Market Overview:

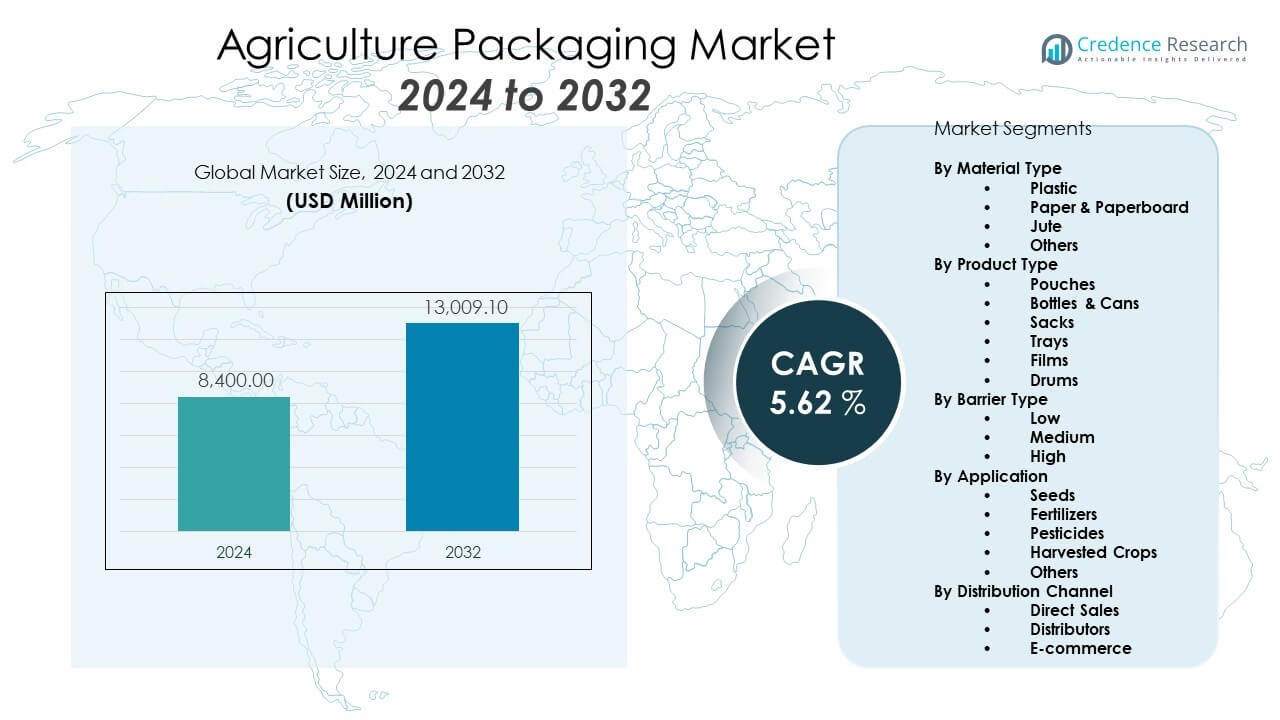

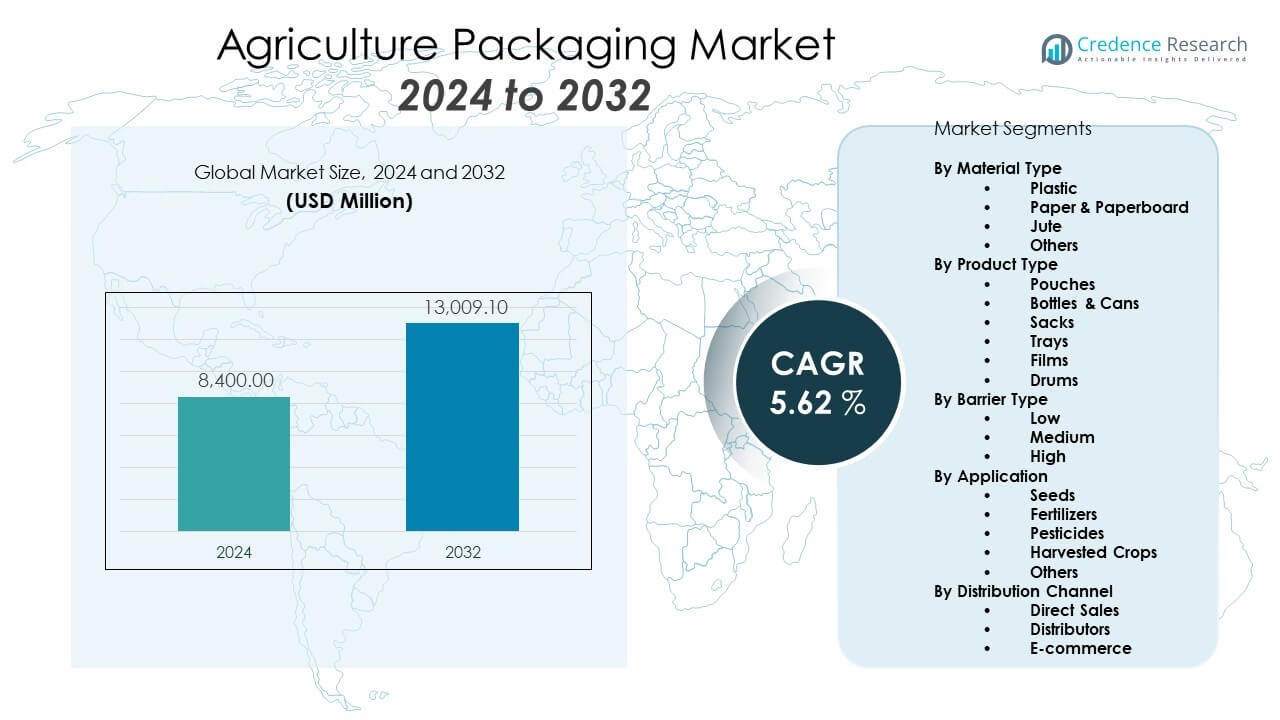

The Agriculture Packaging Market is projected to grow from USD 8,400 million in 2024 to an estimated USD 13,009.1 million by 2032, with a compound annual growth rate (CAGR) of 5.62% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agriculture Packaging Market Size 2024 |

USD 8,400 Million |

| Agriculture Packaging Market, CAGR |

5.62% |

| Agriculture Packaging Market Size 2032 |

USD 13,009.1 Million |

Growth in the Agriculture Packaging Market is primarily driven by rising demand for efficient packaging solutions in the agricultural sector. Increased focus on improving product shelf life, ease of transportation, and protection against environmental factors supports market expansion. Shifting consumer expectations, particularly around sustainable and recyclable packaging materials, continues to push manufacturers toward eco-friendly solutions that align with global regulatory compliance and sustainability goals.

North America and Asia-Pacific are the leading regions in this market. North America benefits from advanced agricultural practices and high consumption of packaged agrochemicals and fertilizers. Asia-Pacific, led by China and India, is growing rapidly due to large-scale farming, rising exports, and supportive government initiatives. Europe maintains steady demand backed by strong environmental policies, while Latin America and the Middle East & Africa emerge with increasing investments in modern agriculture.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights:

- The market is expected to grow from USD 8,400 million in 2024 to USD 13,009.1 million by 2032, at a CAGR of 5.62%.

- Demand is rising for efficient, protective packaging that extends shelf life and enhances transportation safety in agriculture.

- Sustainability is a core growth driver, with rising adoption of biodegradable films, recyclable containers, and paper-based formats.

- Growth in agrochemical applications is boosting demand for leak-proof, chemical-resistant, and regulation-compliant packaging.

- Technological advancements such as smart labels, anti-counterfeit features, and barrier technologies are reshaping packaging formats.

- Export-driven agriculture is pushing demand for climate-resistant, traceable, and multi-language packaging for global compliance.

- North America leads due to advanced agricultural practices, while Asia-Pacific is the fastest-growing region with strong support from China and India.

