Market Overview

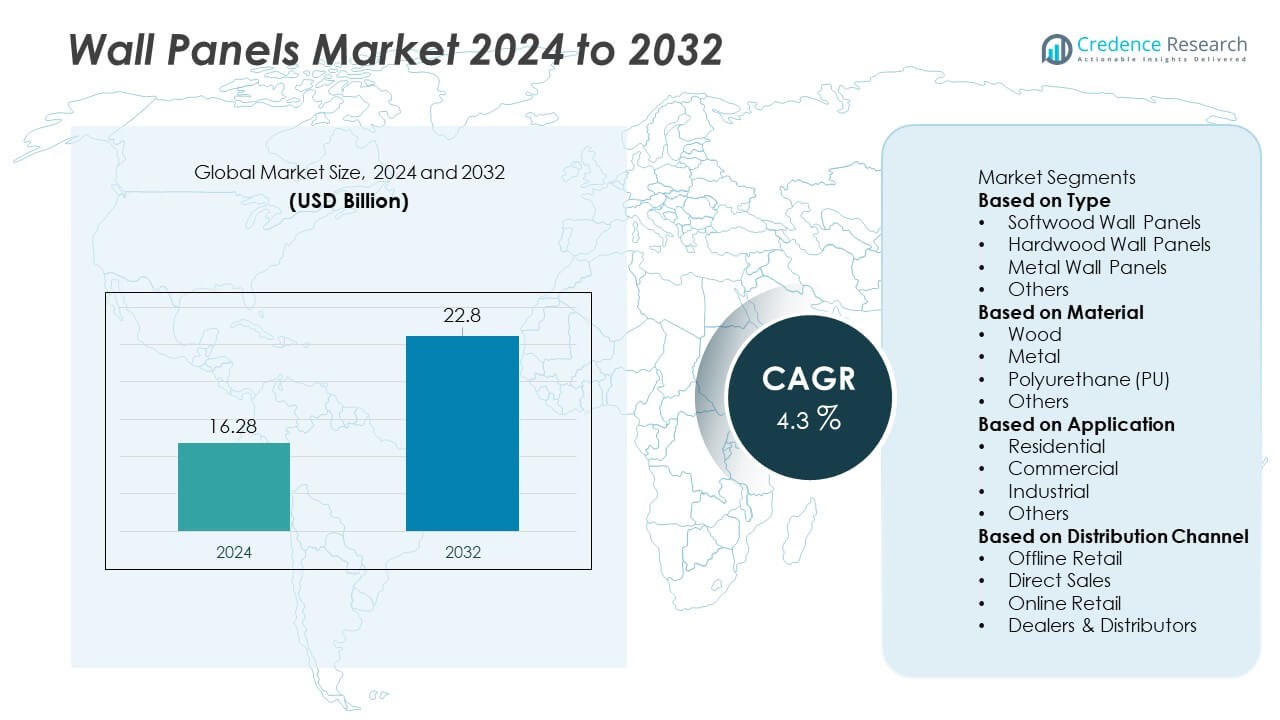

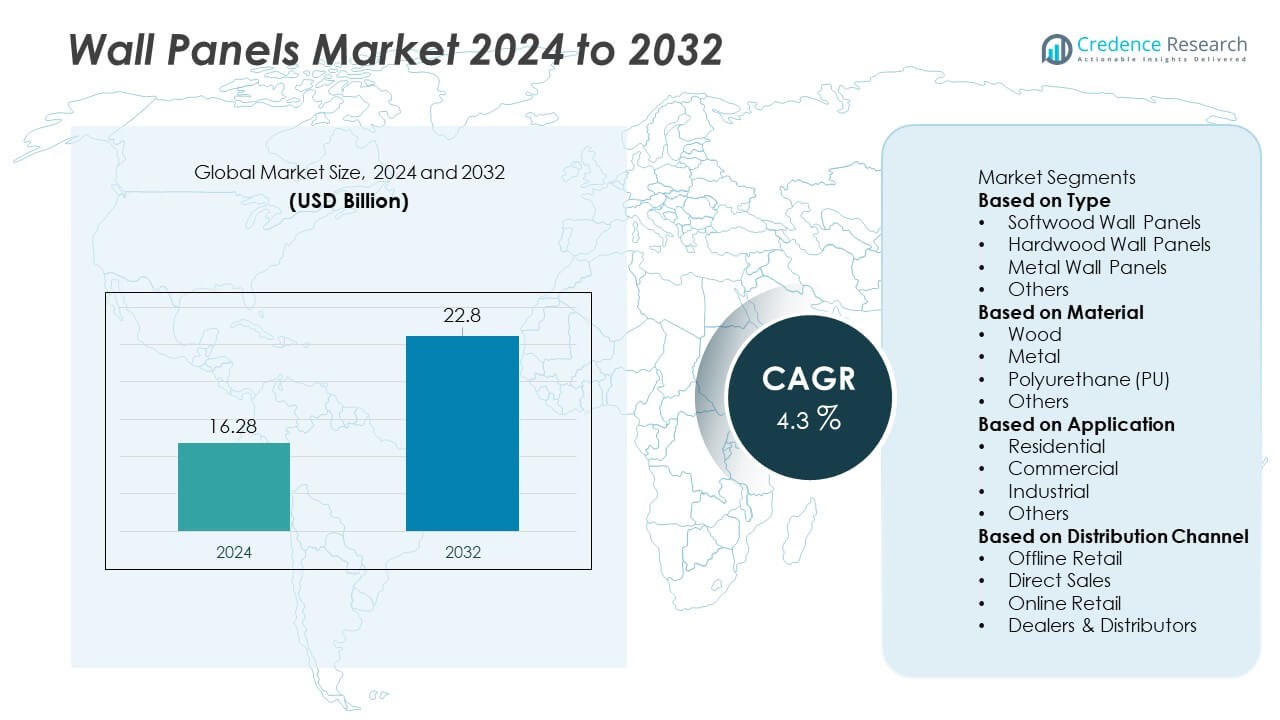

The Wall Panels market was valued at USD 16.28 billion in 2024 and is projected to reach USD 22.8 billion by 2032, expanding at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wall Panels Market Size 2024 |

USD 16.28 Billion |

| Wall Panels Market, CAGR |

4.3% |

| Wall Panels Market Size 2032 |

USD 22.8 Billion |

The Wall Panels market is supported by key players including Armstrong World Industries, USG Corporation, Kingspan Group, Nichiha Corporation, Pfleiderer Group, ATAS International, Kajaria Ceramics, AICA Kogyo Co., Ltd., Daiken Corporation, and Murphy Wall Beds & Panels. These companies strengthen market growth through advanced manufacturing technologies, sustainable material development, and expanded product portfolios for residential, commercial, and industrial applications. Asia Pacific leads the global market with a 39% share, driven by rapid urban construction and rising demand for modular interiors. North America follows with a 28% share, supported by strong renovation activity, while Europe holds a 26% share, driven by strict building standards and high adoption of energy-efficient wall systems.

Market Insights

- The Wall Panels market reached USD 16.28 billion in 2024 and will rise to USD 22.8 billion by 2032 at a CAGR of 4.3%.

- Demand grows as renovation activities increase and softwood wall panels lead the type segment with 41% share, driven by lightweight design and strong residential adoption.

- Key trends include rising use of wood materials holding 44% share, along with growing demand for digitally printed, customizable, and moisture-resistant surfaces across commercial interiors.

- Competition intensifies as Armstrong World Industries, USG, Kingspan, Nichiha, Pfleiderer, AICA Kogyo, ATAS International, Kajaria Ceramics, Daiken, and Murphy Wall Panels expand sustainable product lines and modular installation systems.

