Market Overview

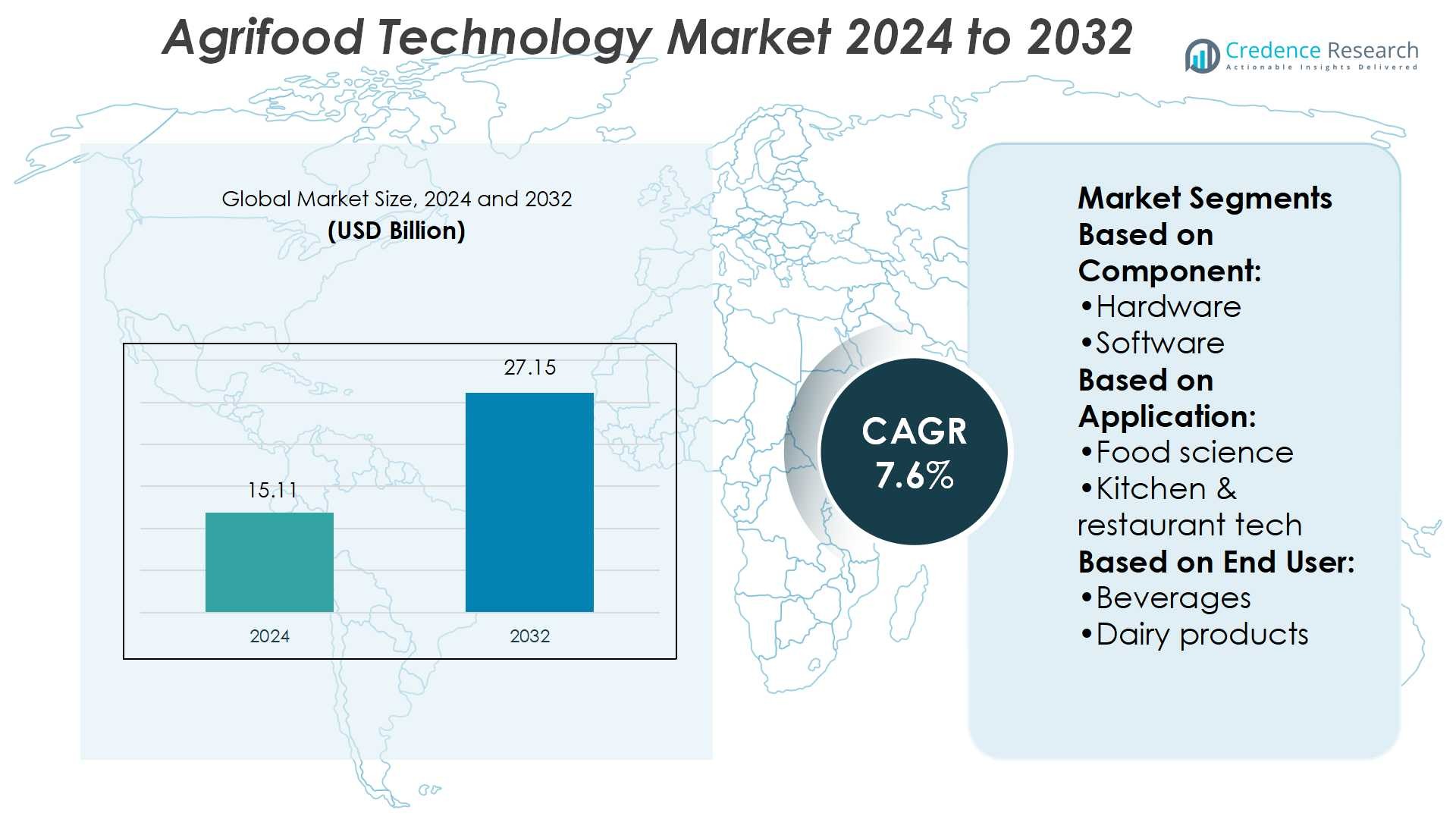

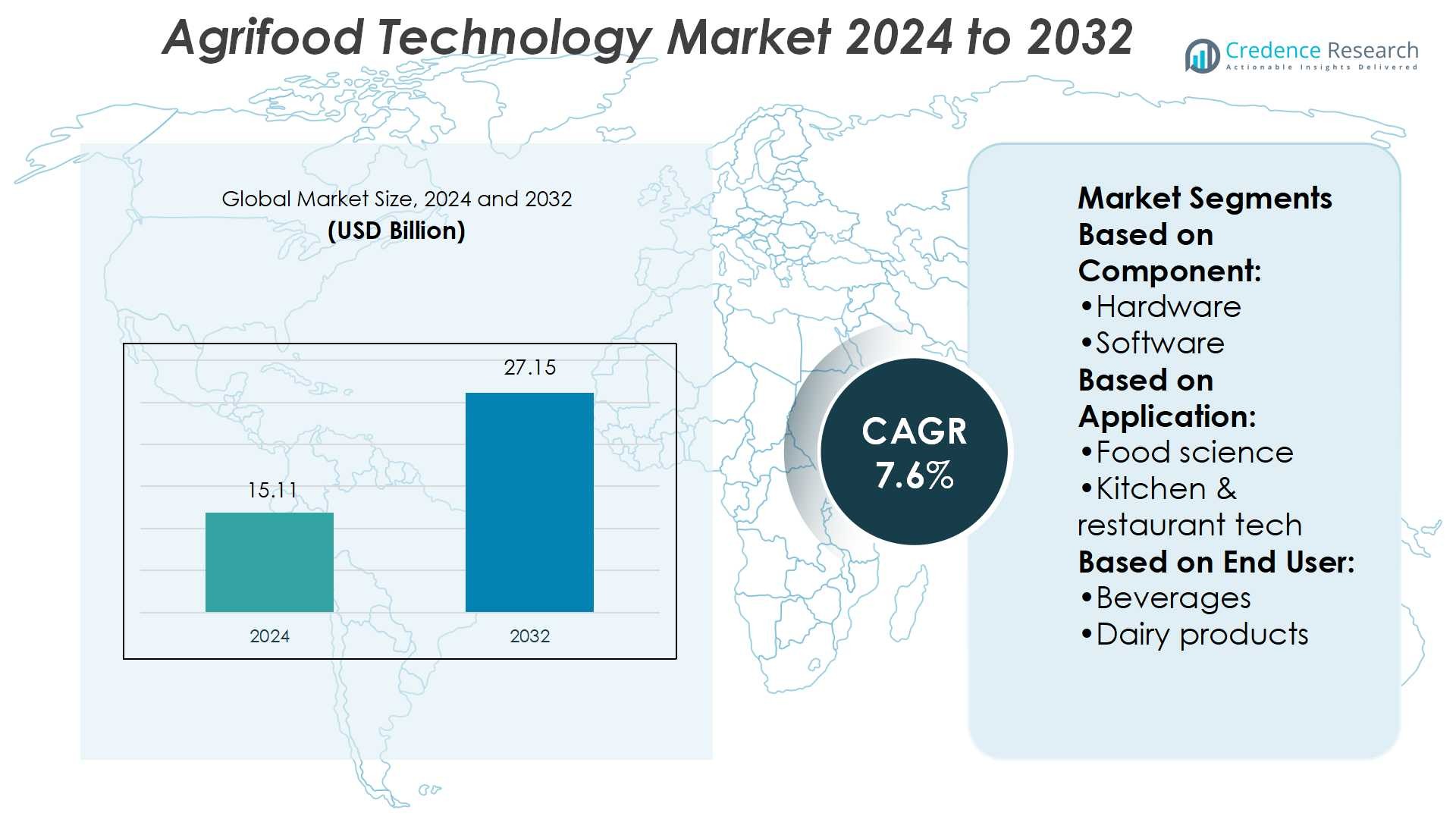

Agrifood Technology Market size was valued USD 15.11 billion in 2024 and is anticipated to reach USD 27.15 billion by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agrifood Technology Market Size 2024 |

USD 15.11 Billion |

| Agrifood Technology Market, CAGR |

7.6% |

| Agrifood Technology Market Size 2032 |

USD 27.15 Billion |

The agrifood technology market is driven by leading players such as TRAX IMAGE RECOGNITION, CUBIQ FOODS, Delivery Hero SE, Carlisle Technology, Miso Robotics, HelloFresh SE, Swiggy, LUNCHBOX, Nymble (Epifeast Inc.), and Flytrex Inc., each advancing innovation across the food value chain. These companies focus on automation, AI-driven analytics, sustainable food solutions, and advanced logistics to address growing consumer demand for efficiency, safety, and convenience. Among regions, Asia-Pacific leads the global market with a 34% share, supported by large-scale food production, rapid adoption of smart farming, and expanding e-commerce-driven delivery systems. This dominance reflects both scale and technological integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The agrifood technology market was valued at USD 15.11 billion in 2024 and is projected to reach USD 27.15 billion by 2032, registering a CAGR of 7.6%.

