Market Overview:

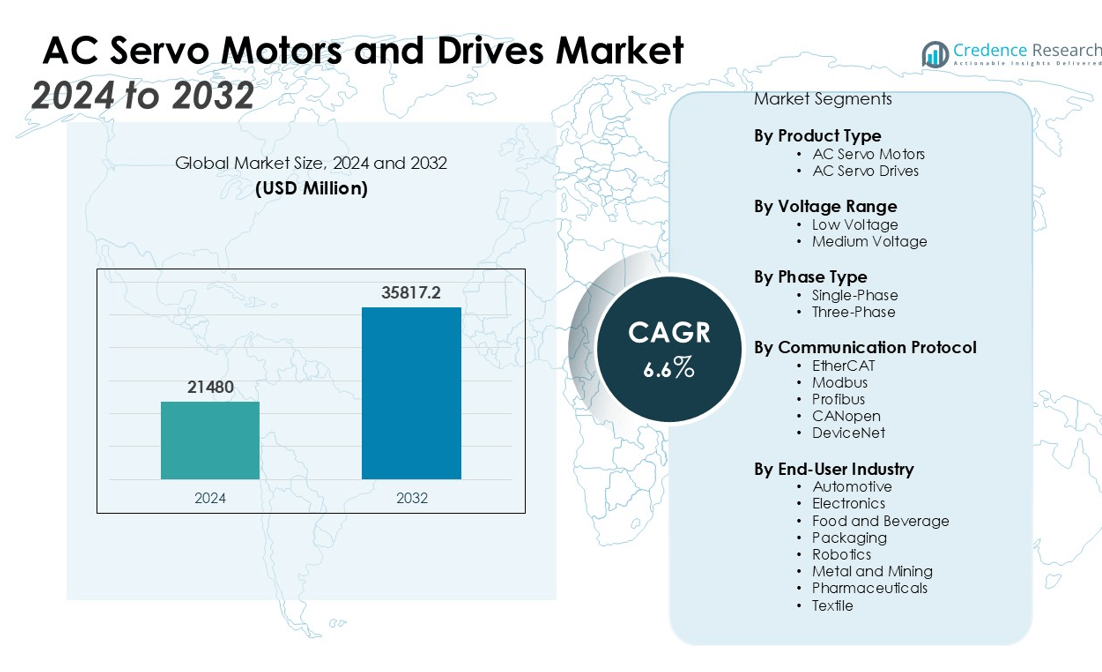

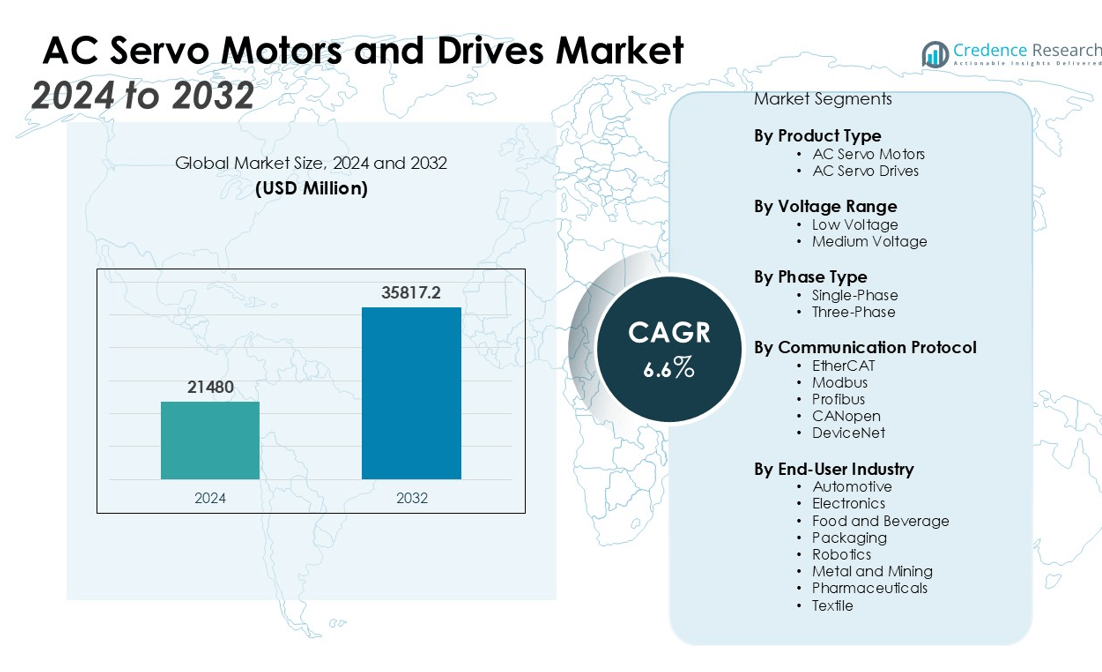

The AC Servo Motors and Drives Market size was valued at USD 21480 million in 2024 and is anticipated to reach USD 35817.2 million by 2032, at a CAGR of 6.6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AC Servo Motors and Drives Market Size 2024 |

USD 21480 million |

| AC Servo Motors and Drives Market, CAGR |

6.6% |

| AC Servo Motors and Drives MarketSize 2032 |

USD 35817.2 million |

Key market drivers include the growing trend towards energy-efficient systems, the expanding industrial automation sector, and technological advancements in motion control systems. The increasing integration of AC servo motors in applications such as CNC machinery, conveyor systems, and robotics, driven by the need for precision and reliability, further supports the market expansion. Additionally, the rise in industrial IoT (IIoT) is propelling the demand for advanced servo drives, offering remote monitoring and predictive maintenance capabilities. The adoption of artificial intelligence (AI) and machine learning (ML) in motion control systems is also enhancing the performance and efficiency of AC servo motors, thereby driving market growth.

Regionally, North America holds the largest market share, driven by a strong manufacturing base and technological advancements. Europe follows closely, supported by the automotive and industrial automation sectors. The Asia-Pacific region is expected to witness the highest growth, fueled by rapid industrialization, particularly in China and India, and a rising emphasis on automation technologies.

Market Insights:

- The AC Servo Motors and Drives Market was valued at USD 21,480 million in 2024 and is expected to reach USD 35,817.2 million by 2032, growing at a CAGR of 6.6%.

- The demand for energy-efficient systems is driving the adoption of AC servo motors, offering reduced energy consumption and operational costs.

