Market Overview:

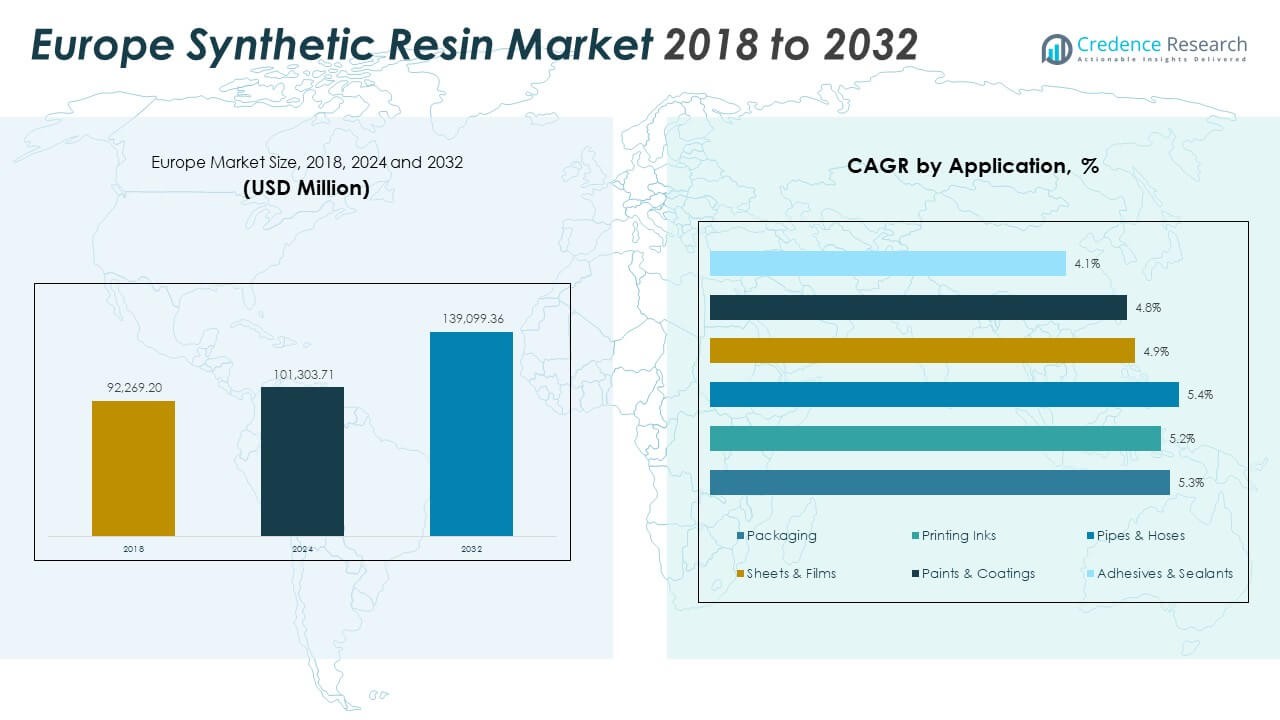

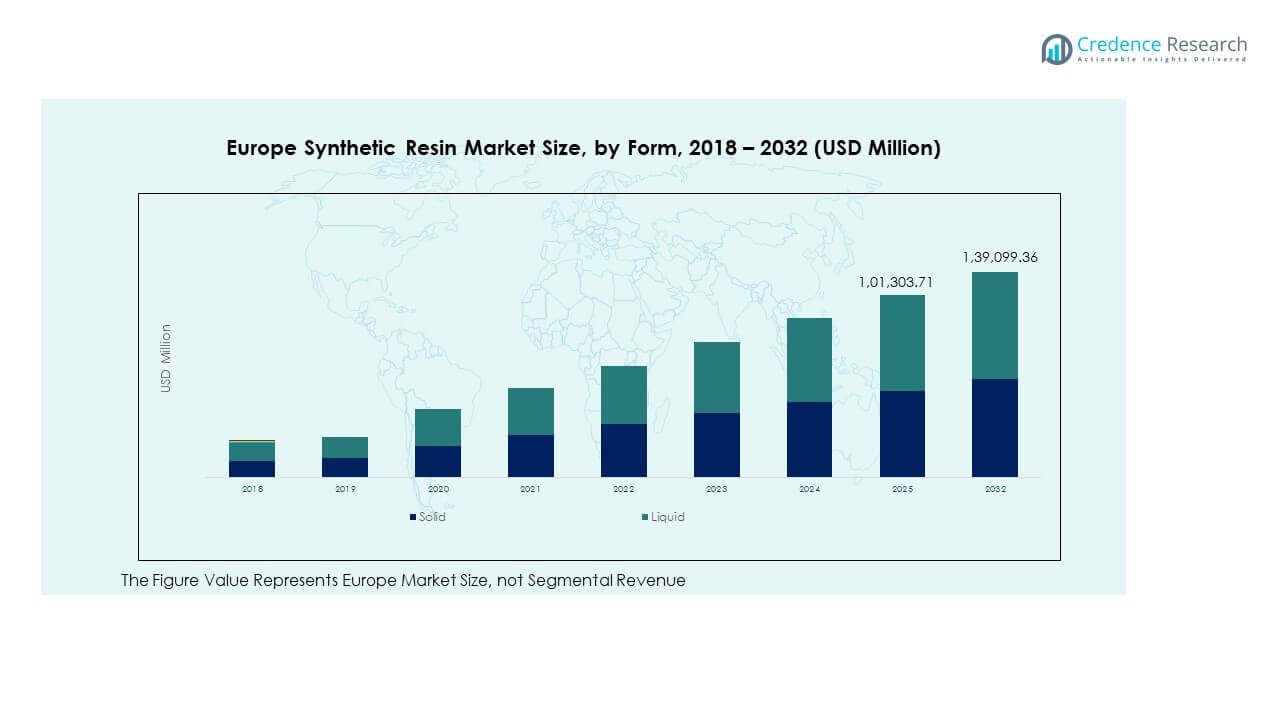

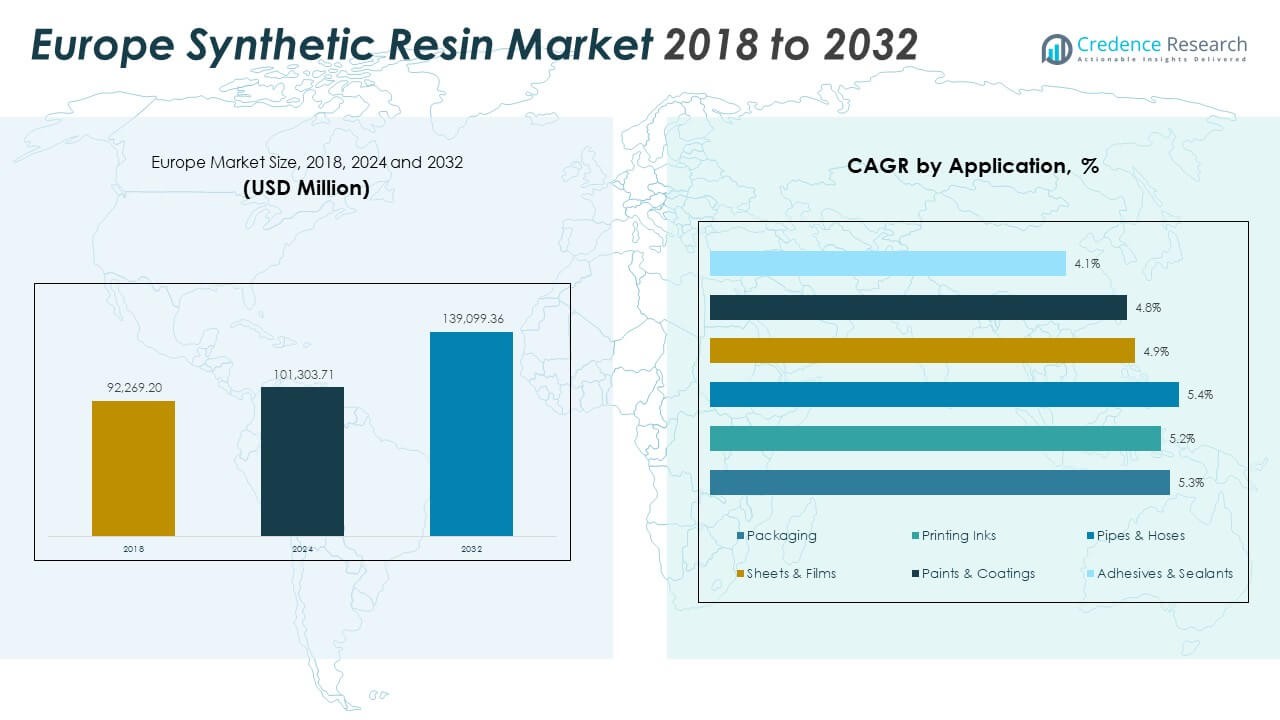

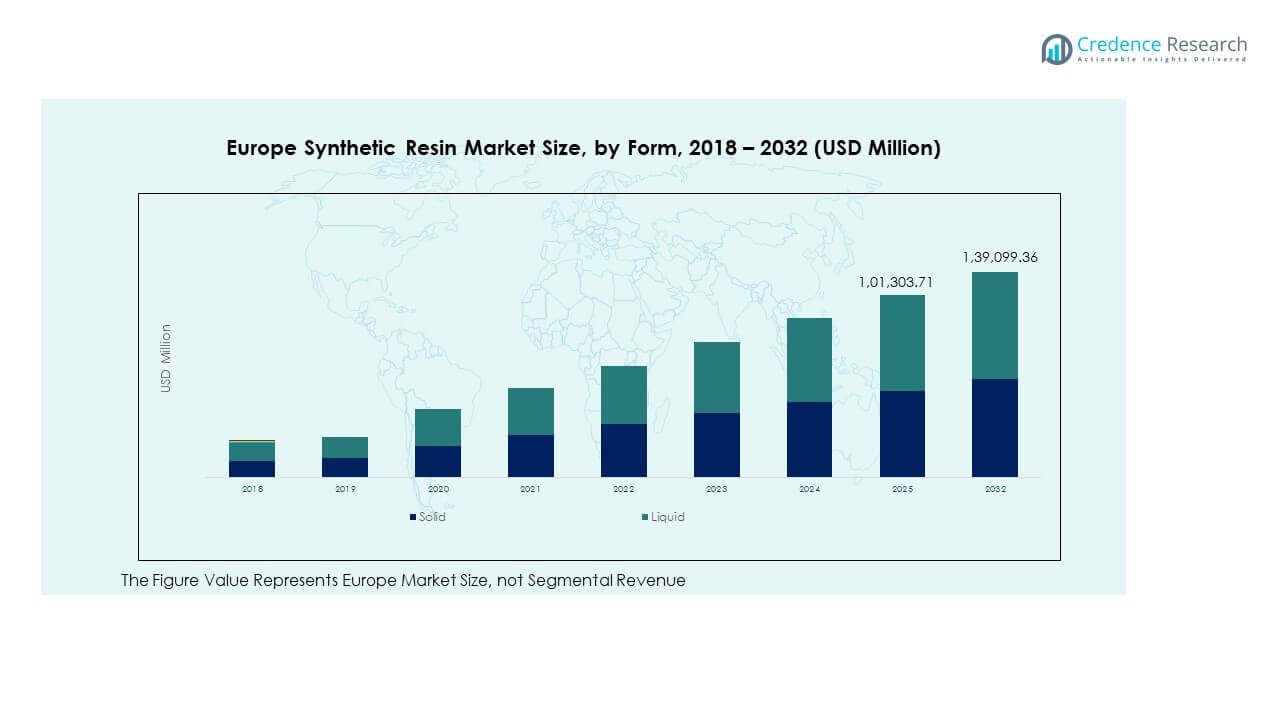

The Europe Synthetic Resin Market size was valued at USD 92,269.20 million in 2018 to USD 1,01,303.71 million in 2024 and is anticipated to reach USD 1,39,099.36 million by 2032, at a CAGR of 4.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Synthetic Resin Market Size 2024 |

USD 1,01,303.71 Million |

| Europe Synthetic Resin Market, CAGR |

4.03% |

| Europe Synthetic Resin Market Size 2032 |

USD 1,39,099.36 Million |

Growing demand from packaging, construction, automotive, and electronics industries is a major driver for this market. Manufacturers are focusing on lightweight and durable materials to improve operational efficiency and meet regulatory standards. High-performance thermoplastic and thermosetting resins are being adopted for their strength, flexibility, and cost-effectiveness. Sustainability targets are encouraging the shift toward bio-based resin solutions. Innovation in recycling technologies is also expanding the product’s appeal across environmentally focused industries, strengthening long-term growth prospects.

Western Europe leads the market due to its advanced manufacturing base and strong presence of major chemical producers. Germany, France, and the UK contribute significantly, supported by well-developed automotive and packaging sectors. Central Europe is emerging as a competitive hub, benefiting from growing investments in resin production. Eastern Europe shows steady growth, backed by rising industrialization and infrastructure development. Regional diversity creates a balanced demand landscape, strengthening the market’s overall expansion potential across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Synthetic Resin Market size was valued at USD 92,269.20 million in 2018, reached USD 1,01,303.71 million in 2024, and is projected to hit USD 1,39,099.36 million by 2032, growing at a CAGR of 4.03%.

- Western Europe leads with a 42% share, supported by advanced manufacturing and strong demand from automotive, construction, and packaging industries. Central Europe follows with 33%, benefiting from cost-competitive production capacity and export strength. Eastern Europe accounts for 25%, reflecting its growing industrial base.

- Eastern Europe is the fastest-growing region with 25% share, driven by infrastructure expansion, foreign investments, and industrial modernization, which are steadily boosting resin demand.

- In 2024, solid resins held nearly 43% of the market share, reflecting their dominance in packaging, construction, and industrial applications.

- Liquid resins accounted for around 57% of the market, supported by their high use in paints, coatings, adhesives, and specialty applications across Europe.

Market Drivers

Growing Demand from Packaging and Construction Industries Driving Revenue Growth

The packaging and construction industries are major demand generators for the Europe Synthetic Resin Market. Lightweight, durable, and cost-effective materials are gaining strong preference in both sectors. Packaging applications include flexible films, rigid containers, and barrier coatings that ensure product safety and shelf life. Construction projects increasingly use synthetic resins for insulation, sealants, adhesives, and structural components. The shift toward sustainable building materials supports higher resin adoption rates. Governments are encouraging green construction practices, strengthening the market outlook. Expanding urban development across Europe boosts infrastructure projects. Strategic investments in material innovation drive steady growth in industrial consumption.

- For example, in 2025, BASF launched Ultramid® Advanced N, a polyphthalamide engineered for high-performance applications. The material is certified with a heat resistance of up to 265 °C, offering low moisture uptake and strong dimensional stability. It is designed for use in electronics, packaging, and electrical insulation.

Rapid Advancements in Polymer Engineering Enhancing Application Scope

Continuous advancements in polymer engineering expand the functional properties of synthetic resins. High-performance resins with better chemical resistance, strength, and thermal stability are entering multiple industries. Manufacturers are focusing on formulations that support high-speed processing and greater design flexibility. This improves compatibility with automated manufacturing systems. Automotive and electronics sectors rely on such innovations to achieve lightweight structures and energy efficiency goals. It allows the market to meet evolving technical requirements. Industrial players are investing in R&D to deliver resins with enhanced end-use performance. This creates strong momentum across critical value chains.

Rising Automotive Sector Focus on Lightweight and Efficient Materials

The automotive sector is prioritizing weight reduction and emission control. Synthetic resins provide strong structural strength while keeping component weight low. Europe’s auto manufacturers are using these resins in body panels, interiors, coatings, and adhesives. It supports improved fuel economy and compliance with strict carbon regulations. Strong collaborations between resin producers and OEMs are driving innovative applications. Market players are expanding resin portfolios to meet EV manufacturing needs. The integration of advanced composites and resin blends further strengthens vehicle design capabilities. This sector remains a critical growth driver for the industry.

Growing Sustainability Goals and Circular Economy Initiatives Boosting Resin Demand

Sustainability targets are accelerating the shift toward eco-friendly resin formulations. Producers are investing in bio-based and recyclable resin solutions to align with EU Green Deal goals. It supports reduced emissions and better resource efficiency. Regulatory frameworks are encouraging industries to adopt circular production models. Demand for resins compatible with recycling and low-carbon processing is increasing steadily. Companies are introducing advanced recovery technologies for used resin products. This helps reduce landfill waste and enhances material life cycles. Strong policy alignment strengthens market confidence and investment inflows.

- For example, LyondellBasell operates its MoReTec molecular recycling pilot plant in Ferrara, Italy, focused on converting mixed plastic waste into feedstock for new polymer production. The facility is part of the company’s circular economy strategy and supports advanced recycling development in Europe. The pilot plant plays a key role in scaling molecular recycling technology.

