Market Overview:

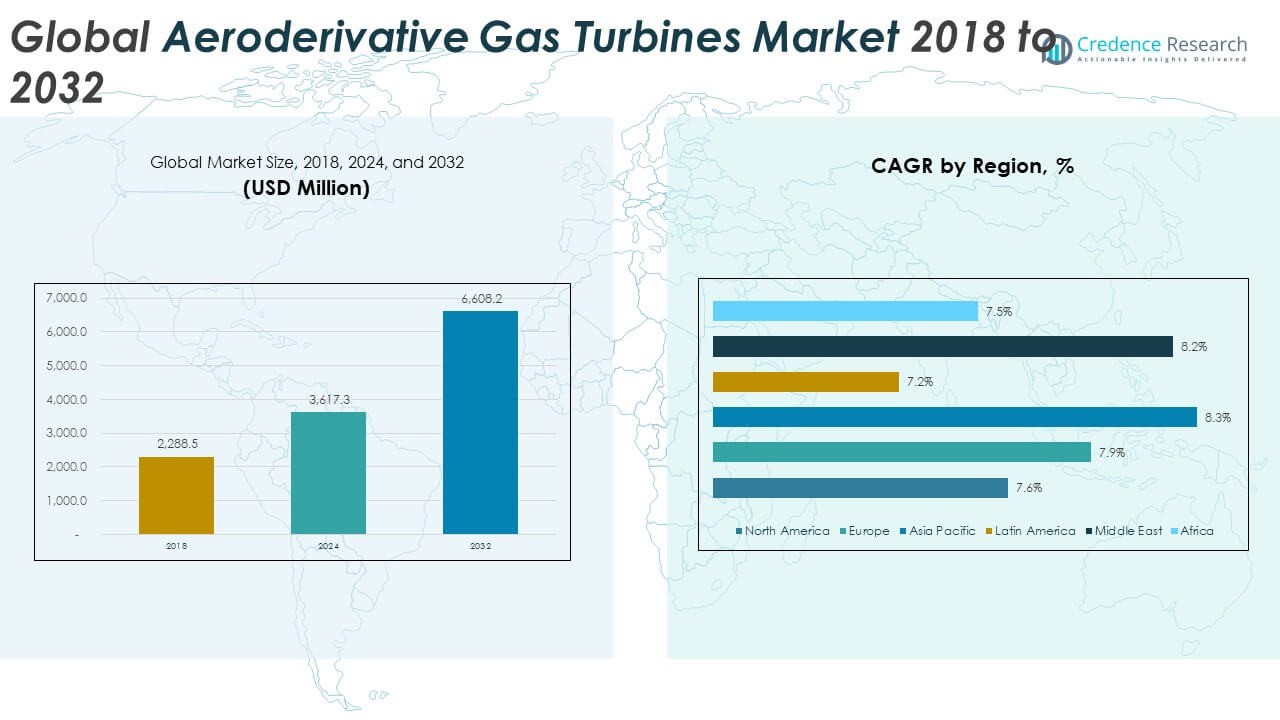

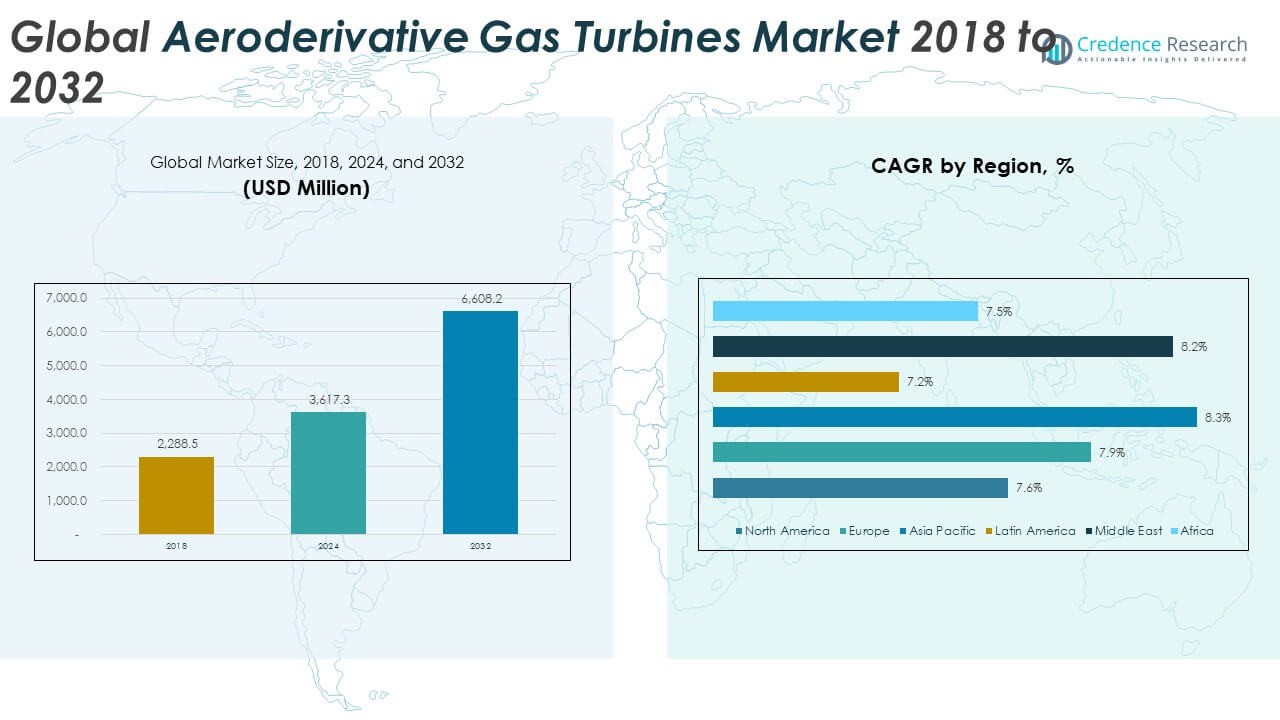

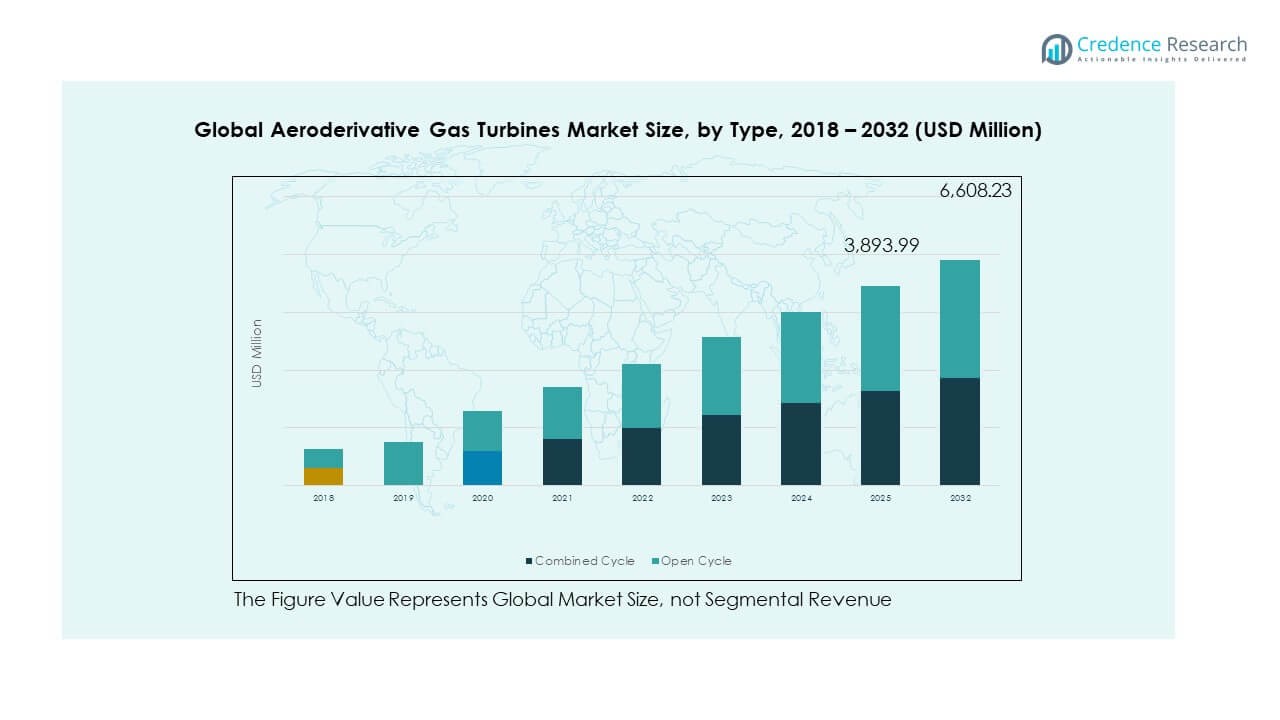

The Global Aeroderivative Gas Turbines Market size was valued at USD 2,288.5 million in 2018 to USD 3,617.3 million in 2024 and is anticipated to reach USD 6,608.2 million by 2032, at a CAGR of 7.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aeroderivative Gas Turbines Market Size 2024 |

