Market Overview

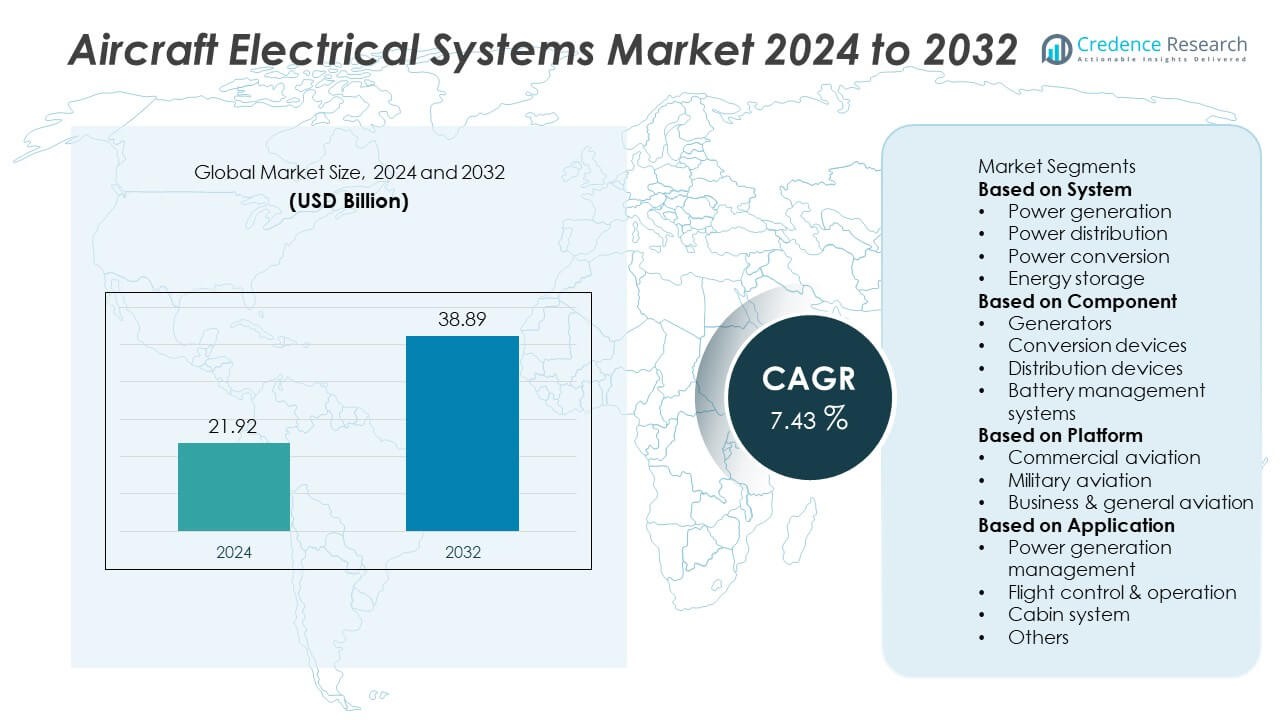

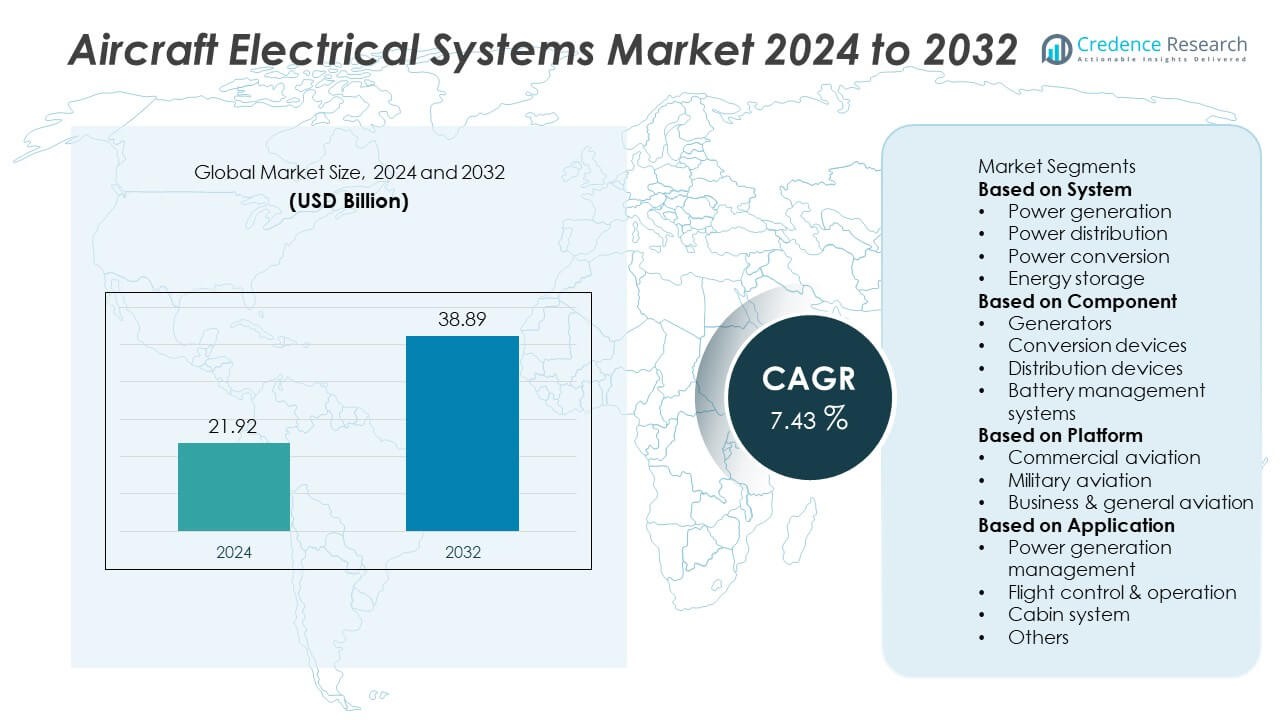

The Aircraft Electrical Systems market reached USD 21.92 billion in 2024 and is projected to reach USD 38.89 billion by 2032, expanding at a 7.43% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Electrical Systems Market Size 2024 |

USD 21.92 Billion |

| Aircraft Electrical Systems Market, CAGR |

7.43% |

| Aircraft Electrical Systems Market Size 2032 |

USD 38.89 Billion |

Top players in the Aircraft Electrical Systems market include GE Aviation, Astronics, Amphenol, Nabtesco, Honeywell, BAE Systems, Meggitt, Ametek, Crane Aerospace & Electronics, and Avionic Instruments. These companies drive industry growth by supplying advanced power generation units, high-voltage distribution systems, conversion devices, and energy storage solutions for modern commercial, military, and business aircraft. Their focus on lightweight architectures, digital power management, and improved thermal efficiency supports the global shift toward more-electric and hybrid-electric platforms. Regionally, North America leads the market with a 37% share due to strong aircraft production and defense investments. Europe follows with a 29% share, supported by major OEM presence, while Asia-Pacific holds 26%, driven by expanding fleets and rising air travel demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aircraft Electrical Systems market reached USD 21.92 billion in 2024 and will grow to USD 38.89 billion by 2032 at a 7.43% CAGR, supported by rising electrification across modern aircraft.

- Demand strengthens as power-generation systems, which hold a 41% segment share, support higher electrical loads driven by advanced avionics, digital cockpits, and onboard electronics.

- Trends center on high-voltage DC systems, smart power-distribution units, lightweight converters, and enhanced energy-storage technologies aligned with more-electric and hybrid-electric aircraft programs.

- Competition intensifies as major players focus on thermal-management innovation, modular electrical architectures, and certification-ready designs to meet increasing reliability and efficiency needs.

- Regionally, North America leads with 37%, followed by Europe at 29%, Asia-Pacific at 26%, Latin America at 5%, and the Middle East & Africa at 3%, reflecting strong global adoption across commercial, military, and general aviation fleets.

