Market Overview

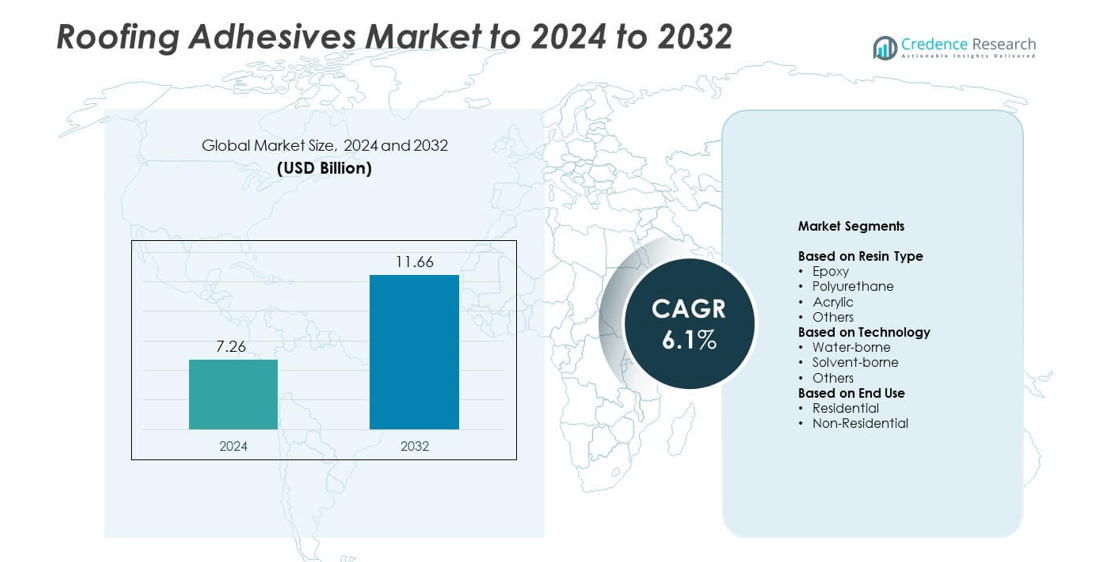

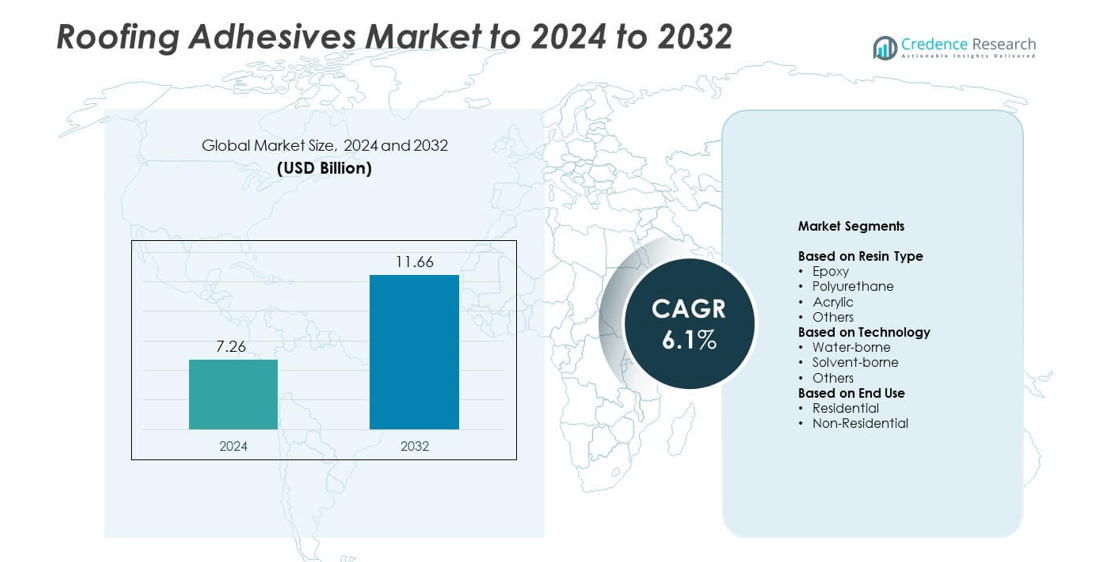

Roofing Adhesives market size was valued at USD 7.26 billion in 2024 and is anticipated to reach USD 11.66 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roofing Adhesives Market Size 2024 |

