Market Overview

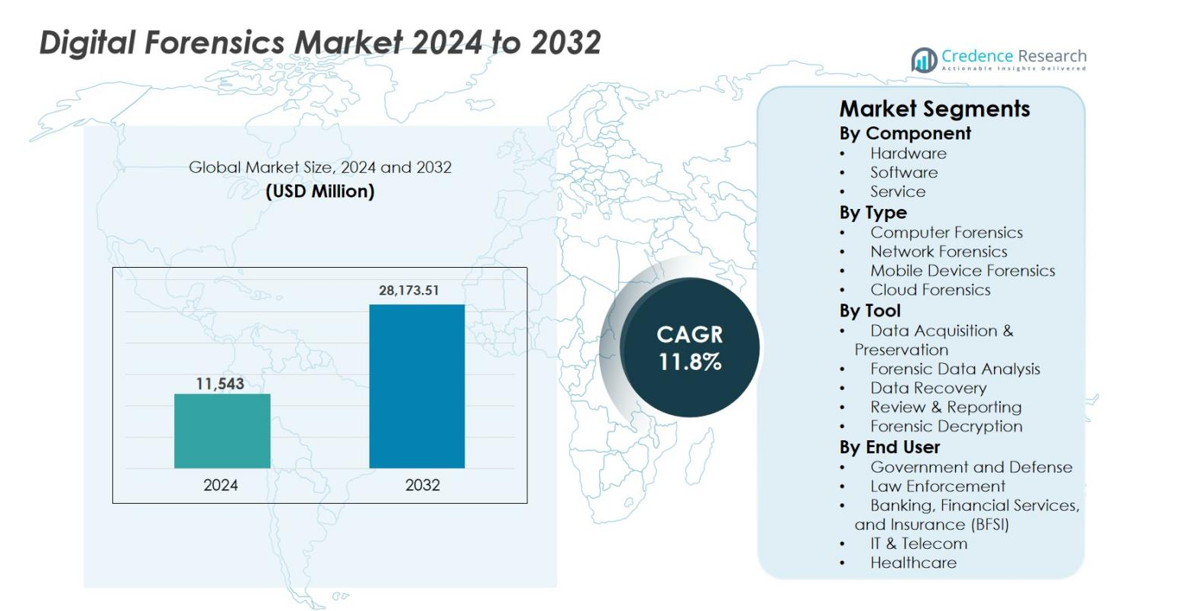

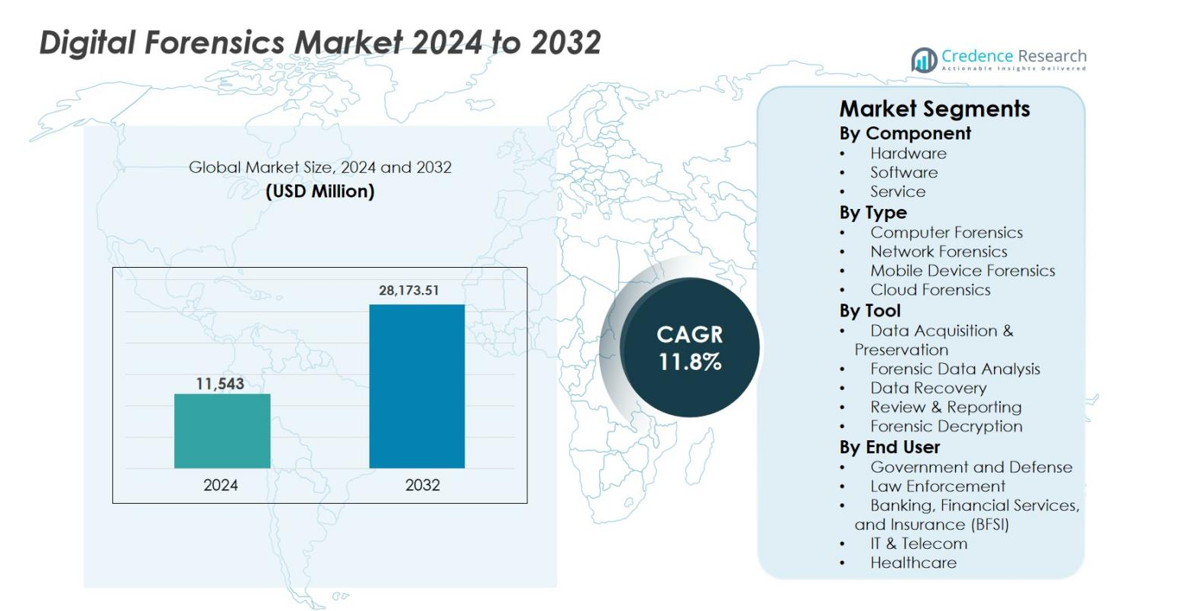

Digital Forensics market size was valued at USD 11,543 million in 2024 and is anticipated to reach USD 28,173.51 million by 2032, growing at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Forensics Market Size 2024 |

