| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aliphatic Diisocyanates Market Size 2024 |

USD 3,608.87 million |

| Aliphatic Diisocyanates Market, CAGR |

6.34% |

| Aliphatic Diisocyanates MarketSize 2032 |

USD 6,112.97 million |

Market Overview:

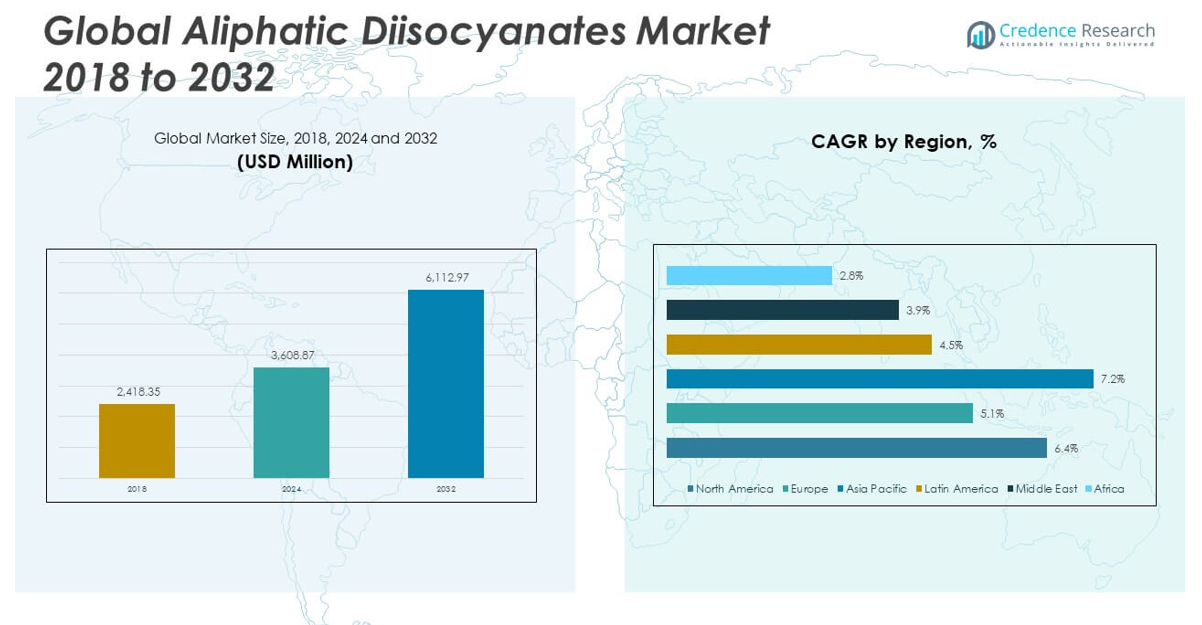

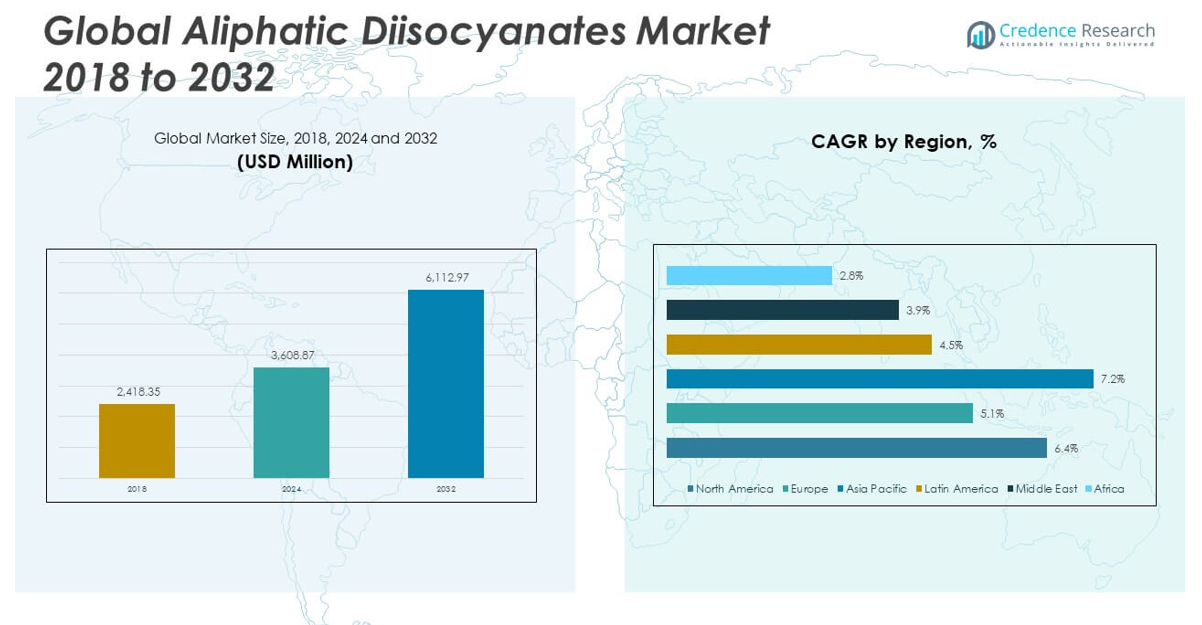

The Global Aliphatic Diisocyanates Market size was valued at USD 2,418.35 million in 2018 to USD 3,608.87 million in 2024 and is anticipated to reach USD 6,112.97 million by 2032, at a CAGR of 6.34% during the forecast period.

Several factors are propelling the growth of the aliphatic diisocyanates market. The automotive industry’s demand for high-performance coatings that offer UV resistance, durability, and aesthetic appeal is a significant driver. Similarly, the construction sector’s need for protective coatings and sealants to enhance infrastructure longevity contributes to market expansion. Additionally, the rising consumer preference for eco-friendly and sustainable materials is encouraging the development of low-VOC and bio-based polyurethane products, further boosting the demand for ADIs. The growing focus on developing energy-efficient and cost-effective alternatives also creates new growth opportunities for market players, aligning with the global push for sustainability.

Regionally, North America leads the aliphatic diisocyanates market. This dominance is attributed to the robust automotive and construction industries in the United States and Canada, where ADIs are extensively utilized in manufacturing high-performance coatings and adhesives. The region’s adoption of advanced technologies and stringent regulatory frameworks, particularly for environmental safety and sustainable manufacturing, further supports market growth. The