Market Overview

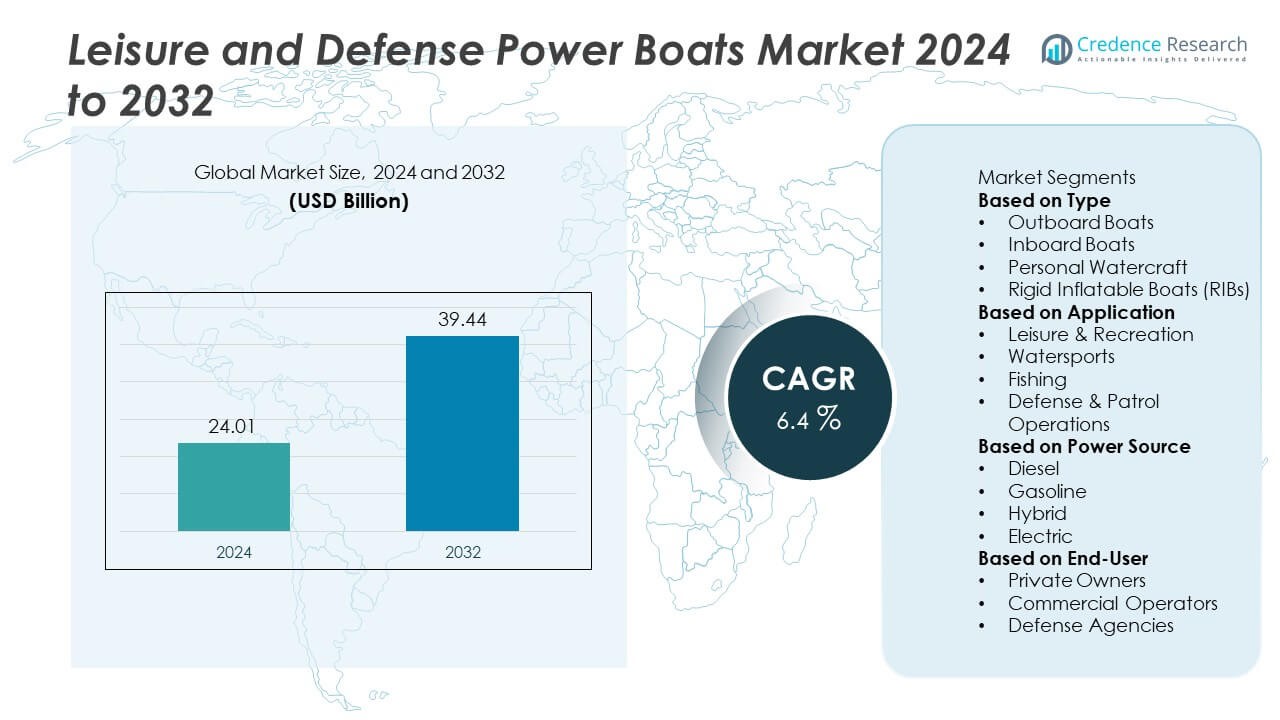

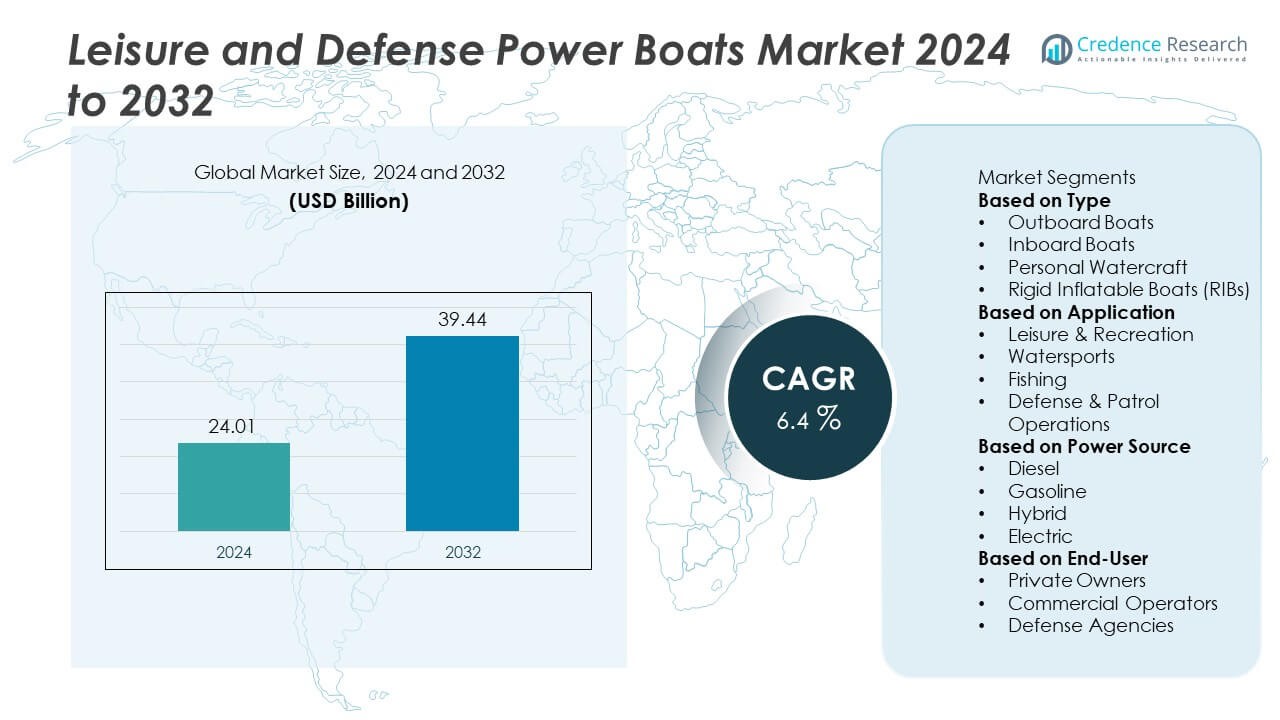

The Leisure and Defense Power Boats market reached USD 24.01 billion in 2024 and is projected to reach USD 39.44 billion by 2032, registering a 6.4% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Leisure and Defense Power Boats Market Size 2024 |

USD 24.01 Billion |

| Leisure and Defense Power Boats Market, CAGR |

6.4% |

| Leisure and Defense Power Boats Market Size 2032 |

USD 39.44 Billion |

Top players in the Leisure and Defense Power Boats market include Brunswick Corporation, Yamaha Motor Corporation, Bombardier Recreational Products (BRP), Beneteau Group, Kawasaki Heavy Industries, Zodiac Nautic, Ferretti Group, Boston Whaler, Damen Shipyards Group, and Viking Yacht Company. These companies drive market growth by offering advanced leisure boats, personal watercraft, luxury yachts, and high-speed patrol vessels designed for both recreational and defense use. North America leads the market with a 38% share, supported by strong marine tourism and robust defense procurement. Europe follows with a 28% share, driven by active boating cultures and established shipbuilding industries. Asia-Pacific holds a 23% share, fueled by rising disposable income, growing coastal tourism, and increasing maritime security needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Leisure and Defense Power Boats market was valued at USD 24.01 billion in 2024 and will reach USD 39.44 billion by 2032, growing at a 6.4% CAGR due to rising demand for recreational and security-focused marine vessels.

- Strong demand for leisure boating and marine tourism drives growth, with outboard boats holding a 46% segment share as users prefer easy maintenance, strong maneuverability, and cost efficiency.

- Key trends include rising adoption of electric and hybrid propulsion, expansion of luxury features, and increased investment in high-speed patrol and rescue vessels driven by maritime security needs.

- Competition strengthens as major players focus on lightweight materials, digital navigation, efficient propulsion systems, and advanced hull designs to enhance performance and comfort.

