Market Overview

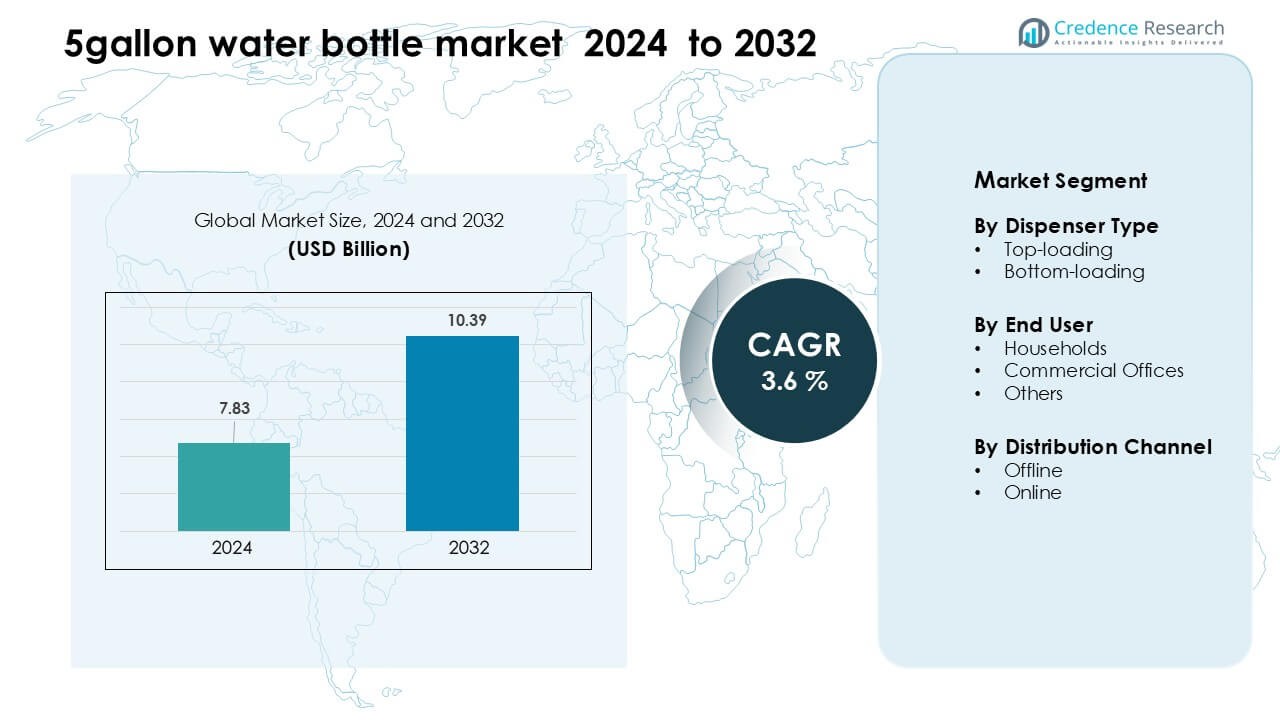

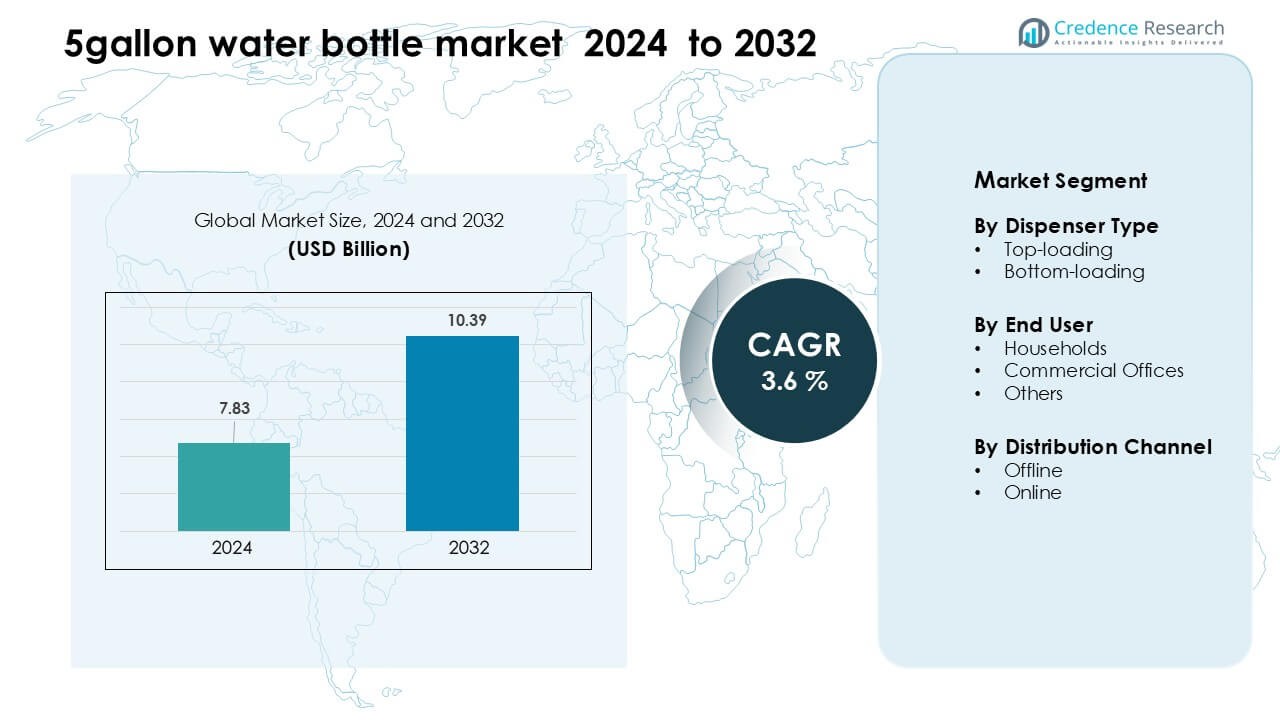

5-Gallon Water Bottles Market was valued at USD 7.83 billion in 2024 and is anticipated to reach USD 10.39 billion by 2032, growing at a CAGR of 3.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 5-Gallon Water Bottle Market Size 2024 |

USD 7.83 Billion |

| 5-Gallon Water Bottle Market, CAGR |

3.6 % |

| 5-Gallon Water Bottle Market Size 2032 |

USD 10.39 Billion |

In the global 5-gallon water bottle market, leading companies such as Primo Water Corporation, Culligan International Company, Danone S.A., Nestlé Waters, Niagara Bottling LLC and Absopure Water Company dominate through established delivery-and-refill programmes and large-scale bottle logistics. These players differentiate via returnable bottle systems, subscription services and service-level contracts with offices and homes. The leading region is North America, accounting for approximately 28 % of global revenue share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global 5-gallon water bottle market is expected to reach USD 10.39 billion by 2032, growing at a CAGR of 3.6 %.

- A key driver is subscription-based delivery models for homes and offices, which increase recurring revenue and customer lock-in.

- A notable trend is rising demand for returnable/refillable bottles and sustainable packaging as consumers and regulators push for environmental responsibility.

- Competitive intensity is high: major players invest in distribution networks, automated logistics and regional consolidation, while obstacles include plastic-waste regulation and rising cost of materials.

- Regionally, North America leads with the highest value share (around 28 % of global revenue) and the household segment holds the largest application share within this market.

Market Segmentation Analysis

By Dispenser type