Asia-Pacific region follows closely, driven by rapid industrialization and urbanization in countries like China and India. The growing automotive and construction sectors in these nations are significantly increasing the demand for ADIs. Europe also holds a substantial market share, with a strong presence of key manufacturers and stringent environmental regulations promoting the use of sustainable and high-performance materials. These factors position Europe as a key player in the expansion of the ADI market.

Market Insights:

- The Global Aliphatic Diisocyanates Market is projected to grow from USD 2,418.35 million in 2018 to USD 6,112.97 million by 2032, driven by strong demand from key sectors like automotive and construction.

- Rising demand for high-performance coatings, especially in the automotive industry, is pushing the growth of ADIs. The need for UV-resistant, durable, and aesthetic coatings in vehicles continues to be a significant market driver.

- The construction sector’s expansion, particularly in infrastructure projects, is driving the use of ADIs in coatings, adhesives, and sealants, supporting the market’s continued growth.

- A growing preference for sustainable materials is creating opportunities in the ADI market. The demand for low-VOC and bio-based products is spurring innovation and aligning with global sustainability efforts.

- Technological advancements in polyurethane production are expanding the application range of ADIs. These innovations are making production more efficient and improving product performance across multiple industries.

- The high production costs and volatility in raw material prices remain significant challenges for the ADI market. Fluctuating prices of petrochemical derivatives can impact manufacturing costs and pricing stability.