- Regionally, North America leads with a 38% share, followed by Europe at 28%, Asia-Pacific at 23%, Latin America at 6%, and the Middle East & Africa at 5%, supported by tourism growth and expanding coastal defense activities.

Market Segmentation Analysis:

By Type

Outboard boats lead this segment with a 46% market share, driven by their strong maneuverability, lower maintenance needs, and wide use in leisure and fishing activities. These boats attract private users due to easy handling and flexible engine upgrades. Personal watercraft also gain traction among watersport users, supported by rising demand for compact and high-speed models. Rigid inflatable boats (RIBs) expand in defense and rescue operations because of their stability and durability. Inboard boats maintain steady adoption in premium leisure and sports boating, supported by strong engine performance and higher onboard comfort.

- For instance, BRP’s Sea-Doo RXP-X 325 produces 325 horsepower and reaches a top speed of 110 km/h, making it one of the fastest production personal watercraft.

By Application

Leisure and recreation dominate this segment with a 52% market share, fueled by growing interest in marine tourism, coastal cruising, and family boating activities. Rising disposable income and expansion of waterfront leisure infrastructure support adoption across major markets. Watersports gain momentum as younger users adopt high-speed models and personal watercraft. Fishing applications show steady growth due to increased use of lightweight and fuel-efficient boats. Defense and patrol operations continue to invest in high-speed interceptor boats and RIBs to strengthen maritime security and surveillance.

- For instance, Kawasaki’s Jet Ski Ultra 310 delivers 310 horsepower and uses a 1,498-cc supercharged engine favored in performance sports.

By Power Source

Gasoline-powered boats hold a 58% market share, driven by their strong performance, widespread availability, and suitability for small to mid-size recreational models. These engines remain popular among leisure and sports users seeking higher speed and reduced vibration. Diesel-powered boats gain preference in larger vessels due to better torque and long-distance efficiency. Hybrid solutions grow as manufacturers adopt cleaner propulsion systems for reduced emissions. Electric powerboats emerge in marinas and inland waterways due to noise reduction benefits and regulatory support for eco-friendly marine mobility.

Key Growth Drivers

Rising Interest in Marine Tourism and Recreational Activities

Growing participation in boating, coastal travel, and water-based leisure activities drives strong demand for power boats. Consumers invest in compact leisure craft, sports boats, and personal watercraft for weekend travel and outdoor recreation. Coastal tourism operators also expand fleets to meet rising guest demand for sailing, cruising, and adventure rides. Waterfront infrastructure improvements, such as marinas and rental services, further support market growth. Higher disposable income in developed and emerging regions encourages spending on premium leisure boats with advanced comfort and safety features.

- For instance, the modern Yamaha Motor’s VX Cruiser HO personal watercraft produces 1898 cc displacement and delivers approximately 149 kW (200 horsepower) output, enabling high-load rental operations.

Increasing Demand for High-Speed Defense and Patrol Vessels

Defense agencies increase procurement of high-speed interceptor boats, RIBs, and tactical vessels to improve maritime security. These boats support coastal surveillance, anti-smuggling operations, and rapid response tasks. Governments invest in lightweight hulls, advanced propulsion, and radar-equipped patrol systems to strengthen naval capabilities. Rising geopolitical tensions and cross-border monitoring requirements accelerate adoption. Manufacturers develop rugged, fuel-efficient defense boats that operate in harsh sea conditions, supporting sustained demand from military, coast guard, and rescue agencies.

- For instance, the Metal Shark 45 Defiant patrol craft uses twin 705-horsepower Cummins QSM11 diesel engines and reaches top speeds approaching 40+ knots during border enforcement duties.

Technological Advancements in Hull Design and Propulsion Systems

Modern power boats benefit from advanced materials, improved hydrodynamics, and efficient propulsion technologies. Lightweight composites enhance performance, speed, and durability. Innovations in outboard engines, hybrid systems, and electric propulsion reduce emissions and enhance fuel savings. Digital navigation tools, integrated control systems, and smart onboard electronics improve safety and user experience. These advancements increase interest among both leisure users seeking premium comfort and defense users requiring precision and reliability.

