Market Overview

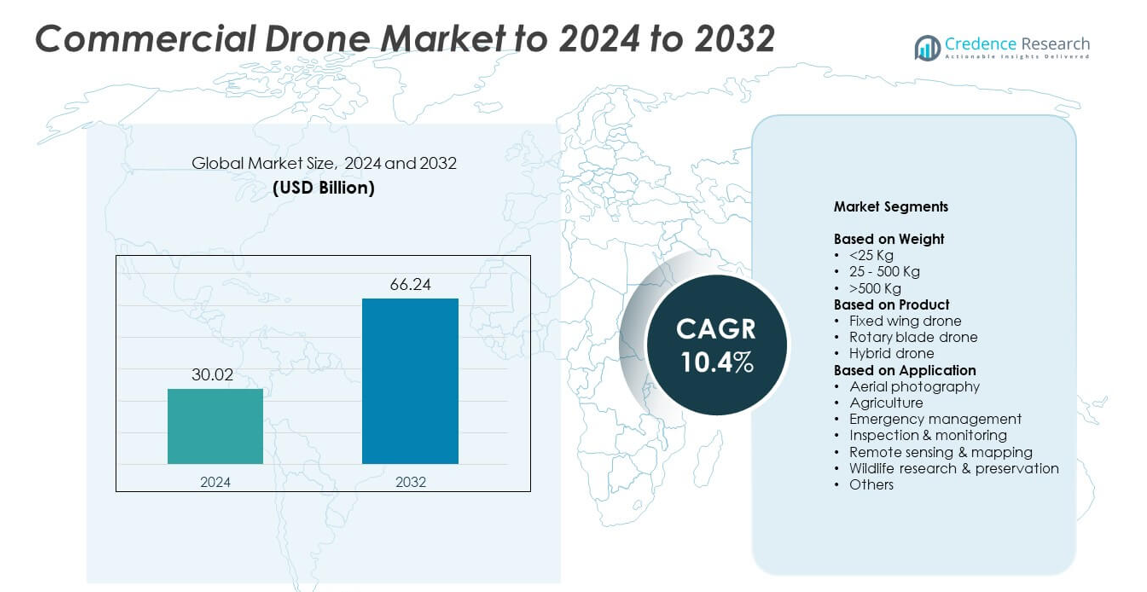

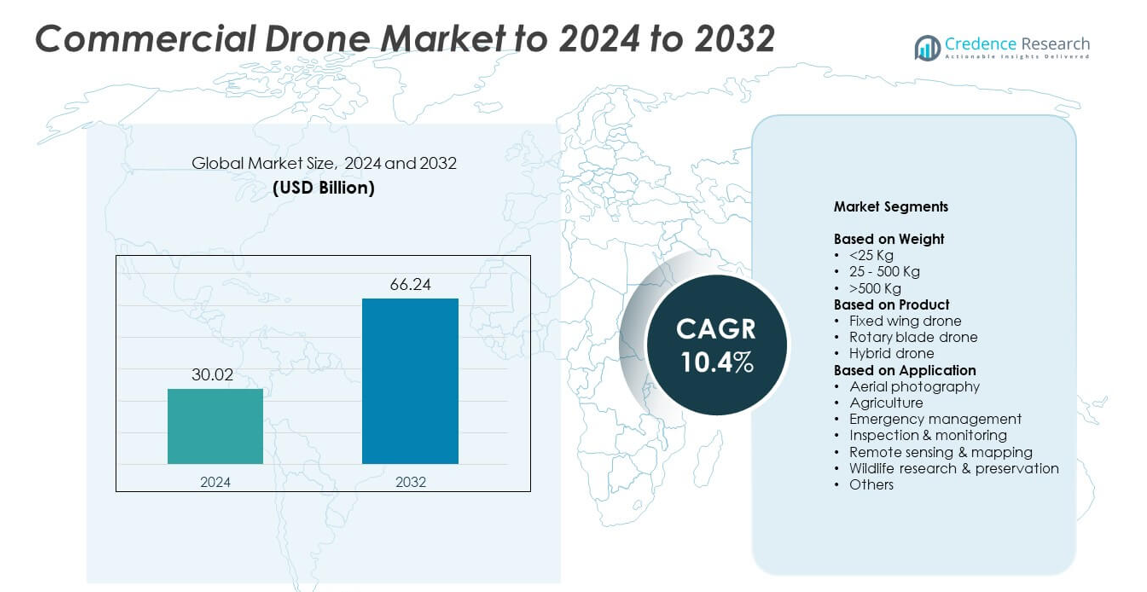

Commercial Drone Market size was valued at USD 30.02 billion in 2024 and is anticipated to reach USD 66.24 billion by 2032, at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Drone Market Size 2024 |

