Market Overview:

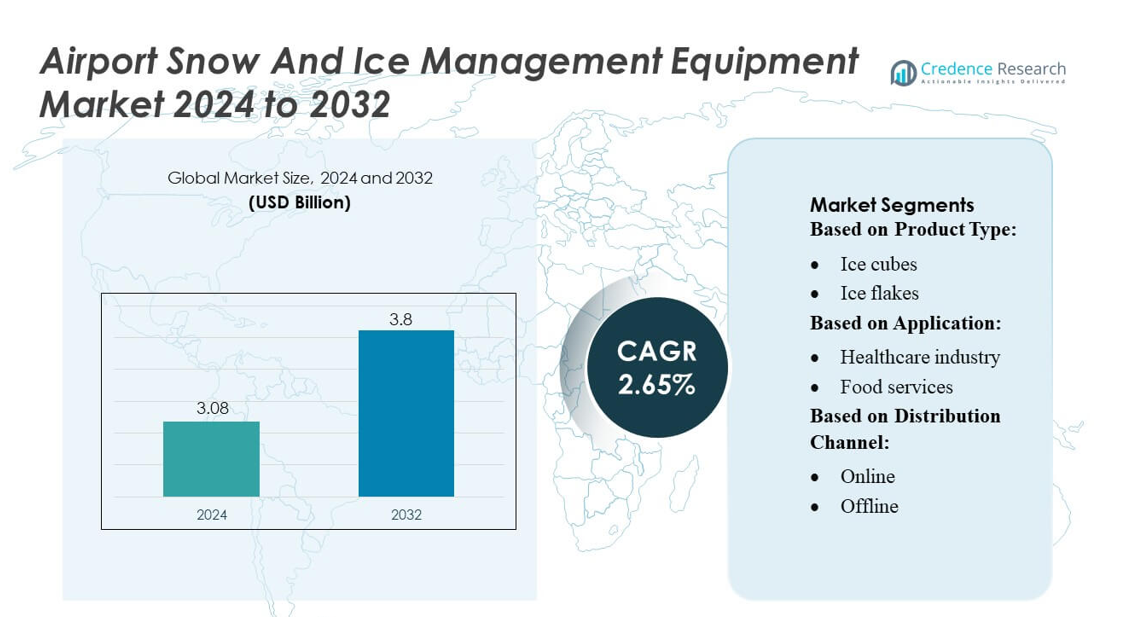

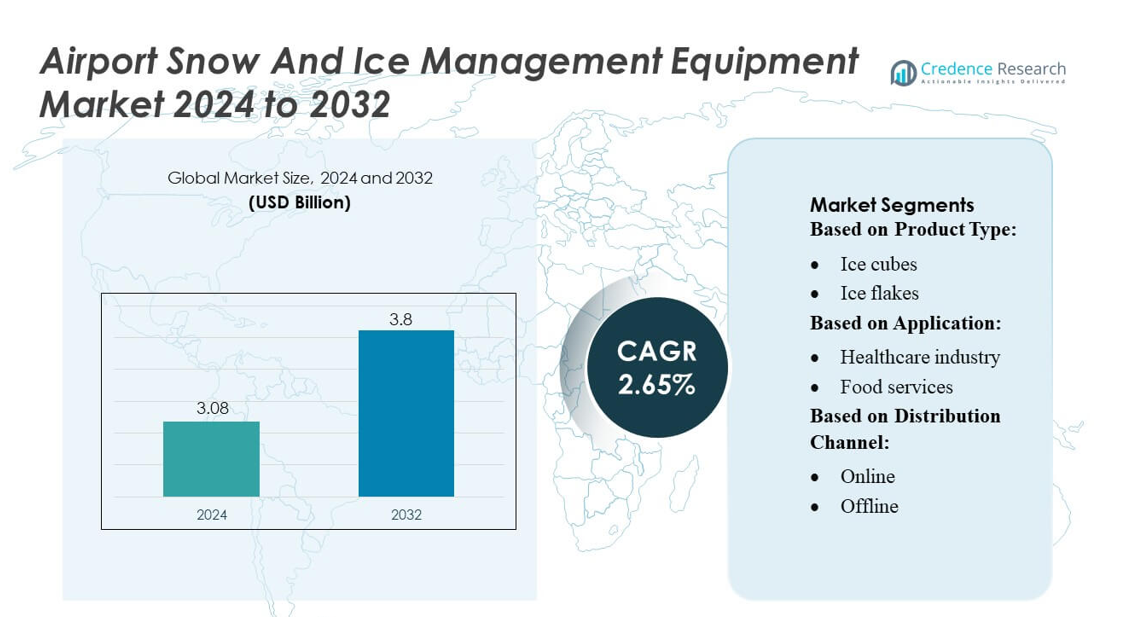

Airport Snow And Ice Management Equipment Market size was valued USD 3.08 billion in 2024 and is anticipated to reach USD 3.8 billion by 2032, at a CAGR of 2.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Snow and Ice Management Equipment Market Size 2024 |

USD 3.08 billion |

| Airport Snow and Ice Management Equipment Market , CAGR |

2.65% |

| Airport Snow and Ice Management Equipment Market Size 2032 |

USD 3.8 billion |

The Airport Snow and Ice Management Equipment Market is highly competitive, with key players such as FANUC CORPORATION, Siemens, Yokogawa Electric Corporation, ABB, Metso, OMRON Corporation, Rockwell Automation, Emerson Electric Co., Honeywell International Inc., and Mitsubishi Electric Corporation driving innovation and technological advancement. These companies focus on developing automated snow removal systems, GPS-enabled de-icing equipment, and eco-friendly ice management solutions to enhance airport operational efficiency and safety. Strategic initiatives, including partnerships, mergers, and regional expansion, allow these players to strengthen their market presence and address growing demand. North America emerges as the leading region, capturing approximately 35% of the market share, driven by high air traffic volumes, stringent safety regulations, and the adoption of advanced snow and ice management technologies in both commercial and regional airports. Continuous investments in modernization and technological innovation are expected to maintain the region’s dominance.

Market Insights

- The Airport Snow and Ice Management Equipment Market was valued at USD 3.08 billion in 2024 and is expected to reach USD 3.8 billion by 2032, growing at a CAGR of 2.65% during the forecast period.