Key Trends & Opportunities

Growing Shift Toward Sustainable and Electric Marine Propulsion

Eco-friendly propulsion becomes a major trend as marinas and coastal regulators push for lower emissions and quieter operations. Electric and hybrid power boats gain traction in lakes, inland waterways, and urban waterfronts. Manufacturers invest in long-range battery systems, fast-charging docks, and lightweight electric motors. Consumers adopt sustainable models for leisure travel, while commercial operators explore electric fleets for tours and rentals. The trend creates new opportunities for innovation in charging infrastructure and marine battery technology.

- For instance, Torqeedo’s Deep Blue 50R outboard provides 50 kW continuous output and uses a high-voltage system that pairs with specific Deep Blue Battery models, such as the Deep Blue Battery 40 (offering 38 kWh usable capacity) or the Deep Blue Battery 80 (offering 77.6 kWh usable capacity), which can be combined for extended range.

Expansion of Luxury Features and Digital Integration

Premium leisure boats increasingly feature smart displays, digital controls, advanced navigation, and automated docking systems. Buyers prefer high-comfort features such as climate-controlled cabins, entertainment systems, and customizable interiors. The rise in luxury marine tourism drives demand for stylish, high-performance models. Manufacturers integrate telematics, remote diagnostics, and safety automation to enhance user experience. This trend expands opportunities in connected boating and high-value recreational vessels.

- For instance, Garmin’s GPSMAP 8417 marine display integrates a 17-inch touchscreen with multi-GNSS positioning and advanced sonar, improving luxury boat navigation.

Key Challenges

High Purchase and Maintenance Costs

Power boats require significant investment, limiting adoption among middle-income buyers. High costs of engines, onboard electronics, and marine-grade materials raise overall vessel prices. Maintenance expenses, storage fees, and fuel consumption further challenge affordability. Commercial and defense operators also face high lifecycle costs due to continuous repair, upgrading, and inspection requirements. These financial barriers slow market penetration in several regions.

Regulatory Restrictions and Environmental Compliance Pressure

Strict regulations on emissions, noise levels, and waterway access challenge manufacturers and users. Coastal regions enforce limits on engine output and restrict high-speed boating in sensitive zones. Defense vessels must comply with safety standards and operational certifications. Environmental rules push manufacturers to redesign propulsion systems and adopt low-emission technologies, increasing development costs. These regulatory burdens slow deployment in some markets and demand continuous adaptation from boat builders.

Regional Analysis

North America

North America leads the Leisure and Defense Power Boats market with a 38% market share, supported by strong demand for recreational boating, fishing activities, and marine tourism. The region benefits from well-developed marina networks, high consumer spending, and strong adoption of premium leisure boats. The U.S. Coast Guard and defense agencies also increase procurement of high-speed patrol boats and RIBs for coastal security. Growing interest in water sports and lake tourism further boosts sales of personal watercraft and outboard models. Technological upgrades in propulsion systems and digital navigation tools continue to strengthen market growth across the region.

Europe

Europe holds a 28% market share, driven by high participation in leisure boating across coastal countries such as Italy, France, Norway, and the U.K. Rising demand for sailing, cruising, and luxury yachts supports strong market expansion. The region benefits from established boatbuilding industries and advanced design capabilities, especially in high-performance and eco-friendly propulsion systems. Defense modernization initiatives in countries including France and Germany increase adoption of patrol boats and rigid inflatable vessels. Environmental regulations also push manufacturers to develop cleaner, fuel-efficient models.

Asia-Pacific

Asia-Pacific accounts for a 23% market share, fueled by rising disposable income, expanding marine tourism, and growing interest in recreational boating across China, Japan, Australia, and Southeast Asia. Coastal resorts increase fleet investments for water sports, tours, and rental activities. Defense and coast guard agencies also procure fast patrol boats and interceptor vessels to strengthen maritime security. Increased focus on local boat manufacturing and rapid adoption of fiberglass and aluminum models drive regional production. Expanding yacht clubs and marina facilities further accelerate market growth.