USD 3,617.3 Million |

| Aeroderivative Gas Turbines Market, CAGR |

7.85% |

| Aeroderivative Gas Turbines Market Size 2032 |

USD 6,608.2 Million |

The market growth is driven by increasing demand for flexible and efficient power generation technologies. Aeroderivative gas turbines are preferred for their quick start-up, low emissions, and operational efficiency across diverse applications, including power plants, oil and gas operations, and industrial facilities. Rising energy needs, integration of renewable energy with backup systems, and investments in distributed power generation are enhancing adoption. Furthermore, advancements in turbine design and digital monitoring systems are helping operators optimize performance while reducing operational costs and maintenance requirements.

Regionally, North America leads the market, supported by its strong energy infrastructure and significant investments in cleaner technologies. Europe also maintains a strong position due to strict emission regulations and emphasis on sustainable energy solutions. The Asia Pacific region is emerging as a high-growth market, with countries like China and India focusing on meeting rising electricity demand and modernizing power infrastructure. Meanwhile, the Middle East leverages aeroderivative turbines for oil and gas applications, while Latin America is showing steady adoption driven by industrial expansion and grid stability needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Aeroderivative Gas Turbines Market was valued at USD 2,288.5 million in 2018, reached USD 3,617.3 million in 2024, and is projected to hit USD 6,608.2 million by 2032, growing at a CAGR of 7.85%.

- North America held the largest share at 31.2% in 2024 due to advanced infrastructure, followed by Europe with 26.8% supported by emission regulations, and Asia Pacific at 24.0% driven by strong electricity demand.

- Asia Pacific is the fastest-growing region, expanding at 8.3% CAGR, fueled by industrialization, renewable integration, and energy infrastructure investments.

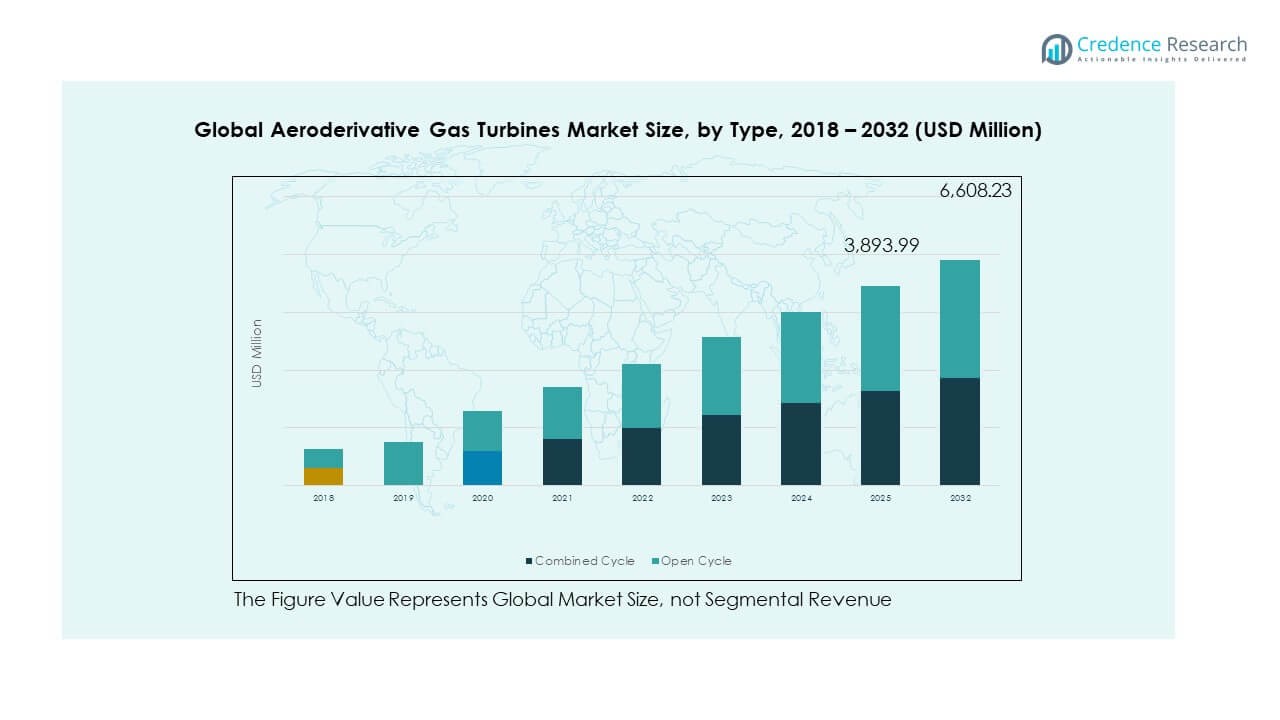

- By type, combined cycle turbines represented roughly 58% of the 2024 market share, supported by their higher efficiency and large-scale utility use.

