Market Overview:

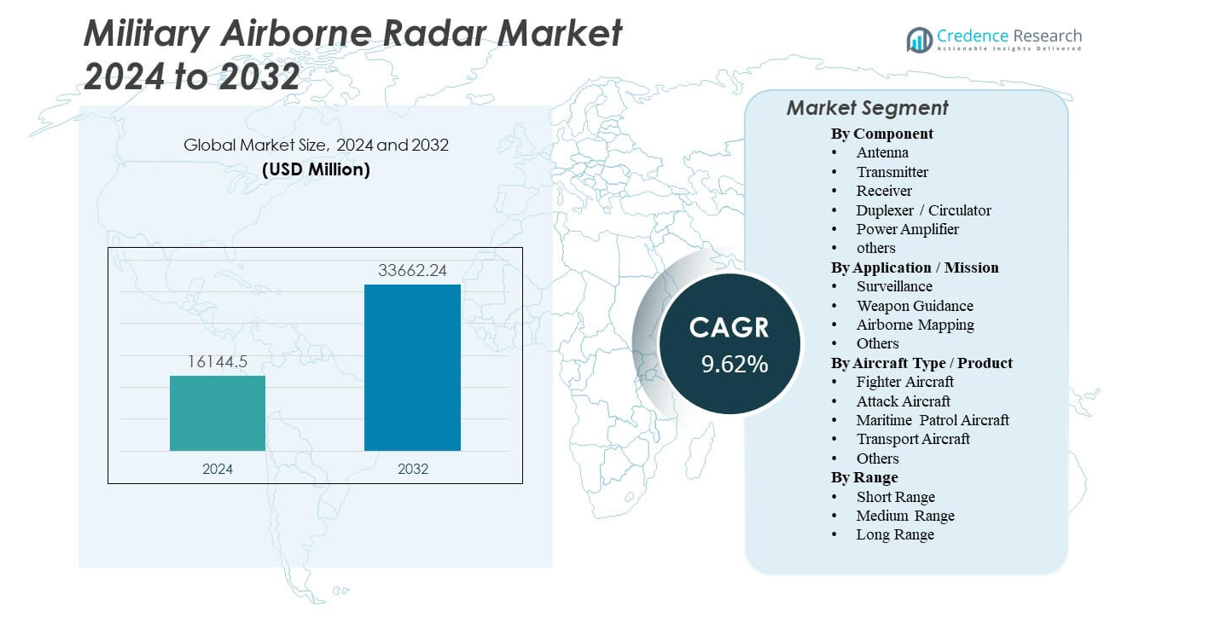

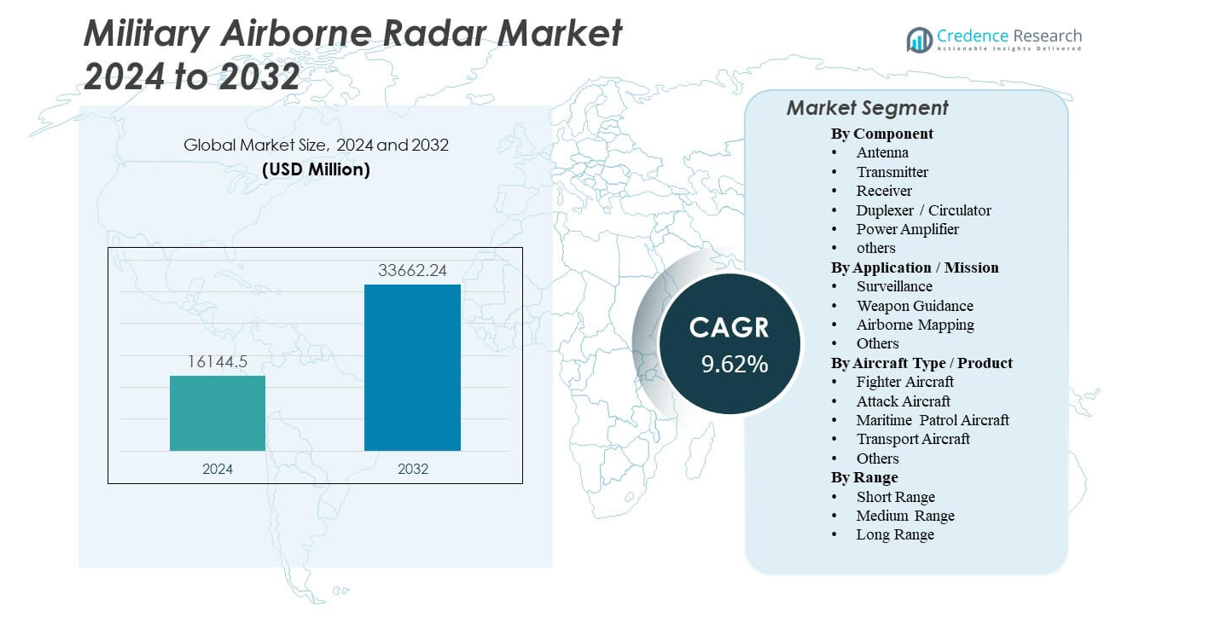

The Military Airborne Radar Market is projected to grow from USD 16,144.5 million in 2024 to an estimated USD 33,662.24 million by 2032, with a compound annual growth rate (CAGR) of 9.62% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Military Airborne Radar Market Size 2024 |

USD 16,144.5 million |

| Military Airborne Radar Market, CAGR |

9.62% |

| Military Airborne Radar Market Size 2032 |

USD 33,662.24 million |

Growth in this market is driven by increasing defense budgets, ongoing fleet modernization, and the rising need for real-time surveillance. Governments are investing in advanced radar systems to enhance intelligence, surveillance, and reconnaissance capabilities. The demand for AESA and GaN-based radar technologies continues to rise due to their superior range, resolution, and electronic countermeasure resistance. Integration of AI-enabled signal processing and modular radar designs further strengthens operational readiness across diverse military platforms.

North America dominates the market, supported by strong defense expenditure and advanced radar development programs in the United States. Europe follows with steady upgrades in aircraft radar systems across NATO member nations. The Asia-Pacific region is emerging rapidly, with countries like China, India, and Japan expanding their aerial surveillance and border security initiatives. The Middle East focuses on enhancing airborne defense infrastructure, while Latin America and Africa show gradual adoption supported by modernization and joint defense projects.

Market Insights:

- The Military Airborne Radar Market is projected to grow from USD 16,144.5 million in 2024 to USD 33,662.24 million by 2032, at a CAGR of 9.62%.

- Increasing defense investments and modernization of air fleets are major factors driving market expansion worldwide.

- Rising demand for AESA and GaN-based radar technologies enhances detection accuracy and multi-mission performance.

- Integration of AI and digital signal processing improves radar efficiency and real-time decision-making capabilities.

- High procurement and maintenance costs of advanced radar systems remain key restraints for developing nations.

