| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Computer Aided Design (CAD) Software Market Size 2024 |

USD 11,882.64 million |

| 3D Computer Aided Design (CAD) Software Market, CAGR |

6.53% |

| 3D Computer Aided Design (CAD) Software Market Size 2032 |

USD 20,443.73 million |

Market Overview

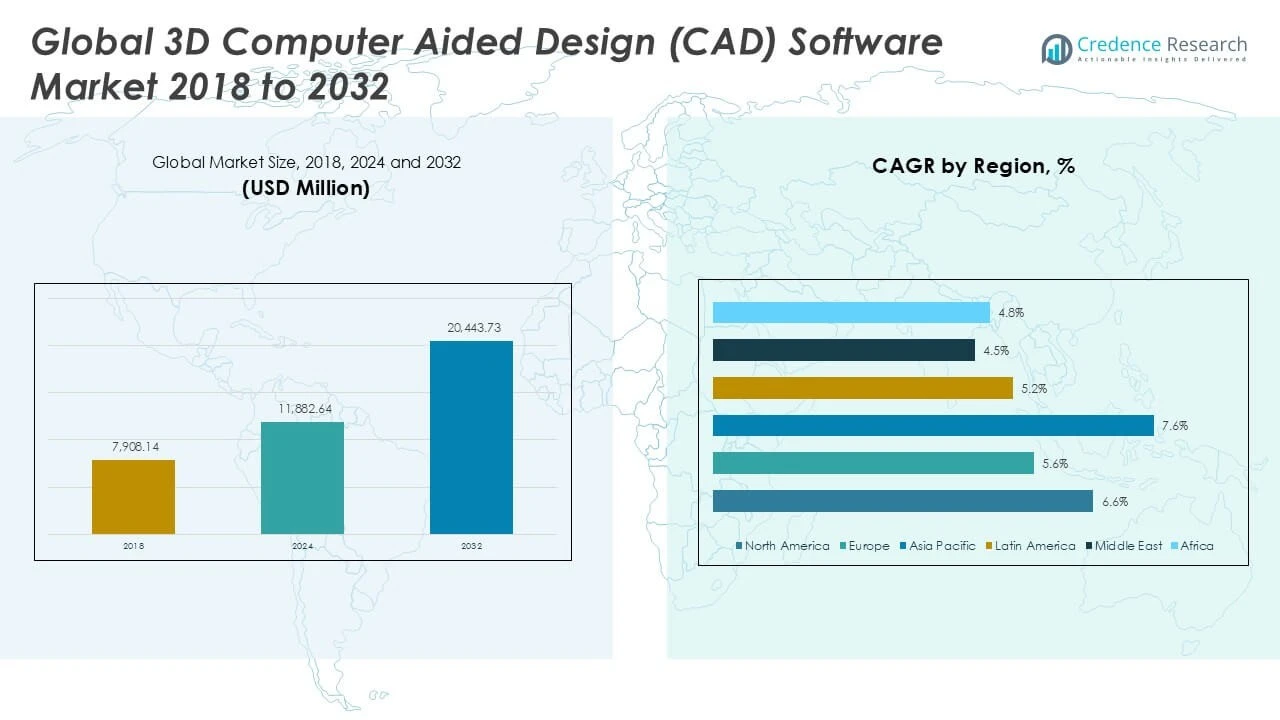

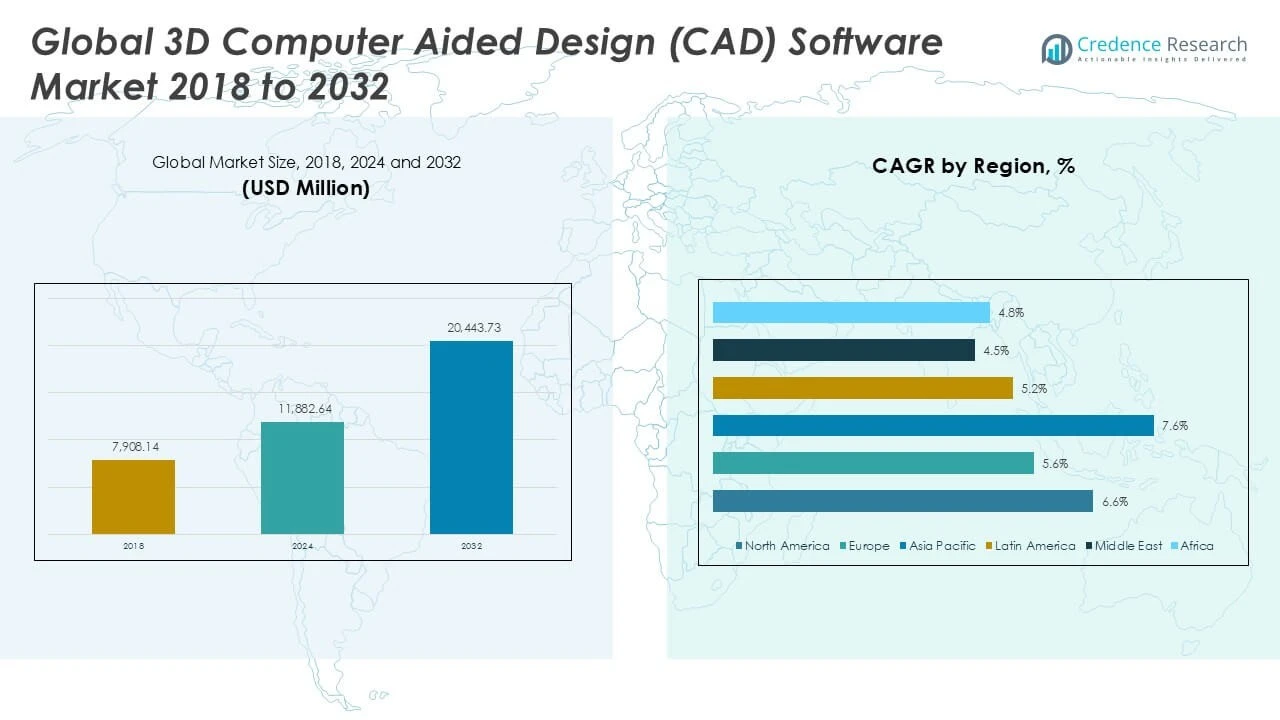

3D Computer Aided Design (CAD) Software Market size was valued at USD 7,908.14 million in 2018 to USD 11,882.64 million in 2024 and is anticipated to reach USD 20,443.73 million by 2032, at a CAGR of 6.53% during the forecast period.

The 3D Computer Aided Design (CAD) Software market is driven by the increasing demand for advanced product visualization, rapid prototyping, and efficient design-to-manufacturing workflows across industries such as automotive, aerospace, architecture, and consumer goods. Organizations are investing in digital transformation to streamline processes, reduce errors, and accelerate product development cycles, which boosts adoption of 3D CAD solutions. The market benefits from ongoing innovations in simulation, cloud-based collaboration, and integration with technologies like artificial intelligence and the Internet of Things, enabling more intelligent and automated design capabilities. Trends include the shift toward subscription-based and cloud deployment models, expanding remote design collaboration, and growing use of generative design tools to optimize performance and sustainability. As companies seek to enhance productivity and maintain competitiveness in rapidly evolving markets, the role of 3D CAD software continues to expand, shaping the future of digital engineering and product innovation.

The 3D Computer Aided Design (CAD) Software Market demonstrates robust geographical diversity, with North America, Europe, and Asia Pacific leading adoption due to advanced manufacturing, construction, and automotive industries. The United States, Germany, China, and Japan remain key countries driving growth through heavy investment in digital transformation and engineering innovation. Emerging regions such as Latin America, the Middle East, and Africa are witnessing steady adoption, supported by infrastructure development and rising demand for design automation in local industries. Companies in these regions prioritize both on-premises and cloud-based CAD solutions to address evolving project requirements. Major players shaping the global 3D CAD software landscape include Autodesk, Dassault Systèmes, and Siemens PLM Software, each offering comprehensive platforms with strong integration capabilities and industry-specific features. These leaders maintain a competitive edge through continuous product development and strategic partnerships, reinforcing the market’s dynamic and innovative nature.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The 3D Computer Aided Design (CAD) Software Market is projected to grow from USD 11,882.64 million in 2024 to USD 20,443.73 million by 2032, reflecting a CAGR of 6.53%.