Market Segmentation Analysis:

By System

Power generation leads this segment with a 41% market share, driven by rising demand for advanced electrical power generation units in modern aircraft. The shift toward more-electric architectures increases the need for efficient generators that support avionics, flight controls, environmental systems, and onboard electronics. Airlines adopt high-capacity generation systems to reduce reliance on hydraulic and pneumatic systems, improving fuel efficiency and lowering maintenance needs. Power distribution grows steadily as aircraft integrate complex wiring networks and digital control units, while power conversion and energy storage gain traction with the development of hybrid-electric and next-generation aircraft platforms.

- For instance, Safran Electrical & Power developed the GENeUS™ 300 generator platform, which has a power output of 300 kW (approximately 375 kVA at 0.8 power factor), enabling higher electrical load support for large commercial jets and meeting new-generation power demands.

By Component

Generators dominate this segment with a 38% market share, supported by their essential role in supplying stable electrical power for propulsion, avionics, and cabin systems. Modern aircraft require high-output, lightweight, and reliable generators to meet rising electrical loads. Distribution devices grow with increased installation of smart power management units, circuit breakers, and digital monitoring systems. Power conversion devices gain traction as aircraft adopt variable frequency and high-voltage DC systems. Battery management systems expand as electric aircraft prototypes and auxiliary power upgrades drive demand for advanced energy storage technologies.

- For instance, GE Aviation’s variable-frequency starter-generator delivers 250 kVA output and reduces system weight by nearly 90 kg compared to legacy designs, enabling improved operational efficiency in advanced commercial aircraft.

By Platform

Commercial aviation holds a 54% market share, driven by high aircraft production rates, expanding passenger traffic, and continuous upgrades in electrical and avionics systems. Airlines prioritize efficient electrical architectures to reduce fuel consumption, support advanced cockpit technologies, and improve cabin comfort. Military aviation follows with advanced power systems used in combat aircraft, UAVs, and mission-critical platforms requiring high reliability and rugged performance. Business and general aviation show steady growth as modern jets integrate sophisticated electrical systems and lightweight power solutions to enhance safety, efficiency, and operational flexibility.

Key Growth Drivers

Rising Adoption of More-Electric and Hybrid-Electric Aircraft

The shift toward more-electric and hybrid-electric aircraft drives major growth in the Aircraft Electrical Systems market. Airlines and OEMs replace hydraulic and pneumatic systems with electrically powered components to improve fuel efficiency, reduce emissions, and lower maintenance costs. Modern aircraft require high-capacity generators, intelligent power distribution units, and lightweight conversion systems to support advanced avionics and flight-control functions. Growing interest in sustainable aviation and electrified propulsion accelerates technological upgrades. As manufacturers invest in next-generation aircraft programs, demand for reliable, high-output electrical architectures continues to rise worldwide.

- For instance, Airbus’ E-Fan X demonstrator featured a 2 MW electric motor and a 3,000 VDC electrical backbone, proving the feasibility of high-voltage propulsion systems for future hybrid-electric aircraft.

Increasing Demand for Advanced Avionics and Onboard Electronics

Rising use of digital cockpit systems, connectivity solutions, and passenger comfort electronics strengthens demand for high-performance electrical systems. Modern aircraft integrate sophisticated navigation, communication, and surveillance tools that require constant and stable electrical power. Airlines also add inflight entertainment, Wi-Fi, and power-supply ports, increasing electrical load requirements. Power generation and distribution systems become vital in maintaining aircraft safety and operational efficiency. Continuous upgrades in avionics for both commercial and military fleets further boost the need for advanced electrical components and architectures.

- For instance, Honeywell’s Primus Epic avionics suite uses a software-based modular architecture within its Modular Avionics Units, requiring advanced electrical integration to maintain stable performance on commercial and defense aircraft.

Growing Aircraft Production and Fleet Modernization Programs

Fleet expansion in commercial aviation and modernization of aging aircraft drive strong demand for upgraded electrical systems. Airlines replace older aircraft with fuel-efficient models that rely heavily on digital power management. Military aviation also invests in next-generation fighter jets, UAVs, and surveillance aircraft requiring high-capacity electrical units. OEMs increase production rates to meet rising passenger traffic, especially in Asia-Pacific and the Middle East. These factors create sustained demand for generators, distribution equipment, conversion devices, and advanced energy storage systems across global fleets.

