Market Overview

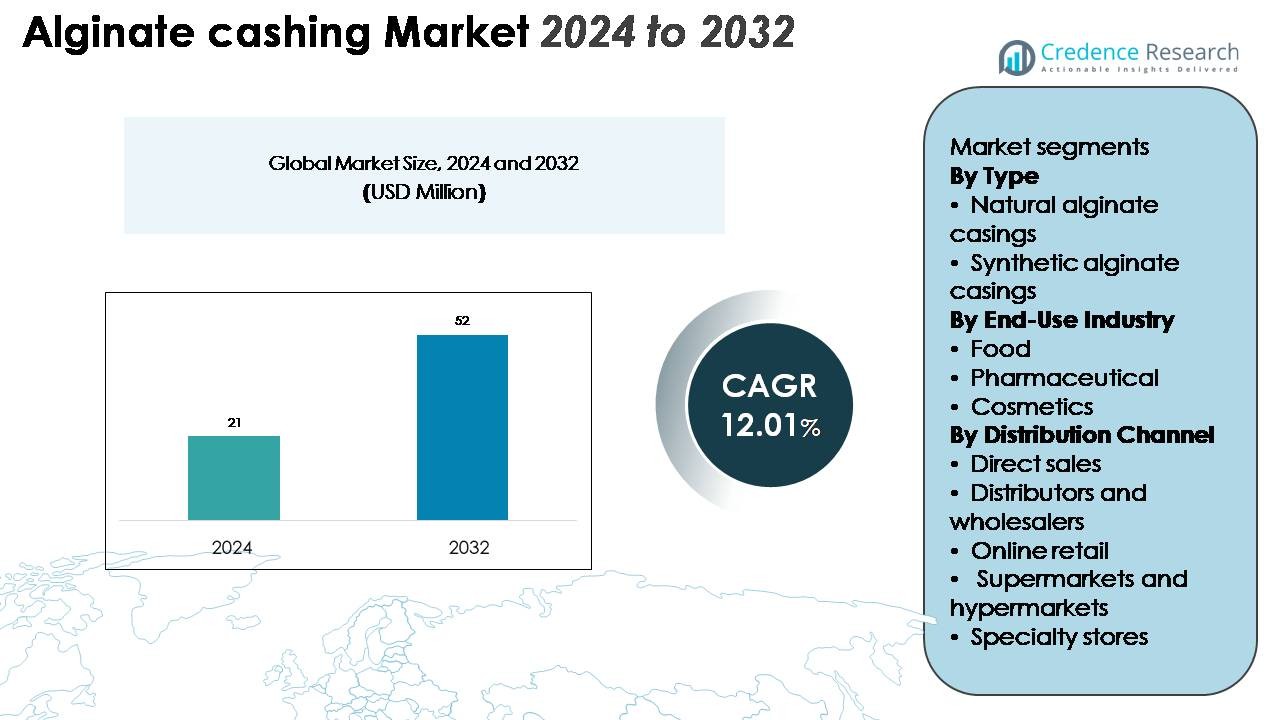

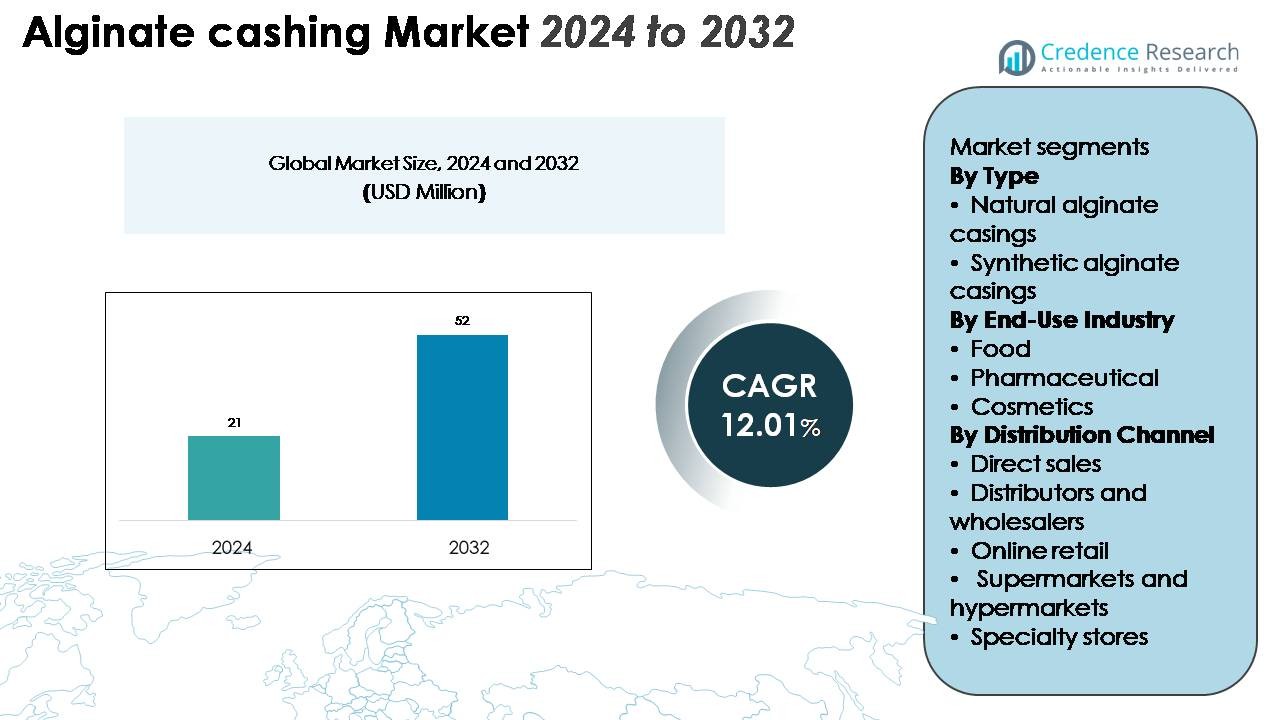

The Alginate Casing Market was valued at USD 21 million in 2024 and is projected to reach USD 52 million by 2032, growing at a CAGR of 12.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alginate Casing Market Size 2024 |

USD 21 Million |

| Alginate Casing Market, CAGR |

12.01% |

| Alginate Casing Market Size 2032 |

USD 52 Million |

Leading companies in the alginate casing market include FMC Corporation, KIMICA Corporation, Qingdao Hyzlin Biology Development Co., Ltd., JRS Group (J. Rettenmaier & Söhne), and Cargill, Incorporated. These players focus on technological innovation, sustainable sourcing of seaweed, and expanding production capacity to meet rising global demand. FMC and Cargill lead in research and distribution strength, while Qingdao Hyzlin leverages Asia’s rich seaweed supply for competitive pricing. JRS Group emphasizes high-quality, customizable casing solutions for food and pharmaceutical use. Regionally, North America dominates the global market with a 34% share, driven by strong adoption of natural and clean-label food ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The alginate casing market was valued at USD 21 million in 2024 and is projected to reach USD 52 million by 2032, growing at a CAGR of 12.01%.

- Rising demand for sustainable, plant-based, and clean-label food products drives strong market growth across global food processing industries.

- The market trend favors natural alginate casings, which hold the largest segment share due to their biodegradable nature and versatility in vegan and meat-based applications.

- Competition remains strong among FMC Corporation, KIMICA Corporation, and Qingdao Hyzlin Biology, focusing on innovation, cost efficiency, and expansion of seaweed sourcing.

- Regionally, North America leads with a 34% share, followed by Europe at 30% and Asia-Pacific at 25%, supported by rising urbanization, food industry automation, and regulatory push for eco-friendly materials.

