Market Overview:

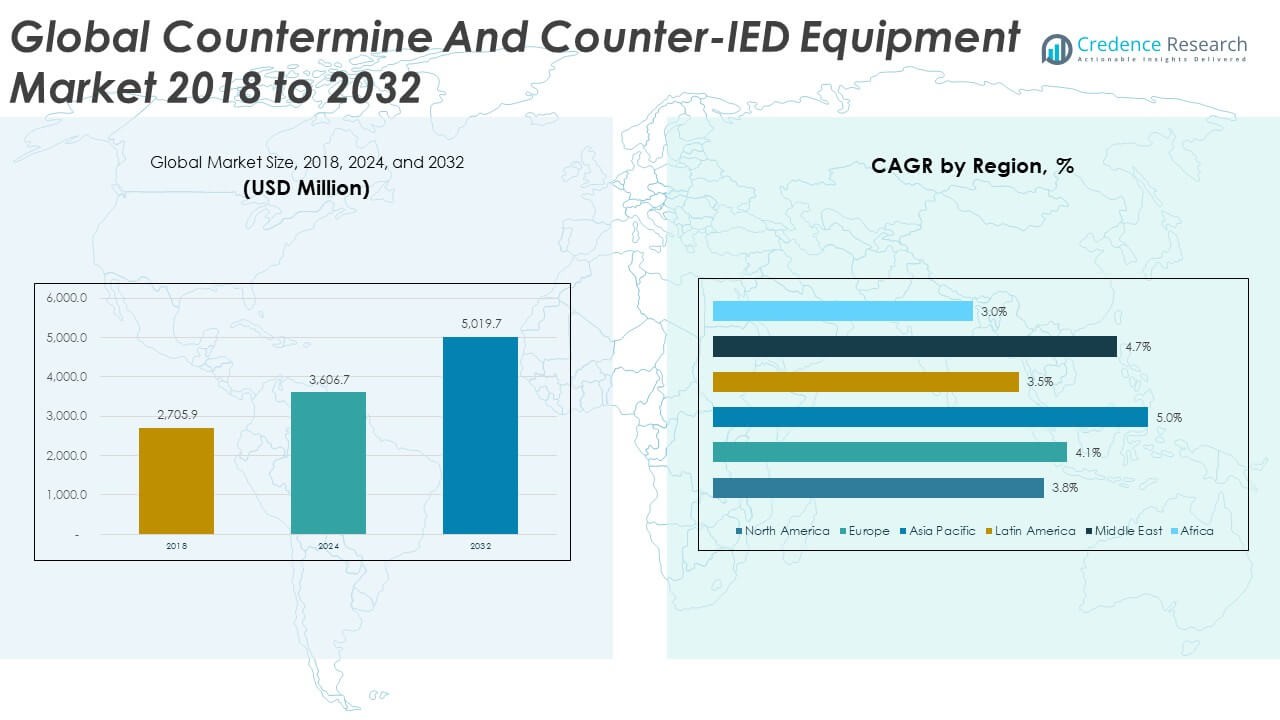

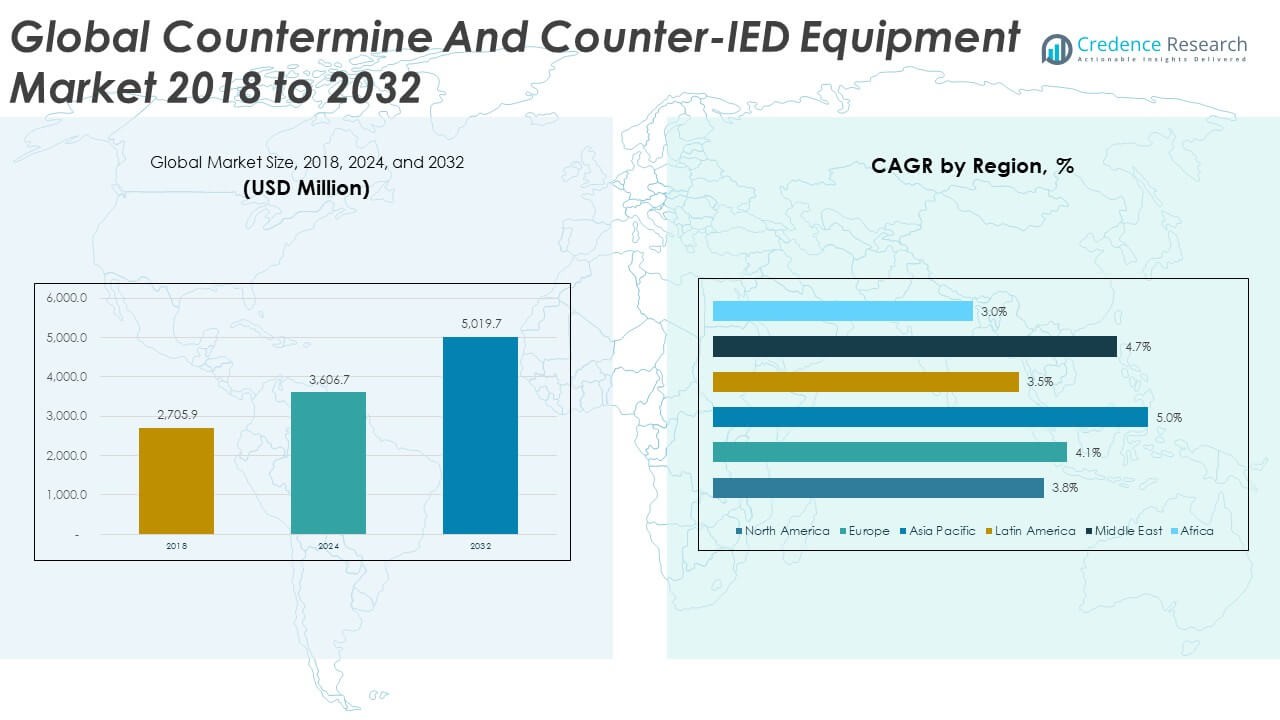

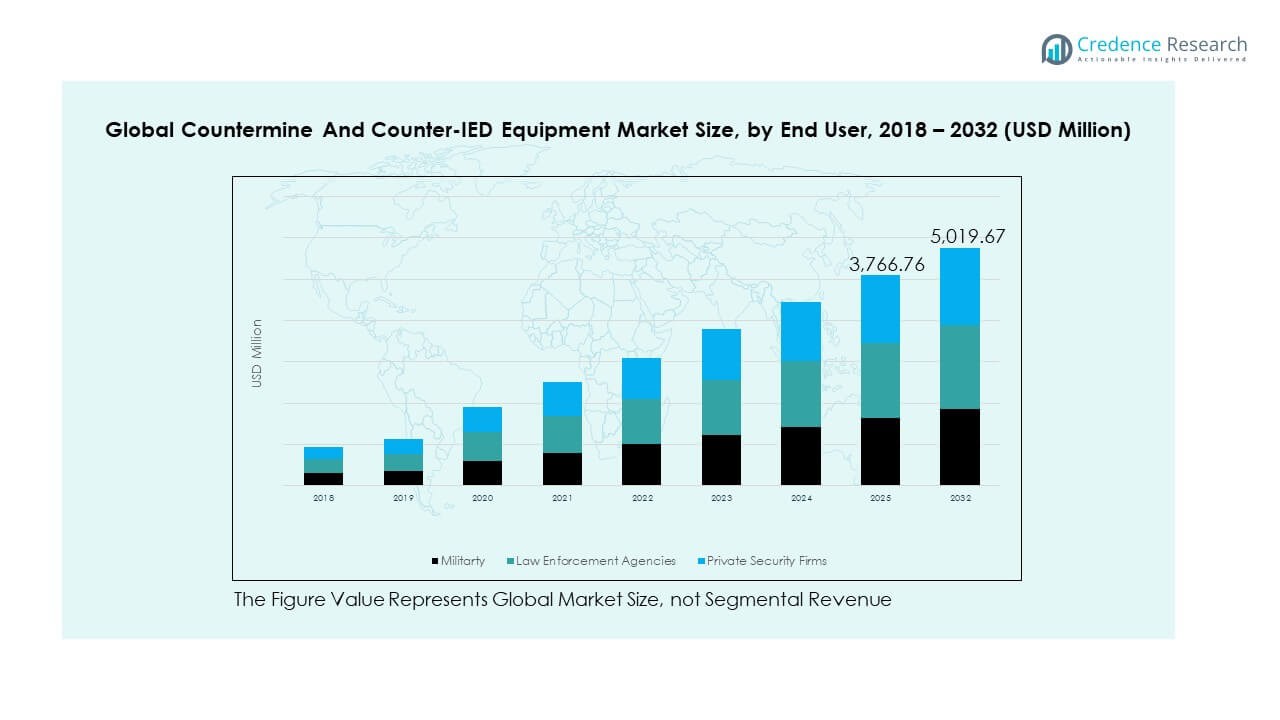

The Global Countermine and Counter-IED Equipment Market size was valued at USD 2,705.90 million in 2018 to USD 3,606.70 million in 2024 and is anticipated to reach USD 5,019.70 million by 2032, at a CAGR of 4.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Countermine and Counter-IED Equipment Market Size 2024 |

USD 3,606.70 Million |

| Countermine and Counter-IED Equipment Market, CAGR |

4.19% |

| Countermine and Counter-IED Equipment Market Size 2032 |

USD 5,019.70 Million |

Growth accelerates due to strong focus on soldier safety, rising cross-border tensions, and ongoing military modernization plans. Nations adopt smart sensors, AI-enabled mapping tools, and autonomous robotic units to