Key Trends & Opportunities

Shift Toward High-Voltage DC and Smart Power Distribution Systems

Aircraft increasingly adopt high-voltage DC systems to support higher electrical loads, reduce wiring complexity, and improve overall system efficiency. Smart power distribution units equipped with digital monitoring, fault detection, and automated load management gain strong traction. These systems enhance aircraft reliability and reduce maintenance downtime by identifying failures in real time. As electric propulsion technologies advance, opportunities emerge for integrating intelligent converters, solid-state circuit breakers, and lightweight wiring. This trend opens new paths for innovation across both commercial and defense aircraft programs.

- For instance, Collins Aerospace developed a 270 VDC power distribution system with solid-state switching capable of handling 15 kW per channel, enabling faster fault isolation and significantly improving load management for high-voltage aircraft architectures.

Advancements in Battery Technologies and Energy Storage Solutions

Energy storage becomes a key opportunity as aviation moves toward electric taxiing, emergency backup systems, and hybrid-electric propulsion. Lightweight lithium-ion, solid-state, and high-density battery systems gain attention for their ability to improve power availability and reduce fuel consumption. Improved battery management systems enhance safety, thermal performance, and energy efficiency. Manufacturers invest in advanced storage solutions that support future electric aircraft concepts. Growing R&D activity in aviation batteries creates long-term innovation opportunities for electrical system suppliers.

- For instance, Saft introduced a new aviation-grade lithium-ion battery pack with more than double the energy density of lead-acid counterparts and an integrated electronic management system designed to deliver stable performance across extreme temperature conditions for next-generation electric and hybrid aircraft platforms.

Key Challenges

High Integration Costs and Complex Certification Requirements

Aircraft electrical systems involve complex integration with avionics, propulsion, and safety-critical components, driving high development and installation costs. Strict aviation certification standards require extensive testing and validation, slowing adoption of new technologies. Retrofitting older aircraft with modern electrical architectures further increases cost and engineering challenges. OEMs and operators face financial burdens when upgrading systems, especially for large commercial fleets. These factors limit rapid modernization and affect adoption rates in cost-sensitive markets.

Thermal Management Issues and Increased Electrical Load

Rising electrical load from advanced avionics, entertainment systems, and electrified components increases heat generation, creating thermal management challenges. Overheating risks can impact system reliability and aircraft safety. High-density electrical units require enhanced cooling technologies, robust insulation, and heat-resistant materials, increasing design complexity. Managing power spikes, preventing electrical faults, and ensuring stable performance in extreme conditions remain critical issues. These challenges require continuous innovation in cooling systems, protective components, and power-management architectures.

Regional Analysis

North America

North America holds a 37% market share, driven by strong aircraft production, extensive fleet modernization programs, and widespread adoption of advanced avionics. Major OEMs and Tier-1 suppliers invest heavily in next-generation electrical architectures, including high-voltage systems and smart power distribution units. Commercial airlines upgrade electrical components to support connectivity, inflight entertainment, and enhanced cockpit systems. The U.S. military also accelerates procurement of advanced fighter jets and UAVs, boosting demand for high-performance electrical systems. Strong R&D spending, robust supply chains, and technological innovation continue to position the region as a leading market.

Europe

Europe accounts for a 29% market share, supported by the presence of major aircraft manufacturers, ongoing sustainability initiatives, and rising investment in more-electric aircraft programs. Airbus and regional aerospace suppliers prioritize lightweight electrical components and energy-efficient architectures across new models. European defense agencies enhance fleets with modern electrical systems for surveillance, transport, and combat aircraft. Strict environmental policies accelerate development of hybrid-electric and high-efficiency power systems. Growing demand for advanced avionics and digital cockpit upgrades further strengthens the market across Germany, France, the U.K., and Italy.

Asia-Pacific

Asia-Pacific holds a 26% market share, driven by rising air passenger traffic, expanding commercial fleets, and increasing investment in domestic aircraft production. China, India, Japan, and South Korea upgrade fleets with modern electrical systems to improve efficiency and meet safety standards. Regional carriers expand capacity, fueling demand for next-generation power generation, distribution, and conversion systems. Rapid urbanization and airport development support further growth. Defense modernization programs add to demand, particularly in combat aircraft and unmanned platforms. Strong manufacturing expansion and technology adoption continue to boost the regional market.