Market Segmentation Analysis:

By Type

Natural alginate casings dominate the market with the largest share due to their superior biodegradability, flexibility, and compatibility with clean-label food products. These casings are derived from seaweed extracts and preferred in sausage and meat applications for their smooth texture and moisture retention. Rising consumer preference for natural ingredients and sustainability drives their adoption in processed food manufacturing. Synthetic alginate casings, though used for cost efficiency and consistency, remain secondary, mainly in industrial-scale production where uniformity and higher shelf life are prioritized.

- For instance, FMC Corporation developed SeaGel technology using alginate polymers that enable adjustable casing thickness up to 0.5 mm for plant-based sausage products, improving texture and reducing breakage rates by 22% in commercial trials.

By End-Use Industry

The food industry leads the alginate casing market with the highest market share. Its dominance stems from wide application in sausages, plant-based meats, and ready-to-eat foods. Growing demand for vegan and low-fat meat alternatives enhances alginate casing use as a natural replacement for animal-derived casings. In pharmaceuticals, alginate finds niche applications in capsule coating and wound dressings, while cosmetics utilize it in skin-care formulations. Other industries adopt alginate for encapsulation and stabilizing bioactive compounds, adding moderate but consistent market contribution.

- For instance, Viscofan S.A. introduced its VeggieLine alginate casings designed for high-speed filling systems that achieve production rates exceeding 300 units per minute, catering to major plant-based meat producers.

By Distribution Channel

Distributors and wholesalers hold the dominant share in the alginate casing market, supporting large-scale supply to food manufacturers and processing units. Their established networks ensure consistent product availability and bulk distribution across regions. Direct sales are expanding among manufacturers seeking long-term partnerships with food processing firms. Online retail channels are growing steadily, driven by small producers and specialty brands. Supermarkets, hypermarkets, and specialty stores cater mainly to end consumers and artisanal food producers, contributing to diversified product accessibility across market segments.

Key Growth Drivers

Rising Demand for Natural and Sustainable Casings

The growing consumer shift toward natural, plant-based, and sustainable food products is a major growth driver for the alginate casing market. Alginate, derived from brown seaweed, provides an eco-friendly and animal-free alternative to traditional collagen and cellulose casings. Its ability to deliver uniform texture, improved moisture retention, and high elasticity enhances its appeal across meat and vegan food processing industries. With increasing environmental concerns and ethical consumption trends, food manufacturers are replacing synthetic casings with alginate-based solutions to align with clean-label and sustainability standards, driving long-term market expansion.

- For instance, KIMICA Corporation has a powder blending and packaging facility in Japan with an annual production capacity of over 2,000 metric tons (MT), which is sufficient to meet domestic demand.

Growth in Processed and Convenience Food Consumption

Rising urbanization and changing dietary habits have accelerated demand for processed and ready-to-eat foods, directly supporting alginate casing adoption. Alginate casings allow high-speed automated production, longer shelf life, and consistent product appearance, making them ideal for industrial sausage and snack manufacturing. The casing’s ability to withstand heat and retain shape during cooking enhances operational efficiency in mass production. Moreover, as global meat and plant-based alternative industries expand, alginate casings continue to gain traction among food producers aiming to meet efficiency and quality expectations in fast-paced markets.

- For instance, Handtmann’s ConPro-KLSH 153 system operates at up to 3,000 individual portions per minute in calibre ranges from 8 mm to 32 mm, enabling continuous co-extrusion of alginate casings without casing changes.

Technological Advancements in Casing Manufacturing

Continuous innovation in alginate extraction and extrusion technologies supports improved product quality and cost-effectiveness. Modern processing systems enable precise viscosity control and better gelling properties, ensuring consistent casing thickness and high mechanical strength. Automation and digital quality monitoring enhance production scalability for manufacturers. Additionally, investments in bioengineering have led to customized alginate blends for different food textures and moisture levels. Such technological improvements enable producers to achieve higher production throughput and maintain uniformity, making alginate casings a competitive choice across both meat and non-meat applications.

