Market Overview

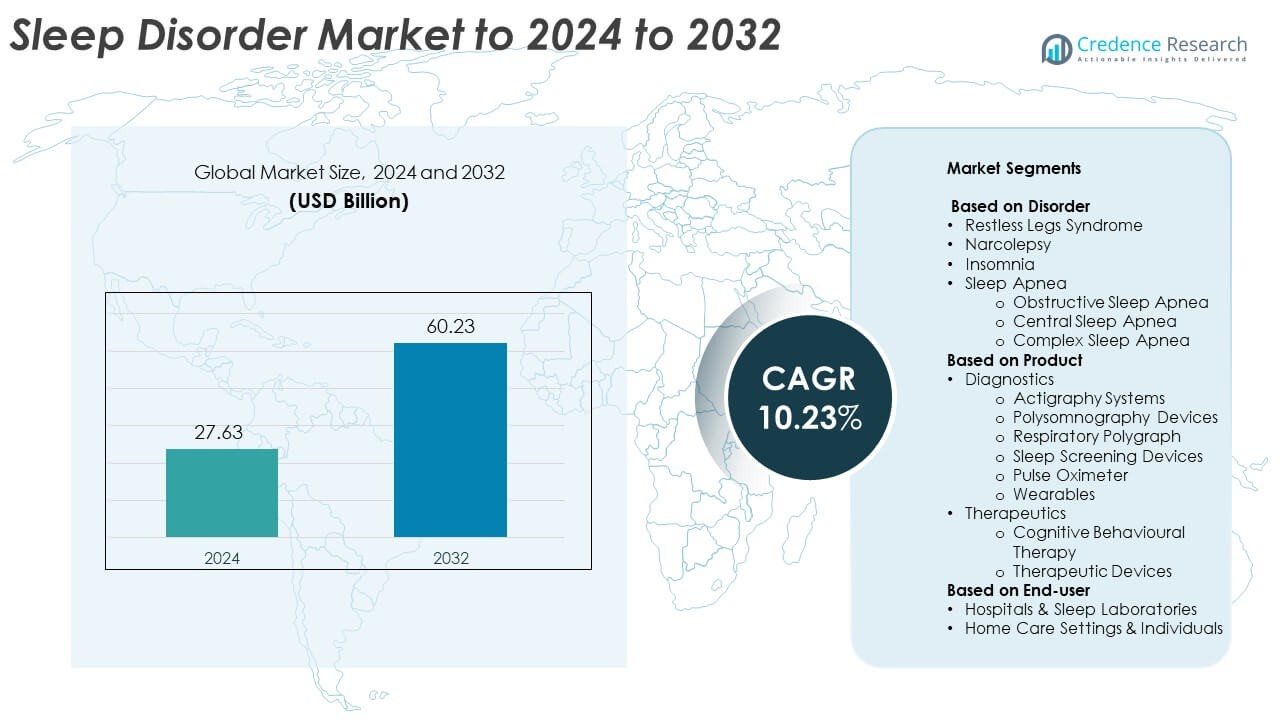

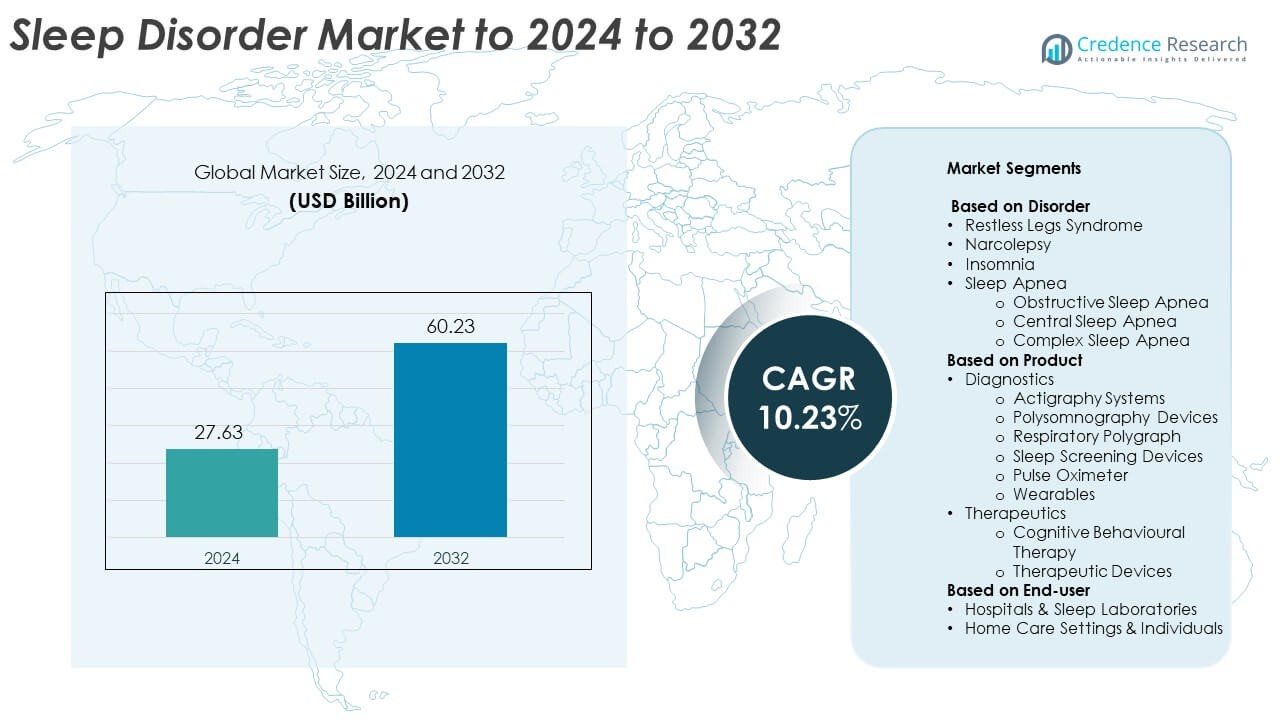

Sleep Disorder Market size was valued at USD 27.63 Billion in 2024 and is anticipated to reach USD 60.23 Billion by 2032, at a CAGR of 10.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleep Disorder Market Size 2024 |

USD 27.63 Billion |

| Sleep Disorder Market, CAGR |

10.23% |

| Sleep Disorder Market Size 2032 |

USD 60.23 Billion |

The Sleep Disorder Market is led by prominent players such as ResMed, Koninklijke Philips N.V., Fisher & Paykel Healthcare, Oura Health, and Fitbit I. These companies dominate through advanced product portfolios in sleep diagnostics, monitoring devices, and therapeutic solutions. Their focus on AI-enabled technologies, wearable innovations, and digital health integration strengthens their market presence. Strategic collaborations and global distribution networks further enhance competitiveness. Regionally, North America leads the market with a 41.2% share in 2024, supported by high awareness, advanced healthcare infrastructure, and strong adoption of sleep therapy devices across both clinical and homecare settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sleep Disorder Market was valued at USD 27.63 Billion in 2024 and is projected to reach USD 60.23 Billion by 2032, growing at a CAGR of 10.23%.

- Rising cases of insomnia and sleep apnea, along with increasing awareness of sleep health, are driving global demand for diagnostics and therapeutic devices.

- Growing adoption of AI-based wearables, home sleep testing systems, and digital monitoring platforms is transforming patient diagnosis and treatment.

- The market remains moderately consolidated, with leading players focusing on innovation, strategic partnerships, and global expansion to strengthen competitive positioning.

- North America leads with a 41.2% share, followed by Europe at 27.6% and Asia-Pacific at 21.4%, while the insomnia segment dominates with 56.8% of the total market share.

Market Segmentation Analysis:

By Disorder

The insomnia segment dominated the sleep disorder market in 2024, accounting for a 56.8% share. Its dominance stems from the rising prevalence of stress-related sleep issues and lifestyle disorders globally. Growing awareness and diagnosis rates have led to higher prescription volumes for sleep aids. Additionally, advancements in behavioral therapies and novel drug formulations are expanding treatment accessibility. Increasing screen time and work-related fatigue continue to elevate insomnia cases, reinforcing this segment’s leadership. In contrast, sleep apnea and restless legs syndrome show steady growth driven by improved diagnostic coverage.

