Market Overview:

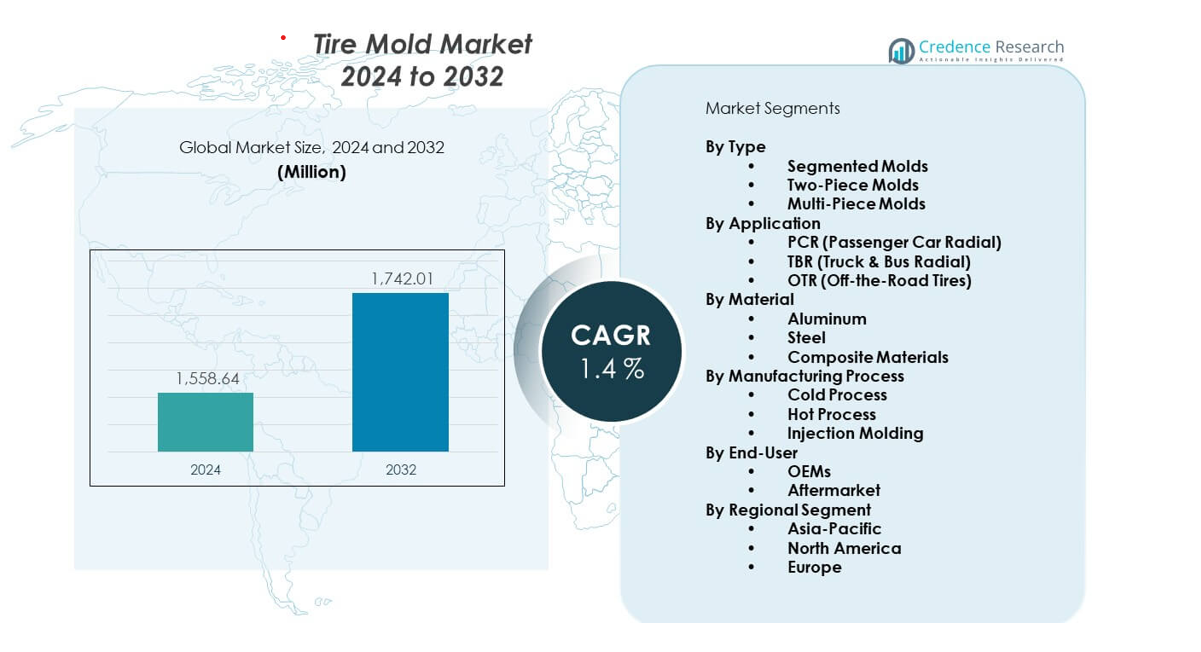

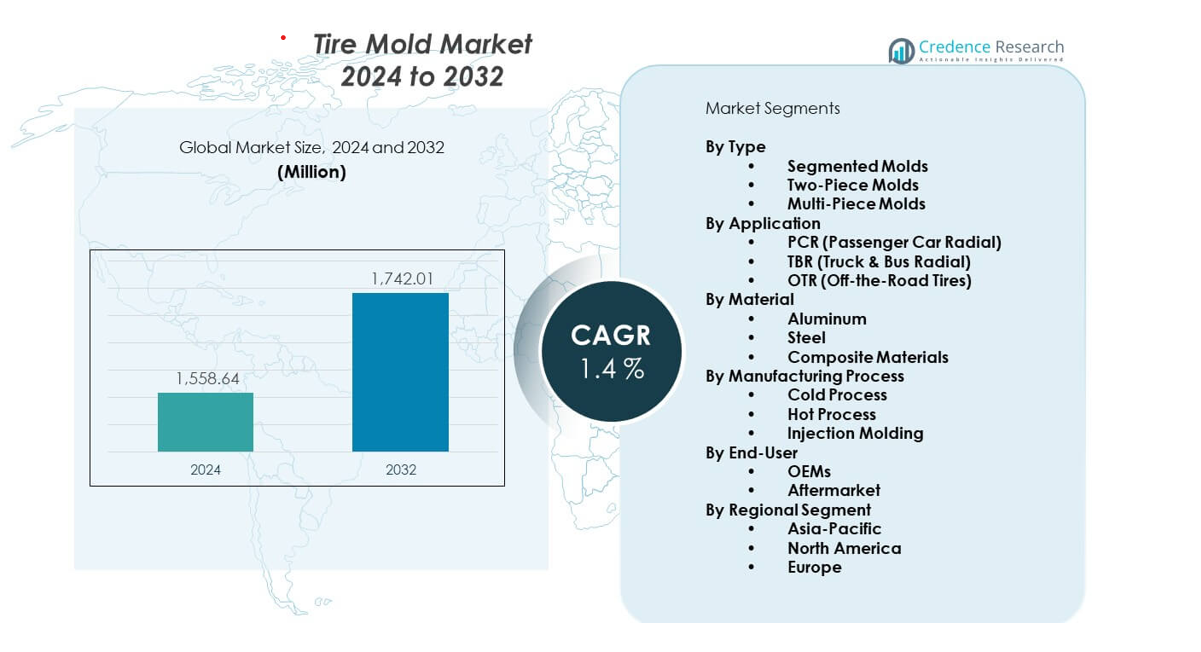

The Tire Mold Market was valued at USD 1,558.64 million in 2024 and is projected to reach USD 1,742.01 million by 2032, registering a CAGR of 1.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tire Mold Market Size 2024 |

USD 1,558.64 million |

| Tire Mold Market CAGR |

1.4% |

| Tire Mold Market Size 2032 |

USD 1,742.01 million |

Manufacturers invest in advanced mold designs as automakers ask for better tread accuracy and stronger durability. Rising demand for premium tires pushes companies to improve mold quality with faster heat transfer and higher pattern precision. The shift toward electric mobility boosts interest in molds that support low-rolling resistance tires. Firms also upgrade production lines to cut cycle time and improve uniformity across large batches.

North America leads due to strong tire production and steady replacement demand across commercial fleets. Europe holds a solid position supported by strict quality norms and active R&D in specialty tires. Asia Pacific grows fastest, driven by rising automotive output in China, India, and Southeast Asia. Emerging countries expand local manufacturing to cut import dependence and supply regional OEMs. Global suppliers strengthen their presence across these markets by setting up new tooling centers and service hubs.

Market Insights:

- The Tire Mold Market reached USD 1,558.64 million in 2024 and is projected to hit USD 1,742.01 million by 2032, growing at a CAGR of 1.4%, supported by stable tire production across OEM and aftermarket channels.

- Asia-Pacific (35%), North America (32%), and Europe (28%) lead the market due to strong tire manufacturing bases, advanced automation, and high-quality standards that sustain long-term mold procurement.

- Asia-Pacific remains the fastest-growing region with 35% share, driven by expanding automotive output, rising EV adoption, and rapid investment in high-precision mold engineering across China, India, Japan, and South Korea.

