintenance components tailored for renewable applications. This trend encourages continuous research and adoption of cutting-edge technology to support the country’s clean energy transition.

Digitalization and Automation in Manufacturing Enhance Productivity and Product Quality

Industrial players within the India Electrical Market increasingly incorporate digital tools and automation in their production lines. Use of robotics, AI-driven quality control, and predictive maintenance reduce operational errors and improve throughput. Digital twins and simulation software help optimize design and manufacturing processes, enabling faster innovation cycles. It fosters a competitive landscape where efficiency and precision gain priority. The trend drives demand for sophisticated electrical components that integrate with automated systems. Manufacturers also invest in workforce upskilling to handle new technologies, ensuring sustainable growth and enhanced product performance.

Market Challenges Analysis:

Infrastructure Bottlenecks and Regulatory Complexities Hinder Market Growth

The India Electrical Market faces challenges due to inconsistent infrastructure development and regulatory hurdles. Delays in project approvals and complex compliance requirements increase lead times and raise costs for manufacturers and developers. Inadequate grid infrastructure in some regions limits efficient power distribution and integration of new technologies. It creates operational inefficiencies and affects supply chain reliability. Fragmented regulatory frameworks across states add complexity to market entry and expansion plans. Companies must navigate varying policies and tariffs, which can deter investment and slow scaling efforts. Overcoming these bottlenecks remains critical to sustaining the sector’s growth momentum.

Raw Material Price Volatility and Skilled Workforce Shortage Impact Market Stability

Fluctuations in prices of key raw materials such as copper, aluminum, and steel significantly affect production costs in the India Electrical Market. Volatile commodity markets increase uncertainty for manufacturers and reduce profit margins. It forces many companies to adjust pricing strategies frequently, impacting competitiveness. Furthermore, the sector encounters a shortage of skilled labor with expertise in advanced electrical technologies and manufacturing processes. This talent gap limits innovation and affects quality control. Training and retaining qualified personnel demand continuous investment, which some organizations find challenging. Addressing these issues is vital to maintaining supply chain stability and ensuring long-term market resilience.

- For instance, in 2025, copper prices on the London Metal Exchange reached a record high of $10,170 per metric ton, with Indian companies like Polycab India and RR Kabel reporting that increased copper prices directly reduced their gross margins, as they were unable to fully pass on the cost increases to customers in certain quarters.

Market Opportunities:

The India Electrical Market benefits from growing investments in renewable energy projects and smart infrastructure development. The increasing installation of solar parks, wind farms, and energy storage systems generates strong demand for specialized electrical components and grid integration solutions. It offers manufacturers opportunities to innovate products tailored for clean energy applications. Government incentives and public-private partnerships accelerate infrastructure upgrades, including smart meters and digital substations. These developments open new avenues for technology providers and service companies to expand their presence. The market can leverage this momentum to establish long-term sustainable growth.

Efforts to electrify remote and underserved regions in India present vast opportunities for the electrical sector. It drives demand for reliable transmission infrastructure, energy-efficient lighting, and off-grid power solutions. Industrial expansion across manufacturing hubs increases the need for high-quality electrical equipment and automation systems. Companies that tailor offerings to meet these diverse demands can capture emerging market segments. Developing affordable, scalable products designed for varied environments enhances competitiveness. This expanding customer base supports ongoing innovation and diversification within the market.

Market Segmentation Analysis:

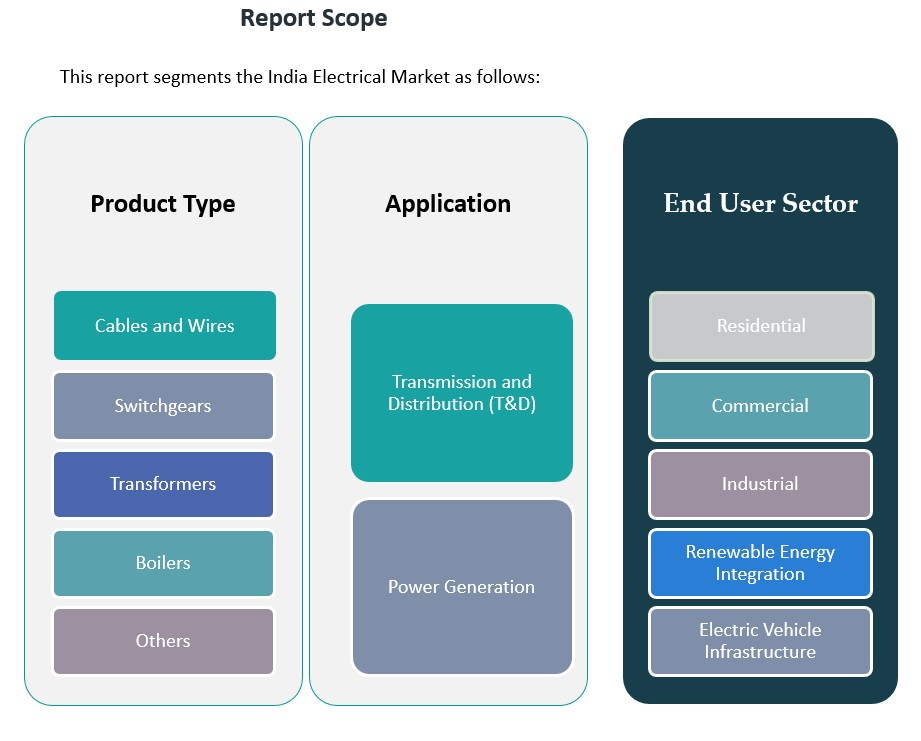

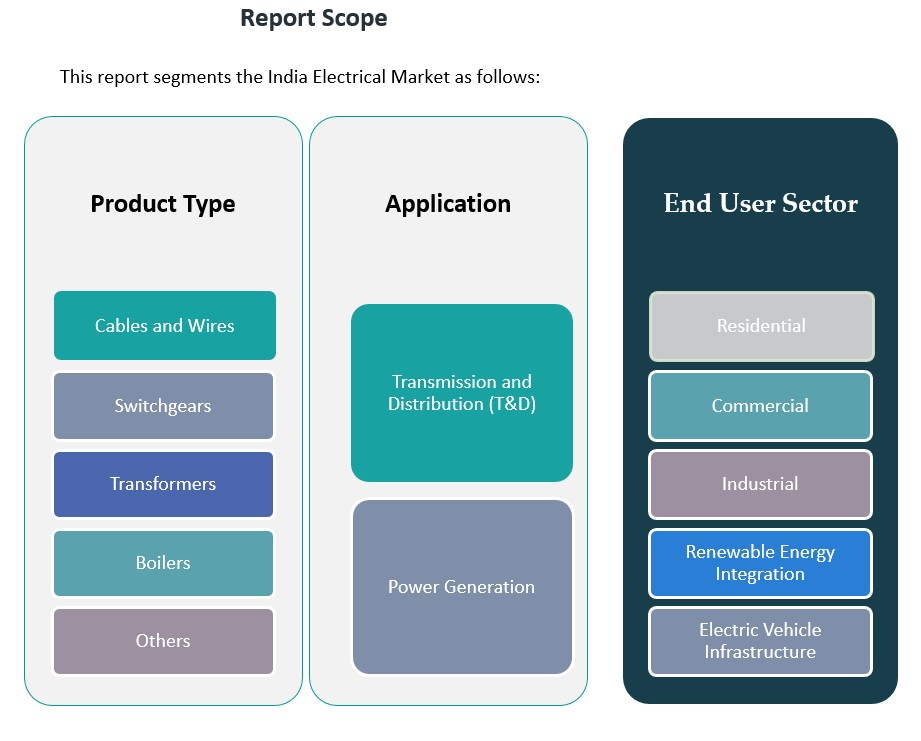

The India Electrical Market divides into key segments based on product type, application, and end-user sector, each driving distinct demand dynamics.

By product type, cables and wires dominate due to their essential role in power transmission and distribution. Switchgears follow closely, benefiting from infrastructure upgrades and increased automation. Transformers support growing power generation and distribution needs, while boilers serve industrial and power plant applications. The ‘Others’ category includes various electrical components that complement these primary products and address niche demands.

By application, transmission and distribution (T&D) represent a critical segment, driven by the need to modernize and expand the national grid. Power generation forms another major application area, fueled by investments in both conventional and renewable energy sources. The modernization of power infrastructure and the integration of renewable projects sustain demand in these segments.

By end-user sector further segments the market into residential, commercial, industrial, renewable energy integration, and electric vehicle infrastructure. Residential and commercial sectors show steady growth due to urbanization and increased electrification. The industrial sector requires high-capacity electrical systems to support manufacturing and processing activities. Renewable energy integration gains prominence through solar and wind power projects, demanding specialized equipment. Electric vehicle infrastructure emerges as a growing segment with the expansion of charging networks and government support for electric mobility.

Segmentation:

By Product Type Segment Analysis

- Cables and Wires

- Switchgears

- Transformers

- Boilers

- Others

By Application Segment Analysis

- Transmission and Distribution (T&D)

- Power Generation

By End User Sector Segment Analysis

- Residential

- Commercial

- Industrial

- Renewable Energy Integration

- Electric Vehicle Infrastructure

Regional Analysis:

The India Electrical Market shows strong regional diversity, shaped by varied industrial development and infrastructure projects. North India commands the largest market share at approximately 35%, driven by the dense population and rapid urbanization in states such as Delhi, Uttar Pradesh, and Haryana. The region experiences robust demand across residential, commercial, and industrial sectors, supported by significant investments in power generation and distribution infrastructure. Large-scale urban development and industrial expansion fuel consistent growth in electrical equipment consumption.