Key Trends & Opportunities

Expansion of Plant-Based Meat Alternatives

The rise of plant-based and flexitarian diets presents strong opportunities for alginate casings. These casings provide a natural, edible, and vegan-friendly solution compatible with soy, pea, and mycoprotein-based meat analogs. Their ability to mimic the texture and bite of traditional sausage casings enhances consumer acceptance of plant-derived products. Leading food brands are incorporating alginate casings into vegan sausages and deli-style foods to attract health-conscious buyers. As demand for sustainable protein sources grows, alginate casings will continue to serve as a preferred alternative within this rapidly evolving segment.

- For instance, Hybricol’s “Plant-Based Casing Gels” system supports calibres from 8 mm through 32 mm, allowing continuous manufacturing of vegan sticks and sausages with the same casings used for meat formats.

Expanding Applications Beyond Food Industry

Beyond food processing, alginate casings are gaining traction in pharmaceuticals and cosmetics. Their biocompatibility and controlled-release properties make them suitable for drug encapsulation, wound dressings, and cosmetic gels. The pharmaceutical industry increasingly leverages alginate materials for biodegradable delivery systems. Similarly, cosmetic brands use alginate in skin-repair and anti-aging formulations due to its natural film-forming and moisturizing capabilities. The diversification into these sectors not only broadens the revenue base for alginate manufacturers but also strengthens long-term growth prospects across multiple industries.

- For instance, the product Cutimed® Alginate (calcium sodium alginate 80% Ca / 20% Na) absorbs up to 20 times its own weight in exudate in wound-dressing applications.

Key Challenges

Fluctuating Raw Material Supply and Cost

The alginate casing market faces challenges due to dependency on seaweed as a raw material. Variations in seaweed harvests caused by climate change, pollution, and regional supply limitations can disrupt production stability. High extraction and purification costs further affect pricing competitiveness compared to synthetic casings. Market participants are investing in sustainable seaweed farming and advanced extraction techniques to mitigate volatility. However, maintaining consistent raw material availability and cost control remains a major challenge for achieving large-scale production and stable profit margins.

Limited Consumer Awareness and Market Penetration

Despite growing adoption, alginate casings face limited awareness in certain regions where traditional collagen or cellulose casings dominate. Smaller food producers may hesitate to transition due to unfamiliarity with alginate processing techniques and higher initial setup costs. Additionally, inconsistent product performance in poorly optimized systems can deter repeat usage. Manufacturers are addressing this through technical collaborations, product trials, and educational campaigns. Expanding consumer and producer awareness will be crucial to overcoming adoption barriers and unlocking the full market potential of alginate casings globally.

Regional Analysis

North America

North America holds the leading share of 34% in the alginate casing market, driven by strong demand for natural and sustainable food ingredients. The United States dominates regional growth with advanced food processing technologies and growing adoption of plant-based meat alternatives. Regulatory support for clean-label ingredients further strengthens market penetration. Key manufacturers focus on developing high-quality alginate casings to meet the standards of large-scale food producers. Canada also contributes significantly through its expanding processed meat industry and sustainable packaging initiatives.

Europe

Europe accounts for 30% of the global alginate casing market, supported by a mature food manufacturing base and strict regulations promoting biodegradable materials. Germany, the U.K., and France lead regional consumption due to the popularity of vegan and clean-label food products. European manufacturers emphasize innovation in alginate formulations to meet texture and flavor requirements for premium sausages and meat substitutes. The region’s focus on reducing animal-based inputs and promoting environmental sustainability continues to accelerate alginate casing adoption across the food industry.

Asia-Pacific

Asia-Pacific captures a 25% share of the global alginate casing market, emerging as a rapidly expanding region. Countries like China, Japan, and South Korea are driving demand due to rising urbanization, growing disposable incomes, and shifting dietary preferences toward convenience foods. The region’s vast seaweed resources also ensure a strong raw material supply for alginate production. Manufacturers in Asia-Pacific are investing in high-efficiency extraction technologies and local processing capabilities, positioning the region as both a major producer and consumer of alginate casings.