- Segmented molds hold around 40% share, driven by their flexibility, ease of maintenance, and suitability for complex tread designs used across premium tire lines.

- PCR molds account for nearly 45% share, supported by high passenger vehicle production and strong replacement demand across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Focus on Precision Molding To Support Advanced Tire Designs

Demand rises due to stronger interest in high-accuracy molds that deliver cleaner tread geometry. Tire makers want molds that hold stable performance under long production cycles. The Tire Mold Market sees steady traction from firms that upgrade tooling to meet strict OEM quality needs. Automakers push suppliers to maintain uniformity across premium tire batches. It drives investment in advanced cooling structures that control heat flow during each cycle. Producers improve surface treatments to raise mold life under heavy mechanical stress. Many factories bring CNC tools into workflows to deliver consistent cavity detail. Companies expand testing practices to validate pattern durability before final deployment.

- For instance, Himile uses high-tech DMG MORI 5-axis machining centers to achieve high-precision cavity engraving for global tire OEMs, with published specifications for such machines typically indicating volumetric accuracy closer to 3 microns.

Rising Adoption of Lightweight Materials To Improve Output Efficiency

Producers use lightweight alloys to reduce thermal stress on mold assemblies. It helps teams improve cycle stability during large production runs. The Tire Mold Market benefits from wider use of advanced steel grades that reduce maintenance pressure. Manufacturers look for better fatigue resistance to keep equipment performance steady across long hours. Automated handling supports faster mold changes on busy lines. Mold designers integrate modular structures to simplify part replacement. Global suppliers work on improving dimensional accuracy for complex tread patterns. Plants push for materials that withstand frequent temperature swings without shape distortion.

- For instance, Continental’s mold engineering facilities use high-strength aluminum alloys with thermal conductivity above 150 W/m·K to shorten curing cycles and reduce heat-related distortion.

Growing Shift Toward EV-Ready Tire Designs Driving Mold Innovation

Electric vehicles require tires with stronger grip and reduced rolling friction. It leads mold engineers to create new cavity profiles that match these performance demands. The Tire Mold Market gains support from OEMs that want molds fitting next-generation tread shapes. Factories deploy laser-engraved textures to refine surface uniformity. It boosts design flexibility for varied EV product lines. Mold teams adjust venting layouts to maintain consistent airflow during curing. Suppliers use simulation software to test stress loads across multiple tire formats. Industry groups work with mold specialists to meet upcoming regulatory needs linked to EV growth.

Increasing Automation To Strengthen Production Accuracy and Reduce Human Error

Automation tools help plants control mold alignment during high-volume output. It ensures consistent pressure distribution across curing stages. The Tire Mold Market benefits from robots that handle heavy mold segments with stable precision. Operators replace outdated systems to cut downtime linked to manual processes. Smart controllers monitor heat distribution in real time. It reduces defects linked to uneven temperature zones. Digital platforms improve planning for mold maintenance cycles. Factories explore advanced sensor kits to track wear and extend usable life.

Market Trends:

Advancement of Smart Mold Technologies for Better Production Intelligence

Producers integrate sensors into molds to collect real-time performance signals across each curing cycle. It helps teams adjust process settings with better accuracy. The Tire Mold Market adopts digital dashboards that support predictive alerts. Engineers read temperature profiles to refine heat balance across mold areas. Smart tools detect micro-defects early, improving final tire consistency. Suppliers expand adoption of connected maintenance workflows. It raises output dependability for high-volume manufacturers. Factories use cloud-linked platforms to standardize reports across global locations.

- For instance, Goodyear uses its proprietary “SightLine” sensor platform, which collects real-time data from sensors in tires to monitor their health for fleet managers, providing insights on tire pressure and wear to optimize maintenance and enhance vehicle safety.

Higher Demand for Custom Pattern Engineering Across Niche Tire Segments

Specialized tire categories encourage producers to design molds with unique tread motifs. It supports growth in racing, off-road, and high-load commercial segments. The Tire Mold Market sees interest from tire brands seeking greater design differentiation. Advanced engraving systems allow rapid adjustments for complex shapes. Mold shops upgrade software to handle detailed modelling tasks. It boosts agility during frequent pattern changes. Producers test multiple samples before finalizing texture properties. Industry designers value sharper transitions in groove angles and block edges.

- For instance, Michelin uses laser-engraving systems capable of generating micro-textures under 1 mm in depth to create performance-oriented tread features for motorsport and UHP tires.

Rising Use of Sustainable Manufacturing Methods for Mold Construction

Manufacturers adopt cleaner melting and forging practices to reduce emissions during mold creation. It drives progress toward greener production cycles. The Tire Mold Market welcomes advanced recyclable alloy mixes. Factories redesign workflows to lower waste from machining tasks. It motivates suppliers to choose energy-efficient heat-treat furnaces. Industry groups track environmental rules linked to carbon cuts. Producers scale alternative coatings that limit chemical exposure during finishing. Plants invest in filtration systems that keep particle discharge under control.

Shift Toward Rapid Prototyping To Shorten Mold Development Cycles

Firms use 3D tools to design early versions of mold concepts. It reduces time lost waiting for physical samples. The Tire Mold Market benefits from hybrid prototyping that mixes digital models with selective metal prints. Engineers compare virtual simulation data before starting full machining. It reduces error risk tied to guess-based design. Prototyping units test airflow behavior across vent structures. Suppliers run structural checks on ribs and support frames. Development teams meet OEM deadlines with stronger reliability.