- Rising demand for advanced product visualization, rapid prototyping, and seamless design-to-manufacturing workflows across manufacturing, automotive, and construction industries is a primary growth driver.

- Trends include increasing adoption of cloud-based CAD platforms, greater use of artificial intelligence and automation tools, and growing emphasis on interoperability and integration with other digital engineering solutions.

- The market remains highly competitive, with leading players such as Autodesk, Dassault Systèmes, and Siemens PLM Software continuously enhancing their product offerings and focusing on strategic collaborations to maintain leadership.

- High costs of implementation, integration challenges with legacy systems, and data security concerns present key restraints for broader adoption, especially among small and medium-sized enterprises.

- North America, Europe, and Asia Pacific dominate market revenue, driven by robust industrial infrastructure, strong investments in digital transformation, and skilled engineering talent; emerging regions like Latin America, the Middle East, and Africa are witnessing increased adoption through infrastructure and technology investments.

- Ongoing innovation, expansion into new industry verticals, and a shift toward subscription-based pricing models create new opportunities, supporting market expansion and the evolution of digital engineering capabilities globally.

Market Drivers

Rising Demand for Enhanced Product Visualization and Prototyping

The 3D Computer Aided Design (CAD) Software Market is experiencing strong growth due to the rising demand for advanced visualization and rapid prototyping across various industries. Organizations in automotive, aerospace, architecture, and consumer goods sectors seek robust solutions to create detailed digital models before moving to production. This approach reduces errors, supports iterative design processes, and helps teams visualize concepts more effectively. The capability to simulate real-world scenarios with digital twins increases confidence in product performance. It enables faster identification of design flaws, supporting better decision-making. Companies prioritize software that allows seamless modifications and design optimization, ultimately shortening development cycles.

- For instance, industries such as automotive and aerospace are increasingly adopting 3D CAD software to enhance digital modeling and reduce design errors.

Acceleration of Digital Transformation Initiatives across Industries

Businesses are accelerating digital transformation to improve efficiency and competitiveness, fueling the adoption of 3D CAD software. The move toward automation and streamlined workflows allows organizations to eliminate manual errors and boost productivity. It supports end-to-end product lifecycle management, connecting design, engineering, and manufacturing teams through integrated platforms. These initiatives drive significant investments in modern CAD solutions that enable secure collaboration and easy access to project data. The push for digitalization also aligns with the broader trend of Industry 4.0, encouraging the integration of smart technologies. It strengthens the case for widespread 3D CAD adoption among both large enterprises and small to medium-sized businesses.

- For instance, the integration of AI and machine learning into CAD software is enhancing automation and streamlining workflows.

Innovation in Cloud-Based Platforms and Collaborative Design Tools

The expansion of cloud computing and remote collaboration tools is transforming the 3D CAD software landscape. Cloud-based CAD platforms provide flexibility, real-time access, and version control, making it easier for geographically dispersed teams to work together on complex projects. It minimizes infrastructure costs and simplifies software deployment and updates. Businesses value the scalability and security features these platforms offer, ensuring uninterrupted workflow. Real-time collaboration fosters innovation and supports agile design processes. The shift toward software-as-a-service models allows organizations to manage costs more efficiently.

Integration of Advanced Technologies for Intelligent Design and Analysis

The integration of artificial intelligence, machine learning, and Internet of Things capabilities within 3D CAD software is driving the market forward. These technologies enhance design automation, support generative design, and enable predictive analysis. It equips users with tools for optimizing product performance and sustainability from the earliest design stages. Intelligent features help automate repetitive tasks and improve accuracy, allowing designers to focus on innovation. The market continues to evolve with advancements in simulation, virtual reality, and digital twins, ensuring that 3D CAD remains at the core of digital engineering strategies.

Market Trends

Growing Adoption of Cloud-Based Deployment and Subscription Licensing Models

The 3D Computer Aided Design (CAD) Software Market is witnessing a notable shift toward cloud-based deployment and subscription licensing models. Organizations prefer cloud solutions for the flexibility, scalability, and remote accessibility they offer. It allows teams to collaborate on designs from different locations, supporting hybrid and remote work environments. The subscription model reduces upfront costs and provides regular updates, ensuring that users always have access to the latest features. This approach aligns with changing business requirements and budgetary considerations. Cloud-based CAD platforms also simplify IT management, making them attractive to companies seeking streamlined operations.