USD 7.26 billion |

| Roofing Adhesives Market, CAGR |

6.1% |

| Roofing Adhesives Market Size 2032 |

USD 11.66 billion |

The roofing adhesives market is led by major companies such as Henkel AG & Co. KGaA, Dow, Sika AG, H.B. Fuller Company, 3M, Arkema, AkzoNobel, Ashland, Borregaard, and Acordis Cellulosic Fibers. These companies maintain strong global positions through innovation in low-VOC formulations, high-performance polyurethane systems, and eco-friendly resin technologies. Strategic expansion across key construction markets and collaboration with roofing material suppliers have strengthened their competitiveness. North America emerged as the leading region with a 36% market share in 2024, driven by strong infrastructure investment, renovation projects, and growing adoption of sustainable and energy-efficient roofing solutions.

Market Insights

- The roofing adhesives market was valued at USD 7.26 billion in 2024 and is projected to reach USD 11.66 billion by 2032, growing at a CAGR of 6.1%.

- Rising construction and renovation projects across residential and commercial sectors are major growth drivers, supported by increasing demand for durable and energy-efficient roofing systems.

- The market trend is shifting toward water-borne and solvent-free adhesives due to environmental regulations and the need for sustainable construction materials.

- Competition is shaped by product innovation, eco-friendly resin development, and global expansion strategies among leading manufacturers.

- North America held a 36% share in 2024, followed by Asia-Pacific at 30% and Europe at 27%, while the polyurethane segment dominated overall with a 43% share driven by strong adhesion performance and flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type

The polyurethane segment dominated the roofing adhesives market with a 43% share in 2024. Its strong adhesion to diverse substrates, superior flexibility, and weather resistance make it ideal for both flat and sloped roofing applications. Polyurethane adhesives are preferred for their excellent bonding with insulation materials and membranes, improving durability in extreme climates. Epoxy and acrylic resins follow, driven by demand in industrial and repair applications. The growing use of moisture-curing polyurethane systems also supports faster installation and reduced downtime in large-scale roofing projects.

- For instance, Holcim Elevate’s I.S.O. Twin Pack lists VOC content at 0 g/L and sets in 5–8 minutes at 16–32 °C, or 8–15 minutes at −7–16 °C.

By Technology

The water-borne segment led the market with a 52% share in 2024, driven by rising demand for low-VOC and eco-friendly solutions. These adhesives are favored for their minimal odor, reduced toxicity, and compliance with stringent environmental regulations. The increasing adoption of green construction materials in commercial and residential roofing further supports this growth. Solvent-borne adhesives maintain a niche presence in high-strength industrial settings where rapid curing and extreme weather durability are required. Advancements in water-borne polymer dispersion technologies continue to enhance performance and bonding strength.

- For instance, Sika’s Sarnacol 2121 is a water-based membrane adhesive approved for slopes up to 10° and used as wet lay-in on absorbent substrates.

By End Use

The non-residential segment held the largest share of 58% in 2024, supported by rising commercial and industrial construction. Growing investments in warehouses, shopping complexes, and institutional buildings have increased the demand for long-lasting, energy-efficient roofing systems. Adhesives play a crucial role in enhancing waterproofing and insulation efficiency in large surface installations. Residential use follows, driven by urban housing projects and reroofing activities in developed markets. Sustainability initiatives and the need for quick installation methods further encourage the adoption of advanced adhesive formulations in the non-residential sector.

Key Growth Drivers

Rising Construction and Infrastructure Development

The rapid expansion of residential, commercial, and industrial construction projects worldwide is fueling demand for roofing adhesives. Urbanization, coupled with increasing renovation activities, boosts the use of advanced adhesive systems for roof insulation and waterproofing. Government investments in infrastructure, particularly in Asia-Pacific and the Middle East, are further strengthening market growth. The need for high-performance adhesives capable of withstanding harsh environmental conditions drives manufacturers to innovate and develop durable, weather-resistant formulations suitable for both flat and sloped roofing applications.

- For instance, Johns Manville’s One-Step Foamable Adhesive permits application at 0 °F (−18 °C) and rising, supporting cold-weather schedules.

