Market Overview:

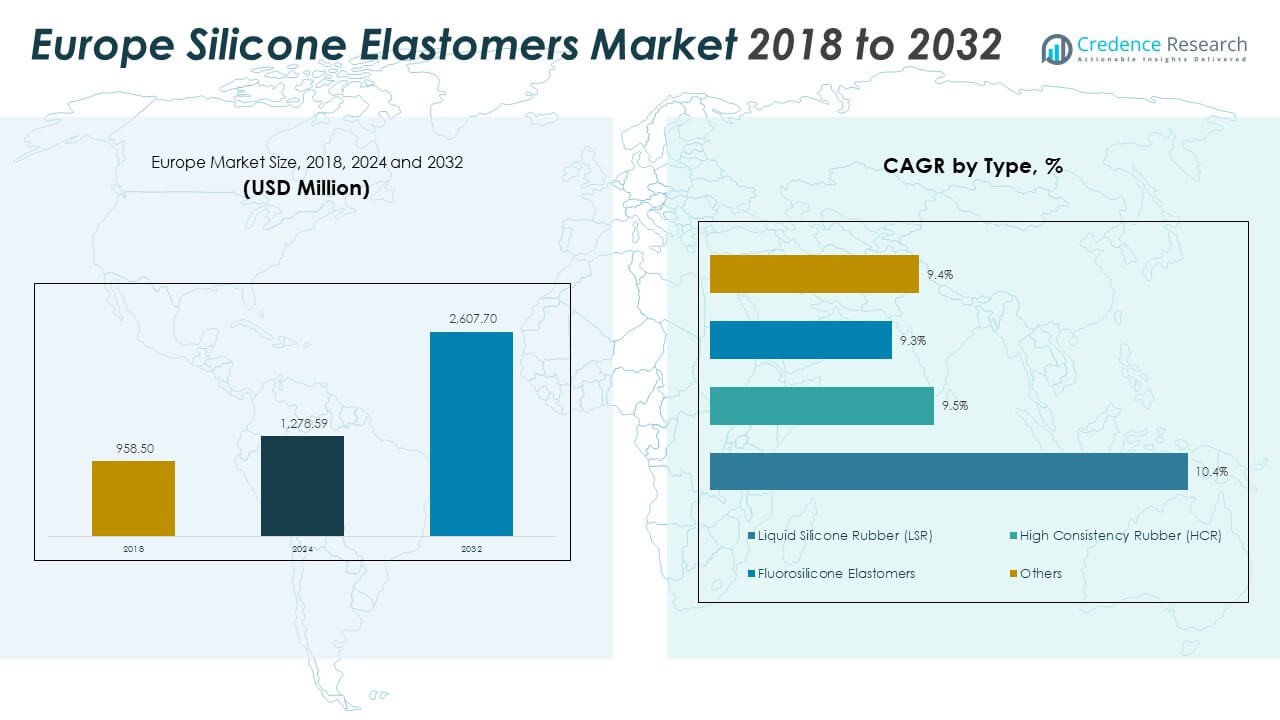

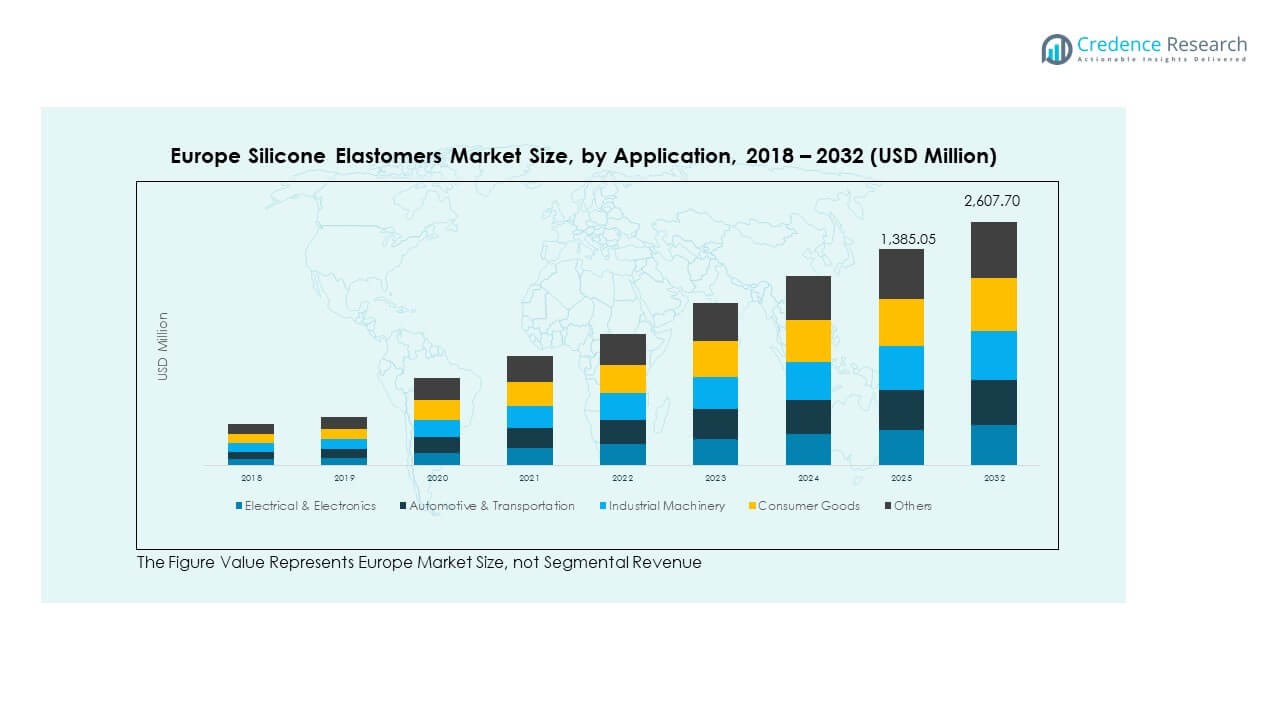

The Europe Silicone Elastomers Market size was valued at USD 958.50 million in 2018 to USD 1,278.59 million in 2024 and is anticipated to reach USD 2,607.70 million by 2032, at a CAGR of 9.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Silicone Elastomers Market Size 2024 |

USD 1,278.59 Million |

| Europe Silicone Elastomers Market, CAGR |

9.23% |

| Europe Silicone Elastomers Market Size 2032 |

USD 2,607.70 Million |

Strong demand from automotive, electronics, and healthcare sectors drives market expansion. Silicone elastomers provide superior heat resistance, electrical insulation, and flexibility, making them essential for vehicle components, circuit protection, and medical devices. Growing electric vehicle production and renewable energy projects across Europe fuel adoption. Continuous R&D in advanced liquid silicone rubber grades and bio-based formulations also supports the industry’s move toward sustainability and higher performance standards.

Western Europe dominates due to its robust manufacturing base and advanced industrial ecosystem. Germany leads with strong demand from automotive and electrical sectors, while France and the U.K. focus on healthcare and aerospace applications. Italy and Spain contribute steadily through industrial and consumer goods production. Eastern Europe, led by Poland and the Czech Republic, is emerging as a manufacturing hub with growing investments in polymer processing and automation. This regional diversity strengthens Europe’s overall competitiveness in silicone elastomer production and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Silicone Elastomers Market was valued at USD 958.50 million in 2018, reached USD 1,278.59 million in 2024, and is projected to achieve USD 2,607.70 million by 2032, growing at a CAGR of 9.23% during the forecast period.

