| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Automotive Lead Acid Battery Market Size 2024 |

USD 386.56 million |

| Africa Automotive Lead Acid Battery Market CAGR |

4.4% |

| Africa Automotive Lead Acid Battery Market Size 2032 |

USD 572.60 million |

Market Overview

Africa Automotive Lead Acid Battery market size was valued at USD 386.56 million in 2023 and is anticipated to reach USD 572.60 million by 2032, at a CAGR of 4.4% during the forecast period (2023-2032).

The Africa automotive lead acid battery market is experiencing steady growth, driven by rising vehicle ownership, expanding urbanization, and increasing demand for affordable energy storage solutions. As economies across the continent develop, the need for reliable transportation has surged, boosting the demand for lead acid batteries in both passenger and commercial vehicles. Additionally, the cost-effectiveness, recyclability, and established infrastructure supporting lead acid batteries continue to make them a preferred choice in the region. Governments are also investing in road infrastructure and incentivizing local automotive assembly, further supporting market expansion. Trends such as the growing use of start-stop technology and the rise of aftermarket battery sales are shaping the market landscape. Moreover, with heightened awareness around battery maintenance and replacement, the aftermarket segment is witnessing notable growth. These factors collectively position lead acid batteries as a vital component of Africa’s evolving automotive sector, despite emerging competition from alternative battery technologies.

The African automotive lead-acid battery market is driven by the growing automotive industry, with a significant demand for reliable energy storage solutions. Key players in this market include major global and regional companies like Exide Technologies, Solite Batteries, and Eveready, alongside local manufacturers such as Nigerian Batteries Limited and Metropolitan Batteries. These companies cater to a wide range of automotive needs, including cars, trucks, and other vehicles, providing essential power solutions. Geographically, the market is concentrated in regions with high vehicle ownership and industrial activity, such as South Africa, Nigeria, and Egypt. These countries represent key hubs for both manufacturing and consumption of automotive batteries. The growing automotive sector, along with increasing demand for renewable energy storage and transportation infrastructure, contributes to the expanding market opportunities in Africa. However, challenges such as economic fluctuations and regulatory hurdles continue to impact the pace of growth in certain regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The African automotive lead-acid battery market was valued at USD 386.56 million in 2023 and is expected to reach USD 572.60 million by 2032, growing at a CAGR of 4.4% during the forecast period (2023-2032).

- The Global Automotive Lead Acid Battery market was valued at USD 21,181.34 million in 2023 and is expected to reach USD 43,052.54 million by 2032, growing at a CAGR of 8.2% from 2023 to 2032.

- The growth is driven by the increasing demand for vehicles and energy storage solutions across the continent.

- A growing automotive industry in key regions like South Africa, Nigeria, and Egypt is boosting market opportunities.

- Technological advancements in battery efficiency and longer life cycles are contributing to market expansion.

- Competition among global and regional players, such as Exide Technologies and Solite Batteries, is intensifying.

- Economic challenges and regulatory barriers in certain regions can hinder market growth.

- South Africa and Nigeria are the major consumers and manufacturers of automotive batteries in Africa.

Report Scope

This report segments the Africa Automotive Lead Acid Battery Market as follows:

Market Drivers

Rising Vehicle Ownership and Urbanization

The steady increase in vehicle ownership across Africa is a primary driver of demand for automotive lead acid batteries. Rapid urbanization and growing middle-class populations in key countries such as South Africa, Nigeria, Egypt, and Kenya are leading to higher automobile sales. For instance, Africa’s automotive battery market is expanding due to increasing use of two-wheelers and three-wheelers in urban areas, coupled with rising disposable incomes. As transportation needs evolve, both new vehicle purchases and the maintenance of aging fleets require reliable battery solutions. Lead acid batteries, being cost-effective and readily available, are well-suited for mass-market vehicles, especially in regions where electric vehicle (EV) infrastructure is still developing. The rise in two-wheelers, passenger cars, and light commercial vehicles further reinforces the consistent demand for starter, lighting, and ignition (SLI) batteries.

Recycling Initiatives and Regulatory Support

Environmental concerns and regulatory efforts are also influencing the automotive lead acid battery market in Africa. Many countries are recognizing the environmental risks associated with improper battery disposal and are taking steps to implement recycling regulations and promote sustainable battery management practices. For instance, Ghana has launched Standard Operating Procedures for responsible lead-acid battery recycling, setting guidelines for environmentally sound management. The recyclability of lead acid batteries is a major advantage, as they are among the most recycled products globally. This supports a circular economy and encourages battery producers to invest in eco-friendly initiatives. As awareness of environmental responsibility increases, both public and private sector efforts are aligning to ensure that lead acid batteries remain compliant with environmental standards while continuing to meet the growing energy needs of Africa’s automotive sector.

Affordable Energy Storage and Established Technology

Lead acid batteries continue to dominate the African automotive battery market due to their affordability and proven technology. In regions where economic constraints are prominent, cost-effectiveness becomes a decisive factor in product selection. Lead acid batteries offer a low upfront cost and are compatible with a broad range of vehicles, including older models that remain in operation in many African countries. Moreover, the technology is mature, with a well-established supply chain, extensive availability of service centers, and widespread technician familiarity. These factors enhance consumer confidence and promote the sustained use of lead acid batteries, even in the face of emerging alternatives like lithium-ion.

Expansion of Automotive Manufacturing and Aftermarket Growth

Africa’s growing focus on local automotive manufacturing and assembly is fostering a supportive environment for the lead acid battery market. Governments are increasingly promoting domestic production through tax incentives and investment-friendly policies to reduce dependence on imports. This has encouraged the establishment of automotive plants and related supply chains, including battery manufacturing and distribution. Additionally, the continent’s large stock of aging vehicles generates strong demand in the replacement and aftermarket battery segment. Frequent battery replacements due to extreme climatic conditions, poor road infrastructure, and limited maintenance awareness contribute to recurring sales, sustaining market momentum.

Market Trends

Rising Demand for Start-Stop Technology

A key trend shaping the Africa automotive lead acid battery market is the growing adoption of start-stop technology in modern vehicles. This system, which automatically shuts down and restarts the engine to reduce fuel consumption and emissions, requires advanced lead acid batteries with enhanced cycling capabilities. For instance, Africa’s automotive battery market is expanding due to increasing use of start-stop systems in passenger and commercial vehicles. As fuel efficiency and environmental awareness gain traction in African urban centers, automakers are integrating start-stop systems in new vehicle models. This has led to a shift in battery demand from conventional flooded batteries to enhanced flooded batteries (EFB) and absorbent glass mat (AGM) variants, which are better suited for high-performance requirements. The trend aligns with broader global movements toward greener automotive solutions and is gradually influencing battery choices across African markets.

Growth of the Automotive Aftermarket Segment

Africa’s large and aging vehicle fleet continues to drive robust growth in the automotive aftermarket segment, particularly for battery replacement. Harsh weather conditions, inconsistent road infrastructure, and limited preventive maintenance practices contribute to frequent battery wear and failure. As a result, battery replacement cycles are shorter compared to more developed markets. For instance, Africa’s automotive aftermarket is growing due to the expansion of informal service networks and small-scale distributors. This dynamic creates sustained demand for lead acid batteries in the aftermarket, where consumers prioritize affordability and availability. Furthermore, the rise of informal service networks and small-scale distributors across the continent facilitates widespread access to replacement batteries, reinforcing the aftermarket’s importance. This trend is expected to remain a major growth pillar, especially in rural and semi-urban areas.

Local Assembly and Manufacturing Expansion

Another significant trend is the expansion of local battery manufacturing and vehicle assembly operations in Africa. Governments in countries such as South Africa, Egypt, Kenya, and Nigeria are actively encouraging local production through favorable policies, tax incentives, and investment in industrial zones. This development not only reduces dependency on imports but also enhances supply chain resilience and lowers costs for end-users. Local production also supports customization to meet regional preferences and environmental conditions, such as heat-resistance and deep-discharge capabilities. As more international and domestic players invest in localized operations, the market is witnessing improved product quality, increased competition, and enhanced distribution efficiency.

Growing Environmental Awareness and Recycling Efforts

Environmental consciousness is gradually influencing purchasing decisions and policy development in the African battery industry. Lead acid batteries have a high recycling rate, which positions them as an environmentally sustainable option when proper disposal systems are in place. Several African countries are now initiating battery recycling programs and formulating regulations to ensure safe handling of hazardous materials. These efforts are complemented by partnerships between public agencies and private stakeholders to build efficient collection and recycling infrastructure. As sustainability becomes a focal point, companies that offer eco-friendly and recyclable battery solutions are gaining favor among consumers and regulatory bodies alike.

Market Challenges Analysis

Inadequate Infrastructure and Supply Chain Constraints

One of the most pressing challenges facing the Africa automotive lead acid battery market is the underdeveloped infrastructure and fragmented supply chain across many regions. Poor road networks, inconsistent electricity supply, and limited logistics capabilities hinder the efficient distribution and servicing of batteries. For instance, Africa’s competitiveness in global battery supply chains is affected by infrastructure limitations, impacting manufacturing and distribution efficiency. These issues increase operational costs and restrict the ability of manufacturers and distributors to reach remote and rural markets effectively. In addition, the lack of advanced battery testing and maintenance facilities further exacerbates product performance concerns, especially in extreme climatic conditions. Many consumers also face difficulties in accessing genuine replacement batteries, leading to a rise in counterfeit and substandard products that undermine trust in reputable brands. These systemic logistical and infrastructure challenges create significant barriers to consistent market expansion and limit the growth potential in less developed areas.

Environmental and Regulatory Pressures Amidst Limited Enforcement

Environmental concerns and tightening regulatory standards present another major hurdle for the lead acid battery industry in Africa. While lead acid batteries are highly recyclable, improper disposal and inadequate recycling infrastructure pose serious environmental and public health risks. In several countries, regulations around battery recycling and hazardous waste management remain either weak or poorly enforced. Informal recycling practices—often conducted without proper safety measures—lead to environmental contamination and occupational health hazards. As global and regional pressure mounts for sustainable manufacturing and responsible waste handling, producers and importers must invest in compliant recycling processes and environmentally safe operations. However, the lack of standardized regulatory frameworks across the continent, coupled with low consumer awareness, complicates compliance efforts and slows the adoption of circular economy practices. This regulatory uncertainty increases business risks for both local and international battery stakeholders operating in Africa.

Market Opportunities

The Africa automotive lead acid battery market presents substantial growth opportunities, driven by the continent’s expanding vehicle population and increasing demand for cost-effective energy storage solutions. As disposable incomes rise and urbanization accelerates, more individuals and businesses are investing in passenger and commercial vehicles, directly boosting the need for dependable starter, lighting, and ignition (SLI) batteries. Additionally, the affordability and proven reliability of lead acid batteries position them as the preferred choice in both new vehicles and replacement markets, particularly in regions where lithium-ion alternatives remain cost-prohibitive. The increasing presence of ride-hailing services, public transport fleets, and logistics operations is also creating demand for durable battery technologies suited for high-usage cycles, offering new opportunities for manufacturers and aftermarket suppliers.

Furthermore, growing investments in local battery manufacturing and regional assembly plants are creating favorable conditions for industry expansion. Governments across Africa are implementing supportive industrial policies, tax incentives, and infrastructure projects that attract battery manufacturers seeking to localize operations. This shift not only reduces dependency on imports but also allows for product customization tailored to African road conditions and climates. In parallel, the rising awareness around battery recycling and environmental sustainability is opening opportunities for companies to offer eco-friendly, compliant recycling solutions. Stakeholders who invest in formal collection, refurbishment, and recycling networks stand to gain regulatory support and consumer trust. As vehicle electrification slowly gains momentum through hybrid and micro-hybrid technologies, there is also potential for enhanced lead acid battery variants—such as EFB and AGM types—to capture a share of the evolving automotive power storage market. Together, these factors underscore a promising landscape for sustained investment and innovation in the Africa automotive lead acid battery sector.