strengthen detection accuracy. Demand grows further as armed forces seek faster threat identification and improved standoff distance during operations. Many procurement agencies prefer rugged solutions that work in harsh terrains. The push to replace aging fleets drives higher spending across detection, neutralization, and protection categories. These factors keep the market resilient and create long-term adoption opportunities.

North America leads this market due to high defense spending, advanced R&D programs, and steady deployment of modern detection systems. Europe follows with strong investments driven by border protection needs and support for NATO-led missions. Asia Pacific shows rapid growth as nations upgrade counter-IED units and strengthen land security frameworks. The Middle East maintains steady demand due to enduring security challenges and active demining efforts. Emerging regions in Africa adopt more solutions to address legacy minefields and improve humanitarian clearance programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Countermine and Counter-IED Equipment Market was valued at USD 2,705.90 million in 2018, reached USD 3,606.70 million in 2024, and is projected to hit USD 5,019.70 million by 2032, expanding at a CAGR of 4.19% during the forecast period.

- North America (33.95%), Europe (23.97%), and Asia Pacific (23.25%) hold the top regional shares, driven by strong defense budgets, active modernization programs, and rising cross-border security challenges.

- Asia Pacific, with a 25% share, is the fastest-growing region due to rising territorial tensions, large-scale military upgrades, and expanded adoption of AI-enabled counter-IED technologies.