- For instance, As of May 2022, Sleepio had been evaluated in 28 studies, including 12 RCTs, which confirmed its effectiveness for reducing insomnia.

By Product

The therapeutics segment held the largest share of 63.2% in 2024, driven by the rising use of therapeutic devices and cognitive behavioral therapy. Continuous Positive Airway Pressure (CPAP) devices remain a preferred treatment for obstructive sleep apnea. Wearable sleep aids and mobile-based behavioral programs are improving patient adherence and monitoring outcomes. Increasing healthcare expenditure and reimbursement support for non-invasive devices further boost this category. Diagnostic devices such as polysomnography and actigraphy systems are gaining traction, but their adoption is limited to clinical environments, keeping therapeutics as the dominant revenue contributor.

- For instance, according to recent investor presentations in the second half of 2025, ResMed’s AirView remote monitoring ecosystem is used to monitor over 33 million patients, while the number of cloud-connectable devices in the market has surpassed 30 million.

By End-user

Hospitals and sleep laboratories led the market with a 58.4% share in 2024. Their dominance is attributed to advanced diagnostic infrastructure and the availability of multidisciplinary care for complex sleep disorders. These facilities offer comprehensive polysomnography, respiratory polygraph, and actigraphy testing under medical supervision. The segment also benefits from increasing patient referrals and insurance coverage for diagnostic procedures. Meanwhile, home care settings are expanding rapidly, supported by the adoption of portable monitoring devices and telemedicine-based therapy. The shift toward at-home diagnostics is enhancing convenience and reducing hospital load, driving balanced growth across both settings.

Key Growth Drivers

Rising Prevalence of Sleep-Related Disorders

The growing global prevalence of sleep disorders, including insomnia, sleep apnea, and narcolepsy, is a major market driver. Sedentary lifestyles, prolonged screen exposure, and increasing stress levels are causing chronic sleep deprivation. According to the World Sleep Society, more than 45% of the world’s population experiences sleep-related issues, highlighting the growing need for diagnosis and treatment. This surge in patient population is accelerating demand for therapeutic devices, behavioral therapies, and medications, driving consistent revenue growth across healthcare and homecare settings.

- For instance, SomnoMed confirms more than 1,000,000 patients treated with oral appliance therapy to date.

Technological Advancements in Diagnostics and Therapeutics

Rapid innovation in sleep disorder diagnostics and therapeutic solutions is transforming patient care. AI-enabled wearable trackers, smart sleep monitoring systems, and portable polysomnography devices allow early detection and continuous monitoring. Therapeutic devices such as adaptive servo-ventilation systems and CPAP technologies are improving compliance and treatment outcomes. Integration of mobile applications and telemedicine platforms enhances patient engagement and accessibility. These innovations reduce diagnostic costs, expand remote care adoption, and create new revenue streams for manufacturers and healthcare providers.

- For instance, ResMed found PAP adherence at 87% with myAir plus AirView, versus 70% with AirView alone.

Increasing Awareness and Healthcare Spending

Rising awareness about sleep health and its impact on mental and physical wellbeing is boosting demand for diagnosis and treatment. Governments and organizations are conducting campaigns to address untreated sleep disorders. Growing healthcare spending, especially in developed economies, supports the availability of advanced diagnostic centers and therapeutic devices. Insurance coverage for sleep apnea treatments and behavioral therapies is further driving adoption. Expanding patient education initiatives are encouraging individuals to seek professional help, fostering market growth across both clinical and home-based care models.

Key Trends & Opportunities

Expansion of Digital Sleep Solutions

Digital transformation in healthcare is creating new opportunities for virtual sleep management. Wearable technology and smartphone-based applications are being integrated with cloud-based analytics to monitor sleep quality. These platforms enable real-time data sharing between patients and physicians, improving treatment personalization. Companies are focusing on software-driven behavioral therapies and AI-supported sleep tracking. The rising popularity of telehealth consultations and subscription-based sleep improvement programs is widening access and creating recurring revenue opportunities for technology-driven healthcare firms.

- For instance, Calm has approximately 4.5 million subscribers to its sleep and mindfulness app.

