| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Cheese Market Size 2024 |

USD 1,724.69 Million |

| Africa Cheese Market, CAGR |

1.51% |

| Africa Cheese Market Size 2032 |

USD 1,944.08 Million |

Market Overview

Africa Cheese Market size was valued at USD 1,724.69 million in 2024 and is anticipated to reach USD 1,944.08 million by 2032, at a CAGR of 1.51% during the forecast period (2024-2032).

The Africa cheese market is driven by rising urbanization, increasing disposable incomes, and growing consumer preference for Western diets. The expanding retail sector, including supermarkets and hypermarkets, has enhanced cheese accessibility, further fueling demand. Additionally, the increasing popularity of fast food and ready-to-eat meals has boosted cheese consumption, particularly among younger demographics. The market is also witnessing a shift towards premium and organic cheese variants, driven by health-conscious consumers seeking natural and preservative-free options. Technological advancements in dairy processing and improved cold chain logistics are further supporting market expansion. However, high production costs and the reliance on imports for specialty cheeses pose challenges. Market trends indicate a growing demand for locally produced cheese as governments promote domestic dairy industries to reduce import dependency. Moreover, innovative product offerings, including flavored and plant-based cheese alternatives, are gaining traction, catering to evolving consumer preferences and dietary restrictions.

The Africa cheese market exhibits diverse growth patterns across key regions, including Egypt, Nigeria, Algeria, Morocco, and other parts of the continent. Egypt and Algeria have well-established dairy industries, supporting both local cheese production and imports, while Nigeria and Morocco are witnessing rising cheese consumption due to urbanization and expanding retail networks. The demand for processed, cheddar, and specialty cheeses is increasing across these regions, driven by changing dietary habits and the growth of fast-food chains. Several global and regional players are actively shaping the market landscape, including Arla Foods, Savencia Fromage & Dairy, Clover Industries Limited, Danone, Hochland SE, Parmalat S.p.A., Al Ain Dairy, FrieslandCampina, and Ruwag Food Industries. These companies focus on expanding their product portfolios, enhancing distribution networks, and investing in innovative cheese varieties to meet evolving consumer preferences. As awareness of dairy nutrition grows, the market is expected to experience steady expansion, with increasing opportunities for both local and international brands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Africa cheese market was valued at USD 1,724.69 million in 2024 and is projected to reach USD 1,944.08 million by 2032, growing at a CAGR of 1.51% during the forecast period.

- Increasing urbanization and changing dietary habits are driving higher cheese consumption, particularly in processed and cheddar cheese segments.

- Rising demand for fast food and ready-to-eat meals is fueling market growth, with quick-service restaurants and bakeries being major consumers.

- Leading companies, including Arla Foods, Danone, FrieslandCampina, and Hochland SE, are expanding their product portfolios and distribution networks to strengthen market presence.

- High dependence on imports and limited local dairy production create supply chain challenges, impacting price stability and product availability.

- Egypt, Nigeria, Algeria, and Morocco are key markets, with strong demand for both locally produced and imported cheese varieties.

- Growing health awareness is driving demand for low-fat, organic, and plant-based cheese alternatives, creating opportunities for innovation.

Report Scope

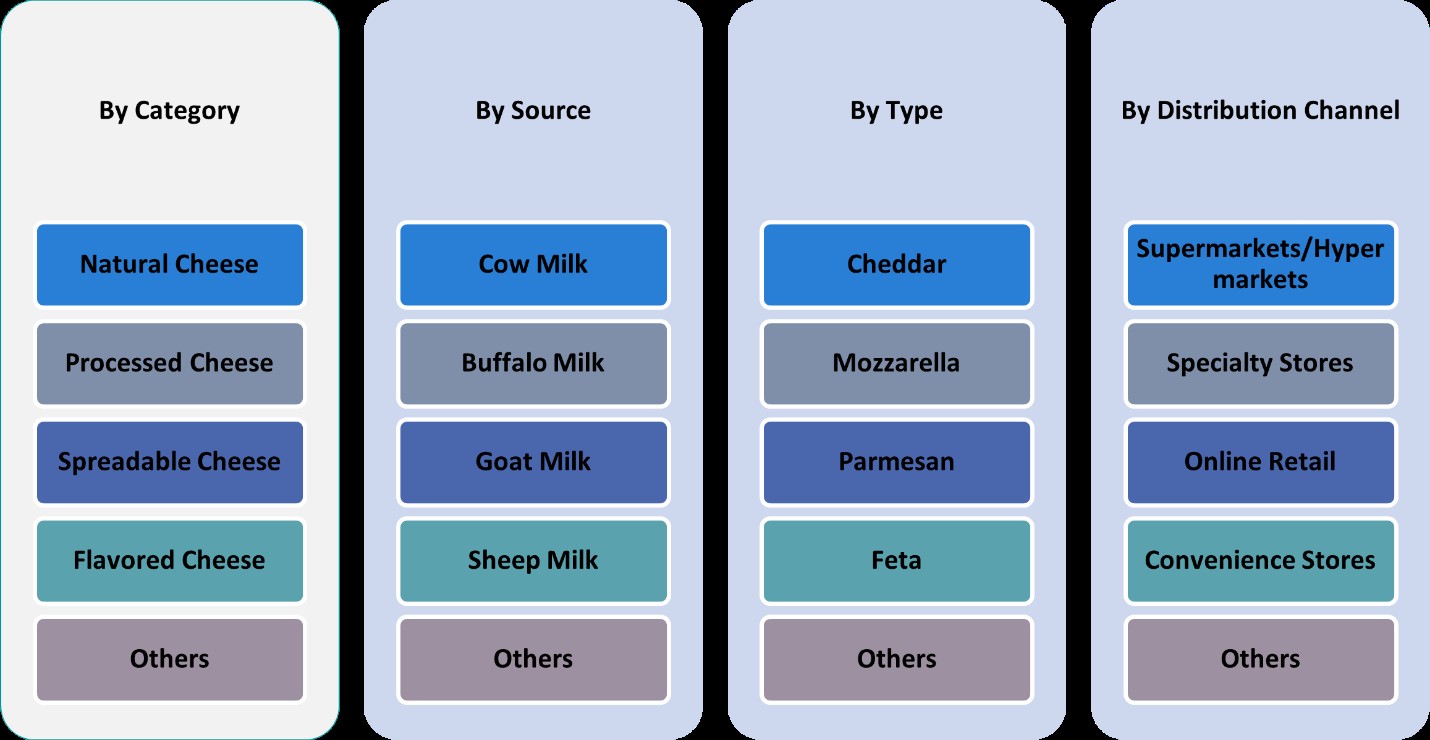

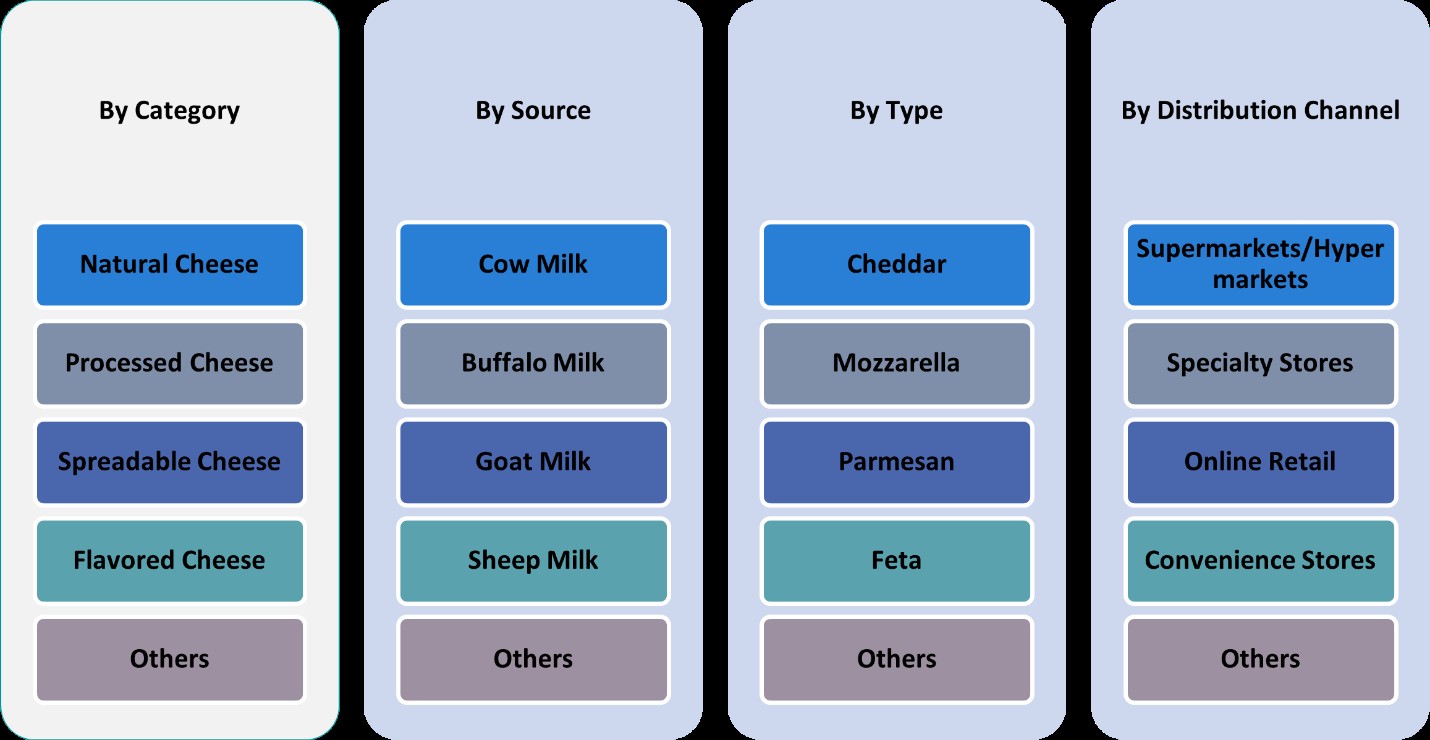

This report segments the Africa Cheese Market as follows:

Market Drivers

Growing Urbanization and Changing Consumer Preferences

The rapid urbanization across Africa is a key driver of the cheese market, as it influences dietary habits and increases demand for convenient food products. For instance, urban centers like Lagos and Nairobi have seen a rise in Western-style fast food outlets, which incorporate cheese into their menus, driving higher consumption of cheese-based products. Additionally, a rising middle class with increasing disposable incomes is willing to spend more on premium dairy products, including cheese. This shift in consumer preferences has led to greater demand for a variety of cheese types, from processed and spreadable cheeses to specialty and artisanal options.

Expansion of Retail and Foodservice Sectors

The growth of modern retail infrastructure, including supermarkets, hypermarkets, and online grocery platforms, has significantly improved cheese accessibility in Africa. Supermarkets now provide refrigerated sections dedicated to dairy products, making it easier for consumers to purchase cheese regularly. In addition, the expansion of quick-service restaurants, cafés, and fast-food chains has further fueled the demand for cheese, particularly for use in pizzas, burgers, sandwiches, and pasta dishes. The increasing presence of international food brands and restaurant franchises in African cities has also contributed to the market’s growth by introducing consumers to cheese-rich dishes and processed cheese products.

Government Initiatives and Local Dairy Industry Development

Several African governments are actively promoting domestic dairy production to reduce reliance on cheese imports and strengthen local economies. For instance, Eswatini has implemented policies to support small-scale dairy farmers and cooperatives, enabling them to scale operations and compete with imported cheese brands. Investments in dairy farming, improved livestock management, and financial incentives for dairy cooperatives have encouraged local cheese production. Governments are also implementing policies to support small and medium-sized dairy enterprises, enabling them to scale operations and compete with imported cheese brands. Additionally, partnerships with international dairy firms have facilitated knowledge transfer and technological advancements in cheese manufacturing, enhancing production efficiency and product quality. These initiatives are crucial in fostering a self-sustaining dairy industry and ensuring consistent cheese supply across the region.

Rising Demand for Specialty and Health-Oriented Cheese

As consumer awareness of nutrition and healthy eating habits increases, there is growing demand for specialty and organic cheeses. Health-conscious consumers are seeking natural, preservative-free, and low-fat cheese options, driving innovation in the market. The rising popularity of plant-based diets has also led to the introduction of dairy-free cheese alternatives, catering to lactose-intolerant and vegan consumers. Additionally, locally sourced and artisanal cheese varieties are gaining traction, as consumers seek unique flavors and support local dairy farmers. This trend is expected to drive diversification in the African cheese market, with manufacturers focusing on innovation to meet evolving consumer demands.