Market Drivers:

Rising Demand for Sustainability:

Sustainability has emerged as a key driver in the Agriculture Packaging Market. Growing awareness about environmental degradation has led stakeholders to seek eco-friendly materials. Biodegradable films, recyclable containers, and paper-based packaging are gaining preference. Governments are enforcing strict regulations around plastic use, prompting innovation in greener alternatives. Consumers also prioritize sustainable packaging that aligns with global climate goals. Major companies are investing in research and development to produce recyclable and compostable packaging options. This trend continues to evolve as new technologies reduce the cost and improve the availability of green packaging. Brands that fail to adapt may risk losing market share to more sustainable competitors.

- For instance, Mondi launched FlexiBag Reinforced, a recyclable mono-PE packaging line that improves puncture resistance, sealability, and barrier protection. The materials are certified as recyclable (by cyclos-HTP) and can include post-consumer recycled content, supporting regulatory compliance while reducing waste from conventional multi-material laminates.

Growth in Agrochemical Applications:

Increased usage of fertilizers and pesticides is accelerating demand for specialized packaging. These products require durable, chemical-resistant, and leak-proof packaging to ensure safety and compliance. Flexible pouches, intermediate bulk containers, and drums are widely adopted. Packaging serves not just containment but also critical functions like dosage control and safe handling. The Agriculture Packaging Market responds to these needs with advanced barrier films and multi-layer containers. Manufacturers are offering tamper-evident and anti-leak solutions that support regulatory compliance. Agrochemical brands increasingly rely on packaging as a tool for branding and information delivery. This segment continues to drive steady revenue growth across global markets.

- For instance, Greif introduced GCUBE Shield technology for intermediate bulk containers (IBCs). This solution features an intermediate polymer blend layer within HDPE construction, which reduces the permeation of gases and enhances shelf life, product stability, and chemical compatibility for agrochemicals. Recyclability is retained, and internal studies show improved performance over traditional barriers, with additional benefits in CO2 emissions reduction.

Technological Advancements in Packaging:

Innovation in materials and design plays a central role in enhancing agriculture packaging efficiency. Smart packaging equipped with QR codes, RFID tags, and sensors improves traceability and supply chain transparency. Barrier technology and anti-counterfeit features further strengthen product integrity. Lightweight and high-strength composites reduce transportation costs. The Agriculture Packaging Market leverages these advancements to offer value-added features for agricultural producers. Packaging innovations support both bulk shipments and small-scale distribution models. Automation in filling, sealing, and labeling further streamlines operations. Technology remains a critical enabler of market competitiveness and profitability.

Export-Oriented Agricultural Production:

The global increase in agricultural exports has led to heightened packaging demand. International trade requires compliance with stringent packaging standards to protect product quality and avoid contamination. Durable and climate-resistant solutions ensure long-distance product integrity. The Agriculture Packaging Market benefits from this trend by offering specialized export-ready packaging solutions. Producers are adopting standardized, labeled, and traceable formats to meet customs and trade norms. Packaging plays a vital role in minimizing spoilage, extending shelf life, and ensuring product authenticity. Growth in cross-border trade channels accelerates the demand for multi-language and regulatory-compliant packaging. Packaging becomes both a functional and strategic asset in export-driven agriculture.

Market Trends:

Adoption of Smart Packaging:

Smart packaging is gaining momentum across agricultural supply chains. QR codes, RFID, and NFC technology allow farmers and distributors to track product movement and ensure traceability. Brands are using interactive packaging for digital engagement and product authentication. Data-rich labels help in managing inventory and provide tamper evidence. The Agriculture Packaging Market integrates smart features to meet evolving consumer and regulatory expectations. These technologies enable better quality control and compliance tracking. Adoption is growing in developed markets and gradually expanding in emerging economies. Smart packaging enhances transparency from farm to fork. It also supports sustainability by minimizing waste through improved logistics. This trend continues to reshape packaging strategies globally.

- For instance, BASF implemented Supply Chain Track and Trace (SCTT) technology for crop protection products. Each package receives a unique data matrix code, which, when scanned throughout the supply chain, enables complete traceability, combats counterfeiting, and allows customers to verify authenticity with a mobile app. This solution boosts regulatory compliance and safety standards across their European operations.

