| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Generic Injectables Market Size 2024 |

USD 104.15 billion |

| Generic Injectables Market, CAGR |

10.80% |

| Generic Injectables Market Size 2032 |

USD 250.43 billion |

Market Overview

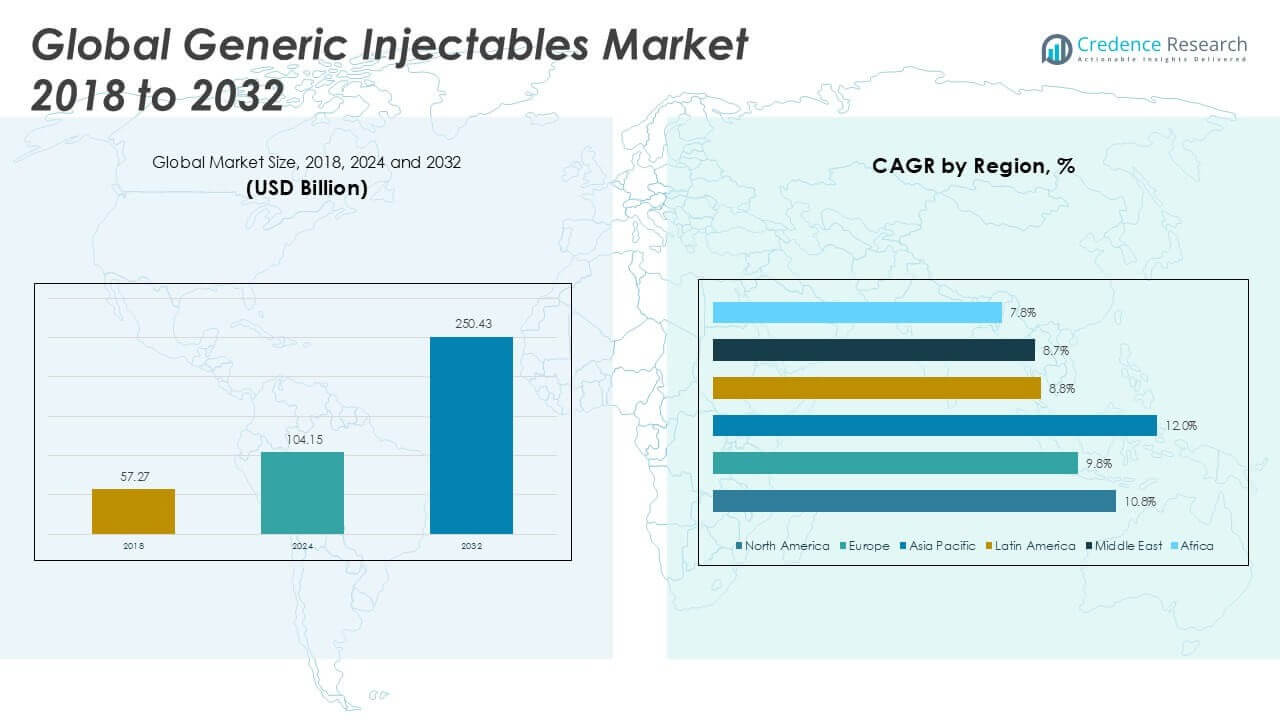

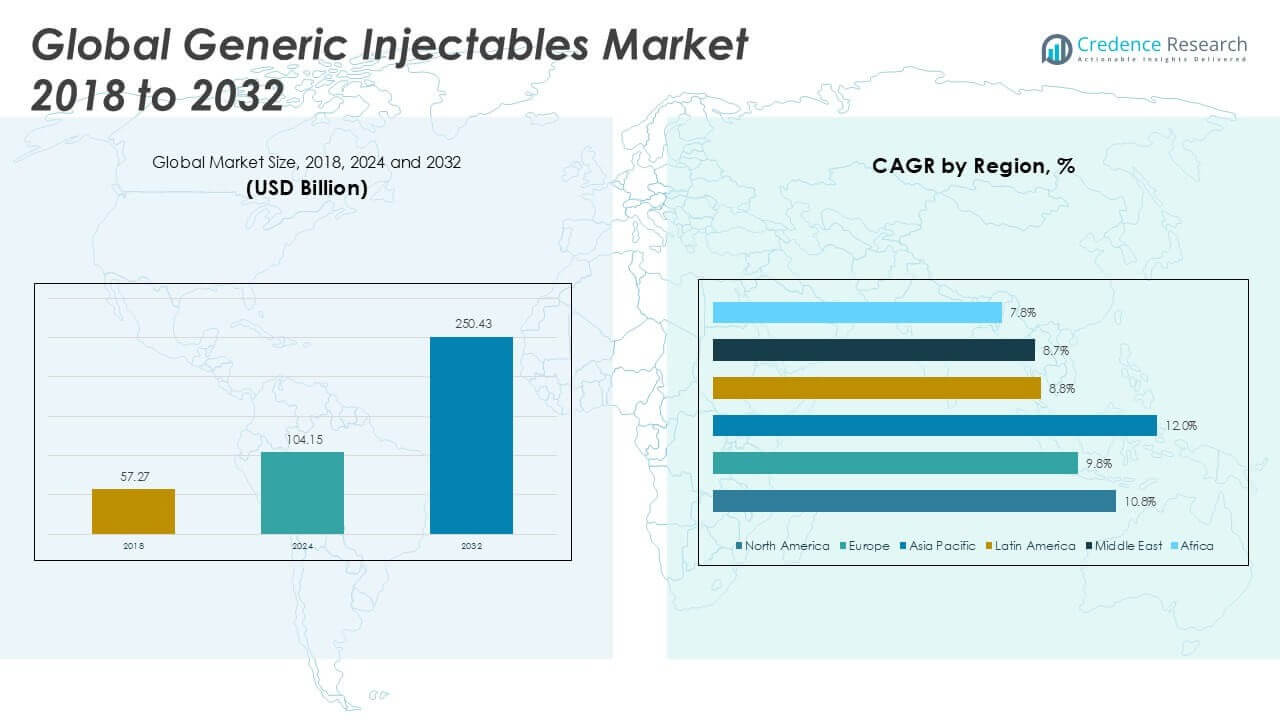

The Generic Injectables Market size was valued at USD 57.27 billion in 2018 to USD 104.15 billion in 2024 and is anticipated to reach USD 250.43 billion by 2032, at a CAGR of 10.80% during the forecast period.

The Generic Injectables Market is experiencing robust growth, driven by increasing prevalence of chronic diseases, rising demand for cost-effective treatment options, and widespread adoption of biosimilars and generic alternatives in healthcare systems globally. Expedited regulatory approvals and patent expirations of branded injectables accelerate the entry of generics, supporting market expansion. Growing investments by pharmaceutical manufacturers in advanced manufacturing technologies and strategic partnerships enhance product availability and quality. Evolving healthcare policies that emphasize affordability and accessibility further boost market adoption. Additionally, expanding hospital infrastructure and the shift toward injectable therapies for rapid and targeted drug delivery contribute to rising demand. Key trends include a surge in contract manufacturing, technological advancements in drug formulation, and increasing focus on emerging markets with large patient populations. These factors collectively position the Generic Injectables Market for sustained growth, as healthcare providers and patients seek safe, effective, and economical injectable solutions.

The Generic Injectables Market demonstrates strong growth across major regions, with North America, Europe, and Asia Pacific emerging as key contributors to overall expansion. North America remains at the forefront due to advanced healthcare infrastructure, high generic adoption, and a strong regulatory environment. Europe follows closely, supported by robust public health systems and government initiatives that encourage the use of generics and biosimilars. Asia Pacific is rapidly advancing, driven by expanding patient populations, healthcare investments, and the growing presence of major pharmaceutical manufacturers in countries like China and India. Leading players shaping the competitive landscape include Pfizer Inc., Novartis AG (Sandoz International GmbH), and Baxter International Inc., each recognized for their extensive product portfolios, global reach, and ongoing investment in research and development. These companies play a pivotal role in advancing product innovation, expanding access, and driving the evolution of the Generic Injectables Market worldwide.