- Asia Pacific leads with a 39% share, followed by North America at 28% and Europe at 26%, while the residential application segment dominates with 46% share due to strong home décor and interior modernization trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Softwood wall panels lead the type segment with a 41% market share, driven by their versatility, lightweight structure, and strong adoption in residential interiors. These panels offer cost-effective installation and meet rising demand for natural aesthetics in modern home décor. Hardwood panels gain traction in premium interior projects due to their durability and high-end appearance, while metal panels expand use in industrial and commercial spaces for fire resistance and structural strength. Other materials, including composite and hybrid panels, support niche applications where moisture and impact resistance are essential. Growing renovation activities and interior upgrades continue to reinforce demand for softwood wall panels.

- For instance, Armstrong World Industries produces wood fiber panels made from rapidly renewable aspen softwood fibers that can achieve a 0.70 NRC acoustic rating (or higher, depending on the mounting method), supporting performance in a variety of commercial spaces such as schools, offices, and libraries.

By Material

Wood dominates the material segment with a 44% market share, supported by its strong preference in residential and commercial interiors for aesthetic appeal, insulation, and design flexibility. The rise in sustainable construction further drives adoption of engineered wood and MDF-based wall panels. Metal panels hold steady demand in industrial and high-traffic environments due to their long life, corrosion resistance, and robust structural properties. Polyurethane (PU) panels gain momentum for their thermal performance, lightweight design, and suitability for energy-efficient buildings. Other materials serve specialized needs in acoustics, hygiene-sensitive spaces, and modern architectural facades.

- For instance, Kingspan Group manufactures PU-insulated architectural panels achieving thermal conductivity as low as 0.022 W/m·K, improving energy efficiency.

By Application

The residential segment leads with a 46% market share, driven by rising home renovation projects, modular interior trends, and consumer preference for decorative and easy-to-install wall solutions. Wood-based and PVC-coated designs remain popular in living rooms, bedrooms, and kitchens due to their durability and aesthetic versatility. The commercial segment follows as offices, retail stores, and hospitality spaces invest in modular panels that support soundproofing and modern interior themes. Industrial applications prioritize metal and PU panels for fire resistance, hygiene compliance, and long-term wear. Growing urban development and improved construction spending continue to strengthen adoption in the residential sector.

Key Growth Drivers

Rising Demand for Interior Renovation and Aesthetic Upgrades

Growing interest in modern interior décor drives strong demand for wall panels, especially in residential and commercial spaces seeking faster and cleaner installation. Consumers prefer panels for their aesthetic flexibility, sound insulation, and long-lasting finish. Renovation activities increase with urban housing development and rising disposable income. Modular interior concepts and the shift toward low-maintenance materials further support adoption. As homeowners and businesses prioritize visually appealing and durable surfaces, the market experiences steady expansion across both new construction and retrofit applications.

- For instance, DAIKEN Corporation manufactures high-density fiberboard (HDF) and medium-density fiberboard (MDF) panels that offer excellent dimensional stability and water resistance, enhancing durability in premium home upgrades.

Growth in Commercial Construction and Infrastructure Projects

The commercial sector increases use of wall panels due to rising construction of offices, hospitality spaces, retail outlets, and institutional buildings. Panels offer efficient installation, structural strength, and enhanced fire and moisture resistance, making them suitable for high-traffic environments. Developers choose wood, metal, and PU-based panels to improve acoustics and energy efficiency. Government infrastructure investments and refurbishment of public buildings also contribute to market growth. As businesses adopt modern architectural themes and sustainable materials, the demand for durable and design-oriented wall panels continues to rise.

- For instance, Nichiha Corporation manufactures fiber cement panels offering superior dimensional stability in humid commercial environments.

Increasing Focus on Sustainable and Energy-Efficient Materials

Sustainability trends accelerate demand for eco-friendly wall panels produced from engineered wood, recycled fibers, and low-emission materials. PU-based insulated panels gain popularity due to their thermal performance and reduced energy consumption. Manufacturers adopt greener production processes and certification standards to meet regulatory requirements and consumer expectations. Sustainable construction practices and green-building certifications boost adoption across residential and commercial projects. As environmental awareness rises, the shift toward lightweight, recyclable, and thermally efficient wall panels becomes a major growth driver.

