Market Overview

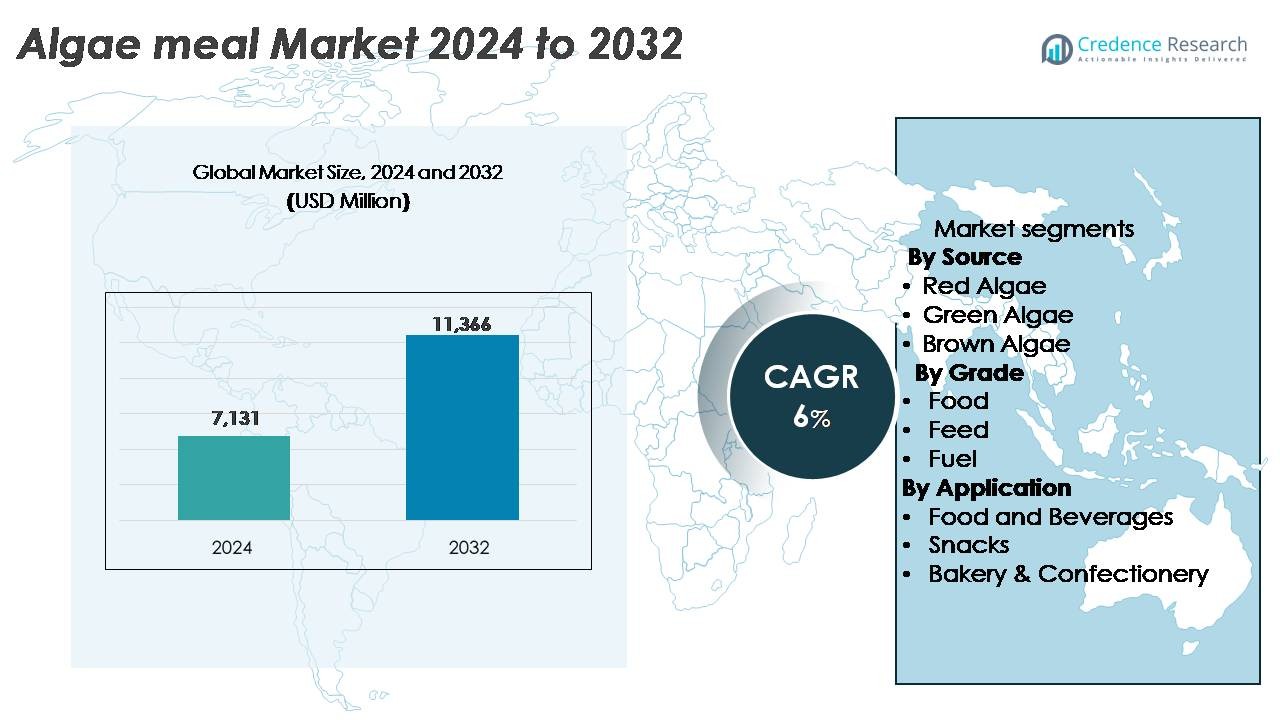

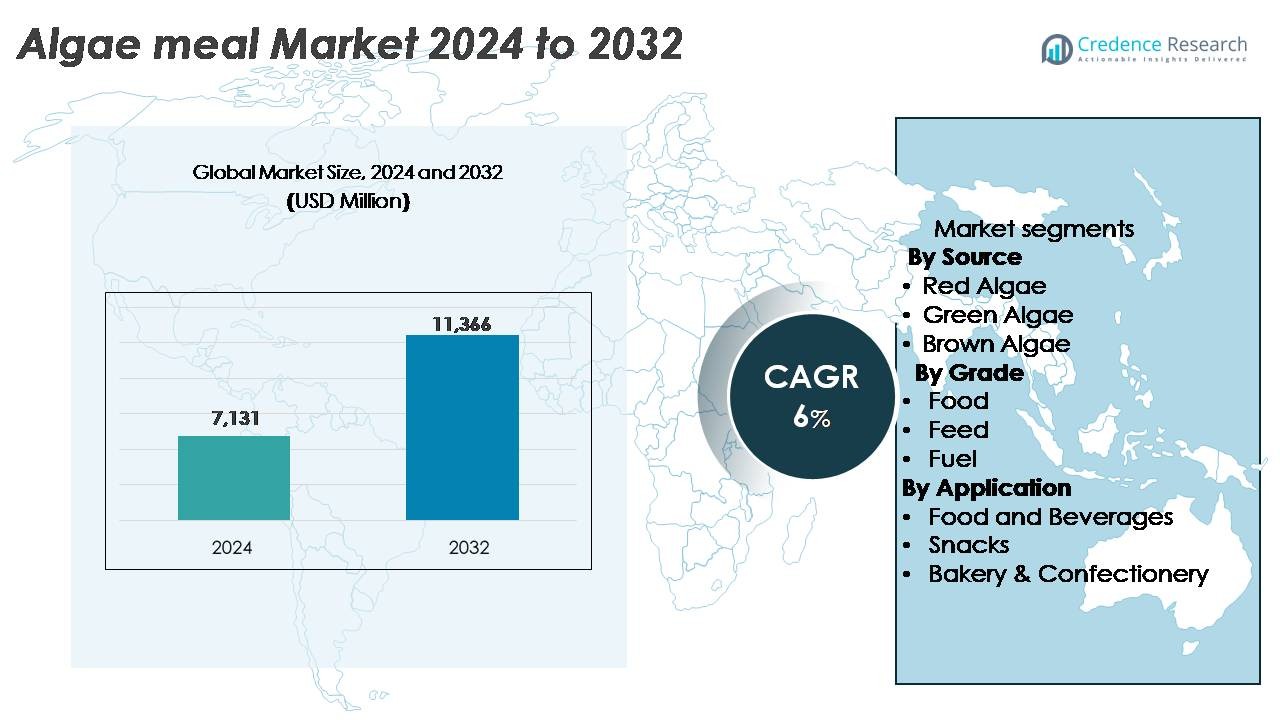

The Algae Meal Market was valued at USD 7,131 million in 2024 and is projected to reach USD 11,366 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algae Meal Market Size 2024 |

USD 7,131 Million |

| Algae Meal Market, CAGR |

6% |

| Algae Meal Market Size 2032 |

USD 11,366 Million |

The market for algae meal features prominent players including Allmicroalgae – Natural Products S.A., AlgaEnergy S.A., Archer Daniels Midland Company, BlueBioTech International GmbH, Cellana Inc., Corbion N.V. (and its subsidiary Corbion Biotech Inc.), Cyanotech Corporation, and DIC Corporation. These firms invest in upstream algae cultivation, product R&D and downstream extraction to build scale, differentiate via high‑protein and bioactive offerings, and serve food, feed and fuel segments. Regionally, North America leads the global algae meal space with a 32% share, driven by strong nutraceutical demand and feed industry adoption, while the Asia Pacific region follows closely with rising aquaculture and alternative‑protein momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global algae meal market stood at around USD 7,131 million in 2024 and is forecast to reach USD 11366 million by 2032 at a CAGR of 6%.

- Rising demand for sustainable protein sources drives market growth, supported by algae’s high protein content, vitamins, and essential amino acids, enabling its use in food, feed, and nutraceuticals.

- Key trends include rapid integration of algae meal in functional foods, bakery, and beverages, along with technological advancements in cultivation and extraction enhancing yield and cost efficiency.

- The market is moderately consolidated, with players such as Corbion N.V., Cyanotech Corporation, and AlgaEnergy S.A. focusing on protein-rich algae strains and product innovation to strengthen global supply chains.

- Asia Pacific holds around 32% of the market, followed by North America at 29.7% and Europe at 25%, while the powder segment and red algae source remain dominant across global applications.