West India holds around 28% of the market, with Maharashtra and Gujarat serving as major industrial and manufacturing hubs. This region benefits from advanced power generation facilities and well-established transmission networks. Growing industrial clusters and export-oriented units increase the need for high-quality electrical components and automation solutions. Government initiatives aimed at upgrading the power grid and increasing renewable energy integration further enhance market opportunities in this area.

South India accounts for about 22% of the market, led by Tamil Nadu, Karnataka, and Andhra Pradesh, which emerge as key centers for electronics manufacturing and renewable energy projects. The region attracts substantial investments in solar and wind power, creating demand for specialized electrical infrastructure. East and Central India collectively represent approximately 15% of the market share. States like Odisha, Jharkhand, and Madhya Pradesh focus on expanding rural electrification and modernizing power systems. These areas offer significant potential for growth, driven by ongoing infrastructure development and increasing industrial activity. Tailoring strategies to regional dynamics remains essential for stakeholders seeking to optimize their market presence.

Key Player Analysis:

- Bharat Heavy Electricals Limited (BHEL)

- ABB India Ltd.

- Schneider Electric India

- Siemens India Ltd.

- Larsen & Toubro (L&T)

Competitive Analysis:

The India Electrical Market features a competitive landscape dominated by established players such as Bharat Heavy Electricals Limited (BHEL), ABB India Ltd., Schneider Electric India, Siemens India Ltd., and Larsen & Toubro (L&T). These companies leverage extensive product portfolios, technological expertise, and strong distribution networks to maintain market leadership. It faces competition from both domestic manufacturers and global firms entering the market through strategic partnerships and joint ventures. Innovation and cost efficiency remain critical factors for gaining market share. Companies invest heavily in research and development to offer advanced, energy-efficient electrical solutions tailored to India’s diverse infrastructure needs. Customer service, compliance with regulatory standards, and sustainable practices also influence competitive positioning. New entrants must navigate complex regulations and invest in local manufacturing to compete effectively. Overall, competition drives continuous improvement and market expansion, benefiting end-users through enhanced product quality and technological advancements.

Recent Developments:

- In January 2025, JSW Steel completed the ₹3,900-crore acquisition of Thyssenkrupp Electrical Steel India (tkES India). This acquisition brings the production of Cold Rolled Grain Oriented (CRGO) electrical steel a key material for transformers and power distribution under domestic control, reducing India’s reliance on imports. The deal was structured through a combination of zero-coupon bonds and equity infusion by JSW Steel and its joint venture partner JFE Steel, and the entity will now operate as JSquare Electrical Steel Nashik.

- In October 2024, Standex International Corporation acquired Amran Instrument Transformers and Narayan Powertech Pvt Ltd, marking the largest acquisition in Standex’s history. This move significantly expands Standex’s low- to medium-voltage instrument transformer business and strengthens its presence in the Indian electrical grid market. The combination of Standex, Amran, and Narayan Powertech is expected to accelerate growth and create a stronger player in the transformer industry, leveraging a broader global footprint and enhanced engineering expertise.

- In Sep 2024, Vedanta Aluminium unveiled two new products for the power and transmission industry. As India’s largest aluminium producer and the world’s largest aluminium wire rod manufacturer, Vedanta’s new offerings are aimed at enhancing the efficiency and reliability of power transmission infrastructure in India.

Market Concentration & Characteristics:

The India Electrical Market exhibits a moderately concentrated structure, dominated by a few key players such as Bharat Heavy Electricals Limited (BHEL), ABB India Ltd., Schneider Electric India, Siemens India Ltd., and Larsen & Toubro (L&T). These companies command significant market share through extensive product offerings, strong brand recognition, and established distribution networks. It faces competition from numerous small and medium enterprises that cater to niche segments and regional demands. The market emphasizes innovation, energy efficiency, and regulatory compliance, pushing firms to continuously improve product quality and technological capabilities. It balances the presence of domestic manufacturers and multinational corporations, creating a dynamic environment that fosters both competition and collaboration. This blend of concentration and diversity shapes the market’s characteristics, influencing pricing strategies, customer preferences, and growth trajectories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user sector. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India Electrical Market will expand steadily, driven by ongoing infrastructure modernization.

- Renewable energy integration will accelerate demand for specialized electrical components.

- Smart grid technologies will become central to improving power distribution efficiency.

- Urbanization will continue to boost residential and commercial electrical consumption.

- Government incentives will stimulate investments in clean energy and grid upgrades.

- Automation and digitalization will enhance manufacturing productivity and product quality.

- Rural electrification programs will open new market segments and increase accessibility.

- Rising electric vehicle adoption will drive growth in charging infrastructure and related electrical equipment.

- Technological innovation will remain crucial for maintaining competitive advantage and market share.

- Collaboration between domestic and international firms will foster knowledge transfer and industry growth.

Market Drivers:

Market Drivers: