Market Overview

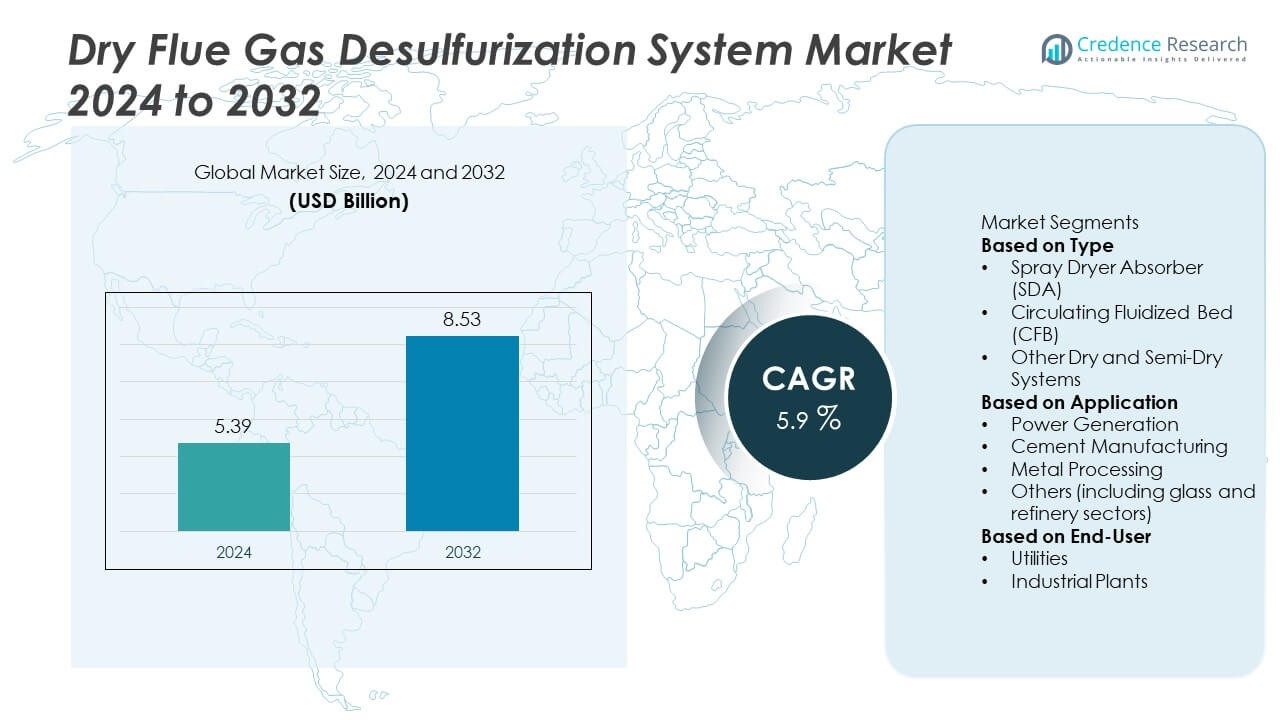

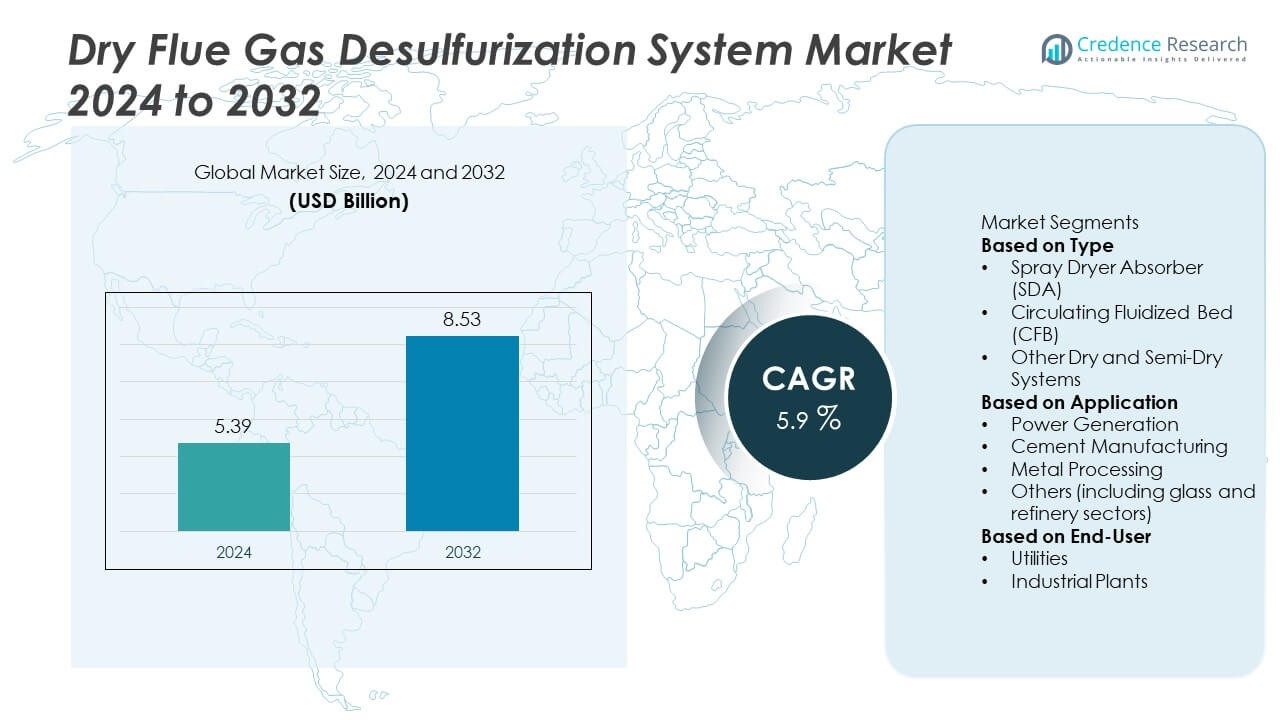

The Dry Flue Gas Desulfurization (FGD) System Market was valued at USD 5.39 billion in 2024 and is projected to reach USD 8.53 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Flue Gas Desulfurization System Market Size 2024 |

USD 5.39 Billion |

| Dry Flue Gas Desulfurization System Market, CAGR |

5.9% |

| Dry Flue Gas Desulfurization System Market Size 2032 |

USD 8.53 Billion |

The dry flue gas desulfurization system market is led by key players such as Mitsubishi Heavy Industries, KC Cottrell India, GEA Group Aktiengesellschaft, John Cockerill, GE Vernova, Hitachi Zosen Inova AG, Babcock & Wilcox Enterprises, CECO Environmental, MET, and Duconenv. These companies dominate through advanced semi-dry and hybrid desulfurization technologies tailored for thermal power and industrial plants. Asia-Pacific emerged as the leading region, holding 36% of the global market share in 2024, supported by rapid industrialization, expanding power generation capacity, and stricter SO₂ emission norms. North America followed with 27%, driven by strong environmental regulations and technological modernization across utility sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The dry flue gas desulfurization system market was valued at USD 5.39 billion in 2024 and is projected to reach USD 8.53 billion by 2032, growing at a CAGR of 5.9%.

- Market growth is driven by strict emission regulations, expanding thermal power generation, and increasing industrial adoption of low-water desulfurization systems for cost-effective pollution control.

- Key trends include rising demand for semi-dry and hybrid systems, digital monitoring integration, and development of high-efficiency sorbents to improve SO₂ removal rates.

- The market is highly competitive with leading players such as Mitsubishi Heavy Industries, GE Vernova, GEA Group, and Babcock & Wilcox focusing on technology upgrades and strategic regional partnerships.

- Asia-Pacific leads with 36% share, followed by North America with 27% and Europe with 24%; the power generation segment holds the largest share at 61%, reflecting strong demand for emission control in thermal plants.