- Key drivers include automation, AI-based analytics, and sustainable food technologies that improve efficiency, safety, and transparency across the food value chain.

- Major trends highlight growing demand for alternative proteins, blockchain-enabled traceability, and robotics in processing, packaging, and restaurant operations.

- Competitive activity is strong, with companies such as TRAX IMAGE RECOGNITION, CUBIQ FOODS, Delivery Hero SE, and others focusing on innovation, while high implementation costs remain a major restraint.

- Asia-Pacific leads the market with a 34% share, supported by rapid adoption of smart farming and e-commerce-driven delivery, while hardware dominates the component segment with a significant share, driven by robotics, IoT systems, and advanced monitoring solutions.

Market Segmentation Analysis:

By Component

In the agrifood technology market, hardware holds the dominant share, accounting for 45% of the segment. Advanced sensors, robotics, and IoT-enabled machinery drive efficiency in food production, storage, and quality monitoring. Hardware adoption is accelerating due to automation demand, precision farming, and real-time food safety compliance. Software follows closely, supporting data analytics, AI-based food modeling, and predictive supply management. Service-based offerings, such as consulting and system integration, remain smaller but continue growing as enterprises seek tailored solutions to optimize digital transformation across food ecosystems.

- For instance, Beyond Meat’s Beyond IV product line (its fourth-generation formula) replaced coconut oil and canola oil with avocado oil, cutting saturated fat content in the product to just 2 grams per link in its Beyond IV Sausage variant.

By Application

Food science leads the application segment with a 38% market share, supported by investments in biotechnology, food safety testing, and nutritional innovation. The demand for healthier formulations, alternative proteins, and sustainable food research drives this growth. Kitchen and restaurant technologies follow, leveraging AI-powered ordering systems, automated cooking equipment, and contactless payment solutions. Delivery and supply chain applications also expand steadily, driven by e-commerce adoption, last-mile logistics optimization, and traceability standards. Other applications, including waste reduction and energy-efficient food systems, gain momentum with rising sustainability mandates and consumer awareness.

- For instance, Tyson’s R&D “Tyson Discovery Center” has a 39,000-square-foot pilot plant in Springdale with 19 test kitchens, a sensory lab, and packaging innovation lab, used to prototype new formats in weeks rather than months.

By End User

Beverages represent the dominant end-user category with 30% of market share, fueled by automation in bottling, real-time quality checks, and growing demand for functional and plant-based drinks. Dairy products and bakery segments also see rapid adoption, integrating smart sensors for freshness monitoring and automated production lines. Meat and seafood players invest in traceability solutions to address food safety and sustainability. Grain and oil processors leverage predictive analytics for yield optimization, while fruits and vegetable producers adopt precision grading and packaging technologies. Diverse applications across end users reflect the sector’s push for efficiency and regulatory compliance.

Key Growth Drivers

Rising Demand for Food Safety and Quality

Stringent global regulations and consumer demand for transparency are driving adoption of agrifood technologies. Automated monitoring systems, IoT sensors, and blockchain-enabled traceability ensure food safety from production to retail. Companies are integrating predictive analytics to detect contamination risks and maintain compliance with international standards. This focus not only reduces recalls but also builds consumer trust, making food safety a core driver. Increasing regulatory oversight across regions further strengthens investment in technologies that safeguard quality and enhance accountability across the value chain.

- For instance, Nestlé scaled a global IoT Platform that now connects over 2.8 million devices in 97 countries, ingesting about 2.1 billion data points to monitor product quality, safety, and connected consumer devices.

Advancements in Automation and Robotics

Automation and robotics are transforming agriculture and food processing by improving efficiency, precision, and scalability. Robotic harvesters, AI-powered food sorters, and automated packaging machines reduce labor dependence and operational costs. Adoption is accelerating in both developed and emerging markets as companies seek to meet rising food demand with fewer resources. Precision farming tools also enable optimized water and fertilizer usage. By reducing waste and improving consistency, automation supports higher yields and safer products, positioning robotics as a major growth driver in agrifood technology adoption worldwide.

- For instance, Kerry Logistics Network implemented the “KOOLBee” sorting robot in Hong Kong, Tianjin and Dongguan since November 2022. This robot increased overall sorting productivity by 270%.

