Market Overview

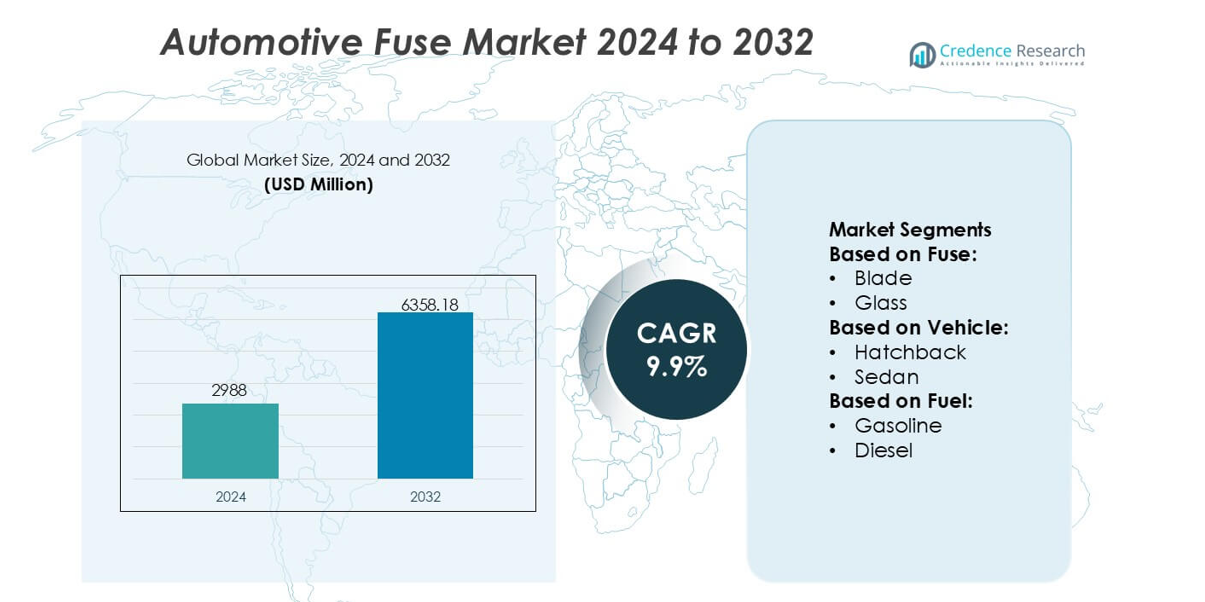

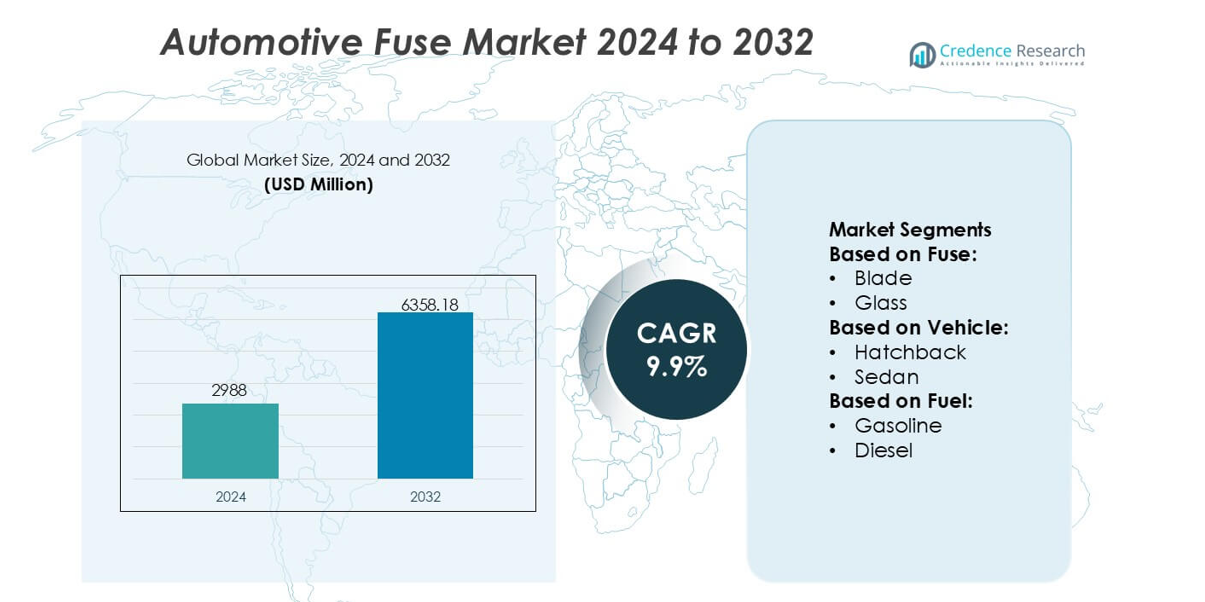

Automotive Fuse Market size was valued USD 2988 million in 2024 and is anticipated to reach USD 6358.18 million by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Fuse Market Size 2024 |

USD 2988 million |

| Automotive Fuse Market, CAGR |

9.9% |

| Automotive Fuse Market Size 2032 |

USD 6358.18 million |

The Automotive Fuse Market is supported by a concentrated group of global electrical and electronics manufacturers that continue to expand their portfolios to meet the rising complexity of vehicle power architectures. These companies strengthen their competitiveness through advancements in high-voltage protection, miniaturized fuse blocks, and fast-acting solutions suited for EVs and ADAS-equipped platforms. Their strategies emphasize R&D investment, OEM partnerships, and integration of smart diagnostic features to enhance system reliability. Regionally, North America leads the market with an exact 34% share, driven by mature automotive manufacturing, strong adoption of advanced safety technologies, and rapid expansion of electric vehicle platforms across major automotive hubs.

Market Insights

- The Automotive Fuse Market reached USD 2988 million in 2024 and is projected to attain USD 6358.18 million by 2032 at a 9.9% CAGR, reflecting strong demand for advanced vehicle protection systems.

- Rising electrification in passenger and commercial vehicles drives adoption of high-voltage and fast-acting fuses, supported by OEM shifts toward EV platforms and ADAS integration.

- Increasing miniaturization, smart diagnostic fuse designs, and solid-state protection trends shape product innovation as manufacturers enhance reliability for power-dense architectures.

- Market growth faces restraints such as thermal management challenges, limited compatibility with next-gen solid-state systems, and fluctuating raw-material availability impacting fuse performance and production.

