Market Overviews

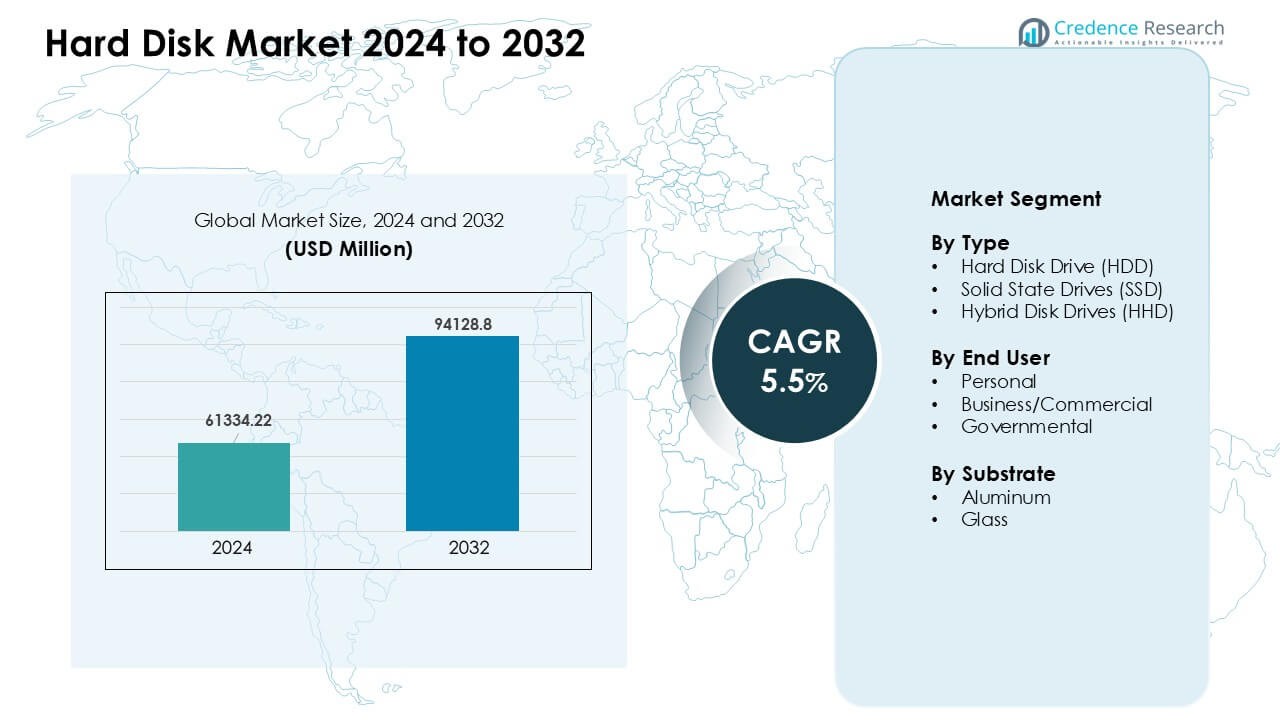

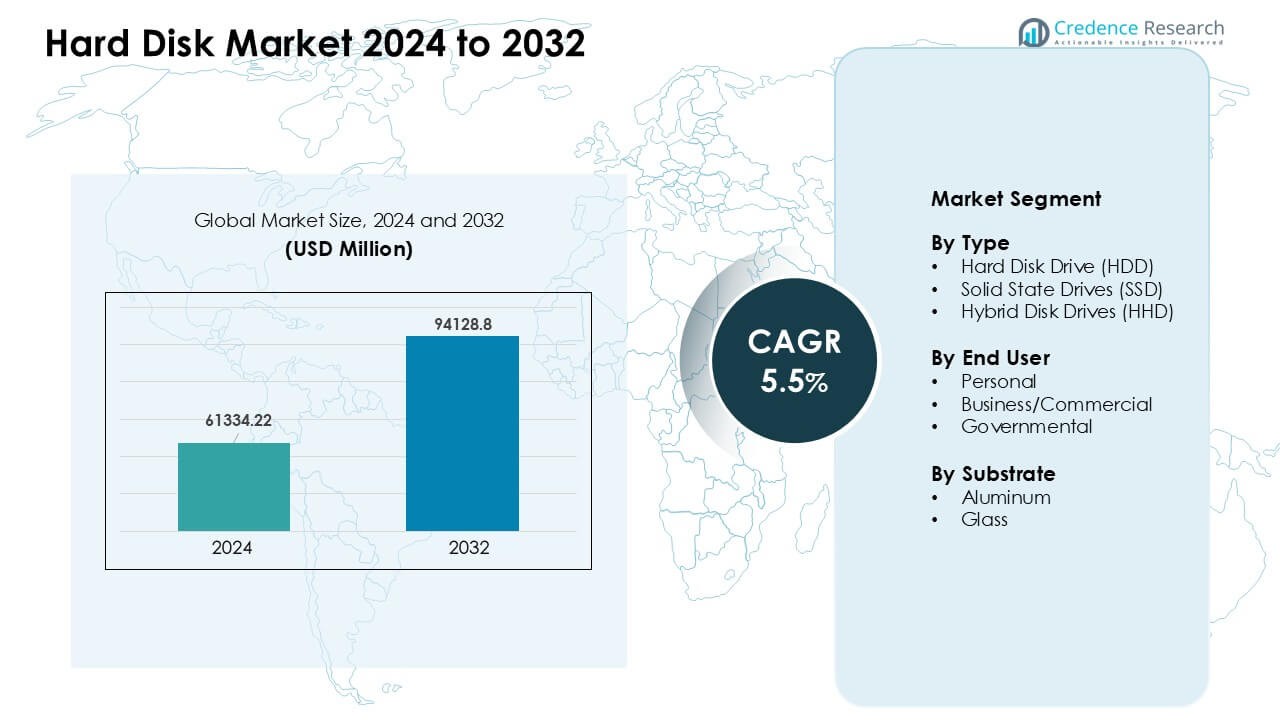

Hard Disk Market was valued at USD 61334.22 million in 2024 and is anticipated to reach USD 94128.8 million by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hard Disk Market Size 2024 |

USD 61334.22 Million |

| Hard Disk Market, CAGR |

5.5% |

| Hard Disk Market Size 2032 |

USD 94128.8 Million |

Top players in the Hard Disk Market include Samsung Electronics, ADATA Technology, Transcend Information, Silicon Power, Seagate Technology, Dell Technologies, Western Digital, ioSafe, Acer Inc., and Lenovo Group Limited. These companies drive competition through high-capacity HDD development, faster and more durable SSD innovations, and tailored solutions for cloud, enterprise, and consumer storage needs. Strong R&D focus and global distribution networks support steady product upgrades and wider market reach. North America emerged as the leading region in 2024 with a 34% share, driven by large data-center expansion, rapid digital adoption, and rising enterprise storage demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hard Disk Market reached USD 22 million in 2024 and is projected to hit USD 94128.8 million by 2032, growing at a CAGR of 5.5%.

- Rising data creation from cloud services, surveillance networks, and enterprise workloads drives strong demand for high-capacity HDDs and SSDs, with HDDs holding about 54% share in 2024.

- Key trends include fast SSD adoption in laptops and business systems, along with growing demand for ultra-high-capacity enterprise drives as AI and analytics workloads expand.

- The market remains competitive as leading players enhance storage density, efficiency, and durability while facing pressure from SSD price drops and increasing cloud-based storage reliance.

- North America led regional demand in 2024 with 34% share, followed by Asia Pacific at 31%, while commercial users dominated the end-user segment with nearly 46% share.

Market Segmentation Analysis:

By Type

Hard Disk Drive (HDD) led the type segment in 2024 with about 54% share. Many buyers picked HDDs due to lower cost per gigabyte and strong use in bulk storage. Cloud vendors and PC makers used HDDs for large, cold-storage setups where capacity mattered more than speed. SSDs grew fast as flash prices dropped and demand for quick boot speeds increased across laptops and gaming systems. Hybrid Disk Drives stayed niche but served users who wanted mid-range speed and moderate capacity without paying full SSD prices.