Market Segmentation Analysis:

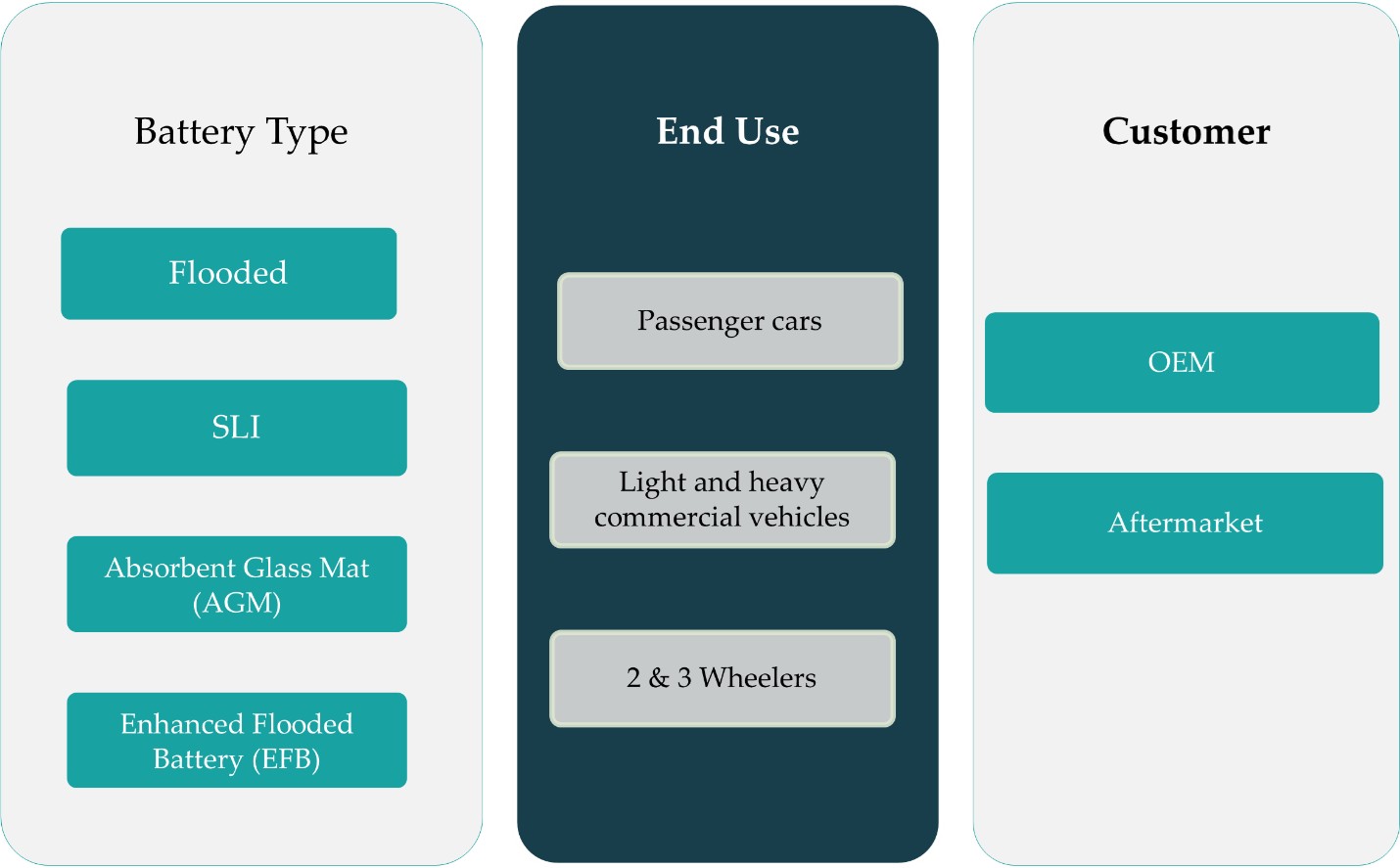

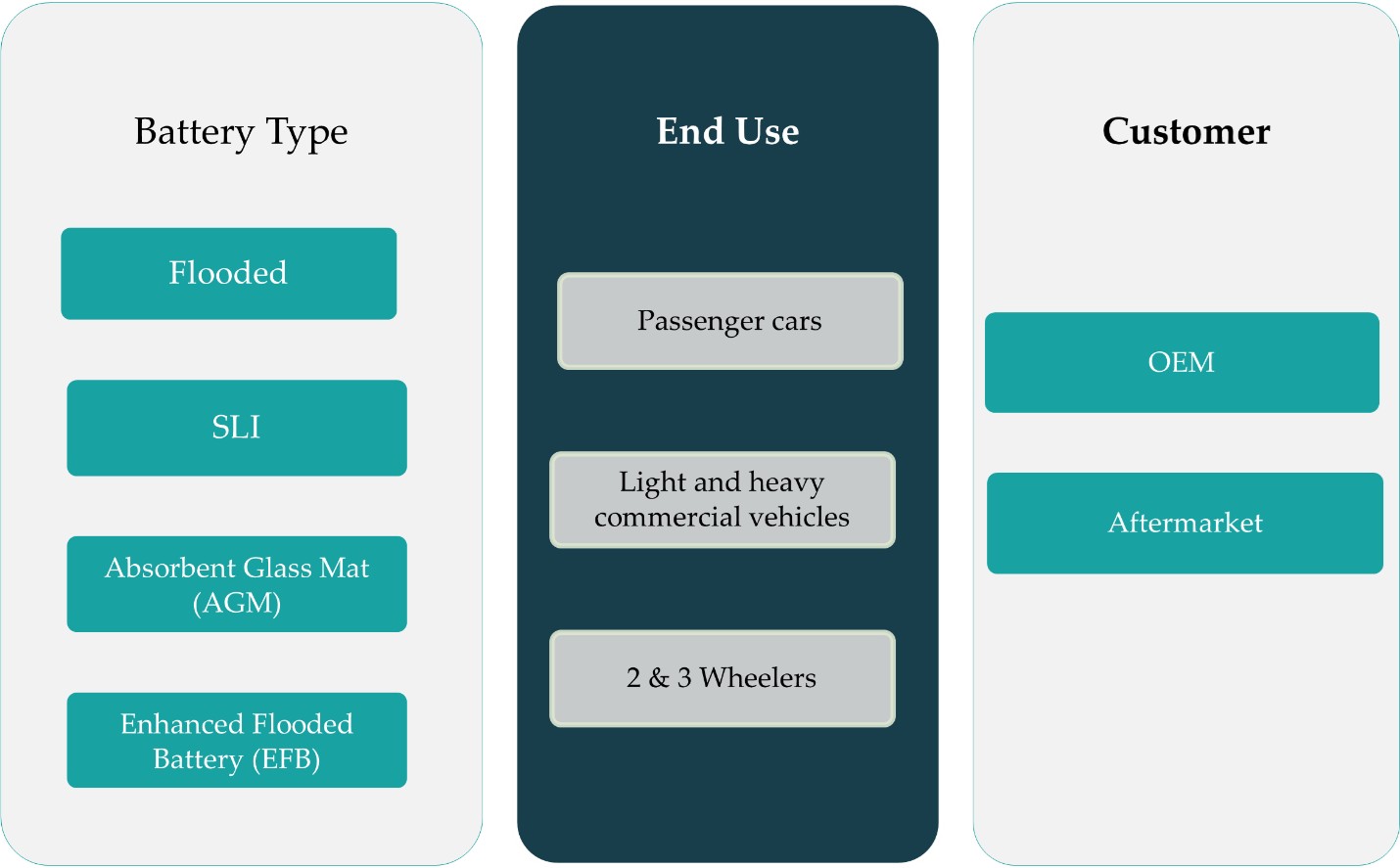

By Battery Type:

The Africa automotive lead acid battery market is segmented by battery type into Flooded, SLI (Starting, Lighting, and Ignition), Absorbent Glass Mat (AGM), and Enhanced Flooded Batteries (EFB). Flooded batteries currently dominate the market due to their low cost, wide availability, and suitability for the continent’s large base of conventional vehicles. SLI batteries continue to hold a significant share, particularly in standard passenger and commercial vehicles, as they provide dependable performance for ignition and electrical systems. However, the market is gradually witnessing a shift toward advanced battery technologies such as AGM and EFB, driven by the growing penetration of start-stop vehicle systems and increased demand for longer battery life in urban traffic conditions. AGM batteries are gaining traction in premium vehicle segments and commercial fleets that require deep cycling capabilities and enhanced vibration resistance. EFBs, known for their improved durability and charge acceptance, are also becoming more relevant as African markets begin to align with global fuel efficiency and emissions standards.