Shift Toward Lightweight Materials:

The Agriculture Packaging Market sees a clear shift toward lightweight packaging materials to reduce shipping costs and environmental impact. Plastic films, thin-walled containers, and flexible pouches are preferred over heavier rigid formats. Manufacturers are reducing material thickness while maintaining durability. This approach optimizes supply chain efficiency and minimizes carbon footprint. New composite materials help balance strength and weight. Lightweight packaging also supports automation and high-speed filling lines. Retailers demand more compact formats for better shelf utilization. This trend is driving innovation in structural design and material science.

- For instance, Amcor released AmLite Ultra Recyclable, a high-barrier OPP-based flexible film. This material eliminates the PET or aluminum layers common in former laminates, enabling recyclability in existing polyolefin streams and reducing the carbon footprint of packages by 64% according to independent certification by the cyclos-HTP Institute. AmLite delivers strong barrier performance, supporting applications in seeds and agricultural products.

Growth of E-commerce in Agri-inputs:

The digitalization of agriculture input sales has triggered packaging changes. Online platforms are now major distribution channels for seeds, fertilizers, and agrochemicals. This requires packaging optimized for parcel shipping and consumer convenience. The Agriculture Packaging Market adapts by offering tamper-evident, resealable, and compact units. E-commerce-friendly packaging ensures damage resistance and brand visibility. Customer experience is improved through ergonomic design and clear labeling. Firms also adopt packaging that integrates with digital logistics systems. E-commerce growth continues to shape packaging form factors and innovation.

Integration of Circular Economy Principles:

Sustainability goals are driving circular economy practices in packaging. Recyclable, compostable, and reusable packaging solutions are gaining traction. Brands are exploring mono-material formats for easier recycling. The Agriculture Packaging Market incorporates life cycle thinking into design processes. Partnerships are forming across supply chains to improve post-use collection and recycling. Packaging companies invest in closed-loop systems and refillable models. Certification and labeling support consumer education and participation. Circularity becomes a core criterion in packaging procurement and innovation.

Market Challenges Analysis:

Complex Regulatory Compliance and Standards:

Navigating different regional regulations for agricultural packaging presents a major challenge. Varying rules for chemical resistance, labeling, environmental impact, and product safety often increase production complexity and cost. The Agriculture Packaging Market must align packaging formats with both international export requirements and domestic farming laws. Smaller manufacturers often face difficulties staying compliant, especially with rapid regulatory updates. Keeping up with pesticide residue guidelines and sustainable material certifications further complicates operations. Companies invest in legal expertise and auditing to ensure global compliance. This complexity can delay product launches and affect profitability.

High Cost of Sustainable Materials and Innovation:

Transitioning to eco-friendly packaging materials adds significant costs. Biodegradable, recyclable, or compostable packaging often carries a price premium over conventional plastics. This limits adoption, especially among small-to-mid-sized producers. The Agriculture Packaging Market must balance innovation with cost competitiveness. Advanced barrier films and smart packaging technologies increase capital and R&D expenditure. Return on investment may take time to realize, particularly in developing markets. Limited recycling infrastructure in many regions further restricts the scalability of sustainable packaging solutions. Without subsidies or regulatory incentives, sustainable innovation adoption remains challenging for many players.

Market Opportunities:

Expansion of Precision Agriculture Packaging:

Precision agriculture techniques require packaging tailored for smaller, customized, and controlled applications. Demand rises for pre-measured sachets, single-use containers, and dosing-friendly formats. The Agriculture Packaging Market addresses these needs by developing innovative packaging solutions that reduce waste and improve efficiency. Digital farming and GPS-guided input distribution benefit from compact and traceable packaging formats. Manufacturers that cater to precision farming demands can gain competitive advantage in developed markets. This opportunity extends across fertilizers, seeds, micronutrients, and crop protection products. Innovation in material formulation and filling automation further enhances this opportunity.