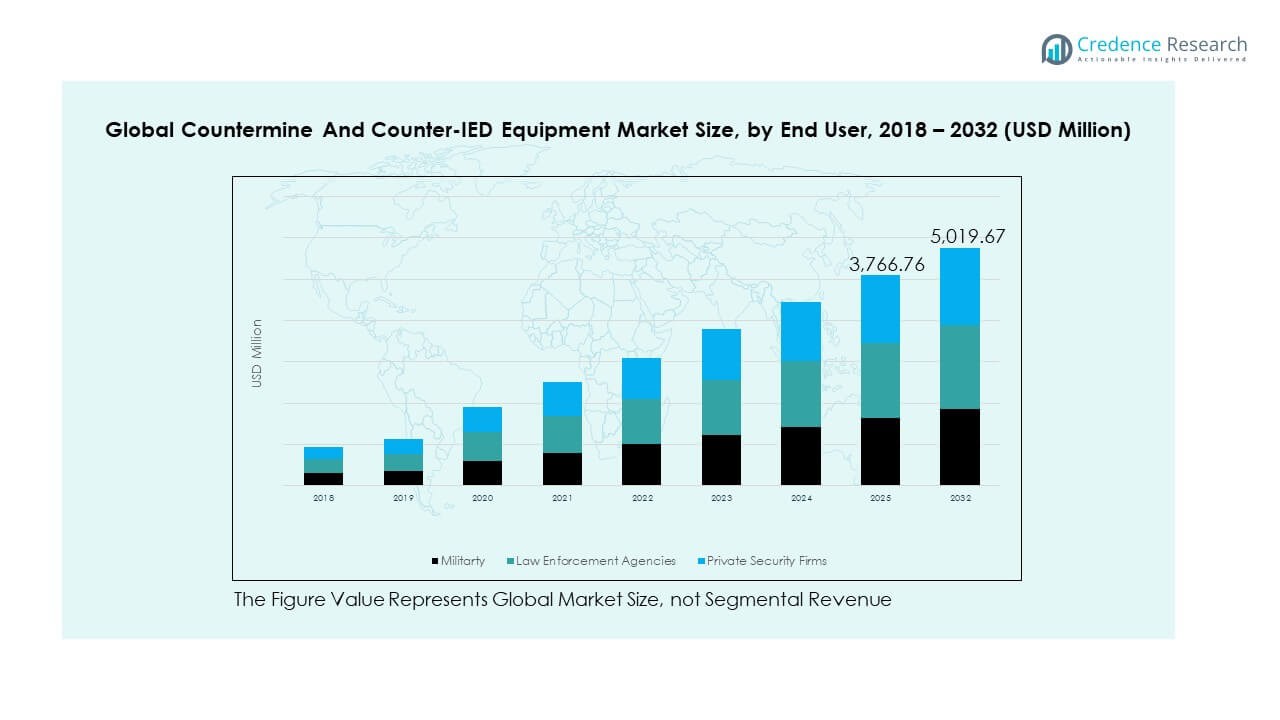

- The military segment accounts for the largest share (approx. 35%), supported by continuous investments in detection suites, EOD robots, and vehicle-mounted systems.

- Law enforcement agencies hold about 40%, while private security firms contribute roughly 25%, reflecting broader adoption of explosive-detection tools across civil protection and critical infrastructure.

Market Drivers:

Rising Demand For Advanced Detection Systems Supported By Military Modernization

The Global Countermine and Counter-IED Equipment Market grows due to stronger priority on detection accuracy and faster field response. Defense agencies deploy ground sensors, handheld scanners, and vehicle-mounted tools to limit hidden explosive threats. Nations expand modernization efforts to replace outdated detection units with systems that improve standoff distance. Procurement divisions adopt integrated suites that merge thermal imaging and ground-penetrating radar for higher clarity. It supports rapid identification of buried objects under different soil types. Growing border pressures lift interest in devices that support large-area scanning tasks. Research programs upgrade core sensor technologies for better coordination with combat teams. Stronger military budgets drive a steady shift toward multi-mission detection platforms.

- For instance, L3Harris’ Minehound VMR3 combined GPR and metal-detection technology is fielded across NATO missions and can detect targets buried up to 40 cm depending on soil density.

Increasing Shift Toward Autonomous and Remote-Controlled Explosive Disposal Tools

Demand rises for autonomous and remotely operated EOD robots that improve field safety. Many forces expand investments in platforms that remove personnel from high-risk zones. Operators use robots with rugged tracks, precision arms, and modular tools that support diverse missions. It improves overall threat-handling speed in urban, desert, and forest terrains. Heavy use of drones lifts capability to map and inspect dangerous sites before ground deployment. Procurement teams prefer systems that integrate live video, AI-assisted route planning, and remote diagnostics. Strong interest in multi-sensor robots reshapes standards for explosive disposal units. Adoption expands due to strong mission reliability and reduced risk to frontline teams.

- For instance, Teledyne FLIR’s PackBot EOD robot has been deployed in over 50 countries and carries up to 20 kg of payload with a 6-axis manipulator for precise neutralization tasks.