Growing Adoption of Home Sleep Testing Devices

Home-based sleep testing devices are gaining traction as patients seek convenience and cost-effective solutions. Miniaturized and wireless diagnostic tools such as portable respiratory polygraphs and actigraphy systems are driving adoption in home settings. These devices reduce waiting times for laboratory testing and enable continuous monitoring over multiple nights. Rising consumer interest in self-monitoring, coupled with expanding e-commerce distribution, supports the demand surge. Manufacturers offering user-friendly, FDA-approved home testing kits are expected to capture a larger share in this evolving market segment.

- For instance, ZOLL Itamar’s WatchPAT 300 holds FDA clearance K180775 and is indicated from age 12; using total sleep time helps avoid up to 20% misclassification reported with recording time.

Integration of AI and Predictive Analytics

The use of artificial intelligence and predictive analytics in sleep medicine is opening new frontiers for data-driven diagnosis and treatment. AI algorithms analyze patient data to identify sleep patterns, predict apnea episodes, and suggest tailored therapy adjustments. Predictive systems also help in early identification of chronic conditions linked to sleep deprivation, such as cardiovascular or metabolic disorders. Healthcare providers leveraging AI-supported platforms achieve improved clinical accuracy and patient compliance, positioning technology as a central enabler of personalized sleep care.

Key Challenges

High Cost of Diagnostic and Therapeutic Devices

The elevated cost of diagnostic procedures and therapeutic devices remains a major challenge. Sleep studies conducted in laboratories involve expensive equipment like polysomnography systems and require trained specialists, increasing overall healthcare costs. Similarly, CPAP and advanced ventilation devices demand significant upfront investment. These financial barriers limit access, particularly in low-income regions, where reimbursement coverage is limited. The high price of sleep-related therapies continues to restrict mass adoption, despite increasing global awareness of the importance of sleep health.

Limited Awareness and Underdiagnosis in Developing Regions

Underdiagnosis and lack of awareness in emerging economies hinder market growth. Many individuals experiencing sleep-related symptoms do not seek medical attention due to social stigma or limited healthcare accessibility. The shortage of certified sleep specialists and diagnostic centers further compounds the problem. Insufficient public health initiatives and low prioritization of sleep medicine in healthcare programs delay early intervention. This knowledge gap results in untreated conditions, reducing patient outcomes and restricting the market’s potential expansion across developing countries.

Regional Analysis

North America

North America dominated the sleep disorder market in 2024 with a 41.2% share. The region’s leadership is driven by high awareness of sleep health, advanced healthcare infrastructure, and significant adoption of diagnostic and therapeutic devices. The United States contributes the majority of regional revenue due to strong insurance coverage and growing cases of sleep apnea and insomnia. Continuous innovation in wearable devices and home-based sleep testing further supports growth. The presence of leading manufacturers and sleep centers ensures sustained regional expansion through early diagnosis and technologically advanced treatments.

Europe

Europe accounted for a 27.6% share of the global sleep disorder market in 2024. The region benefits from an expanding network of sleep laboratories and increasing government initiatives promoting mental and sleep health. Countries such as Germany, the United Kingdom, and France lead adoption due to strong healthcare systems and favorable reimbursement policies. Growing awareness of sleep-related comorbidities like hypertension and obesity fuels diagnostic demand. The introduction of digital sleep monitoring platforms and smart therapeutic devices supports steady regional growth, with rising collaborations between healthcare providers and device manufacturers.

Asia-Pacific

Asia-Pacific captured a 21.4% share in 2024 and is expected to record the fastest growth rate through 2032. Rising stress levels, changing work patterns, and growing urbanization are increasing sleep disorder prevalence across China, Japan, India, and South Korea. Expanding healthcare access and the emergence of telemedicine are boosting diagnosis and therapy adoption. Investments in sleep clinics and low-cost wearable devices are supporting market penetration. Increasing research on sleep-related diseases and rising disposable incomes contribute to strong market momentum, making Asia-Pacific a key growth region for both diagnostics and therapeutics.

Latin America

Latin America held a 6.3% share of the global market in 2024. Growing awareness of sleep health, coupled with gradual improvements in healthcare infrastructure, is driving adoption of sleep disorder diagnostics. Brazil and Mexico are leading markets due to the expansion of urban healthcare facilities and higher diagnosis rates of sleep apnea. Economic development and government programs focused on chronic disease prevention further encourage growth. However, limited access to specialized sleep centers and affordability challenges continue to restrict market potential, although rising telehealth adoption is expected to improve accessibility.

