Market Overview

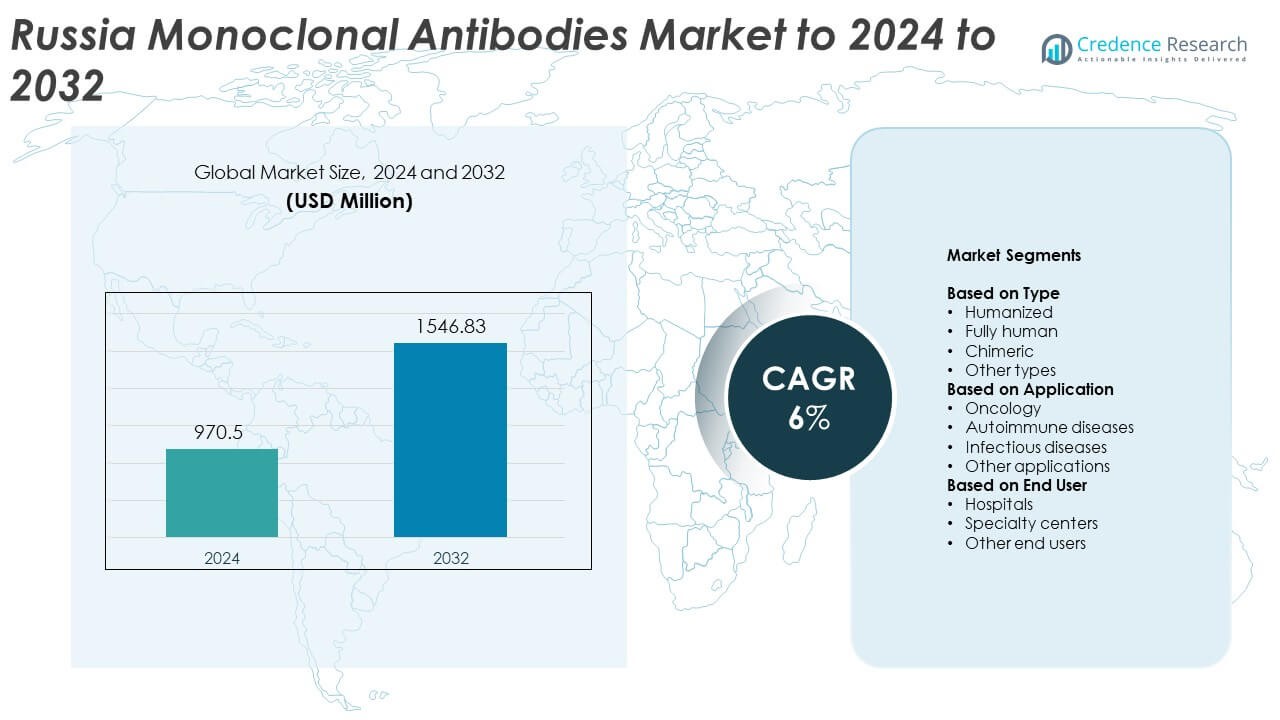

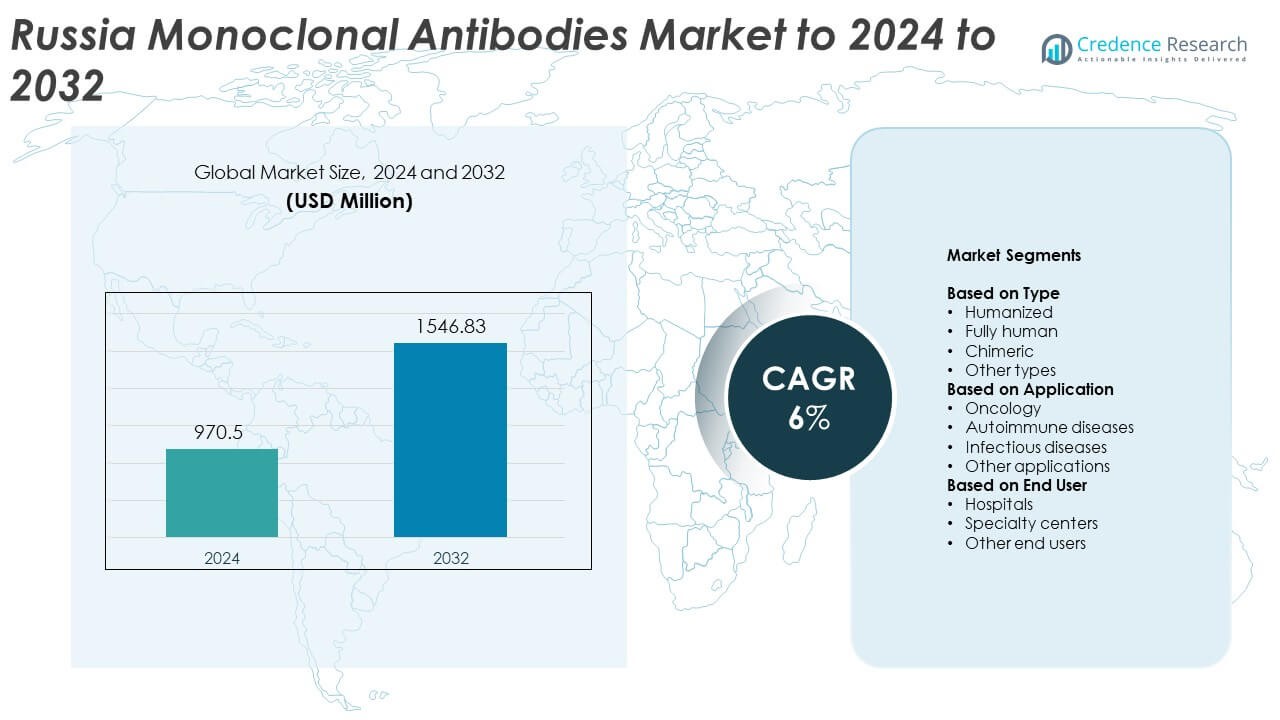

Russia Monoclonal Antibodies Market size was valued at USD 970.5 million in 2024 and is anticipated to reach USD 1,546.83 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Monoclonal Antibodies Market Size 2024 |

USD 970.5 Million |

| Russia Monoclonal Antibodies Market, CAGR |

6% |

| Russia Monoclonal Antibodies Market Size 2032 |

USD 1,546.83 Million |

The Russia monoclonal antibodies market is led by BIOCAD, AbbVie, F. Hoffmann-La Roche, Amgen, Generium, Bristol Myers Squibb, Pfizer, Johnson & Johnson, Sanofi, Takeda Pharmaceutical Company, Eli Lilly and Company, Merck, Novartis, Regeneron Pharmaceuticals, Biogen, GlaxoSmithKline, Boehringer Ingelheim International, Alexion Pharmaceuticals, R-Pharm, and Nanolek. These companies compete through strong biologics portfolios, expanding R&D pipelines, and partnerships aimed at improving domestic production capacity. The Central Federal District leads the market with a 36.4% share due to its concentration of advanced research centers, oncology facilities, and biopharmaceutical manufacturing hubs, solidifying its role as Russia’s core region for monoclonal antibody development and distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Russia monoclonal antibodies market was valued at USD 970.5 million in 2024 and is projected to reach USD 1,546.83 million by 2032, growing at a CAGR of 6%.

- Rising prevalence of chronic diseases, increased biologics manufacturing, and government healthcare funding are driving steady market expansion across the country.

- Ongoing advancements in biosimilars and antibody-drug conjugates are shaping innovation and enhancing accessibility of cost-effective treatments.

- Competition is intensifying among major global and domestic players focusing on local production, affordability, and clinical research expansion.

