Market overview

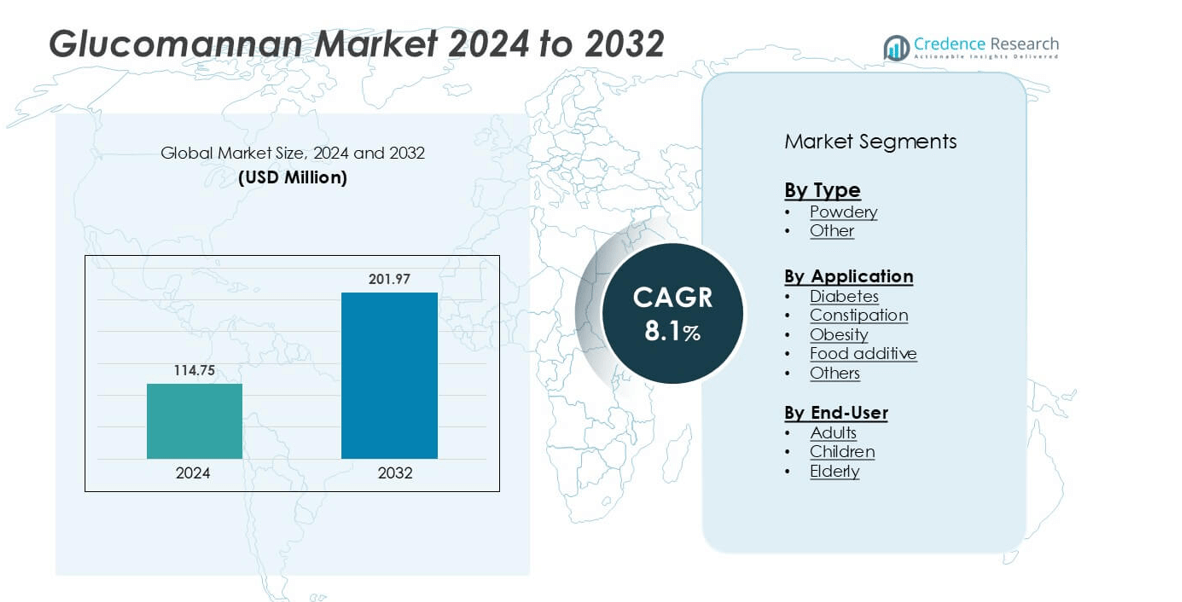

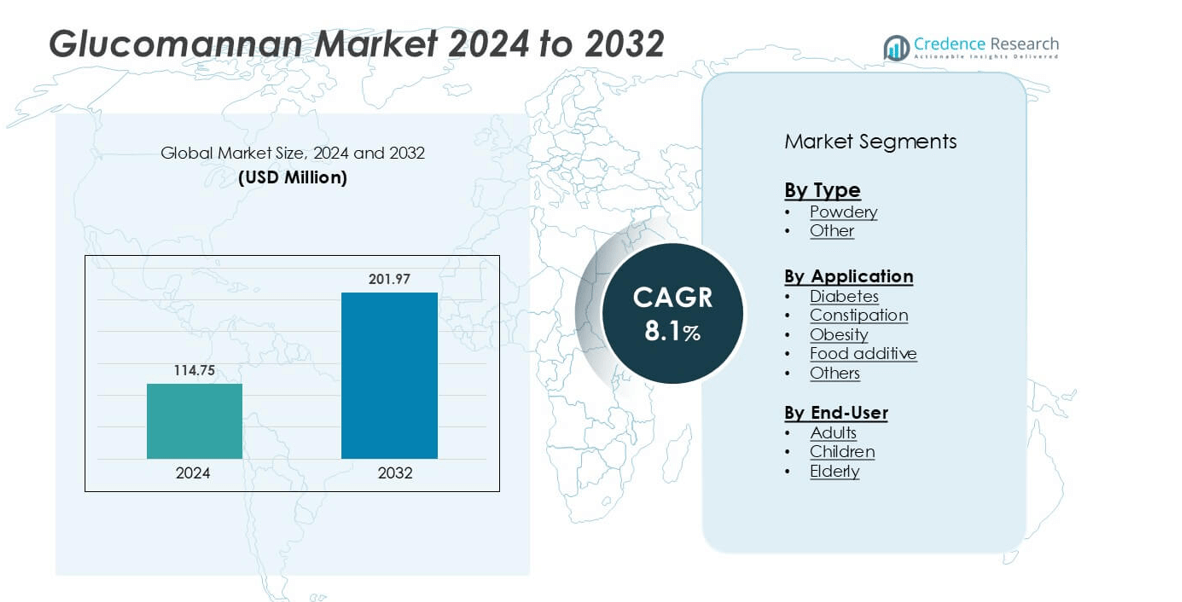

Glucomannan market size was valued USD 114.75 million in 2024 and is anticipated to reach USD 201.97 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glucomannan Market Size 2024 |