- North America leads with 34% market share, while blade fuses remain the dominant segment with the highest usage in automotive electrical circuits, driven by standardized designs and widespread integration across global vehicle fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fuse

Blade fuses hold the dominant share in the Automotive Fuse Market due to their compact profile, low replacement cost, and broad compatibility with modern passenger and commercial vehicles. OEMs prefer blade formats because they support streamlined electrical distribution, faster assembly integration, and stable protection against overcurrent events. Demand rises further as vehicle architectures adopt higher circuit densities, requiring reliable and easily serviceable fuse layouts. EV fuses gain momentum with the rapid expansion of high-voltage powertrains, but blade fuses remain the primary choice across global manufacturing platforms.

- For instance, Bel Fuse Inc. offers automotive and EV fuses specifically engineered for high-voltage applications with clear numerical specifications such as its 0AKK Series stud-mount EV/eMobility fuses rated for up to 1000 VDC and current capacities between 63 A and 350 A, enabling robust overload and short circuit protection in electric powertrain junction boxes and battery packs.

By Vehicle

Passenger cars account for the largest share in the vehicle-wise segmentation, supported by the widespread adoption of advanced electronics, infotainment modules, ADAS systems, and high-load auxiliary components. Among passenger cars, SUVs represent the leading sub-segment due to higher electrical distribution demands and rapid global production growth. Light-duty commercial vehicles also show rising usage of high-capacity fuses as fleets modernize with telematics, safety systems, and connected power modules. Increasing electrification across vehicle categories strengthens the importance of stable circuit protection, reinforcing fuse deployment across new-generation automotive platforms.

- For instance, Rockwell Automation’s Allen-Bradley E300 electronic overload relay used by automotive OEMs in power-distribution and protection assemblies.