- Western Europe holds 58% of the market share, driven by Germany, France, and the U.K. due to strong automotive, electronics, and healthcare industries that heavily rely on high-performance silicone materials.

- Northern and Southern Europe collectively represent 27% of the market, supported by advancements in renewable energy, consumer goods, and medical device manufacturing across Nordic countries, Italy, and Spain.

- Eastern Europe, accounting for 15%, is the fastest-growing region fueled by rising industrial automation, expanding automotive component production, and supportive government investment in polymer processing.

- By application, Electrical & Electronics (31%) and Automotive & Transportation (29%) are the leading segments, followed by Industrial Machinery (20%), highlighting the growing dependence on silicone elastomers in precision, heat-resistant, and durable components.

Market Drivers

Growing Integration of Silicone Elastomers in Automotive and Electronics Manufacturing

The Europe Silicone Elastomers Market benefits from rising use in automotive and electronics manufacturing. It offers superior flexibility, high heat resistance, and electrical insulation, making it essential for gaskets, seals, and cable insulation. The automotive industry uses silicone elastomers in EV batteries and under-hood components for temperature endurance. The electronics sector adopts them for protecting circuits and ensuring long service life. Strict EU regulations promoting safer and durable materials increase demand. Strong investments in lightweight and reliable polymers reinforce market expansion. Growing R&D supports enhanced silicone grades for next-generation products.

- For instance, Wacker Chemie AG introduced ELASTOSIL® CM 185 in June 2024, a silicone rubber compound engineered for electric vehicle battery modules, showcased at the Battery Show Europe in Stuttgart. It prevents fire propagation during thermal runaway and maintains insulation stability up to 205°C, as verified by Wacker’s 2024 technical documentation and press releases.