- For instance, Seagate in its Q2 2024 results reported that Mass Capacity HDDs contributed 83% of total HDD revenue, underscoring how enterprise-grade, high-capacity HDDs remained central to bulk and cold storage deployments.

By End User

Business and commercial users dominated the end-user segment in 2024 with nearly 46% share. Large firms relied on high-capacity drives for servers, analytics tasks, and backup setups. Strong digital adoption, rising data logs, and storage needs from AI tools supported higher orders. Personal users boosted SSD sales in laptops and desktops as device makers pushed thin designs. Government buyers raised spending on secured storage for surveillance, defense data, and citizen records, but the commercial sector stayed ahead due to broader and steady demand.

By Substrate

Aluminum substrates held the largest share in 2024 with about 62%. Drive makers used aluminum because the material offered low cost, easy machining, and stable performance for high-volume HDD output. The durability and shock resistance supported wide use in desktop and server drives. Glass substrates grew in premium HDDs as brands aimed for higher track density and smoother surfaces. Rising demand for large enterprise drives encouraged more testing of glass-based platters, but aluminum stayed dominant due to strong supply chains and lower production expenses.

- For instance, Western Digital confirmed that its high-capacity HDD platforms continue to use aluminum platters across multiple product lines, supporting consistent yields and large-scale manufacturing efficiency.

Key Growth Drivers

Surge in Global Data Generation

Rising data creation across cloud services, streaming platforms, surveillance networks, and enterprise systems drives steady demand for high-capacity hard disks. Companies collect larger data logs from AI workloads, user analytics, and digital applications, which require scalable and low-cost storage. HDDs remain essential for bulk and archival needs where capacity outweighs speed. Data centers expand racks to store long-term files, backups, and video archives, boosting multi-terabyte drive orders. Personal and commercial users also add external drives for photos, media, and project backups. This surge in data volume keeps demand strong, especially in enterprise and cloud storage setups.

- For instance, Western Digital stated that its nearline HDD platforms are widely used by hyperscale cloud customers, with individual drive capacities exceeding 20 TB to support dense and cost-efficient storage clusters.

Growing Adoption of Cloud and Hybrid IT Models

Cloud vendors and enterprises push storage expansion as hybrid IT models gain more use worldwide. Companies run mixed setups that combine on-premise servers with public cloud platforms, raising the need for flexible, high-capacity hard disks. HDDs deliver cost efficiency for long-term data retention, while SSDs handle performance-driven tasks. Businesses increase storage pools to support digital transformation, remote work systems, and rising software workloads. Service providers deploy large storage clusters that rely on multi-disk arrays for redundancy and uptime. This shift toward blended IT environments supports stable growth in both HDD and SSD shipments.

Expansion of Surveillance and Edge Storage Needs

Security systems and smart-city projects depend on continuous video capture, which increases the use of surveillance-grade hard disks. Cameras produce high-resolution footage that must be stored for long durations, pushing government and commercial buyers toward high-capacity drives. Edge setups in retail, transportation, and industrial sites rely on local storage for quick access and backup security. Many organizations expand surveillance networks and require reliable disks built for 24/7 workloads. Higher camera counts, sharper video quality, and regulatory rules for longer retention all raise storage needs. This trend keeps demand strong for durable and high-capacity HDDs.

- For example, Toshiba Electronics Europe states that its S300 Surveillance HDDs support 24/7 operation. The company also specifies workload ratings of up to 180 TB per year for these drives. These features align with continuous video recording and multi-camera surveillance systems.

Key Trend & Opportunity

Shift Toward High-Capacity Enterprise Drives

Enterprises upgrade storage arrays to higher-capacity HDDs as AI, analytics, and cloud tools increase data loads. Brands invest in advanced recording technologies, such as heat-assisted magnetic recording, to expand terabyte limits. This shift creates chances for vendors to offer ultra-high-capacity drives designed for large datasets and long-term retention. Cloud providers look for drives that balance cost, density, and reliability. As workloads grow, firms adopt multi-petabyte systems, opening strong opportunities for performance improvements and new enterprise-focused storage solutions. The move toward large-scale storage helps vendors differentiate through durability, speed stability, and better power efficiency.

