Market Overview:

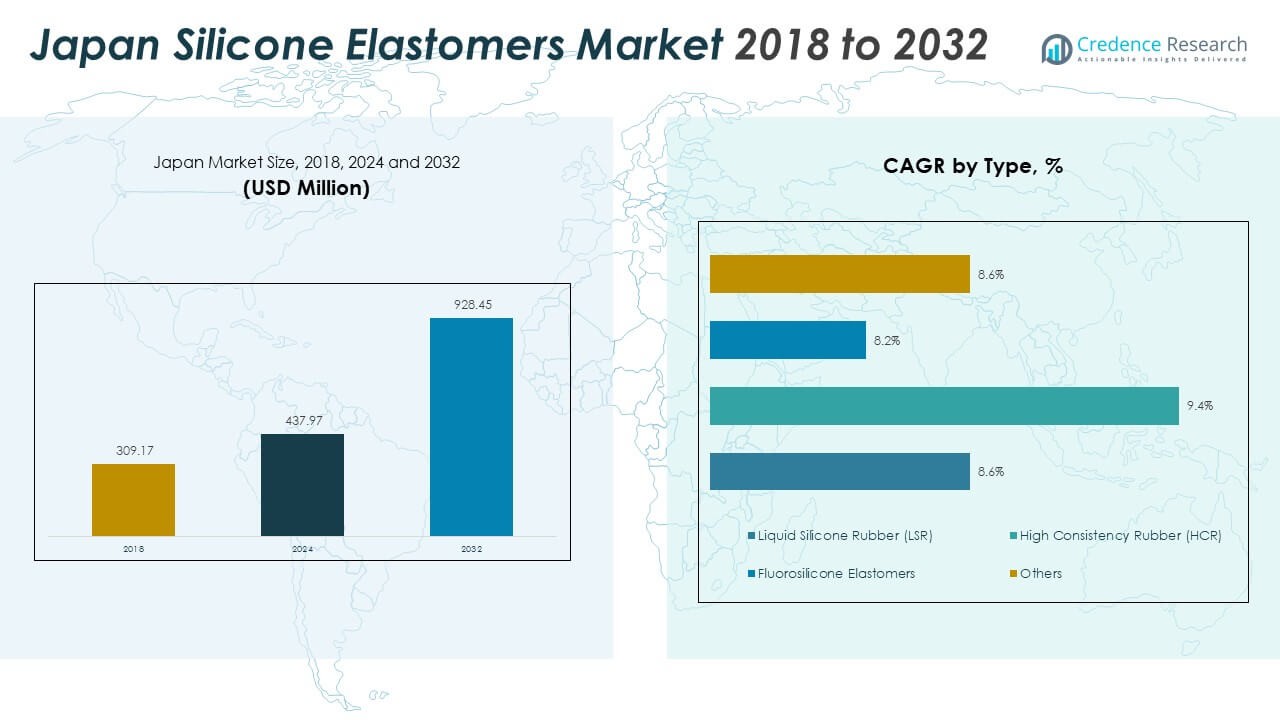

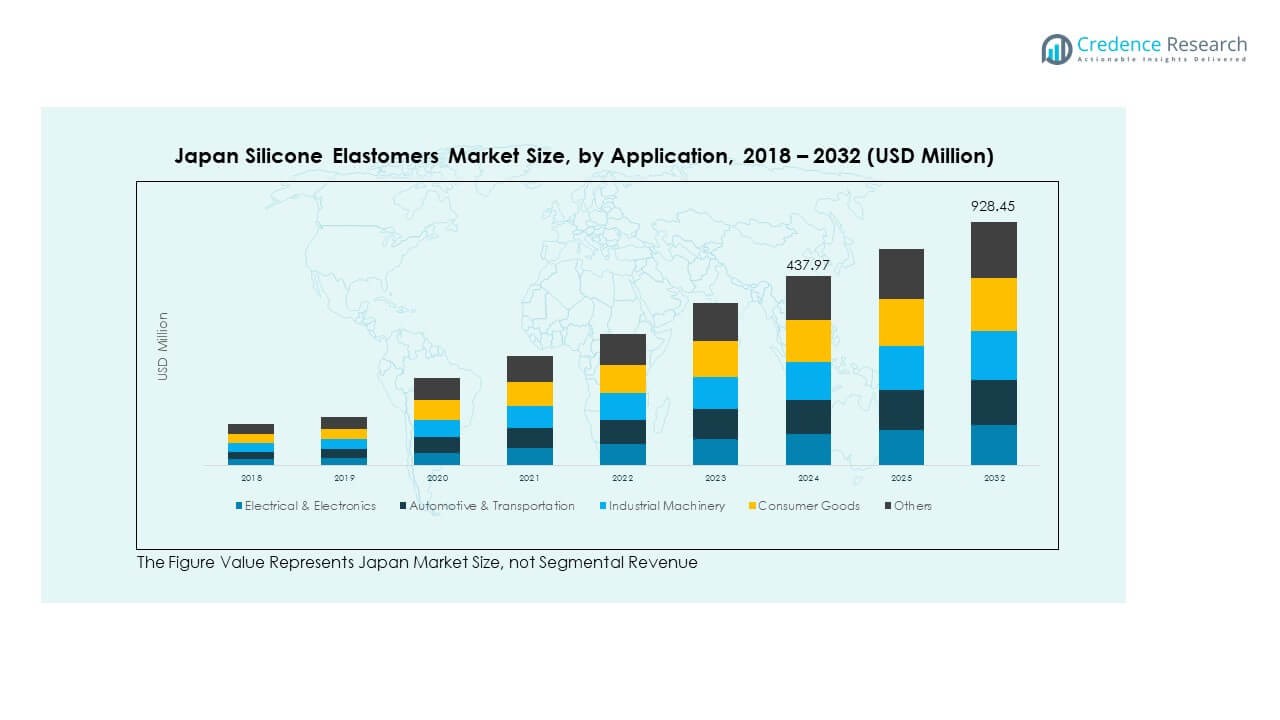

The Japan Silicone Elastomers Market size was valued at USD 309.17 million in 2018 to USD 437.97 million in 2024 and is anticipated to reach USD 928.45 million by 2032, at a CAGR of 9.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Silicone Elastomers Market Size 2024 |

USD 437.97 Million |

| Japan Silicone Elastomers Market, CAGR |

9.85% |

| Japan Silicone Elastomers Market Size 2032 |

USD 928.45 Million |

Growth in automotive, electronics, and healthcare industries drives the market’s strong expansion. Silicone elastomers offer flexibility, heat resistance, and durability that meet advanced industrial needs. Increasing use in electric vehicle components, sensors, and wearable medical devices enhances market demand. Expanding industrial automation and rapid material innovation support continued adoption. Manufacturers focus on improving mechanical strength, process efficiency, and biocompatibility to serve diversified applications across high-value sectors.

Regionally, Kanto leads due to its dense concentration of electronics, automotive, and chemical industries. Kansai follows with strong demand from automotive and medical device manufacturing clusters in Osaka and Kyoto. Chubu and Kyushu are emerging hubs, driven by semiconductor, renewable energy, and industrial machinery growth. Japan’s emphasis on precision engineering and sustainable materials sustains its dominance in advanced silicone elastomer production within the Asia-Pacific region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Silicone Elastomers Market was valued at USD 309.17 million in 2018, reached USD 437.97 million in 2024, and is projected to attain USD 928.45 million by 2032, growing at a CAGR of 9.85%.

- Kanto leads with a 42% share due to strong electronics and automotive manufacturing, followed by Kansai at 33%, driven by medical and industrial production, and Chubu at 15%, supported by machinery and EV components.

- Kyushu, holding a 10% share, remains the fastest-growing region due to rapid semiconductor expansion and renewable energy projects that raise silicone demand.