Growing Need For Counter-IED Solutions Due To Rising Irregular Warfare and Cross-Border Tension

Irregular conflict patterns lift demand for tools that detect improvised threats placed on roads, bridges, and checkpoints. Countries strengthen patrol missions with high-end jammers and vehicle protection suites. The Global Countermine and Counter-IED Equipment Market gains support from long-term defense strategies focused on rapid threat suppression. Forces deploy new command platforms that enable better intelligence exchange during field missions. It enhances coordination between reconnaissance teams, armored convoys, and EOD squads. Growth in asymmetric warfare pushes heavy use of smart counter-IED kits with modular design. Many militaries expand inventory of neutralization tools to keep operations uninterrupted. Increased geopolitical strain encourages faster adoption of threat-prevention solutions.

Rising Humanitarian Demining Programs and Global Initiatives Supporting Safer Land Rehabilitation

Humanitarian groups increase clearance missions across regions affected by past conflicts. Governments fund long-term mine removal efforts to reduce civilian casualties and open land for development. It raises demand for portable detectors, protective suits, and field-ready neutralization kits. International alliances promote new safety standards that encourage use of advanced scanning systems. Civil defense units coordinate with global agencies to improve training quality and equipment reliability. Many donors support projects that require durable and low-maintenance detection units. Growth in sustainable land rehabilitation pushes steady procurement of modern demining solutions. Rising public safety efforts encourage broader deployment across rural and semi-urban zones.

Market Trends:

Growing Adoption Of AI-Enabled Detection Platforms and Smart Analytical Systems

AI tools reshape field detection performance across multiple mission types. The Global Countermine and Counter-IED Equipment Market shifts toward platforms that classify threats using real-time pattern analysis. Forces integrate machine learning modules that improve identification of explosive signatures. It enhances precision during night-time and low-visibility missions. Many solutions merge sensor fusion with predictive alerts to assist faster field commands. Automated data logs help commanders track recurring threat patterns across large zones. Adoption grows among nations that prioritize fast-response operations. Strong interest in software-driven detection accelerates development of next-generation analytical platforms.

- For instance, Raytheon’s AI-enabled Boomerang system identifies hostile fire direction within one second and supports rapid return-fire coordination.

Rising Integration of Unmanned Aerial Vehicles In Demining and Reconnaissance Tasks

UAV units support aerial mapping of suspected danger areas with advanced imaging sensors. Many defense forces deploy drones to strengthen early-stage inspection before personnel enter a zone. The Global Countermine and Counter-IED Equipment Market benefits from this shift toward airborne assessment. It helps teams detect irregular ground signatures with high precision. Drone-mounted thermal systems reveal hidden triggers and wiring paths in complex terrain. Increased endurance of mid-size UAVs enables longer route-clearing missions. More agencies adopt drones to support large-area scanning in remote regions. The trend supports safer planning for ground-based clearance teams.

- For instance, DJI’s Matrice 300 paired with Zenmuse H20T thermal payload is used in global humanitarian demining missions and offers 23× optical zoom with 640×512 thermal resolution.

Wider Use of Modular and Multi-Mission Equipment To Improve Operational Flexibility

Modular systems gain traction due to rising field diversity and mission complexity. Many forces prefer kits that support quick assembly or tool swapping. The Global Countermine and Counter-IED Equipment Market expands toward systems that combine scanning, neutralization, and signaling in one frame. It reduces load weight and improves mobility in harsh environments. Field units use modular add-ons to support rapid task shifts with minimal downtime. Procurement agencies select devices that integrate with existing tactical communication tools. More manufacturers design equipment with open-architecture formats to enable future upgrades. Adoption strengthens due to strong interest in scalable mission design.

