Market Overview

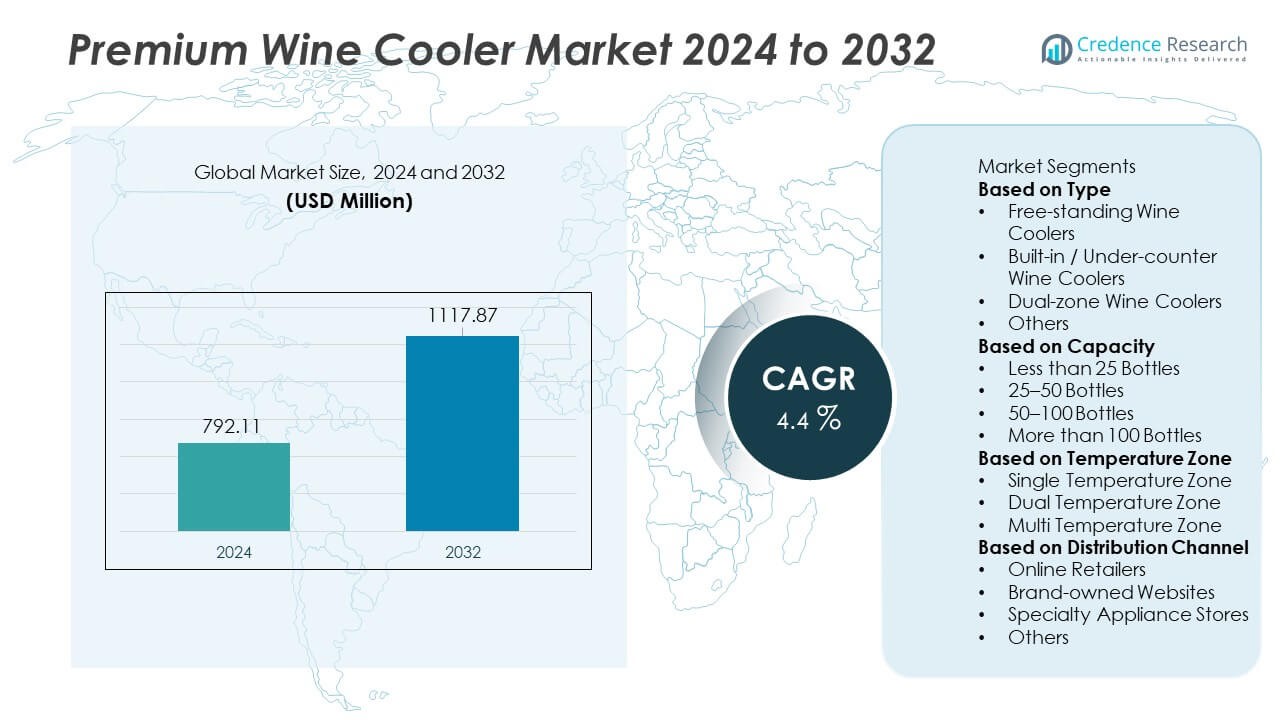

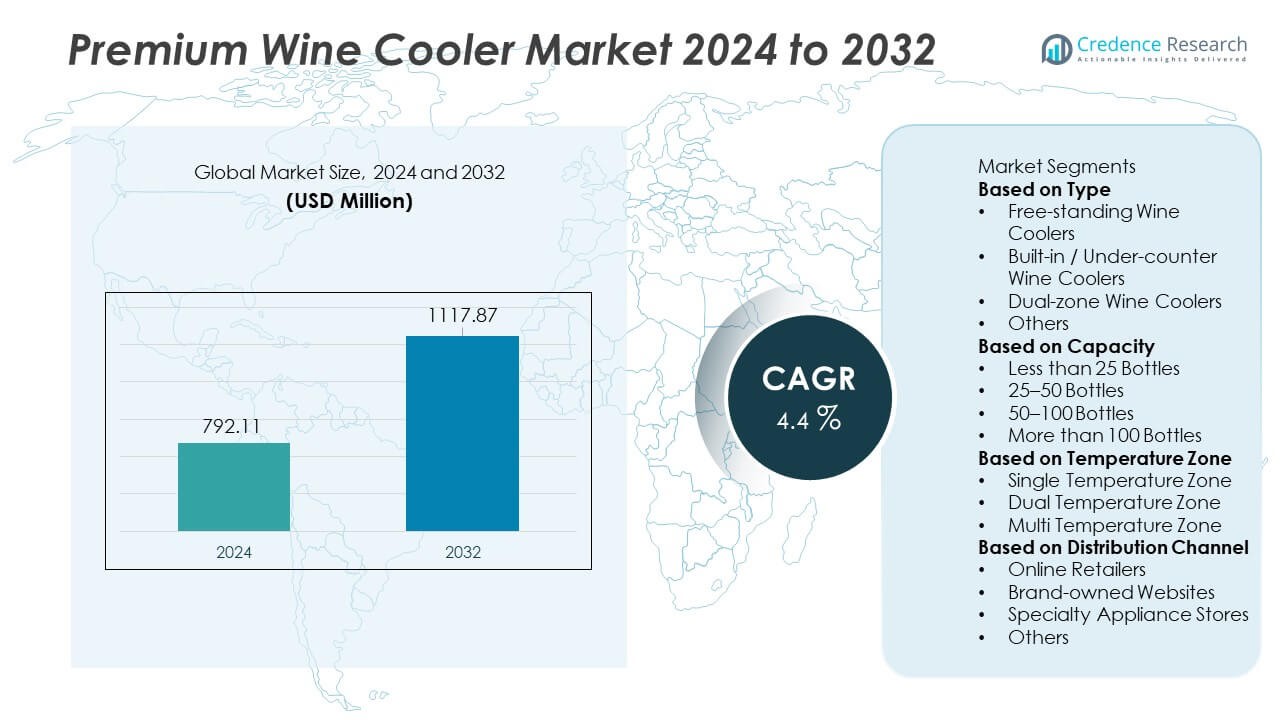

The Premium Wine Cooler Market size reached USD 792.11 million in 2024 and is expected to rise to USD 1117.87 million by 2032, registering a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Wine Cooler Market Size 2024 |

USD 792.11 Million |

| Premium Wine Cooler Market, CAGR |

4.4% |

| Premium Wine Cooler Market Size 2032 |

USD 1117.87 Million |

The Premium Wine Cooler market is shaped by leading players such as Haier Group, LG Electronics, Whirlpool Corporation, Electrolux AB, Bosch, Samsung Electronics, Avanti Products, NewAir, EuroCave, and Danby Appliances. These companies compete through advanced cooling technologies, multi-zone designs, and smart connectivity features that appeal to both residential and commercial users. North America stands as the leading region with a market share of 37%, driven by strong wine consumption trends, high disposable incomes, and rapid adoption of luxury kitchen appliances. Europe follows closely with significant demand supported by its long-established wine culture and preference for premium preservation systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Premium Wine Cooler market reached USD 792.11 million in 2024 and will grow to USD 1117.87 million by 2032 at a CAGR of 4.4%, supported by rising adoption of luxury home appliances.

- Demand grows due to rising wine consumption and the need for precise storage, with free-standing units leading the type segment at 46% share and the 25–50 bottle capacity range holding a 39% share.

- Key trends include rising preference for dual-zone systems, which dominate the temperature zone segment with a 52% share, and growing upgrades toward smart, connected cooling solutions.

- The competitive landscape includes major players such as Haier, LG, Whirlpool, Electrolux, Bosch, Samsung, NewAir, EuroCave, Avanti, and Danby focusing on energy-efficient builds and premium designs.

- North America leads the global market with a 37% share, followed by Europe at 32%, while Asia Pacific expands rapidly with a 20% share driven by urbanization and premium lifestyle adoption.