Market Trends

Surging Adoption of Bio-Based and Recyclable Resin Materials in Production

The Europe Synthetic Resin Market is witnessing strong adoption of bio-based and recyclable resins. Industries are shifting from fossil-based polymers to sustainable alternatives. These new formulations help companies meet regulatory compliance and reduce environmental footprints. It supports increased demand from packaging, automotive, and consumer goods sectors. Manufacturers are scaling investments in chemical recycling and feedstock recovery systems. New technological solutions are ensuring better product quality and mechanical strength. Bio-based resins also enhance corporate sustainability reporting outcomes. These developments are reshaping the material supply chain.

Expanding Role of Digitalization and Smart Manufacturing in Resin Processing

Digital manufacturing solutions are transforming how resin producers operate. Automation and IoT-enabled monitoring systems improve production efficiency and material traceability. It allows manufacturers to optimize energy use, minimize waste, and ensure consistent product quality. AI-based predictive models enable better plant management and lower downtime. Resin formulators are leveraging digital twins to simulate performance before scaling up production. Smart process control helps maintain strict quality standards. This shift creates a more agile and responsive manufacturing ecosystem. It positions producers to respond faster to shifting demand patterns.

Growing Penetration of Advanced Composite Applications in High-Value Industries

High-value industries such as aerospace, energy, and defense are adopting advanced resin composites. These composites provide high strength-to-weight ratios and superior resistance properties. The Europe Synthetic Resin Market benefits from increased R&D in epoxy and polyurethane systems. It supports the development of lightweight turbine blades, aircraft interiors, and protective coatings. Manufacturers are expanding partnerships with specialized composite producers to boost technical capabilities. Regulatory incentives for energy efficiency are pushing adoption in wind and solar infrastructure. The focus on performance-driven materials continues to rise. This trend strengthens long-term market visibility.

- For instance, Siemens Gamesa and RWE in August 2025 successfully installed recyclable resin-based wind turbine blades at the 1.4 GW Sofia Wind Project, with over 50% of blades now featuring fully recyclable thermoset resin, reported in European wind energy news.

Shifting Consumer Preferences Toward Sustainable and High-Performance Products

Consumer industries are demanding materials that combine durability, safety, and environmental responsibility. Resins with lower VOC emissions and better recyclability are becoming more prominent. It reflects changing consumer awareness and regulatory pressure. Companies are redesigning packaging and product components to align with eco-label certifications. Brand owners are partnering with resin suppliers to meet net-zero goals. Product innovation pipelines are increasingly centered on lifecycle impact. Marketing strategies highlight environmental performance as a competitive advantage. This evolving preference base creates new demand channels for resin producers.

- For example, in July 2025, Henkel introduced its Aquence PS 3017 RE adhesive at Labelexpo Europe. The product was presented as a recyclable adhesive solution and is certified for recyclability by the Cyclos-HTP Institute for PET packaging applications. This launch strengthened Henkel’s focus on sustainable packaging materials in the European market.

Market Challenges Analysis

Stringent Regulatory Frameworks and Environmental Compliance Pressures Affecting Production Flexibility

Strict environmental regulations are increasing operational complexity for producers. The Europe Synthetic Resin Market must comply with REACH, EU Green Deal, and waste reduction targets. These regulations mandate cleaner production methods and strict emissions control. Compliance often involves significant capital investments and longer product development timelines. Smaller producers face resource constraints in adapting to evolving standards. The pressure to eliminate hazardous additives adds further technical challenges. Regulatory audits and certification processes demand consistent operational discipline. This creates barriers for new entrants and influences pricing strategies across the industry.

Volatile Raw Material Prices and Supply Chain Disruptions Impacting Cost Structures

Feedstock price volatility remains a critical concern for resin manufacturers. Petroleum-derived inputs fluctuate due to geopolitical tensions and energy market shifts. It affects production costs and pricing stability. Supply chain disruptions further increase operational risks. Transport delays, raw material shortages, and energy price spikes strain profit margins. Producers are adopting hedging strategies and localized sourcing to manage cost swings. Inventory management systems are being improved to minimize disruptions. This uncertainty challenges long-term contract negotiations with downstream industries. It puts pressure on market participants to maintain competitiveness.