- For instance, cloud-based CAD solutions are improving workflow efficiency by enabling real-time collaboration and secure access to design environments.

Expansion of Artificial Intelligence and Automation in Design Processes

Integration of artificial intelligence and automation tools within the 3D Computer Aided Design (CAD) Software Markets is transforming the design process. AI-driven features support generative design, automatically creating optimized solutions based on project constraints. It enables designers to explore a broader range of concepts with greater efficiency and accuracy. Automation helps eliminate repetitive manual tasks, reducing errors and improving workflow productivity. Companies leverage these capabilities to speed up innovation and maintain a competitive edge. The rise of AI-powered analytics within CAD platforms supports better decision-making and product development.

- For instance, AI-driven CAD tools are automating repetitive tasks and optimizing design accuracy, reducing manual intervention.

Increased Emphasis on Interoperability and Seamless Integration with Other Digital Tools

The demand for greater interoperability and integration with other engineering and business systems shapes the 3D CAD software landscape. Organizations require CAD platforms that connect smoothly with product lifecycle management (PLM), enterprise resource planning (ERP), and manufacturing execution systems (MES). It ensures seamless data exchange and collaboration across departments, reducing silos and supporting end-to-end digital workflows. Enhanced interoperability improves project outcomes and accelerates time-to-market. Vendors focus on providing open APIs and compatibility with a wide range of third-party tools. The trend toward connected digital ecosystems drives innovation and adoption of flexible CAD solutions.

Emergence of Advanced Visualization Technologies for Immersive Design Experiences

Emerging visualization technologies, such as augmented reality (AR), virtual reality (VR), and digital twin solutions, are gaining traction in the 3D Computer Aided Design (CAD) Software Market. These tools enable users to interact with 3D models in immersive environments, improving design validation and stakeholder engagement. It helps teams identify issues early and refine prototypes before physical production. The adoption of AR and VR enhances training, collaboration, and presentation capabilities, supporting efficient communication across global teams. Organizations invest in advanced visualization to enhance user experience and optimize product development processes. The growing relevance of these technologies is shaping the future direction of CAD software innovation.

Market Challenges Analysis

High Cost of Implementation and Complexity in Software Integration

The 3D Computer Aided Design (CAD) Software Market faces significant challenges related to the high cost of software implementation and integration with existing enterprise systems. Many organizations encounter budget constraints when upgrading to advanced CAD platforms or transitioning from legacy systems. It often requires substantial investments in hardware, training, and technical support. Integrating CAD solutions with other digital tools, such as PLM or ERP systems, can create compatibility issues and demand specialized expertise. The complexity of managing large datasets and maintaining interoperability increases operational burdens for both IT departments and end users. Companies must carefully evaluate total ownership costs to ensure long-term value from their software investments.

- For instance, businesses struggle with aligning digital twin technologies with outdated infrastructure, leading to operational disruptions and increased transition times.

Data Security Concerns and Shortage of Skilled Professionals

Data security and privacy remain pressing challenges in the 3D Computer Aided Design (CAD) Software Market, particularly with the rise of cloud-based platforms and global collaboration. Protecting sensitive intellectual property and proprietary design information requires robust cybersecurity measures, which not all organizations are fully equipped to deploy. It becomes increasingly difficult to ensure compliance with evolving data protection regulations across different regions. The market also faces a shortage of skilled professionals who possess both domain expertise and proficiency in advanced CAD tools. Training new users and retaining experienced talent represent ongoing obstacles for businesses seeking to maximize the return on their technology investments. These challenges can slow digital transformation and impact overall productivity.

Market Opportunities

Expansion into Emerging Markets and Untapped Industry Verticals

The 3D Computer Aided Design (CAD) Software Market offers significant growth opportunities through expansion into emerging markets and new industry verticals. Rapid industrialization and infrastructure development in regions such as Asia-Pacific, Latin America, and the Middle East increase demand for advanced design tools. It creates favorable conditions for vendors to establish local partnerships and tailor solutions for sector-specific requirements in construction, healthcare, and education. Organizations in these regions look for affordable, scalable CAD platforms that support their digital transformation goals. The ability to address the unique needs of small and medium-sized enterprises opens up new revenue streams. Companies can leverage local talent and market knowledge to drive adoption and build long-term customer relationships.