- Industrial automation across various sectors, including automotive and manufacturing, is fueling the growth of the AC Servo Motors and Drives Market.

- Advancements in motion control technologies, such as improved algorithms and IIoT integration, enhance the performance and adaptability of AC servo motors.

- The integration of IIoT enables remote monitoring and predictive maintenance, improving efficiency and reducing downtime.

- North America holds 28% of the market share, followed by Europe with 24%, and Asia-Pacific leads with 35% due to rapid industrialization and automation.

- High initial costs and technical complexities, along with integration challenges, hinder widespread adoption of AC servo motors, especially for SMEs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Energy-Efficient Systems

The AC Servo Motors and Drives Market is experiencing significant growth due to the increasing demand for energy-efficient systems. Industries are focusing on reducing energy consumption to lower operational costs and minimize environmental impact. AC servo motors offer superior efficiency compared to traditional motors, enabling better control and reduced energy wastage. As industries prioritize sustainability, the need for energy-efficient servo motors continues to rise.

- For instance, the Siemens SINAMICS V90 PN servo drive system is deployed in industrial applications with a minimum operational power of 0.05kW, demonstrating precise and efficient performance in textile manufacturing.

Expansion of Industrial Automation

The widespread adoption of industrial automation is a key driver for the AC Servo Motors and Drives Market. Automated processes require precise, reliable, and high-performance motion control, which AC servo motors provide. These motors are essential in applications such as CNC machinery, robotics, and packaging systems. The growth in automation across various sectors, including automotive, manufacturing, and electronics, fuels the demand for AC servo motors and drives.