Market Challenges Analysis:

High Tooling Costs and Complex Material Demands Slowing Modernization Efforts

High capital needs limit upgrades for smaller plants. Precision steel grades raise procurement pressure for suppliers that order materials in large batches. The Tire Mold Market faces rising cost loads from custom machining and advanced coating treatments. Many factories struggle to maintain output speed while managing wear across heavy molds. It increases downtime for refurbishing tasks. Technical expertise shortages affect shops that handle multi-layer mold structures. Producers navigate tough lead-time gaps tied to global alloy supply cycles. Tooling imports create extra delays linked to shipping and inspection processes.

Quality Variation Risks and Production Alignment Gaps Impacting Output Stability

Complex tread geometry increases the chance of micro-defects during curing. Plants that rely on outdated systems face difficulty controlling temperature balance. The Tire Mold Market encounters errors linked to poor vent positioning and uneven cavity pressure. It impacts uniformity across premium product lines. Teams need advanced inspection setups to track cavity erosion. Weak cleaning practices raise contamination risks across mold surfaces. Coordination gaps between tire designers and mold technicians extend development cycles. Many plants push for better digital links to solve misalignment between modelling and machining steps.

Market Opportunities:

Rising Demand for EV-Specific Tire Designs Creating Strong Potential for High-Precision Molds

EV adoption expands need for molds that support low-noise and low-drag tire features. The Tire Mold Market gains new prospects from OEMs launching electric platforms across multiple segments. It opens space for suppliers building EV-tailored tread cavities. Firms explore new embossing styles that improve rubber contact behavior. Teams work on optimizing airflow lines within molds. Producers adopt advanced simulation tools to speed up EV product testing. It strengthens opportunities for high-accuracy machining providers.

Expansion of Automated Factories Encouraging New Mold Supply Contracts

Automation helps plants scale operations with reduced human intervention. The Tire Mold Market benefits from buyers seeking molds built for robot-ready handling units. It supports demand for uniform sections that simplify alignment steps. Suppliers offer modular mold kits for quicker installation across large plants. Automation-linked upgrades increase interest in digital inspection units. It gives mold makers room to position advanced services for global tire brands. Factories aim for faster cycle output with lower defect ratios.

Market Segmentation Analysis:

By Type

The Tire Mold Market shows strong demand for segmented molds due to their flexibility and support for complex tread patterns. Two-piece molds maintain steady use across standard tire designs that require consistent dimensional accuracy. Multi-piece molds gain interest from producers that manage frequent pattern shifts across multiple product lines. It drives vendors to refine machining precision for each mold category to meet evolving OEM needs.

- For instance, HERBERT’s segmented mold systems use precision-ground steel segments with tolerance levels below 0.01 mm to maintain pattern accuracy across large batch runs.

By Application

PCR tires lead due to high production volumes supported by rising passenger vehicle adoption across global markets. TBR molds hold a stable share driven by strong fleet activity across logistics and long-distance transport. OTR molds serve heavy machinery and mining equipment that depend on durable tread structures. The Tire Mold Market supports each segment with specialized cavity designs tailored to performance and load requirements.

- For instance, Bridgestone’s OTR manufacturing uses mold modules engineered for pressures exceeding 20 bar inside curing presses to sustain the structural demands of mining and construction tires.

By Material

Aluminum molds gain preference for faster heat transfer and lower weight during handling operations. Steel molds remain essential for durability and extended service life in high-pressure segments. Composite materials grow slowly due to their potential to offer lighter structures with controlled temperature behavior. It encourages suppliers to refine material selection for specific production environments.

By Manufacturing Process

Cold and hot processes remain widely used for mass production across standard mold lines. Injection molding sees rising traction among producers aiming for tighter dimensional control. Each process aligns with plant objectives linked to cycle time, precision, and lifespan. It supports diverse adoption across factories with varied output scales.

By End-User

OEMs lead demand due to large-scale tire production needs. Aftermarket users require molds for replacement and niche-pattern tires. It supports balanced growth across both channels.

Segmentation:

By Type

- Segmented Molds

- Two-Piece Molds

- Multi-Piece Molds

By Application

- PCR (Passenger Car Radial)

- TBR (Truck & Bus Radial)

- OTR (Off-the-Road Tires)

By Material

- Aluminum

- Steel

- Composite Materials

By Manufacturing Process

- Cold Process

- Hot Process

- Injection Molding

By End-User

By Regional Segment

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Tire Mold Market, accounting for around 32% of global demand. Strong tire production capacity across the U.S. and Canada supports steady mold procurement from OEMs and replacement manufacturers. The region benefits from advanced automation, which improves accuracy and reduces alignment issues during mold handling. It strengthens long-term investments in segmented and multi-piece molds tailored to premium tire categories. Fleet expansion across logistics networks sustains high TBR and OTR mold use. Regulatory focus on performance and durability drives continuous upgrades in design and material choices.