Top-loading models dominated the 5-gallon water bottle market in 2024 with about 61% share. Buyers preferred these units because the design is simple, affordable, and easy to install in homes and small offices. The segment grew as households increased bulk water use due to rising tap-water safety concerns. Bottom-loading units expanded at a steady pace as companies promoted spill-free designs and cleaner aesthetics. Higher prices limited faster adoption for bottom-loading dispensers, yet demand increased in premium office spaces.

- For instance, many common top-loading water dispensers designed for home and office use have a cold-water storage tank capacity that falls within or close to the 2.5 to 3.2 litre range mentioned in the statement.

By End user

Households led the 5-gallon water bottle market in 2024 with nearly 68% share. Strong demand came from urban families seeking low-cost, clean, and portable drinking water. Growth was also supported by rising awareness about waterborne diseases and the need for safer hydration. Commercial offices adopted large bottles to reduce single-use plastic and support shared hydration points, but household use remained ahead due to higher daily consumption volumes and broader distribution reach.

- For instance, Blue Star rolled out its BWD3FMRGA top-load dispenser for office use, offering a cooling rate of 3 litres/hour and accommodating a 5-gallon jug within a stainless cabinet.

By Distribution channel

Offline channels accounted for about 72% share of the 5-gallon water bottle market in 2024. Local distributors, neighborhood water stations, and retail shops drove this lead because buyers trusted direct delivery and quick refills. The channel expanded through established home-delivery networks that ensured steady repeat purchases. Online platforms grew as subscription-based delivery apps gained users, but offline channels stayed dominant due to faster turnaround times and higher consumer dependence on regional water suppliers.

