Market Overview

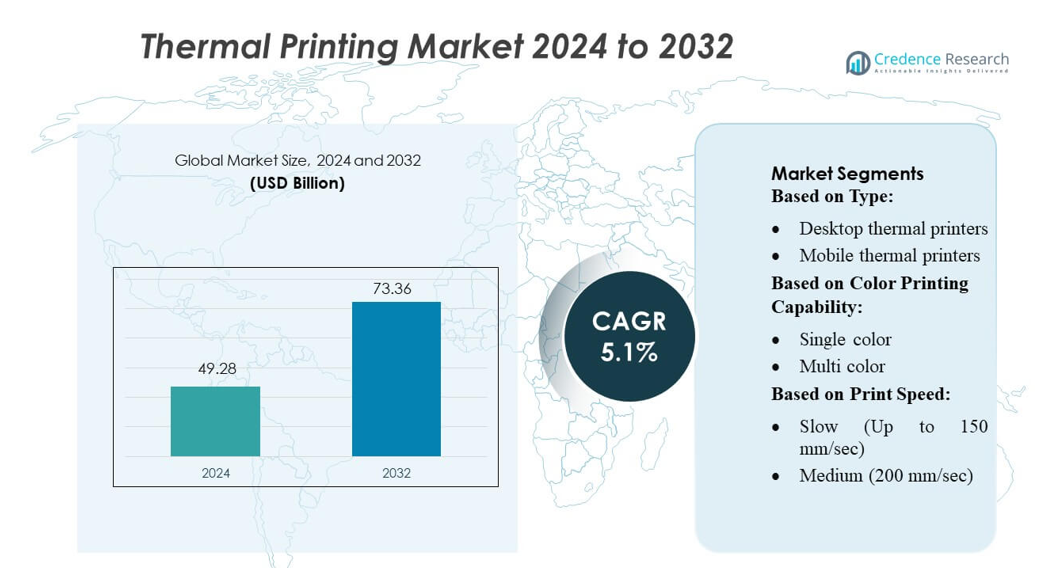

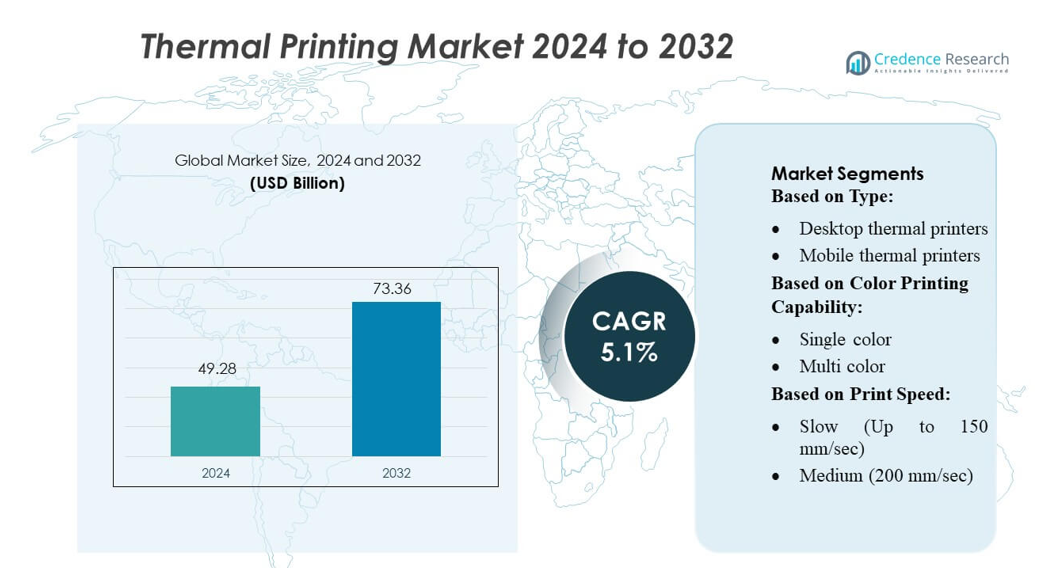

Thermal Printing Market size was valued USD 49.28 billion in 2024 and is anticipated to reach USD 73.36 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermal Printing Market Size 2024 |

USD 49.28 billion |

| Thermal Printing Market, CAGR |

5.1% |

| Thermal Printing Market Size 2032 |

USD 73.36 billion |

The global thermal printing market features a competitive environment with leading players such as Brother Industries, Ltd., Honeywell International Inc., Citizen Systems Japan Co., Ltd., Seiko Epson Corporation, TSC Auto ID Technology Co., Ltd., GoDEX International Co., Ltd., Toshiba TEC Corporation, Sato Holdings Corporation, Bixolon Co., Ltd. and Zebra Technologies Corporation. These firms maintain strong market presence by continuously enhancing print speed, reliability and broader application capabilities—from mobile receipt printing to industrial-grade label production. They also expand offerings to include IoT-enabled and cloud-managed print solutions, targeting sectors such as retail, logistics, healthcare and manufacturing. The most dominant region remains North America, which captured roughly 35.8 % of global market revenue in 2024, driven by high adoption in retail POS systems, warehouse automation, and regulatory-driven demand in healthcare and logistics.