USD 30.02 billion |

| Commercial Drone Market, CAGR |

10.4% |

| Commercial Drone Market Size 2032 |

USD 66.24 billion |

The Commercial Drone Market is shaped by leading players including SZ DJI Technology Co Ltd, AeroVironment Inc., Autel Robotics, Intel Corporation, Parrot Drones SAS, PrecisionHawk Inc., Draganfly Innovations Inc., YUNEEC International, Guangzhou EHang Intelligent Technology Co. Ltd, and Aeronavics Ltd. These companies drive market growth through advanced flight systems, stronger imaging solutions, and wider use across agriculture, construction, logistics, and public safety. North America leads the global market with about 38% share due to strong enterprise adoption, early regulatory support, and high investment in drone-based inspection and emergency applications. Europe and Asia Pacific follow with rising industrial integration and expanding commercial pilots.

Market Insights

- The Commercial Drone Market was valued at USD 30.02 billion in 2024 and is expected to reach USD 66.24 billion by 2032, growing at a CAGR of 10.4%.

- Strong demand in inspection, mapping, and agriculture drives rapid adoption of lightweight drones, which held about 62% share of the weight segment in 2024.

- AI-driven automation, BVLOS approvals, and expanding drone delivery pilots shape major trends, with rotary blade drones leading the product segment at nearly 68% share.

- Competition intensifies as major vendors improve navigation, imaging, and endurance while meeting evolving regulatory and safety requirements.

- North America held about 38% share in 2024, followed by Europe at nearly 27% and Asia Pacific at around 25%, supported by industrial automation, public safety demand, and growing enterprise use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Weight

Drones under 25 kg held the dominant share in 2024 with about 62% of the Commercial Drone Market. Their strong lead came from easy regulatory approval, lower operating cost, and wide use across photography, mapping, farming, and inspection tasks. Lightweight models support simple training needs and smooth deployment for small and large enterprises. Growing demand for compact UAVs in real estate surveys and media also strengthens this segment. Mid-weight and heavy drones grow at a steady pace for cargo, defense, and industrial tasks but remain smaller due to higher price and licensing needs.

- For instance, DJI’s Matrice 300 RTK has a maximum takeoff weight of 9 kg, as stated in its official specification sheet.

By Product

Rotary blade drones accounted for the largest share in 2024 with nearly 68% of the Commercial Drone Market. Their widespread use comes from strong hovering ability, smooth vertical takeoff and landing, and high control in tight spaces. These features support major tasks such as inspection, agriculture spraying, surveillance, and short-range delivery. The flexible design also attracts new buyers in construction and utilities. Fixed-wing models expand in long-range mapping, while hybrid drones gain traction in energy, mining, and large-area monitoring due to extended flight endurance.

- For instance, Parrot’s ANAFI USA weighs 500 g and offers 32× zoom with a maximum flight time of 32 minutes, according to its technical documentation.

By Application

Aerial photography led the Commercial Drone Market in 2024 with around 31% share. High demand came from media, real estate, tourism, and event coverage, supported by stable 4K capture, smooth flight control, and simple operations for both hobby and professional users. Growth in marketing content and social platforms further boosts this segment. Agriculture follows with strong uptake in spraying and crop monitoring, while inspection, emergency response, and remote sensing gain momentum as industries expand digital workflows and rely more on automated field data.

Key Growth Drivers

Rising Industrial Automation Demand

Industries now depend on drones for faster data capture and lower field labor needs. Sectors such as construction, agriculture, energy, and mining use UAVs to improve accuracy and cut operational delays. High-resolution imaging and automated mapping help companies monitor assets and detect risks early. This shift supports faster project cycles and stronger safety standards. Growing digital workflows across major industries keep this driver strong

- For instance, Kespry reported that by early 2020, its customers had flown a total of 127,000 missions (with 50,000 flown in 2019 alone), captured a total of 25.4 million images (with 10.6 million captured in 2019 alone), and surveyed a total of 4.38 million acres (with 1.36 million acres surveyed in 2019 alone).

