Market Overviews

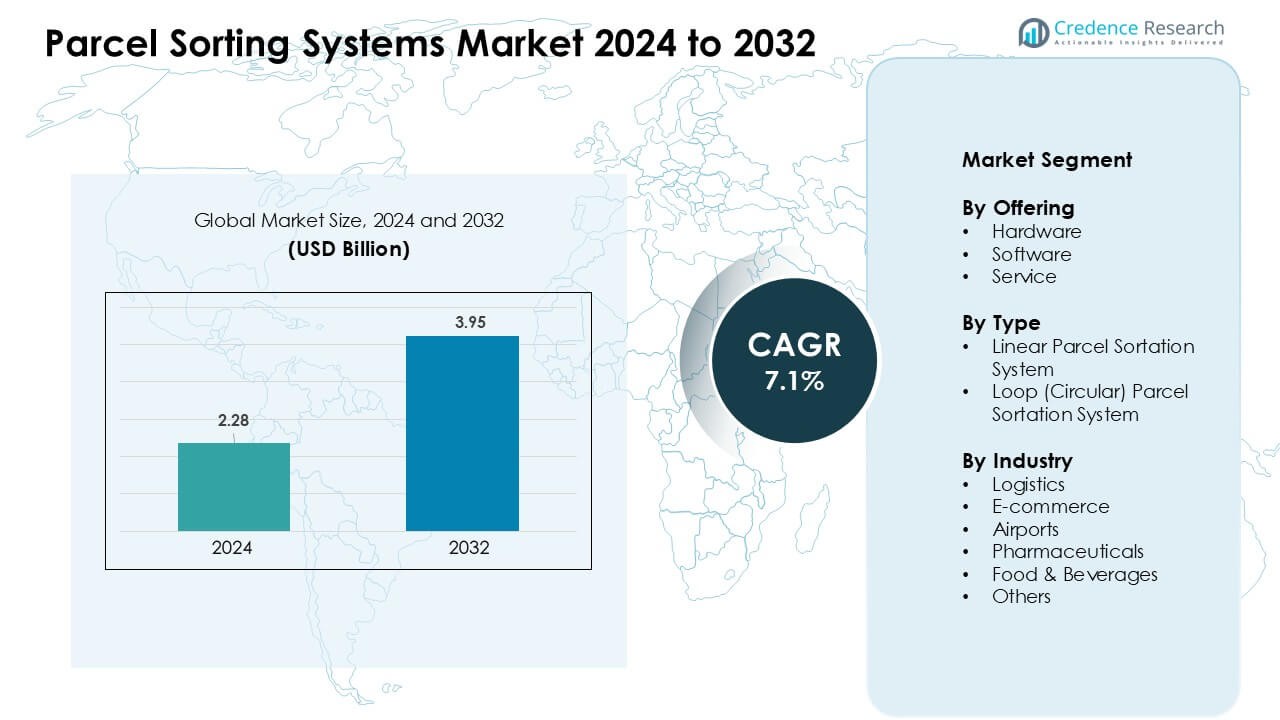

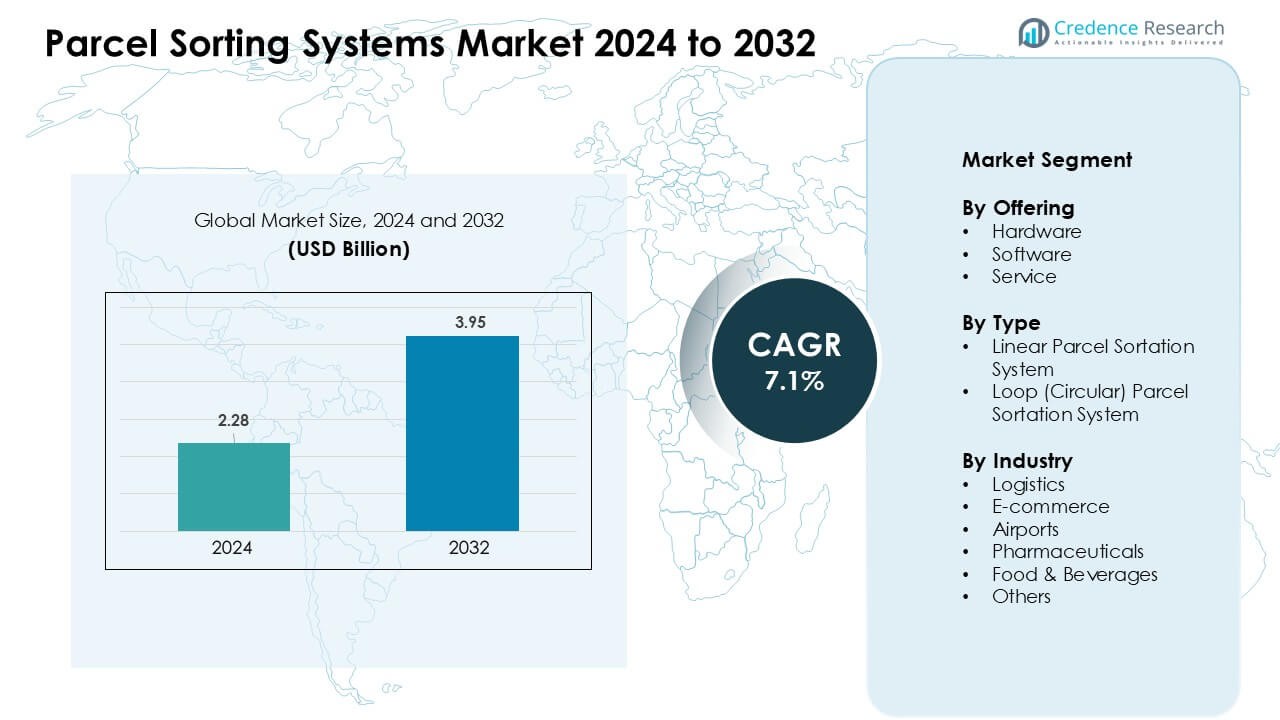

Parcel Sorting Systems Market was valued at USD 2.28 billion in 2024 and is anticipated to reach USD 3.95 billion by 2032, growing at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Parcel Sorting Systems Market Size 2024 |

USD 2.28 Billion |

| Parcel Sorting Systems Market, CAGR |

7.1% |

| Parcel Sorting Systems Market Size 2032 |

USD 3.95 Billion |

The Parcel Sorting Systems Market is shaped by major players such as Okura Yusoki, Honeywell International, Bastian Solutions, Kion Group, Dematic, Vanderlande, Beumer Group, Körber, Interroll, and Daifuku. These companies compete through high-speed conveyors, advanced vision scanners, robotics integration, and AI-driven routing platforms designed to support growing parcel volumes from e-commerce and logistics networks. Each player strengthens its position through automation upgrades, software innovation, and global service capabilities. North America emerged as the leading region in 2024 with a 37% share, driven by large fulfillment centers, strong investment in warehouse automation, and rapid expansion of last-mile delivery operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Parcel Sorting Systems Market reached USD 2.28 billion in 2024 and is projected to hit USD 3.95 billion by 2032, growing at a CAGR of about 7.1%.

- Growth is driven by rising e-commerce parcel volumes and large automation upgrades in logistics hubs, boosting demand for high-speed conveyors, scanners, and AI-based routing tools.

- Trends include rapid adoption of robotics, cloud-connected monitoring platforms, and energy-efficient sorters that support flexible layouts and higher throughput.