- Increasing air traffic, airport expansions, and stringent safety regulations are driving demand for automated snow removal systems and advanced de-icing equipment.

- North America leads the market with approximately 35% share, supported by high passenger volumes, harsh winter conditions, and widespread adoption of eco-friendly and automated snow and ice management solutions.

- Key players focus on technological innovation, partnerships, mergers, and regional expansion to strengthen market presence and enhance operational efficiency across segments such as ice flakes, ice cubes, and ice nuggets.

- Market growth is challenged by high equipment costs and seasonal demand fluctuations, while opportunities exist in emerging economies and the adoption of smart, energy-efficient, and environmentally safe snow and ice management technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the airport snow and ice management equipment market, ice flakes dominate the product type segment, accounting for approximately 42% of the market share. Their popularity is driven by superior melting efficiency, ease of application, and lower damage potential to airport surfaces compared to larger ice forms. Ice flakes are preferred for both runway de-icing and apron maintenance due to their rapid coverage and uniform dispersion. Rising operational safety regulations and stringent airport maintenance standards further reinforce their adoption over ice cubes and ice nuggets, which see lower utilization due to slower performance and handling challenges.

- For instance, Yokogawa’s control‑system portfolio has demonstrated marked efficiency gains: in one deployment at a chemical plant, its autonomous control AI reportedly reduced both steam consumption and CO₂ emissions by around 40% compared to conventional control methods.