Market Insights

- The Generic Injectables Market was valued at USD 104.15 billion in 2024 and is projected to reach USD 250.43 billion by 2032, at a CAGR of 10.80% during the forecast period.

- Market growth is driven by the rising prevalence of chronic diseases, increased demand for cost-effective treatment options, and a high rate of patent expirations for branded injectables.

- A notable trend is the rapid adoption of biosimilars and complex injectables, supported by expedited regulatory approvals and growing confidence in generic alternatives among healthcare providers.

- Key players such as Pfizer Inc., Novartis AG (Sandoz International GmbH), and Baxter International Inc. maintain a strong competitive edge through robust product portfolios, global manufacturing capabilities, and active investment in R&D.

- Market restraints include a complex regulatory environment, stringent quality standards, and supply chain disruptions that challenge timely product availability and profitability.

- North America leads regional growth due to advanced healthcare infrastructure and high generic uptake, followed by Europe with strong public health policies, while Asia Pacific is the fastest-growing region driven by large patient populations and expanding pharmaceutical manufacturing.

- The market continues to benefit from strategic partnerships, innovation in drug delivery technologies, and ongoing efforts to improve access and affordability in both developed and emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Prevalence of Chronic Diseases and Increasing Healthcare Demand

Chronic diseases such as diabetes, cancer, and cardiovascular conditions are on the rise globally, driving greater demand for injectable therapies. Physicians often prefer injectables for their rapid onset of action and reliable bioavailability, especially in acute and critical care settings. The increasing burden of chronic illnesses compels healthcare providers to seek cost-effective solutions, prompting wider adoption of generic injectables. Aging populations in both developed and emerging economies further intensify the need for accessible, affordable treatment options. Governments and insurance providers are encouraging the use of generics to reduce overall healthcare expenditure and improve patient access. This environment supports strong market growth, with generics filling crucial gaps in patient care across diverse healthcare systems.

- For instance, the increasing prevalence of chronic diseases is a key factor propelling the global generic injectables market, with governments prioritizing cost-effective treatment options.

Patent Expirations and Accelerated Regulatory Approvals Fuel Market Expansion

A significant wave of patent expirations for branded injectables is opening opportunities for generic manufacturers. These expirations allow new players to introduce cost-competitive alternatives, intensifying market competition and expanding the range of available therapies. Regulatory authorities are streamlining approval processes for generic injectables to expedite their entry into the market. Such regulatory efficiency not only fosters innovation but also ensures quicker access for patients in need of essential medications. The Generic Injectables Market benefits directly from these favorable regulatory trends, with stakeholders leveraging fast-track pathways and abbreviated approval processes. The competitive landscape continues to evolve, supporting broader patient access to high-quality injectable drugs.

- For instance, regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) are prioritizing generic injectables to ensure broader patient access.

Advancements in Manufacturing Technologies and Industry Investments

The pharmaceutical industry is investing heavily in advanced manufacturing technologies to enhance the quality, consistency, and safety of generic injectables. Adoption of automation, aseptic processing, and high-speed filling lines reduces production costs while maintaining stringent regulatory compliance. Strategic collaborations between drug manufacturers and contract development and manufacturing organizations (CDMOs) improve supply chain efficiency and scalability. These investments help address market demands for larger volumes and greater reliability in product availability. Companies are also focusing on reducing risks of shortages and ensuring continuous supply to hospitals and clinics. It supports the long-term stability and credibility of generic injectable solutions in the healthcare landscape.

Rising Focus on Emerging Markets and Accessibility Initiatives

Emerging economies present significant growth opportunities for the Generic Injectables Market due to expanding healthcare infrastructure and rising demand for affordable treatments. Governments and non-governmental organizations are implementing initiatives to improve access to essential medicines, making generic injectables a priority. Pharmaceutical firms are tailoring product portfolios and distribution strategies to meet the unique needs of these markets. Local manufacturing and partnerships with regional players enable faster market entry and address logistical challenges. Rising awareness among healthcare professionals and patients further stimulates demand in these regions. The market is poised for substantial expansion, driven by growing populations and evolving healthcare priorities in developing countries.