- Competition remains intense among Okura Yusoki, Honeywell, Bastian Solutions, Kion Group, Dematic, Vanderlande, Beumer Group, Körber, Interroll, and Daifuku as they expand modular systems and long-term service capabilities.

- North America led the market in 2024 with a 37% share, while hardware dominated the offering segment with about 63% share due to high deployment of conveyor systems and advanced scanning technologies.

Market Segmentation Analysis:

By Offering

Hardware dominated the offering segment in 2024 with about 63% share. Demand rose as logistics and e-commerce hubs expanded high-speed conveyors, scanners, and automated diverters to handle rising parcel volumes. Hardware remained essential due to strong adoption of barcode and vision-based identification units that improve sorting accuracy. Growth also came from warehouse automation programs that replaced manual lines with faster, modular systems. Software grew steadily with increased use of data analytics and routing tools, while service advanced through maintenance contracts that support 24/7 operations.

- For instance, JD.com operates a fully automated warehouse in Shanghai that handles around 200,000 orders per day through robotic systems processing receiving, storage, picking, and sorting end‑to‑end using automated conveyors and robots.

By Type

Linear parcel sortation systems led the type segment in 2024 with nearly 58% share. These systems gained traction because they offer higher throughput, straightforward layouts, and flexible integration for mid to large-scale distribution centers. Many operators preferred linear designs due to lower installation complexity and strong adaptability for mixed-parcel flows. Loop systems also grew as airports and large e-commerce hubs adopted continuous circular tracks to manage peak-hour surges. Rising global parcel traffic and pressure for faster order fulfillment strengthened demand across both types.