By Fuel

Gasoline vehicles currently dominate the fuel-type segmentation as they continue to constitute the highest share of global vehicle production and maintain extensive electrical architecture requiring multiple fuse categories. Their broad adoption across emerging and developed markets supports steady fuse consumption. However, all-electric vehicles represent the fastest-growing sub-segment, driven by the integration of high-voltage batteries, traction inverters, and DC fast-charging systems that require advanced EV-specific fuses. Hybrid vehicles further expand fuse demand through dual-powertrain layouts, while FCEVs introduce specialized protection needs aligned with hydrogen system safety requirements.

Key Growth Drivers

Rising Electronics Integration Across Vehicle Architectures

The rapid expansion of electronic content in vehicles drives strong fuse adoption as OEMs integrate ADAS modules, infotainment systems, advanced lighting units, and safety electronics. Each added subsystem increases circuit density, making reliable overcurrent protection essential for preventing electrical failures and safeguarding critical components. Automakers strengthen fuse deployment as they shift toward zonal E/E architectures, enabling distributed power management with higher current loads. This transformation accelerates the need for compact, thermally stable, and high-interrupt-capacity fuses across both passenger and commercial vehicle platforms.

- For instance, ABB Ltd. offers sophisticated electrical protection systems such as the Emax 2 smart circuit breaker, equipped with advanced Ekip trip units that perform comprehensive real-time diagnostics.

Accelerating Shift Toward Electrified Powertrains

Growth in electric and hybrid vehicle production significantly increases demand for fuses designed to withstand high-voltage and high-current environments. EV batteries, traction inverters, DC fast chargers, and onboard power electronics require specialized fuses with enhanced thermal resistance and rapid response capabilities. Automotive OEMs adopt advanced fuse technologies to ensure safe current interruption and system stability during peak load fluctuations. Expansion of public charging infrastructure and rising regulatory pressure toward zero-emission mobility further strengthen the market for EV-specific fuse solutions.

- For instance, NXP Semiconductors N.V. has advanced high-voltage powertrain reliability through its GD316x series isolated gate drivers, engineered for traction inverters operating up to 1200 V with reinforced isolation rated at 8 kV surge capability and a 2.5 kVrms isolation barrier.

Increased Safety and Regulatory Compliance Requirements

Global safety standards and stringent regulatory protocols encourage OEMs to integrate robust circuit protection solutions across all vehicle classes. Regulatory bodies emphasize enhanced electrical safety to mitigate short circuits, thermal events, and wiring-system failures. Fuse manufacturers respond by developing products with improved arc suppression, higher breaking capacities, and greater reliability under harsh operating conditions. As connected and autonomous features expand, compliance-driven electrical safety becomes increasingly critical, bolstering demand for advanced fuse technologies that meet evolving international certification requirements.

Key Trends & Opportunities

Growth of High-Voltage EV Fuse Innovation

The market sees strong innovation in EV fuse designs tailored for high-voltage circuits, creating opportunities for manufacturers specializing in ultra-fast-acting, high-interrupt-rating products. With EV platforms adopting 400V–800V architectures, suppliers invest in materials that support superior thermal endurance and stable operation during regenerative braking and rapid acceleration cycles. Increased adoption of silicon-carbide-based power electronics intensifies the need for fuses capable of handling higher switching frequencies. This trend positions EV fuses as one of the most technologically dynamic product categories in the market.

- For instance, Larsen & Toubro Limited demonstrates advanced high-voltage protection engineering through its execution of 765 kV GIS substations for national transmission projects, where equipment integrated by L&T operates with documented short-circuit withstand ratings of 63 kA and insulation levels tested up to 1550 kVp.

Expansion of Smart and Resettable Fuse Technologies

Automotive manufacturers explore smart fuses and resettable polymer-based protection devices as they modernize electrical distribution systems. These components enable real-time diagnostics, fault logging, and remote reset capabilities, supporting predictive maintenance and reducing downtime. Integration opportunities expand as vehicles adopt zonal power architectures and software-defined functionalities that demand intelligent protection layers. Advancements in solid-state fuse designs further attract OEM interest by improving response precision and reducing mechanical wear, paving the way for broader adoption in next-generation automotive E/E platforms.