Increasing Focus On Durable and Low-Maintenance Materials To Support Harsh-Environment Missions

Manufacturers invest in materials that withstand heat, moisture, vibration, and impact. Sustainability goals push interest in long-life sensors with stable calibration cycles. The Global Countermine and Counter-IED Equipment Market benefits from strong preference for rugged engineering. It ensures consistent performance across deserts, jungles, and snowbound regions. Nations adopt systems built with lighter composite frames that help reduce operator fatigue. More units choose sealed housings that limit dust and water intrusion during field activity. Advances in battery technology extend operating cycles for handheld tools. The market shifts toward designs that reduce repair needs and improve lifecycle cost.

Market Challenges Analysis:

High Equipment Costs, Complex Maintenance Needs, and Limited Technical Compatibility Across Forces

Cost pressure limits adoption of advanced detection and disposal tools within many regions. Procurement teams face difficulty aligning budgets with rising demand for high-end platforms. The Global Countermine and Counter-IED Equipment Market deals with challenges linked to complex maintenance cycles. It increases training needs for technicians and field operators. Many older systems struggle with integration when connected to modern command platforms. Differences in operational standards create compatibility limitations during joint missions. Nations with restricted funding struggle to maintain large inventories of updated equipment. These factors slow rapid deployment of next-generation tools.

Operational Complexity, Skill Gaps, Harsh-Terrain Barriers, and Unpredictable Threat Patterns

Field missions require high skill levels to handle diverse explosive devices across unstable environments. Many regions report shortages of trained EOD specialists capable of managing modern platforms. The Global Countermine and Counter-IED Equipment Market faces barriers from unpredictable threat evolution. It forces units to adapt without established benchmarks for new threat forms. Harsh terrain restricts movement of heavy equipment during clearance tasks. Poor infrastructure in conflict zones slows transport and support operations. Frequent system upgrades raise training requirements for frontline users. These limits reduce field efficiency and extend mission timelines.

Market Opportunities:

Growing Scope For AI-Driven Threat Analytics, Smart Sensors, and Autonomous Clearance Units

The Global Countermine and Counter-IED Equipment Market gains opportunity from rapid transition toward digital threat analysis. Many defense units plan to adopt AI-based detection models that reduce guesswork. It opens pathways for next-generation sensors that capture deeper subsurface data. Drone-assisted mapping expands market reach within high-risk zones. Research programs promote development of autonomous robots for safer explosive handling. Nations show interest in tools that support long-duration missions. Strong focus on precision creates room for advanced analytical engines.

Expanding Demand For Humanitarian Clearance, Training Support, and International Collaboration Programs

Rising humanitarian clearance missions open new avenues for portable devices and low-cost detection kits. The Global Countermine and Counter-IED Equipment Market gains support from international partnerships that strengthen mine action programs. It enables better training opportunities for civil defense and aid groups. More agencies request lightweight gear suited for remote rural operations. Growing cooperation between donor nations increases funding for advanced tools. High demand in developing regions fuels requirement for durable solutions. These factors present sustained growth potential across long-term demining efforts.

Market Segmentation Analysis:

By Type

The Global Countermine and Counter-IED Equipment Market features strong demand across detection, neutralization, protection, and training tools. Detection equipment leads due to its critical role in early threat identification across urban and remote zones. Neutralization systems gain traction because forces need reliable tools that disable explosive devices with precision. It supports safer field operations where route clearance remains essential. Protection equipment grows due to rising focus on safeguarding personnel with armored kits and blast-resistant gear. Training and simulation equipment also expands, driven by the need for realistic preparation that strengthens operator readiness. Each category supports mission continuity across conflict and peacekeeping operations.

By End User

Military units dominate demand due to large-scale procurement programs and rising modernization goals. Armed forces invest in advanced scanners, jammers, and robotic systems that improve mission flexibility. Law enforcement agencies increase their adoption to manage domestic security threats and support emergency response teams. It encourages steady spending on portable detection devices and rapid-disposal tools. Private security firms show gradual uptake focused on protecting critical sites such as energy facilities, transport hubs, and large events. Many firms deploy compact and durable systems suited for limited personnel. Growth across all end-user groups reflects stronger emphasis on public safety and operational resilience.

- For instance, U.S. police departments widely deploy Kromek’s D3S wearable radiation detector, which identifies isotopes within one second using real-time spectral data.