Market Opportunities

Rising Investments in Green Chemistry and Circular Resin Technologies Creating Growth Pathways

Sustainability-focused investments are unlocking new opportunities for market expansion. The Europe Synthetic Resin Market is benefiting from strong funding for green chemistry and circular technology development. Governments and private players are financing advanced recycling infrastructure. Companies are exploring enzymatic and chemical depolymerization to improve recovery rates. It strengthens supply security while reducing waste and emissions. Eco-innovation hubs are driving faster commercialization of new resin grades. These technologies position the market as a leader in sustainable material innovation. Regulatory backing further supports rapid adoption across industries.

Expanding Applications in High-Growth Industries Offering Competitive Edge for Producers

Emerging applications in renewable energy, healthcare, and mobility sectors create strong demand potential. Resins with specialized performance characteristics meet evolving technical standards in these industries. It enables producers to diversify product portfolios and target new revenue streams. Advanced composites and specialty resin blends offer competitive advantages in niche applications. Strategic collaborations with OEMs and R&D institutions accelerate market penetration. This expansion helps companies strengthen their position in future-ready industries. These opportunities align with broader economic modernization goals across Europe.

Market Segmentation Analysis

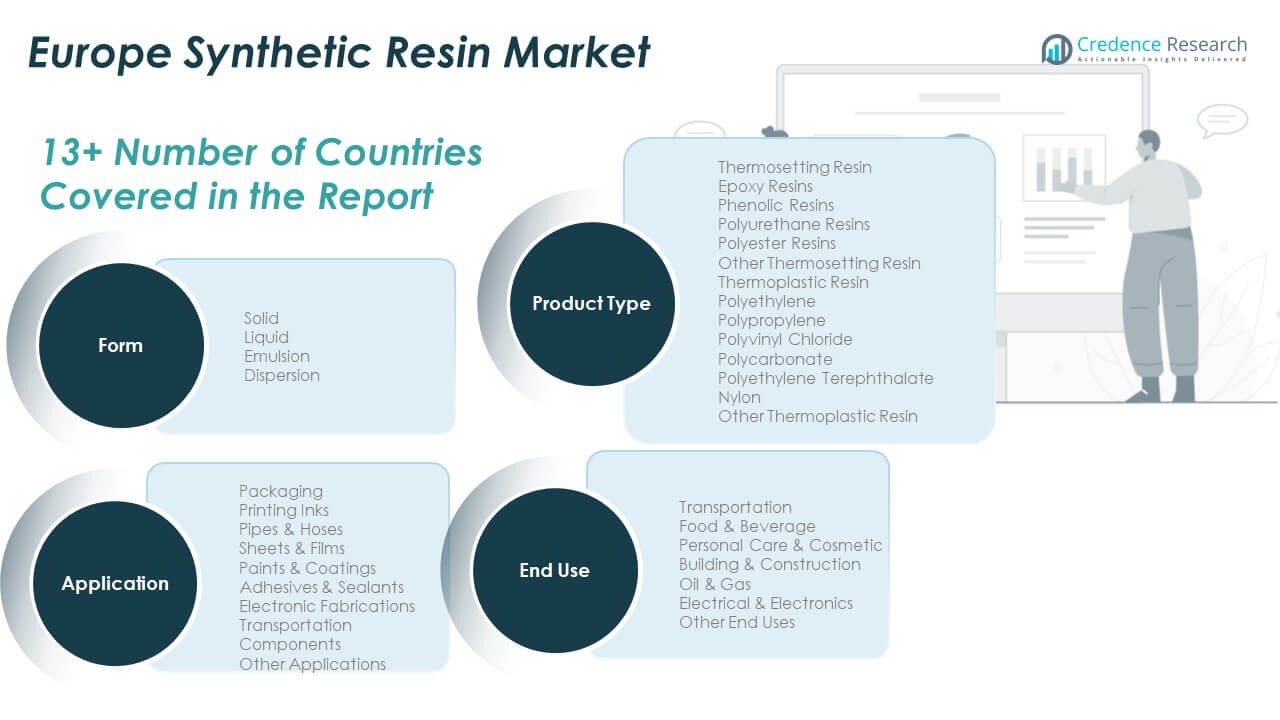

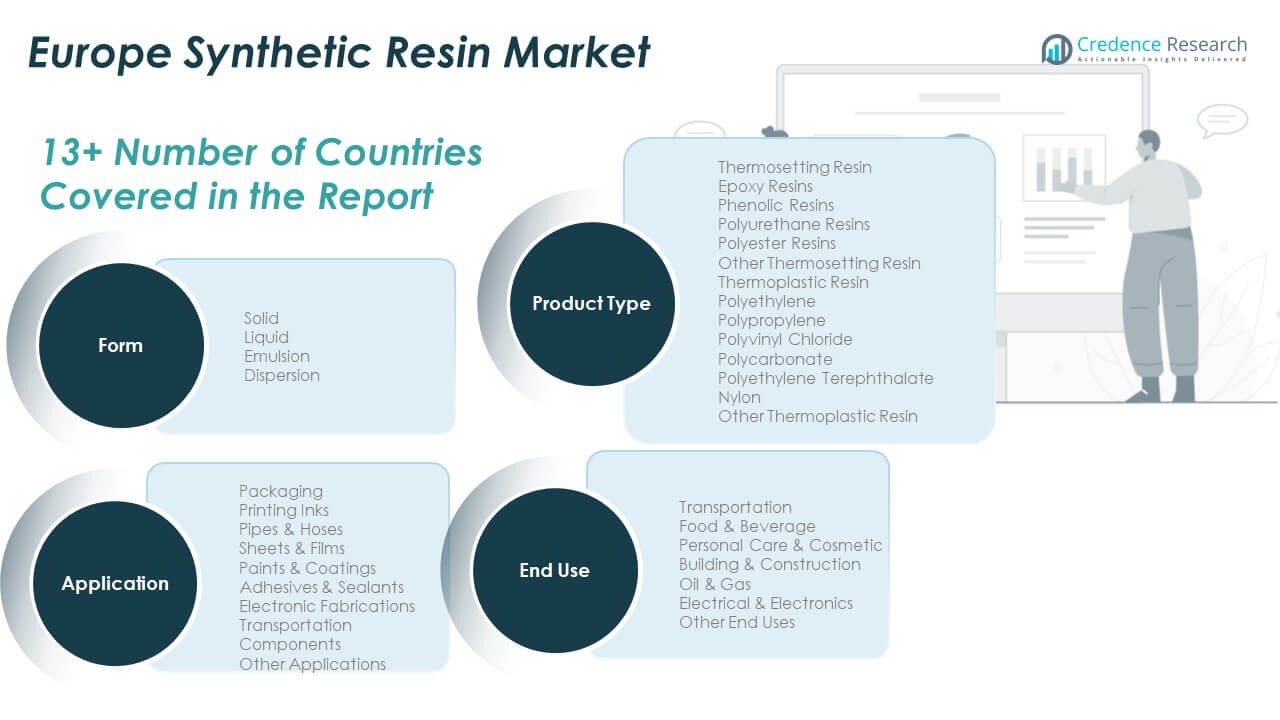

The Europe Synthetic Resin Market is segmented by form, application, end use, and product type, reflecting its broad industrial reach.