Market Trends

Increasing Demand for Processed and Convenience Cheese

The Africa cheese market is witnessing a surge in demand for processed cheese, driven by its affordability, extended shelf life, and versatility in various food applications. Consumers are increasingly opting for ready-to-eat and easy-to-use cheese products, such as slices, spreads, and shredded cheese, which align with fast-paced urban lifestyles. The expansion of quick-service restaurants (QSRs) and fast-food chains across Africa has further accelerated this trend, as these establishments heavily rely on processed cheese for burgers, pizzas, and sandwiches. Additionally, the rise of home cooking and online food recipe trends is encouraging consumers to experiment with cheese-based dishes, fueling market growth.

Growing Popularity of Premium and Specialty Cheese

A noticeable shift toward premium and specialty cheese varieties is emerging, particularly among middle- and high-income consumers. For instance, imported cheeses like gouda and brie are gaining popularity in urban centers such as Johannesburg and Nairobi, where supermarkets like Shoprite and Carrefour have expanded their premium cheese selections. Artisanal and locally crafted cheese varieties are also attracting attention, as they offer unique flavors and align with the growing preference for authentic, high-quality products. Additionally, cheese manufacturers are innovating with flavored and infused cheeses, incorporating ingredients such as herbs, spices, and truffles to cater to evolving consumer tastes.

Expansion of Dairy-Free and Plant-Based Cheese Alternatives

The rise of lactose intolerance awareness, veganism, and plant-based diets has spurred demand for dairy-free cheese alternatives in Africa. For instance, plant-based cheese brands like Violife and Daiya are introducing vegan cheese products made from nuts and soy, catering to health-conscious consumers. Consumers are increasingly exploring plant-based options made from nuts, soy, and other non-dairy sources, driven by health-conscious choices and dietary restrictions. Global food brands and local startups are introducing vegan cheese products to cater to this growing segment, leveraging advancements in food technology to improve taste, texture, and nutritional value. This trend is expected to create new opportunities for market expansion while diversifying product offerings to meet changing consumer preferences.

Strengthening Distribution Channels and E-Commerce Growth

Improved retail infrastructure and the rapid adoption of e-commerce are significantly impacting the African cheese market. Supermarkets, hypermarkets, and specialty dairy stores are enhancing their cheese assortments, ensuring better accessibility and visibility for various cheese brands. Meanwhile, the rise of online grocery shopping platforms is providing consumers with convenient access to a wide range of cheese products, particularly in urban areas. Digital marketing and direct-to-consumer (DTC) sales strategies are further driving consumer engagement, enabling cheese producers to reach a broader audience and promote new product launches effectively. This trend highlights the increasing role of technology in shaping the future of the Africa cheese market.

Market Challenges Analysis

High Dependence on Imports and Supply Chain Constraints

The Africa cheese market faces significant challenges due to its heavy reliance on imported cheese products. For instance, countries like Nigeria and Kenya import a substantial portion of their cheese due to insufficient local dairy production capacity, as highlighted by reports from the African Dairy Conference. This reliance makes cheese prices highly volatile, as they are influenced by fluctuating import duties, currency exchange rates, and global dairy market trends. Additionally, inadequate cold chain infrastructure and inefficient logistics create distribution challenges, particularly in remote and rural areas. Without proper refrigeration and transportation facilities, cheese products risk spoilage, leading to increased wastage and higher costs for businesses. These supply chain limitations hinder market expansion and accessibility, particularly for premium and specialty cheeses that require strict storage conditions.

High Production Costs and Limited Consumer Affordability

Local cheese production in Africa remains constrained by high production costs, including expenses related to dairy farming, feed, processing, and packaging. Many small-scale dairy farmers struggle with limited access to quality feed, veterinary services, and modern processing equipment, resulting in lower yields and inconsistent product quality. Additionally, electricity and water shortages further escalate operational costs, making locally produced cheese less competitive against cheaper imported alternatives. On the consumer side, affordability remains a significant challenge, as cheese is still considered a luxury product in many African households. Lower-income consumers prioritize staple foods over dairy products, limiting the market’s growth potential. Addressing these challenges requires government support, investment in local dairy farming, and technological advancements to improve cost efficiency and affordability.

Market Opportunities

The Africa cheese market presents significant growth opportunities driven by increasing local dairy production and government initiatives supporting the dairy industry. Many African countries are investing in dairy farming infrastructure, improving livestock management, and offering financial incentives to small-scale farmers. These efforts aim to enhance domestic cheese production, reducing reliance on imports and creating a self-sustaining dairy industry. Additionally, technological advancements in cheese processing and packaging are enabling local manufacturers to produce high-quality cheese at competitive prices. The rising trend of artisanal and locally sourced cheeses is also gaining traction, appealing to consumers who seek authentic, fresh, and unique flavors. By focusing on sustainable dairy farming and leveraging modern production techniques, local producers have the potential to expand their market share and cater to the growing demand for cheese across various income groups.