- For instance, the Amazon facility handled by Honeywell Intelligrated with its 4,800 m conveyors and sliding‑shoe plus cross‑belt sorters evidences how linear layout supports high‑volume parcel flows and flexible parcel size handling in a large‑scale fulfillment center.

By Industry

E-commerce dominated the industry segment in 2024 with about 42% share. Rapid online retail expansion pushed large marketplaces and third-party logistics firms to scale automated sortation for faster last-mile dispatch. E-commerce players invested in high-speed systems to reduce delivery cycles and handle frequent product returns. Logistics firms followed with strong adoption in regional hubs and cross-docks. Airports, pharmaceuticals, and food & beverages sectors also expanded automation as they pursued secure parcel handling, temperature-sensitive movement, and improved compliance requirements.

Key Growth Drivers

E-commerce Expansion and Rising Parcel Volumes

Rapid e-commerce growth continues to drive large-scale deployment of automated parcel sorting systems across distribution hubs. Online marketplaces now push daily parcel counts to record levels, forcing operators to replace manual handling with high-speed sorters that maintain accuracy during peak demand. Retailers and logistics firms expand fulfillment networks to support next-day and same-day delivery, which increases the need for fast throughput and flexible routing. High return rates also add sorting pressure, prompting investment in multi-directional conveyors, advanced scanning units, and adaptive software. Growing cross-border trade further strengthens demand, as carriers must manage higher parcel diversity across regional and global networks.

- For instance, JD.com operates the Kunshan Asia No.1 Intelligent Logistics Park, a highly automated parcel sorting hub in China. The facility has a reported peak capacity of up to 4.5 million parcels per day using advanced conveyors and robotic systems. This scale supports JD.com’s same-day and next-day delivery commitments across key regions.

Automation Adoption in Logistics and Warehousing

Logistics companies accelerate automation to reduce labor strain, manage rising wages, and improve processing reliability. Many operators shift toward smart facilities featuring connected conveyors, machine-vision scanners, and automated diverters that limit downtime and improve traceability. Warehouses expand automation programs to resolve staffing gaps during seasonal peaks and reduce human-error risk in high-velocity environments. Integrated parcel sorters also help carriers consolidate shipments, improve dock utilization, and maintain tighter delivery windows. Global supply chain disruptions have encouraged operators to adopt automation that maintains operational continuity, making advanced sortation a key investment focus for modern logistics infrastructure.

Advancement of AI, Vision Systems, and Real-Time Data Tools

AI-enabled routing, vision-based parcel identification, and machine learning analytics strengthen demand for next-generation sortation systems. Operators adopt software that predicts bottlenecks, adjusts routing speeds, and improves load balancing across multiple chutes. Vision systems help identify damaged labels, irregular parcels, or unreadable barcodes, improving accuracy and reducing rework. Real-time dashboards enhance visibility for fulfillment managers and allow dynamic decision-making during peak surges. The shift toward sensor fusion, cloud connectivity, and digital twins also creates avenues for future upgrades that support predictive maintenance and smarter warehouse synchronization. These improvements make advanced sortation technology central to modern parcel operations.

- For instance, Alibaba’s Cainiao Network operates large automated sorting hubs that use AI vision and real-time data platforms. During major shopping festivals, Cainiao has reported handling over 100 million parcels per day across its logistics network. Individual automated sortation lines in key hubs are designed to process around 30,000 parcels per hour per line

Key Trends & Opportunities

Growth of Robotics and Autonomous Mobile Integration

Robotics plays a major role in next-generation parcel sorting as operators integrate autonomous mobile robots (AMRs), robotic arms, and smart conveyors into sorting lines. AMRs support inter-zone transport, while robotic arms handle irregular or heavy parcels that conventional systems struggle to manage. This creates opportunities for fully automated workflows where parcel induction, sorting, and dispatch rely on minimal human intervention. Robotics also allows modular expansion, letting operators scale capacity without redesigning entire facilities. Increased demand for labor efficiency, rising warehouse safety standards, and growing investment in robotics-as-a-service models strengthen this trend across global distribution networks.

- For instance, Amazon has deployed over 1 million robots across its global fulfillment network. These robots include mobile drive units and robotic arms integrated with automated sorting systems. This deployment supports large-scale automation of picking, sorting, and packing operations.