Latin America

Latin America holds a 6% market share, supported by increasing interest in coastal recreation, marine tourism, and fishing activities. Countries such as Brazil, Mexico, and Argentina show rising adoption of outboard and personal watercraft models. Growth in tourism-focused coastal towns increases demand for rental boats and guided water activities. Defense agencies also expand procurement of rigid inflatable boats and patrol vessels for border and coastal surveillance. Economic fluctuations limit high-end boat purchases, yet steady adoption continues across mid-range leisure models.

Middle East & Africa

The Middle East & Africa account for a 5% market share, driven by luxury marine tourism, waterfront development projects, and increased interest in high-performance leisure boats. Wealthier regions such as the UAE, Saudi Arabia, and Qatar invest in premium yachts and sports boats. Defense and maritime security agencies procure high-speed interceptor vessels to enhance coastal monitoring. Africa sees growing interest in fishing and small leisure vessels but remains price-sensitive. Expansion of marinas, tourism infrastructure, and government security initiatives support ongoing market development across the region.

Market Segmentations:

By Type

- Outboard Boats

- Inboard Boats

- Personal Watercraft

- Rigid Inflatable Boats (RIBs)

By Application

- Leisure & Recreation

- Watersports

- Fishing

- Defense & Patrol Operations

By Power Source

- Diesel

- Gasoline

- Hybrid

- Electric

By End-User

- Private Owners

- Commercial Operators

- Defense Agencies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Leisure and Defense Power Boats market includes leading players such as Brunswick Corporation, Yamaha Motor Corporation, Bombardier Recreational Products (BRP), Beneteau Group, Kawasaki Heavy Industries, Zodiac Nautic, Ferretti Group, Boston Whaler, Damen Shipyards Group, and Viking Yacht Company. These companies compete by offering a wide range of high-performance leisure boats, personal watercraft, luxury yachts, rigid inflatable boats, and advanced patrol vessels. Manufacturers focus on lightweight materials, efficient propulsion systems, and digitally integrated navigation to meet rising demand across both recreational and defense applications. Strategic partnerships with marina operators, tourism companies, and defense agencies help expand market reach and strengthen after-sales support. Continuous investment in hybrid and electric propulsion further strengthens competitiveness as sustainability becomes a key purchasing factor. Innovation in hull design, onboard comfort, and safety systems remains central to maintaining product differentiation in a growing and technologically evolving marine market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Brunswick Corporation

- Yamaha Motor Corporation

- Bombardier Recreational Products (BRP)

- Beneteau Group

- Kawasaki Heavy Industries

- Zodiac Nautic

-

Ferretti Group

- Boston Whaler

- Damen Shipyards Group

- Viking Yacht Company

Recent Developments

- In September 2025, Brunswick Corporation announced the strategic consolidation of its fiberglass boat manufacturing operations to optimise production across its boat brands.

- In April 2025, Yamaha also acquired Telwater, an Australian boat manufacturer, to expand its marine business sales network and strengthen its foundations in the global recreational marine market.

- In March 2025, Yamaha Motor Corporation did introduce a new, next-generation model of its HARMO system to the Japanese market, which included integration with their Helm Master EX system to boost maneuverability and expand compatibility.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Power Source, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recreational boating will rise as marine tourism and coastal activities grow.

- Electric and hybrid propulsion systems will gain traction across leisure and patrol vessels.

- Advanced hull materials will improve durability, speed, and fuel efficiency for new models.

- Smart navigation, automation, and digital safety features will enhance onboard experience.

- Defense agencies will increase procurement of high-speed patrol and interceptor boats.

- Rigid inflatable boats will expand in rescue, surveillance, and military operations.

- Luxury yachts and premium leisure boats will see higher adoption among affluent buyers.

- Growth in marina infrastructure will support wider use of leisure and rental fleets.

- Sustainability regulations will push manufacturers to adopt cleaner technologies.

- Coastal security needs will drive innovation in lightweight, high-performance defense vessels.