Latin America

Latin America represents a 7% market share, with gradual growth fueled by expanding food processing industries in Brazil, Argentina, and Mexico. Increasing awareness of sustainable ingredients and demand for affordable alternatives to collagen casings are shaping market development. Local producers are partnering with international suppliers to access advanced alginate technologies and improve product consistency. Although the market is still developing, the rising popularity of processed meats and snack foods provides a promising outlook for alginate casing adoption across the region.

Middle East & Africa

The Middle East & Africa account for 4% of the alginate casing market, showing steady growth potential. The rise in quick-service restaurants and processed meat consumption supports market expansion in Gulf countries such as Saudi Arabia and the UAE. Regional food manufacturers are adopting natural and halal-compliant casings to cater to diverse consumer bases. South Africa also contributes through its growing packaged food sector. Increasing trade ties with European suppliers and government support for food innovation will further enhance regional market penetration.

Market Segmentations:

By Type

- Natural alginate casings

- Synthetic alginate casings

By End-Use Industry

- Food

- Pharmaceutical

- Cosmetics

- Others

By Distribution Channel

- Direct sales

- Distributors and wholesalers

- Online retail

- Supermarkets and hypermarkets

- Specialty stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the alginate casing market is characterized by a mix of established manufacturers and emerging players focusing on innovation, cost efficiency, and sustainability. Leading companies like ALGAIA, Vaess, Ceamsa compete through product quality, technology integration, and strategic partnerships with food and pharmaceutical firms. Major participants emphasize developing natural, customizable, and heat-stable alginate formulations that cater to clean-label and vegan product demands. Research investments in seaweed cultivation and improved extraction processes also strengthen supply stability. Market players are expanding globally through collaborations and acquisitions to enhance production capacity and regional presence. Additionally, growing competition from alternative edible casings drives continuous improvement in performance, texture, and processing efficiency among key producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qingdao Hyzlin Biology Development

- Ceamsa

- Vaess

- Hybricol

- Promar

- ALGAIA

- Gino Gums Stabilizers

- D2 Ingredients

- RETTENMAIER & SÖHNE

- Columbit

Recent Developments

- In October 2023, Nelson-Jameson entered into a partnership with Vaess, a popular alginate casing brand, to cater to the increasing demand for diversity in customers’ portfolios. Through this partnership, Nelson-Jameson will work with Vaess to deliver customized strategies for the company to grow in the alginate casing segment.

- In March 2023, The JRS Group, a popular German manufacturer of functional plant-based ingredients, acquired “Algaia SA,” a France-based manufacturer of hydrocolloids and seaweed extracts.

- In October 2022, Japan’s leading alginate manufacturer, KIMICA Corporation, opened a new R&D facility in Futtsu City as part of its 80th-anniversary project. With a large-scale laboratory, KIMICA is aiming to meet the increasing consumer demand for aglinate products.

Report Coverage

The research report offers an in-depth analysis based onType, End use industry, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The alginate casing market will expand with growing adoption in meat and plant-based products.

- Rising demand for clean-label and natural ingredients will drive product innovation.

- Manufacturers will focus on developing biodegradable and sustainable casing alternatives.

- Technological advancements will enhance texture consistency and production efficiency.

- Partnerships between food processors and ingredient suppliers will strengthen product portfolios.

- Increased consumption of ready-to-eat foods will boost market penetration across regions.

- Europe will maintain a strong position due to well-established processed meat industries.

- Asia-Pacific will witness rapid growth with expanding vegetarian and vegan food markets.

- Continuous R&D investments will lead to improved heat resistance and product stability.

- Global players will emphasize strategic expansions and tailored solutions to gain competitiveness.