- North America leads the market due to significant radar R&D activities and large-scale military programs.

- Asia-Pacific shows the fastest growth, driven by expanding defense budgets and regional security initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Market Drivers

Rising Global Defense Expenditure and Strategic Modernization Programs

Global military budgets continue to rise, driving investments in radar modernization. Nations prioritize radar upgrades to enhance air dominance and early-warning capabilities. The Military Airborne Radar Market benefits from the integration of active electronically scanned array (AESA) technology that improves detection range and reliability. Governments in the U.S., China, and India invest heavily in indigenous radar development programs. Defense alliances support radar standardization to strengthen joint operations. Procurement of next-generation fighter jets also fuels the need for multi-mode radars. Increased cross-border surveillance demands enhance radar deployment across fleets. Strategic modernization programs ensure continuous demand growth across major defense markets.

- For instance, Northrop Grumman’s AN/APG-81 AESA radar, integrated into the F-35 Lightning II, delivers simultaneous air-to-air and air-to-ground detection, high-resolution SAR mapping, and electronic warfare capabilities. It is the core radar for over 3,000 planned F-35 aircraft globally, providing advanced situational awareness and mission versatility across all combat environments.

Growing Deployment of UAVs and Unmanned Combat Aircraft

The expansion of unmanned aerial vehicles (UAVs) in defense operations drives radar demand. Advanced radar systems support navigation, surveillance, and threat identification in autonomous missions. The Military Airborne Radar Market grows as nations adopt synthetic aperture radar (SAR) and maritime surveillance radars for UAV platforms. Lightweight radar units enhance operational range without compromising payload efficiency. Leading manufacturers develop compact, high-resolution radar modules for tactical drones. Integration of radar with data-link systems improves intelligence gathering. Countries increase funding for UAV fleets to support border security and reconnaissance. This expansion continues to strengthen radar integration in unmanned combat operations.