Market Segmentation Analysis:

By Source

Red Algae dominates the Algae Meal Market with a 42% share, driven by its high protein content and bioactive compounds suitable for food, feed, and nutraceutical applications. Green Algae holds a significant portion due to its fast growth rate and rich vitamin profile, supporting functional food and animal feed demand. Brown Algae is gaining traction in aquaculture feed and biofuel production, while other algae types, including blue-green varieties, are leveraged for specialty applications. Rising demand for sustainable protein and nutraceutical ingredients fuels the adoption of diverse algae sources globally.

- For instance, a production trial by Cellana, Inc. showed residual algae meal containing 59% protein by weight after oil extraction.

By Grade

The food-grade segment leads the market with a 48% share, supported by increasing consumption of algae-based supplements, protein powders, and functional ingredients. Feed-grade algae is expanding rapidly due to its use in aquaculture, poultry, and livestock feed, enhancing growth performance and health. Fuel-grade algae is emerging as a renewable energy source, with ongoing R&D in biofuel production. Regulatory support, sustainability initiatives, and growing awareness of algae’s nutritional benefits drive the adoption across these grades, with food applications remaining the dominant sub-segment in terms of market share.

- For instance, Cellana, Inc. achieved a dry microalgae biomass protein content of approximately 59% (or 59 g per 100 g) in a production trial, a figure that is consistent with high-protein microalgae strains and supports its use in supplements and powders.

By Application

Food and beverages constitute the largest application segment with a 45% share, driven by high demand for algae protein in health drinks, smoothies, and fortified products. Snacks and bakery & confectionery segments are expanding as manufacturers incorporate algae powder for nutritional enrichment and natural coloring. Functional and clean-label trends further boost algae inclusion in consumer products. Innovation in taste, texture, and processing methods supports broader adoption. Among these, food and beverages remain the dominant sub-segment, reflecting the growing global preference for nutritious, plant-based ingredients in daily diets.

Key Growth Drivers

Rising Demand for Sustainable Protein Sources

The growing global population and increasing health consciousness are driving demand for sustainable, high-protein alternatives. Algae meal offers a nutrient-dense, eco-friendly protein source for human consumption, livestock feed, and aquaculture. Its high amino acid content, vitamins, and minerals make it suitable for functional foods, beverages, and supplements. Moreover, regulatory support for sustainable ingredients and consumer preference for plant-based proteins boost market adoption. Companies are expanding cultivation and extraction technologies to meet rising demand, enhancing yield efficiency and product quality. This focus on sustainability strengthens algae meal’s position as a preferred protein source, ensuring long-term market growth across multiple sectors.

- For instance, Corbion N.V. developed a microalgae protein concentrate with a protein content of 62 g per 100 g of dry biomass, suitable for human nutrition and feed applications.

Expansion of Aquaculture and Livestock Feed Industry

The aquaculture and livestock sectors are increasingly adopting algae meal due to its nutritional benefits, including omega-3 fatty acids and essential micronutrients. Algae supplementation improves animal growth, immunity, and overall health, driving higher feed efficiency. Rising seafood and poultry consumption globally amplifies demand for high-quality feed ingredients. Companies are developing tailored algae-based feed solutions for different species, optimizing formulation and digestibility. Strategic partnerships between feed manufacturers and algae producers further expand market penetration. Continuous innovations in algae cultivation methods, such as photobioreactors and open-pond systems, ensure consistent supply, supporting growth in animal nutrition and sustaining the market’s expansion trajectory.

- For instance, Cyanotech Corporation, a leading producer of microalgae products, utilizes Spirulina biomass that naturally contains a high protein concentration, typically ranging from 55 to 70 g of protein per 100 g of dry biomass

Government Support and Sustainability Initiatives

Governments worldwide promote algae production through subsidies, grants, and regulatory frameworks that encourage sustainable agriculture and renewable resources. Policies targeting reduced carbon footprints and resource-efficient feed production enhance algae meal adoption. Sustainability-driven initiatives by private companies, NGOs, and research institutions also stimulate R&D, enabling cost-effective and scalable cultivation methods. For instance, projects focusing on closed-loop systems and wastewater-based algae cultivation enhance environmental benefits. These combined efforts increase algae meal production capacity, reduce operational costs, and strengthen market confidence. Supportive regulatory environments and global focus on sustainable food systems act as crucial drivers, fostering long-term growth across food, feed, and industrial applications.