Furthermore, the expanding foodservice industry and increasing penetration of retail distribution channels provide a lucrative opportunity for cheese manufacturers. The rapid growth of fast-food chains, bakeries, and restaurants is driving higher demand for cheese-based products, particularly in urban areas. Additionally, the rise of e-commerce and online grocery platforms is making cheese more accessible to a broader consumer base. This digital transformation allows local and international cheese brands to engage directly with customers, offering a diverse range of cheese varieties through convenient purchasing options. The growing awareness of health benefits associated with dairy consumption is also encouraging the development of low-fat, organic, and plant-based cheese alternatives. As dietary preferences evolve, there is a strong potential for innovation in cheese formulations that cater to lactose-intolerant and health-conscious consumers. By capitalizing on these market trends, businesses can position themselves for long-term growth and profitability in the African cheese market.

Market Segmentation Analysis:

By Category:

The Africa cheese market is segmented into cheddar, processed cheese, spreadable cheese, flavored cheese, and others, each catering to distinct consumer preferences and applications. Cheddar cheese remains one of the most popular categories due to its versatility, long shelf life, and widespread use in home cooking and foodservice applications. It is commonly used in sandwiches, pasta, and as a topping in various dishes. Processed cheese is also witnessing strong demand, driven by its affordability, extended shelf stability, and convenience in fast-food and ready-to-eat meals. This segment is particularly favored by quick-service restaurants and bakeries for its consistent texture and easy melting properties. Spreadable cheese is gaining traction among urban consumers who prefer quick and easy breakfast options, making it a staple in households and cafes. Flavored cheeses, infused with herbs, spices, and specialty ingredients, are attracting consumers looking for premium and gourmet experiences. The “others” segment includes artisanal and specialty cheeses, offering unique textures and flavors, further enriching the market landscape.

By Source:

The market is also segmented based on the source of milk, including cow, buffalo, goat, sheep, and others, reflecting diverse consumer preferences and dietary requirements. Cow milk-based cheese dominates the market due to its widespread availability, high production efficiency, and familiarity among consumers. It is extensively used across all cheese categories, from cheddar to processed and spreadable cheeses. Buffalo milk cheese, known for its rich texture and higher fat content, is gaining popularity in premium and specialty cheese segments. Goat and sheep milk cheeses are witnessing increasing demand among health-conscious consumers due to their perceived digestive benefits and unique flavors. These cheese varieties appeal to lactose-sensitive individuals and those seeking gourmet alternatives. The “others” category includes plant-based cheese alternatives, which are slowly gaining traction as vegan and lactose-free diets become more prevalent. With the growing focus on dietary diversity and health-conscious consumption, alternative milk-based cheeses present a promising avenue for market expansion in Africa.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Egypt

Egypt holds the largest share of the Africa cheese market, accounting for approximately 32% of the total market revenue. The country’s strong cheese consumption culture, driven by traditional dairy-based diets, significantly contributes to this dominance. Local production of cheese, particularly varieties like feta and roumy, is well-established, with many small-scale and large-scale dairy processors catering to domestic demand. Additionally, the expanding retail and foodservice sectors have increased cheese accessibility, supporting market growth. The Egyptian government’s initiatives to enhance dairy farming and improve local cheese production further bolster market expansion. Moreover, the increasing penetration of international cheese brands and growing consumer preference for premium cheese varieties are contributing to the sector’s steady growth.

Nigeria

Nigeria represents around 24% of the Africa cheese market, driven by rapid urbanization and changing dietary preferences. The rise of fast-food chains and increased consumption of Western-style cuisine have significantly boosted the demand for processed and cheddar cheese in the country. Nigeria’s large and youthful population, coupled with an expanding middle class, is further driving cheese consumption. However, the country relies heavily on cheese imports due to limited local dairy production, which results in high prices and supply chain challenges. Investments in domestic dairy farming and government policies promoting local cheese manufacturing are expected to improve market conditions. Additionally, the growing adoption of e-commerce and supermarket chains in urban centers is enhancing cheese availability and accessibility.