- Stringent regulatory compliance and environmental concerns are prompting manufacturers to adopt eco-friendly solutions. This pressure has led to increased investments in research and development for low-VOC and bio-based alternatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from the Automotive Industry

The automotive industry is one of the leading drivers for the growth of the Global Aliphatic Diisocyanates Market. ADIs are widely used in automotive coatings, offering enhanced UV resistance, durability, and aesthetic appeal to vehicles. The rising demand for high-performance coatings in vehicles, particularly in premium and electric models, is pushing the market forward. Car manufacturers increasingly prioritize the protection and longevity of exterior finishes, driving the demand for polyurethane products made with ADIs. Additionally, the trend toward lightweight materials and fuel efficiency in vehicles benefits from the use of ADIs in components such as coatings, adhesives, and sealants. The automotive sector’s increasing focus on environmental sustainability and eco-friendly materials further strengthens this market’s prospects.

- BASF’s Lupranate® M 20 S is a solvent-free product based on 4,4′-diphenylmethane diisocyanate (MDI) with an average functionality of approximately 2.7. According to BASF’s technical data, it is used in the manufacture of insulating foams, higher-density rigid foams, semi-rigid foams for automotive applications, sound insulation, packaging foams, casting materials, binders, adhesives, and sealants.

Expansion of the Construction Sector

The expansion of the construction sector is another crucial factor fueling the growth of the Global Aliphatic Diisocyanates Market. ADIs play a vital role in providing coatings, adhesives, and sealants that are crucial for enhancing the durability and lifespan of construction materials. In particular, these chemicals are used in protective coatings for infrastructure projects, including bridges, roads, and buildings. As urbanization continues to rise globally, the demand for materials that offer long-term protection against harsh environmental conditions has intensified. Governments and private sector entities are increasingly investing in infrastructure, which is expected to result in a continuous rise in the need for high-performance products made from ADIs.

- For example, Covestro’s Bayhydur® XP 7067 is a water-dispersible aliphatic polyisocyanate crosslinker developed for high-performance polyurethane coatings, including automotive applications. According to Covestro’s official product literature, Bayhydur® XP 7067 offers excellent UV and weathering resistance, making it suitable for durable automotive and industrial coating.

Growing Preference for Sustainable Materials

Sustainability is a growing concern across industries, and this has positively impacted the Global Aliphatic Diisocyanates Market. Consumers and manufacturers alike are demanding greener, low-VOC, and bio-based materials, prompting innovation within the ADI market. The shift towards sustainable products is accelerating as more industries seek alternatives to traditional, more environmentally harmful chemicals. ADIs have emerged as a key solution in creating polyurethane products that meet these eco-friendly requirements. Manufacturers are now producing ADIs that have a reduced environmental impact, aligning with the broader market trend of sustainability and circular economy principles. These innovations not only cater to the demand for greener products but also support compliance with stricter environmental regulations.

Technological Advancements in Polyurethane Production

Technological advancements in polyurethane production are helping expand the application range of ADIs. New manufacturing techniques have led to the development of higher-performance, more cost-effective products. These improvements contribute to the broader adoption of ADIs across various industries, such as automotive, construction, and consumer goods. The introduction of smart manufacturing processes and automation has further boosted the efficiency and scalability of ADI production. Additionally, these technological strides are enhancing the performance characteristics of ADI-based products, making them more suitable for diverse and demanding applications. The constant evolution of ADI production processes ensures that these materials remain integral to industries requiring advanced chemical solutions.

Market Trends:

Shift Towards Bio-based and Low-VOC Aliphatic Diisocyanates

A significant trend in the Global Aliphatic Diisocyanates Market is the growing shift towards bio-based and low-VOC (volatile organic compounds) products. With increasing environmental concerns and regulatory pressure, manufacturers are prioritizing the development of ADIs derived from renewable sources. This shift caters to the rising demand for more sustainable and eco-friendly products across multiple industries, including automotive and construction. As governments around the world implement stricter environmental regulations, the demand for low-VOC formulations is gaining momentum. These bio-based and low-VOC ADIs offer similar performance benefits as conventional products but with reduced environmental impacts. This trend aligns with the broader industry move toward green chemistry and sustainability, with more companies exploring innovative solutions to meet these requirements.