Market Segmentation Analysis:

By Type

The Spray Dryer Absorber (SDA) segment dominated the dry flue gas desulfurization system market in 2024, accounting for approximately 56% of the total share. Its leadership stems from its lower water requirement, compact design, and cost-effectiveness compared to wet FGD systems. SDA systems are widely adopted in medium-capacity power plants and waste incineration facilities, where space and water availability are limited. Their ability to achieve up to 95% SO₂ removal efficiency while minimizing sludge generation makes them a preferred choice for both new installations and retrofits, particularly in North America and Europe.

- For instance, Babcock & Wilcox Enterprises, Inc. offers Dry Flue Gas Desulfurization (FGD) systems, including its Circulating Dry Scrubber (CDS) technology, for sulfur dioxide removal in power and industrial applications. B&W has a global track record with thousands of megawatts of installed FGD capacity.

By Application

The power generation segment held the largest share of around 61% in 2024, driven by the continued use of coal and lignite-based plants in emerging economies. Utilities and independent power producers are integrating dry FGD systems to comply with tightening sulfur emission limits under U.S. EPA and EU directives. These systems enable high operational reliability and simplified maintenance. Increasing electricity demand in China, India, and Southeast Asia, combined with government-supported retrofitting programs, continues to fuel installations in thermal and waste-to-energy plants.

- For instance, Mitsubishi Heavy Industries has implemented Dry Sorbent Injection (DSI) systems, which use significantly less water compared to wet scrubbers

By End-User

Utilities accounted for nearly 68% of the dry flue gas desulfurization system market in 2024, supported by large-scale deployment in coal-fired and biomass power stations. The segment’s dominance is reinforced by regulatory pressure to achieve ultra-low sulfur dioxide emissions in grid-connected facilities. Utilities prefer dry and semi-dry systems for their high efficiency, modularity, and low operational costs. Industrial plants, including cement and metal processing units, are also increasing adoption to align with carbon neutrality and air quality targets, enhancing market penetration across Asia-Pacific and Europe.

Key Growth Drivers

Stringent Environmental Regulations

Tightening emission standards across regions are fueling the demand for dry flue gas desulfurization systems. Agencies such as the U.S. EPA and European regulators enforce strict limits on sulfur dioxide emissions from industrial and power generation sources. These systems provide a reliable way to meet compliance requirements without high water use. Governments in Asia-Pacific are also introducing emission reduction mandates, encouraging utilities and manufacturers to install cost-efficient dry and semi-dry systems to ensure cleaner and safer air quality.

- For instance, GE’s patented semi-dry NIDTM technology was installed in 2016 at the ZW Nowa heat and power plant in Dąbrowa Górnicza, Poland, helping the facility comply with new European emissions standards. The ZW Nowa plant is owned by TAMEH Polska and is significantly smaller than 900 MW.

Expansion of Thermal and Waste-to-Energy Plants

The growing number of thermal power and waste-to-energy facilities is strengthening market growth for dry FGD systems. These technologies are widely chosen for their compact design, lower maintenance needs, and effective sulfur removal performance. Developing nations are expanding energy infrastructure and emphasizing pollution control upgrades, creating steady demand for retrofits and new installations. This expansion aligns with global decarbonization and clean air initiatives, promoting greater adoption across energy-intensive sectors.

- For instance, Hitachi Zosen Inova AG (now Kanadevia Inova) has deployed Semi-Dry Flue Gas Cleaning Systems at various waste-to-energy plants, some with capacities exceeding 250,000 metric tons of waste annually, designed to meet or exceed stringent emissions standards.

Rising Industrialization and Air Quality Concerns

Rapid industrial expansion, particularly in Asia-Pacific, is increasing the need for air quality management systems. Industries such as cement, metal, and chemicals are deploying dry FGD systems to control emissions while maintaining operational efficiency. Governments and environmental bodies are pushing stricter regulations on industrial emissions, prompting manufacturers to adopt advanced pollution control equipment. Public awareness of air quality issues further supports market momentum, with industries seeking sustainable and compliant solutions.