- For instance, the Yaskawa MOTOMAN HP6 industrial robot achieves a repetitive positioning accuracy of ±0.08mm, enabling highly precise automation tasks in industrial production.

Advancements in Motion Control Technology

Technological advancements in motion control systems are enhancing the performance of AC servo motors and drives. Innovations in servo drive technology, such as improved algorithms and better integration with industrial IoT (IIoT), are making these systems more efficient and adaptable. These developments allow for more precise control, increased torque density, and enhanced system reliability. The evolution of these technologies supports the growing adoption of AC servo motors in complex industrial applications.

Increasing Integration with Industrial IoT (IIoT)

The integration of AC servo motors with Industrial IoT (IIoT) is a significant factor contributing to market growth. By enabling remote monitoring and predictive maintenance, IIoT connectivity allows businesses to optimize performance and reduce downtime. The ability to collect real-time data and make data-driven decisions improves the overall efficiency of operations. This trend is driving the adoption of advanced AC servo motor systems in industries seeking smarter, more efficient manufacturing solutions.

Market Trends:

Increasing Adoption of Advanced Motion Control Technologies

The AC Servo Motors and Drives Market is witnessing a significant trend toward the adoption of advanced motion control technologies. Manufacturers are increasingly integrating AI and machine learning algorithms into servo drives to enhance system efficiency and precision. These innovations enable real-time adjustments, improving the overall performance and responsiveness of AC servo systems. The incorporation of these technologies into motion control systems allows for optimized operations across complex applications such as robotics, CNC machines, and automated assembly lines. Enhanced integration with automation software and industrial IoT platforms further accelerates the demand for these systems, driving improvements in productivity and process control. This shift towards smarter and more adaptive servo drives is shaping the future of the AC servo motor industry.

- For instance, Estun Automation, by leveraging Siemens Tecnomatix simulation and virtual commissioning technology, reduced shopfloor commissioning time for battery and photovoltaic production lines by 12 days per line.

Growth in Demand for High-Performance and Customizable Solutions

Another key trend in the AC Servo Motors and Drives Market is the growing demand for high-performance, customizable solutions. Industries are seeking servo motors that offer higher torque density, precision, and energy efficiency tailored to specific applications. This demand is leading to the development of more versatile systems that can be easily adapted to various industrial requirements. The shift towards more compact, high-performance solutions is particularly evident in sectors such as robotics, packaging, and material handling. Manufacturers are focusing on delivering highly customizable products that can meet the unique needs of diverse industries, ensuring that customers can achieve optimal performance and reliability. This trend is positioning the AC servo motors and drives as a critical component for next-generation industrial automation.

- For instance, the ATO 1kW AC servo motor, used in resistance welding machines for automotive manufacturing, enables control of welding pressure and precise force programming with PLC integration, improving welding accuracy and reliability in industrial production.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the major challenges in the AC Servo Motors and Drives Market is the high initial investment and maintenance costs. AC servo systems are more expensive compared to conventional motors due to their advanced technology and precision components. The cost of installation and integration into existing systems can be a significant barrier for small and medium-sized enterprises (SMEs) with limited budgets. Additionally, these systems require specialized maintenance and skilled personnel for upkeep, further adding to the total cost of ownership. Despite the long-term benefits in energy savings and efficiency, the upfront financial commitment can discourage some businesses from adopting these technologies, limiting their widespread implementation.

Technical Complexity and Integration Challenges

Another challenge in the AC Servo Motors and Drives Market is the technical complexity and integration difficulties. These systems often require customized solutions to meet specific industrial requirements, which can increase the complexity of installation and integration into existing automation processes. Companies must invest in training their workforce and ensuring compatibility with other equipment and software. The complexity of configuring and fine-tuning these systems may also lead to extended implementation timelines, affecting overall productivity. These challenges can slow down the adoption of AC servo systems, particularly in industries with less advanced automation capabilities.