USD 11,543 million |

| Digital Forensics Market, CAGR |

11.8% |

| Digital Forensics Market Size 2032 |

USD 28,173.51 million |

Digital Forensics market is driven by the strong presence of established technology and investigation solution providers focusing on advanced analytics, automation, and scalable forensic platforms. Key players such as Cellebrite, Magnet Forensics, MSAB, OpenText Corporation, Exterro, IBM, Cisco Systems, LogRhythm, NUIX, and Paraben Corporation strengthen their positions through continuous software innovation, integrated investigation workflows, and strategic partnerships with law enforcement and enterprises. North America leads the market with an exact 38.4% share, supported by mature cybersecurity infrastructure, high digital evidence usage, and strong regulatory enforcement. Europe follows with a 27.1% share, driven by stringent compliance requirements, while Asia-Pacific holds 22.6% share, supported by rapid digitalization and rising cybercrime incidents.

Market Insights

- Digital Forensics market was valued at USD 11,543 million in 2024 and is projected to grow at a CAGR of 11.8% through the forecast period, driven by expanding digital evidence requirements across sectors.

- Rising cybercrime, data breaches, and digital fraud incidents across enterprises, financial institutions, and government agencies are major growth drivers, increasing demand for advanced forensic investigation, evidence preservation, and litigation support solutions.

- Software is the dominant component segment with 48.6% share, while Computer Forensics leads by type at 34.9% share, supported by high usage of enterprise systems and growing corporate investigations; AI-enabled forensic data analysis tools continue to gain traction.

- The market landscape is shaped by continuous innovation from key players focusing on integrated platforms, automation, cloud forensics, and scalable investigation workflows to address complex, multi-device data environments.

- North America leads with 38.4% market share, followed by Europe at 27.1% and Asia-Pacific at 22.6%, with Asia-Pacific showing the fastest growth due to rapid digitalization and rising cybercrime activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The Digital Forensics market by component is led by Software, which accounted for 48.6% market share in 2024, driven by rising demand for advanced analytics, automation, and scalable forensic platforms. Software solutions enable efficient data acquisition, analysis, visualization, and reporting across large and complex datasets, making them essential for modern investigations. Increasing cybercrime volumes, encrypted data environments, and multi-device investigations accelerate software adoption. Services continue to grow due to demand for managed forensics and incident response, while hardware remains critical for data extraction, though its growth is comparatively moderate.

- For instance, OpenText Forensic (EnCase) positions its software around artifact-first, AI-assisted workflows and advertises support for 36,000+ devices and cloud sources, reflecting how tool breadth and automation push software adoption in multi-device cases.

By Type

By type, Computer Forensics dominated the Digital Forensics market with a 34.9% share in 2024, supported by widespread use of desktops, laptops, and enterprise servers in cyber incidents and legal investigations. High volumes of corporate data breaches, insider threats, and regulatory audits sustain demand for computer-based forensic analysis. Mobile Device Forensics is expanding rapidly due to smartphone penetration, while Network and Cloud Forensics gain traction as organizations migrate to cloud infrastructures and face increasingly sophisticated network-based attacks.

- For instance, EnCase Forensic is widely documented in court proceedings and compliance investigations for its ability to collect and analyze full disk images, registry artifacts, and deleted files from Windows and Linux systems, reinforcing the dominance of computer-based evidence in litigation and corporate investigations.

By Tool

The Digital Forensics market by tool is led by Forensic Data Analysis, holding 31.7% market share in 2024, as investigators prioritize tools that transform raw data into actionable evidence. Advanced analytics, AI-assisted pattern recognition, and timeline reconstruction drive strong adoption. Growing data complexity across endpoints, networks, and cloud environments reinforces this dominance. Data Acquisition & Preservation tools remain foundational, while Review & Reporting and Forensic Decryption tools gain importance due to stricter compliance requirements and the rising prevalence of encrypted digital evidence.

Key Growth Drivers

Rising Cybercrime and Digital Fraud Incidents

The Digital Forensics market is driven by the sharp rise in cybercrime, digital fraud, and data breaches across enterprises and public institutions. Increasing ransomware attacks, phishing schemes, identity theft, and insider threats require advanced forensic capabilities for evidence collection and investigation. Digital forensics supports incident reconstruction, legal proceedings, and regulatory reporting. The expansion of digital data across endpoints, networks, and cloud platforms further increases investigation complexity, sustaining strong demand for comprehensive forensic tools and services.

- For instance, the FBI’s Internet Crime Complaint Center (IC3) reported over 880,000 cybercrime complaints in 2023, with significant losses linked to phishing, identity theft, and business email compromise, reinforcing the importance of digital forensics in law-enforcement investigations and prosecution support.