Increased Demand for Biodegradable Formats:

Growing environmental awareness among consumers and regulatory bodies encourages adoption of biodegradable packaging. Opportunities emerge for suppliers offering plant-based polymers, compostable films, and fiber-based containers. The Agriculture Packaging Market is rapidly moving toward these alternatives to meet global sustainability targets. Companies that provide cost-effective, scalable biodegradable options stand to gain substantial market share. Collaboration with recycling providers and government-backed sustainability initiatives also fuels this growth. Emerging markets offer untapped potential for eco-conscious packaging formats, especially in organic farming segments.

Market Segmentation Analysis:

By Material Type

The Agriculture Packaging Market segments by material type into plastic, paper & paperboard, jute, and others. Plastic remains dominant due to durability and moisture resistance. Paper-based options are gaining traction for their biodegradability. Jute and other bio-based materials are expanding across niche applications.

- For instance, Water-based barrier coatings offer moisture, grease, and vapor resistance for paper packaging, overcoming recyclability challenges associated with plastic (PE) or PFAS coatings. These coatings, often using bio-sourced materials, allow paper packaging to retain its repulpability and can significantly improve recyclability compared to conventional coatings.

By Product Type

Segmentation by product type includes pouches, bottles & cans, sacks, trays, films, and drums. Sacks and pouches dominate in seeds and fertilizers. Bottles and cans are prevalent for liquid pesticides. Trays and films serve fresh produce, while drums handle bulk exports.

- For instance, Berry Global offers tamper-evident pouring closures that are one-piece, mono-material HDPE designs. These closures are fully compliant with EU single-use plastic regulations and feature an integrated tamper-evident tab, aiding in recyclability. The design is widely available across product segments, reflecting industry-leading standards for both safety and environmental compliance.

By Barrier Type

Packaging solutions are further segmented into low, medium, and high-barrier packaging. High-barrier materials are widely used for agrochemicals to ensure shelf-life and safety. Low-barrier formats find use in domestic and low-risk applications.

By Application

Applications include seeds, fertilizers, pesticides, harvested crops, and others. Each application has unique packaging needs based on chemical compatibility, dosage, and transit durability. Fertilizers and pesticides account for the bulk of demand.

By Distribution Channel

Distribution is segmented into direct sales, distributors, and e-commerce. Traditional retail and dealership models remain prevalent, while e-commerce sees rapid growth, especially in urban and tech-savvy regions. Digital channels demand tamper-resistant and parcel-optimized packaging.

Segmentation:

By Material Type

- Plastic

- Paper & Paperboard

- Jute

- Others

By Product Type

- Pouches

- Bottles & Cans

- Sacks

- Trays

- Films

- Drums

By Barrier Type

By Application

- Seeds

- Fertilizers

- Pesticides

- Harvested Crops

- Others

By Distribution Channel

- Direct Sales

- Distributors

- E-commerce

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Agricultural Chemical Packaging Market, accounting for approximately 34% of the global market. Growth is driven by advanced farming technologies, high agrochemical usage, and stringent regulatory standards. The United States leads due to innovation in packaging formats and widespread adoption of precision agriculture. Canada contributes steadily with rising demand for bulk and sustainable packaging. Mexico supports growth through export-oriented farming and robust distribution infrastructure.

Asia-Pacific

Asia-Pacific accounts for around 29% of the market and is the fastest-growing region, fueled by expanding agricultural output and government initiatives in China, India, and Southeast Asia. China leads with extensive use of fertilizers and large-scale farming reforms. India is adopting smart and sustainable packaging, while countries like Vietnam, Indonesia, and Thailand show strong demand due to export-driven agriculture and digital agri-input distribution. Local production and material diversification are accelerating regional growth.

Europe

Europe holds about 18% of the market, characterized by strict environmental legislation and a push toward circular economy packaging. Countries like Germany, France, and the Netherlands drive demand for recyclable and compostable solutions. The region emphasizes eco-conscious materials and standardized labelling for traceability across the agricultural supply chain.

Latin America

Latin America represents roughly 11% of the market, led by Brazil and Argentina with their extensive farming activities and growing consumption of agrochemicals. The region is focusing on improving packaging logistics for large-scale crop protection and fertilizer distribution. Export-oriented agriculture is supporting the adoption of durable and efficient packaging.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of the global market. Growth is supported by infrastructure development, greenhouse farming, and increasing trade of agricultural products. Countries across the region are adopting modern packaging solutions to align with international standards and export requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Mondi Group

- Sonoco Products Company

- Greif Inc.