By End Use:

Based on end use, the market is categorized into passenger cars, light and heavy commercial vehicles, and 2 & 3 wheelers. Passenger cars represent the largest segment, fueled by rising personal vehicle ownership across urban centers and a growing middle-class population. As vehicle demand rises in cities like Lagos, Nairobi, and Johannesburg, so does the need for reliable battery solutions, especially in hot climates where battery degradation is accelerated. Light and heavy commercial vehicles also contribute significantly to battery demand, particularly in logistics, agriculture, and public transportation sectors. These vehicles require robust batteries with higher load capacity and durability, often opting for AGM or EFB technologies. Meanwhile, the two- and three-wheeler segment—prominent in both rural and high-density urban areas—relies heavily on low-cost flooded batteries due to price sensitivity and basic energy needs. Together, these end-use segments shape a dynamic market, offering diverse opportunities for manufacturers and suppliers to meet region-specific performance and affordability requirements.

Segments:

Based on Battery Type:

- Flooded

- SLI

- Absorbent Glass Mat

- Enhanced Flooded Battery

Based on End Use:

- Passenger cars

- Light and heavy commercial vehicles

- 2 & 3 Wheelers

Based on Customer:

Based on the Geography:

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Egypt

Egypt accounts for approximately 25% of the Africa automotive lead acid battery market, making it one of the region’s most significant contributors. The country’s strong automotive assembly sector, strategic location, and growing domestic demand for vehicles have all contributed to sustained market growth. Egypt is home to several battery manufacturers and suppliers, which enhances local availability and lowers dependency on imports. Government initiatives to modernize the transportation system and expand electric mobility, combined with a large base of aging vehicles requiring frequent battery replacements, are further fueling demand. Additionally, the warm climate leads to faster battery degradation, increasing aftermarket sales. Egypt’s push for industrial self-reliance and export-driven manufacturing also supports continued investment in lead acid battery production.

Nigeria

Nigeria holds a market share of approximately 22%, ranking second in the region. As Africa’s most populous country and a major hub for West Africa, Nigeria’s automotive battery market is driven by high vehicle density in urban areas like Lagos, Abuja, and Port Harcourt. The country’s reliance on affordable two-wheelers and used imported vehicles sustains strong demand for low-cost flooded lead acid batteries. Despite challenges such as unreliable power supply and import restrictions, the growing logistics and ride-hailing sectors are stimulating demand for higher-performance batteries. Additionally, government interest in local automotive production and proposed recycling regulations are gradually improving the business climate for battery suppliers. However, the widespread informal battery trade and presence of counterfeit products remain issues that legitimate players must navigate.

Algeria

Algeria represents about 18% of the Africa automotive lead acid battery market, supported by a relatively developed vehicle fleet and a strategic focus on industrial diversification. The government has prioritized local automotive manufacturing through joint ventures and import substitution policies, which has created opportunities for domestic battery production. The country’s climate and road conditions contribute to steady demand for durable and heat-resistant lead acid batteries. In addition to personal vehicles, Algeria has a strong market for commercial and fleet applications, further expanding the need for reliable energy storage. With ongoing efforts to upgrade infrastructure and increase vehicle electrification, Algeria is poised to grow its influence in the regional battery market.

Morocco

Morocco captures around 16% of the regional market, driven by its advanced automotive manufacturing ecosystem and robust export capacity. As a key supplier to both domestic and European markets, Morocco has established itself as a competitive hub for vehicle production and component supply, including lead acid batteries. The country benefits from a skilled labor force, modern industrial zones, and strong government support for renewable and automotive technologies. Morocco’s lead acid battery demand is split between domestic consumption and OEM supply chains, with a rising share of advanced AGM and EFB battery types. The presence of global automotive brands and consistent export activity ensures a stable and growing market for battery suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exide Technologies

- Business Strategy

- Financial Overview

- TBS (Tata Battery Service)

