Market Overview:

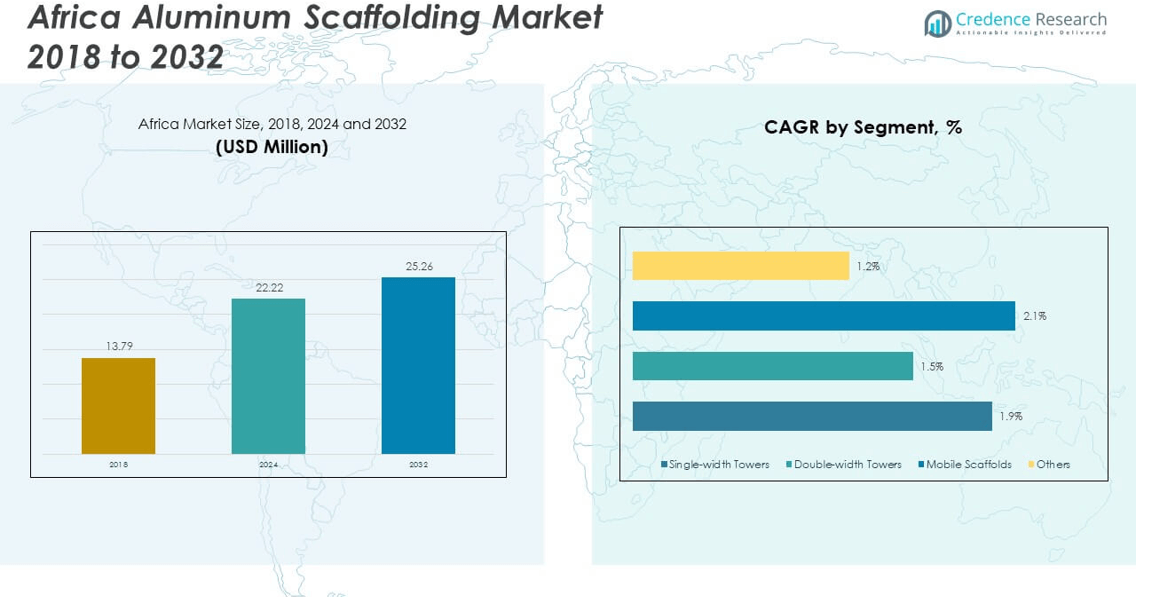

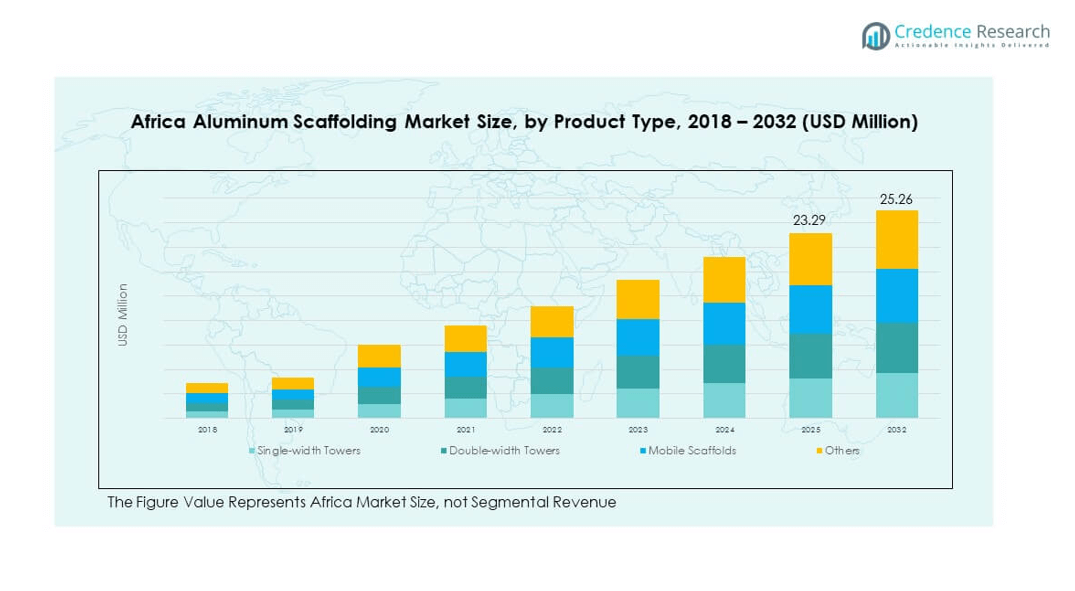

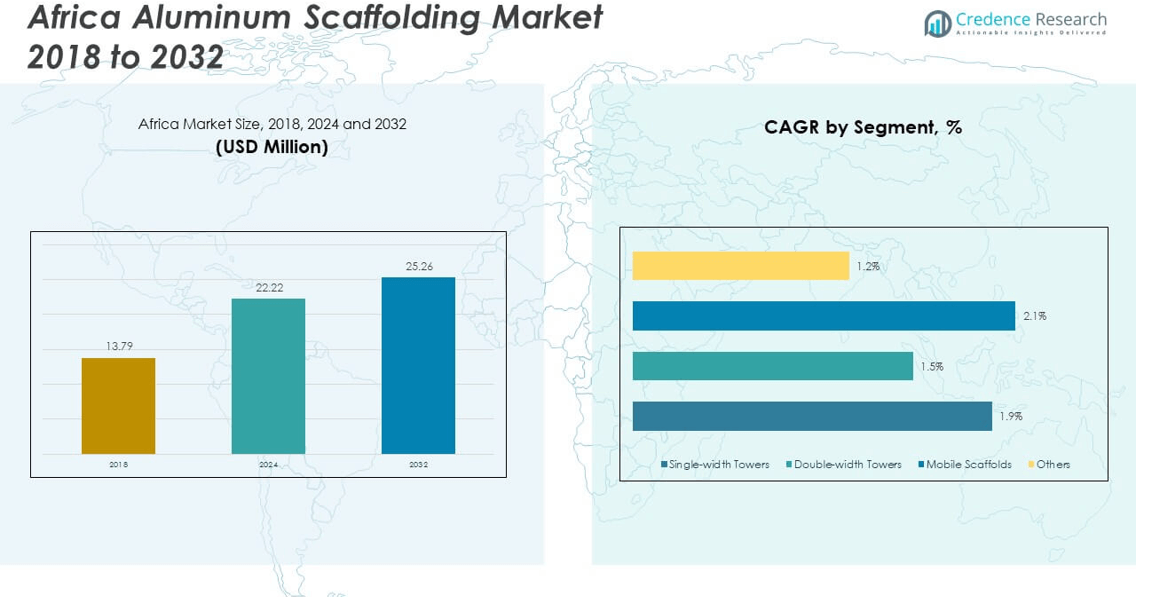

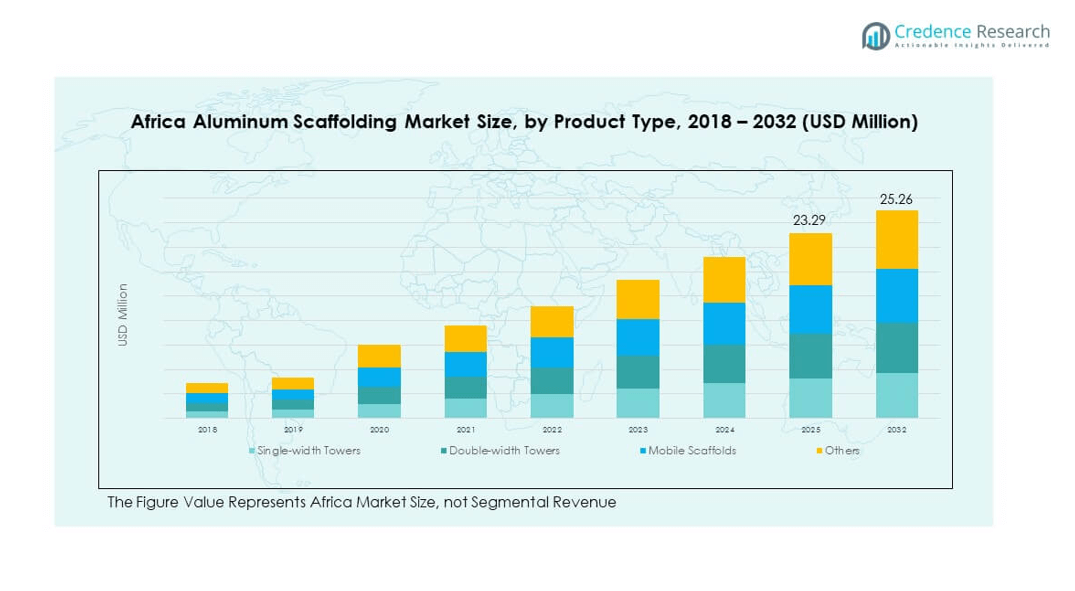

The Africa Aluminum Scaffolding Market size was valued at USD 13.79 million in 2018 to USD 22.22 million in 2024 and is anticipated to reach USD 25.26 million by 2032, at a CAGR of 1.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Aluminum Scaffolding Market Size 2024 |

USD 22.22 million |

| Africa Aluminum Scaffolding Market, CAGR |

1.20% |

| Africa Aluminum Scaffolding Market Size 2032 |

USD 25.26 million |

The growth of the Africa Aluminum Scaffolding Market is primarily driven by increased infrastructure development across commercial and industrial sectors. Governments and private investors are focusing on urban expansion, transport network upgrades, and industrial plant construction, all of which demand lightweight, durable, and modular scaffolding systems. The rising preference for aluminum scaffolds stems from their ease of assembly, corrosion resistance, and reduced maintenance costs, making them ideal for high-frequency use in large-scale and time-sensitive projects. Additionally, heightened emphasis on worker safety is encouraging adoption of compliant scaffolding systems.

Regionally, South Africa leads the market due to its advanced construction sector, established regulations, and higher demand for efficient access systems. Countries like Egypt and Nigeria are emerging markets, fueled by rapid urbanization, industrial growth, and ongoing government infrastructure programs. East African nations are also witnessing gradual growth, supported by regional construction projects, cross-border connectivity efforts, and increased foreign direct investments in real estate and public infrastructure development.

Market Insights:

- The Africa Aluminum Scaffolding Market was valued at USD 22.22 million in 2024 and is projected to reach USD 25.26 million by 2032, growing at a CAGR of 1.20%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Rapid urbanization and infrastructure projects across South Africa, Egypt, and Nigeria are driving sustained demand for modular and mobile aluminum scaffolding systems.

- Safety regulations and compliance standards are pushing construction firms to adopt certified, lightweight scaffolding over traditional materials.

- High import dependence and fluctuating currency rates continue to restrain cost competitiveness, especially for small and mid-sized contractors.

- South Africa dominates the market with the largest share due to a mature construction ecosystem and strong regulatory enforcement.

- North and West African countries are emerging markets supported by public infrastructure spending and industrial development.

- Limited regulatory enforcement in some regions and reliance on informal scaffolding structures hinder the broader adoption of aluminum systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Infrastructure Expansion Projects Across Urban and Industrial Zones Fuel Scaffolding Demand

The surge in public and private construction activities across Africa has significantly driven the demand for safe and durable access systems. Urbanization across key cities has pushed the need for high-rise residential and commercial buildings, leading to widespread adoption of aluminum scaffolding solutions. It offers advantages such as lightweight structure, corrosion resistance, and fast assembly, which are essential in time-sensitive projects. The Africa Aluminum Scaffolding Market benefits from these construction trends, with aluminum systems replacing traditional steel frameworks in multiple sectors. Governments are prioritizing transportation infrastructure, airports, and bridges, creating continuous demand for compliant scaffolding setups. Energy and utility sectors are also investing in expansion projects that require temporary access systems during installations and inspections.

- For example, Wellmade, an ISO 9001 and CE-certified manufacturer, operates a 50,000 m² automated facility with 50 production lines focused on quick-lock scaffolding. Its ergonomic systems allow a two-person team to assemble 100 meters of scaffold in under 45 minutes, improving efficiency and reducing worker strain.

Stringent Safety Regulations Accelerate the Shift to Certified Scaffolding Systems

Workplace safety standards are being increasingly enforced across Africa, compelling construction firms to upgrade their scaffolding systems to meet international safety norms. Regulatory bodies in several countries are aligning with European and ISO standards, which support the adoption of high-quality aluminum scaffolding. The Africa Aluminum Scaffolding Market gains from this shift, as companies look to mitigate accident risks and improve worker safety compliance. It also supports inspection and maintenance protocols in industrial and commercial spaces, where safe elevation systems are critical. Construction stakeholders are actively replacing outdated or makeshift platforms with certified, load-tested scaffolds. This demand for precision-manufactured systems reinforces the importance of lightweight yet robust scaffolds in daily operations.

Growing Preference for Modular and Customizable Scaffolding Systems

The construction and industrial sectors in Africa are prioritizing modular scaffolding solutions that can be adapted to complex geometries and varying project requirements. The Africa Aluminum Scaffolding Market responds to this demand by offering systems with flexible configurations and easy transportability. Modular designs facilitate safe installation in confined or irregular spaces, especially in refurbishment and facility upgrade projects. It plays a vital role in large industrial sites such as refineries and plants, where quick access and safe working platforms are essential. Contractors value the time-saving and labor-reducing nature of modular scaffolds. These systems also reduce the storage footprint, making them viable in resource-limited environments

- For instance, PERI’s UP Flex modular system features components with a metric grid in 25cm increments, allowing flexible assembly on sites with complex geometry, such as industrial plants and oil refineries.

Public and Private Sector Investments Drive Growth in Residential and Commercial Segments

Major government housing programs and private real estate developments have boosted construction activities in Africa, especially in urbanizing economies. The Africa Aluminum Scaffolding Market capitalizes on this trend by supplying durable systems suitable for mid- to high-rise buildings. It supports developers focusing on both affordable housing and luxury projects, given the versatile nature of aluminum scaffolds. Commercial buildings such as malls, offices, and hotels also demand access solutions that meet aesthetic, functional, and safety benchmarks. Investment flows from international donors and local infrastructure funds have further energized large-scale construction. It helps contractors adopt modern equipment, reducing reliance on outdated manual frameworks. Real estate growth across Nigeria, Kenya, Egypt, and South Africa underpins this increased consumption.

Market Trends:

Rental and Leasing Services Gain Popularity Among Construction Companies

A growing number of construction companies across Africa are shifting toward renting scaffolding equipment instead of making capital-intensive purchases. The Africa Aluminum Scaffolding Market benefits from this trend, as rental services offer scalable access to certified systems on a project-specific basis. Contractors prefer leasing to manage short-term site needs while avoiding long-term storage or maintenance obligations. This model ensures availability of modern, well-maintained systems without upfront investment. It enables small and medium-sized enterprises to meet compliance requirements with limited budgets. Rental providers also offer technical support, which appeals to projects lacking in-house scaffolding expertise. Demand for short-term, flexible rental agreements is particularly high in urban developments and maintenance contracts.

Integration of Digital Inspection Tools and Smart Safety Accessories

Contractors are adopting digital tools for scaffolding management, inspection, and tracking to enhance safety and efficiency. The Africa Aluminum Scaffolding Market sees increased integration of RFID tags, GPS modules, and mobile inspection apps to monitor scaffold conditions and locations. These tools help prevent misuse, reduce assembly errors, and track compliance. Digital logs simplify maintenance scheduling and improve accountability across teams. Site managers can verify installation integrity through mobile platforms before each shift begins. Smart accessories, such as visual safety indicators and pre-assembled locking mechanisms, further reduce human error.

- For instance, the ScaffTrack system utilizes passive RFID tags combined with GPS modules to enable real-time tracking of scaffolding structures. Each scaffold is tagged with a unique digital identifier that logs location-stamped inspection data, including time-stamped images. This setup ensures verifiable proof of inspection and automates compliance reporting through a secure cloud platform.

Rising Demand for Lightweight Scaffolding in Maintenance and Facility Upkeep

Industrial facilities and commercial spaces increasingly require safe, lightweight scaffolding for routine maintenance and repairs. The Africa Aluminum Scaffolding Market meets this demand through portable systems that are easy to assemble and dismantle without heavy equipment. It allows operations to continue with minimal disruption, especially in sectors such as aviation, utilities, and manufacturing. Maintenance teams prefer mobile tower scaffolds and foldable units that fit into constrained areas. Lightweight designs reduce fatigue for workers involved in frequent repositioning. It enhances productivity and safety during HVAC repairs, electrical inspections, and interior refurbishments.

- For instance, Altrad Group’s Alumetrix multidirectional scaffolding offers a lightweight standard of just 4kg for a 2m element, with a 3m ledger at 6kg and 3m deck at 11kg. These aluminum systems replace heavier steel frames, enabling faster assembly and transport for large-scale projects such as bridge construction and aviation hubs.

Product Innovation Focused on Ergonomics and Quick Assembly Solutions

Manufacturers are developing ergonomic scaffolding systems with intuitive design features that enhance usability and reduce labor fatigue. The Africa Aluminum Scaffolding Market sees a rise in quick-locking joints, pre-marked assembly components, and foldable designs that support solo or two-person operations. These innovations reduce the skill barrier for scaffold assembly and help maintain project schedules in tight labor markets. Projects in remote areas or short-duration refurbishments especially benefit from tools-free or semi-automatic locking mechanisms. Ergonomic designs ensure safe posture and minimal strain for technicians during assembly and dismantling. This shift reduces injury rates and shortens training cycles for new staff.

Market Challenges Analysis:

High Price Sensitivity and Limited Access to Quality Imports in Budget-Conscious Regions

Several African markets remain highly price-sensitive, posing challenges for premium aluminum scaffolding suppliers. The Africa Aluminum Scaffolding Market struggles to compete with low-cost steel alternatives and informal access structures in rural and peri-urban regions. It faces constraints in supply chain continuity due to heavy reliance on imports for key components and finished systems. Customs duties, shipping delays, and currency fluctuations increase product costs, further limiting affordability. Smaller construction firms often opt for locally fabricated, non-compliant platforms due to cost pressure. Distributors face resistance in regions lacking awareness of the long-term benefits of aluminum scaffolds. It hinders full-scale adoption in budget-constrained projects, especially in low-margin sectors such as public housing or small-scale maintenance.

Inconsistent Regulatory Enforcement and Fragmented Training Standards Across Countries

The lack of uniform enforcement of safety standards across African nations limits the widespread adoption of certified scaffolding systems. The Africa Aluminum Scaffolding Market encounters variability in how national and municipal agencies regulate scaffold use on worksites. Some countries have adopted formal codes aligned with European standards, while others still rely on outdated or informal safety practices. It creates uncertainty for suppliers and contractors operating across borders. The absence of centralized training and certification programs for scaffold assembly and inspection also limits market maturity. Construction crews often lack formal exposure to modern scaffolding techniques. This challenge delays standardization and deters international players from expanding in countries with weak regulatory frameworks or poor enforcement mechanisms.

Market Opportunities:

Rising Demand for Green Building Certifications and Sustainable Construction Practices

There is growing awareness around sustainable construction across Africa, with governments and developers targeting green building certifications. The Africa Aluminum Scaffolding Market is well-positioned to benefit from this trend, given aluminum’s recyclability and low carbon footprint compared to steel. It aligns with sustainable construction practices by enabling reusable, long-lifespan access systems. Project owners looking to meet LEED or EDGE certification goals seek scaffolding solutions that support sustainability benchmarks. It gives aluminum scaffolding providers an edge in bidding for eco-conscious projects.

Regional Infrastructure Development Initiatives Backed by International Funding

Multilateral institutions and development banks are supporting large-scale infrastructure projects across Africa, creating new opportunities for scaffolding manufacturers. The Africa Aluminum Scaffolding Market can scale by partnering with EPC firms and government contractors managing roads, railways, and urban redevelopment. It benefits from predictable demand cycles in internationally financed projects with high compliance standards. Suppliers that align with procurement frameworks and offer certified systems can expand their footprint in high-growth markets.

Market Segmentation Analysis:

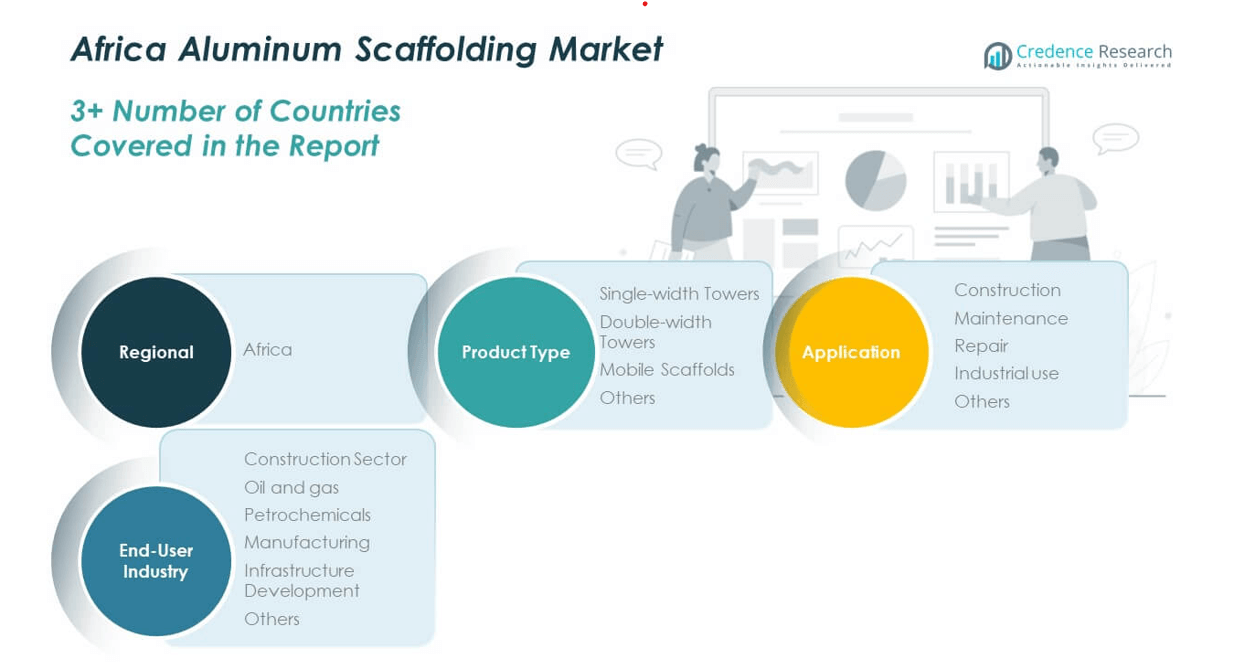

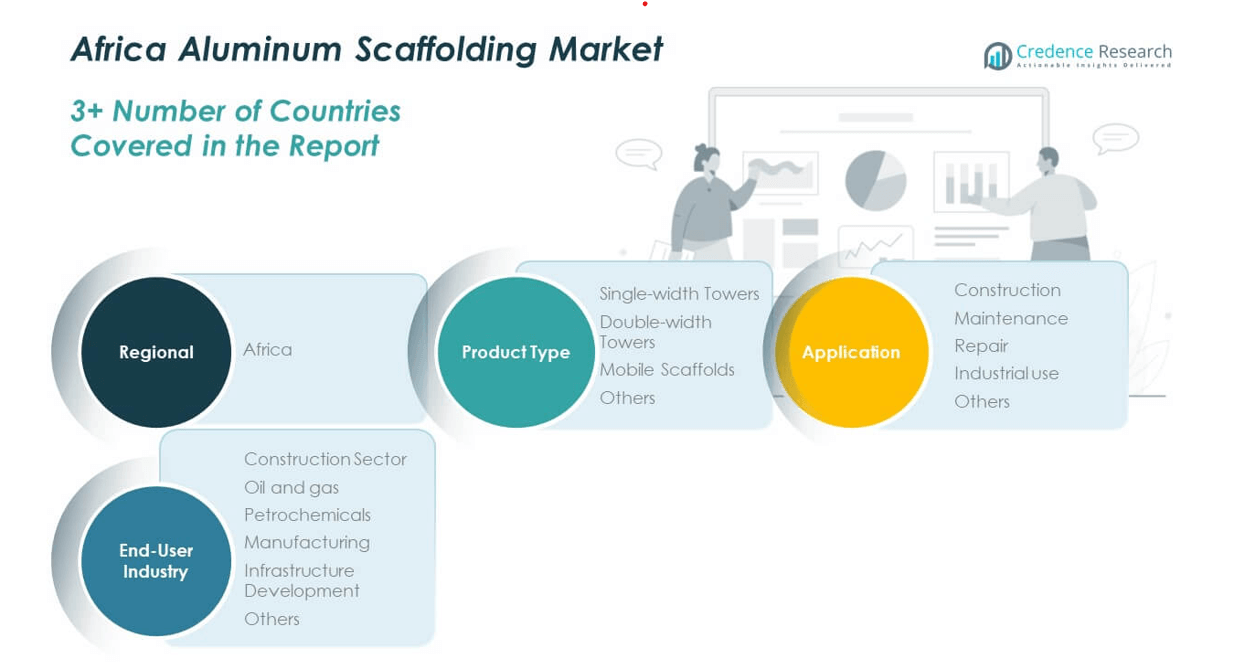

The Africa Aluminum Scaffolding Market is segmented by product type, application, and end-user industry, each contributing uniquely to overall market growth.

By product types, mobile scaffolds dominate due to their flexibility, portability, and increasing use in dynamic construction and maintenance environments. Double-width towers follow closely, particularly in high-rise and large-scale projects, while single-width towers serve indoor and space-constrained applications. The “others” category includes custom and modular scaffolding systems gaining traction in specialized use cases.

- For instance, Disc-O-Scaff, a leading manufacturer in South Africa, supplies Selflock mobile scaffold towers equipped with castors, enabling rapid movement and assembly across sites for maintenance and renovation work.

By application, the construction segment leads the market, driven by expanding infrastructure and urban development projects across the region. Maintenance holds the second-largest share, supported by ongoing industrial and facility upkeep needs. Repair and industrial use segments show consistent demand in plants, refineries, and utilities. The “others” category includes event setups and temporary structures used in non-traditional environments.

- For example, Tanzania’s construction sector continues to grow rapidly, supported by large-scale infrastructure projects such as the Standard Gauge Railway and power generation facilities. These developments require extensive scaffolding deployment for tower, bridge, and structural work. Leading suppliers provide compliant, modular platforms tailored to project specifications, supporting safe and efficient operations across diverse construction environments.

By end-user, the Africa Aluminum Scaffolding Market serves diverse end-user industries, with the construction sector accounting for the largest share. It benefits from public and private sector investments in commercial, residential, and civil infrastructure. Oil and gas, petrochemicals, and manufacturing sectors increasingly rely on compliant scaffolding for safety and efficiency during installations and turnarounds. Infrastructure development projects, including airports, railways, and power plants, also drive demand. The “others” segment reflects niche uses across entertainment, education, and public administration.

Segmentation:

By Product Type:

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application:

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry:

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

Regional Analysis:

South Africa leads the Africa Aluminum Scaffolding Market, holding a market share of 34%. It benefits from a mature construction ecosystem, established regulatory standards, and consistent demand from urban infrastructure and industrial maintenance sectors. Major cities like Johannesburg, Cape Town, and Durban continue to invest in high-rise commercial buildings and transport networks, fueling consistent demand for lightweight, modular scaffolding systems. The presence of international contractors and suppliers enhances product quality and safety awareness in the region. Public sector infrastructure spending and private real estate developments further support market stability. The country’s regulatory enforcement of construction safety standards also favors the adoption of certified aluminum scaffolds.

North Africa holds the second-largest market share at 28%, with Egypt and Morocco acting as primary contributors. Egypt’s national infrastructure projects, such as housing developments and transportation corridors, continue to boost demand for temporary access systems. Morocco is witnessing growth in commercial and industrial construction, including renewable energy facilities that require scaffolding for installation and maintenance. The Africa Aluminum Scaffolding Market in this region benefits from both local and international investments into logistics hubs and manufacturing zones. Strong government policy support for infrastructure development drives market demand. Access to ports and proximity to Europe also make North Africa a strategic location for imported scaffolding materials.

West Africa holds 19% of the market, while East Africa follows with 13%, both representing emerging regions with rising potential. Nigeria leads West Africa with demand centered around urbanization, oil and gas infrastructure, and commercial construction. Kenya, Tanzania, and Ethiopia contribute to growth in East Africa through ongoing investments in public buildings, power plants, and road projects. The Africa Aluminum Scaffolding Market in these regions faces challenges related to fragmented regulation and limited access to certified products but shows upward momentum due to population growth and urban expansion. Southern and Central Africa collectively hold the remaining 6%, where growth remains gradual but supported by mining projects and industrial maintenance needs. These markets present long-term opportunities for suppliers offering durable, lightweight, and safety-compliant scaffolding solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SGB-Cape

- SA Scaffold Group

- HUGO Scaffolds Limited

- Wapo Scaffolding (T) Limited

- Southey Contracting

- Liberty Events and Contracts Scaffolding Ltd.

- Form-Scaff (WACO International)

- Kasthew Construction Uganda

- Neetoo Industries & Co. Ltd.

- Afix Scaff

Competitive Analysis:

The Africa Aluminum Scaffolding Market features a mix of regional players and global manufacturers competing across diverse end-use sectors. Leading companies include Layher, PERI, Altrad, and Altrex, each offering modular systems aligned with international safety standards. Local suppliers such as Ace Scaffolding and Kwikstage Africa cater to cost-sensitive markets and provide rental services across construction, industrial, and event applications. It remains competitive due to demand for quick installation, safety compliance, and after-sales support. Companies invest in product innovation, localized supply chains, and strategic partnerships to expand their regional footprint. Rental and leasing models are gaining ground, prompting suppliers to differentiate through service offerings. Market players also focus on training programs and technical support to build long-term client relationships. Regulatory changes and rising safety awareness continue to shape competitive dynamics. Companies that deliver scalable, safe, and cost-effective solutions retain an edge in this evolving landscape.

Recent Developments:

- In April 2025, Doka announced new scaffolding product lines developed in cooperation with AT‑PAC. These lines launched at bauma 2025 include systems tailored to high‑load, façade, and complex geometry applications. They bring modular versatility and reinforce its position across global scaffolding markets.

- In February 2024, SGB-Cape announced a strategic partnership with ICR Group. In this partnership, SGB-Cape has positioned itself as a key partner, reinforcing its commitment to delivering unparalleled industrial service solutions to clients.

Market Concentration & Characteristics:

The Africa Aluminum Scaffolding Market is moderately fragmented, with a growing presence of both international and domestic suppliers. It is shaped by demand from construction, industrial maintenance, and infrastructure sectors, with rental services playing a key role in accessibility. The market favors lightweight, modular designs that ensure safety and adaptability across applications. It remains cost-sensitive, which drives competition among manufacturers offering both standard and customizable solutions. Regional disparities in regulatory enforcement influence procurement behaviors and supplier strategies. Local distributors often collaborate with global brands to bridge supply gaps and meet quality standards. The market’s growth trajectory aligns closely with urban development, infrastructure expansion, and rising awareness of workplace safety.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Africa Aluminum Scaffolding Market is expected to grow steadily as construction and infrastructure projects expand across both urban and semi-urban areas.

- Adoption of aluminum scaffolding will increase due to its lightweight, corrosion-resistant properties, and faster assembly time compared to traditional systems.

- Demand for modular and mobile scaffolding solutions will rise, driven by the need for flexibility in complex project environments.

- Government-backed housing, transportation, and industrial initiatives will continue to create long-term opportunities for scaffolding suppliers.

- Rental and leasing models will gain further traction, particularly among small and mid-sized contractors seeking cost-effective, short-term solutions.

- Technological advancements in scaffold design and safety features will support compliance with evolving occupational safety standards.

- Training and certification programs for scaffold assembly and safety inspection will become more common, boosting skilled labor availability.

- Local manufacturing and regional assembly units will increase, helping mitigate import-related challenges and reduce delivery timelines.

- Market penetration will deepen in West and East Africa as regulatory frameworks strengthen and construction activity diversifies.

- Strategic collaborations between international and local players will enhance distribution networks and service offerings across key growth regions.