Segmentation:

By Type

- Detection Equipment

- Neutralization Equipment

- Protection Equipment

- Training and Simulation Equipment

By End User

- Military

- Law Enforcement Agencies

- Private Security Firms

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Countermine and Counter-IED Equipment Market size was valued at USD 938.15 million in 2018 to USD 1,224.63 million in 2024 and is anticipated to reach USD 1,656.49 million by 2032, at a CAGR of 3.8% during the forecast period. Market Share: 33.95% of 2024 global revenue. North America maintains a dominant position due to high defense spending, advanced technology adoption, and strong industrial capacity. Governments expand procurement of detection and disposal systems to improve mobility and reinforce border protection. It benefits from established suppliers that deliver robotics, armored units, and multi-sensor platforms. Law enforcement agencies deploy portable detection kits to strengthen urban safety. Continuous R&D investment drives precision upgrades and improved automation. Military modernization initiatives lift demand for integrated platforms suited for fast-response missions. Ongoing training exercises support readiness across diverse terrains, helping the region sustain its leadership.

Europe

The Europe Global Countermine and Counter-IED Equipment Market size was valued at USD 652.67 million in 2018 to USD 864.68 million in 2024 and is anticipated to reach USD 1,193.68 million by 2032, at a CAGR of 4.1% during the forecast period. Market Share: 23.97% of 2024 global revenue. Europe shows strong momentum due to rising cross-border risks, NATO-driven modernization, and structured procurement programs. Defense ministries adopt jammers, scanners, and neutralization systems to reinforce mission stability. It benefits from collaborative alliances that harmonize defense standards across member countries. Nations upgrade armored vehicles and robotics to counter evolving threats. Eastern Europe increases spending due to heightened security pressure. Law enforcement agencies strengthen explosive-handling units for urban protection. Strong engineering capability supports innovation in defense electronics, helping Europe maintain steady growth.

Asia Pacific

The Asia Pacific Global Countermine and Counter-IED Equipment Market size was valued at USD 598.28 million in 2018 to USD 838.72 million in 2024 and is anticipated to reach USD 1,243.87 million by 2032, at a CAGR of 5.0% during the forecast period. Market Share: 23.25% of 2024 global revenue. Asia Pacific expands rapidly due to rising defense programs, escalating border pressures, and strong security modernization. Nations invest in advanced detection systems and autonomous EOD robots to improve field reliability. It benefits from large territorial coverage that requires scalable and rugged equipment for remote zones. Heightened territorial tensions drive adoption of vehicle-mounted systems and protection units. Domestic defense production accelerates as key countries strengthen industrial capability. Governments implement long-term security frameworks to handle evolving threats. Growing skill development and modernization initiatives keep the region on an upward trajectory.

Latin America

The Latin America Global Countermine and Counter-IED Equipment Market size was valued at USD 291.70 million in 2018 to USD 375.05 million in 2024 and is anticipated to reach USD 496.45 million by 2032, at a CAGR of 3.5% during the forecast period. Market Share: 10.40% of 2024 global revenue. Latin America grows steadily due to rising urban threat-management needs, expanding security reforms, and targeted modernization. Governments strengthen detection capabilities across borders, airports, and public zones. It benefits from portable systems that support rapid deployment across varied terrain. Defense agencies procure neutralization tools to manage remote-area threats. Organized crime concerns increase demand for protection gear and tactical robotics. Law enforcement boosts training to strengthen explosive-handling capacity. Partnerships with global suppliers improve access to advanced tools, supporting gradual but consistent progress.

Middle East

The Middle East Global Countermine and Counter-IED Equipment Market size was valued at USD 183.46 million in 2018 to USD 251.49 million in 2024 and is anticipated to reach USD 362.92 million by 2032, at a CAGR of 4.7% during the forecast period. Market Share: 6.97% of 2024 global revenue. The Middle East maintains strong demand due to persistent conflict zones, high security risks, and the need for resilient equipment. Governments invest in armored vehicles, detection systems, and advanced jammers to safeguard operations. It benefits from international cooperation programs that support technology transfer and capability enhancement. Nations adopt sophisticated neutralization systems suited for varied terrains. Strong protection needs drive adoption of blast-resistant gear. Border agencies upgrade scanning systems to secure major transit routes. Expanded EOD training programs reinforce national readiness across the region.