USD 114.75 million |

| Glucomannan Market CAGR |

8.1% |

| Glucomannan Market Size 2032 |

USD 201.97 million |

Leading suppliers in the global glucomannan market include NOW Foods, FMC Biopolymer, Green Fresh Group, Konjac Foods, AuNutra Industries Inc., and TIC Gums Inc. which compete through formulation innovation, supply-chain integration, and targeted B2B partnerships to serve nutraceutical and food manufacturers. North America is the leading region, accounting for 36.4% of global demand, driven by strong consumer interest in weight-management and clean-label ingredients and high per-capita supplement consumption. These companies leverage regional R&D hubs and regulatory familiarity to secure distributor relationships and scale product placement across dietary supplements, functional foods and specialty ingredients channels, collectively capturing the largest share of commercial volumes while investing in capacity and product diversification to address rising global demand.

Market Insights

- The global glucomannan market was valued at USD 114.75 million in 2024 and is projected to grow at a CAGR of 8.1% from 2024 to 2032, driven by increasing demand for natural dietary fibers and plant-based ingredients.

- Market growth is primarily driven by rising consumer awareness of weight management, digestive health, and diabetes control, boosting demand for glucomannan-based supplements and functional foods.

- Emerging trends include innovation in product formulations, expanding applications in clean-label food products, and growing adoption in nutraceuticals and pharmaceuticals.

- The competitive landscape is moderately fragmented, with major players such as FMC Biopolymer, Green Fresh Group, Konjac Foods, and AuNutra Industries focusing on product diversification and global expansion strategies.

- Regionally, North America holds around 36.4% of the market share, followed by Europe with 9% while the powdery type segment dominates with over 60% share, reflecting strong demand in dietary supplement and food applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The glucomannan market by type is primarily divided into powdery and other forms. The powdery segment dominates the market, accounting for the largest share due to its high solubility, ease of formulation, and extensive use across dietary supplements and food products. The powdered form is favored for its superior absorption and versatility in pharmaceutical and nutraceutical applications. Growing consumer preference for plant-based and clean-label ingredients further strengthens its position. Additionally, its compatibility with a variety of functional foods and beverages continues to drive demand within this segment.

- For instance, AuNutra Industries offers a glucomannan powder branded GlucoMax™ that delivers at least 95% viscosity retention and a molecular weight in the range of 200,000–2,000,000 Da, making it highly suitable for functional food and supplement uses

By Application

Based on application, the glucomannan market is segmented into diabetes, constipation, obesity, food additives, and others. The obesity segment holds the dominant market share, driven by increasing global concerns over weight management and the growing adoption of natural appetite suppressants. Glucomannan’s proven efficacy in promoting satiety and reducing caloric intake makes it a popular ingredient in slimming supplements. The rising prevalence of lifestyle-related health conditions and the shift toward preventive healthcare solutions continue to accelerate market growth in this application area.

- For instance, Low-molecular-weight glucomannan (LMW-GM) with a molecular weight of approximately 419 Da can be created through enzymatic hydrolysis. Standard, high-molecular-weight glucomannan has a much higher molecular weight (e.g., 500,000–2,000,000 Da).

By End Use

Among the broader end-use categories, food additives represent a rapidly expanding sub-segment, contributing significantly to overall market growth. The demand surge is fueled by the ingredient’s multifunctional properties, including thickening, gelling, and stabilizing capabilities, which enhance texture and quality in processed foods. Its recognition as a safe, natural, and non-allergenic additive supports its increasing adoption in bakery, confectionery, and beverage industries. Moreover, the clean-label trend and regulatory support for natural additives continue to propel the use of glucomannan across global food manufacturing sectors.

Key Growth Drivers

Rising Prevalence of Lifestyle Diseases

The increasing incidence of obesity, diabetes, and digestive disorders is a major driver of the glucomannan market. Consumers are becoming more health-conscious and are actively seeking natural solutions for weight management and metabolic health. Glucomannan, a water-soluble dietary fiber, is scientifically recognized for its ability to promote satiety, regulate blood sugar levels, and improve gut health. These attributes have boosted its inclusion in dietary supplements and functional foods. Moreover, the growing emphasis on preventive healthcare and the shift toward plant-based nutrition continue to propel demand, especially in developed economies with high awareness levels.

- For instance, AuNutra Industries Inc. markets its GlucoMax™ glucomannan powder with a molecular weight range of 200,000 to 2,000,000 Daltons and water-absorption capacity up to 50 times its weight, supporting its inclusion in satiety-focused supplements.