Shift Toward Sustainable and Alternative Foods

Sustainability imperatives and consumer preferences for healthier diets are driving technological innovation. Food companies invest in plant-based proteins, lab-grown meat, and bioengineered crops to meet changing demand. Agrifood technologies enable resource-efficient production, reduced carbon emissions, and minimal waste across supply chains. Governments also support sustainable agriculture initiatives through subsidies and R&D funding. This shift is creating new markets for alternative foods while reinforcing circular economy practices. The sustainability push ensures continued adoption of innovative agrifood solutions, making it a primary growth driver shaping industry transformation.

Key Trends & Opportunities

Integration of AI and Data Analytics

AI and data analytics are reshaping agrifood operations, enabling predictive crop management, personalized nutrition, and demand forecasting. Companies leverage machine learning for accurate food quality checks, automated supply chain decisions, and waste reduction. Predictive analytics also enhance farm-level productivity by providing real-time insights into soil, weather, and crop health. The trend creates opportunities for technology providers offering end-to-end digital solutions. As food systems become increasingly data-driven, AI integration emerges as a central trend unlocking efficiency, sustainability, and profitability in the global agrifood technology market.

- For instance, Tyson Foods’ “Industrial automation” program uses computer vision at its processing plants to perform real-time chicken tray counts. The system monitors up to 45 million head processed per week to detect under- or over-production in packaging racks.

Expansion of E-commerce and Smart Delivery Systems

E-commerce platforms and smart delivery systems present new opportunities in the agrifood technology market. Increasing consumer preference for online grocery and meal delivery services accelerates investments in last-mile logistics, automated warehousing, and temperature-controlled packaging. Startups and established players deploy drones, robotics, and AI-driven fleet management to reduce delivery times and costs. Traceability technologies also enhance consumer trust in online-purchased food products. The integration of smart delivery with supply chain analytics ensures freshness and compliance, making this trend a key opportunity for companies targeting urban and digital-first consumers.

- For instance, Kraft Heinz is building a 775,000-square-foot automated distribution center in DeKalb, Illinois, which will move more than 60% of its North American foodservice business and approximately 30% of all dry goods through automated facilities.

Key Challenges

High Implementation and Integration Costs

Adopting agrifood technologies requires significant investment in hardware, software, and workforce training. Many small and medium enterprises face challenges in accessing the capital needed to implement robotics, IoT systems, or blockchain solutions. Integration with existing infrastructure adds to costs, delaying large-scale adoption. The financial burden often restricts advanced technology to large corporations, creating a market gap. Until costs decline through scalable production or government incentives, high implementation expenses will remain a key challenge to broader agrifood technology adoption across global markets.

Data Security and Interoperability Issues

With increasing reliance on connected systems, agrifood companies face rising risks of data breaches and cyberattacks. Sensitive supply chain information, farm-level production data, and consumer records must be protected. Lack of standardized platforms and interoperability among technologies further complicates integration, leading to inefficiencies and vulnerabilities. Companies struggle to balance innovation with cybersecurity investments, especially in fragmented markets. Addressing data governance, compliance with privacy laws, and developing interoperable systems remain critical. These challenges must be resolved to ensure trust and continuity in the growing agrifood technology ecosystem.

Regional Analysis

North America

North America holds 32% of the agrifood technology market, driven by strong adoption of automation, robotics, and AI in food production and processing. The U.S. leads with advanced R&D investments, while Canada focuses on sustainable farming practices and traceability systems. High consumer demand for organic, plant-based, and functional foods further accelerates technological integration. Well-established infrastructure and strong venture capital support for agri-tech startups reinforce growth. Strict food safety regulations also drive adoption of monitoring and blockchain-based solutions. The region’s focus on efficiency, quality, and sustainability keeps North America at the forefront of agrifood technology development.

Europe

Europe accounts for 28% of the global market, supported by stringent food safety regulations and sustainability initiatives. Countries such as Germany, France, and the Netherlands lead in implementing precision farming, automated processing, and traceability solutions. The European Union’s Farm-to-Fork Strategy emphasizes eco-friendly practices, boosting demand for sustainable agrifood technologies. Rising adoption of plant-based proteins and alternative food sources also strengthens growth. Robust investment in digital agriculture platforms, supported by public-private partnerships, drives innovation. With a strong regulatory environment and consumer demand for transparency, Europe continues to be a significant hub for agrifood technology adoption and innovation.