Shift Toward Energy-Efficient and Sustainable Roofing Systems

Growing environmental awareness and green building initiatives are driving the adoption of sustainable roofing adhesives. Manufacturers are focusing on solvent-free, water-borne, and low-VOC formulations to meet stringent emission standards. These adhesives improve insulation performance and contribute to overall building energy efficiency. Demand is rising from both residential and commercial projects seeking to reduce carbon footprints. The push for LEED certification and eco-compliant construction materials further supports this transition toward energy-efficient roofing systems across developed and emerging economies.

- For instance, GAF’s EverGuard SA TPO shows an initial SRI of 101 and a three-year aged SRI of 82 under ASTM E1980.

Rising Use of Polyurethane-Based Adhesives

Polyurethane adhesives are gaining strong traction due to their superior bonding strength, flexibility, and weather resistance. These properties make them ideal for bonding insulation panels, membranes, and tiles in both hot and cold climates. The increasing preference for lightweight and durable roofing materials also supports polyurethane adoption. Continuous innovation in moisture-curing and hybrid polyurethane technologies enhances adhesion speed and durability, reducing installation time. This growing reliance on polyurethane formulations significantly contributes to the overall expansion of the roofing adhesives market.

Key Trends & Opportunities

Growing Adoption of Smart and Reflective Roof Systems

The rise of smart and reflective roof technologies presents new opportunities for adhesive manufacturers. Roofing adhesives compatible with reflective membranes and cool roof coatings are in high demand for temperature regulation and energy savings. Advancements in adhesive chemistry ensure strong bonding with reflective materials, improving roof longevity. The trend toward intelligent roofing systems that integrate sensors for leak detection and thermal monitoring further expands market potential for technologically adaptable adhesives.

- For instance, Carlisle’s Sure-Flex KEE HP PVC membrane, in white, reports an initial Solar Reflectance Index (SRI) of 103, as calculated per ASTM E1980.

Expansion of Modular and Prefabricated Construction

The global growth of modular and prefabricated buildings is creating fresh opportunities in the roofing adhesives market. Prefabricated roof assemblies require adhesives that deliver fast curing and long-lasting performance during transport and installation. Adhesive manufacturers are developing formulations optimized for automated application processes, ensuring efficiency and uniformity. This trend aligns with the increasing focus on time-saving and cost-effective construction methods, particularly in urban housing and commercial infrastructure development.

- For instance, Mapei’s MAPEPUR ROOF FOAM M reaches full hardening in 1.5–5 hours and has a soundproofing capacity of 58 dB.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material costs, particularly petroleum-based polymers and resins, remains a key challenge. Price fluctuations directly impact production costs and profit margins for adhesive manufacturers. Dependence on global supply chains for raw materials exposes companies to disruptions caused by geopolitical tensions and trade barriers. Manufacturers are mitigating these risks through long-term supplier partnerships and increased use of bio-based alternatives, though adoption remains gradual due to higher production costs.

Stringent Environmental and Safety Regulations

Tight environmental regulations governing volatile organic compounds (VOCs) and hazardous chemicals challenge the industry. Compliance requires continuous reformulation of adhesive products, raising R&D and manufacturing expenses. Regulatory frameworks, particularly in Europe and North America, demand low-emission, non-toxic adhesives, limiting the use of traditional solvent-borne products. While these rules drive sustainability, they also increase development time and costs, creating barriers for small and medium-sized manufacturers striving to remain competitive.

Regional Analysis

North America

North America held a 36% share of the roofing adhesives market in 2024, driven by high adoption in commercial and residential roofing applications. The U.S. leads the region due to strong construction activity, renovation projects, and preference for energy-efficient building materials. Growing demand for polyurethane and water-borne adhesives aligns with sustainability goals under LEED standards. Canada’s cold-weather construction sector further supports adhesive use for insulation and waterproofing applications. Key players are focusing on advanced low-VOC formulations to meet regulatory compliance and enhance durability in modern roofing systems.

Europe

Europe accounted for a 27% share of the global roofing adhesives market in 2024, supported by stringent environmental regulations and strong emphasis on sustainable construction. Germany, France, and the U.K. lead demand due to rising renovation activities and government incentives promoting green building materials. The region’s growing focus on water-borne and solvent-free adhesives enhances adoption in both new and refurbishment projects. Innovation in eco-friendly resin systems and reflective roofing membranes continues to shape the competitive landscape, particularly in northern and western European markets emphasizing energy-efficient construction.