Market Trends

Surge in Biosimilars and Complex Generic Injectables

The growing acceptance of biosimilars and complex generics is transforming the landscape of injectable therapies. Pharmaceutical companies are investing in the development of biosimilar injectables to offer alternatives for high-cost biologics, meeting the demands of healthcare systems for affordable treatments. Regulatory agencies have introduced specific pathways to support biosimilar approvals, making it easier for manufacturers to enter the market. The Generic Injectables Market benefits from these developments by expanding its product range and offering more targeted therapies for chronic and rare diseases. Physicians and patients are increasingly confident in the safety and efficacy of biosimilars, driving adoption. The trend signals a move toward more specialized injectable solutions that address both clinical and economic challenges.

- For instance, the Indian pharmaceutical industry is expanding its portfolio into complex generics and biosimilars, addressing unmet medical needs and enhancing market differentiation.

Expansion of Contract Manufacturing and Outsourcing Partnerships

Contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) are playing a vital role in market expansion. Pharmaceutical companies are leveraging third-party manufacturing to enhance production capacity, reduce time-to-market, and optimize costs. Strategic outsourcing allows manufacturers to access specialized expertise and advanced technologies without major capital investment. The Generic Injectables Market is experiencing strong collaboration between generic drug developers and CMOs, resulting in greater efficiency and flexibility in supply chains. Companies are scaling up production to meet surging demand across both mature and emerging markets. The trend supports continuous innovation and ensures reliable access to a broad range of injectable therapies.

- For instance, the U.S. generic injectables pharmaceutical contract manufacturing market is projected to grow significantly, driven by increasing demand for outsourcing partnerships.

Adoption of Advanced Drug Delivery Systems and Packaging Innovations

Innovations in drug delivery systems and packaging are shaping the evolution of generic injectables. Manufacturers are introducing prefilled syringes, auto-injectors, and dual-chamber devices to improve convenience, safety, and dosing accuracy. User-friendly formats are in high demand among hospitals, clinics, and home healthcare providers. The Generic Injectables Market incorporates these advances to enhance patient adherence and minimize medication errors. Sustainable packaging solutions are also gaining traction, reflecting growing environmental awareness within the pharmaceutical industry. The integration of smart packaging technologies further improves traceability and product integrity throughout the distribution process.

Emphasis on Emerging Markets and Expanded Product Portfolios

Emerging markets are at the forefront of the latest expansion trends, with companies prioritizing local needs and healthcare delivery models. Manufacturers are broadening their portfolios to include a wider variety of therapeutic classes, catering to the growing incidence of chronic and infectious diseases. Partnerships with regional distributors and healthcare providers facilitate faster entry and improved access to generic injectables. The Generic Injectables Market is experiencing a shift toward tailored solutions that reflect unique demographic and epidemiological patterns in developing regions. Educational initiatives and government programs promote the safe and effective use of injectables in these settings. The trend positions the market for sustained growth in regions with large, underserved patient populations.

Market Challenges Analysis

Complex Regulatory Landscape and Stringent Quality Standards

The Generic Injectables Market faces significant challenges from the complex regulatory environment and strict quality requirements enforced by health authorities. Regulatory agencies demand rigorous evidence of bioequivalence, stability, and sterility for generic injectables, making approval processes lengthy and resource-intensive. Manufacturers must invest in advanced facilities and comprehensive quality management systems to meet global standards. Variations in regulatory frameworks across different countries further complicate international expansion strategies. Delays in product approvals or failures in compliance can lead to costly recalls, import bans, or reputational damage. The need for continuous documentation, inspection, and process validation increases operational complexity for market participants.

Supply Chain Disruptions and Pricing Pressures Impact Market Growth

Supply chain disruptions present ongoing risks, as injectable products require specialized storage, transportation, and handling. Shortages of raw materials, transportation bottlenecks, and manufacturing interruptions can affect the consistent availability of generic injectables in healthcare settings. The Generic Injectables Market contends with intense pricing pressures from both public and private payers, reducing profit margins and challenging long-term sustainability. Intense competition among manufacturers often leads to aggressive price reductions and bidding wars, which can compromise investment in research, development, and supply chain resilience. The market must balance affordability with the need to maintain high-quality standards and reliable product supply.