- Metropolitan Batteries

- Battery Centre

- Solite Batteries

- Nigerian Batteries Limited

- Sabat Batteries

- Eveready

Competitive Analysis

The African automotive lead-acid battery market is highly competitive, with both global and regional players vying for dominance. Leading companies like Exide Technologies, Solite Batteries, Eveready, Nigerian Batteries Limited, and Metropolitan Batteries are key contenders, each offering a range of products to meet the growing demand for energy storage solutions in the automotive sector. The market is expanding due to the rising automotive industry, especially in regions with high vehicle ownership such as South Africa, Nigeria, and Egypt. These countries are not only key consumers of automotive batteries but also important manufacturing hubs. Technological advancements in battery efficiency, longer life cycles, and the need for sustainable energy storage solutions are contributing to the market’s expansion. Additionally, the growing interest in renewable energy and transportation infrastructure further supports the demand for automotive batteries. However, the market also faces challenges such as economic fluctuations, regulatory hurdles, and regional disparities in development. Despite these challenges, the overall outlook for the market remains positive, with increasing opportunities for growth in both established and emerging markets across Africa.

Recent Developments

- In November 2024, EnerSys showcased the iQ Mini™ battery monitoring device and maintenance-free NexSys® Thin Plate Pure Lead (TPPL) batteries, which offer longer service life and faster recharge rates.

- In July 2024, Exide Industries Ltd. introduced an advanced Absorbent Glass Mat (AGM) battery for Starting, Lighting, and Ignition (SLI) applications in the automotive market. This new battery is designed to deliver enhanced performance, including improved starting power, and potentially longer lifespan compared to traditional lead-acid batteries.

- In August 2023, Clarios, a global leader in advanced low-voltage battery manufacturing and recycling, is acquiring Paragon GmbH & Co. KGaA’s power business, which specializes in batteries and battery management systems for the automotive industry. This acquisition enhances Clarios’ engineering capabilities and supports its low-voltage and lithium-ion projects, significantly expanding the team dedicated to developing new low-voltage architectures.

- In May 2023, C&D Technologies, Inc. introduced the Pure Lead Max (PLM) VRLA battery, designed for long lifespan and improved performance in UPS and data center applications.

- In April 2023, the acquisition of IBCS by EnerSys is a strategic move to expand its motive power services and strengthen its presence in the UK market. This addition will enhance EnerSys’s range of battery-related services, including installation, maintenance, repair, and replacement.

Market Concentration & Characteristics

The African automotive lead-acid battery market exhibits moderate to high concentration, with a mix of global and regional players dominating the industry. Key international companies such as Exide Technologies, Eveready, and Solite Batteries have established a strong presence in major markets, including South Africa, Nigeria, and Egypt. At the same time, local manufacturers like Nigerian Batteries Limited and Metropolitan Batteries also play a significant role, catering to regional demands with cost-effective and durable products. The market is characterized by fierce competition among these companies, which focus on product quality, affordability, and technological innovation to capture market share. As the automotive sector continues to grow, driven by increased vehicle ownership and infrastructure development, the demand for lead-acid batteries remains high. However, the market faces challenges such as economic fluctuations and regulatory barriers that may affect growth potential in certain regions, requiring companies to adapt to changing conditions.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, End Use, Customer and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The African automotive lead-acid battery market will continue to grow as vehicle ownership increases across the continent.

- Technological advancements in battery design will improve the efficiency and lifespan of automotive batteries.

- The shift toward renewable energy solutions will drive demand for energy storage, benefiting the automotive battery market.

- South Africa, Nigeria, and Egypt will remain key markets due to their strong automotive sectors.

- Regional manufacturers will expand their production capacities to meet the growing demand for cost-effective solutions.

- Regulatory changes and government policies will influence market dynamics, with increased emphasis on sustainability.

- Economic growth in emerging African markets will contribute to higher vehicle sales and greater battery consumption.

- Competition in the market will intensify, with both global and local companies focusing on product innovation and quality.

- Growing infrastructure development and increased investment in transportation will further boost battery demand.

- Challenges such as fluctuating raw material prices and regulatory complexities will need to be navigated for sustained growth.