Market Overview

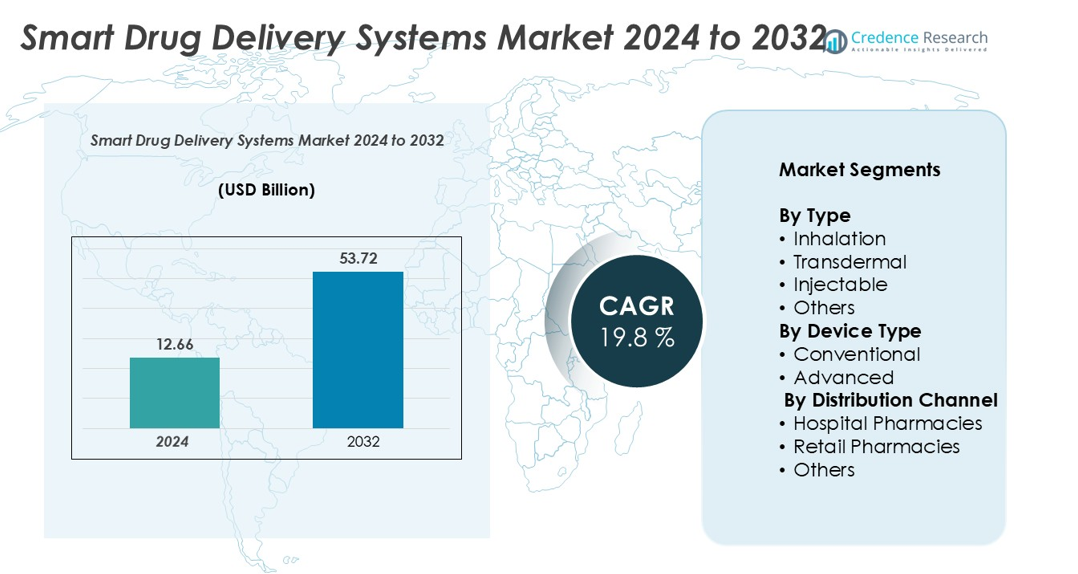

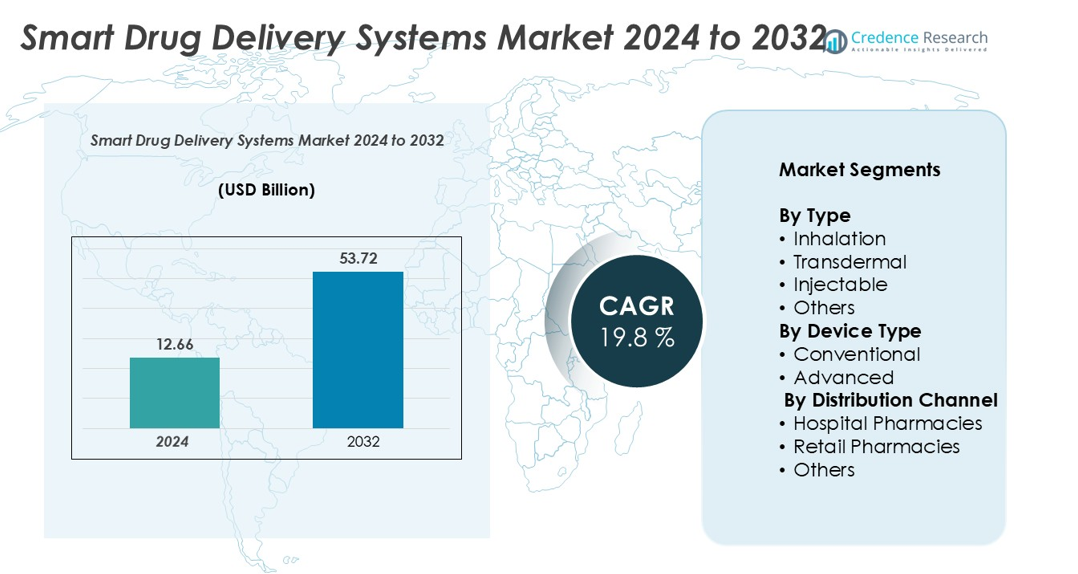

The Smart Drug Delivery Systems Market size was valued at USD 12.66 billion in 2024 and is anticipated to reach USD 53.72 billion by 2032, at a CAGR of 19.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Drug Delivery Systems Market Size 2024 |

USD 12.66 billion |

| Smart Drug Delivery Systems Market, CAGR |

19.8% |

| Smart Drug Delivery Systems Market Size 2032 |

USD 53.72 billion |

The Smart Drug Delivery Systems market is led by major players including Medtronic, Nemara, BD (Becton, Dickinson and Company), Ypsomed, E3D Elcam Drug Delivery Devices, West Pharmaceutical Services Inc., Kindeva Drug Delivery, Gerresheimer AG, and Baxter. These companies focus on developing advanced wearable injectors, smart inhalers, and connected delivery platforms to improve treatment precision and patient adherence. North America dominates the market with a 38% share, driven by strong R&D investments and early technology adoption. Europe follows with 29%, supported by robust healthcare infrastructure. Asia Pacific, holding 22%, is the fastest-growing region, fueled by rising healthcare access and expanding digital health initiatives.