Asia-Pacific

Asia-Pacific dominated the roofing adhesives market with a 30% share in 2024, driven by rapid urbanization and infrastructure growth. China, India, and Japan lead consumption due to large-scale industrial and residential construction. Rising investments in smart cities and affordable housing projects support the use of advanced adhesives for waterproofing and thermal insulation. Polyurethane and acrylic adhesives are gaining traction for their durability and versatility in tropical and humid climates. Expanding construction spending and government initiatives for sustainable building practices further strengthen regional market growth.

Latin America

Latin America captured a 4% share of the roofing adhesives market in 2024, supported by ongoing residential expansion and infrastructure development. Brazil and Mexico are the key contributors, with growing adoption of polyurethane and solvent-borne adhesives in commercial roofing. Increasing investments in housing modernization and energy-efficient construction materials are enhancing market penetration. The shift toward low-VOC adhesives aligns with regional environmental standards. Economic recovery and foreign construction investments are expected to boost adhesive demand, particularly for industrial and commercial building applications.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the roofing adhesives market in 2024. Growth is supported by large-scale infrastructure projects in the GCC and increasing construction in South Africa. High temperatures and extreme weather conditions drive demand for high-performance polyurethane and epoxy adhesives. Governments’ focus on sustainable urban development and tourism infrastructure further supports product adoption. Rising investments in smart and energy-efficient roofing systems, particularly in Saudi Arabia and the UAE, continue to strengthen the region’s long-term market potential.

Market Segmentations:

By Resin Type

- Epoxy

- Polyurethane

- Acrylic

- Others

By Technology

- Water-borne

- Solvent-borne

- Others

By End Use

- Residential

- Non-Residential

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The roofing adhesives market is dominated by major global players such as Henkel AG & Co. KGaA, Dow, Sika AG, H.B. Fuller Company, 3M, Arkema, AkzoNobel, Ashland, Borregaard, and Acordis Cellulosic Fibers. These companies lead through extensive product portfolios, strong global distribution networks, and continuous innovation in resin technologies. The competitive environment focuses on developing high-performance adhesives with superior weather resistance, low VOC emissions, and strong substrate compatibility. Strategic collaborations with construction material suppliers and expansion into emerging markets enhance their market presence. Manufacturers are increasingly investing in research to introduce bio-based and solvent-free formulations aligned with green building standards. Continuous product diversification, along with mergers and acquisitions, strengthens competitiveness across residential and non-residential segments. The growing shift toward digitalized production and smart application technologies further supports operational efficiency, positioning established manufacturers ahead in an evolving, sustainability-driven construction materials industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Henkel AG & Co. KGaA

- Dow

- Sika AG

- B. Fuller Company

- 3M

- Arkema

- AkzoNobel

- Ashland

- Borregaard

- Acordis Cellulosic Fibers

Recent Developments

- In 2025, H.B. Fuller Launched the Millennium PG-1 EF ECO₂ Series, a sprayable commercial roofing adhesive using compressed CO₂ atmospheric gas instead of chemical blowing agents to reduce emissions and environmental impact.

- In 2024, Sika AG expanded its manufacturing in China, opening a new facility in Liaoning province for a range of products including mortars, tile adhesives, and waterproofing solutions.

- In 2024, Henkel AG & Co. KGaA launched products like Pattex No More Nails Stick & Peel, a removable adhesive for the DIY market

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Technology, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The roofing adhesives market will expand with increasing global construction and renovation activities.

- Adoption of water-borne and solvent-free adhesives will rise due to stricter environmental rules.

- Polyurethane-based formulations will remain dominant for their superior bonding and flexibility.

- Demand for adhesives compatible with reflective and cool roofing systems will grow.

- Technological innovations will improve curing time and weather resistance of adhesive products.

- Sustainable and bio-based resin systems will gain wider acceptance across developed markets.

- Growth in modular and prefabricated construction will create new application opportunities.

- Asia-Pacific will continue to lead due to rapid urbanization and infrastructure projects.

- Manufacturers will focus on R&D to develop high-performance, low-emission adhesive solutions.

- Strategic partnerships and regional expansion will strengthen competitive positioning among global players.