Innovation in Advanced Technologies and Customizable Solutions

The integration of artificial intelligence, cloud computing, and augmented reality presents opportunities for the 3D Computer Aided Design (CAD) Software Market to deliver enhanced value to users. It allows companies to introduce intelligent automation, predictive analytics, and immersive design experiences. Customizable CAD solutions can address niche market demands and help clients achieve greater efficiency and creativity. The rise of software-as-a-service models supports flexible deployment, making high-end design capabilities accessible to a wider user base. Vendors that prioritize user experience and seamless integration with other digital tools can strengthen their competitive advantage. Ongoing investment in R&D and partnerships with technology providers ensure that CAD platforms remain at the forefront of innovation.

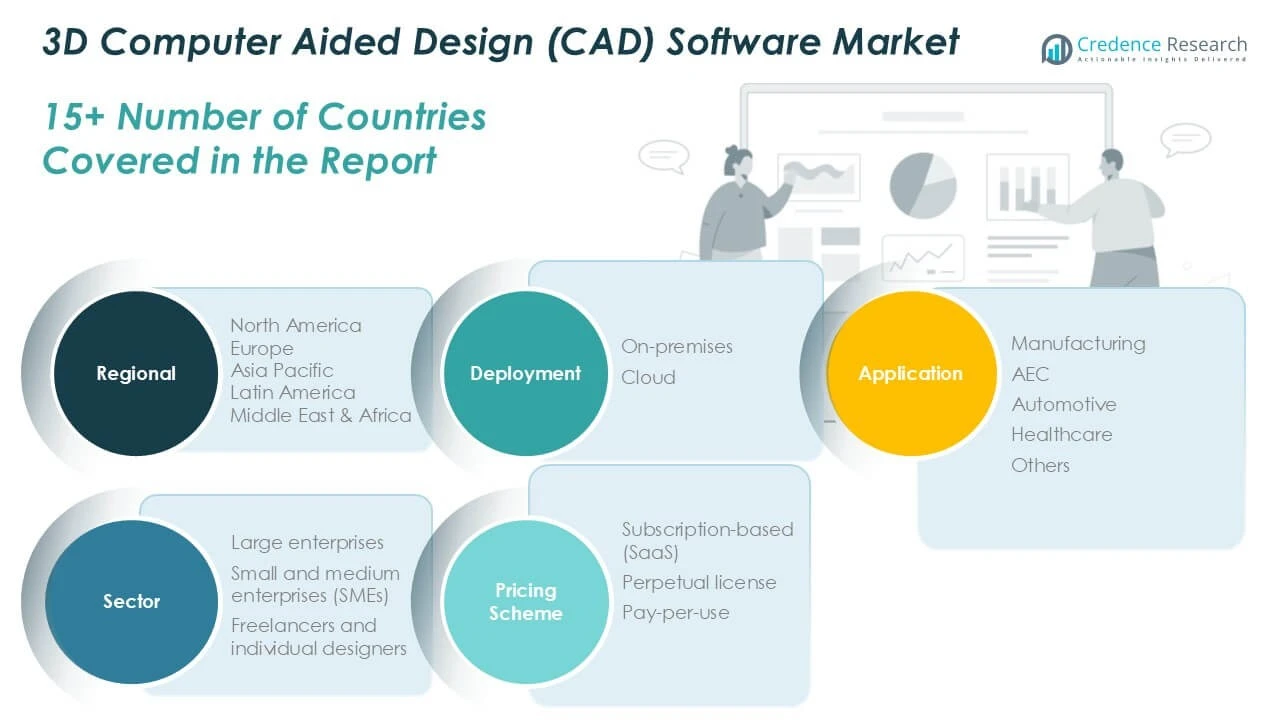

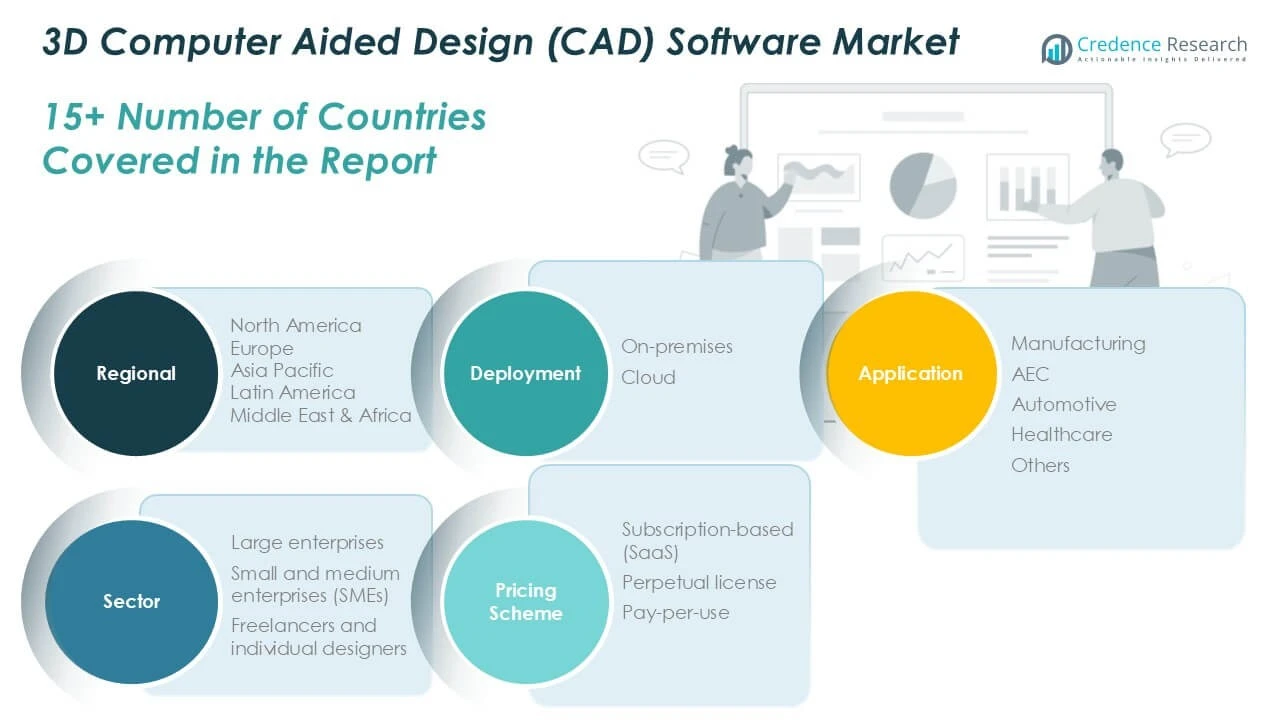

Market Segmentation Analysis:

By Sector:

On-premises solutions continue to attract organizations with rigorous data security and compliance requirements, particularly in industries where intellectual property protection is critical. Cloud-based solutions are witnessing faster growth, driven by the demand for scalability, flexibility, and remote accessibility. It supports collaborative workflows and reduces infrastructure costs, making cloud deployment especially attractive to small and medium-sized enterprises and organizations with globally distributed teams.

By Application:

Application-wise, manufacturing dominates the 3D CAD software market, driven by the need for detailed product visualization, prototyping, and efficient design-to-production processes. The architecture, engineering, and construction (AEC) segment leverages CAD for precise planning, modeling, and coordination across multi-disciplinary teams. Automotive companies rely on CAD to accelerate product development, ensure regulatory compliance, and enhance vehicle design innovation. The healthcare segment uses CAD for medical device development, prosthetic modeling, and the customization of implants, reflecting the technology’s expanding use in specialized fields. Other applications include education, consumer goods, and electronics, each adopting 3D CAD solutions to improve design accuracy and accelerate time-to-market.

By Sector Segment:

Large enterprises invest in advanced CAD platforms to streamline operations across global locations, manage complex projects, and integrate with enterprise resource planning and product lifecycle management systems. Small and medium enterprises (SMEs) seek scalable and cost-effective solutions, with many adopting cloud-based CAD platforms for operational efficiency and lower capital expenditure. Freelancers and individual designers represent a growing segment, attracted by subscription-based licensing and flexible deployment options. It allows independent professionals to access powerful design tools without substantial upfront investment.