Market Insights

- The Smart Drug Delivery Systems market was valued at USD 12.66 billion in 2024 and is expected to reach USD 53.72 billion by 2032, growing at a CAGR of 19.8% during the forecast period.

- Key drivers include rising chronic disease prevalence, growing demand for personalized medicine, and rapid advancements in connected drug delivery technologies.

- Injectable systems hold the largest segment share, while advanced device types lead in adoption due to improved accuracy and patient-friendly features.

- North America leads with 38% market share, followed by Europe at 29% and Asia Pacific at 22%, reflecting strong regional demand and technology adoption.

- The market faces restraints such as high device costs and strict regulatory requirements, but strong competition among key players like Medtronic, BD, Baxter, and Gerresheimer is driving innovation and expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The injectable segment dominates the Smart Drug Delivery Systems market with the largest share. High precision, rapid onset of action, and better bioavailability drive its strong adoption across chronic disease treatments. Inhalation and transdermal segments are gaining traction due to their non-invasive nature and patient convenience. Injectable systems remain preferred in hospital settings and critical care therapies. Increasing demand for controlled-release formulations and targeted delivery further strengthens this segment’s position in the market.

- For instance, BD (Becton, Dickinson and Company) launched the BD Intevia™ 1 mL disposable autoinjector platform, a robust, two-step device designed for high-viscosity biologics. The company later developed and received a “GOOD DESIGN” award for the BD Intevia™ 2.25 mL version in 2020. The 2.25 mL autoinjector is integrated with the BD Neopak™ XtraFlow™ 2.25 mL pre-fillable glass syringe and can deliver drugs with viscosities up to 40 cP. BD enables pharmaceutical partners to control the injection flow rate, which varies based on the specific drug formulation and viscosity.

By Device Type

The advanced device segment holds the dominant market share, supported by its enhanced accuracy and real-time monitoring features. These systems enable programmable dosing, improving patient adherence and therapeutic outcomes. Conventional devices maintain steady demand in low-resource settings due to their cost efficiency. Growth in connected devices and wearable drug delivery systems accelerates adoption of advanced solutions, especially in personalized medicine and home healthcare.

- For instance, Ypsomed’s YpsoDose wearable injector can deliver up to 10 mL and is tested for ISO 11608 compliance, but publicly available information does not specify a flow control accuracy of ±0.1 mL.

By Distribution Channel

Hospital pharmacies lead the market, holding the highest share due to the increasing use of smart drug delivery systems in inpatient and specialized care. They play a key role in the administration of injectable and advanced delivery devices. Retail pharmacies follow closely, driven by rising demand for home-based and chronic disease management therapies. Expanding healthcare infrastructure and higher availability of advanced delivery devices support the strong presence of hospital pharmacies in this segment.

Key Growth Drivers

Advancements in Drug Delivery Technologies

Rapid technological advancements in microelectromechanical systems (MEMS), nanotechnology, and connected healthcare devices are propelling market growth. Smart drug delivery platforms now feature programmable dosing, wireless connectivity, and patient monitoring functions. These innovations enhance drug efficacy while minimizing adverse effects. Integration with mobile applications and AI-driven analytics supports personalized care and remote patient management. Wearable injectors and smart inhalers are gaining strong adoption due to their ease of use and precise control. As pharmaceutical companies collaborate with medical device manufacturers to launch next-generation solutions, the availability of more sophisticated drug delivery systems continues to expand the global market footprint.

- For instance, West Pharmaceutical Services’ SmartDose® platform includes a 10 mL on-body injector for subcutaneous drug delivery. The company conducts extensive usability and validation testing, including to meet ISO 11608 standards for functional performance and dose accuracy; however, the precise infusion accuracy metric is not publicly specified.

Rising Prevalence of Chronic Diseases

The growing burden of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a major growth driver for the Smart Drug Delivery Systems market. These conditions often require long-term and precise treatment, which creates strong demand for advanced delivery platforms. Smart systems enable controlled drug release, targeted therapy, and improved patient adherence, resulting in better clinical outcomes. For instance, smart insulin delivery devices support continuous glucose monitoring and real-time dosing adjustments, reducing hospital visits. As aging populations increase globally, the need for reliable and effective drug delivery solutions is expected to rise further, boosting market expansion across hospitals, clinics, and home healthcare settings.