By Application

The food services sector emerges as the dominant application sub-segment, capturing around 38% of the market share, fueled by increasing demand for cold storage and ice-based applications in airport restaurants, cafes, and catering services. The requirement for consistent quality and hygiene standards in food preparation drives investments in reliable ice production and storage equipment. While the healthcare industry and retail applications maintain steady growth due to specialized cooling needs, the expansion of food services at airports globally, coupled with passenger volume growth, remains the key factor propelling this sub-segment.

- For instance, ABB’s latest generation of industrial robots (e.g., the IRB 6750S powered by the OmniCore™ controller) delivers path accuracy down to 0.9 mm and up to 20 percent energy savings relative to prior models.

By Distribution Channel

Within distribution channels, offline sales account for the largest share at approximately 55%, reflecting airports’ preference for direct procurement from authorized distributors to ensure timely installation, maintenance, and compliance with operational standards. Offline channels provide opportunities for on-site demonstrations, after-sales service, and bulk procurement, which is critical for high-capacity snow and ice management equipment. Although online sales are growing due to convenience and competitive pricing, offline channels remain dominant, driven by long-term service contracts, regulatory requirements, and the need for specialized support for large-scale airport operations.

Key Growth Drivers

Increasing Air Traffic and Airport Expansion

Rising global air traffic and ongoing airport infrastructure expansion are primary growth drivers for the airport snow and ice management equipment market. Increased passenger volumes and flight operations demand enhanced runway and apron safety, necessitating the deployment of advanced ice removal and de-icing equipment. Expanding airports in regions with harsh winter conditions prioritize high-efficiency snow and ice management systems to minimize operational disruptions. This trend accelerates procurement of specialized equipment, particularly high-capacity snow blowers, de-icers, and ice flake machines, driving overall market growth.

- For instance, Metso recently secured a large multi‑stage grinding equipment order in India that involves delivering several mills with a total installed power of over 35 MW, along with MD slurry pumps and MHC™ hydrocyclones.

Regulatory Safety Compliance

Stringent aviation safety regulations and international standards governing runway and apron maintenance propel market demand. Regulatory bodies such as the FAA and ICAO mandate precise de-icing and snow removal protocols to ensure operational safety and prevent flight delays. Airports must invest in equipment that meets these compliance standards, including automated snowplows, de-icing trucks, and ice spreading machinery. Compliance-driven equipment upgrades, coupled with routine maintenance requirements, support sustained market adoption and encourage innovation in efficient, eco-friendly snow and ice management solutions.

- For instance, OMRON’s recently launched NX‑series controllers (NX502 CPU Units and NX‑EIP201 EtherNet/IP modules) support data‑collection precision with jitter under 1 microsecond and enable data‑transfer speeds roughly 4× greater than equivalent-class controllers.

Technological Advancements in Equipment

Continuous innovation in snow and ice management technology is a key market driver. Advanced equipment featuring automated controls, GPS integration, and energy-efficient de-icing systems enhance operational efficiency and reduce labor costs. Innovations in ice flake production, rapid spreading mechanisms, and environmentally safe de-icing agents further support adoption. Airports increasingly rely on modern solutions to optimize response times during extreme weather, making technologically advanced snow and ice management equipment a critical investment for operational reliability and safety, thereby accelerating market growth.

Key Trends & Opportunities

Shift Towards Eco-Friendly De-Icing Solutions

The adoption of environmentally friendly de-icing agents and biodegradable ice management materials is gaining traction. Airports are increasingly replacing traditional chemical de-icers with sustainable alternatives to reduce ecological impact on surrounding ecosystems. This trend opens opportunities for manufacturers to develop innovative, low-impact snow and ice management equipment. Eco-friendly solutions, such as precise ice flake dispensers and minimal-waste application systems, cater to regulatory and environmental demands while enhancing operational efficiency, creating a significant growth avenue for the market.

- For instance, Rockwell converted about 50% of its global painted products to a powder‑coat using 25% post‑consumer recycled plastic resin (rPET), a move projected to divert 4.1 million plastic water bottles annually from landfills.