Stringent Regulatory and Compliance Requirements

Growing regulatory oversight related to data protection, cybersecurity, and digital evidence management supports steady growth in the Digital Forensics market. Compliance with data privacy regulations, financial reporting standards, and cybersecurity mandates requires organizations to maintain audit trails and forensic readiness. Digital forensics solutions help ensure lawful evidence handling, litigation support, and compliance reporting. Rising penalties for non-compliance and increased regulatory enforcement continue to drive enterprise investments in standardized forensic platforms and professional services.

- For instance, the European Commission reported that GDPR enforcement resulted in fines exceeding €2.1 billion cumulatively by 2023, pushing enterprises to adopt forensic tools that ensure lawful evidence handling and audit-ready documentation during investigations.

Expansion of Cloud, Mobile, and IoT Ecosystems

The rapid adoption of cloud computing, mobile devices, and IoT technologies significantly drives the Digital Forensics market. These environments generate large volumes of distributed and dynamic data, increasing the need for specialized forensic tools. Cloud and mobile forensics enable effective evidence extraction and analysis across virtualized and connected systems. As remote work and smart infrastructure adoption accelerate, organizations increasingly rely on advanced forensic solutions to manage complex digital ecosystems.

Key Trends & Opportunities

Integration of AI and Advanced Analytics

The integration of artificial intelligence and advanced analytics represents a major trend in the Digital Forensics market. AI-powered tools automate data classification, accelerate evidence identification, and enhance pattern recognition across large datasets. Advanced analytics improve investigation accuracy and reduce time-to-resolution. This trend creates opportunities for vendors offering intelligent and scalable forensic platforms that address rising case volumes and limited forensic expertise across enterprises and law enforcement agencies.

- For instance, law enforcement agencies adopting Cellebrite’s advanced analytics report the ability to process and correlate data from thousands of mobile applications and cloud sources, highlighting how AI-enhanced platforms address rising case volumes and skill constraints while improving investigation speed and consistency.

Growing Demand for Managed and Cloud-Based Forensics Services

The Digital Forensics market is witnessing strong demand for managed and cloud-based forensic services as organizations seek flexible and cost-efficient investigation models. Limited in-house expertise and infrastructure drive reliance on external service providers. Cloud-based platforms support rapid deployment, remote investigations, and collaborative workflows. This trend creates opportunities for service providers to deliver incident response, e-discovery, and compliance-driven forensic services on scalable subscription and on-demand models.

- For instance, Kroll’s global incident response practice documents that a large share of its investigations are now conducted using secure cloud-hosted forensic environments, allowing clients to perform remote triage, e-discovery, and regulatory reporting while reducing internal infrastructure and staffing requirements.

Key Challenges

Data Encryption and Privacy Constraints

Widespread adoption of strong encryption and stringent privacy regulations presents a major challenge for the Digital Forensics market. Encrypted devices and cloud platforms restrict access to digital evidence, while privacy laws limit data collection and cross-border transfers. These factors increase investigation complexity, extend case timelines, and require continuous innovation in lawful access and decryption technologies, while also increasing compliance costs, demanding specialized expertise, intensifying legal scrutiny, and slowing evidence acquisition across multinational investigations and regulated industries.

Shortage of Skilled Digital Forensics Professionals

The Digital Forensics market faces a shortage of skilled professionals capable of managing advanced investigations across cloud, mobile, and emerging digital environments. Rapid technological evolution outpaces workforce training, increasing operational costs and limiting adoption. Organizations and vendors increasingly focus on automation, user-friendly tools, and specialized training programs to address talent constraints and support sustainable market growth, while encouraging academic partnerships, certification programs, and continuous upskilling initiatives to strengthen expertise, improve efficiency, and ensure long-term investigative readiness.

Regional Analysis

North America

North America dominated the Digital Forensics market with an 38.4% market share in 2024, driven by high cybercrime incidence, advanced digital infrastructure, and strong regulatory enforcement. The region benefits from early adoption of advanced forensic software, AI-enabled analytics, and cloud-based investigation platforms. Widespread use of digital evidence in criminal investigations, corporate litigation, and compliance audits sustains demand. Strong presence of leading technology providers, well-funded law enforcement agencies, and mature cybersecurity frameworks further reinforce market leadership across the United States and Canada.

Europe

Europe accounted for 27.1% market share in 2024, supported by stringent data protection regulations, rising cyber threats, and increasing cross-border digital investigations. The enforcement of data privacy and cybersecurity regulations drives demand for compliant forensic tools and evidence management solutions. Financial services, government agencies, and critical infrastructure operators remain key adopters. Growing cyber fraud cases and the need for litigation readiness strengthen market growth. Countries such as Germany, the UK, and France lead adoption due to strong legal frameworks and advanced digital ecosystems.