Expanding Use in Public Safety and Emergency Response

Public agencies deploy drones for search, disaster response, and real-time surveillance. UAVs offer rapid area coverage, reduce human exposure to danger, and support fast decision-making. The growing use of thermal cameras and night-vision tools improves rescue outcomes. Governments also adopt drones for firefighting support, hazard checks, and crowd monitoring. Rising investment in safety infrastructure fuels long-term growth.

- For instance, Teledyne FLIR’s SIRAS payload Vue TV128 combines a 16 megapixel visible camera with up to 128× zoom and a radiometric Boson thermal camera at 640 × 512 resolution.

Growth of E-Commerce and Delivery Applications

Rising online orders push interest in drone-based last-mile delivery. Small UAVs help cut delivery time, reduce traffic loads, and support remote-area access. Retailers and logistics firms test automated payload systems for medicine, groceries, and small parcels. Regulatory pilots in several countries open paths for broader adoption. As urban congestion rises, delivery drones gain stronger commercial value.

Key Trends & Opportunities

Advances in AI and Autonomous Flight

AI-driven drones improve path planning, collision avoidance, and adaptive navigation. These features reduce operator skill needs and support complex missions in large or sensitive zones. Autonomous capabilities also speed mapping, surveillance, and inspection tasks. Vendors now combine computer vision and edge processing to support fast analytics on site. This trend opens opportunities for industrial and infrastructure automation.

- For instance, Skydio’s X10 drone uses an onboard NVIDIA Jetson Orin module and six navigation cameras arranged in a trinocular configuration to provide full 360-degree visibility.

Rising Adoption of BVLOS Operations

Regulators in many regions test rules for Beyond Visual Line of Sight flights. BVLOS enables long-range inspection of pipelines, farms, railways, and power lines. This shift cuts manpower needs and improves coverage of dispersed assets. Telecom and energy firms show strong interest as they link drones with 5G for real-time data. Expanding regulatory acceptance creates new commercial service models.

- For instance, According to Delair’s current product documentation, the updated UX11 fixed-wing drone’s specifications include up to 80 minutes endurance, a 53 km range, and the capability to map 300 acres in a single flight at 120m altitude.

Growth of Specialized Drone Services

Many companies prefer outsourcing instead of buying their own fleets. Drone-as-a-service providers supply skilled pilots, automated platforms, and processed analytics. This approach lowers upfront cost and allows users to focus on insights rather than operations. Growth in sectors such as insurance, utilities, and surveying strengthens this opportunity. Rising demand for packaged data improves service scalability.

Key Challenges

Strict Regulatory Restrictions

Flight rules, privacy limits, and licensing requirements slow wider adoption. Many regions still restrict BVLOS flights, nighttime use, and operations near urban or sensitive zones. These barriers limit entry for new service providers and delay long-range projects. Certification rules also raise costs for both manufacturers and operators. Slow harmonization across countries remains a major challenge.

Operational Risks and Safety Concerns

Drones face risks related to battery limits, collision hazards, and signal loss. These issues can disrupt flights and create safety problems near buildings or people. Weather sensitivity further affects stability in wind, rain, or heat. Enterprises require better reliability before scaling high-value missions. Stronger safety systems and better training remain essential to overcome these concerns.

Regional Analysis

North America

North America held the leading share of the Commercial Drone Market in 2024 with about 38%. Strong adoption in construction, agriculture, utilities, and public safety continues to support steady expansion. The United States drives most demand due to advanced regulations, early BVLOS testing, and strong investment from enterprises and government agencies. High use of drones in inspection, mapping, and emergency response lifts commercial spending. Canada adds growth through agriculture and mining applications. Expanding drone delivery pilots in urban zones further reinforces North America’s leadership.

Europe

Europe accounted for nearly 27% of the market in 2024, driven by strong regulatory support, high-quality manufacturing, and broad enterprise adoption. Countries such as Germany, France, and the UK lead demand for drones in inspection, transport, and environmental monitoring. The region benefits from advanced safety standards and rising use of UAVs in energy, rail, and infrastructure management. Growth in precision farming and cross-border logistics adds new opportunities. Ongoing EU initiatives for unified air mobility also strengthen long-term adoption across major industries.