Key Trends & Opportunities

Shift Toward Semi-Dry and Hybrid Systems

A major market trend is the move toward semi-dry and hybrid desulfurization systems that combine dry operation with partial humidification. This approach enhances sulfur removal efficiency while minimizing water usage and maintenance. Utilities are increasingly adopting hybrid configurations for retrofits where space or cost limits full wet FGD systems. The flexibility and performance consistency of these solutions under variable plant loads make them ideal for meeting evolving emission standards.

- For instance, Marsulex Environmental Technologies (MET) has supplied advanced air pollution control systems, including Dry Flue Gas Desulfurization (DFGD) technology, for numerous power plant installations in various countries.

Technological Advancements and Digital Integration

Manufacturers are focusing on digital control and automation to enhance system efficiency and reliability. Smart sensors and AI-driven analytics are being integrated to monitor SO₂ levels, optimize reagent use, and predict maintenance needs. These innovations reduce operational costs and downtime while improving compliance performance. Advancements in sorbent materials and reactor design are further increasing removal rates, positioning next-generation dry FGD systems as a sustainable and cost-effective emission control option.

- For instance, CECO Environmental, through its HEE-Duall brand, offers advanced high-efficiency dry scrubbers with automated controls. These systems are designed with features that help reduce operating costs and minimize maintenance downtime, leading to a low total cost of ownership.

Key Challenges

High Installation and Maintenance Costs

The significant upfront investment required for dry FGD systems remains a barrier for small and mid-scale industries. Costs associated with equipment, installation, and routine maintenance increase the overall project burden. Despite offering operational savings and compliance benefits, many plants delay upgrades due to budget constraints. Limited access to financing in developing regions further restricts system deployment, slowing the adoption rate among cost-sensitive operators.

Competition from Alternative Technologies

Dry desulfurization systems face strong competition from wet and regenerative technologies that deliver higher removal efficiencies for large-scale plants. Established infrastructures and proven reliability make these alternatives appealing in certain applications. In regions where water availability is not a concern, wet FGD systems often dominate. The presence of competing solutions, combined with inconsistent regulatory enforcement, continues to challenge the broader adoption of dry FGD systems across global industrial sectors.

Regional Analysis

North America

North America held a market share of 27% in 2024, driven by strict air emission regulations enforced by the U.S. Environmental Protection Agency and the Canadian Environmental Protection Act. Power generation and cement industries remain key adopters of dry FGD systems due to their proven reliability and lower water consumption. The replacement of aging wet scrubbers with semi-dry technologies is increasing across utilities. Continuous investments in emission control infrastructure and technological innovation by leading manufacturers such as Babcock & Wilcox Enterprises and GE Vernova further support regional growth.

Europe

Europe accounted for 24% of the global market in 2024, supported by strong regulatory frameworks under the Industrial Emissions Directive and the European Green Deal. Countries such as Germany, the United Kingdom, and France lead installations due to ongoing decarbonization and industrial retrofitting projects. The cement and waste-to-energy sectors are key contributors to demand. Utilities are transitioning toward energy-efficient semi-dry systems to meet low-emission targets. The presence of established engineering firms and government incentives for clean industrial operations continue to sustain steady growth across the region.

Asia-Pacific

Asia-Pacific dominated the market with a 36% share in 2024, driven by rapid industrialization and coal-based power generation in China, India, and Japan. Governments across the region are tightening SO₂ emission standards, prompting extensive adoption of dry and hybrid FGD systems. Expansion of cement and metal production facilities is also creating strong demand for cost-effective desulfurization technologies. Increasing infrastructure investments and public-private partnerships in air quality management programs support growth. Regional players are focusing on developing localized, low-cost systems to meet rising domestic demand while ensuring compliance with international environmental norms.