- For instance, intense competition among manufacturers often leads to aggressive price reductions and bidding wars, which can compromise investment in research, development, and supply chain resilience.

Market Opportunities

Expansion into Emerging Markets and Untapped Geographies

Significant growth opportunities exist in emerging markets where rising healthcare investments and improving infrastructure drive demand for affordable injectable therapies. Pharmaceutical companies can strengthen their presence by establishing local manufacturing units, forming strategic alliances with regional distributors, and tailoring product portfolios to address specific disease burdens. Government healthcare initiatives and public health programs support the wider adoption of generic injectables in regions with limited access to branded medications. The Generic Injectables Market stands to benefit from these developments by capturing new patient populations and building long-term relationships with local healthcare providers. Companies that invest in education, training, and capacity building can further differentiate themselves and enhance brand trust.

Innovation in Drug Delivery Technologies and Complex Formulations

Innovations in drug delivery technologies and the development of complex formulations offer substantial opportunities for growth and differentiation. The adoption of prefilled syringes, auto-injectors, and long-acting injectables can improve patient compliance and safety while reducing administration errors. Companies focusing on biosimilars, oncology injectables, and other specialty segments can access lucrative high-growth areas within the Generic Injectables Market. It can leverage advances in formulation science and device engineering to create value-added products that address unmet clinical needs. Expanding research capabilities and securing regulatory approvals for novel delivery systems will position market players to capture emerging opportunities and sustain long-term competitive advantages.

Market Segmentation Analysis:

By Product Type:

Small molecule injectables account for the largest share due to their extensive use in a broad range of therapeutic areas and relatively straightforward manufacturing requirements. Small molecules, including antibiotics, analgesics, and antihypertensive drugs, remain staples in hospitals and clinics worldwide. Large molecule injectables, which include complex biologics and biosimilars, are expanding rapidly as biotechnological innovation advances. It benefits from growing demand for biologic therapies in chronic disease management and specialty care, making large molecules a key focus for future growth and differentiation.

By Application:

The oncology segment dominates the market, supported by a rising global cancer burden and the critical role of injectables in chemotherapy and immunotherapy regimens. Generic injectables offer cost-effective alternatives for high-priced branded oncology drugs, enabling greater patient access and adherence. The infectious diseases segment remains vital, especially amid heightened awareness of antibiotic resistance and emerging global health threats. Cardiology and diabetes applications follow closely, with injectables playing a significant role in acute interventions, chronic disease control, and hospital-based therapies. Immunology represents a growing field, driven by the need for advanced treatments for autoimmune conditions and allergic disorders. The “others” category captures diverse uses in areas such as pain management, anesthesia, and gastrointestinal diseases.

By Container Type:

By container type, vials continue to be the most prevalent format, valued for their adaptability to various drugs and suitability for both single and multiple doses. Prefilled syringes are rapidly gaining favor due to their convenience, improved safety profile, and reduction in dosing errors, which aligns with hospital and home care trends. Ampoules maintain relevance in emergency and acute care settings, offering secure storage and easy administration. Premix solutions address the demand for ready-to-use formulations that streamline pharmacy and nursing workflows. The Generic Injectables Market is also witnessing innovation in container types, with manufacturers exploring smart packaging and alternative delivery formats to further support efficiency and patient safety in healthcare environments. This segmentation highlights the market’s responsiveness to evolving clinical requirements and underscores its capacity to serve a wide array of therapeutic and operational needs.