Market Opportunities:

Expansion in Emerging Markets and Industrial Sectors

The AC Servo Motors and Drives Market presents significant opportunities in emerging markets where industrialization and automation are rapidly growing. Regions such as Asia-Pacific and Latin America are witnessing increased investments in manufacturing, robotics, and infrastructure, creating a strong demand for high-efficiency motion control solutions. As industries in these regions modernize their operations, there is a clear opportunity for AC servo systems to replace older technologies with more advanced and energy-efficient solutions. The expanding automotive, electronics, and packaging industries in these regions are particularly poised for growth, offering substantial opportunities for manufacturers to tap into new markets.

Advancements in Industrial IoT and Automation Integration

There is a growing opportunity for the AC Servo Motors and Drives Market to leverage advancements in Industrial IoT (IIoT) and automation. The rise of smart manufacturing and Industry 4.0 technologies presents a favorable environment for integrating AC servo motors with IoT platforms. This integration allows for real-time data collection, predictive maintenance, and improved system optimization. As industries seek to enhance operational efficiency and reduce downtime, the demand for smart, interconnected servo drives is increasing. This trend positions AC servo systems to become essential components in the digital transformation of manufacturing, further driving market expansion.

Market Segmentation Analysis:

By Product Type

The AC Servo Motors and Drives Market is divided into AC servo motors and drives. The motor segment holds a larger share due to its essential role in applications requiring precise control, such as robotics, CNC machines, and automated systems. AC servo drives, which control the speed, torque, and position of motors, support the growing demand for automation and efficient operation.

- For instance, Yaskawa Electric Corporation reached a milestone with total shipments of 4 million AC servo motor by June 2004, demonstrating their extensive use in precision automation applications.

By Voltage Range

The market is segmented into low voltage and medium voltage AC servo systems. Low voltage systems dominate due to their versatility in a wide range of industrial applications. Medium voltage systems are increasingly adopted in industries such as heavy machinery and energy, where higher power and reliability are critical.

- For instance, ABB’s low voltage AC drives support power ratings up to 5,600kW while maintaining operation at voltages up to 690V, making them suitable for diverse manufacturing and process automation tasks.

By Phase Type

The AC Servo Motors and Drives Market is segmented into single-phase and three-phase systems. Three-phase systems account for a larger market share, primarily because of their higher efficiency and performance in industrial environments that require continuous power. Single-phase systems are more common in smaller, cost-efficient applications.

Segmentations:

- By Product Type:

- AC Servo Motors

- AC Servo Drives

- By Voltage Range:

- Low Voltage

- Medium Voltage

- By Phase Type:

- By Communication Protocol:

- EtherCAT

- Modbus

- Profibus

- CANopen

- DeviceNet

- By End-User Industry:

- Automotive

- Electronics

- Food and Beverage

- Packaging

- Robotics

- Metal and Mining

- Pharmaceuticals

- Textile

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Established Market with Strong Growth

North America holds 28% of the global AC Servo Motors and Drives Market share, driven by a robust industrial sector and technological advancements. The U.S. and Canada have well-established manufacturing industries that are increasingly adopting automation solutions to improve productivity and efficiency. The automotive and aerospace sectors are key contributors to the demand for high-performance motion control systems. North America’s strong focus on smart manufacturing, coupled with significant investments in Industry 4.0 technologies, supports the market growth. The region’s established infrastructure and regulatory support for advanced manufacturing technologies further reinforce its position in the global market.

Europe: Focus on Automation and Sustainability

Europe accounts for 24% of the AC Servo Motors and Drives Market share, with countries like Germany, France, and the UK leading the adoption of advanced automation systems. The region’s emphasis on energy efficiency and sustainability has accelerated the shift towards more efficient and precise motion control systems. Germany’s manufacturing sector, particularly in automotive and machine tools, significantly contributes to the market’s expansion. Stringent regulatory standards for energy consumption and the increasing focus on green manufacturing further drive the adoption of energy-efficient AC servo systems. The growing demand for robotics and automation in industries such as healthcare and logistics also plays a pivotal role in market growth in Europe.