Africa

The Africa Global Countermine and Counter-IED Equipment Market size was valued at USD 41.67 million in 2018 to USD 52.14 million in 2024 and is anticipated to reach USD 66.26 million by 2032, at a CAGR of 3.0% during the forecast period. Market Share: 1.44% of 2024 global revenue. Africa grows gradually due to humanitarian demining requirements and widespread mine contamination. Many regions rely on portable detectors and rugged protective gear suitable for rural conditions. It benefits from international partnerships that provide equipment and training support. Defense and civil units adopt low-maintenance neutralization tools due to infrastructure limitations. Training initiatives strengthen operational capability in high-risk areas. Demand rises for cost-effective systems that work across diverse soil conditions. Donor-backed programs and incremental infrastructure development contribute to ongoing progress in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Countermine and Counter-IED Equipment Market reflects strong competition driven by defense modernization, rising cross-border risks, and growing investment in advanced detection and disposal systems. Major players strengthen their positions through robotics, high-precision sensors, armored platforms, and advanced jamming technologies. It benefits companies with strong R&D capacity, integrated product portfolios, and established government partnerships. Many suppliers focus on modular designs that support fast deployment across complex terrains. Firms expand through alliances that improve access to global procurement programs. Continuous upgrades in software, automation, and threat-analysis tools shape competitive differentiation. Leading companies maintain an advantage through long-term contracts and large-scale supply networks. The market stays dynamic due to rapid technology shifts and evolving field requirements.

Recent Developments:

- In June 2025, Chemring Group’s U.S. subsidiary Chemring Sensors and Electronic Systems completed the sale of its Explosive Hazard Detection line of business—including the Husky Mounted Detection System (HMDS) ground‑penetrating radar and the MDS‑10 handheld mine detector, both long‑standing counter‑IED and countermine systems—to ELTA North America, which is establishing a dedicated Combat Engineering Center of Excellence to further develop these route‑ and area‑clearance capabilities for U.S. and allied forces (transaction announced 16 June 2025).

- In March 2025, General Dynamics Land Systems, a business of General Dynamics Corporation , announced a set of partnership agreements with Applied Intuition, Palantir Technologies, General Dynamics Mission Systems, General Dynamics Information Technology and Strategic Technology Consulting to embed advanced autonomy, data fusion, AI and digital engineering tools across its combat vehicle portfolio, strengthening the software backbone that underpins mission sets such as route‑clearance, survivability and counter‑IED operations on modern, mine‑ and IED‑threatened battlefields (announcement dated 26 March 2025).

- In November 2024, Allen‑Vanguard announced a strategic collaboration with Metis Aerospace to combine Allen‑Vanguard’s RF-based counter‑IED and counter‑drone jamming expertise (including its ANCILE C‑UAS system) with Metis’ passive RF detection technologies such as SKYPERION, creating a more mobile, integrated detect‑and‑defeat solution aimed at emerging drone and RF‑triggered IED threats in the global Countermine and Counter‑IED Equipment Market (news dated 15 November 2024).

Report Coverage:

The research report offers an in-depth analysis based on Type and End User segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for advanced detection tools will support wider field deployment.

- Autonomous and robotic EOD systems will gain stronger adoption across defense fleets.

- AI-driven pattern analysis will upgrade threat identification accuracy in high-risk zones.

- Nations will increase investments in force protection equipment for ground operations.

- Multi-sensor fusion platforms will reshape detection standards across rugged terrains.

- Training and simulation systems will expand to build skilled explosive-handling teams.

- Portable jamming devices will evolve to counter more complex remote-trigger threats.

- Growing regional instability will sustain procurement cycles across major defense blocks.

- Industrial partnerships will accelerate innovation and cross-border technology sharing.

- Long-term funding programs will support scalable modernization across all end-users.