- The Electrical & Electronics segment contributes the largest share at 34%, supported by high demand in semiconductors, power modules, and advanced consumer electronics.

- The Automotive & Transportation segment follows with a 28% share, driven by electric vehicle adoption and the need for heat-resistant and durable silicone components.

Market Drivers

Growing Demand in Automotive and Electric Vehicle Manufacturing

The Japan Silicone Elastomers Market benefits from rapid growth in automotive and electric vehicle production. Silicone elastomers are widely used for gaskets, hoses, and vibration dampers due to their flexibility and thermal resistance. Automakers rely on these materials for high-temperature engine components and durable electrical insulation. Increasing adoption of electric vehicles creates new demand for silicone-based thermal management solutions. Manufacturers enhance formulations to improve performance under extreme conditions. It supports improved reliability and efficiency in electric powertrains. Rising environmental regulations push automakers toward lightweight, energy-efficient materials. This strengthens the market’s importance across the automotive supply chain.

- For instance, Dow’s DOWSIL™ EC-8425 Electrically Conductive Adhesive and SILASTIC™ silicone elastomers are utilized in Japan’s electric vehicle manufacturing for efficient thermal gap filling and durable battery insulation, ensuring high conductivity and long-term reliability in advanced mobility applications.

Expansion in Consumer Electronics and Semiconductor Manufacturing

Japan’s electronics and semiconductor sectors drive extensive use of silicone elastomers in molding, sealing, and encapsulation. These materials protect sensitive circuits and sensors from heat and contamination. Manufacturers depend on their stable dielectric properties for precision components. The rise in wearable devices and flexible displays supports market expansion. It plays a key role in ensuring reliability in compact electronic systems. Leading Japanese producers are optimizing materials for low-voltage and high-frequency applications. Ongoing R&D investment enhances product stability and miniaturization capability. This integration into next-generation electronics sustains long-term growth.

- For example, as of March 2025, Tokyo Electron held 24,996 active patents in semiconductor production equipment and maintained a global patent application rate of roughly 75% for six consecutive years. The company’s recognition in Clarivate’s Top 100 Global Innovators 2025 underscores its leadership in advancing precision technologies for next-generation electronics and display manufacturing.

Rising Use in Medical and Healthcare Device Production

The healthcare industry drives significant demand for biocompatible silicone elastomers. Medical-grade formulations are used in tubing, implants, and diagnostic devices. These materials ensure safety, sterilization compatibility, and mechanical strength. The aging population in Japan increases the need for advanced healthcare solutions. It enables manufacturers to deliver high-performance components for surgical and therapeutic use. Local producers develop specialized grades to meet strict medical standards. Investment in medical innovation supports domestic supply resilience. This growing healthcare integration strengthens the market’s long-term outlook.

Increasing Adoption in Industrial and Construction Applications

Japan’s industrial and construction sectors use silicone elastomers in sealing, insulation, and structural applications. Their resistance to UV, chemicals, and temperature variations supports infrastructure durability. Industrial machinery benefits from their mechanical and electrical insulation properties. It enhances performance in harsh operating environments. Demand for energy-efficient and fire-resistant materials continues to grow. Building and electronics industries increasingly use these materials for sustainability goals. Domestic producers improve material consistency and environmental compliance. The continued focus on safety and reliability drives widespread adoption across industrial projects.

Market Trends

Shift Toward High-Performance and Specialty Silicone Grades

Manufacturers in the Japan Silicone Elastomers Market emphasize high-performance formulations tailored to advanced applications. Specialty grades with enhanced thermal conductivity and transparency support electronics and lighting components. Companies are developing low-volatile and flame-retardant products for safety compliance. The focus on durability and lightweight design promotes substitution of conventional polymers. It improves manufacturing efficiency across industries. Research partnerships between domestic producers and universities foster innovation in silicone chemistry. Global customers demand precise performance standards, encouraging continuous formulation upgrades. This trend strengthens Japan’s position in premium material production.

Integration of Smart Manufacturing and Automation in Production Processes

Automation and digitalization are transforming silicone elastomer manufacturing. Robotics and real-time monitoring systems improve process precision and reduce waste. It enables consistent material quality for complex molding applications. Producers deploy AI-driven analytics to optimize production parameters and predict equipment performance. The shift toward Industry 4.0 enhances supply reliability and cost efficiency. Smart manufacturing technologies help reduce energy consumption and downtime. Partnerships with equipment manufacturers improve overall plant productivity. This modernization trend strengthens Japan’s global competitiveness in elastomer manufacturing.

- For instance, ARUM Inc. a Japanese company providing AI software for manufacturing developed ARUMCODE, an AI program-writing system for precision component machining. Using ARUMCODE, the programming time required for complex components was cut from 16 hours (manual technician labor) down to just 15 minutes via automated AI code generation, achieving an accuracy level of 5 microns

Growing Focus on Sustainable and Eco-Friendly Material Development

Sustainability is becoming a major influence in Japan’s silicone elastomer industry. Producers are investing in recyclable and low-emission material formulations. It supports compliance with Japan’s environmental goals and international regulations. Companies explore renewable raw materials and closed-loop production systems. Consumer electronics and automotive sectors encourage adoption of cleaner materials. Process innovations reduce solvent usage and waste generation. Green manufacturing certification strengthens brand reputation. Growing global demand for sustainable materials enhances export opportunities. This environmental focus aligns with Japan’s national sustainability commitments.

- For example, in January 2024, Asahi Kasei obtained ISCC PLUS certification for several thermoplastic elastomers and rubbers, confirming the verified use of biomass and recycled raw materials in its production processes. The certification ensures full traceability of sustainable inputs throughout the supply chain, reinforcing Asahi Kasei’s commitment to circular manufacturing.

Rising Collaboration Between Material Producers and End-Use Industries

Collaborative development between silicone producers and industrial users is reshaping innovation cycles. Partnerships aim to meet precise performance and design specifications. The Japan Silicone Elastomers Market benefits from co-engineering initiatives in healthcare, automotive, and electronics. It accelerates product validation and market entry for new applications. Companies exchange data for customized formulations suited to operating conditions. Joint R&D accelerates scaling of advanced elastomer technologies. These collaborations strengthen long-term supplier-customer relationships. The integration of feedback-driven design supports faster innovation and commercial success.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes

The Japan Silicone Elastomers Market faces rising production costs linked to raw materials and energy prices. Manufacturing requires precision mixing, curing, and quality testing, increasing operational expenses. Limited availability of high-purity silicon compounds affects pricing stability. It challenges small and medium producers struggling with economies of scale. Stringent quality requirements in automotive and medical applications further raise compliance costs. Specialized equipment investments extend payback periods. Market players focus on automation and local sourcing to reduce costs. Maintaining consistent supply while controlling expenses remains a key obstacle.

Stringent Environmental Regulations and Import Dependency on Raw Materials

Tough environmental regulations challenge producers to meet emission and waste disposal standards. Japan imports a significant share of raw silicon feedstock, increasing exposure to supply disruptions. It raises procurement risks when geopolitical issues or trade constraints occur. Regulatory limits on hazardous chemicals add pressure to reformulate products. Transitioning to greener production processes requires substantial capital investment. The slow approval process for new materials delays commercialization. Producers must balance innovation with environmental compliance to remain competitive. These challenges collectively slow short-term market expansion.

Market Opportunities

Rising Adoption of Silicone Elastomers in Renewable Energy and EV Applications

Growth in renewable energy projects and electric vehicle manufacturing creates strong demand for silicone elastomers. The Japan Silicone Elastomers Market benefits from use in high-voltage insulation, sealing, and battery protection. It enhances system reliability in demanding environments. Domestic companies explore partnerships with EV battery and solar equipment manufacturers. High-temperature-resistant silicone components improve energy efficiency and safety. Expanding energy transition goals boost material consumption. This alignment with green energy industries presents long-term opportunities for Japanese producers.