Market Insights

- The Thermal Printing Market reached USD 49.28 billion in 2024 and is projected to hit USD 73.36 billion by 2032 at a 5.1% CAGR, supported by rising demand in retail, logistics, and healthcare.

- Growing need for fast, reliable, and cost-efficient printing solutions drives adoption across barcode labeling, POS systems, and industrial packaging, strengthening demand for high-speed and mobile thermal printers.

- The market shows strong competitive activity as major players enhance IoT-enabled printers, cloud-managed systems, and rugged industrial models to expand their product portfolios.

- Material cost fluctuations and limitations in color thermal printing remain key restraints, especially in applications requiring long-term durability or multi-color outputs.

- Regionally, North America leads with 35.8% share, while industrial thermal printers hold the largest segment contribution due to their extensive use in warehouse automation and high-volume labeling operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Industrial thermal printers dominate the market with an estimated over 45% share, driven by their high durability, superior throughput, and ability to support continuous printing in logistics, warehousing, and manufacturing environments. These printers gain strong traction as enterprises expand automated labeling and traceability systems. Desktop thermal printers maintain wide adoption in offices and retail counters due to compact design and low operating costs, while mobile thermal printers rise steadily as field services and last-mile delivery operations prioritize portability and instant receipt or label generation.

- For instance, Brother Industries, Ltd. enhanced industrial performance through its TJ-4522TN model, which delivers a print speed of 12 inches per second (305 mm/s) and supports 300-dpi resolution for high-volume barcode output.

By Color Printing Capability

Single-color printers hold the dominant position with over 60% market share, supported by extensive usage in retail POS systems, transportation labels, barcodes, and shipping tags where clarity, speed, and cost efficiency outweigh color needs. Their simplified mechanisms, lower consumable costs, and faster output strengthen adoption across high-volume applications. Multi-color thermal printers continue to grow in specialized sectors such as branded labeling and product identification, as businesses increasingly emphasize visual differentiation and compliance with packaging standards that require multi-color indicators.

- For instance, Honeywell International Inc. offers the PC45D direct-thermal printer, which delivers 6 inches per second (approximately 152.4 mm/s) print speed at 300-dpi precision for high-density barcodes, enabling reliable single-color output in continuous industrial workflows.

By Print Speed

Fast printers operating at around 300 mm/sec lead the segment with approximately 40% market share, driven by strong utilization in retail, logistics, and warehouse operations that require rapid, uninterrupted label or receipt output. Their balance between speed, performance, and cost makes them the preferred choice for high-demand workflows. Medium-speed printers remain relevant for office and small business usage, while ultra-fast printers at 400 mm/sec gain momentum in large distribution centers. Slow-speed printers continue serving low-volume applications where compactness and lower costs are prioritized.

Key Growth Drivers

Expansion of Retail, Logistics, and E-Commerce Operations

The rapid expansion of retail and e-commerce ecosystems strongly accelerates demand for thermal printing solutions that support high-volume labeling, inventory tagging, and POS operations. Companies enhance last-mile delivery workflows and warehouse automation, increasing the requirement for durable, fast, and cost-efficient thermal printers. Barcode and QR-code usage intensifies as businesses prioritize visibility and real-time tracking. Thermal printers gain additional traction due to low maintenance needs and reliable output, making them essential in omnichannel fulfillment and distribution networks managing rising shipment volumes.

- For instance, Citizen Systems Japan Co., Ltd. strengthened logistics efficiency with its CT-S4500 model, which delivers a 4-inch print width, 200 mm/s print speed, and 203-dpi resolution, enabling high-density barcode and shipping-label production in fast-moving fulfillment environments.

Growing Adoption of Mobility and Real-Time Printing

The market benefits from the widespread adoption of mobile thermal printers across transportation, field services, healthcare, and public safety. Organizations deploy handheld devices to enable on-site label generation, instant ticketing, and real-time documentation, improving operational efficiency and accuracy. The rising usage of connected devices and wireless technologies further strengthens demand for compact, battery-efficient printers. Improved ruggedness and enhanced communication protocols allow seamless integration with enterprise mobility platforms, making mobile thermal printing a pivotal driver in environments prioritizing speed, traceability, and workforce flexibility.

- For instance, Seiko Epson Corporation advanced mobile productivity with its Epson TM-P20II, which delivers a 100 mm/s print speed, operates for up to 27 hours on a single battery charge (for the Bluetooth model), and supports Bluetooth 5.0 and 802.11ac Wi-Fi connectivity for seamless integration with enterprise mobility platforms.