Market Segmentation Analysis:

By Type

Free-standing wine coolers lead this segment with a 46% market share, supported by strong demand for flexible placement and easy installation. These units appeal to homeowners seeking premium storage without structural changes. Built-in and under-counter models gain traction in luxury kitchens but grow at a slower pace due to higher installation costs. Dual-zone coolers attract collectors who store different wine types together, improving segment momentum. Rising home remodeling and interest in smart cooling features support overall market expansion, while makers enhance efficiency and noise control to improve adoption.

- For instance, Haier upgraded its Dual-Zone Series with an inverter compressor, which helps in cutting noise levels and improving energy use through precise load adjustment. The model also incorporates Wi-Fi monitoring linked to internal smart sensors that maintain temperature stability within optimal ranges.

By Capacity

The 25–50 bottles sub-segment dominates with a 39% market share, driven by strong adoption in urban homes and compact commercial spaces. This capacity range offers the right balance between storage space and footprint, making it ideal for modern kitchens. Units under 25 bottles attract beginners but face limitations for long-term storage. Larger options, including 50–100 bottles and above 100 bottles, gain interest among collectors and hospitality venues seeking wider assortments. Growing consumer interest in wine curation and vibration-free cooling supports demand across all tiers.

- For instance, NewAir introduced a 46-bottle built-in wine cooler using a compressor-based cooling system drawing approximately 90W to 100W of power. The system utilizes a digital sensor to maintain temperatures with controls for specific ranges (e.g., 40-55°F in the upper zone and 50–66°F in the lower zone).

By Temperature Zone

Dual-temperature zone wine coolers hold the leading position with a 52% market share, as buyers prefer precise climate settings for red and white wines. This flexibility makes dual-zone units popular among premium households, bars, and tasting rooms. Single-zone models remain relevant for basic storage but grow slowly due to limited versatility. Multi-zone designs attract high-end users seeking advanced preservation for varied collections. Rising awareness of proper wine aging and the integration of smart thermostatic controls continue to strengthen demand for dual-zone cooling systems.

Key Growth Drivers

Growing Demand for Home Luxury Appliances

Rising consumer interest in premium home appliances drives strong demand for high-end wine coolers. Households invest in advanced cooling systems as disposable incomes rise and home entertainment gains importance. Luxury kitchen upgrades and modular interiors further boost adoption across urban regions. Consumers also prioritize design aesthetics, quieter operation, and enhanced storage stability. These factors push manufacturers to introduce sophisticated models with sleek finishes, multi-zone cooling, and energy-efficient compressors, strengthening market growth.

- For instance, Bosch (BSH Home Appliances) offers wine storage lines featuring two precise temperature zones (5-20°C) and exceptionally quiet operation, with some models keeping noise levels as low as 38 dB.

Expansion of Wine Consumption and Collecting Culture

A growing wine-drinking population accelerates demand for reliable and stylish storage solutions. More consumers now maintain personal wine collections at home, requiring ideal temperature and humidity control. Restaurants, boutique bars, and tasting rooms also upgrade storage infrastructure to preserve wine quality. Rising awareness of proper storage conditions encourages adoption of premium coolers that protect aroma, flavor, and shelf life. These preferences support steady market expansion across residential and commercial segments.

- For instance, EuroCave developed a collector-grade unit (specifically the Royale line) equipped with a variable-speed compressor for reduced vibration, resulting in an extremely low noise level of 34 dB(A).

Advancement in Cooling and Smart Control Technologies

Improvements in thermoelectric systems, inverter compressors, and digital sensors enhance cooling precision and energy performance. Smart features such as app-based monitoring, temperature alerts, and automated climate adjustments attract tech-focused buyers. Manufacturers integrate UV-resistant glass, vibration-control motors, and humidity management to preserve wine integrity. These innovations boost efficiency while offering superior user experience. Increased interest in smart kitchens creates long-term opportunities for advanced, connected wine storage systems.