- For instance, ABB Ltd. offers sophisticated electrical protection systems such as the Emax 2 smart circuit breaker, equipped with advanced Ekip trip units that perform comprehensive real-time diagnostics.

Increasing Opportunity in Connected and Autonomous Vehicles

Connected and autonomous vehicles introduce significantly higher power requirements due to extensive sensor arrays, computing modules, and redundant safety systems. This creates a strong opportunity for fuse suppliers to deliver high-stability, fast-response protection components that secure sensitive electronics. As Level 2+ to Level 4 automation advances, demand rises for fuses that support continuous, high-bandwidth data processing without electrical interruptions. The shift toward software-intensive mobility ecosystems further drives the need for scalable fuse architectures aligned with complex digital vehicle platforms.

Key Challenges

Managing Thermal Stress and High Current Loads in EV Platforms

Electrified vehicles generate extensive thermal and electrical stresses that challenge the durability and reliability of traditional fuses. High-voltage powertrains expose components to sustained current surges, rapid temperature cycling, and high transient loads. Manufacturers must engineer fuses with advanced alloys, improved arc-quenching materials, and reinforced housings to ensure stable interruption performance. Meeting these requirements increases development complexity and cost, making it difficult for some suppliers to scale production while maintaining performance consistency across demanding EV applications.

Cost Pressure and Standardization Constraints for OEM Integration

OEMs consistently push suppliers to reduce fuse costs while meeting tighter space, performance, and compatibility requirements. Standardization across diverse vehicle platforms remains challenging, as fuse ratings and configurations must align with varying regional norms, voltage architectures, and vehicle classes. These constraints limit design flexibility and increase engineering overhead. Suppliers face difficulties in differentiating their offerings amid commoditization trends, particularly in legacy fuse categories. Balancing cost efficiency with innovation becomes a persistent challenge as automotive electrical systems grow more complex.

Regional Analysis

North America

North America holds an exact 32% share of the Automotive Fuse Market, supported by the strong presence of advanced vehicle manufacturers, high adoption of ADAS-equipped models, and rapid penetration of electric vehicles. OEMs emphasize sophisticated electrical architectures that require high-capacity and thermally stable fuses, strengthening demand across premium passenger cars and light commercial fleets. Growth is further driven by stringent electrical safety regulations and the expansion of connected-vehicle ecosystems. Robust EV production in the U.S. and Canada accelerates uptake of high-voltage fuse solutions designed for traction batteries and high-power electronic modules.

Europe

Europe accounts for an exact 28% share, driven by the region’s strong automotive manufacturing base and continued advancements in electrified mobility. Leading OEMs integrate increasingly complex electrical systems aligned with EU regulatory directives focused on efficiency, emissions reduction, and functional safety. High adoption of hybrid and battery-electric models boosts demand for advanced EV fuses capable of supporting 400V and 800V powertrains. Premium vehicle brands also elevate fuse utilization through enhanced infotainment, autonomous features, and safety electronics. Increasing investment in solid-state architectures further supports the shift toward next-generation circuit protection devices.

Asia Pacific

Asia Pacific leads the market with an exact 34% share, supported by high-volume automotive production across China, India, Japan, and South Korea. Regional OEMs incorporate extensive electrical subsystems to meet rising demand for connected features, telematics, and advanced safety technologies. China’s accelerated shift toward electric mobility significantly boosts EV-specific fuse consumption, particularly in high-voltage architectures for fast-charging environments. Growing purchasing power and rapid SUV adoption increase fuse deployment in passenger vehicles. Strong supplier ecosystems and cost-competitive manufacturing strengthen Asia Pacific’s position as the dominant and fastest-evolving market for automotive fuses.

Latin America

Latin America captures an exact 4% share, shaped by steady vehicle production growth in Brazil and Mexico and increasing integration of electronic safety components across mid-range passenger cars. OEMs adopt improved circuit-protection systems to comply with emerging regulatory frameworks and to enhance vehicle durability in varied climatic conditions. Expansion of light commercial fleets, along with rising aftermarket demand for blade and glass fuses, supports market stability. Although EV adoption remains gradual, early investments in charging infrastructure and electrified mobility programs create long-term opportunities for higher-capacity fuse technologies.