- For example, Basonat® HI 100 and HI 100 NG are solvent-free, aliphatic polyisocyanates from BASF, engineered for highly durable, lightfast, and weather-resistant polyurethane coatings across a wide range of demanding applications, with no added solvents and excellent flexibility in formulation.

Growth in Demand for High-Performance Coatings

The demand for high-performance coatings is another key trend influencing the Global Aliphatic Diisocyanates Market. Industries that require coatings with superior durability, UV resistance, and chemical stability, such as automotive, marine, and industrial applications, are increasingly relying on ADIs. These coatings enhance the longevity of materials exposed to harsh environments, contributing to their growing popularity in multiple sectors. The need for coatings that maintain aesthetic quality while providing functional benefits, like corrosion resistance and easy maintenance, is driving innovation in ADI-based formulations. This trend is expected to increase the adoption of ADIs in coatings as industries seek to meet the rising demand for high-quality, long-lasting finishes.

- For example, Evonik Industries, in its official product literature, highlights that VESTANAT® IPDI-based polyisocyanates provide excellent light stability and weather resistance, making them especially suitable for high-performance coatings that require superior UV resistance and minimal yellowing compared to conventional aromatic diisocyanate coatings.

Integration of Advanced Manufacturing Technologies

The adoption of advanced manufacturing technologies is transforming the production processes in the Global Aliphatic Diisocyanates Market. Automation and AI-driven technologies are enabling more efficient, precise, and scalable production of ADIs, resulting in higher output and reduced costs. These technologies also support the creation of customized ADI products that meet the specific needs of industries like automotive, construction, and electronics. The integration of Industry 4.0 technologies, such as real-time data monitoring and predictive maintenance, is enhancing overall manufacturing efficiency. These advancements are not only improving the cost-effectiveness of ADI production but also driving market competition as companies seek to maintain a technological edge in production processes.

Increased Investment in Research and Development

Investment in research and development (R&D) is another growing trend within the Global Aliphatic Diisocyanates Market. Companies are heavily investing in R&D activities to innovate and develop new ADI formulations with enhanced performance characteristics. This includes improving the chemical properties of ADIs, exploring new applications, and creating solutions that are more cost-effective and environmentally friendly. These efforts are fueling market growth by expanding the range of ADI-based products available to meet evolving industry needs. Additionally, collaborations between manufacturers and research institutions are accelerating the pace of innovation, allowing for the development of specialized products that cater to niche applications, further diversifying the market.

Market Challenges Analysis:

High Production Costs and Raw Material Price Volatility

One of the significant challenges faced by the Global Aliphatic Diisocyanates Market is the high production costs and raw material price volatility. The synthesis of ADIs requires specialized chemical processes and raw materials, such as toluene diisocyanate and other petrochemical derivatives, which are subject to fluctuating prices. These price changes, driven by factors such as geopolitical instability, supply chain disruptions, and fluctuations in crude oil prices, can significantly impact manufacturing costs. This volatility makes it difficult for manufacturers to maintain stable pricing and profit margins, especially in highly competitive markets. Additionally, the high production costs hinder the affordability of ADI-based products for smaller businesses and limit the market’s accessibility to some regions.

Regulatory Compliance and Environmental Concerns

The Global Aliphatic Diisocyanates Market also faces the challenge of stringent environmental regulations and compliance requirements. ADIs are chemicals that, while essential for certain industries, are associated with environmental and health risks, particularly in terms of VOC emissions and toxicity during production and use. Increasing regulations in regions like the EU and North America are pushing manufacturers to adopt safer and more environmentally friendly practices, which may require significant investments in research, development, and new production technologies. The pressure to meet these regulations, coupled with the need to develop low-VOC and bio-based alternatives, presents a challenge for manufacturers striving to maintain competitiveness without compromising environmental and safety standards.