- The Central Federal District led with a 36.4% share in 2024, followed by the Northwestern and Volga districts, while the fully human antibody segment dominated the market with a 44.7% share.

Market Segmentation Analysis:

By Type

The fully human segment dominated the Russia monoclonal antibodies market with a 44.7% share in 2024. Its leadership is driven by reduced immunogenicity, superior therapeutic efficacy, and extended half-life compared to chimeric and humanized types. Fully human antibodies are widely used in oncology and autoimmune disease treatments due to their higher patient compatibility. Increasing development of biosimilar versions and growing approvals for fully human antibodies by domestic biopharma firms such as BIOCAD and Generium also strengthen this segment’s dominance across Russia’s expanding biologics landscape.

- For instance, AbbVie’s REVEAL phase-3 psoriasis trial randomized 1,212 adults and showed 71% of adalimumab-treated patients achieved PASI-75 at week 16 versus 7% on placebo.

By Application

The oncology segment held the largest share of 53.2% in 2024, supported by rising cancer prevalence and strong adoption of targeted monoclonal therapies. Monoclonal antibodies such as trastuzumab and rituximab remain central to cancer management in Russia’s healthcare system. Expanding national cancer control programs and wider reimbursement coverage for biologic drugs enhance accessibility. Growth in R&D investments for tumor-specific antibody development further supports the dominance of the oncology application segment within the market.

- For instance, AstraZeneca’s real-world PACIFIC-R study, which analyzed patients with unresectable stage III NSCLC who received durvalumab after chemoradiotherapy, included a full analysis set of 1,153 adults. These patients received a median of 23 durvalumab infusions, providing evidence for the sustained use of this therapy in oncology practice.

By End User

Hospitals accounted for the largest share of 62.5% in 2024, driven by their established infrastructure for biologic infusions and specialist treatment facilities. Most monoclonal antibody therapies are administered in hospital settings due to the need for close clinical monitoring and advanced diagnostic capabilities. Russia’s expansion of tertiary healthcare centers and increased government spending on oncology and immunology care continue to strengthen hospital-based utilization. Growing integration of biologic therapies into standard treatment protocols reinforces hospitals as the primary end users in the market.

Key Growth Drivers

Rising Prevalence of Chronic and Autoimmune Diseases

The growing incidence of cancers, rheumatoid arthritis, and multiple sclerosis in Russia is boosting monoclonal antibody adoption. These biologics offer targeted action with improved safety over conventional drugs, driving higher physician preference. Expanding government healthcare initiatives focused on oncology and immunology further support access to advanced biologic therapies. Increasing patient awareness and early diagnosis rates are also contributing to consistent demand across hospital and specialty care segments.

- For instance, A phase-3 psoriasis study (NCT02762955) of BIOCAD’s BCD-057 randomized 346 adults and demonstrated equivalent efficacy to reference adalimumab. At week 16, 60.34% of patients on BCD-057 and 63.37% of patients on reference adalimumab achieved PASI-75, with the 95% confidence interval falling within the pre-specified equivalence margin.

Expanding Domestic Biopharmaceutical Manufacturing Capacity

Russia’s increased investment in domestic biologics production has strengthened market growth. Companies such as BIOCAD and Generium have enhanced monoclonal antibody manufacturing capabilities to reduce dependence on imports. Government support for import substitution under the “Pharma 2030” strategy is accelerating local production. This expansion ensures stable supply, lower treatment costs, and improved accessibility to high-quality monoclonal antibodies across regional healthcare institutions.

- For instance, Generium’s ustekinumab biosimilar completed a phase-3 trial across 33 Russian centers with 422 patients before national registration.

Technological Advancements in Antibody Engineering

Ongoing innovations in antibody engineering, including bispecific and antibody-drug conjugate (ADC) platforms, are fueling therapeutic diversity. Russian and international firms are investing in next-generation antibody technologies to improve efficacy and minimize side effects. Advanced R&D collaborations with global players have enabled local scientists to develop highly specific monoclonal antibodies for oncology and autoimmune diseases. These innovations are expected to enhance treatment precision and long-term disease management outcomes.