- Open cycle turbines accounted for around 42% of the 2024 share, favored in mobile, defense, and distributed power applications requiring rapid deployment.

Market Drivers

Rising Demand for Efficient and Flexible Power Generation Solutions Driving Market Adoption

The Global Aeroderivative Gas Turbines Market benefits from strong demand for advanced power generation systems. Power producers and industrial operators prefer turbines that deliver quick start-up, high efficiency, and low emissions. These features support grid stability and address growing electricity needs in regions facing demand surges. It enables operators to balance renewable integration with reliable backup power. The demand grows further where intermittent solar and wind power dominate energy mix. Governments prioritize cleaner energy technologies, pushing adoption of aeroderivative turbines. Industrial sectors such as oil and gas also value their adaptability. These combined drivers sustain momentum across developed and emerging markets.

- For instance, General Electric’s LM6000 aeroderivative gas turbineachieves over 40% efficiency in simple cycle mode and can ramp up to full power in less than 10 minutes, enabling responsive grid support during demand surges.

Expanding Role in Distributed Power Generation and Mobile Energy Systems

The market grows as distributed power generation gains significance in remote areas and industrial hubs. Aeroderivative gas turbines support mobile power projects, defense operations, and offshore facilities. It allows deployment in modular configurations, improving flexibility for temporary and permanent installations. Strong focus on energy access in rural economies strengthens adoption of decentralized power. The market attracts investment from both public and private stakeholders. Businesses deploy turbines where rapid installation and reliable energy are critical. Operators adopt them for disaster recovery and emergency response setups. These roles highlight their expanding function beyond conventional utilities.

- For instance, Siemens Energy’s SGT-A45TR mobile aeroderivative turbinedelivers rapid deployment capabilities, providing over 44 MW of electrical output and being fully operational in less than two weeks from site arrival, suited for emergency and remote applications.

Regulatory Pressure to Reduce Emissions and Improve Energy Efficiency Accelerates Adoption

The Global Aeroderivative Gas Turbines Market expands under the influence of environmental regulations and climate goals. Governments mandate strict emission controls, pushing industries to adopt cleaner generation technologies. It helps reduce nitrogen oxide and carbon emissions compared with traditional gas turbines. Operators achieve compliance while maintaining reliable energy supply. The shift aligns with national commitments under global climate frameworks. Utilities adopt these turbines to meet targets without compromising efficiency. Growth accelerates in countries promoting renewable integration and clean backup systems. These pressures reinforce long-term market adoption and investment.

Growing Demand in Oil, Gas, and Industrial Operations Enhances Market Relevance

Oil and gas operators demand aeroderivative turbines for offshore platforms, pipeline stations, and refineries. It offers compact design, mobility, and resilience under challenging environments. Industrial sites adopt turbines for cogeneration, lowering costs and ensuring efficiency. The Global Aeroderivative Gas Turbines Market also benefits from petrochemical and manufacturing expansions. Industries invest in solutions that support both energy reliability and environmental compliance. Flexible load-following capability makes turbines vital for fluctuating operations. Their operational resilience in harsh conditions strengthens acceptance. These drivers ensure robust demand across energy-intensive industries worldwide.

Market Trends

Integration of Digital Monitoring and Predictive Maintenance Strengthens Market Growth

The Global Aeroderivative Gas Turbines Market embraces digital technologies to optimize operations. Operators integrate advanced sensors, AI, and predictive analytics to reduce downtime. It supports proactive maintenance, extending turbine lifespan and lowering costs. Digital monitoring improves fuel use and performance efficiency. Operators track real-time data to enhance decision-making. Manufacturers design systems with built-in connectivity for remote oversight. Predictive insights reduce unplanned outages, crucial for critical facilities. This trend enhances reliability and strengthens customer confidence across industries.

- For instance, Siemens Energyimplemented its Omnivise monitoring platform, enabling real-time data analysis from over 1,500 sensors per turbine, resulting in a reported 30% reduction in unplanned downtime at monitored facilities.

Rising Adoption in Hybrid Energy Systems Supports Energy Transition Efforts

The market sees growing adoption of turbines in hybrid configurations with renewable sources. It balances intermittent solar and wind power by delivering quick-start backup. The Global Aeroderivative Gas Turbines Market plays a vital role in energy transition strategies. It bridges renewable reliability gaps with flexible generation. Energy firms integrate turbines with storage systems to stabilize grids. Operators secure continuous supply without relying on fossil-heavy alternatives. Hybrid models reduce costs for power producers. This trend demonstrates the adaptability of aeroderivative technologies in diverse energy environments.