Middle East & Africa

The Middle East & Africa accounted for a 3.5% share of the sleep disorder market in 2024. Market growth is supported by increasing recognition of sleep disorders as a public health issue and the establishment of specialized sleep clinics in Gulf Cooperation Council countries. The region is witnessing gradual adoption of portable diagnostic devices and CPAP systems. Rising healthcare investments in Saudi Arabia, the UAE, and South Africa are improving diagnosis and treatment availability. Despite limited awareness in rural areas, urban centers are driving regional demand through expanding hospital-based sleep management services.

Market Segmentations:

By Disorder

- Restless Legs Syndrome

- Narcolepsy

- Insomnia

- Sleep Apnea

- Obstructive Sleep Apnea

- Central Sleep Apnea

- Complex Sleep Apnea

By Product

- Diagnostics

- Actigraphy Systems

- Polysomnography Devices

- Respiratory Polygraph

- Sleep Screening Devices

- Pulse Oximeter

- Wearables

- Therapeutics

- Cognitive Behavioural Therapy

- Therapeutic Devices

By End-user

- Hospitals & Sleep Laboratories

- Home Care Settings & Individuals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sleep Disorder Market features key players such as ResMed, Koninklijke Philips N.V., Fisher & Paykel Healthcare, Oura Health, Fitbit I, Natus Medical, Nihon Kohden, LivaNova, WEINMANN Emergency Medical Technology GmbH + Co. KG, Teleflex, BMC Medical, Drive DeVilbiss International, Sleep Shepherd, Sleepace, Cadwell Laboratories, Asahi Kasei Corporation, Apple Inc., Oxysleep Maxcare, Avadel, and Eli Lilly. The market is highly competitive, driven by technological innovation and strong research capabilities. Companies are focusing on developing advanced diagnostic tools, AI-driven sleep monitoring devices, and therapeutic solutions that enhance patient comfort and compliance. Strategic collaborations with healthcare providers, expansion into emerging economies, and product diversification are key growth strategies. The competition is also shaped by the integration of wearable technologies and digital sleep platforms, improving accessibility and treatment accuracy. Continuous investment in R&D, digital transformation, and personalized therapy solutions ensures sustained competitiveness across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ResMed

- Koninklijke Philips N.V.

- Fisher & Paykel Healthcare

- Oura Health

- Fitbit I

- Natus Medical

- Nihon Kohden

- LivaNova

- WEINMANN Emergency Medical Technology GmbH + Co. KG

- Teleflex

- BMC Medical

- Drive DeVilbiss International

- Sleep Shepherd

- Sleepace

- Cadwell Laboratories

- Asahi Kasei Corporation

- Apple Inc.

- Oxysleep Maxcare

- Avadel

- Eli Lilly

Recent Developments

- In 2025, Eli Lilly launched Mounjaro (tirzepatide) in India for treating type 2 diabetes and obesity

- In 2024, Avadel received FDA approval for Lumryz to treat cataplexy or excessive daytime sleepiness (EDS) in pediatric patients aged 7 years and older with narcolepsy.

- In 2022, Oxysleep Maxcare launched an exclusive centre for sleep disorders and Respiratory care with rehabilitation facilities.

Report Coverage

The research report offers an in-depth analysis based on Disorder, Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by rising global sleep disorder prevalence.

- Technological innovation in wearable and home-based diagnostics will enhance early detection.

- Increasing adoption of AI-enabled sleep monitoring systems will improve personalized therapy outcomes.

- Expansion of telemedicine platforms will make sleep treatments more accessible to remote patients.

- Growing public health initiatives will raise awareness about the importance of sleep wellness.

- Behavioral therapies and non-drug interventions will gain preference over traditional sedatives.

- Partnerships between device makers and healthcare providers will accelerate digital health integration.

- Emerging markets in Asia-Pacific and Latin America will show faster adoption of affordable solutions.

- Advancements in cognitive behavioral therapy will strengthen non-invasive treatment options.

- Regulatory focus on patient safety and data accuracy will drive innovation and clinical reliability.