Market Opportunities:

Increasing Demand for Sustainable and Eco-friendly Alternatives

The Global Aliphatic Diisocyanates Market presents significant opportunities due to the growing demand for sustainable and eco-friendly alternatives. Environmental regulations and consumer preference for greener products are driving innovation in bio-based and low-VOC ADIs. Manufacturers are focusing on developing solutions that reduce environmental impact while maintaining high performance. These innovations create new avenues for growth, particularly in industries such as automotive, construction, and consumer goods, where eco-friendly solutions are increasingly prioritized. Companies that invest in sustainable technologies can capture a larger market share by meeting the demand for environmentally responsible products.

Expansion in Emerging Markets and New Applications

Emerging markets, particularly in Asia-Pacific and Latin America, offer substantial growth opportunities for the Global Aliphatic Diisocyanates Market. Rapid industrialization and urbanization in these regions are leading to increased demand for high-performance materials, including ADI-based products. The expansion of the automotive and construction industries in these markets further drives demand for ADIs. Additionally, the diversification of ADI applications into sectors such as electronics, medical devices, and renewable energy opens up new growth prospects. Manufacturers can capitalize on these trends by tailoring their products to meet the unique needs of these expanding markets.

Market Segmentation Analysis:

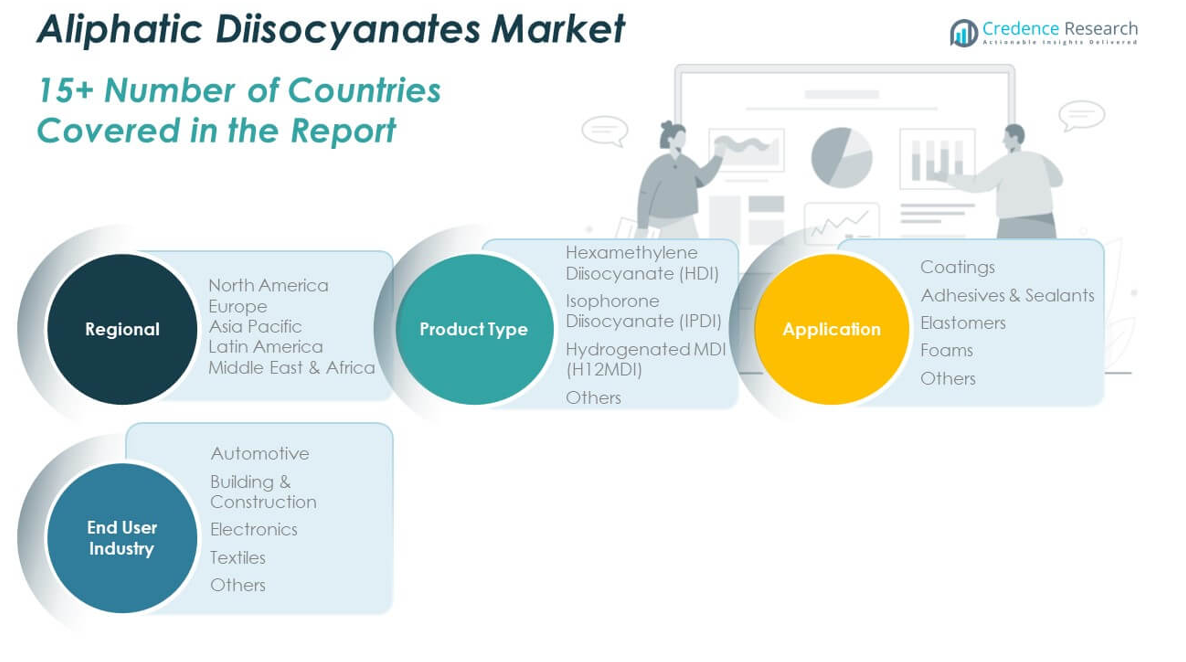

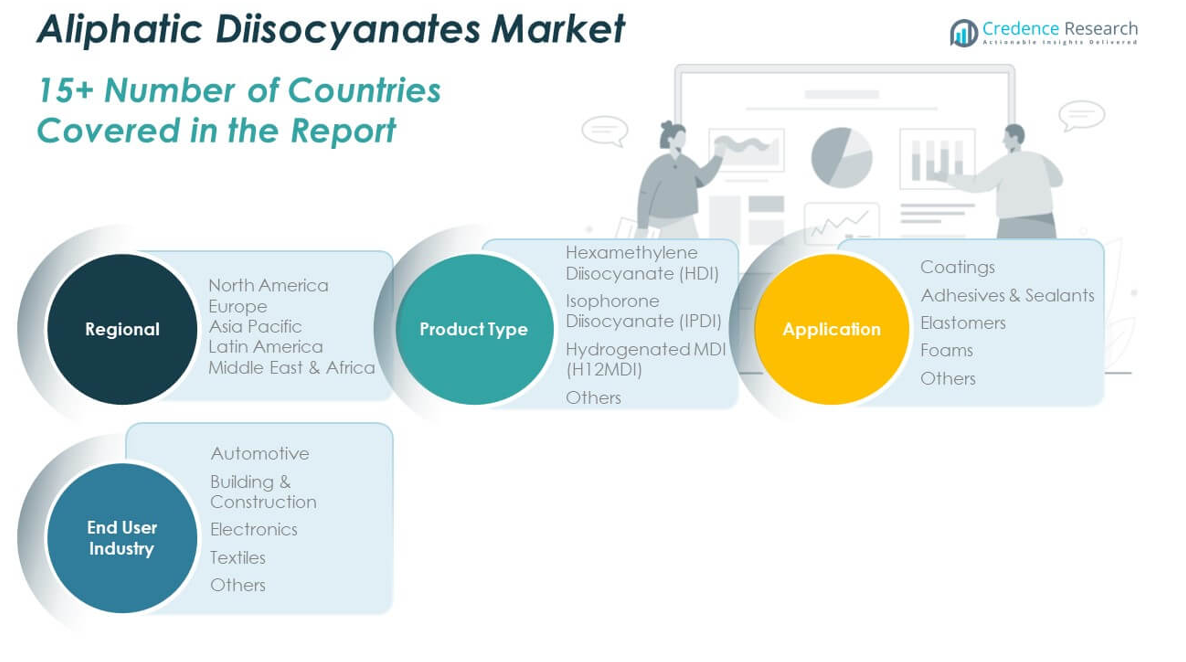

The Global Aliphatic Diisocyanates Market is segmented by product type, application, and end-user industry.