Key Trends & Opportunities

Rising Interest in Multi-Zone and Custom Storage Designs

Consumers increasingly seek wine coolers that support varied storage needs, boosting demand for dual-zone and multi-zone models. These units appeal to users who store diverse wine types with different aging conditions. Custom wood racks, LED lighting, and modular shelving enhance aesthetic appeal and usability. The trend aligns with premium kitchen design, where built-in coolers complement modern interiors. Ongoing innovation in layout flexibility and temperature zoning strengthens product adoption.

- For instance, Vinotemp introduced a multi-zone unit featuring three independent cooling chambers, each regulated by precision sensors that maintain temperature within a ±0.5°C range. The system uses a 140W compressor with vibration measured below 6 m/s², and includes customizable wooden shelves supporting loads up to 18 kilograms per shelf.

Growth of Online Sales and Premium E-Commerce Retail

E-commerce platforms expand visibility for premium wine coolers, offering wide model comparisons, customer reviews, and doorstep delivery. Digital channels help brands reach urban and semi-urban markets with minimal physical presence. Online exclusive models, virtual demos, and extended warranties encourage faster purchase decisions. Rising trust in online appliance purchases creates strong opportunities for manufacturers to scale distribution and promote high-value, feature-rich product lines.

- For instance, LG Electronics offers various wine coolers and refrigerators, including models with a Smart Inverter Compressor which is known for efficient, quiet, and durable operation.

Key Challenges

High Initial Cost Limiting Broader Adoption

Premium wine coolers often carry high purchase and installation costs, restricting adoption among price-sensitive consumers. Units with multi-zone cooling, smart connectivity, and advanced compressors require significant investment. Commercial users also face higher maintenance expenses, reducing appeal for small-scale establishments. These cost barriers slow adoption in emerging markets, where consumers still prefer basic storage solutions. Manufacturers must balance premium features with affordability to expand reach.

Energy Consumption and Performance Variability

Wine coolers rely on compressors or thermoelectric systems, both of which face performance challenges in high-temperature environments. Energy usage increases when units operate in warmer rooms, raising operating costs. Thermoelectric models offer quieter operation but struggle with temperature stability. Compressor-based systems provide stronger cooling but generate more noise and vibration. Addressing these performance trade-offs remains essential for long-term customer satisfaction and wider market penetration.

Regional Analysis

North America

North America leads the Premium Wine Cooler market with a market share of 37%, supported by strong consumer interest in luxury kitchen appliances and rising wine consumption across the U.S. and Canada. High disposable incomes encourage purchases of multi-zone and built-in units for modern homes. Restaurants, tasting rooms, and boutique bars expand premium storage installations to maintain quality standards. Growing adoption of smart home ecosystems also increases demand for connected cooling technologies. Well-established appliance brands and strong retail networks further strengthen market penetration across residential and commercial segments.

Europe

Europe holds a market share of 32%, driven by a well-established wine culture and strong demand for high-quality preservation systems. Consumers in France, Italy, Germany, and the U.K. invest in advanced coolers to support personal collections and premium kitchen upgrades. Built-in models see higher popularity due to widespread integration of modular kitchen designs. Commercial wine storage needs also rise across hotels, wineries, and fine-dining venues. Growing focus on energy-efficient cooling and noise-reduction features continues to support adoption, making Europe one of the most mature regional markets.

Asia Pacific

Asia Pacific accounts for a market share of 20%, fueled by rising urbanization, growing premium hospitality infrastructure, and increasing wine consumption in China, Japan, South Korea, and Australia. Expanding high-income groups adopt dual-zone and smart coolers to support luxury lifestyle preferences. Hotels, premium bars, and modern retail stores invest in advanced storage systems to maintain wine quality. Rapid growth of e-commerce enhances access to global brands. The region shows strong potential for future expansion as consumers shift toward high-end appliances and organized storage solutions.