Key Trends & Opportunities

Adoption of Lightweight and Modular Panel Designs

Lightweight and modular wall panels gain strong traction as builders and interior designers seek quicker installation and reduced labor costs. Panels with click-and-lock mechanisms, pre-finished surfaces, and customizable textures support greater design flexibility. Demand rises for materials offering moisture resistance, acoustic performance, and fire-rated properties. Modular construction in offices, healthcare, and hospitality sectors expands opportunities for advanced panel systems. This trend supports faster project timelines and encourages wider use in retrofit applications where minimal downtime is critical.

- For instance, ATAS International manufactures aluminum wall panels with panel gauge thickness reaching 0.032 inches, allowing low-weight installation without compromising strength.

Expansion of Digital Printing and Customizable Architectural Finishes

Digital printing technology allows manufacturers to offer customized textures, patterns, and high-definition finishes that replicate stone, wood, and metal surfaces. Designers increasingly adopt customizable panels to achieve premium aesthetics without high material costs. Commercial spaces benefit from brand-specific or theme-based wall designs. Technological advancements enhance surface durability, scratch resistance, and fade protection. The trend creates opportunities for product differentiation and expands the market for decorative and premium-grade wall panels across multiple end-use industries.

- For instance, Kajaria Ceramics applies high-definition digital printing technology that ensures accurate reproduction of natural wood and stone textures with enhanced visual depth and minimal shade variation.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

The wall panels market faces cost pressures due to volatile prices of wood, metal, PU, and resin-based materials. Global supply chain disruptions and inconsistent availability of quality raw materials increase production challenges. Manufacturers experience rising transportation and procurement costs, affecting pricing and profit margins. These fluctuations limit adoption in cost-sensitive markets and force companies to adjust sourcing strategies. Stabilizing raw material supply remains crucial for long-term market sustainability.

Competition from Low-Cost Alternatives and Limited Awareness in Emerging Markets

Low-cost wall coverings such as wallpapers, paints, and basic cladding materials compete directly with wall panels, especially in developing regions. Limited consumer awareness of benefits like durability, insulation, and moisture resistance restricts adoption. Budget-sensitive residential buyers often choose cheaper alternatives despite shorter lifespan. Market penetration remains slow in rural and low-income areas due to lack of distribution networks and installation expertise. Expanding education, marketing, and dealer networks is essential to overcome this challenge.

Regional Analysis

North America

North America holds a market share of 28%, driven by strong demand for wall panels in residential remodeling, commercial interiors, and institutional construction. The U.S. leads adoption due to rising preference for modern décor, improved acoustic performance, and energy-efficient building materials. Developers increasingly choose engineered wood, PU, and metal panels for durable and low-maintenance applications. Growth in office renovations, hospitality upgrades, and healthcare infrastructure further supports demand. The region also benefits from robust distribution networks and high consumer awareness. Continued investment in green buildings and premium interior solutions strengthens long-term market expansion.

Europe

Europe accounts for a market share of 26%, supported by advanced construction standards, widespread adoption of sustainable materials, and growing emphasis on energy-efficient wall systems. Countries such as Germany, the U.K., France, and Italy drive strong demand for wood-based and PU-insulated panels in commercial and residential spaces. The region prioritizes environmentally certified products, boosting the use of low-emission and recyclable materials. Renovation of aging infrastructure and expansion of modern office spaces contribute to steady growth. Europe’s architectural focus on aesthetic, durable, and modular interiors further enhances demand for high-quality wall panels.