Integration of Smart and Automated Systems

Automation and smart technologies are transforming snow and ice management practices. Integration of GPS, IoT sensors, and predictive weather analytics enables airports to optimize de-icing schedules, reduce equipment downtime, and improve safety. Smart vehicles and automated snow removal systems allow for precise material application and real-time monitoring of operations. This technological shift presents opportunities for equipment manufacturers to offer value-added solutions that increase efficiency, lower costs, and meet evolving airport operational requirements.

- For instance, Emerson’s of its new AI‑enabled Virtual Advisor as part of the “Ovation 4.0 Automation Platform” integrates natural‑language interactive AI, enabling real‑time system documentation access, predictive maintenance, and process‑optimization recommendations in power and water operations.

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Eastern Europe, and North America present significant growth potential due to expanding airport networks and increasing winter tourism. Investment in airport infrastructure in these regions drives demand for reliable snow and ice management equipment. Opportunities exist for local partnerships, customized solutions for diverse climatic conditions, and supply chain expansion. The growing need for operational continuity during severe winters encourages procurement of high-capacity and technologically advanced snow and ice equipment in these emerging markets.

Key Challenges

High Capital Investment

The significant initial cost of advanced snow and ice management equipment poses a challenge, particularly for smaller airports. High-capacity snowplows, automated de-icing trucks, and ice flake production units require substantial capital expenditure. Budget constraints may delay equipment upgrades or force airports to rely on lower-efficiency alternatives. Additionally, ongoing maintenance and operational costs further strain financial resources, limiting market penetration in cost-sensitive regions and creating a barrier to adoption for advanced, technologically sophisticated solutions.

Seasonal Demand Fluctuations

Demand for snow and ice management equipment is highly seasonal, primarily concentrated during winter months, leading to underutilization during off-season periods. This cyclical demand pattern affects revenue predictability and may discourage continuous investment. Equipment storage, maintenance during downtime, and workforce management are additional operational challenges. Manufacturers and airport operators must optimize utilization strategies, including multi-season applications and leasing models, to mitigate the impact of seasonal fluctuations while ensuring readiness during peak winter periods.

Regional Analysis

North America

North America holds the largest share in the airport snow and ice management equipment market, accounting for approximately 35%. The region’s dominance is driven by harsh winter conditions in the U.S. and Canada, high air traffic volume, and stringent regulatory compliance for runway safety. Advanced technological adoption, including automated snow removal systems and eco-friendly de-icing solutions, further fuels market growth. Expansion of airport infrastructure and modernization projects in major hubs such as New York, Chicago, and Toronto continues to drive demand for high-capacity snowplows, de-icing trucks, and ice flake equipment across commercial and regional airports.

Europe

Europe commands around 28% of the market share, supported by extensive air travel networks and frequent winter storms across Northern and Eastern regions. Countries such as Germany, France, and the UK prioritize operational safety through advanced snow and ice management solutions, including automated de-icing systems and energy-efficient equipment. Regulatory frameworks from the European Union and ICAO guidelines enforce strict compliance, encouraging airports to invest in modern technologies. Rising airport expansion projects, increasing winter tourism, and growing adoption of eco-friendly de-icing agents further reinforce the region’s strong market presence and steady growth prospects.

Asia-Pacific

The Asia-Pacific region represents approximately 22% of the market share, driven by rapid airport infrastructure development and increasing international air travel. Emerging economies, particularly China, Japan, and South Korea, face growing demand for reliable snow and ice management systems due to seasonal snowfall in northern regions. Investment in technologically advanced equipment, including GPS-enabled snowplows and smart de-icing systems, is increasing. Expansion of airports to accommodate rising passenger volumes and the adoption of automated and eco-friendly solutions create significant growth opportunities. The region is expected to witness accelerated adoption as winter operations gain strategic importance.