Increasing Focus on Lightweight and Modular Design Enhances Deployment Flexibility

Manufacturers design turbines with lighter materials and modular structures to support faster deployment. It enables transport to remote or offshore locations with reduced costs. The Global Aeroderivative Gas Turbines Market gains traction in sectors requiring mobility and compact power. Portable and scalable units serve military, oil rigs, and disaster recovery applications. Operators benefit from shorter installation times and lower operational complexity. Modular designs also improve customization for varying capacities. Growing investments in advanced materials fuel further innovations. This design focus widens adoption in diverse industrial landscapes.

Expanding Use in Peaking Power Applications Reinforces Market Role

Utilities deploy aeroderivative turbines for peaking power to handle demand spikes. It supports grid stability during peak hours without compromising efficiency. The Global Aeroderivative Gas Turbines Market benefits from utilities seeking cost-effective solutions. These turbines start rapidly, delivering power within minutes. It provides an advantage over conventional systems with slower response times. Utilities value their ability to complement renewable-heavy grids. Adoption grows in markets with fluctuating electricity demand. This trend highlights their strategic role in modern energy infrastructure.

- For instance, Pratt & Whitney’s FT8 units in Australia regularly respond to grid peaks, reaching full load in under 10 minutesand providing up to 60 MW each to stabilize supply.

Market Challenges Analysis

High Capital Investment and Maintenance Complexity Limits Wider Adoption

The Global Aeroderivative Gas Turbines Market faces challenges linked to high upfront costs. Capital investment required for purchase and installation deters small utilities. It often restricts adoption in developing economies with limited budgets. Maintenance costs remain high due to specialized components and skilled labor needs. Limited availability of trained technicians creates operational risks. Industries reliant on continuous operations hesitate to adopt due to downtime concerns. Financing hurdles further slow project implementation. These factors collectively constrain penetration in cost-sensitive markets.

Fuel Supply Volatility and Competition from Alternative Technologies Restrains Growth

Volatility in natural gas supply impacts turbine adoption across regions. The Global Aeroderivative Gas Turbines Market competes with renewable and storage solutions. It struggles to maintain cost advantage when fuel prices rise sharply. Energy policies in some countries favor renewable subsidies, limiting turbine investments. Market penetration faces resistance where solar and storage become more affordable. Fuel transport and logistics challenges add operational risks. Global focus on net-zero targets also shifts priorities to alternatives. These dynamics create headwinds for long-term growth.

Market Opportunities

Expanding Role in Energy Transition and Decarbonization Creates New Opportunities

The Global Aeroderivative Gas Turbines Market gains opportunities from rising decarbonization initiatives worldwide. Governments prioritize cleaner power generation to meet climate targets. It enables integration with renewable energy while reducing emissions. Industrial operators explore turbine adoption to align with green goals. Hybrid energy systems create additional opportunities for deployment. Growing demand for sustainable grid solutions strengthens adoption prospects. This pathway ensures steady growth for manufacturers and service providers.

Growing Deployment Across Emerging Markets Strengthens Market Prospects

Emerging economies invest in modernizing energy infrastructure, creating strong growth potential. The Global Aeroderivative Gas Turbines Market benefits from industrialization and expanding electricity demand. It supports reliable energy supply in fast-growing regions with grid instability. Oil and gas projects in developing nations also demand compact and flexible turbines. Modular design offers easier transport and installation in remote areas. Governments in these markets seek to balance energy access and sustainability. These opportunities highlight significant growth prospects in new geographies.