By form, solid resins dominate due to their strong mechanical properties and cost efficiency in mass manufacturing. Liquid resins support high-performance coatings and adhesives, while emulsions and dispersions enable improved surface finishes and flexibility in packaging and paints. These varied forms ensure manufacturers can meet specific process and performance requirements across multiple industries.

By application, packaging remains the largest segment, supported by demand for lightweight and durable materials. Paints and coatings also hold a significant share, driven by infrastructure and automotive activities. Adhesives, sealants, and electronic fabrications are expanding with strong R&D investments and performance-driven end uses. Pipes, hoses, sheets, and films contribute further by addressing specialized industrial requirements across construction and manufacturing sectors. Each application area leverages different resin properties to enhance functional performance.

By end use, transportation, food and beverage, and building and construction lead adoption, supported by regulatory and sustainability goals. Electrical and electronics industries use high-performance resins for insulation and precision components. Personal care, cosmetics, oil and gas, and other sectors create diverse growth opportunities.

- For example, Tetra Pak utilizes food-grade polyethylene and polypropylene resin blends for barrier properties in beverage cartons, resulting in <0.1 mg/L migration levels—endorsed per EU food safety standards.

By product type, thermosetting resins such as epoxy and polyurethane dominate due to high strength, heat resistance, and stability. Thermoplastic resins including polyethylene, polypropylene, PVC, and PET offer flexibility and recyclability, driving their use in packaging and consumer applications. This balanced segmentation reflects a strong demand base across Europe’s industrial landscape.