Shift Toward Sustainable and Energy-Efficient Operations

Sustainability drives new opportunities as parcel hubs adopt energy-efficient motors, regenerative conveyors, and intelligent power-management systems. Many operators seek greener infrastructure to meet corporate sustainability goals and reduce operational costs tied to energy-intensive equipment. Lightweight materials, optimized belt designs, and software-controlled idle modes reduce system footprints while improving throughput. Governments and enterprises introduce carbon-reduction mandates that push facilities toward eco-friendly procurement standards. This trend supports long-term modernization as companies favor equipment that minimizes emissions without compromising speed or accuracy, generating strong investment momentum for sustainable sorting technologies.

Expansion of Cloud-Based Control and Predictive Platforms

Cloud-connected sortation platforms enable remote monitoring, automated performance tuning, and predictive maintenance scheduling. This trend offers major opportunities for global operators running multi-site networks, as cloud dashboards unify system performance under a single interface. Predictive tools help identify wear patterns, sensor faults, or bottlenecks before failure occurs, reducing downtime. Cloud control also supports software-based upgrades, making systems more adaptable to evolving parcel profiles. As data security improves, more carriers leverage cloud ecosystems to harmonize workflows, improve staff allocation, and streamline planning across regional hubs. This shift creates strong momentum for software-centric innovations.

- For instance, Siemens’ MindSphere platform connects and monitors thousands of assets across automated logistics and material-handling facilities. The platform enables real-time condition monitoring and predictive maintenance based on sensor data. These capabilities help operators detect faults early and reduce unplanned downtime in sorting operations.

Key Challenges

High Capital Costs and Complex Integration Requirements

Parcel sorting systems require significant upfront investment, which creates barriers for small and mid-sized operators. Hardware installations demand large floor areas, extensive conveyor layouts, and advanced scanning units, increasing infrastructure costs. Integration with existing warehouse management systems adds complexity, as operators must synchronize diverse equipment from multiple vendors. Downtime during installation can disrupt parcel flow, making upgrades difficult during peak seasons. Many firms also face long approval cycles, as financial planning must account for depreciation, maintenance, and software licensing. These challenges slow adoption and limit automation benefits for smaller logistics networks.

Operational Downtime, Labor Skills Gap, and Maintenance Burden

Advanced sorting equipment requires skilled technicians who can manage sensors, robotics, vision units, and software interfaces. Many regions face shortages of trained personnel, creating operational strain during faults or peak loads. Unplanned downtime disrupts parcel movement and impacts delivery commitments, forcing firms to invest heavily in preventive maintenance programs. Complex equipment also demands timely calibration, parts replacement, and software updates to maintain performance. Operators struggle to maintain uptime when handling diverse parcel shapes, damaged barcodes, or high-density surges. These operational hurdles make reliability and workforce training critical challenges for global parcel hubs.

Regional Analysis

North America

North America led the Parcel Sorting Systems Market in 2024 with about 37% share. Strong e-commerce activity, large third-party logistics networks, and heavy adoption of warehouse automation supported regional dominance. Major carriers expanded high-speed sortation hubs to handle rising B2C and B2B parcel volumes, while retailers upgraded fulfillment centers to meet next-day delivery targets. The region also benefited from advanced AI-enabled routing software and widespread deployment of vision-based scanners. Investments in robotics, cloud-connected operations, and sustainability-focused systems strengthened overall modernization, keeping North America ahead in automation maturity and throughput capacity.

Europe

Europe accounted for nearly 30% share in 2024, driven by strong parcel flows across cross-border e-commerce and dense logistics networks. Automation adoption accelerated as postal operators and integrators upgraded sortation lines to reduce labor dependence and improve processing accuracy. Regulatory emphasis on energy efficiency encouraged the installation of low-power conveyors and eco-friendly hardware. Airports and pharma distribution centers added advanced sorting units to meet rising compliance requirements. Growing parcel diversity from online marketplaces and expanding last-mile networks further pushed European facilities to invest in flexible, high-speed sorting technologies.

Asia-Pacific

Asia-Pacific captured roughly 27% share in 2024 and remained the fastest-growing region. Expanding e-commerce giants, rising digital payment adoption, and booming urban delivery networks drove heavy investment in advanced sortation systems. China, Japan, South Korea, and India scaled automated hubs to manage increasing parcel density across metropolitan clusters. Many operators adopted AI-enabled scanners, modular conveyors, and robotics to handle peak-season surges. Government-supported logistics modernization programs and growing participation of regional 3PLs enhanced system adoption, strengthening APAC’s position as a high-volume, automation-focused parcel processing market.