- For instance, Seagate confirmed that its Mozaic HAMR platform achieved 4 TB per platter, enabling a 40 TB-class HDD design for enterprise data centers.

The company reported active customer sampling of these HAMR-based drives as part of its high-capacity roadmap.

Rising Use of SSDs in Consumer and Commercial Devices

The falling cost of flash storage and strong demand for fast boot times push SSD adoption across laptops, desktops, and small business servers. Device makers shift toward SSD-centric designs for portability and speed. This creates openings for storage vendors to expand product lines across entry-level, mid-range, and high-performance SSDs. SSDs also support gaming, creative workloads, and mobile productivity tools. Commercial buyers upgrade to SSDs for better security, quick data access, and reduced downtime. As flash density improves and price gaps narrow, SSDs offer a fast-growing opportunity for higher-margin storage products across global markets.

- For instance, Samsung Electronics specifies that the 990 PRO NVMe SSD delivers sequential read speeds up to 7,450 MB/s. The company positions this drive for high-performance PCs, workstations, and professional workloads.

Growth in Edge Computing and Industrial Automation

Edge locations such as factories, retail stores, and logistics hubs generate more local data as automation expands. These sites need reliable storage that handles temperature shifts, vibration, and continuous workloads. HDD and SSD makers gain chances to create ruggedized models for industrial setups. Automated systems, robotics, and IoT sensors add constant data streams that require quick local access before transferring files to the cloud. The rise of smart infrastructure and real-time analytics increases interest in high-endurance storage devices. Vendors can grow by offering tailored solutions that meet evolving edge performance and durability needs.

Key Challenge

Competition from Cloud-Based Storage Alternatives

Many businesses move data to cloud platforms to reduce hardware management costs, creating pressure on physical drive sales. Cloud services offer subscription-based access, scaling options, and built-in redundancy, reducing demand for on-premise storage. This shift affects small and mid-sized firms that prefer paying monthly fees over buying hardware. Some workloads no longer require local drives, lowering enterprise HDD orders. Vendors must adapt by targeting data centers directly or offering hybrid solutions. The challenge grows as cloud platforms improve performance and storage optimization tools, pushing hardware makers to justify long-term value and lower total cost of ownership.

Rapid SSD Advancements Impacting HDD Demand

SSDs continue to gain share as flash memory prices drop and performance improves. Many buyers choose SSDs for faster boot times, better durability, and silent operation. This trend reduces demand for HDDs, especially in personal devices and thin-form laptops. Enterprises also replace older HDD units in performance-critical systems with SSDs. As SSD capacities expand, the cost gap narrows, creating more pressure on traditional hard disk shipments. HDD makers must focus on ultra-high-capacity drives and specialized segments to stay relevant. This shift challenges long-term HDD growth and forces stronger innovation cycles.

Regional Analysis

North America

North America led the hard disk market in 2024 with about 34% share. Strong data-center expansion and rising cloud storage needs kept demand high across major U.S. and Canadian enterprises. Large tech firms invested in multi-petabyte storage to support AI, analytics, and streaming platforms. Consumer upgrades toward SSD-based laptops also grew, while external HDDs stayed popular for backups. Public sector projects and rising surveillance networks further boosted drive adoption. The region’s mature IT base and continuous digital growth kept North America ahead in both enterprise and consumer storage categories.

Europe

Europe held nearly 27% share in 2024, driven by strong enterprise digitalization across Germany, the U.K., France, and the Nordics. Companies expanded storage systems to support cloud adoption and regulatory compliance for data retention. High-capacity HDDs found wide use in financial services, telecom, and manufacturing sectors. SSD shipments also increased as firms upgraded workstations and servers. Surveillance storage demand continued to rise across public infrastructure. Despite cost pressures and slower PC refresh cycles, Europe maintained steady market activity supported by advanced industrial systems and strong investment in secure and scalable storage solutions.