By Product Type, the market is primarily divided into Hexamethylene Diisocyanate (HDI), Isophorone Diisocyanate (IPDI), Hydrogenated MDI (H12MDI), and others. HDI holds the largest share due to its widespread use in coatings, especially for automotive and industrial applications. IPDI is gaining traction in the coatings sector, owing to its enhanced performance properties. H12MDI is increasingly used in high-performance applications such as adhesives and elastomers.

- For example, IPDI’s exceptional weather resistance and gloss retention make it a preferred choice for automotive topcoats and architectural coatings, with global capacity concentrated among five major producers (Evonik, Covestro, Vencorex, BASF, and Wanhua) totaling about 140,000 tons as of 2023.

By Application, the market includes coatings, adhesives & sealants, elastomers, foams, and others. Coatings lead the segment, driven by the growing demand in automotive, construction, and industrial applications for UV-resistant and durable coatings. Adhesives & sealants follow, supported by their use in the automotive and construction industries. Elastomers and foams are expanding, with applications in automotive interiors and insulation materials.

- For instance, polyurethane coatings made with ADIs are used to protect bridges, metal buildings, and wind turbine blades, offering excellent outdoor durability and smooth finishes that minimize dirt build-up and repel rain.

By End-User Industry, the automotive sector holds a dominant position, utilizing ADIs in coatings, adhesives, and elastomers for vehicle parts and interiors. The building & construction industry follows closely, driven by the demand for protective coatings and sealants in infrastructure projects. Electronics and textiles also contribute to the market, driven by the need for durable and flexible materials in these industries. Other sectors, such as consumer goods and medical, are emerging, further diversifying the application base for ADIs.