Latin America

Latin America held close to 4% share in 2024, supported by expanding e-commerce activity in Brazil, Mexico, and Chile. Logistics firms invested in automated sortation to manage rising parcel flows linked to improving digital retail penetration. Infrastructure upgrades in regional hubs and emerging 3PL networks encouraged gradual adoption of conveyors, barcode scanners, and route-optimization software. Despite slower modernization compared to major markets, increasing warehouse investments and cross-border trade expansion created steady opportunities. Growing demand for reliable parcel handling and reduced delivery times continues to strengthen the shift toward automated systems.

Middle East & Africa

The Middle East & Africa region accounted for about 2% share in 2024, driven by rising e-commerce adoption and expanding logistics infrastructure in the UAE, Saudi Arabia, and South Africa. Major distribution hubs integrated automated sorters to support international cargo movement and fast-growing domestic parcel demand. Investments in free-trade zones, airport expansions, and smart logistics parks accelerated interest in advanced sortation. However, limited automation penetration in emerging economies and high capital costs slowed broader adoption. Ongoing digitalization efforts and strong government support for logistics innovation continue to create growth opportunities across the region.

Market Segmentations:

By Offering

- Hardware

- Software

- Service

By Type

- Linear Parcel Sortation System

- Loop (Circular) Parcel Sortation System

By Industry

- Logistics

- E-commerce

- Airports

- Pharmaceuticals

- Food & Beverages

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Parcel Sorting Systems Market features strong competition among global automation leaders such as Okura Yusoki, Honeywell International, Bastian Solutions, Kion Group, Dematic, Vanderlande, Beumer Group, Körber, Interroll, and Daifuku. These companies focus on high-speed conveyors, vision-based scanners, AI-enabled routing tools, and modular sortation platforms that support large logistics hubs and e-commerce fulfillment centers. Many players expand portfolios through integrated robotics, predictive maintenance software, and cloud-connected control systems that improve throughput and reduce downtime. Strategic partnerships with 3PLs, retailers, and postal operators help strengthen market reach. Continuous investments in energy-efficient systems, low-footprint designs, and flexible layouts allow vendors to serve facilities with diverse parcel flows and space constraints. Leading firms also enhance service capabilities through remote diagnostics, real-time monitoring, and long-term maintenance contracts, ensuring stable system performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Okura Yusoki Co., Ltd.

- Honeywell International, Inc.

- Bastian Solutions, LLC

- Kion Group AG

- Dematic

- Vanderlande Industries B.V.

- Beumer Group

- Körber AG

- Interroll Group

- Daifuku Co., Ltd.

Recent Developments

- In July 2025, Honeywell announced it would evaluate strategic alternatives for its Productivity Solutions & Services and Warehouse & Workflow Solutions businesses, the units that include Honeywell Intelligrated and its sortation/product portfolio a move that could lead to structural changes affecting its parcel-sortation product line and go-to-market.

- In March 2025, Bastian Solutions, LLC Bastian Solutions announced the merger of viastore North America into Bastian Solutions (bringing viastore’s intralogistics software and systems capabilities under the Bastian name) a strategic consolidation to broaden Bastian’s automation and sortation integration offerings in North America.

- In October 2024, Vanderlande Industries B.V. Announced (reported) as the successful bidder to acquire Siemens’ logistics unit (Siemens Logistics), expanding Vanderlande’s footprint and capabilities in airport and parcel sortation technology.

Report Coverage

The research report offers an in-depth analysis based on Offering, Type, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as e-commerce players expand high-speed fulfillment and return-processing networks.

- Logistics firms will upgrade hubs with AI-enabled routing and predictive maintenance tools.

- Robotics and AMR integration will increase to handle irregular parcels and reduce manual induction.

- Vision-based scanners will gain adoption as parcels grow more diverse and label issues become common.

- Cloud-based monitoring platforms will support remote diagnostics and multi-site performance control.

- Energy-efficient motors and low-power conveyors will grow as operators pursue sustainability goals.

- Modular and scalable sorter designs will expand to support rapid capacity changes in warehouses.

- Airports and postal operators will automate sorting lines to improve service levels and reduce errors.

- Software-driven optimization will become central as operators push for faster cycle times and higher accuracy.

- Emerging markets will increase adoption as new 3PL hubs, economic zones, and e-commerce networks expand.