Middle East & Africa

The Middle East & Africa region captured 7% of the dry FGD market share in 2024, led by industrial growth in Saudi Arabia, South Africa, and the United Arab Emirates. The region’s adoption rate is increasing due to stricter emission laws and ongoing diversification efforts in energy-intensive industries. Oil refineries, metal processing plants, and power utilities are integrating dry systems to reduce sulfur output while conserving water. Regional governments are investing in green technology and air pollution control initiatives, positioning the market for gradual but steady expansion through the forecast period.

South America

South America accounted for 6% of the market share in 2024, driven by environmental reforms and industrial modernization in Brazil, Argentina, and Chile. The power generation and cement sectors dominate demand as governments enforce stricter emission standards. Brazil’s increasing focus on sustainable industrial production and public health has accelerated FGD system installations in thermal power plants. Multinational firms are partnering with local manufacturers to provide cost-effective dry systems suited to regional climatic conditions. Rising awareness of air pollution’s economic and health impacts continues to support long-term market development.

Market Segmentations:

By Type

- Spray Dryer Absorber (SDA)

- Circulating Fluidized Bed (CFB)

- Other Dry and Semi-Dry Systems

By Application

- Power Generation

- Cement Manufacturing

- Metal Processing

- Others (including glass and refinery sectors)

By End-User

- Utilities

- Industrial Plants

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dry flue gas desulfurization system market features major players such as Mitsubishi Heavy Industries, KC Cottrell India, GEA Group Aktiengesellschaft, John Cockerill, GE Vernova, Hitachi Zosen Inova AG, Babcock & Wilcox Enterprises, CECO Environmental, MET, and Duconenv. These companies compete through technological innovation, cost optimization, and large-scale project execution across power generation and industrial sectors. Leading manufacturers focus on expanding their portfolios with high-efficiency, low-maintenance systems suitable for both new installations and retrofits. Partnerships with utilities, regional engineering firms, and governments are helping them strengthen their presence in Asia-Pacific and Europe. Continuous research into hybrid and semi-dry technologies, integration of automation for process control, and enhanced sorbent utilization remain central strategies to improve performance and regulatory compliance. Global market competition is expected to intensify as emission standards tighten and demand for sustainable desulfurization solutions increases across emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Heavy Industries

- KC Cottrell India

- GEA Group Aktiengesellschaft

- John Cockerill

- GE Vernova

- Hitachi Zosen Inova AG

- Babcock & Wilcox Enterprises

- CECO Environmental

- MET

- Duconenv

Recent Developments

- In June 2025, Duconenv secured a contract for a 2 × 350 MW seawater FGD system in East Africa, supplying a complete FGD solution including dry injection sub-systems.

- In May 2025, GE Vernova expanded its FGD service offerings, promoting upgrades for both wet and dry systems including a patented Mer-Cure activated carbon injection system to improve mercury capture rates in FGD units.

- In May 2025, GE Vernova announced deployment of its SulfiTrac online sulfite analyzer integrated into FGD systems, capable of controlling oxygen injection to maintain gypsum purity, reducing blower energy consumption and mercury re-emissions.

- In 2025, Mitsubishi Heavy Industries continues to promote its FGD capabilities, offering systems capable of 99% SO₂ removal efficiency even under high inlet concentrations.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as industries focus on stricter emission compliance.

- Demand for dry and semi-dry FGD systems will rise due to water conservation needs.

- Asia-Pacific will remain the leading region, supported by large-scale industrial growth.

- Power generation will stay the dominant application segment through wider retrofit projects.

- Hybrid desulfurization systems will gain popularity for balancing efficiency and cost.

- Manufacturers will integrate digital monitoring and automation for better operational control.

- Investments in high-performance sorbents and materials will enhance system efficiency.

- Government incentives for cleaner industrial technologies will boost installation rates.

- Partnerships between global and regional engineering firms will strengthen market penetration.

- Long-term growth will focus on sustainable, low-maintenance emission control solutions worldwide.