Segmentation:

By Product Type:

- Hexamethylene Diisocyanate (HDI)

- Isophorone Diisocyanate (IPDI)

- Hydrogenated MDI (H12MDI)

- Others

By Application:

- Coatings

- Adhesives & Sealants

- Elastomers

- Foams

- Others

By End-User Industry:

- Automotive

- Building & Construction

- Electronics

- Textiles

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Aliphatic Diisocyanates Market

The North America Aliphatic Diisocyanates Market size was valued at USD 765.29 million in 2018, USD 1,125.66 million in 2024, and is anticipated to reach USD 1,914.06 million by 2032, at a CAGR of 6.4% during the forecast period. North America holds a significant share in the Global Aliphatic Diisocyanates Market, driven by the robust demand from the automotive and construction industries. The U.S. is the major contributor, where ADIs are extensively used in coatings, adhesives, and sealants. Stringent environmental regulations are pushing manufacturers to innovate and adopt low-VOC and sustainable ADI alternatives. The region’s strong technological infrastructure and large-scale manufacturing capabilities further support market growth. With a growing trend towards high-performance coatings and eco-friendly products, North America is expected to maintain its dominance in the coming years.

Europe Aliphatic Diisocyanates Market

The Europe Aliphatic Diisocyanates Market size was valued at USD 474.82 million in 2018, USD 671.66 million in 2024, and is anticipated to reach USD 1,039.89 million by 2032, at a CAGR of 5.1% during the forecast period. Europe’s market growth is primarily driven by the automotive, construction, and coatings industries. The region’s emphasis on environmental sustainability and compliance with stringent regulations has led to increased demand for bio-based and low-VOC ADIs. Countries such as Germany, France, and the U.K. are leading in industrial applications, with manufacturers focusing on innovation to meet the rising demand for high-quality and eco-friendly ADI-based products. Europe continues to show strong growth, particularly in green technologies, which boosts market prospects.

Asia Pacific Aliphatic Diisocyanates Market

The Asia Pacific Aliphatic Diisocyanates Market size was valued at USD 982.67 million in 2018, USD 1,524.66 million in 2024, and is anticipated to reach USD 2,751.54 million by 2032, at a CAGR of 7.2% during the forecast period. The region is the fastest-growing market, driven by rapid industrialization, urbanization, and increased demand from the automotive, construction, and consumer goods sectors. Countries like China and India are witnessing significant growth in manufacturing and infrastructure development, which fuels the demand for ADIs. Additionally, Asia-Pacific’s expanding automotive sector, particularly electric vehicles, is a key contributor to market growth. The rise of sustainable and bio-based solutions in the region further strengthens market expansion.

Latin America Aliphatic Diisocyanates Market

The Latin America Aliphatic Diisocyanates Market size was valued at USD 99.97 million in 2018, USD 147.07 million in 2024, and is anticipated to reach USD 216.35 million by 2032, at a CAGR of 4.5% during the forecast period. Latin America is gradually increasing its market share in the Global Aliphatic Diisocyanates Market, driven by the construction and automotive industries in countries like Brazil and Mexico. The demand for ADIs in coatings, adhesives, and sealants is rising with the growing need for infrastructure development and automotive production. Economic stability and increasing investments in industrial applications further support market growth in this region. The trend toward sustainability is also emerging in Latin America, creating opportunities for environmentally friendly ADI solutions.

Middle East Aliphatic Diisocyanates Market

The Middle East Aliphatic Diisocyanates Market size was valued at USD 63.70 million in 2018, USD 86.37 million in 2024, and is anticipated to reach USD 121.85 million by 2032, at a CAGR of 3.9% during the forecast period. The Middle East market is experiencing steady growth due to increasing infrastructure and construction activities. Countries like Saudi Arabia and the UAE are investing heavily in infrastructure projects, which drive the demand for ADIs in coatings and sealants. The region’s automotive sector, though smaller compared to other regions, is also contributing to market expansion. The focus on sustainable practices and environmentally friendly products is gradually increasing the adoption of low-VOC and bio-based ADIs in the region.