Expanding Applications in Food and Beverage Industry

Glucomannan’s multifunctional properties—such as thickening, stabilizing, and gelling—have expanded its use in the food and beverage sector. Food manufacturers are leveraging its natural, non-allergenic characteristics to replace synthetic additives and enhance texture and shelf life. Its increasing application in bakery, confectionery, and beverages aligns with the global clean-label movement. Moreover, consumer demand for low-calorie and high-fiber products drives innovation in glucomannan-based formulations. The ingredient’s ability to improve product viscosity and mouthfeel without adding calories makes it particularly attractive for health-focused product lines, accelerating market growth across multiple categories.

- For instance, Chibio Biotech offers a high-purity glucomannan grade with at least 95 % content and a viscosity specified at 37,000 mPa·s for a 1 % aqueous solution, allowing manufacturers to achieve targeted mouthfeel and stability in plant-based dairy alternatives.

Growing Nutraceutical and Dietary Supplement Demand

The expanding nutraceutical industry, fueled by rising consumer interest in natural and functional supplements, is a significant growth driver for the glucomannan market. Its clinically proven benefits in promoting satiety, reducing cholesterol, and aiding digestion have strengthened its position as a key ingredient in weight management and digestive health products. Increased investments in research and product development by supplement manufacturers further support market expansion. Additionally, the rising popularity of vegan and plant-based supplements enhances glucomannan’s appeal, particularly among younger, health-conscious consumers seeking natural alternatives to synthetic fibers.

Key Trends & Opportunities

Innovation in Product Formulations

Manufacturers are increasingly focusing on innovative glucomannan formulations to enhance product efficacy and consumer appeal. Advancements in encapsulation technologies and blending techniques are improving the ingredient’s stability and bioavailability. These innovations enable its use in a broader range of applications, including ready-to-drink beverages, gummies, and meal replacements. Furthermore, collaborations between nutraceutical and food companies are fostering the development of multifunctional health products that combine glucomannan with probiotics, vitamins, and minerals. This trend not only broadens market reach but also creates new opportunities for premium, value-added product lines.

- For instance, in the journal Horticulturae in 2017, aimed to create an antimicrobial film by combining KGM from Yunnan Genyun Konjac Resource Corp. with sweet basil oil.

Expanding Penetration in Emerging Markets

Emerging economies in Asia-Pacific and Latin America present significant growth opportunities for the glucomannan market. Rising disposable incomes, urbanization, and increasing awareness of dietary health benefits are fueling demand for fiber-rich foods and supplements. Countries such as China, India, and Brazil are witnessing growing adoption of functional ingredients driven by government initiatives promoting healthier diets. The availability of raw materials, particularly konjac roots, in Asian countries further strengthens supply chain advantages. This regional expansion is expected to contribute significantly to global market revenue in the coming years.

Key Challenges

Fluctuating Raw Material Availability and Prices

The glucomannan market is highly dependent on the supply of konjac roots, primarily cultivated in limited regions such as China and Japan. Seasonal variations, weather disruptions, and agricultural constraints can lead to inconsistent raw material availability and price volatility. These fluctuations affect production costs and profit margins for manufacturers. Additionally, growing global demand may strain existing supply chains, creating potential shortages. Ensuring sustainable sourcing and investing in regional cultivation expansion are critical to maintaining market stability and meeting rising demand.

Limited Consumer Awareness and Regulatory Barriers

Despite its proven health benefits, glucomannan faces limited consumer awareness in certain regions, especially in developing markets. Misconceptions regarding its safety and efficacy can hinder product adoption. Moreover, varying regulatory frameworks across countries pose challenges for manufacturers seeking product approvals and health claims. Compliance with labeling, dosage, and purity standards requires significant investment and time, delaying market entry. Addressing these issues through educational campaigns, transparent marketing, and harmonized global regulations will be essential for unlocking the market’s full growth potential.

Regional Analysis

North America

North America dominated the Glucomannan market with a 36.4% share in 2024. The region’s strong demand stems from the growing use of glucomannan in dietary supplements and functional foods. Rising obesity and diabetes rates drive higher consumption of fiber-rich products. The United States leads due to the popularity of low-carb and vegan food trends. Manufacturers are also focusing on clean-label formulations and sustainable sourcing to meet consumer expectations. Canada shows increasing adoption in nutraceuticals and weight management products, supported by favorable health awareness and government nutrition programs.

Europe

Europe accounted for a 28.9% share of the Glucomannan market in 2024. The region benefits from strong regulatory support for plant-based and high-fiber food ingredients. Demand for glucomannan in bakery, beverages, and dietary supplements continues to rise, especially in Germany, France, and the U.K. The European Food Safety Authority’s approval for glucomannan’s role in weight reduction has increased product adoption. Clean-label and organic formulations further strengthen regional growth. Increasing preference for plant-derived thickeners and low-calorie food additives supports market expansion across the region.