Asia Pacific

Asia Pacific captured the largest growth momentum in 2024 with around 31% share. China, Japan, South Korea, and India drove strong demand from data centers, consumer electronics, and enterprise IT expansion. Rapid growth in e-commerce, 5G rollout, and digital payments increased storage needs across regional businesses. Local laptop and smartphone makers pushed high SSD adoption, while large cloud providers added massive HDD volumes for bulk storage. Strong manufacturing ecosystems and high-volume production also supported competitive pricing. Asia Pacific’s fast digital shift and rising device shipments positioned the region as the most dynamic contributor to global demand.

Latin America

Latin America accounted for roughly 5% share in 2024, supported by steady adoption of cloud services, surveillance systems, and enterprise storage upgrades. Brazil, Mexico, and Chile led regional demand as companies modernized IT infrastructure and expanded digital operations. Growth in online banking, mobile services, and public-sector digitalization raised storage requirements. Consumer HDDs and SSDs saw moderate demand in PC upgrades and gaming systems. Limited manufacturing capacity and economic fluctuations slowed broader uptake, but rising cloud and security investments helped maintain stable market activity across the region.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, driven by growing data-center development in the UAE, Saudi Arabia, and South Africa. Governments expanded smart-city, surveillance, and digital service projects, raising storage demand. Enterprises in banking, telecom, and energy increased investment in secure storage systems. Consumer SSD adoption also rose as device upgrades gained pace. However, uneven digital infrastructure and higher hardware costs restricted wider penetration. Despite these constraints, the region showed steady growth led by national digital transformation plans and expanding cloud footprints.

Market Segmentations:

By Type

- Hard Disk Drive (HDD)

- Solid State Drives (SSD)

- Hybrid Disk Drives (HHD)

By End User

- Personal

- Business/Commercial

- Governmental

By Substrate

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hard disk market features major players such as Samsung Electronics, ADATA Technology, Transcend Information, Silicon Power, Seagate Technology, Dell Technologies, Western Digital, ioSafe, Acer Inc., and Lenovo Group Limited. These companies compete through advancements in storage density, energy efficiency, durability, and performance across HDDs, SSDs, and hybrid drives. Leading brands focus on developing high-capacity enterprise drives to meet rising data-center workloads while expanding SSD portfolios for consumer and commercial devices. Many firms strengthen global distribution networks, enhance security features, and expand service offerings to support cloud, surveillance, and industrial applications. Intense R&D investment and frequent product upgrades help vendors maintain competitive positions as demand grows for scalable, cost-effective, and high-speed storage solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung Electronics

- ADATA Technology Co., Ltd.

- Transcend Information, Inc.

- Silicon Power

- Seagate Technology

- Dell Technologies Inc.

- Western Digital

- ioSafe

- Acer Inc.

- Lenovo Group Limited

Recent Developments

- In March 2025, Samsung announced its next-gen SSD lineup: the “9100 PRO Series” with PCIe 5.0 positioning itself for high-performance storage requirements.

- In October 2024, Western Digital launched and began shipping its UltraSMR HDD line with capacities up to 32TB, the highest-capacity ePMR-based hard disks, aimed at hyperscale, cloud, and AI data-center workloads that need dense, low-TCO storage.

- In April 2024, Lenovo Group Limited launched new ThinkCentre tower desktops powered by AMD Ryzen Pro 8000-series processors, offering hybrid storage options that combine PCIe Gen4 SSDs with up to 2TB 3.5″ SATA HDDs to balance performance and high-capacity hard disk storage for enterprise customers.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User, Substrate and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hard disk demand will rise as global data generation accelerates across industries.

- Enterprise buyers will adopt larger-capacity HDDs to support AI, analytics, and cloud workloads.

- SSD penetration will expand in consumer and commercial devices as flash prices decline.

- Hybrid storage models will gain traction in data centers for balanced cost and performance.

- Surveillance networks will drive steady demand for high-endurance HDDs.

- Edge computing growth will boost need for rugged and reliable storage devices.

- Manufacturers will invest in new recording technologies to increase drive density.

- Competition will intensify as vendors enhance durability, speed, and energy efficiency.

- Cloud adoption will shape long-term storage strategies for enterprises and service providers.

- Emerging digital economies will create new opportunities across APAC, Latin America, and MEA.