Growing Export Potential and Product Diversification in Asia-Pacific Markets

Japan’s strong reputation for quality materials supports its export growth in Asia-Pacific. Neighboring countries invest in electronics, construction, and healthcare, increasing import needs. The market’s expertise in high-precision formulations drives regional collaboration. It creates opportunities for joint ventures and licensing agreements. Product diversification toward low-cost, high-performance elastomers strengthens competitive positioning. Emerging economies prefer Japanese-grade silicones for durability and purity. Expanding regional trade agreements enhance global reach. This export-driven growth supports Japan’s manufacturing leadership.

Market Segmentation Analysis

By Type

Liquid Silicone Rubber (LSR) leads the Japan Silicone Elastomers Market owing to its superior moldability, stability, and resistance to high temperatures. It is widely adopted in automotive seals, medical implants, and electronic encapsulation, ensuring consistent performance and manufacturing efficiency. Rising demand from the healthcare and consumer electronics sectors supports strong volume growth. Producers enhance LSR curing speed and tensile strength to improve durability and reduce cycle time. Automated injection systems further boost precision and reduce waste. High Consistency Rubber (HCR) follows with stable use in traditional molding and extrusion applications for industrial and automotive parts. Its mechanical strength and temperature tolerance ensure reliability under harsh conditions. Continuous automation and blending improvements sustain its competitiveness in Japan’s high-specification manufacturing environment.

- For instance, according to Shin-Etsu’s official catalog, the KE-951-U grade silicone rubber achieves a tensile strength of up to 11 MPa and elongation at break of 600% under standardized testing, which aligns with its broad utilization in molding and extrusion for critical components in the automotive and electrical industries.

By Application

Electrical and electronic applications hold a dominant share due to Japan’s leadership in semiconductors, sensors, and power modules. Silicone elastomers provide excellent insulation, flexibility, and dielectric properties for miniaturized devices and LED assemblies. The automotive and transportation sector also represents a key revenue contributor, driven by expanding electric vehicle production and thermal management needs. Industrial machinery and consumer goods segments benefit from silicone’s vibration control, sealing, and ergonomic properties, supporting the shift toward durable and sustainable materials. Construction applications rely on silicone for glazing, sealing, and waterproofing to enhance building efficiency and safety. The “Others” category includes aerospace and healthcare, where reliability and biocompatibility remain essential for precision applications and long-term performance stability.

- For instance, Wacker’s specialty silicones have been supplied to Japanese construction projects for advanced weather- and UV-resistant sealants, as substantiated by their regional market presence and company production reports. The “Others” category includes aerospace and healthcare, where reliability and biocompatibility remain essential for precision applications and long-term performance stability.

Segmentation

By Type

- Liquid Silicone Rubber (LSR)

- High Consistency Rubber (HCR)

- Fluorosilicone Elastomers

- Others

By Application

- Electrical & Electronics

- Automotive & Transportation

- Industrial Machinery

- Consumer Goods

- Construction

- Others

Regional Analysis

Kanto Region – Leading Market with 42% Share

The Kanto region dominates the Japan Silicone Elastomers Market with a 42% share, driven by its strong industrial and technological ecosystem. Tokyo and Kanagawa serve as hubs for electronics, automotive, and chemical manufacturing. High R&D intensity and the presence of global corporations like Shin-Etsu Chemical and Dow Corning Japan support advanced material innovation. The region’s robust infrastructure and skilled workforce sustain high production capacity. It benefits from proximity to research institutions that enhance product development efficiency. Government-backed initiatives for energy-efficient materials strengthen growth. The Kanto region remains the primary contributor to national output and export volume.