- For example, in early 2025, Westlake Epoxy launched its EpoVIVE™ portfolio in Europe, introducing sustainable epoxy solutions for high-performance composite applications. The announcement highlighted the use of bio-circular raw materials to support low-carbon manufacturing. The launch was officially unveiled at JEC World in Paris.

Segmentation

By Form

- Solid

- Liquid

- Emulsion

- Dispersion

By Application

- Packaging

- Printing Inks

- Pipes & Hoses

- Sheets & Films

- Paints & Coatings

- Adhesives & Sealants

- Electronic Fabrications

- Transportation Components

- Other Applications

By End Use

- Transportation

- Food & Beverage

- Personal Care & Cosmetic

- Building & Construction

- Oil & Gas

- Electrical & Electronics

- Other End Uses

By Product Type

· Thermosetting Resin

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Other Thermosetting Resin

· Thermoplastic Resin

- Polyethylene

- Polypropylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Nylon

- Other Thermoplastic Resin

Regional Analysis

Western Europe holds the largest share of the Europe Synthetic Resin Market, accounting for 42% of the total market. Strong demand from Germany, France, and the UK supports this leadership. The region benefits from well-established automotive, construction, and packaging industries. Robust manufacturing infrastructure and advanced R&D capabilities strengthen product innovation. Government regulations promoting sustainability drive adoption of bio-based and recyclable resins. Strategic investments in digital manufacturing also enhance production efficiency. Western Europe continues to set industry benchmarks in resin quality, performance, and compliance.

Central Europe accounts for 33% of the market share, supported by expanding industrial capacity and strong export networks. Poland, Austria, and the Czech Republic are major contributors to regional growth. It benefits from rising investments in automotive, electronics, and construction applications. Growing collaborations between local manufacturers and global chemical firms are improving production standards. Central Europe is positioning itself as a cost-competitive manufacturing hub. Advancements in thermoplastic and thermosetting resin technologies are supporting regional diversification. This segment is becoming an attractive base for new resin investments.

Eastern Europe holds a 25% market share and is witnessing steady growth. Countries such as Hungary, Romania, and Slovakia are modernizing their chemical and materials industries. Rapid urban development and infrastructure expansion support resin consumption in construction and transportation. It benefits from improving trade connectivity with Western European markets. Increasing foreign investments are strengthening local production and downstream applications. Favorable government incentives are encouraging capacity expansion and technology transfer. Eastern Europe is emerging as a strong growth contributor within the regional landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Europe Synthetic Resin Market features intense competition among global and regional producers focused on innovation and capacity expansion. Companies emphasize sustainable production methods to meet EU regulatory standards. It sees active investment in R&D to develop high-performance thermoplastic and thermosetting solutions. Strategic collaborations with automotive, packaging, and construction industries help manufacturers secure stable demand. Firms are integrating advanced recycling technologies to strengthen their sustainability credentials. Product differentiation through material performance, cost efficiency, and technical support remains a key competitive factor. Expanding production hubs and targeted acquisitions also support stronger market positions. Competitive intensity is expected to remain high with continuous product innovation and policy-driven shifts.

Recent Developments

- In October 2025, Mitsui Chemicals, Inc. and Polyplastics Co., Ltd., a wholly owned subsidiary of Daicel Corporation, announced a new strategic partnership in Europe targeting marketing operations for engineering resins. This collaboration is part of Daicel Group’s reorganization plan, unveiled on October 16, 2025, and it aims to increase operational synergies across the synthetic resin market in Europe while optimizing group-wide resources.

- In October 2025, SMX (Security Matters Ltd) introduced a new molecular traceability solution for synthetic resins in Europe, aimed at supporting verified products and sustainable supply chains. This launch ushers in advanced traceability across resin manufacturing, enabling stakeholders to ensure environmental compliance and product authenticity throughout the value chain.

- In October 2025, SABIC unveiled a series of advanced material solutions at K 2025, with a particular emphasis on innovative synthetic resin products that help customers design and manufacture increasingly sustainable everyday products in the European market.

Report Coverage

- The research report offers an in-depth analysis based on Form, Application, End Use and Product Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

Write a future outlook in professional tone of [ Europe Synthetic Resin Market] in 10 concise bullet points. Each point should focus on a different aspect of the market’s growth, without using subheadings or repetitive phrases. Keep the word count between 190-200. Add no values