Segments:

Based on Sector:

Based on Application:

- Manufacturing

- AEC

- Automotive

- Healthcare

- Others

Based on Sector Segment:

- Large enterprises

- Small and medium enterprises (SMEs)

- Freelancers and individual designers

Based on Pricing:

- Subscription-based (SaaS)

- Perpetual license

- Pay-per-use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America 3D Computer Aided Design (CAD) Software Market

North America 3D Computer Aided Design (CAD) Software Market grew from USD 2,730.86 million in 2018 to USD 4,049.45 million in 2024 and is projected to reach USD 6,991.49 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.6%. North America is holding a 34% market share. The United States remains the dominant contributor, driven by extensive adoption in manufacturing, automotive, and AEC sectors. Canada supports growth through investments in cloud-based design platforms and digital engineering initiatives. Strong technology infrastructure and a large base of engineering professionals support robust software adoption. The region benefits from a competitive vendor landscape and high innovation activity.

Europe 3D Computer Aided Design (CAD) Software Market

Europe 3D Computer Aided Design (CAD) Software Market grew from USD 1,865.73 million in 2018 to USD 2,681.88 million in 2024 and is expected to reach USD 4,287.00 million by 2032, growing at a CAGR of 5.6%. Europe commands a 21% market share. Germany, France, and the United Kingdom lead the market, driven by automotive, aerospace, and construction industries. Adoption of 3D CAD solutions supports digital transformation strategies and compliance with regulatory standards. Investments in Industry 4.0 technologies and a strong focus on sustainability drive continuous demand. European organizations are prioritizing integration and interoperability across digital engineering platforms.

Asia Pacific 3D Computer Aided Design (CAD) Software Market

Asia Pacific 3D Computer Aided Design (CAD) Software Market grew from USD 2,408.11 million in 2018 to USD 3,810.11 million in 2024 and is set to reach USD 7,120.24 million by 2032, reflecting a CAGR of 7.6%. Asia Pacific accounts for 35% market share. China, Japan, and South Korea are major markets, with India showing strong growth potential. Rising manufacturing investments, rapid urbanization, and government-led digitalization initiatives fuel demand for advanced design tools. Organizations in this region adopt both on-premises and cloud-based CAD solutions. Market growth is reinforced by expanding infrastructure projects and a growing pool of skilled design professionals.

Latin America 3D Computer Aided Design (CAD) Software Market

Latin America 3D Computer Aided Design (CAD) Software Market grew from USD 446.52 million in 2018 to USD 663.96 million in 2024 and is forecasted to reach USD 1,032.74 million by 2032, at a CAGR of 5.2%. Latin America holds a 5% market share. Brazil and Mexico are key contributors, leveraging CAD software to modernize manufacturing and construction sectors. Companies are prioritizing digital workflows to improve efficiency and competitiveness. Adoption is supported by partnerships with global software providers and government investments in technology-driven economic growth. The region continues to benefit from education and training initiatives aimed at building design and engineering talent.

Middle East 3D Computer Aided Design (CAD) Software Market

Middle East 3D Computer Aided Design (CAD) Software Market expanded from USD 245.15 million in 2018 to USD 339.77 million in 2024 and is projected to reach USD 502.78 million by 2032, growing at a CAGR of 4.5%. The Middle East secures a 3% market share. The United Arab Emirates and Saudi Arabia lead market activity, focusing on large-scale construction and infrastructure projects. Organizations in oil, gas, and utilities sectors increasingly integrate 3D CAD for asset management and facility design. Regional growth is supported by digitalization initiatives and strategic investments in smart city development. Demand is rising for cloud-based and mobile-friendly CAD solutions to support remote project management.

Africa 3D Computer Aided Design (CAD) Software Market

Africa 3D Computer Aided Design (CAD) Software Market grew from USD 211.78 million in 2018 to USD 337.48 million in 2024 and is expected to reach USD 509.48 million by 2032, reflecting a CAGR of 4.8%. Africa represents a 3% market share. South Africa, Nigeria, and Egypt drive demand, supported by growth in construction, energy, and education sectors. It remains an emerging market with untapped potential for cloud-based CAD adoption. Government investments in infrastructure and technical education are creating new opportunities. Organizations seek accessible and affordable CAD solutions to support national development goals and enhance local engineering capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Autodesk Inc.