Rising Use of Automated Identification and Data Capture (AIDC)

Accelerated digital transformation and the growing emphasis on automated identification push enterprises to invest in high-performance thermal printers. AIDC systems rely on accurate barcode, RFID, and smart label printing, especially across manufacturing, pharmaceuticals, transportation, and food supply chains. Thermal printing technologies offer consistent print quality and high throughput, enabling efficient tracking and regulatory compliance. Increasing implementation of serialization, anti-counterfeiting measures, and product authentication further elevates the need for specialized thermal printers that support long-lasting and scannable labels in regulated industries.

Key Trends & Opportunities

Increasing Shift Toward Industrial-Grade and High-Speed Printing

A significant market trend involves the rising preference for high-speed and industrial-grade thermal printers that support continuous operations in demanding environments. Companies invest in advanced print engines offering higher durability, larger media capacity, and faster output to meet supply chain automation requirements. The adoption of rugged printers in production facilities creates opportunities for vendors to introduce enhanced mechanisms, improved heat management, and predictive maintenance capabilities. This trend aligns with the industry’s move toward smart factories and integrated labeling systems supporting real-time visibility.

- For instance, TSC Auto ID Technology Co., Ltd. strengthened high-speed industrial performance with its MH261T series, delivering a 10-inch-per-second (254 mm/s) print speed, 450-meter ribbon capacity, and 300-dpi resolution for precision labeling in high-volume manufacturing lines.

Advancements in Color Thermal Printing and Label Customization

Color thermal printing technologies create new opportunities as brands increasingly focus on visually differentiated packaging, compliance labeling, and product identification. Innovations in multi-color thermal transfer ribbons, media materials, and printheads enable higher-resolution labels suitable for branding and safety warnings. Industries such as food, chemicals, and retail utilize color-coded tags to improve traceability and reduce operational errors. This shift encourages manufacturers to develop cost-effective, multi-color models that provide better versatility without compromising speed or durability, expanding adoption across specialized applications.

- For instance, GoDEX International Co., Ltd. offers the RT200i series, a monochrome labeling system that supports 203-dpi (or 300-dpi on the RT230i variant) high-precision printing for detailed graphics and identification in continuous industrial workflows.

Integration of IoT and Cloud-Based Print Management

A growing opportunity emerges from the integration of thermal printers with IoT and cloud platforms that support remote monitoring, centralized device management, and data analytics. Enterprises adopt connected printing systems to optimize performance, reduce downtime, and streamline fleet operations across multiple locations. Cloud-enabled configurations allow real-time updates, device diagnostics, and seamless workflow automation. This trend benefits sectors with distributed operations—such as logistics, retail chains, and healthcare—by improving traceability and enabling data-driven decision-making based on printing activity and service metrics.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Disruptions

Thermal printing manufacturers face challenges stemming from volatile prices of components such as thermal printheads, specialty coated papers, and resin ribbons. Global supply chain disruptions create extended lead times and cost pressures, affecting production efficiency and pricing strategies. Dependence on imported components further intensifies procurement risks for suppliers. These fluctuations compel companies to redesign sourcing strategies, diversify supplier bases, and invest in alternative materials while maintaining product quality, which becomes increasingly difficult in competitive price-sensitive markets.

Limitation in Color Capability and Long-Term Durability

Despite technological progress, thermal printing continues to face constraints in delivering high-quality, multi-color output and long-term durability in harsh environments. Direct thermal labels can fade when exposed to heat, light, or chemicals, restricting their use in certain industrial or archival applications. Some sectors still prefer laser or inkjet technologies for color-intensive or long-lasting prints. Overcoming these limitations requires continued innovation in media formulations, coating technologies, and thermal transfer systems, posing technical and cost-related challenges for manufacturers aiming to broaden application scope.

Regional Analysis

North America

North America holds the largest share of the thermal printing market at around 35%, driven by strong adoption across retail, logistics, and healthcare. The region benefits from advanced supply-chain systems, widespread use of POS terminals, and early adoption of mobile printing solutions. High replacement rates and continuous upgrades to faster, more durable printers further reinforce its leadership. Growing e-commerce activity and strict healthcare labeling regulations continue supporting steady demand for thermal printing technologies.

Europe

Europe accounts for roughly 25–30% of the market, supported by strong demand in retail, industrial manufacturing, transportation, and healthcare. The region’s focus on regulatory compliance, durable labeling, and sustainable printing materials contributes to consistent adoption. Expansion of automated warehouses and modernization of ticketing systems in public transport also drive growth. European industries increasingly opt for advanced thermal transfer solutions to improve print longevity and meet strict quality standards.