Segments:

Based on Product Type:

- Large Molecule Injectables

- Small Molecule Injectables

Based on Application:

- Oncology

- Infectious Diseases

- Cardiology

- Diabetes

- Immunology

- Others

Based on Container Type:

- Vials

- Premix

- Prefilled Syringes

- Ampoules

- Others

Based on Route of Administration:

- Intravenous (IV)

- Intramuscular (IM)

- Subcutaneous (SC)

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Generic Injectables Market

North America Generic Injectables Market grew from USD 21.01 billion in 2018 to USD 37.72 billion in 2024 and is projected to reach USD 91.01 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.8%. North America is holding a 36% market share in 2024, making it the largest regional market. The United States is the key contributor, driven by robust healthcare infrastructure, high adoption of generic drugs, and a strong regulatory framework supporting rapid generic approvals. Canada follows with expanding biosimilar uptake and government cost-containment initiatives. Demand is further supported by the prevalence of chronic diseases and a well-established network of hospital and retail pharmacies. Strategic investments by leading pharmaceutical firms and favorable reimbursement policies continue to drive regional growth in the Generic Injectables Market.

Europe Generic Injectables Market

Europe Generic Injectables Market grew from USD 13.94 billion in 2018 to USD 24.28 billion in 2024 and is projected to reach USD 54.37 billion by 2032, with a CAGR of 9.8%. Europe holds a 23% market share in 2024, reflecting strong adoption across Germany, the United Kingdom, France, and Italy. The region benefits from supportive healthcare policies, a high share of public sector spending, and initiatives to encourage biosimilars. Key countries have implemented pricing regulations that promote generic uptake and expand patient access. The increasing burden of chronic illnesses and well-developed hospital networks further support growth. It continues to witness collaboration between governments and pharmaceutical companies to expand access and ensure supply chain resilience.

Asia Pacific Generic Injectables Market

Asia Pacific Generic Injectables Market grew from USD 17.32 billion in 2018 to USD 33.18 billion in 2024 and is expected to reach USD 86.70 billion by 2032, at the highest CAGR of 12.0%. Asia Pacific commands a 32% market share in 2024, with China, India, and Japan leading regional growth. China’s large patient pool and government-driven generics initiatives boost volumes, while India’s dominance in manufacturing and exports enhances supply capabilities. Japan maintains steady growth through regulatory reforms and rising demand for cost-effective therapies. Southeast Asian countries such as Indonesia and Thailand are expanding access through public health programs. The region’s rapid urbanization, growing healthcare investments, and increasing prevalence of non-communicable diseases create strong long-term potential for the Generic Injectables Market.

Latin America Generic Injectables Market

Latin America Generic Injectables Market grew from USD 2.34 billion in 2018 to USD 4.190 billion in 2024 and is projected to reach USD 8.74 billion by 2032, at a CAGR of 8.8%. Latin America accounts for 4% of the market share in 2024, with Brazil, Mexico, and Argentina being the primary markets. Expansion is fueled by healthcare reforms, rising public healthcare expenditure, and increasing awareness about generic alternatives. Brazil leads with a large pharmaceutical industry and supportive government policies, while Mexico and Argentina see growing investment in local production. Infrastructure improvements and regulatory harmonization continue to boost the market. It remains poised for steady growth as healthcare access broadens and demand for affordable therapies rises.

Middle East Generic Injectables Market

Middle East Generic Injectables Market grew from USD 1.74 billion in 2018 to USD 2.92 billion in 2024 and is projected to reach USD 6.02 billion by 2032, reflecting a CAGR of 8.7%. The region holds a 3% market share in 2024, with the Gulf Cooperation Council (GCC) countries such as Saudi Arabia and the United Arab Emirates leading market expansion. Government initiatives to localize pharmaceutical manufacturing and reduce dependency on imports are key growth drivers. Demand for chronic disease treatments is rising, supported by investments in hospital infrastructure and improved access to healthcare services. The Generic Injectables Market in the Middle East benefits from increasing health insurance coverage and strategic partnerships with multinational firms. It is expected to witness moderate growth as healthcare systems continue to modernize.

Africa Generic Injectables Market

Africa Generic Injectables Market grew from USD 0.93 billion in 2018 to USD 1.85 billion in 2024 and is projected to reach USD 3.58 billion by 2032, with a CAGR of 7.8%. Africa accounts for a 2% market share in 2024, with South Africa, Egypt, and Nigeria representing key countries. Regional growth is supported by expanding government health programs, international aid, and efforts to improve pharmaceutical supply chains. South Africa leads with established manufacturing capacity, while Egypt’s initiatives to boost local production are strengthening access. Nigeria’s large population drives demand for affordable injectables, especially for infectious and chronic diseases. The Generic Injectables Market in Africa is set to grow as healthcare infrastructure expands and generics gain wider acceptance among patients and providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AstraZeneca

- Baxter International Inc.