Asia Pacific

Asia Pacific captured about 25% share in 2024, supported by fast industrial expansion, strong drone manufacturing capacity, and growing use across agriculture and surveying. China remains the largest contributor with heavy investment in commercial applications, logistics, and smart-city projects. India, Japan, and South Korea add momentum through rising adoption in mapping, public safety, and utilities. The region benefits from drone-friendly policies and expanding pilot programs in delivery and infrastructure monitoring. Increasing demand for automation across farming and construction further lifts market growth.

Latin America

Latin America held around 6% of the market in 2024, with rising adoption across agriculture, mining, and environmental monitoring. Brazil and Mexico lead deployments as farms use drones for spraying, vegetation checks, and yield planning. Mining operators in Chile and Peru also rely on UAVs for terrain mapping and safety inspections. Limited regulatory harmonization slows wider expansion, but improving guidelines and lower equipment costs support gradual growth. Growing interest from security agencies and infrastructure firms is expected to strengthen demand in the coming years.

Middle East and Africa

Middle East and Africa accounted for nearly 4% share in 2024, supported by selective but growing use across oil and gas, utilities, construction, and border monitoring. Gulf countries adopt drones for large infrastructure projects, urban planning, and emergency response. Africa sees expanding applications in agriculture, wildlife monitoring, and delivery pilots for medical supplies in rural zones. Regulatory constraints and skill shortages slow adoption, yet government-led digitalization programs create new opportunities. Rising interest in smart-city initiatives is expected to lift drone usage across the region.

Market Segmentations:

By Weight

- <25 Kg

- 25 – 500 Kg

- >500 Kg

By Product

- Fixed wing drone

- Rotary blade drone

- Hybrid drone

By Application

- Aerial photography

- Agriculture

- Emergency management

- Inspection & monitoring

- Remote sensing & mapping

- Wildlife research & preservation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Commercial Drone Market features strong competition shaped by leading companies such as SZ DJI Technology Co Ltd, AeroVironment Inc., Autel Robotics, Intel Corporation, Parrot Drones SAS, PrecisionHawk Inc., Draganfly Innovations Inc., YUNEEC International, Guangzhou EHang Intelligent Technology Co. Ltd, and Aeronavics Ltd. Market rivalry stays intense as vendors improve flight stability, imaging quality, autonomous navigation, and AI-based analytics. Many producers focus on expanding their product range to serve inspection, mapping, agriculture, surveillance, and delivery applications. Advances in battery efficiency, sensor integration, and BVLOS-ready platforms strengthen their competitive edge. Companies also invest in partnerships with agriculture, energy, construction, and logistics firms to scale enterprise adoption. Growing interest in service-based drone models encourages firms to offer data analytics, fleet management, and cloud-based platforms to retain customers. As regulations evolve, manufacturers compete through safety compliance, training ecosystems, and deeper software integration to secure stronger market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SZ DJI Technology Co Ltd

- AeroVironment Inc.

- Autel Robotics

- Intel Corporation

- Parrot Drones SAS

- PrecisionHawk Inc.

- Draganfly Innovations Inc.

- YUNEEC International

- Guangzhou EHang Intelligent Technology Co. Ltd

- Aeronavics Ltd.

Recent Developments

- In 2025, AeroVironment launched the VAPOR Compact Long Endurance (CLE) helicopter UAS, featuring enhanced autonomy, reduced size and weight, longer flight duration, and flexible payloads.

- In 2025, DJI announced the Agras T100, T70P, and T25P agricultural drones for global availability, emphasizing autonomous operation and safety for commercial use.

- In 2024, Autel Robotics launched the Autel Alpha industrial drone, upgraded with 560x hybrid zoom, dual thermal cameras, 20km transmission, and IP55 rating for energy inspection and emergency management

Report Coverage

The research report offers an in-depth analysis based on Weight, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Commercial drones will play a larger role in industrial automation and field data tasks.

- BVLOS approvals will expand, enabling long-range inspection and large-area monitoring.

- AI-powered autonomous navigation will support safer and more precise flight operations.

- Drone delivery services will grow as logistics firms scale last-mile networks.

- Agricultural adoption will rise through advanced spraying, crop health sensing, and yield tracking.

- Public safety agencies will increase drone use for surveillance, disaster response, and rescue work.

- Energy and utility operators will rely more on UAVs for routine asset inspection.

- Drone-as-a-service models will expand as companies avoid direct fleet ownership.

- Improved battery technology will extend flight time and allow heavier payloads.

- Integration with 5G networks will enable real-time data transfer and remote fleet control.