Africa Aliphatic Diisocyanates Market

The Africa Aliphatic Diisocyanates Market size was valued at USD 31.90 million in 2018, USD 53.45 million in 2024, and is anticipated to reach USD 69.27 million by 2032, at a CAGR of 2.8% during the forecast period. Africa’s market for ADIs is growing at a moderate pace, primarily driven by demand in the construction and automotive sectors. Countries like South Africa and Nigeria are investing in infrastructure development, creating opportunities for ADIs in coatings and adhesives. The region’s adoption of eco-friendly and sustainable products is expected to gain momentum in the coming years, opening up new growth avenues. The market remains in the early stages but is gradually expanding as industrial activities increase.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Covestro AG

- BASF SE

- Wanhua Chemical Group Co. Ltd.

- Huntsman Corporation

- Evonik Industries

- Vencorex

- Asahi Kasei

- Tosoh Corporation

Competitive Analysis:

The Global Aliphatic Diisocyanates Market is highly competitive, with several key players dominating the industry. Leading companies such as BASF, Covestro, and Huntsman are investing heavily in research and development to enhance their product portfolios and improve ADI production efficiency. These companies focus on offering high-performance, sustainable, and low-VOC ADIs to meet the increasing demand for eco-friendly solutions across various industries. Market players also adopt strategies such as mergers and acquisitions, partnerships, and geographic expansion to strengthen their market presence. Regional players are focusing on expanding their manufacturing capabilities to cater to the rising demand from emerging markets, particularly in Asia Pacific. The competition is further intensified by the growing trend toward bio-based ADIs, with manufacturers exploring new technologies to create sustainable alternatives. The need for constant innovation and compliance with stringent environmental regulations remains a key challenge for industry players.

Recent Developments:

- In April 2025, Wanhua Chemical announced the successful acquisition of Vencorex’s specialty isocyanate business, including the HDI monomer production facility near Grenoble, France (70,000 tons annual capacity), and access to Vencorex’s sales channels and intellectual property. This acquisition strengthens Wanhua’s position in the aliphatic isocyanate market, optimizes its European supply chain, and mitigates risks related to tariffs and global economic uncertainties

- In October 2024, ADNOC International Germany Holding AG announced a voluntary public takeover offer to acquire all shares of Covestro AG at €62 per share. This acquisition, the largest of a European company by a Middle Eastern firm, is part of Covestro’s “Sustainable Future” strategy, supporting its climate neutrality goals and the transition to a circular economy.

Market Concentration & Characteristics:

The Global Aliphatic Diisocyanates Market is moderately concentrated, with a few key players holding significant market share. Large multinational corporations such as BASF, Covestro, and Huntsman dominate the market, driven by their extensive production capabilities, strong brand presence, and advanced research and development efforts. These companies focus on expanding their product offerings, particularly in sustainable and low-VOC ADIs, to meet growing environmental concerns. Smaller regional players contribute to market diversification, often focusing on niche applications or localized production. The market is characterized by steady technological advancements, with manufacturers increasingly adopting automation and eco-friendly practices. Competitive rivalry remains high as companies strive to innovate while adhering to stringent regulatory requirements. The market dynamics are shaped by factors such as supply chain management, technological adoption, and the ability to meet changing customer demands for sustainable products.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Aliphatic Diisocyanates Market will continue to grow, driven by strong demand in automotive and construction sectors.

- Sustainability efforts will promote the development of bio-based and low-VOC ADIs, broadening their applications across multiple industries.

- Infrastructure development in emerging economies will increase the need for ADIs in coatings, adhesives, and sealants.

- Technological innovations in ADI production, such as automation and Industry 4.0 integration, will enhance efficiency and product quality.

- The demand for high-performance coatings in automotive and aerospace applications will remain a key market driver.

- Regional players focusing on cost-effective and eco-friendly solutions will intensify competition in the market.

- Growing consumer preference for sustainable materials will spur further innovation in ADI products.

- Increasing environmental regulations will push manufacturers to develop safer, more environmentally friendly ADI formulations.

- The Asia Pacific region will see the highest growth due to industrialization and infrastructure expansion.

- Strategic partnerships and mergers among key players will continue to drive market growth and innovation.