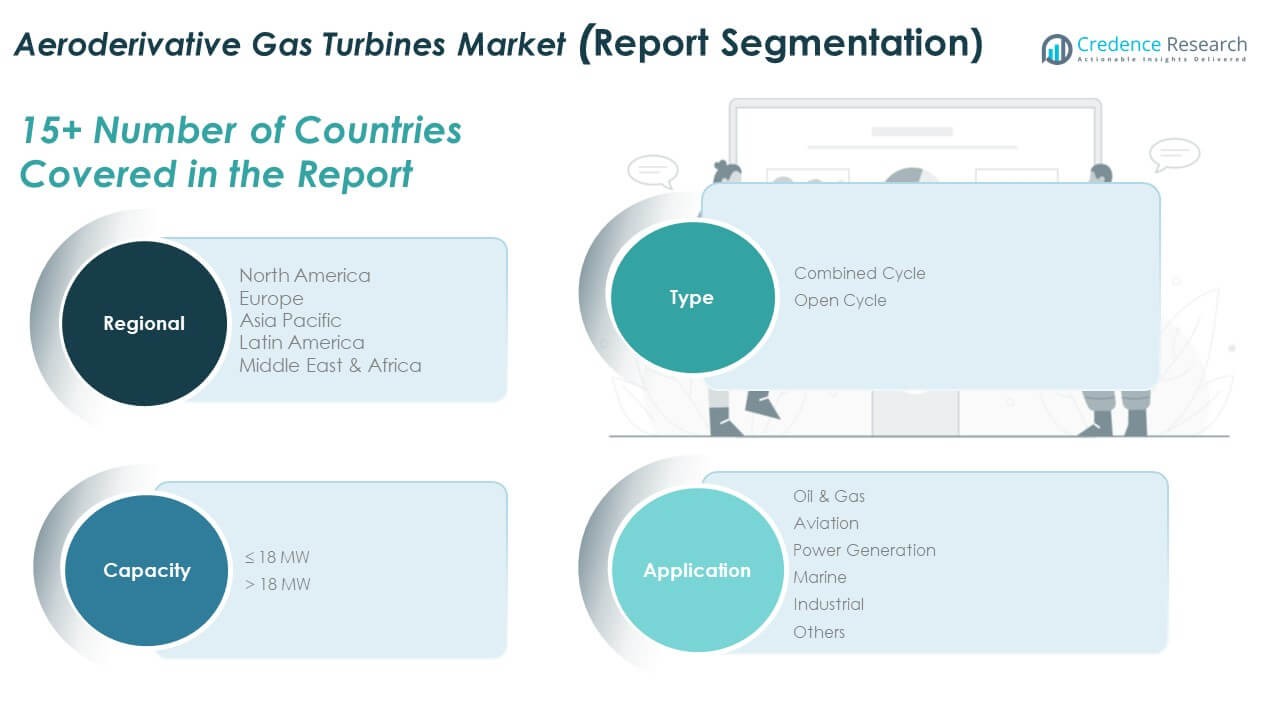

Market Segmentation Analysis:

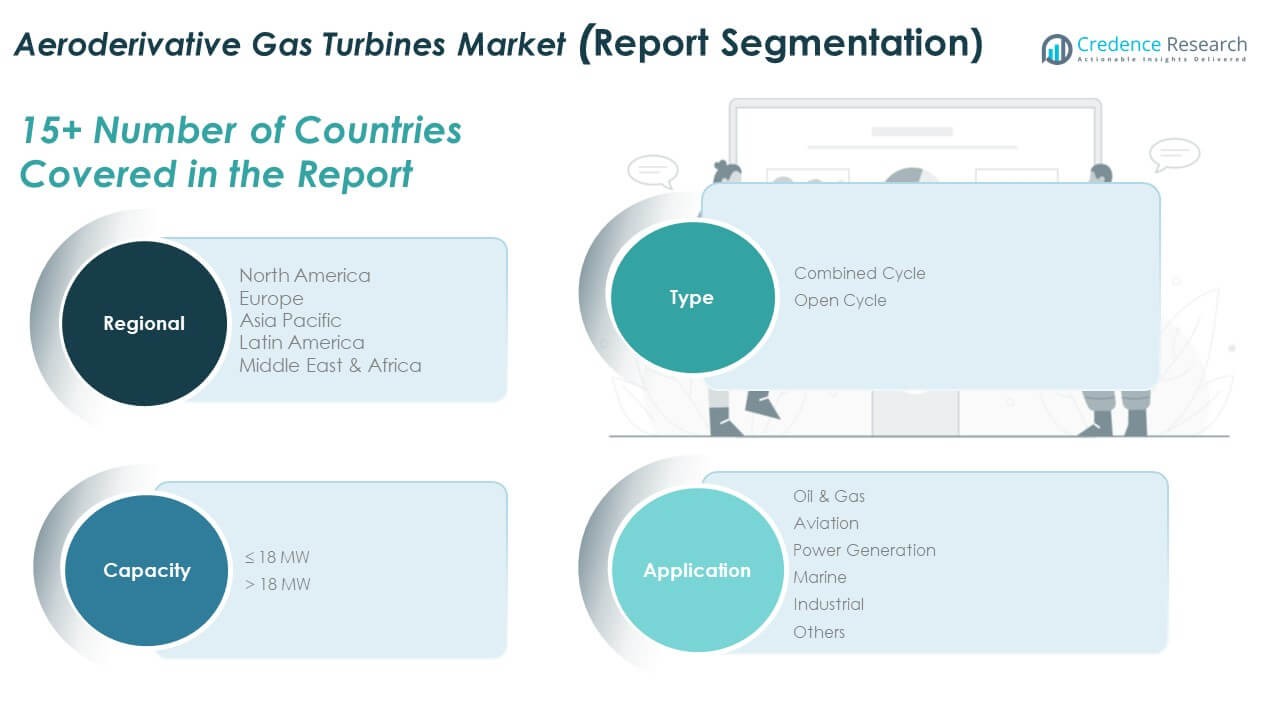

The Global Aeroderivative Gas Turbines Market is segmented

By type into combined cycle and open cycle systems. Combined cycle units dominate due to higher efficiency and ability to support large-scale power generation. Open cycle turbines hold steady demand where rapid deployment, mobility, and lower upfront costs are critical, such as in remote and defense applications.

- For example, Siemens Energy’s SGT-A05 aeroderivative open cycle system delivers up to 16 MW output and can be brought online in under 10 minutes, ideal for mobile military and emergency response power needs.

By capacity, the market is divided into ≤18 MW and >18 MW categories. Smaller turbines suit distributed generation and mobile applications, while larger capacity units gain traction in utilities and industrial hubs seeking stable and scalable energy supply.

- For instance, Mitsubishi Power’s FT8® MOBILEPAC® offers 30 MW in portable form, successfully used for disaster recovery and remote industrial sites.

By application, the Global Aeroderivative Gas Turbines Market spans oil and gas, aviation, power generation, marine, industrial, and others. Oil and gas remains a strong segment due to turbine use in offshore rigs, compressor stations, and refineries. Aviation demand is supported by advanced engines derived from aerospace technologies, while power generation represents a core growth segment driven by grid stability needs. It also finds applications in marine operations where compact and durable energy systems are vital. Industrial users adopt turbines for cogeneration, cost efficiency, and emissions control. The diversity of applications highlights the adaptability of aeroderivative turbines across industries and geographies, ensuring robust long-term demand.

- For instance, Siemens’ SGT-A35 RB aeroderivative turbine, derived from the RB211, delivers up to 38 MW of output with high power density. It has been widely deployed worldwide across oil and gas operations, including offshore platforms, where compact, efficient turbines are essential for reliable power generation.

Segmentation:

By Type

- Combined Cycle

- Open Cycle

By Capacity

By Application

- Oil & Gas

- Aviation

- Power Generation

- Marine

- Industrial

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Aeroderivative Gas Turbines Market size was valued at USD 722.72 million in 2018 to USD 1,128.24 million in 2024 and is anticipated to reach USD 2,026.74 million by 2032, at a CAGR of 7.6% during the forecast period. North America accounts for 31.2% share of the global market, supported by its strong energy infrastructure and early adoption of advanced turbine technologies. The U.S. leads demand with extensive use in power generation and oil and gas operations. It benefits from the region’s emphasis on flexible and efficient solutions to stabilize renewable-heavy grids. Canada and Mexico also contribute with industrial and distributed power projects. Regulatory support for emission reduction enhances deployment. Investments in hybrid systems further expand market opportunities. The region remains a leader due to technological innovation and established manufacturing capabilities.

Europe

The Europe Global Aeroderivative Gas Turbines Market size was valued at USD 615.39 million in 2018 to USD 975.95 million in 2024 and is anticipated to reach USD 1,790.83 million by 2032, at a CAGR of 7.9% during the forecast period. Europe holds 26.8% market share, driven by strict emission norms and strong renewable integration policies. Countries such as Germany, the UK, and France lead adoption across power generation and industrial sectors. It benefits from government incentives supporting low-emission technologies. Industrial operators also adopt turbines for cogeneration and district heating. Demand in Southern Europe grows due to rising energy security concerns. Russia’s role in energy supply influences adoption of flexible turbine systems. The region remains central to innovation in clean energy strategies.

Asia Pacific

The Asia Pacific Global Aeroderivative Gas Turbines Market size was valued at USD 541.69 million in 2018 to USD 877.30 million in 2024 and is anticipated to reach USD 1,654.04 million by 2032, at a CAGR of 8.3% during the forecast period. Asia Pacific represents 24.0% of the global share, supported by growing electricity demand and industrialization. China drives large-scale installations to meet grid stability and industrial needs. It gains momentum from renewable integration, where turbines balance variable supply. India accelerates demand with infrastructure development and rising energy requirements. Japan and South Korea expand adoption in marine and power generation applications. Australia focuses on distributed and hybrid energy systems. The region is emerging as the fastest growing market globally.