Asia-Pacific: Rapid Growth and Industrialization

Asia-Pacific dominates the AC Servo Motors and Drives Market with a 35% share, driven by rapid industrialization in countries such as China, India, and Japan. The automotive, electronics, and consumer goods sectors are increasingly adopting automation technologies, creating a strong demand for high-performance servo motors and drives. With a large manufacturing base and the expansion of smart factories, the region is poised for significant market development. The rise of the industrial IoT and government initiatives to modernize infrastructure further bolster market prospects in Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- FANUC Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Schneider Electric SE (France)

- Delta Electronics, Inc. (Taiwan)

- ABB Group (Switzerland)

- Fuji Electric Co., Ltd. (Japan)

- Siemens AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- Kollmorgen Corporation (The U.S.)

- Nidec Corporation (Japan)

- Rockwell Automation, Inc. (The U.S.)

Competitive Analysis:

The AC Servo Motors and Drives Market is highly competitive, with key players focusing on technological innovation, product differentiation, and strategic partnerships. Major companies like Siemens AG, Mitsubishi Electric, Yaskawa Electric, and Rockwell Automation dominate the market, offering advanced solutions for various industrial applications. These players invest heavily in R&D to enhance motor efficiency, precision, and connectivity, aligning with the growing demand for automation and energy-efficient systems. The rise of Industrial IoT (IIoT) and smart manufacturing has further intensified competition, pushing companies to integrate connectivity features in their products. Regional players are also gaining traction, particularly in Asia-Pacific, due to the region’s rapid industrialization and increased automation adoption. With rising demand from industries such as automotive, robotics, and packaging, the market continues to see innovation and competitive pricing, driving continuous product advancements and improving customer experiences.

Recent Developments:

- In April 2025, ABB E-mobility launched three new EV charging products at ACT Expo 2025: the A200/300 All-in-One chargers, the MCS1200 Megawatt Charging System, and the ChargeDock Dispenser, expanding ABB’s EV charging portfolio.

- In May 2025, ABB announced its agreement to acquire BrightLoop, a Paris-based power electronics company, with the acquisition expected to close in the third quarter of 2025, aimed at expanding ABB’s off-highway vehicle and marine electrification business.

- In July 2025, Delta Electronics entered a strategic partnership with Microchip Technology to develop and deploy silicon carbide (SiC) solutions for advanced power applications.

Market Concentration & Characteristics:

The AC Servo Motors and Drives Market is moderately concentrated, with a few key players holding significant market share, including Siemens AG, Mitsubishi Electric, Yaskawa Electric, and Rockwell Automation. These companies lead through strong R&D capabilities, technological advancements, and strategic partnerships, offering a range of high-performance solutions. The market is characterized by continuous innovation, driven by the demand for energy-efficient, precise, and reliable systems across industries such as automotive, robotics, and manufacturing. While large players dominate, regional manufacturers are also expanding their presence, especially in emerging markets like Asia-Pacific. This growth is fueled by rapid industrialization, increasing automation, and the rise of Industry 4.0 technologies, driving both competition and collaboration. The market exhibits high competition in product offerings, price differentiation, and customer support, creating opportunities for both established and new entrants.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Voltage Range, Phase Type, Communication Protocol, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The AC Servo Motors and Drives Market is poised for continued growth, driven by increasing demand for automation across various industries.

- Technological advancements, including the integration of artificial intelligence and machine learning, are enhancing the performance and efficiency of servo systems.

- The adoption of Industry 4.0 practices is accelerating, leading to greater implementation of smart manufacturing solutions.

- Energy efficiency remains a key focus, with industries seeking solutions that reduce operational costs and environmental impact.

- The automotive sector, particularly electric vehicle production, is contributing significantly to market expansion.

- Asia-Pacific continues to lead in market share, driven by rapid industrialization and manufacturing activities.

- Medium voltage servo systems are gaining popularity, especially in heavy-duty applications requiring higher power.

- The trend towards miniaturization is evident, with demand for compact and high-performance servo motors increasing.

- Predictive maintenance capabilities are becoming standard features, enhancing system reliability and reducing downtime.

- The market is witnessing increased competition, prompting companies to innovate and offer differentiated products to meet diverse customer needs.