Latin America

Latin America captures a 5% market share, supported by steady growth in commercial aviation and increasing interest in fleet renewal programs. Airlines modernize electrical systems to improve efficiency, reduce operating costs, and support new avionics. Brazil and Mexico lead demand due to active participation in aerospace manufacturing and maintenance sectors. Budget constraints slow large-scale upgrades, yet regional carriers continue adopting advanced power systems for safety and performance improvements. Gradual defense investments in patrol and transport aircraft also contribute to market growth.

Middle East & Africa

The Middle East & Africa hold a 3% market share, driven by ongoing fleet expansion, rising air travel demand, and strong investments in premium aircraft by regional airlines. Gulf carriers prioritize advanced electrical systems to support connectivity, high-end cabin features, and fuel-efficient operations. Defense modernization programs in the UAE, Saudi Arabia, and South Africa boost adoption of high-capacity power systems. Growing airport infrastructure and new aviation projects contribute to market expansion. Despite economic challenges in parts of Africa, gradual improvements in aviation infrastructure support long-term growth.

Market Segmentations:

By System

- Power generation

- Power distribution

- Power conversion

- Energy storage

By Component

- Generators

- Conversion devices

- Distribution devices

- Battery management systems

By Platform

- Commercial aviation

- Military aviation

- Business & general aviation

By Application

- Power generation management

- Flight control & operation

- Cabin system

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Aircraft Electrical Systems market features key players such as GE Aviation, Astronics, Amphenol, Nabtesco, Honeywell, BAE Systems, Meggitt, Ametek, Crane Aerospace & Electronics, and Avionic Instruments. These companies compete by developing advanced power generation units, smart distribution systems, high-efficiency converters, and reliable energy storage solutions tailored for modern aircraft platforms. The market emphasizes lightweight materials, higher voltage architectures, and enhanced thermal management to meet increasing electrical load demands. Vendors invest heavily in R&D to support more-electric and hybrid-electric aircraft programs. Strategic partnerships with OEMs and Tier-1 suppliers strengthen integration across commercial, military, and business aviation segments. Companies also focus on digital monitoring, predictive maintenance, and modular electrical components to improve aircraft reliability and reduce operational costs. As electrification accelerates, competition intensifies around innovation, certification compliance, and long-term support capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Aviation

- Astronics

- Amphenol

- Nabtesco

- Honeywell

- BAE Systems

- Meggitt

- Ametek

- Crane Aerospace & Electronics

- Avionic Instruments

Recent Developments

- In June 2025, BAE Systems plc published its vision for aircraft electrification, including integrated control systems and power conversion architectures supporting more-electric and hybrid-electric aircraft.

- In April 2024, Safran Electrical & Power launched GENeUSCONNECT, a new series of high-power electrical harnesses. These harnesses complement the company’s existing electrical systems for next-generation all-electric and hybrid aircraft.

- In August 2023, Astronics Corporation accepted purchase orders from ten eVTOL aircraft OEMs for electrical power-distribution, conversion and vehicle charge-control systems for emerging urban air mobility.

Report Coverage

The research report offers an in-depth analysis based on System, Component, Platform, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- More-electric and hybrid-electric aircraft will accelerate demand for high-capacity electrical architectures.

- High-voltage DC systems will gain wider adoption to support increased onboard electrical loads.

- Lightweight generators and smart power-distribution units will become standard in new aircraft platforms.

- Advanced battery technologies will expand use in electric taxiing, backup power, and hybrid propulsion.

- Digital power-management systems will enhance efficiency, reliability, and predictive maintenance.

- Thermal-management innovations will improve safety and durability of high-density electrical components.

- UAVs and next-generation military aircraft will drive demand for rugged, high-performance electrical systems.

- Retrofit programs will rise as airlines upgrade aging fleets with modern electrical components.

- OEM partnerships will strengthen to support integrated electrical architectures across aircraft families.

- Sustainability goals will push manufacturers to adopt cleaner, lighter, and more efficient electrical technologies.