- Berry Global Inc.

- ProAmpac LLC

- Scholle IPN

- NNZ Group

- LC Packaging

- International Paper Company

Competitive Analysis:

The Agriculture Packaging Market features a moderately consolidated structure with key players commanding notable market shares. Major companies focus on sustainability, lightweight materials, and smart packaging innovations. Strategic partnerships, regional expansions, and acquisitions are common tactics. Competition is driven by product differentiation, cost efficiency, and regulatory compliance. Local players often compete on pricing and customized solutions for niche applications. Global brands invest in R&D to enhance barrier properties and reduce environmental impact. Pricing pressures persist, particularly in emerging markets. Competitive intensity is expected to increase with rising demand for eco-friendly and high-performance packaging solutions.

Market Concentration & Characteristics:

The Agriculture Packaging Market demonstrates a moderately consolidated structure with a mix of global conglomerates and regional players. It features strong innovation activity, particularly in sustainable materials, smart packaging technologies, and high-barrier films. Entry barriers stem from regulatory compliance, material sourcing, and advanced equipment requirements. Global players maintain competitive advantages through patents, economies of scale, and established supply networks. Private label brands are gaining traction, especially in low-cost segments. Competitive dynamics are shaped by environmental regulations, supply chain innovation, and shifting consumer expectations. Product differentiation, packaging versatility, and brand reputation are crucial to maintain market leadership.

Recent Developments:

- In July 2025, Greif Inc. entered into an acquisition agreement with Packaging Corporation of America (PCA), selling its U.S. containerboard business—which includes two mills and eight sheet feeder plants—for $1.8billion. The transaction, expected to close in Q3 2025, is intended to allow Greif to sharpen its core packaging portfolio and advance strategic growth priorities in the packaging sec

- In July 2024, Mondi Group launched FlexiBag Reinforced, an advanced mono-PE-based recyclable packaging solution designed for cost-efficiency and improved mechanical properties. FlexiBag Reinforced offers superior puncture resistance, enhanced sealability, and customizable barrier protection, making it suitable for agricultural applications such as seed and fertilizer packaging. The solution also supports incorporation of post-consumer recycled material to reduce virgin plastic use.

- In June 2025, Amcor plc unveiled a novel sustainable packaging solution for Butterball’s turkey breast range. The new Perflex® shrink bag features an integrated handle, eliminating excess packaging material and removing the need for manual netting. This design not only simplifies the packaging process but also delivers a 22% reduction in carbon footprint, a 23% reduction in non-renewable energy demand, and a 22% reduction in water usage compared to previous options.

- In April 2025, Sonoco Products Company highlighted its push for sustainable packaging by showcasing GREENCAN and EnviroCan rigid paper packaging at Vitafoods Europe. These solutions, made from up to 98% paperboard, provide robust barrier properties, moisture protection, and are fully recyclable via household paper recycling streams. The initiative supports the growing demand for eco-friendly agriculture and food packaging.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Product Type, Barrier Type, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Smart packaging adoption will increase for real-time tracking and improved product traceability across agri-input logistics.

- Sustainable material usage will expand, driven by stringent regulations and rising consumer awareness across global markets.

- Lightweight and flexible packaging formats will gain traction due to reduced transport costs and better handling.

- Digital agriculture trends will demand specialized packaging for precision dispensing and traceable applications.

- Biodegradable formats will witness strong adoption across developed and emerging economies, especially for fertilizers and seeds.

- Customization in packaging design will rise to meet diverse needs of organic, export-focused, and smallholder farming segments.

- E-commerce in agri-inputs will drive demand for compact, parcel-ready packaging with tamper-evident features.

- Regional players will form joint ventures with material innovators to scale eco-friendly packaging solutions.

- Brand differentiation will become crucial, with packaging used for farmer education, QR labeling, and visual appeal.

- Advanced filling, sealing, and automation technologies will shape operational efficiencies across packaging lines.