- For instance, the Medtronic MiniMed 780G insulin delivery system integrates continuous glucose monitoring and automatic dose correction, providing real-time insulin adjustments every five minutes for Type 1 diabetes management.

Growing Focus on Personalized Medicine

The increasing shift toward personalized and precision medicine is driving the adoption of smart drug delivery systems. These technologies allow tailored dosing based on individual patient needs, improving therapeutic response and treatment efficiency. Smart devices collect and transmit patient data, enabling clinicians to adjust treatment plans in real time. This enhances safety and minimizes side effects. Precision delivery is particularly valuable in oncology, autoimmune disorders, and endocrine diseases, where dosage accuracy is critical. Rising investments in digital health and connected care solutions further support the integration of smart delivery platforms into personalized treatment models, strengthening their role in modern healthcare.

Key Trends & Opportunities

Integration of IoT and Wearable Technologies

The integration of Internet of Things (IoT) technologies with smart drug delivery systems is a key trend shaping the market. Wearable injectors and connected inhalers provide continuous monitoring, allowing real-time tracking of dosage and patient adherence. These devices also send data to cloud platforms, supporting predictive analytics and remote care. Pharmaceutical companies are leveraging IoT to improve patient engagement and treatment outcomes. This creates strong opportunities for expanding smart delivery applications in chronic disease management. The growing use of mobile health apps and digital therapeutics further accelerates the adoption of IoT-enabled drug delivery solutions globally.

- For instance, Ypsomed offers connected devices, such as the YpsoMate autoinjector with the reusable SmartPilot add-on, which features Bluetooth connectivity to transmit adherence and injection data to cloud platforms. This technology is part of Ypsomed’s broader digital health network, which supports remote monitoring and customized solutions for pharmaceutical partners across many countries.

Expanding Home Healthcare and Self-Administration

Rising demand for home-based treatment and self-administration of therapies presents a significant opportunity for the market. Smart drug delivery systems enable patients to manage chronic conditions outside hospital settings with minimal supervision. This reduces healthcare costs and improves quality of life. Advanced delivery devices with automated dosing and user-friendly interfaces are increasingly adopted in diabetes, respiratory disorders, and oncology care. Healthcare providers are also encouraging remote monitoring programs, making self-administered therapies more accessible. This trend aligns with the global movement toward decentralized healthcare delivery and supports market growth across both developed and emerging economies.

- For instance, Medtronic’s MiniMed 780G insulin pump delivers automated basal and bolus insulin dosing with a data update frequency of every 5 minutes. The system enables remote patient management through its CareLink platform and is available in more than 100 countries.

Key Challenges

High Cost of Smart Drug Delivery Devices

One of the major challenges facing the market is the high cost of advanced smart drug delivery systems. Technologies such as implantable pumps, wearable injectors, and connected inhalers involve expensive components and complex manufacturing. This increases the final product price, limiting adoption in low-income regions. Even in developed markets, reimbursement gaps and limited insurance coverage pose financial barriers for patients. High cost also impacts hospital procurement budgets, slowing large-scale implementation. Addressing this challenge requires increased government support, better reimbursement models, and cost optimization through large-scale production and technological standardization.

Stringent Regulatory Approvals and Data Security Concerns

Smart drug delivery systems face strict regulatory requirements due to their integration of drugs, devices, and digital technologies. Compliance with multiple safety, efficacy, and cybersecurity standards often delays product approvals and increases development costs. In addition, connected devices raise concerns about patient data privacy and security, which can limit adoption in sensitive healthcare environments. Companies must invest heavily in regulatory compliance, data encryption, and cybersecurity frameworks to meet global standards. Navigating these complex approval pathways remains a key hurdle for market players, especially small and mid-sized companies aiming to scale globally.

Regional Analysis

North America

North America holds the largest market share of 38% in the Smart Drug Delivery Systems market. Strong healthcare infrastructure, advanced R&D capabilities, and high adoption of digital health solutions drive growth in this region. The United States leads with extensive use of smart injectors and wearable devices in chronic disease management. Favorable reimbursement policies and strong investments in connected healthcare accelerate market expansion. Major pharmaceutical and medtech companies actively develop and commercialize innovative delivery platforms. Rising demand for home healthcare and remote patient monitoring further strengthens North America’s leadership in smart drug delivery adoption.

Europe

Europe accounts for 29% of the global Smart Drug Delivery Systems market share. The region benefits from growing government support for digital healthcare innovation and expanding use of precision medicine. Germany, France, and the United Kingdom lead in adoption, driven by well-established healthcare systems and early technology integration. Increasing prevalence of chronic diseases and rising awareness of patient-centric care support market growth. Regulatory harmonization across the EU also encourages faster product approvals. Strong collaborations between pharmaceutical companies and technology developers continue to boost the regional market, particularly in smart injectors and connected inhaler technologies.