Key Trends & Opportunities

Rising Focus on Biosimilar Development

The growing expiration of patents for major biologics is creating opportunities for biosimilar monoclonal antibodies. Russian manufacturers are investing in cost-effective biosimilars to increase treatment accessibility and market competitiveness. BIOCAD’s development of trastuzumab and rituximab biosimilars demonstrates this progress. With growing acceptance from healthcare providers and supportive regulatory pathways, biosimilars are expected to play a vital role in expanding patient access to affordable antibody therapies.

- For instance, Celltrion’s ustekinumab biosimilar CT-P43 phase-3 trial randomized 509 patients and achieved efficacy equivalence to the originator through week 28.

Increased Government Healthcare Funding

Expanding federal healthcare budgets and reimbursement programs are improving access to monoclonal antibody treatments. The Russian government’s focus on advanced biologic drugs for oncology and autoimmune conditions supports both demand and innovation. Integration of monoclonal antibodies into national treatment guidelines and hospital formularies is encouraging greater clinical use. This trend provides strong market opportunities for local producers and global pharmaceutical partners.

- For instance, GENERIUM conducted a Phase III randomized study of its tocilizumab biosimilar Complarate in patients with rheumatoid arthritis, enrolling 465 participants (310 in the biosimilar arm, 155 in the reference drug arm).

Key Challenges

High Treatment and Development Costs

The high cost of monoclonal antibody therapies remains a key barrier to widespread adoption in Russia. Manufacturing complexity, expensive raw materials, and cold-chain logistics contribute to elevated prices. Limited reimbursement coverage for certain biologics further restricts patient access in smaller healthcare centers. Addressing affordability challenges is essential to broaden market penetration and sustain long-term growth in therapeutic antibody use.

Regulatory and Approval Delays

Stringent regulatory processes and long approval timelines hinder the introduction of new monoclonal antibody products in Russia. Complex quality assessment and local clinical trial requirements often delay commercialization. Smaller biotech firms face additional hurdles in meeting Good Manufacturing Practice (GMP) standards. Streamlined approval pathways and harmonized regulations with global standards could accelerate innovation and product availability in the Russian market.

Regional Analysis

Central Federal District

The Central Federal District held the largest share of 36.4% in the Russia monoclonal antibodies market in 2024. Moscow and Voronezh serve as key medical and biopharmaceutical hubs with advanced oncology centers and research facilities. The region benefits from strong healthcare funding, well-developed logistics, and access to major hospitals offering monoclonal antibody therapies. Expansion of clinical research programs and collaborations with domestic biopharma firms continue to strengthen the district’s leadership position in monoclonal antibody adoption and production.

Northwestern Federal District

The Northwestern Federal District accounted for 19.8% of the market in 2024, driven by advanced healthcare infrastructure in Saint Petersburg and Kaliningrad. The presence of leading cancer and immunology institutes supports early adoption of antibody-based therapies. The district’s participation in international clinical trials and collaboration with European research centers foster innovation. Ongoing efforts to improve biologic drug distribution and strengthen tertiary care hospitals are enhancing the regional reach of monoclonal antibody treatments.

Volga Federal District

The Volga Federal District captured a 15.6% share in 2024, with key cities such as Kazan, Samara, and Nizhny Novgorod driving healthcare modernization. Regional hospitals have expanded the use of monoclonal antibodies for oncology and infectious diseases. Increased government support for local production and distribution of biologics is improving accessibility. Growth in diagnostic infrastructure and the establishment of specialized immunotherapy units continue to support steady adoption of advanced biologic treatments across the Volga region.

Siberian Federal District

The Siberian Federal District held an 11.2% share in 2024, supported by growing healthcare investments in Novosibirsk, Krasnoyarsk, and Irkutsk. Regional hospitals are expanding the use of monoclonal antibodies in oncology and autoimmune disease management. Government initiatives to improve healthcare access in remote areas and expand biologics cold-chain networks are boosting market growth. Collaboration between Siberian research centers and national pharmaceutical institutes continues to enhance the development and application of advanced antibody therapies.