Key Trends & Opportunities

Integration into Functional Foods and Nutraceuticals

Algae meal is increasingly incorporated into functional foods, beverages, and nutraceuticals, leveraging its rich protein, vitamin, and bioactive content. Companies innovate with algae powders, protein concentrates, and extracts for health drinks, protein bars, and fortified snacks. Rising consumer interest in immunity-boosting, plant-based, and clean-label products accelerates adoption. Technological advancements in taste masking, encapsulation, and product formulation expand its applicability. This trend creates opportunities for partnerships between algae producers and food manufacturers, enabling co-branded products and premium offerings. Growing awareness of algae’s health benefits positions it as a strategic ingredient in health-focused product lines, opening new revenue streams for market players globally.

Expansion in Bakery, Snacks, and Beverage Applications

Algae meal is increasingly used in bakery, confectionery, and snack products to enhance nutritional content and natural coloring. The shift toward plant-based, high-protein, and functional snacks fuels innovation in formulations, such as algae-enriched cookies, protein bars, and beverages. Consumers prefer products with added health benefits without compromising taste or texture. Market players invest in R&D to develop scalable processing technologies and palatable formulations. This trend offers opportunities for new product launches, private-label innovations, and regional expansion. By aligning with health and wellness trends, algae meal integration into mainstream food products enhances brand differentiation and market penetration.

- For instance, AlgaEnergy S.A. developed a Spirulina powder containing 60 g of protein per 100 g, which was incorporated into protein bars and cookies to improve protein content and color stability.

Key Challenges

High Production Costs and Scalability Issues

Algae cultivation and processing involve significant capital and operational expenses, limiting large-scale adoption. Photobioreactors, nutrient inputs, and extraction technologies contribute to elevated costs compared to conventional protein sources. Scalability challenges, such as maintaining consistent quality and optimizing growth conditions, hinder widespread supply. Market players must invest in technological innovations, automation, and energy-efficient systems to reduce production costs. Price sensitivity among consumers and feed manufacturers further complicates market expansion. Overcoming these financial and operational constraints is crucial for ensuring competitive pricing, expanding production capacity, and sustaining long-term growth in the algae meal market.

Regulatory and Quality Compliance

Strict regulations for food, feed, and nutraceutical products pose challenges for algae meal producers. Compliance with safety, purity, and nutritional standards requires rigorous testing and documentation, increasing time and costs. Variability in regional regulations complicates international trade and market entry. Quality control for bioactive content, heavy metal limits, and microbial safety is critical to maintaining consumer trust and meeting industry certifications. Companies must implement robust quality management systems and adhere to Good Manufacturing Practices (GMP). Navigating regulatory complexities while ensuring consistent product standards remains a key challenge for market players, impacting expansion and adoption across global markets.

Regional Analysis

North America

In North America, the market holds an estimated 29.7% share of the global algae‑meal space in 2024. This prominence stems from strong demand for sustainable protein, growing functional food and feed sectors, and mature aquaculture and livestock industries. Producers benefit from supportive regulation, high consumer awareness, and substantial R&D investment in algae‑derived ingredients. These factors sustain North America’s leadership and underpin the region’s robust growth over the forecast period.

Europe

Europe commands approximately 25% of the global algae meal market in 2024. The region’s share reflects regulatory frameworks backing natural ingredients, widespread plant‑based diet adoption, and a robust feed industry seeking alternative proteins. Key countries such as Germany, France, and the UK lead production and consumption of algae‑based ingredients. Continuous innovation in extraction technologies and sustainability‑driven policies support Europe’s stable market position and moderate growth trajectory.

Asia Pacific

Asia Pacific is estimated to hold around 32% of the market in 2024, making it the largest regional segment. Rapid growth in aquaculture, livestock feed demand, and plant‑based food consumption drives adoption of algae meal products. Countries like China, India, and Japan invest heavily in cultivation and processing infrastructure. Favorable climatic conditions, low production costs, and a growing middle‑class fuel this region’s leading share and strong forecasted expansion.