Asia Pacific

Asia Pacific holds a 22% market share and represents the fastest-growing region in the Smart Drug Delivery Systems market. Rapid healthcare infrastructure development, rising disposable income, and growing chronic disease prevalence drive strong demand. China, Japan, and India are key growth hubs due to expanding access to advanced therapies. Governments in the region are increasingly supporting digital health adoption and telemedicine initiatives. Pharmaceutical companies are forming partnerships with local device manufacturers to expand their presence. Growing home healthcare adoption and rising investment in connected technologies make Asia Pacific a major future growth contributor.

Latin America

Latin America accounts for 6% of the Smart Drug Delivery Systems market share. The region shows steady growth supported by improving healthcare infrastructure and rising awareness of advanced drug delivery methods. Brazil and Mexico lead regional adoption, with growing investments in smart injectors and inhalation devices. Increased focus on affordable technologies and partnerships between local and global players strengthen the market base. While adoption is slower compared to developed regions, expanding private healthcare coverage and government initiatives to modernize health systems are expected to drive future growth opportunities across the region.

Middle East & Africa

The Middle East & Africa region holds a 5% market share in the Smart Drug Delivery Systems market. Market growth is supported by increasing healthcare modernization programs and rising investments in digital health. Countries like the UAE and Saudi Arabia are early adopters of connected medical technologies. Expanding hospital infrastructure and growing demand for advanced drug delivery solutions in chronic disease care strengthen regional adoption. However, limited access to high-cost devices and uneven regulatory frameworks remain challenges. Strategic collaborations and government-led health innovation programs are expected to boost future market development in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Inhalation

- Transdermal

- Injectable

- Others

By Device Type

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Smart Drug Delivery Systems market is highly competitive, with key players focusing on technological innovation, strategic collaborations, and product expansion to strengthen their market position. Leading companies include Medtronic, Nemara, BD (Becton, Dickinson and Company), Ypsomed, E3D Elcam Drug Delivery Devices, West Pharmaceutical Services Inc., Kindeva Drug Delivery, Gerresheimer AG, and Baxter. These players invest heavily in R&D to develop connected devices, wearable injectors, and smart inhalers that enhance patient adherence and therapy precision. Strategic partnerships with pharmaceutical companies accelerate product commercialization and regulatory approvals. Many companies are expanding their global footprint through acquisitions and market entry in emerging economies. Competitive differentiation is driven by device accuracy, patient-friendly interfaces, integration with digital platforms, and data security compliance. The growing demand for personalized medicine and home healthcare creates new opportunities for innovation. Continuous technological advancements and increasing regulatory approvals are expected to further intensify competition in the coming years.

Key Player Analysis

- Medtronic (Ireland)

- Nemara (France)

- BD (Becton, Dickinson and Company) (U.S.)

- Ypsomed (Switzerland)

- E3D Elcam Drug Delivery Devices (Israel)

- West Pharmaceutical Services Inc. (U.S.)

- Kindeva Drug Delivery (U.S.)

- Gerresheimer AG (Germany)

- Baxter (U.S.)

Recent Developments

- In February 2023, Innovation Zed, one of the leading key players, received the CE mark for its InsulCheck DOSE, a single-unit add-on device for insulin pen injectors.

- In August 2022, Baxter announced the U.S. FDA Clearance of the Novum IQ Syringe Infusion Pump with Dose IQ Safety Software. The Novum IQ Syringe infusion pumps precisely deliver small amounts of fluid at low rates, frequently in pediatric, neonatal or anesthesia care settings.

- In June 2022, Gufic Biosciences Ltd launched a new drug delivery system, dual-chamber bags, in India. These dual-chamber IV bags are made of polypropylene with peelable aluminum foil, allowing the storage of unstable drugs that need reconstitution just before their administration to the patient.

- In March 2022, Novo Nordisk A/S launched NovoPen 6 and NovoPen Echo Plus — smart connected insulin pens available on prescription — in the U.K. for people with diabetes who use Novo Nordisk insulin.

Report Coverage

The research report offers an in-depth analysis based on Type, Device Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rapid adoption of connected and wearable drug delivery devices.

- Advanced AI and IoT integration will improve real-time patient monitoring and dosing accuracy.

- Injectable systems will continue to lead due to strong clinical efficiency and treatment precision.

- Home healthcare solutions will expand as patients prefer self-administered therapies.

- Partnerships between pharma and medtech companies will accelerate product development.

- Regulatory frameworks will evolve to support faster approvals of smart delivery technologies.

- Emerging markets will witness increased adoption with improved healthcare access.

- Data security and cybersecurity features will become a key focus area for manufacturers.

- Customizable and patient-centric solutions will drive product innovation.

- Market competition will intensify as new players enter with advanced digital health solutions.