Asia-Pacific

Asia-Pacific held the largest share of 42.1% in the global Glucomannan market in 2024. China and Japan dominate production due to abundant konjac root availability and advanced processing infrastructure. The rising popularity of traditional foods like konjac noodles and dietary supplements supports consistent growth. Expanding applications in cosmetics, pharmaceuticals, and food processing industries boost demand. India and South Korea are witnessing strong consumption growth driven by health-conscious consumers. Growing export potential of glucomannan-based food products strengthens the region’s leadership position globally.

Latin America

Latin America accounted for a 6.2% share of the Glucomannan market in 2024. The region’s growth is driven by increasing demand for natural dietary fibers in functional foods and beverages. Brazil and Mexico lead consumption due to a growing focus on digestive health and weight management. Local manufacturers are introducing glucomannan-based supplements to meet consumer preference for plant-based ingredients. Expansion of health food retail and online distribution channels supports adoption. Rising awareness of clean-label and low-calorie diets is expected to further accelerate regional market growth.

Middle East & Africa

The Middle East & Africa represented a 3.8% share of the Glucomannan market in 2024. The market is gradually expanding, driven by increasing awareness of plant-based nutrition and dietary fiber benefits. The UAE and South Africa are key markets with rising demand for functional foods and nutraceuticals. Import-dependent supply chains from Asia-Pacific suppliers meet growing local requirements. Expanding health and wellness retail infrastructure supports product availability. As consumers prioritize sustainable and natural ingredients, glucomannan is gaining traction in premium food and supplement categories across the region.

Market Segmentations:

By Type

By Application

- Diabetes

- Constipation

- Obesity

- Food additive

- Others

By End-User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global Glucomannan market features several prominent companies such as NOW Foods, FMC Biopolymer, Green Fresh Group, Konjac Foods, AuNutra Industries Inc., and TIC Gums Inc., among others. These players lead through strategies such as product innovation, strategic partnerships, and strong geographic footprints. Producers emphasize sustainable sourcing, high-purity extraction, and technological advancements in processing to meet global quality standards. The focus on clean-label, plant-based, and functional food ingredients drives steady innovation in product formulation. Manufacturers are expanding production capacity and investing in R&D to enhance solubility, stability, and viscosity control for diverse applications. Rising adoption in dietary supplements, pharmaceuticals, and food additives strengthens the competitive landscape. Strategic alliances, joint ventures, and technology collaborations are common to maintain price stability and regional market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Konjac Foods Co., Ltd.

- FMC Corporation

- NOW Foods

- The Konjac Sponge Company

- Zeroodle

- Slendier

- Shanghai Brilliant Gum Co., Ltd.

- Henan Xin Industry Co., Ltd.

- Baoji Konjac Chemical Co., Ltd.

- Hubei Yizhi Konjac Biotechnology Co., Ltd.

- Hubei Jianshi Nongtai Industry Co., Ltd.

- Hubei Yushizhi Konjac Biotechnology Co., Ltd.

- Hubei Yizhi Konjac Biotechnology Co., Ltd.

- Hubei Jianshi Nongtai Industry Co., Ltd.

Recent Developments

- In January 2024, the Precision Nutrition Platform was deployed in clinical settings by combining the Mayo Clinic’s protocols and proficiency with Hologram’s personalized nutrition infrastructure. It included a predictive analytics capability to detect potential health risks based on dietary patterns and suggested preventive measures directly to patients.

- In September 2023, Jarrow Formulas introduced the Glucomannan + Chromium dietary supplement, which aims to support healthy blood sugar balance and insulin sensitivity. This product combines the effects of glucomannan, a soluble dietary fiber, with the trace mineral chromium, shifting the focus from general weight management to targeted metabolic support.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The glucomannan market is expected to grow steadily due to rising consumer awareness of dietary fiber benefits.

- Increasing demand for weight management and digestive health products will drive market expansion.

- Food and beverage manufacturers are likely to introduce more functional products incorporating glucomannan.

- Technological advancements in extraction, encapsulation, and blending will enhance product stability and bioavailability.

- Collaborations between nutraceutical and food companies will foster development of multifunctional health formulations.

- Expansion in emerging economies will create new market opportunities and broaden regional adoption.

- Integration of glucomannan with probiotics, vitamins, and minerals will support premium product launches.

- Regulatory support for natural and plant-based ingredients will encourage product innovation.

- Online retail and e-commerce platforms will improve market accessibility and consumer reach.

- Research on novel applications and delivery systems will sustain long-term market growth