Latin America

Latin America accounts for about 8% of global market share in 2024. Growth in the region is supported by increasing livestock and aquaculture production, rising demand for sustainable feed ingredients, and expanding food and beverage sectors. While production capabilities remain less developed compared to other regions, favorable raw material availability and emerging market investments offer promising opportunities for future expansion.

Middle East & Africa

The Middle East & Africa region holds roughly 6% of the global market in 2024. Market growth here is driven by government initiatives targeting food security, alternative protein adoption, and sustainability goals. High production costs, limited infrastructure, and lower consumer awareness hamper faster growth. Nonetheless, increasing governmental and private investment in algae cultivation and feed solutions signals rising potential in the medium term.

Market Segmentations:

By Source

- Red Algae

- Green Algae

- Brown Algae

- Others

By Grade

By Application

- Food and Beverages

- Snacks

- Bakery & Confectionery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the algae meal market features a mixture of large global players and agile niche firms that together drive innovation, scale, and differentiation. Firms such as Corbion N.V., Cyanotech Corporation, DIC Corporation and AlgaEnergy S.A. hold strong positions, thanks to their extensive R&D, integrated supply‑chains and diversified product portfolios. These companies pursue growth via product launches, strategic partnerships, acquisitions and geographic expansion to tap food, feed and bio‑fuel applications. The evolving market places high value on scale‑efficient algae cultivation technologies, cost‑effective extraction methods, and regulatory‑compliant ingredient portfolios, which enables attackers and incumbents alike to race on both cost and innovation fronts. With barriers to entry easing due to improved cultivation systems, competition is set to intensify, making strategic collaborations and unique value propositions increasingly critical.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AlgaEnergy S.A.

- Corbion N.V.

- BlueBioTech International GmbH

- Archer Daniels Midland Company

- Allmicroalgae – Natural Products S.A.

- Corbion Biotech Inc.

- DIC Corporation

- Cellana Inc.

- Corbion

- Cyanotech Corporation

Recent Developments

- In August 2023, ZIVO and Alimenta Algae SAC will convert its old microalgae production plant into a modern cultivation and processing center. The new version of this plant intends to manufacture up to 100 thousand kg of dried algae products per year and will begin its operation during Q2 or Q3 of 2025. Lima, Peru, claims that Alimenta Algae, a subsidiary of Grupo Alimenta, is set to make the required investments in cultivation ponds and downstream processing as per the supply agreement between ZIVO.

- In August 2023, Dasang has unveiled GoldRlla, a novel product created from Chlorlla, a nutrint-dns microalga abundant in protein, fibr, vitamins, minerals, and essential nutrients such as vitamin B12. The company is activly promoting this superfood to global food manufacturers, emphasizing its nutritional benefits, liver health advantages, and its ability to mask off-flavors in soy.

Report Coverage

The research report offers an in-depth analysis based on Source, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly prioritise low‑carbon and circular cultivation methods for algae‑meal production.

- Manufacturers will scale integrated feed‑ and food‑grade assets to service both livestock industries and human nutrition segments.

- Algae‑meal derivatives will penetrate emerging markets in Asia Pacific and Latin America as middle classes grow and feed demand rises.

- Product innovation will focus on algae blends delivering complete amino‑acid profiles and functional bioactives, enabling premium pricing.

- Strategic M&A and partnerships among ingredient players and food/feed manufacturers will accelerate market consolidation.

- Regulatory alignment on algae‑based feed and food ingredients will simplify market access and widen adoption across regions.

- Cost reduction via improved photobioreactor designs and automated downstream processing will enhance competitiveness versus conventional proteins.

- Value‑added applications such as algae‑fortified snacks and bakery goods will diversify revenue streams beyond feed.

- Operational resilience will rely on geography‑agnostic supply chains to mitigate climate and raw‑material volatility.

- Brand‑led differentiation around sustainability and natural nutrition will drive consumer adoption and premium positioning.