Southern and Other Federal Districts

The Southern and other federal districts collectively accounted for 17% of the market in 2024. Cities such as Rostov-on-Don, Krasnodar, and Volgograd are leading regional adoption due to improved healthcare infrastructure and growing oncology centers. Expansion of specialty hospitals and distribution networks is enhancing biologic drug availability. Rising awareness of targeted therapies and government programs promoting regional healthcare equality are driving broader access to monoclonal antibody treatments across southern Russia and surrounding territories.

Market Segmentations:

By Type

- Humanized

- Fully human

- Chimeric

- Other types

By Application

- Oncology

- Autoimmune diseases

- Infectious diseases

- Other applications

By End User

- Hospitals

- Specialty centers

- Other end users

By Geography

- Central Federal District

- Northwestern Federal District

- Volga Federal District

- Siberian Federal District

- Southern and Other Federal Districts

Competitive Landscape

Key players in the Russia monoclonal antibodies market include BIOCAD, AbbVie, F. Hoffmann-La Roche, Amgen, Generium, Bristol Myers Squibb, Pfizer, Johnson & Johnson, Sanofi, Takeda Pharmaceutical Company, Eli Lilly and Company, Merck, Novartis, Regeneron Pharmaceuticals, Biogen, GlaxoSmithKline, Boehringer Ingelheim International, Alexion Pharmaceuticals, R-Pharm, and Nanolek. The market is marked by strong competition between global pharmaceutical giants and leading domestic manufacturers focusing on therapeutic innovation and biosimilar development. Increasing collaboration between international firms and local producers supports technology transfer, cost efficiency, and supply chain stability. Continuous investment in antibody engineering, biologics manufacturing, and clinical research enhances therapeutic accessibility. Government-backed incentives promoting domestic biologic production and import substitution are further strengthening the competitive landscape across Russia’s rapidly expanding monoclonal antibodies sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BIOCAD

- AbbVie

- Hoffmann-La Roche

- Amgen

- Generium

- Bristol Myers Squibb

- Pfizer

- Johnson & Johnson

- Sanofi

- Takeda Pharmaceutical Company

- Eli Lilly and Company

- Merck

- Novartis

- Regeneron Pharmaceuticals

- Biogen

- GlaxoSmithKline

- Boehringer Ingelheim International

- Alexion Pharmaceuticals

- R-Pharm

- Nanolek

Recent Developments

- In 2024, Johnson & Johnson submitted an application for the subcutaneous formulation of Darzalex in combination with bortezomib, lenalidomide, and dexamethasone (D-VRd) for newly diagnosed multiple myeloma patients who are eligible for an autologous stem cell transplant (ASCT).

- In 2023, BIOCAD’s original anti-CD20 monoclonal antibody authorized by the Russian Ministry of Health, divozilimab, for the treatment of relapsing multiple sclerosis.

- In 2023, BIOCAD began clinical trials for BCD-248, a bispecific mAb for the treatment of multiple myeloma.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing with steady demand for oncology and autoimmune therapies.

- Domestic manufacturers will expand biologics production capacity under national healthcare initiatives.

- Adoption of biosimilar monoclonal antibodies will increase due to cost advantages.

- Technological progress in antibody engineering will enhance therapeutic efficiency and safety.

- Government reimbursement programs will improve patient access to advanced biologic treatments.

- Collaboration between Russian and international biopharma companies will boost local innovation.

- Rising healthcare spending will strengthen hospital infrastructure for biologic administration.

- Increased clinical trials will support the development of novel monoclonal antibody therapies.

- Expanding cold-chain logistics will enhance drug distribution across remote regions.

- Ongoing regulatory reforms will streamline product approvals and accelerate market growth.