- Biocon

- Fresenius SE & Co. KGaA

- GlaxoSmithKline plc

- Hikma Pharmaceuticals plc

- Johnson & Johnson Services, Inc.

- Lupin Ltd.

- Merck KGaA

- Mylan N.V.

- Novartis AG (Sandoz International GmbH)

- Pfizer Inc.

- Piramal Pharma Solutions

- Sanofi

Competitive Analysis

The competitive landscape of the Generic Injectables Market is characterized by the presence of established global players with extensive product portfolios and strong distribution networks. Leading companies such as Pfizer Inc., Novartis AG (Sandoz International GmbH), Baxter International Inc., Johnson & Johnson Services, Inc., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals plc, GlaxoSmithKline plc, Mylan N.V., Sanofi, Biocon, Lupin Ltd., Piramal Pharma Solutions, AstraZeneca, and Merck KGaA shape the market’s dynamics through strategic investments in research and development, robust manufacturing capabilities, and targeted expansion into emerging markets. These companies actively pursue product innovation, focusing on biosimilars, complex formulations, and advanced drug delivery systems to address evolving clinical needs. Strategic collaborations, mergers, and acquisitions enable them to strengthen market presence, enhance supply chain resilience, and accelerate the launch of new generic injectables. The leading players emphasize compliance with stringent regulatory requirements, prioritizing quality and patient safety. Their global reach, combined with the ability to adapt to shifting regulatory and market trends, allows them to sustain competitive advantage and drive the ongoing evolution of the Generic Injectables Market.

Recent Developments

- In August 2024, Lupin launched Doxorubicin Hydrochloride Liposome Injection, a generic cancer treatment drug, in the U.S.

- In June 2024, Teva Pharmaceuticals Inc., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., developed an authorized generic injectable of Victoza to treat patients with type 2 diabetes.

- In April 2024, Baxter International introduced five novel generic injectables that feature ready-to-use formulations to help support patient safety.

- In February 2024, SCHOTT Pharma, one of the providers of pharmaceutical drug containment solutions and delivery systems, launched glass vials optimized for deep-cold storage of generic injectables.

Market Concentration & Characteristics

The Generic Injectables Market exhibits moderate to high concentration, with a few multinational pharmaceutical companies dominating global sales and product innovation. It is characterized by significant barriers to entry, including stringent regulatory requirements, high capital investments, and the need for advanced manufacturing capabilities. Leading players leverage economies of scale, robust R&D pipelines, and strong distribution channels to maintain their competitive edge. The market features a broad product spectrum, ranging from small molecule injectables to complex biologics and biosimilars, catering to diverse therapeutic needs. Continuous product launches, investment in drug delivery technologies, and expanding portfolios of biosimilar injectables highlight the market’s dynamic and innovation-driven nature. The emphasis on quality, safety, and regulatory compliance defines the competitive landscape, while increasing global demand for affordable and effective treatments continues to drive market evolution

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Container Type, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Generic Injectables Market will continue to expand, supported by rising demand for cost-effective therapies worldwide.

- Patent expirations of major branded injectables will create new opportunities for generic manufacturers.

- The adoption of biosimilars and complex injectable formulations is expected to increase significantly.

- Regulatory agencies will streamline approval processes to accelerate market entry for generic injectables.

- Companies will invest in advanced manufacturing technologies to enhance product quality and supply reliability.

- Strategic partnerships and mergers will become more common as firms seek to expand global reach and diversify portfolios.

- Growing healthcare investments in emerging markets will drive strong demand for generic injectables.

- Focus on patient safety, product traceability, and sustainable packaging will shape future innovations.

- The prevalence of chronic diseases will fuel continuous growth in key therapeutic segments such as oncology, cardiology, and diabetes.

- Digitalization of healthcare and improved distribution infrastructure will increase accessibility and efficiency across all regions.