Asia Pacific

Asia Pacific leads the global market with a market share of 39%, fueled by rapid urbanization, rising middle-class income, and expanding construction across China, India, Japan, and Southeast Asia. Residential projects increase demand for affordable and decorative wall panels, while commercial developments adopt PU, metal, and MDF panels for structural performance and design flexibility. Large-scale infrastructure investments and smart-city initiatives further accelerate growth. The region also benefits from strong manufacturing capabilities and competitive pricing. Increasing adoption of modular interiors and digital-print decorative panels continues to drive market expansion in Asia Pacific.

Latin America

Latin America holds a market share of 5%, driven by growing construction activity and rising interest in cost-effective, aesthetic, and lightweight wall solutions. Brazil, Mexico, and Argentina lead adoption, especially in residential upgrades and commercial interiors. The region experiences increasing use of MDF and PVC panels due to affordability and easy installation. Demand grows as urbanization accelerates and property renovations become more frequent. Despite economic fluctuations, expanding retail and hospitality sectors contribute to market growth. Improvements in supply chains and rising awareness of modern interior materials support steady adoption across key countries.

Middle East & Africa

The Middle East & Africa region accounts for a market share of 4%, influenced by rising construction in hospitality, commercial complexes, and premium residential developments. The UAE, Saudi Arabia, and South Africa drive adoption with strong demand for decorative and thermally efficient wall systems. Harsh climatic conditions increase preference for PU-insulated and metal panels. Large-scale infrastructure projects, shopping malls, and luxury real estate developments contribute to market expansion. Although adoption is concentrated in high-income zones, increasing urban development and modern interior trends support gradual growth across emerging markets in the region.

Market Segmentations:

By Type

- Softwood Wall Panels

- Hardwood Wall Panels

- Metal Wall Panels

- Others

By Material

- Wood

- Metal

- Polyurethane (PU)

- Others

By Application

- Residential

- Commercial

- Industrial

- Others

By Distribution Channel

- Offline Retail

- Direct Sales

- Online Retail

- Dealers & Distributors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Armstrong World Industries, USG Corporation, Kingspan Group, Nichiha Corporation, Murphy Wall Beds & Panels, Pfleiderer Group, ATAS International, Kajaria Ceramics, AICA Kogyo Co., Ltd., and Daiken Corporation. These companies compete by expanding their product portfolios with advanced wood, metal, fiberboard, and polyurethane-based wall panels tailored for residential, commercial, and industrial applications. Manufacturers prioritize innovations such as high-definition digital printing, moisture-resistant coatings, fire-rated designs, and modular installation systems to enhance durability and aesthetics. Strategic partnerships with builders, architects, and distributors strengthen market reach, while investments in sustainable materials support green-building trends. Leading brands also focus on lightweight, customizable, and acoustic-enhanced panels to address diverse design requirements. As competition intensifies, companies differentiate through quality consistency, expanded retail networks, and strong after-sales support to capture growing demand across global construction and interior renovation markets.

Key Player Analysis

Recent Developments

- In November 2025, Armstrong World Industries, Inc. expanded its CASTWORKS Walls lineup by launching six new designer wall-panel profiles made from glass-fiber reinforced gypsum (GRG/GFRG).

- In September 2025, Armstrong World Industries, Inc. acquired Canadian manufacturer Geometrik Manufacturing Inc. to strengthen its wood-panel product offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for decorative and modular wall panels will rise as renovation activities expand.

- Adoption of digitally printed and customizable designs will increase across residential and commercial interiors.

- Sustainable and low-emission materials will gain stronger preference in green-building projects.

- Lightweight and moisture-resistant panels will see higher use in high-humidity environments.

- Industrial and commercial sectors will adopt more fire-rated and acoustic wall panel systems.

- Energy-efficient PU-insulated wall panels will gain traction in modern construction.

- Manufacturers will expand product lines with advanced coatings and durable surface finishes.

- Distribution through online channels will grow as buyers prefer easy comparison and quick delivery.

- Asia Pacific will remain a major growth region due to rapid urbanization and rising interior upgrades.

- Partnerships with architects and builders will increase to drive adoption of premium and design-focused wall panels.