Algeria

Algeria holds a market share of approximately 18%, with strong demand for both locally produced and imported cheese. The country’s preference for dairy products, particularly in traditional dishes, supports consistent cheese consumption. Algerian consumers favor soft cheeses and processed cheese variants, which are widely used in sandwiches and fast food. The government’s efforts to develop the local dairy sector, including subsidies for dairy farmers and modernization of processing facilities, are driving market expansion. However, high import dependency for specialty cheeses and limited cold chain infrastructure remain key challenges. The increasing presence of international dairy brands and rising health-conscious consumer trends are encouraging demand for organic and low-fat cheese options.

Morocco

Morocco accounts for about 15% of the Africa cheese market, with rising consumer interest in cheese due to expanding retail networks and foodservice outlets. The country’s tourism sector also plays a significant role in driving demand for premium and specialty cheeses, particularly in hotels and restaurants. Moroccan consumers are gradually incorporating cheese into their daily diets, leading to increased sales of processed and spreadable cheese varieties. Government initiatives to strengthen the dairy industry and improve milk production are expected to support further market growth. Additionally, Morocco’s trade agreements with European dairy producers facilitate the import of high-quality cheese, catering to evolving consumer tastes. The rest of Africa collectively holds the remaining 11% of the market, with potential growth opportunities in emerging economies where dairy consumption is gradually increasing.

Key Player Analysis

- Arla Foods

- Savencia Fromage & Dairy

- Clover Industries Limited

- Danone

- Hochland SE

- Parmalat S.p.A.

- Al Ain Dairy

- FrieslandCampina

- Ruwag Food Industries

Competitive Analysis

The Africa cheese market is highly competitive, with key players focusing on product innovation, strategic partnerships, and expansion of distribution channels to strengthen their market presence. Leading companies such as Arla Foods, Savencia Fromage & Dairy, Clover Industries Limited, Danone, Hochland SE, Parmalat S.p.A., Al Ain Dairy, FrieslandCampina, and Ruwag Food Industries play a significant role in shaping industry dynamics. These players leverage their strong brand recognition, extensive product portfolios, and advanced processing technologies to cater to the region’s growing demand for cheese. The growing demand for premium and health-conscious cheese options, such as organic and low-fat varieties, has led to increased investments in research and development. Additionally, businesses are leveraging advanced dairy processing technologies to enhance product quality and extend shelf life, ensuring wider distribution across urban and rural areas. Strategic partnerships and acquisitions play a crucial role in market expansion, allowing companies to strengthen their supply chains and improve production capabilities. The rise of e-commerce and modern retail formats has also contributed to greater accessibility, enabling cheese brands to reach a broader consumer base. As competition intensifies, companies are focusing on cost-effective production methods and sustainable dairy farming practices to gain a competitive edge in the growing African cheese market.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The Africa cheese market exhibits a moderate to high level of concentration, with a mix of multinational corporations and regional producers competing for market share. Large dairy companies dominate the industry, leveraging strong distribution networks, advanced processing technologies, and extensive product portfolios to cater to diverse consumer preferences. However, local and small-scale producers play a crucial role in meeting the demand for traditional and affordable cheese varieties. The market is characterized by rising demand for processed and cheddar cheese, driven by urbanization, changing dietary habits, and the expansion of quick-service restaurants and retail chains. Additionally, there is a growing preference for organic, low-fat, and specialty cheeses, reflecting increasing health consciousness among consumers. Supply chain challenges, including dependence on imports and fluctuating raw material costs, impact market dynamics. Despite these constraints, continued investments in dairy farming, technological advancements, and expanding retail infrastructure are expected to drive sustained market growth in Africa.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Africa cheese market is expected to witness steady growth, driven by increasing urbanization and changing dietary preferences.

- Rising demand for processed and cheddar cheese will continue to shape market expansion across key regions.

- Investments in local dairy farming and cheese production are likely to reduce dependency on imports and improve supply chain efficiency.

- Growing health consciousness will boost demand for organic, low-fat, and plant-based cheese alternatives.

- Expanding retail infrastructure, including supermarkets and e-commerce platforms, will enhance cheese accessibility for consumers.

- Technological advancements in dairy processing will improve product quality, shelf life, and production efficiency.

- Increasing partnerships and acquisitions among industry players will strengthen market presence and drive innovation.

- Government initiatives supporting dairy industry growth will create opportunities for local cheese manufacturers.

- Fast food and foodservice sector expansion will continue to fuel cheese consumption across urban markets.

- Rising disposable incomes and evolving consumer tastes will drive premium and specialty cheese demand in the coming years.