Asia-Pacific

Asia-Pacific leads the agrifood technology market with a 34% share, driven by large-scale food production, population growth, and rapid digital adoption. China, India, and Japan dominate with investments in smart farming, e-commerce-driven food delivery, and automation in food processing. Government-backed initiatives promoting food security and sustainability boost adoption of IoT, AI, and blockchain solutions. Growing urbanization and rising disposable incomes fuel demand for convenience foods and safe supply chains. The region also witnesses strong growth in alternative proteins and plant-based products. Asia-Pacific’s scale and innovation ecosystem secure its leadership position in the global agrifood technology market.

Latin America

Latin America captures 4% of the agrifood technology market, with Brazil and Mexico leading adoption. The region’s focus on improving agricultural productivity and reducing post-harvest losses drives demand for digital farming tools, cold chain solutions, and logistics technologies. Export-oriented economies, particularly in fruits, vegetables, and meat, accelerate the adoption of food safety and traceability systems. While investment levels remain lower compared to developed regions, international collaborations and government-led modernization programs are enhancing adoption. Increasing consumer demand for packaged and processed foods also supports market growth, positioning Latin America as an emerging participant in agrifood technology development.

Middle East & Africa

The Middle East & Africa region holds a 2% share of the agrifood technology market, with adoption centered on addressing food security challenges and water scarcity. Countries such as the UAE, Saudi Arabia, and South Africa are investing in vertical farming, hydroponics, and precision irrigation technologies to meet rising demand. Import dependency has pushed governments to encourage local food production using advanced technologies. Emerging e-commerce platforms and growing urbanization also drive investment in food logistics and cold chain solutions. Although adoption remains at an early stage, the region presents significant growth potential through innovation-led agricultural modernization.

Market Segmentations:

By Component:

By Application:

- Food science

- Kitchen & restaurant tech

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the agrifood technology market players such as TRAX IMAGE RECOGNITION, CUBIQ FOODS, Delivery Hero SE, Carlisle Technology, Miso Robotics, HelloFresh SE, Swiggy, LUNCHBOX, Nymble (Epifeast Inc.), and Flytrex Inc. The agrifood technology market is highly competitive, shaped by rapid innovation and diverse business models. Companies are investing heavily in automation, AI-driven analytics, and sustainable food solutions to address rising demand for efficiency, safety, and transparency across the value chain. Digital platforms and smart logistics strengthen food delivery and supply chain operations, while robotics and IoT transform production and processing. Meal-kit services, smart kitchen systems, and drone-based logistics are expanding consumer convenience and accessibility. The market’s competitiveness is reinforced by continuous R&D, strategic partnerships, and the push toward sustainability-driven technologies, ensuring ongoing disruption and growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Farmers Edge Inc. partnered with Taurus Ag Marketing Inc. to expand access to high-quality soil testing solutions across Canada. Taurus will improve the availability of advanced lab services, delivering industry-leading turnaround times and tailored insights to support data-driven decisions for growers, agronomists, and agri-businesses.

- In April 2025, Garmin introduced the Instinct 3 Series in India, raising the bar for rugged smartwatch innovation. The Instinct 3 Series delivers robust features to endure the most demanding environment and is tailored for adventure seekers, outdoor enthusiasts, and fitness lovers.

- In November 2024, Sony Group Corporation (Japan) and CardioComm Solutions (U.S.) partnered to integrate its advanced ECG technology into Sony’s mSafety platform, enhancing wearable technology capabilities. This collaboration allows users to monitor heart health directly through a wearable device without a smartphone connection.

- In February 2024, Samsung introduced the Galaxy Fit 3 to the Indian market. This entry-level health and fitness tracker features a 1.6-inch AMOLED display, which is 45% wider than its predecessor.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and machine learning will enhance predictive farming and food quality checks.

- Automation and robotics will streamline processing, packaging, and restaurant operations.

- Blockchain-based traceability will improve food safety and strengthen consumer trust.

- Drone and autonomous delivery systems will expand last-mile food logistics.

- Sustainable farming technologies will support reduced water use and lower carbon emissions.

- Alternative proteins and lab-grown meat will gain stronger market presence.

- Smart kitchen appliances will drive convenience for households and restaurants.

- E-commerce platforms will continue reshaping food purchasing and distribution.

- Governments will increase support for agri-tech innovation through policies and incentives.

- Data-driven solutions will improve supply chain efficiency and reduce food waste.