Asia-Pacific

Asia-Pacific held 22.6% market share in 2024 and represents the fastest-growing region in the Digital Forensics market. Rapid digitalization, expanding internet penetration, and rising cybercrime incidents across enterprises drive strong demand. Increasing adoption of cloud services, mobile devices, and IoT technologies intensifies the need for advanced forensic capabilities. Government initiatives to strengthen cybersecurity infrastructure and growing investments by law enforcement agencies further support growth. China, India, Japan, and South Korea are key contributors due to expanding digital economies.

Latin America

Latin America captured 6.4% market share in 2024, driven by increasing awareness of cybercrime prevention and digital evidence management. Rising incidents of financial fraud, identity theft, and organized cybercrime encourage adoption of forensic solutions. Governments and financial institutions increasingly invest in digital investigation tools to strengthen legal enforcement and regulatory compliance. Market growth remains moderate due to budget constraints, but expanding digital transformation initiatives and improving cybersecurity frameworks across Brazil, Mexico, and Argentina support steady adoption.

Middle East & Africa

The Middle East & Africa region accounted for about 5.5% market share in 2024, supported by growing cybersecurity investments and digital governance initiatives. Increasing cyber threats targeting critical infrastructure, government systems, and financial institutions drive demand for digital forensic solutions. Governments emphasize strengthening digital investigation capabilities to support national security and regulatory compliance. Adoption remains uneven due to skill gaps and infrastructure limitations, but rising smart city projects and digital modernization programs continue to create long-term growth opportunities.

Market Segmentations

By Component

- Hardware

- Software

- Service

By Type

- Computer Forensics

- Network Forensics

- Mobile Device Forensics

- Cloud Forensics

By Tool

- Data Acquisition & Preservation

- Forensic Data Analysis

- Data Recovery

- Review & Reporting

- Forensic Decryption

By End User

- Government and Defense

- Law Enforcement

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Digital Forensics market features a dynamic and innovation-driven competitive landscape characterized by continuous product enhancement, strategic partnerships, and expansion of service capabilities. Leading players such as Cellebrite, Magnet Forensics, MSAB, OpenText Corporation, Exterro, IBM, Cisco Systems, LogRhythm, NUIX, and Paraben Corporation focus on strengthening software platforms that support multi-device, cloud, and encrypted data investigations. Companies invest heavily in AI-enabled analytics, automation, and scalable architectures to improve investigation speed and accuracy. Strategic collaborations with law enforcement agencies, enterprises, and government bodies help expand market reach and application scope. Vendors also emphasize integrated solutions that combine data acquisition, analysis, and reporting to streamline forensic workflows. Ongoing innovation, global expansion, and portfolio diversification remain central strategies as competition intensifies across enterprise, legal, and public-sector digital investigation environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM

- Magnet Forensics

- Cellebrite

- Open Text Corporation

- LogRhythm, Inc.

- Cisco Systems, Inc.

- Exterro

- MSAB

- Paraben Corporation

- NUIX

Recent Developments

- In February 2025, Cellebrite entered into a government contract valued at USD 2.4 million with the Ministry of the Interior of Georgia to supply its Inseyets digital forensics platform. This platform facilitates lawful mobile device data extraction to support criminal investigations.

- In July 2024, LogRhythm and Exabeam announced their strategic merger to form a new cyber security solutions company. This merger aims to enable both companies to deliver an advanced AI-driven security operations platform to their customers.

- In March 2024, Cisco acquired Splunk, bolstering its cybersecurity and AI analytics capabilities. Splunk’s expertise in machine data analysis improves Cisco’s offerings in threat detection, incident response, and digital forensics. The integration will give organizations deeper visibility, allowing faster and more accurate investigations.

Report Coverage

The research report offers an in-depth analysis based on Component, Type, Tool, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital Forensics market will increasingly adopt AI and machine learning to automate evidence identification and reduce investigation timelines.

- Cloud forensics capabilities will expand as enterprises migrate critical workloads and data to cloud environments.

- Mobile and IoT forensics will gain importance due to growing use of smart devices and connected systems.

- Demand for scalable and centralized forensic platforms will rise across enterprises and law enforcement agencies.

- Managed and outsourced forensic services will see higher adoption to address skill shortages and cost constraints.

- Integration of digital forensics with cybersecurity and incident response platforms will strengthen.

- Forensic solutions will evolve to handle encrypted and privacy-protected data more effectively.

- Regulatory compliance and litigation readiness will remain key adoption drivers across regulated industries.

- Emerging economies will witness faster adoption due to increasing digitalization and cybercrime awareness.

- Continuous product innovation and strategic partnerships will shape long-term competitive dynamics.