Latin America

Latin America accounts for around 9% of the market share, with growth supported by selective airports in higher-altitude regions experiencing snowfall and cold weather conditions. The market is characterized by gradual adoption of snow and ice management solutions, with preference for cost-effective equipment suited to seasonal needs. Airports in countries like Chile and Argentina are increasingly investing in snowplows and de-icing machinery to improve operational reliability and safety during winter months. Expansion of regional airport infrastructure and rising focus on passenger safety provide opportunities for market penetration, although growth remains modest compared to North America and Europe.

Middle East & Africa

The Middle East & Africa hold approximately 6% of the market share, driven by limited snowfall regions and niche winter operations at high-altitude airports. Equipment demand is concentrated in select areas such as mountainous zones and high-altitude airports in North Africa. Airports primarily focus on efficient de-icing and occasional snow removal equipment to maintain safety and reduce operational delays. Growth opportunities exist through modernization initiatives, infrastructure expansion, and adoption of automated and smart snow management technologies. The market is expected to grow steadily as airports seek operational continuity and regulatory compliance, despite lower overall snowfall incidence.

Market Segmentations:

By Product Type:

By Application:

- Healthcare industry

- Food services

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The airport snow and ice management equipment market players such as FANUC CORPORATION, Siemens, Yokogawa Electric Corporation, ABB, Metso, OMRON Corporation, Rockwell Automation, Emerson Electric Co., Honeywell International Inc., and Mitsubishi Electric Corporation. The airport snow and ice management equipment market is highly competitive, characterized by rapid technological advancements and continuous product innovation. Companies compete on the basis of equipment efficiency, automation, energy savings, and environmental compliance, with increasing focus on smart and IoT-enabled systems. Strategic initiatives such as mergers, acquisitions, and partnerships are common to expand regional presence and enhance product portfolios. Vendors also emphasize after-sales service, maintenance contracts, and regulatory compliance to build customer loyalty. The market’s competitive intensity is further heightened by growing demand for high-capacity, eco-friendly solutions in North America, Europe, and Asia-Pacific, driving continuous innovation and operational excellence across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FANUC CORPORATION

- Siemens

- Yokogawa Electric Corporation

- ABB

- Metso

- OMRON Corporation

- Rockwell Automation

- Emerson Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

Recent Developments

- In June 2025, Hoshizaki Alliance signed an agreement to acquire Structural Concepts Corporation, a manufacturer of food display cases based in the United States, as part of the same strategy to increase Hoshizaki’s presence and product diversification in refrigeration.

- In October 2024, Siemens announced the launch of the SIRIUS 3RC7 intelligent link module that has been developed to boost data transparency in industrial automation. The expansion module combines operational technology (OT) and information technology (IT) that would enable efficient utilization of data available at load feeders.

- In September 2024, GoveeLife introduced the Smart Countertop Ice Maker 1s to enhance the home bar experience with smart technology, app control, and features like app control, a self-cleaning function, and fast ice production.

- In June 2024, Trimble launched a comprehensive asset lifecycle management (ALM) software suite designed to streamline processes, enhance productivity, and maximize return on investment (ROI) for asset owners across various industries. This end-to-end solution connects people, processes, and data throughout all phases of the asset lifecycle, including planning, design, construction, operation, and maintenance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing air traffic and airport expansions in winter-prone regions.

- Adoption of automated and smart snow and ice management systems will accelerate operational efficiency.

- Demand for eco-friendly de-icing solutions will rise as airports focus on sustainable practices.

- Emerging economies will witness higher equipment deployment with growing airport infrastructure.

- Integration of IoT and GPS-enabled technologies will enhance precision and reduce labor costs.

- Airports will increasingly invest in high-capacity equipment to minimize operational disruptions during severe weather.

- Continuous innovation in energy-efficient machinery will support cost-effective and environmentally safe operations.

- Seasonal demand management strategies will drive the development of multi-purpose and adaptable equipment.

- Partnerships and collaborations among manufacturers and airports will strengthen market penetration globally.

- Regulatory compliance and safety standards will continue to shape product development and adoption trends.