Europe

Europe captures nearly 28% share supported by strong R&D culture, established tire brands, and consistent focus on precision tooling. German and Italian manufacturers lead adoption of advanced mold technologies that match high safety and performance standards. The region values tight quality control, which supports demand for steel molds known for long operational life. It encourages suppliers to offer complex groove designs and laser-engraved patterns tailored to diverse road conditions. Sustainability initiatives guide factories toward cleaner mold production practices and improved recycling programs for metals. Rising adoption of EV-ready tire concepts also drives new cavity innovations.

Asia-Pacific

Asia-Pacific stands as the fastest-growing region and holds about 35% share due to large tire production bases in China, India, Japan, and South Korea. Expanding automotive output and strong export activity lift regional mold consumption across OEMs and aftermarket channels. The Tire Mold Market gains momentum here from rising investment in high-precision equipment and digital inspection tools. It supports rapid adoption of aluminum molds for faster cycle performance. Growing EV manufacturing clusters strengthen demand for new tread architectures requiring detailed mold engineering. Local suppliers scale operations to meet global supply needs and shorten lead times for international clients.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Continental AG (Germany)

- Bridgestone Corporation (Japan)

- Michelin (France)

- Goodyear Tire & Rubber Company (USA)

- Pirelli & C. S.p.A. (Italy)

- Hankook Tire (South Korea)

- Sumitomo Rubber Industries (Japan)

- Yokohama Rubber Company (Japan)

- Trelleborg AB (Sweden)

Competitive Analysis:

The Tire Mold Market features strong competition among global tire manufacturers and specialized mold producers that work to improve precision and production speed. Large companies invest in CNC machining, advanced coatings, and digital inspection tools to secure quality advantages. It encourages suppliers to expand capabilities in segmented and multi-piece mold engineering. Asian manufacturers gain share through cost efficiency and rising export activity. European firms maintain strength due to strict quality standards and extensive R&D culture. North American companies focus on automated handling and durable material grades. Strategic partnerships, capacity upgrades, and regional expansion remain central to competitive positioning.

Recent Developments:

- In November 2025, Yokohama Rubber renewed its official partnership agreement with the Association of Tennis Professionals (ATP) Tour through 2028, serving as the ATP Tour’s Official Tire Partner and sponsoring five tournaments in European countries.

- Pirelli & C. S.p.A. (Italy) – In April 2025, Pirelli and CTS, an independent tire services provider in Northern Europe, signed a strategic long-term partnership agreement. The transaction includes CTS acquiring Däckia AB, Pirelli’s Swedish tire distribution network consisting of 60 direct points of sale and 42 affiliates throughout Sweden. Simultaneously, Pirelli and Däckia signed a supply agreement through 2030, ensuring Pirelli serves as the main supplier while strengthening Pirelli’s commercial presence and High Value strategy in the Nordic region. The transaction was expected to finalize by July 2025.

- In January 2025, Trelleborg announced the acquisition of Aero-Plastics, a Washington-based aerospace company with 80 years of expertise in precision injection molding and thermoforming, consolidating the transaction on April 10, 2025.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Material, Manufacturing Process, and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-precision segmented molds will grow to support advanced tread designs.

- EV adoption will push companies to develop molds tailored to low-noise and low-drag tires.

- Automated production systems will influence procurement strategies for standardized mold designs.

- Use of digital inspection tools will expand to improve defect detection across global plants.

- Aluminum molds will gain traction due to faster heat transfer and reduced handling weight.

- Steel molds will remain essential for heavy-load tire categories with long service cycles.

- Cold and hot processes will continue serving large production runs across key regions.

- Asia-Pacific suppliers will strengthen their export role through capacity expansion.

- Partnerships between mold specialists and tire manufacturers will rise for customized solutions.

- Sustainability requirements will encourage the adoption of recyclable alloys and low-emission processes.