Kansai Region – Emerging Center for Automotive and Medical Manufacturing with 33% Share

The Kansai region holds a 33% share, supported by major automotive and healthcare device manufacturing clusters in Osaka, Kyoto, and Hyogo. Demand for high-performance silicone elastomers is growing across EV components, diagnostic devices, and industrial seals. It plays a crucial role in integrating automation and precision molding technologies. Local manufacturers invest in sustainable production processes and new product formulations. The availability of raw material suppliers and technical expertise fosters a competitive environment. Collaboration between universities and producers enhances applied research. Kansai’s manufacturing adaptability drives steady regional expansion.

Chubu and Kyushu Regions – Expanding Industrial Bases with 25% Combined Share

Chubu and Kyushu together account for a 25% share of the Japan Silicone Elastomers Market. Chubu’s strong automotive and machinery sectors fuel demand for high-consistency rubber and heat-resistant materials. It supports localized supply for electric vehicle assembly lines. Kyushu’s semiconductor and electronics industries accelerate use in encapsulation and insulation applications. The regional focus on renewable energy and robotics fosters diversification in end-use segments. Infrastructure upgrades and export-focused policies strengthen industrial competitiveness. It is emerging as a key area for future investment and technological collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow Inc.

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Stockwell Elastomerics

- Specialty Silicone Products, Inc.

Competitive Analysis

The Japan Silicone Elastomers Market is characterized by high competition among global and domestic producers. Major players include Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Dow Corning Japan, Momentive Performance Materials, and Elkem ASA. These companies focus on product innovation, regional expansion, and strategic alliances with end-use industries. It encourages continuous development of high-performance, low-volatile, and medical-grade elastomers. Local producers strengthen their advantage through precision manufacturing and quality control systems. R&D investments target advanced formulations for EVs, semiconductors, and medical devices. The competitive landscape favors firms with sustainable practices and technical expertise. Integration across value chains ensures consistent supply and cost optimization, reinforcing long-term market leadership.

Recent Developments

- In October 2025, Elkem ASA introduced SILBIONE™ LSR Select EC 70, an electrically conductive and biocompatible liquid silicone rubber designed for medical applications. This product represents a technological breakthrough in silicon-based advanced materials tailored for the healthcare and medical device sectors.

- In May 2025, Shin-Etsu Chemical Co., Ltd. launched new silicone elastomer gels named KSG-16-SF and KSG-19-PF, designed to improve the texture and functionality of personal care products. These gels offer innovative features such as high light-diffusion capabilities, with KSG-16-SF providing a pronounced soft-focus effect and KSG-19-PF delivering a delicate powdery finish.

- In January 2025, Wacker Chemie AG inaugurated two new specialty silicone production facilities in Tsukuba, Japan, and Jincheon, South Korea, investing tens of millions of euros. The Tsukuba plant focuses on silicone thermal interface materials crucial for electric vehicles, helping Wacker serve the growing Japanese automotive and construction sectors more efficiently.

Report Coverage

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advancements in material engineering will improve the mechanical and thermal stability of silicone elastomers across industrial sectors.

- Increasing electric vehicle adoption will strengthen demand for high-performance silicone used in insulation, gaskets, and heat management.

- Expanding semiconductor and electronics manufacturing will drive use in encapsulation, sealing, and flexible circuit protection applications.

- Medical-grade silicone elastomers will gain prominence in device manufacturing due to biocompatibility and sterilization resilience.

- Sustainability initiatives will encourage producers to adopt cleaner production technologies and recyclable silicone formulations.

- Automation and AI-based process control will enhance production efficiency, reduce waste, and improve product consistency.

- Strategic R&D partnerships between universities and producers will accelerate the development of specialty silicone grades.

- Growing export opportunities within Asia-Pacific will strengthen Japan’s position as a premium silicone materials supplier.

- Integration of silicone elastomers in renewable energy systems will open new avenues for product innovation and market expansion.

- Continuous government support for material science innovation will ensure the Japan Silicone Elastomers Market remains globally competitive.