Increasing Focus on Multi-Mode and Network-Centric Capabilities

Defense agencies prefer multi-mode radars that perform search, tracking, and mapping in one platform. These systems deliver flexibility across diverse aerial missions. The Military Airborne Radar Market benefits from rising adoption of network-centric radar architectures that share real-time data across units. Modern radar suites link with electronic warfare and communications systems to enhance situational awareness. Nations upgrade older radar fleets to match multi-domain battlefield requirements. Integration with satellite and ground systems improves threat coordination. Such convergence of technologies raises performance standards in both tactical and strategic missions. Defense forces invest in modular radar architectures for easy upgrades and interoperability.

- For instance, Thales’ RBE2 AESA radar, fitted on the Dassault Rafale, enables simultaneous multi-target tracking and high-resolution ground mapping under all weather conditions. It has recorded over 150,000 flight hours across multiple air forces, demonstrating strong reliability and continuous software-driven enhancements.

Technological Innovation in Signal Processing and Artificial Intelligence

Advances in digital signal processing and AI algorithms drive radar evolution. AI-enabled systems reduce operator workload and enhance target recognition accuracy. The Military Airborne Radar Market sees new radar systems capable of differentiating between aerial and ground targets in complex environments. Adaptive beamforming techniques improve detection under heavy electronic interference. Machine learning models predict and classify threats faster than traditional systems. Governments support research on autonomous radar decision-making to boost mission efficiency. Companies integrate AI modules into AESA radars for predictive tracking. These innovations redefine radar capabilities for future aerial warfare environments.

Key Market Trends

Shift Toward AESA and GaN-Based Radar Systems

Active electronically scanned array (AESA) technology dominates new procurement contracts. Governments prioritize AESA radars for superior beam steering and low maintenance. The Military Airborne Radar Market trends toward GaN-based transmitters that deliver higher efficiency and power density. These components improve detection of stealth targets and reduce system size. Leading companies integrate GaN modules to enhance thermal performance and longevity. AESA radars support faster frequency hopping to counter electronic jamming. Global radar manufacturers expand production lines for AESA variants. The shift strengthens operational reliability in both tactical and strategic missions.

Integration of Radar with Advanced Avionics and C4ISR Systems

adar technology increasingly merges with command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) frameworks. The Military Airborne Radar Market evolves toward integrated mission systems that share data across platforms. Network-enabled radar suites enhance coordination among fighter jets and ground units. These integrations improve situational awareness and reduce decision-making time in complex missions. Modern combat aircraft employ radars as central nodes in digital warfare ecosystems. Interoperability between radar and avionics strengthens mission continuity. Industry leaders invest in open-architecture systems to enable easy upgrades. This trend defines the new standard in airborne mission management.

Growing Demand for Maritime Patrol and Surveillance Aircraft

The demand for radar-equipped maritime patrol aircraft expands with global maritime security concerns. Nations upgrade radar systems for coastal surveillance and anti-submarine operations. The Military Airborne Radar Market benefits from multi-domain surveillance programs covering sea and air defense. Long-range radars with surface detection features gain importance in naval cooperation. Manufacturers focus on radar designs that track low-flying aircraft and small vessels. Countries in Asia-Pacific and the Middle East emphasize maritime domain awareness. Governments invest in radar modernization to monitor exclusive economic zones. This trend accelerates global adoption of advanced airborne radar technologies.

- For instance, Thales’ Searchmaster airborne surveillance radar can track up to 1,000 targets simultaneously and provides 360° AESA coverage. It supports five mission types, including maritime patrol, anti-surface warfare, anti-submarine warfare, ground surveillance, and air surveillance.

Rise of Compact, Modular, and Lightweight Radar Systems

Miniaturization drives innovation across airborne radar production. Compact radar modules enable deployment on smaller aircraft and UAVs. The Military Airborne Radar Market shows strong momentum for modular radar designs that simplify maintenance and upgrades. These systems support multiple mission profiles without increasing aircraft load. New radar configurations improve mobility and fuel efficiency. Lightweight structures enhance range and reduce lifecycle costs. Aerospace firms design plug-and-play radar units adaptable to different platforms. This modular trend fosters scalability and rapid technology deployment across air fleets.

- For instance, Raytheon’s PhantomStrike AESA radar is a modular lightweight radar system weighing under 100 lbs, half the size and cost of legacy APG-82 and APG-79 systems, designed for rapid installation on smaller fighter and UAV platforms according to official Raytheon releases.

Market Challenges Analysis

High Procurement and Lifecycle Costs of Advanced Radar Systems

Modern radar systems require large budgets for research, procurement, and maintenance. Governments face rising expenses due to expensive semiconductor components and software integration. The Military Airborne Radar Market experiences pressure from cost escalation across development phases. Complex AESA and GaN modules add to overall expenses and training requirements. Smaller nations find it difficult to sustain radar modernization programs. Long certification processes extend procurement timelines. Maintenance costs rise with the need for specialized personnel and diagnostic equipment. These financial barriers limit adoption among developing defense markets.