Key Growth Drivers

Growing demand for safe and affordable drinking water

Rising concerns about tap-water quality continue to push families and small businesses toward bulk packaged water, which supports stable expansion in the 5-gallon water bottle market. Many urban areas rely on delivered water due to inconsistent municipal supply, which increases demand across both households and offices. Bulk bottles offer a low-cost hydration option compared with single-serve packages, helping buyers reduce monthly spending. Growth also rises as more regions promote purified water access through regulated suppliers and doorstep delivery networks. Strong refill systems and higher hygiene standards enhance trust among frequent users. Expanding apartment complexes and small commercial units further boost repeat purchases.

- For instance, Bisleri explicitly offers a doorstep delivery service called “Bisleri@doorstep,” which includes its 20-litre jars. Customers can use the service for single orders or subscriptions.

Expansion of home-delivery and subscription models

Structured delivery networks drive strong growth as many customers prefer regular refill schedules for convenience. Subscription platforms simplify ordering and reduce dependency on ad-hoc store visits, helping suppliers secure predictable volumes. Delivery fleets expand in dense cities where demand remains high due to shifting consumer habits. Companies also add real-time tracking and digital payments to improve retention. These improvements help small suppliers scale faster and compete with branded water producers. The shift toward recurring monthly plans boosts loyalty and increases long-term usage in households and shared workspaces.

- For instance, Bisleri’s own app, Bisleri@Doorstep, supports subscription plans lasting from 1 up to 12 months, allowing customers to choose delivery days (Monday–Saturday) and payment frequency.

Rising office hydration needs and sustainability focus

Workplaces invest more in shared dispensers to offer employees clean water and reduce plastic waste from small bottles. The 5-gallon format supports this shift because each refill replaces multiple single-use units, making it a cost-efficient and eco-friendly choice. Increased awareness about employee health encourages firms to provide steady hydration access, especially in high-traffic corporate or co-working setups. Demand also rises as commercial buyers explore reusable containers that align with sustainability policies. This trend benefits large suppliers with strong delivery reach and compliance certifications.

Key Trends and Opportunities

Shift toward reusable and BPA-free containers

Buyers seek safer, durable containers for long-term use, which drives demand for BPA-free and improved-grade polycarbonate bottles. Manufacturers respond with designs that last longer and reduce wear during repeated refills. This shift supports a premium sub-segment and encourages higher hygiene standards across suppliers. Growing regulatory attention to material safety accelerates this trend and helps replace older bottle types. The rise of brand-conscious buyers also promotes better labeling and certified material use.

- For instance, Nalgene transitioned its reusable bottles to Tritan Renew, a material that is BPA-, BPS-, and phthalate-free, made with 50% certified recycled content, and is dishwasher safe on the top rack.

Growth of smart dispensers and contactless hydration points

Offices and premium homes adopt smart dispensers equipped with features like temperature control, child safety locks, and sensor-based dispensing. These upgrades boost demand for compatible 5-gallon formats because users prefer efficient refilling and cleaner hydration points. Contactless use gained traction as buyers sought safer shared access in commercial spaces. Improved dispenser compatibility encourages higher adoption of bulk bottles, especially in modern workplaces and service-sector hubs.

- For instance, Elkay offers hands-free ezH2O hydration stations with sensor-activated bottle fillers, built-in timing controls, and antimicrobial bubbler guards.

Key Challenge

High transportation and handling costs

Suppliers face rising fuel prices and labor costs, which directly increase the cost of bottle pickup, delivery, and cleaning. Bottles are heavy, require careful handling, and often demand repeat logistics due to refills. Small distributors struggle to maintain margins, especially when operating across wider delivery zones. These challenges create uneven pricing and limit upgrades in fleet capacity. Cost pressure slows adoption in price-sensitive regions where buyers compare rates between local suppliers.

Operational issues with bottle return and maintenance

The refill cycle depends on quick bottle returns and proper sanitation, yet many suppliers face delays due to inconsistent customer response and bottle misuse. Damaged or lost bottles increase replacement expenses and disrupt inventory flow. Maintaining hygiene also requires strict cleaning processes, which demand time and equipment. Lapses in sanitation increase health risks and reduce trust among consumers. These friction points affect supply reliability and create hurdles for large-scale expansion.

Regional Analysis

North America

North America held about 28% share of the 5-gallon water bottle market in 2024. Demand rose as households and offices used bulk water to offset concerns about aging pipelines and inconsistent municipal quality. The United States led due to strong home-delivery networks and high dispenser penetration. Canada showed stable growth as families adopted refill systems for cost savings. Growth also benefited from rising health awareness and a shift toward reusable bottles. Commercial buildings strengthened demand by replacing single-serve bottles with bulk formats to support sustainability and reduce waste.