Latin America

The Latin America Global Aeroderivative Gas Turbines Market size was valued at USD 233.66 million in 2018 to USD 357.55 million in 2024 and is anticipated to reach USD 624.48 million by 2032, at a CAGR of 7.2% during the forecast period. Latin America secures 8.4% share of the global market, driven by Brazil and Argentina’s industrial and energy investments. It benefits from demand in oil and gas projects and localized power generation. Distributed systems are adopted to stabilize grids in remote areas. Governments focus on energy diversification to reduce dependence on hydropower. Mexico’s ties with North American supply chains further support demand. Industrial growth across the region boosts uptake in small and medium capacity turbines. Market growth is steady but faces constraints from budgetary limitations.

Middle East

The Middle East Global Aeroderivative Gas Turbines Market size was valued at USD 109.39 million in 2018 to USD 176.32 million in 2024 and is anticipated to reach USD 330.41 million by 2032, at a CAGR of 8.2% during the forecast period. The Middle East accounts for 4.2% market share, heavily supported by oil and gas operations. Offshore platforms and refineries adopt turbines for reliability and compact design. It strengthens energy operations where efficiency and mobility are critical. GCC countries lead demand with investments in cleaner energy solutions. Israel and Turkey expand deployment in industrial and power applications. Strong government focus on diversification drives hybrid and distributed energy adoption. The region gains significance as it blends fossil fuel wealth with new energy strategies.

Africa

The Africa Global Aeroderivative Gas Turbines Market size was valued at USD 65.68 million in 2018 to USD 101.96 million in 2024 and is anticipated to reach USD 181.73 million by 2032, at a CAGR of 7.5% during the forecast period. Africa represents 5.4% share of the global market, primarily driven by South Africa, Egypt, and Nigeria. It benefits from projects supporting electricity access and grid modernization. Governments promote decentralized power solutions to address rural demand. Oil and gas operations in North and West Africa boost uptake. Industrial growth contributes to adoption of small and mid-capacity turbines. Market opportunities are rising with foreign investments in infrastructure. It remains a developing market with significant long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Aeroderivative Gas Turbines Market features a concentrated competitive landscape led by multinational corporations with established portfolios. General Electric, Siemens, and Pratt & Whitney dominate with strong technological expertise and broad customer bases. Baker Hughes and Mitsubishi Heavy Industries strengthen competition through specialized solutions tailored for oil, gas, and industrial use. Solar Turbines Incorporated captures demand in distributed and mid-sized capacity projects. It is shaped by continuous innovation in turbine efficiency, emission control, and digital monitoring systems. Companies focus on mergers, product launches, and regional expansions to secure market presence. Competition intensifies as firms integrate hybrid energy capabilities to align with renewable adoption. Regional players also emerge, targeting niche applications and localized demand. The market remains defined by scale advantages, strategic partnerships, and investments in advanced materials, ensuring that leading firms retain significant influence over global adoption trends.

Recent Developments:

- In July 2025, GE Vernova announced a major delivery agreement with Crusoe, a leading AI infrastructure provider, to supply 29 LM2500XPRESS aeroderivative gas turbine packages for Crusoe’s data centers, targeting rapid AI-driven energy demand and emissions mitigation.

- In December 2024, Siemens Energy entered a strategic partnership with UK power giant SSE on the “Mission H2 Power” project, focused on developing combustion systems for the SGT5-9000HL gas turbine to operate 100% on hydrogen, supporting full decarbonization of SSE’s Keadby 2 Power Station.

Report Coverage:

The research report offers an in-depth analysis based on Type, Capacity and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Aeroderivative Gas Turbines Market will grow steadily with wider integration of turbines into hybrid power systems, ensuring balanced energy supply across renewables and traditional sources.

- Regulatory pressure to cut emissions and the global commitment to clean energy technologies will continue to drive strong adoption in both developed and emerging regions.

- Digital monitoring solutions and predictive analytics will improve operational efficiency, extend turbine lifespan, and reduce downtime for critical power and industrial operations.

- Industrial users will expand adoption, prioritizing cogeneration systems that ensure consistent energy security while improving overall cost efficiency in high-demand environments.

- Oil and gas projects will sustain reliance on compact aeroderivative turbines, particularly for offshore platforms, refinery processes, and pipeline compression facilities.

- Emerging economies will present major opportunities as rising electricity demand and infrastructure investments increase the need for flexible and efficient power solutions.

- Utilities will deploy turbines more frequently for peaking power and renewable balancing, strengthening grid stability in fluctuating demand scenarios.

- Advances in turbine technology will deliver improved fuel efficiency, lower emissions, and longer operational lifespan for new-generation models.

- Regional players will build influence by targeting niche applications with affordable, adaptable solutions tailored to local needs.

- Strategic mergers, partnerships, and localized manufacturing will reshape competitive dynamics, enabling companies to expand reach and strengthen global presence.