Latin America

Latin America holds a market share of 7%, supported by expanding wine consumption and gradual adoption of premium household appliances across Brazil, Argentina, Chile, and Mexico. Urban households invest in compact and mid-capacity coolers to support growing interest in organized wine storage. Tourism and hospitality sectors adopt advanced cooling systems to maintain service standards in premium restaurants and boutique hotels. Rising exposure to international brands through online channels also enhances awareness. Although price sensitivity remains high, demand for premium units grows steadily among affluent customer groups.

Middle East & Africa

The Middle East & Africa region captures a market share of 4%, driven by rising luxury hospitality projects and premium residential developments in the UAE, Saudi Arabia, and South Africa. High-income consumers adopt built-in and multi-zone coolers to support upscale home designs. Premium hotels, restaurants, and resorts expand wine storage installations to cater to global travelers. Hot climates increase reliance on advanced cooling technologies to maintain temperature stability. While adoption remains concentrated in affluent segments, ongoing construction of luxury real estate continues to drive gradual market expansion.

Market Segmentations:

By Type

- Free-standing Wine Coolers

- Built-in / Under-counter Wine Coolers

- Dual-zone Wine Coolers

- Others

By Capacity

- Less than 25 Bottles

- 25–50 Bottles

- 50–100 Bottles

- More than 100 Bottles

By Temperature Zone

- Single Temperature Zone

- Dual Temperature Zone

- Multi Temperature Zone

By Distribution Channel

- Online Retailers

- Brand-owned Websites

- Specialty Appliance Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features key players such as Haier Group, LG Electronics, Whirlpool Corporation, Electrolux AB, Bosch, Samsung Electronics, Avanti Products, NewAir, EuroCave, and Danby Appliances. These companies focus on expanding product lines with advanced cooling technologies, smart connectivity, and energy-efficient components to strengthen market presence. Premium brands emphasize vibration-control systems, multi-zone temperature management, and UV-shielded glass to enhance wine preservation standards. Manufacturers also invest in sleek design upgrades to align with modern kitchen aesthetics and built-in installation trends. Partnerships with specialty retailers, expansion of e-commerce channels, and regional distribution enhancements support wider accessibility. Innovation in inverter compressors, humidity stabilization, and app-based monitoring continues to differentiate high-end offerings. As competition intensifies, companies prioritize reliability, noise reduction, and premium materials to target both residential buyers and luxury hospitality segments.

Key Player Analysis

- Haier Group

- LG Electronics

- Whirlpool Corporation

- Electrolux AB

- Bosch (BSH Home Appliances)

- Samsung Electronics

- Avanti Products

- NewAir

- EuroCave

- Danby Appliances

Recent Developments

- In April 2024, Samsung showcased a new built-in kitchen appliance lineup at events like EuroCucina 2024 and the “Welcome to BESPOKE AI” global launch, confirming their push into the premium built-in segment in the European and global markets.

- In 2023, Avanti Products expanded its built-in wine cooler range. The new models offered better energy efficiency and touch controls, targeting consumers looking for sleek, integrated wine storage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Temperature Zone, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dual-zone and multi-zone coolers will rise as consumers store varied wine types.

- Smart connectivity features will expand with wider use of app-based monitoring and alerts.

- Energy-efficient compressor and inverter technologies will gain stronger adoption across regions.

- Built-in and under-counter models will see higher demand due to modern kitchen designs.

- Commercial adoption will increase as hotels, bars, and tasting rooms upgrade premium storage.

- E-commerce sales will grow as more buyers prefer online model comparison and digital warranties.

- High-end materials and noise-reduction technologies will become key differentiators for brands.

- Compact and mid-capacity coolers will remain popular among urban households with limited space.

- Manufacturers will expand regional distribution to capture rising demand in Asia Pacific and Latin America.

- Sustainability-focused buyers will drive interest in low-vibration, energy-efficient, and long-life cooling systems.