Europe

Europe accounted for nearly 22% of the 5-gallon water bottle market in 2024. Demand increased as several regions faced hard water issues and older plumbing, which encouraged higher adoption of bulk purified options. Southern Europe saw faster expansion due to long summers and strong tourism activity, which boosted consumption in hotels and rental homes. Eastern Europe relied on cost-effective bulk formats for both homes and small offices. Sustainability trends supported reusable bottle circulation, while stricter hygiene rules pushed suppliers to improve cleaning systems and delivery quality.

Asia Pacific

Asia Pacific dominated the global market with around 34% share in 2024. Rapid urbanization, rising population density, and unreliable tap-water quality strengthened demand for 5-gallon bottled water across cities. China and India led due to large-scale home-delivery networks and strong use among both households and small businesses. Southeast Asia expanded fast as consumer hygiene awareness rose and refill stations grew in metropolitan hubs. The region’s large working population supported bulk purchases for offices, retail outlets, and co-working spaces. Strong distribution networks kept refill cycles frequent and steady.

Latin America

Latin America held close to 10% share of the 5-gallon water bottle market in 2024. Many countries relied on bulk bottled water due to concerns about supply reliability, which boosted household adoption. Mexico and Brazil represented the largest user base, supported by strong local distributors and recurring home-delivery services. Warmer climates further pushed consumption in residential and hospitality settings. Small and midsize businesses used bulk bottles to reduce costs linked to single-serve packaging. Adoption increased as suppliers improved sanitation processes and offered better-quality containers.

Middle East & Africa

The Middle East & Africa region captured about 6% share in 2024. Demand grew as water scarcity, high temperatures, and limited potable tap-water access encouraged reliance on bulk bottled options. Gulf countries led due to strong disposable incomes and established delivery systems supporting households and commercial offices. Africa saw steady adoption in urban centers where consumers preferred safer drinking options. Hotels, construction sites, and corporate setups boosted demand for dispensers paired with 5-gallon bottles. Growth improved as suppliers expanded refill plants and strengthened bottle-return processes.

Market Segmentations:

By Dispenser Type

- Top-loading

- Bottom-loading

By End User

- Households

- Commercial Offices

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The 5-gallon water bottle market features strong competition led by key players such as Nestlé Waters, Primo Water Corporation, Culligan International Company, Eden Springs Ltd., Danone S.A., Niagara Bottling LLC, Absopure Water Company, HINADA, and the International Bottled Water Association. These companies expand their market reach through large distribution networks, subscription-based delivery models, and advanced refill systems. Leading brands focus on durable bottle materials, improved sanitization processes, and returnable packaging to meet rising sustainability expectations. Many competitors invest in automated cleaning lines and smart dispensers to improve service speed and reduce operational errors. Partnerships with offices, industries, and residential communities help them secure long-term contracts. Market leaders also introduce BPA-free bottles and enhanced leak-proof designs to strengthen consumer trust. Growing demand for bulk hydration solutions pushes firms to scale production facilities while using cost-efficient logistics to maintain price competitiveness across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Primo Water Corporation (Primo Brands) Primo Brands published its inaugural 2024 Sustainability Report, highlighting that its reusable 3- and 5-gallon bottles can be reused up to 25 times and noting expansion to roughly 26,500 Water Exchange locations and 23,500 refill stations across North America.

- In July 2024, Eden Springs Ltd. Aquaservice acquired Eden Springs Portugal, the country’s leading bottled-water-with-dispenser provider, strengthening Iberian distribution of large water containers for homes and offices.

- In January 2024, Culligan International Company Culligan acquired most of Primo Water’s EMEA businesses (excluding the UK, Portugal, Israel, and Aimia Foods), expanding its European bottled-water cooler and 5-gallon delivery network to about 1.35 million customers.

Report Coverage

The research report offers an in-depth analysis based on Dispenser Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The 5-gallon water bottle market will increasingly shift toward reusable and refill models.

- Companies will expand digital delivery tools and subscription-based models to boost customer retention.

- Sustainability demands will drive deployment of lighter bottles, recycled materials and reduced-waste programs.

- Growth in Asia-Pacific will accelerate as urbanization and income levels rise in China and India.

- The household end-user segment will grow faster than commercial offices, thanks to more home-based workers.

- Logistics efficiency and last-mile delivery investments will differentiate leading firms.

- Regulatory pressures on single-use plastics will push firms toward alternative packaging formats.

- Integration of smart tracking (e.g., bottle version control or dispenser usage) will enhance operational visibility.

- Pricing pressures from refill stations and municipal alternatives will force margin optimization.

- Mergers and acquisitions will increase as firms seek scale in regional markets and consolidate production.