- Bentley Systems, Inc.

- Bricsvs NV.

- Beijing Generous Digital Technology Co., Ltd. (CAXA)

- Dassault Systemes

- Graphisoft

- Hexagon AB

- Oracle

- PTC

- Schott Systeme GmbH

- Siemens

- Dassault Systemes Solidworks Corporation

- ZWSOFT Co., Ltd.

Competitive Analysis

The 3D Computer Aided Design (CAD) Software Market is defined by intense competition and rapid innovation, with leading players such as Autodesk, Dassault Systèmes, Siemens PLM Software, and PTC consistently driving industry standards. These companies maintain strong global footprints and continually invest in research and development to advance the capabilities of their CAD platforms. These organizations invest in features such as artificial intelligence integration, cloud deployment, and advanced simulation tools to provide comprehensive design platforms. The market environment encourages differentiation through industry-specific modules, flexible licensing models, and seamless interoperability with other digital engineering tools. Strong emphasis is placed on enhancing user experience, enabling greater collaboration, and improving workflow efficiency across diverse sectors. Companies pursue strategic alliances and acquisitions to strengthen their portfolios and expand global reach. This dynamic competitive landscape pushes all participants to innovate, adapt, and respod swiftly to shifting technological trends and client expectations.

Recent Developments

- In May 2023, PTC unveiled the latest edition of Creo+, a CAD solution offered as a software-as-a-service. Creo+ combines the reliable features and capabilities of Creo with cloud-based tools to simplify CAD administration and augment design collaboration. This new version empowers customers to design with greater ease, speed, and collaboration.

- In February 2023, Nextech AR Solutions Corp. introduced the latest Quad Topology Converter Update for Toggle3D. This update positions Toggle3D as the leading CAD to web 3D design platform, allowing users to create quad tessellations. This enhancement significantly enhances the overall quality of 3D models.

- In December 2022, IronCAD has improved its CAD software to help customers design products more efficiently. They recently launched IRONCAD 2023, with several enhancements that make it easier to innovate and bring designs to life faster. These improvements include 2D drawing views, better performance for 3D assemblies, 3D curve constraints, 3D positional constraint categories, and more detailed 3D designs and environments.

- In September 2022, in collaboration with Ansys, Autodesk unlocked the innovative product design and manufacturing proficiencies of Fusion 360 at AU 2022. The new update enables faster iteration, automates the machine software design process, and brings Fusion’s power and agility to the user’s browser or device.

Market Concentration & Characteristics

The 3D Computer Aided Design (CAD) Software Market displays moderate to high market concentration, with a small group of global firms accounting for a substantial share of total revenue. It is characterized by a strong emphasis on research and development, continuous technological advancement, and the integration of cloud, AI, and simulation technologies into core product offerings. The market favors solutions that deliver scalability, interoperability, and user-friendly interfaces to serve a wide spectrum of industries, including manufacturing, automotive, AEC, and healthcare. Leading vendors set industry benchmarks for quality, security, and performance, while also supporting flexible licensing models that attract both large enterprises and individual professionals. Rapid innovation cycles, high client switching costs, and the strategic importance of ongoing software updates define the competitive landscape. It values collaboration, seamless workflow integration, and industry-specific customization, reinforcing its essential role in global digital engineering and design.

Report Coverage

The research report offers an in-depth analysis based on Sector, Application, Sector Segment, Pricing and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The 3D computer aided design (CAD) software market is expected to grow with increasing demand across manufacturing, automotive, and aerospace sectors.

- Advancements in simulation and digital twin technologies will enhance the capabilities of 3D CAD tools.

- Cloud-based deployment models are gaining traction due to their scalability and remote accessibility.

- Integration of artificial intelligence is expected to streamline design processes and improve automation.

- The rise in product customization and complex engineering requirements will boost software adoption.

- Educational institutions and training centers are increasingly incorporating CAD software into their curricula.

- Small and medium enterprises are adopting cost-effective 3D CAD solutions to improve productivity.

- The expansion of 3D printing technology will continue to support the growth of CAD software usage.

- Software vendors are focusing on user-friendly interfaces and enhanced compatibility with other tools.

- Strategic mergers and acquisitions are expected to strengthen product portfolios and market presence.