Concerns Over Cybersecurity and Electronic Warfare Vulnerabilities

Electronic warfare threats challenge radar reliability in contested airspaces. Adversaries develop advanced jamming and spoofing technologies to disable detection systems. The Military Airborne Radar Market faces challenges in safeguarding radar data networks. Integration with C4ISR systems exposes radars to cyber-intrusion risks. Governments invest in encryption protocols, yet vulnerabilities persist due to software complexity. Continuous patching and testing increase operational downtime. Cyber-resilient radar frameworks require constant innovation. These issues highlight the urgency for defense agencies to secure radar ecosystems across mission networks.

Market Opportunities

Emerging Demand for AI-Driven Predictive Radar Analytics

Artificial intelligence opens new possibilities in radar analytics and mission automation. AI-based systems enable faster target recognition and reduced operator dependency. The Military Airborne Radar Market gains traction through machine learning models that enhance radar performance. Predictive analytics allow early threat identification, improving mission outcomes. Industry leaders integrate AI in AESA systems to optimize frequency allocation. Governments sponsor research for intelligent radar systems capable of autonomous operation. The push for smarter warfare strengthens radar innovation pipelines. These developments present major opportunities for defense technology suppliers.

Expansion of Cross-Border Defense Collaborations and Export Programs

International defense partnerships stimulate radar technology exchange and co-production. The Military Airborne Radar Market benefits from joint ventures among NATO members and allied nations. Collaborative projects reduce production costs and foster standardization. Export programs by the U.S., France, and Israel expand radar deployment in emerging economies. Technology sharing agreements promote interoperability across multinational air forces. Governments prioritize local manufacturing to boost defense self-reliance. The trend creates strong export potential for next-generation radar systems. Expanding alliances continue to open new opportunities for global radar manufacturers.

Market Segmentation Analysis:

By Component

The antenna segment leads the Military Airborne Radar Market due to its central role in signal transmission and reception. Advanced phased-array antennas deliver higher accuracy and broader scanning coverage. Transmitters and receivers remain vital for ensuring consistent signal strength and data clarity during operations. Duplexers and circulators enable smooth transmission between send and receive cycles. Power amplifiers improve signal output for long-range detection. The segment benefits from ongoing innovation in solid-state technologies and miniaturized electronics. Integration of digital signal processors strengthens radar performance. The inclusion of inertial and stabilization systems ensures accurate readings across dynamic flight environments.

- For instance, Northrop Grumman’s AN/APG-81 AESA radar, used on the F-35 Lightning II, features an antenna array of 1,676 transceivers and provides air-to-air detection ranges up to 125 km for targets with a 1 m² radar cross-section, with a reported mean time between failures (MTBF) exceeding 700 hours.

By Application / Mission

Surveillance applications dominate the Military Airborne Radar Market, driven by growing demand for early warning and reconnaissance capabilities. Weapon guidance systems rank second due to continuous upgrades in targeting precision and missile engagement. Airborne mapping, including synthetic aperture radar (SAR), supports intelligence and battlefield analysis. Radar solutions in this category provide real-time imagery and terrain monitoring for tactical missions. Other uses include navigation, search, and rescue operations that enhance mission flexibility. Expanding border surveillance programs further boost demand across both developed and emerging defense markets.

- For instance, Saab’s Erieye AEW&C radar, installed on the Saab 2000 platform, has an instrumental range of 450 km and can detect fighter-sized targets at 350 km in dense electronic warfare environments, with 360° coverage and the ability to track multiple air and sea targets simultaneously.

By Aircraft Type / Product

Fighter aircraft hold the largest share of the Military Airborne Radar Market due to their high deployment rate and advanced radar integration. Attack aircraft and maritime patrol variants use radars for targeting and sea surveillance functions. Transport aircraft integrate radar for navigation and threat detection during large-scale missions. Multi-mission capabilities increase operational value for airborne early warning systems. Other aircraft types, including unmanned and reconnaissance models, show growing adoption of lightweight radar solutions. The trend toward radar modernization across fleets reinforces strong growth within this segment.

By Range

Long-range radar systems dominate the Military Airborne Radar Market, supporting early detection and wide-area surveillance. Medium-range systems serve tactical missions and multi-domain coordination. Short-range radars remain critical for navigation and target engagement in low-altitude combat. Long-range solutions enable strategic coverage over maritime and border zones. Nations focus on improving radar resolution and detection range to enhance situational awareness. Defense modernization programs emphasize scalable radar range systems adaptable to different mission profiles. This diversity sustains steady growth across all operational categories.