Middle East & Africa

The Middle East & Africa region holds an exact 2% share, influenced by moderate vehicle assembly activities and strong reliance on imported automotive components. Fuse demand remains concentrated in commercial fleets and utility vehicles that require reliable circuit protection under harsh operating environments. Growth is supported by rising adoption of SUVs and pickup models, along with expanding aftermarket replacement needs. Electrification remains limited but shows early momentum in urban centers, enabling initial deployment of high-voltage fuses. Increasing government interest in safety compliance gradually strengthens the integration of advanced fuse technologies.

Market Segmentations:

By Fuse:

By Vehicle:

By Fuel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Fuse Market is shaped by a diverse group of global electrical and electronics manufacturers, including Siemens AG, Bel Fuse Inc., Rockwell Automation, Inc., ABB Ltd., NXP Semiconductors N.V., Larsen & Toubro Limited, Mitsubishi Electric Corporation, General Electric Company, Schneider Electric SE, and Eaton Corporation plc. the Automotive Fuse Market is defined by continuous technology advancement, rapid electrification, and rising safety requirements across global vehicle platforms. Manufacturers focus on improving fuse reliability, thermal performance, and response speed to support the expanding electronics load in modern cars, especially within EVs, hybrid systems, and ADAS-enabled architectures. Companies strengthen their positions by developing compact, high-interrupt capacity fuses that withstand elevated voltages and harsh operating environments. Strategic collaborations with OEMs and Tier-1 suppliers accelerate product customization and integration into next-generation electrical systems. Growing emphasis on modular fuse boxes, smart diagnostics, and solid-state protection solutions further reshapes competition, pushing vendors to expand R&D efforts and enhance material engineering capabilities. As regulatory standards become more stringent and demand for efficient circuit protection accelerates, competition intensifies around innovation, manufacturing scale, and differentiated product portfolios.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Bel Fuse Inc.

- Rockwell Automation, Inc.

- ABB Ltd.

- NXP Semiconductors N.V.

- Larsen & Toubro Limited

- Mitsubishi Electric Corporation

- General Electric Company

- Schneider Electric SE

- Eaton Corporation plc

Recent Developments

- In October 2024, Littelfuse, Inc. has launched its 871 Series Ultra-High Amperage SMD Fuse, providing the industry’s first small surface-mount device (SMD) fuses with ratings up to 200 Amps. This expands on the 881 Series’ 125A maximum and is designed to meet the demands of high-power applications in compact electronic designs.

- In May 2024, Eaton launched a new portfolio of its Bussmann series fuses for commercial electric vehicles (EVs), showcasing them at the ACT Expo in Las Vegas, Nevada. These fuses are designed to meet the high power and demanding environmental requirements of electrified commercial vehicles.

- In April 2024, Bel Fuse’s EV-fitted fuses, expanded come in various formats, including fast-acting square-body and ceramic tube power fuses, with mounting choices such as PCB mounting (for soldering), socket mounting, and screw connection. The fuses are designed to protect critical components in EV systems from overcurrent and short circuits.

Report Coverage

The research report offers an in-depth analysis based on Fuse, Vehicle, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-voltage fuses will rise as EV adoption accelerates across global markets.

- Automakers will increasingly integrate compact and thermally efficient fuse designs to support power-dense architectures.

- Solid-state protection technologies will gain traction, gradually complementing traditional fuse formats.

- Intelligent fuse systems with diagnostic and monitoring capabilities will become more common in advanced vehicles.

- ADAS expansion will drive the need for fast-response fuses that protect sensitive electronic modules.

- Suppliers will invest more in miniaturization to meet space-constrained electrical layouts in next-generation vehicles.

- Regulatory pressure on safety and emission reduction will encourage stronger innovation in circuit protection.

- Collaborations between fuse manufacturers and OEMs will grow to enable platform-specific customization.

- Material advancements will enhance fuse durability under high temperature and vibration conditions.

- Asia-Pacific will remain a major production and consumption hub as automotive electronics continue to scale.