Asia-Pacific

Asia-Pacific represents about 30% of the market and stands as the fastest-growing region. Rapid expansion of e-commerce, logistics networks, and large-scale manufacturing boosts demand for reliable, cost-effective thermal printers. Countries such as China, India, and Indonesia heavily invest in retail digitization and warehouse automation, increasing usage of barcode and label printing. Local production of printers and consumables also supports affordable adoption, making the region a key contributor to global market growth.

Latin America

Latin America holds approximately 5–10% of the thermal printing market, with growth driven by expanding retail activity, digital payment systems, and logistics modernization. Countries are increasingly upgrading POS systems and adopting barcode-based inventory management. Although adoption is slower compared with major regions, investment in e-commerce infrastructure and transportation systems continues to create steady demand for thermal printers across industries.

Middle East & Africa

The Middle East & Africa region captures around 7–8% of the market, supported by rising adoption of thermal printers in retail, government services, and transportation. Expanding shopping centers, improved logistics networks, and modernization of ticketing operations contribute to growth. Harsh operating environments in some areas increase the preference for rugged thermal transfer printers. While the market remains nascent, ongoing digitization and infrastructure development present strong long-term potential.

Market Segmentations:

By Type:

- Desktop thermal printers

- Mobile thermal printers

By Color Printing Capability:

By Print Speed:

- Slow (Up to 150 mm/sec)

- Medium (200 mm/sec)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the thermal printing market features prominent participants such as Brother Industries, Ltd., Honeywell International Inc., Citizen Systems Japan Co., Ltd., Seiko Epson Corporation, TSC Auto ID Technology Co., Ltd., GoDEX International Co., Ltd., Toshiba TEC Corporation, Sato Holdings Corporation, Bixolon Co., Ltd., and Zebra Technologies Corporation. The thermal printing market features a highly competitive environment characterized by continuous advancements in print quality, speed, and reliability. Companies focus on developing compact, energy-efficient, and high-performance printers that meet the growing needs of retail, logistics, manufacturing, and healthcare operations. Innovations in printhead technology, rugged mobile devices, and cloud-based fleet management strengthen vendors’ ability to serve diverse application areas. Many manufacturers expand their offerings with improved connectivity options, including Bluetooth, Wi-Fi, and IoT integration, to support real-time data capture and workflow automation. Competitive strategies also include regional expansion, enhanced after-sales services, and targeted pricing to address both enterprise-level and small business requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Brother Industries, Ltd.

- Honeywell International Inc.

- Citizen Systems Japan Co., Ltd.

- Seiko Epson Corporation

- TSC Auto ID Technology Co., Ltd.

- GoDEX International Co., Ltd.

- Toshiba TEC Corporation

- Sato Holdings Corporation

- Bixolon Co., Ltd.

- Zebra Technologies Corporation

Recent Developments

- In April 2025, Source Technologies acquired AMT Datasouth’s printer assets, expanding its product portfolio to include thermal printing solutions for labels, barcodes, and receipts. This strategic acquisition strengthens Source Technologies’ position in the thermal printing market and provides enhanced offerings in label, barcode, and receipt printing.

- In March 2025, Distribution Management (DM) expanded its product offerings by partnering with Brother to include Brother’s thermal desktop and industrial printers. This strategic partnership will enhance DM’s portfolio of thermal printing, mobile, and labeling solutions, which supports Brother’s growth strategy.

- In October 2024, Munbyn announced the launch of two new label printers aimed at small and medium-sized businesses. The Realwriter RW402 addresses common challenges including paper waste and downtime with advanced technology that reduces paper jams to under 0.01%.

- In July 2024, Adobe announced users can order printed products on Adobe Express through add-ons developed with Adobe Express Embed SDK partners. With the Adobe Express Embed SDK, print service providers can enable their customers to design and modify creations for business cards, flyers, posters, cards, and invitations, leveraging access to hundreds of thousands of Adobe’s premium templates, fonts, and stock images within their platforms.

Report Coverage

The research report offers an in-depth analysis based on Type, Color Printing Capability, Print Speed and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as retail, logistics, and e-commerce operations increase their use of barcode and label printing.

- Mobile thermal printers will gain wider adoption as industries prioritize portability and real-time documentation.

- Demand for industrial high-speed thermal printers will rise with the advancement of automated warehouses and manufacturing lines.

- Adoption of color thermal printing will grow as brands emphasize visual labeling and compliance requirements.

- IoT-enabled printers will become more common, supporting remote monitoring and predictive maintenance.

- Cloud-based print management will strengthen workflow automation across distributed facilities.

- Healthcare and pharmaceuticals will increase reliance on durable labeling for traceability and safety compliance.

- Advancements in eco-friendly thermal papers and ribbons will drive sustainability-focused upgrades.

- Integration with RFID and smart labeling technologies will gain momentum in supply chain systems.

- Emerging markets will contribute significantly as digital retail and logistics infrastructure continue to expand.