Segmentation:

By Component

- Antenna

- Transmitter

- Receiver

- Duplexer / Circulator

- Power Amplifier

- others

By Application / Mission

- Surveillance

- Weapon Guidance

- Airborne Mapping

- Others

By Aircraft Type / Product

- Fighter Aircraft

- Attack Aircraft

- Maritime Patrol Aircraft

- Transport Aircraft

- Others

By Range

- Short Range

- Medium Range

- Long Range

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North American region leads the Military Airborne Radar Market with an approximate market share of 38.36% in 2024. Strong defense spending in the United States and widespread adoption of advanced radar systems on airborne platforms underpin this dominance. The region’s mature industrial base and long-standing defense alliances boost procurement activity. It continues to invest in next-generation radar architectures, including AESA and software-defined variants, which drive demand. Robust research and development ecosystems further support market leadership. The presence of major radar manufacturers headquartered in North America also reinforces its position.

In Europe the market share hovers near 20-25%, supported by coordinated defence procurement among NATO member states. Countries such as France, Germany, Italy and the UK drive airborne radar upgrades for fighter, transport and AEW&C platforms. Interoperability standards and joint development programmes promote radar system deployment across the region. The region emphasizes modular upgrades and legacy-fleet modernization, which sustains steady adoption of airborne radar solutions. Investment flows from emerging Eastern European markets and Baltic states further enhance growth. Europe’s commitment to defense autonomy and local manufacturing supports its market presence.

The Asia-Pacific region records a share of approximately 30-35%, with the highest growth trajectory among major geographies. Rapid fleet expansion, UAV adoption and maritime patrol needs push demand in countries such as China, India, Japan and South Korea. Regional tensions and border security imperatives motivate accelerated airborne radar procurement programmes. Local manufacturing and technology partnerships reduce dependency on imports and support shorter delivery cycles. Emerging economies in Southeast Asia and Oceania now contribute increasing incremental demand. The combination of fleet growth and modernization underpins this region’s rising significance in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Military Airborne Radar Market features several established global players that dominate technology provision and contract fulfilment. Leading companies include Lockheed Martin Corporation, L3Harris Technologies and Northrop Grumman Corporation based in the U.S., along with European firms such as Thales Group and Saab AB. These firms maintain competitive edges through sustained investment in research and development of AESA, GaN‐based transmitters and software-defined radar systems. They leverage broad avionics integration and global service networks to support radar system lifecycle requirements. Mid-tier and emerging defence contractors increasingly challenge incumbents via niche specialisations, regional partnerships and cost-effective solutions. The market exhibits pressures for faster delivery, lower total cost of ownership and increased modularity. Suppliers that respond with open architectures and upgradeable platforms strengthen their competitive standing. The interplay between innovation, contract wins and export programmes will shape leadership in this market.

Recent Developments:

- In November 2025, Lockheed Martin advanced the Military Airborne Radar market by demonstrating the use of a 5th Generation F-22 Raptor fighter to command a drone in-flight through open cockpit interfaces at Nellis Air Force Base, Nevada.

- In October 2025, Saab was awarded a contract valued at approximately $46 million by the U.S. Army to deliver Giraffe 1X airborne radar systems, with deliveries set to begin in 2026. This deal highlights the U.S. Army’s increasing reliance on advanced mobile radar solutions for enhanced air defense and counter-unmanned aerial system capabilities, leveraging Giraffe 1X’s real-time air surveillance and operational flexibility across ground and naval platforms.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application / Mission, Aircraft Type / Product and Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Military Airborne Radar Market will experience consistent growth driven by defense modernization and increased border security needs.

- Integration of advanced radar technologies like AESA and GaN-based systems will remain a major innovation focus.

- Demand for compact and lightweight radar modules will expand, supporting UAV and next-generation aircraft platforms.

- Artificial intelligence and machine learning will enhance real-time threat detection and signal processing efficiency.

- Multi-mode radar systems capable of surveillance, tracking, and guidance will gain higher adoption across armed forces.

- The shift toward software-defined and modular radar architectures will improve system flexibility and upgrade potential.

- Cross-border defense collaborations will accelerate radar co-development and technology transfer programs.

- Expanding maritime patrol and ISR missions will boost radar installation on long-range and multi-role aircraft.

- Asia-Pacific will emerge as a key growth region with rising procurement by major defense economies.

- Sustainability in radar manufacturing and extended lifecycle support will shape long-term industry competitiveness.