Expanding Demand in Healthcare and Medical Device Applications

Healthcare innovation drives higher consumption of silicone elastomers in Europe. The material’s biocompatibility, sterilization resistance, and durability support applications in implants, prosthetics, and medical tubing. The region’s aging population increases demand for advanced healthcare devices. It supports widespread use in respiratory care, wound management, and diagnostic tools. Manufacturers are introducing precision-molded silicone components that meet stringent medical standards. Hospitals and laboratories depend on silicone’s ability to maintain performance under repeated sterilization cycles. Continuous upgrades in healthcare technology strengthen the material’s position in medical sectors.

- For instance, Elkem ASA’s Silbione™ medical-grade silicone complies with ISO 10993 and USP Class VI standards, ensuring proven biocompatibility and safety for healthcare and implantable applications. Elkem’s official product data highlights its use in long-term medical devices, supporting high performance in European healthcare manufacturing.

Sustainability-Driven Adoption of Energy-Efficient Materials Across Industries

Industrial users are shifting toward energy-efficient silicone elastomers to align with Europe’s sustainability goals. The material enables longer component lifespans and lower maintenance costs in multiple industries. Governments encourage green manufacturing under the EU Green Deal, accelerating adoption. Silicone’s recyclability potential and low emission production methods appeal to manufacturers. The market benefits from the ongoing replacement of less durable synthetics. OEMs use silicone elastomers for energy-efficient sealing and insulation systems. The growing demand for sustainable infrastructure and eco-friendly products drives steady expansion.

Rising Industrial Automation and Advanced Material Engineering Initiatives

Rapid industrial automation enhances demand for silicone elastomers in mechanical and robotic systems. It withstands extreme operating conditions in automation lines and high-temperature processes. Manufacturers focus on developing elastomers with precise hardness and elasticity control. The material’s role in shock absorption and vibration damping is vital for industrial machinery. Investments in advanced compounding technologies ensure improved material consistency. The Europe Silicone Elastomers Market gains momentum from smart factories using reliable, long-life components. Continuous innovation improves performance under dynamic and mechanical stress, sustaining growth.

Market Trends

Advancements in Liquid Silicone Rubber Technologies for Complex Product Designs

Innovations in liquid silicone rubber (LSR) are shaping the market’s future. European manufacturers are developing faster-curing, low-viscosity LSR grades for precision molding. It supports miniaturization in medical and electronic components. Demand for intricate, flexible parts with high dimensional accuracy continues to rise. Automated injection molding systems enhance production efficiency and reduce waste. The shift toward compact and multi-material design applications strengthens the segment. The Europe Silicone Elastomers Market benefits from the trend toward integrated and high-performance solutions. Continuous material innovations ensure better design flexibility and cost optimization.

Transition Toward Bio-Based and Low-Emission Silicone Elastomer Production

Sustainability initiatives are leading producers to adopt bio-based silicone elastomers. Major European chemical firms invest in renewable feedstocks and green production methods. New formulations reduce VOC emissions and carbon footprint during processing. Manufacturers focus on lifecycle sustainability assessments and compliance with REACH standards. Bio-silicone alternatives address environmental and health concerns of end users. It aligns with the circular economy goals promoted by the European Union. Market participants are integrating waste management systems to recover valuable by-products. The shift toward eco-friendly materials strengthens brand value and regulatory compliance.

Rising Focus on Smart Silicone Applications in Wearables and Connected Devices

Smart devices and wearables create new opportunities for silicone elastomers. Their comfort, skin compatibility, and durability make them suitable for continuous-use gadgets. Producers design conductive and stretchable silicones for flexible circuits and sensors. The Europe Silicone Elastomers Market sees growing use in fitness bands and medical trackers. Companies integrate embedded sensors within silicone matrices for real-time data transmission. The trend aligns with digital health initiatives and IoT expansion. Enhanced material conductivity and responsiveness increase adoption in soft electronics. Demand for flexible, reliable materials in connected devices sustains steady growth.

- For example, Dow Inc. offers SILASTIC™ silicone elastomers widely used in wearable and healthcare applications, recognized for their high flexibility, durability, and skin compatibility. These materials deliver strong electrical insulation and mechanical performance, making them suitable for advanced consumer and medical device components, according to Dow’s official product information.

Increased Collaboration Between Industry and Academia for Material Innovation

Collaborative research between universities and manufacturers accelerates new silicone elastomer development. European research institutes focus on hybrid formulations with tailored mechanical and thermal properties. These initiatives enhance competitiveness and local production capacities. Cross-sector partnerships enable pilot-scale testing of novel silicone applications. Funding programs under Horizon Europe stimulate innovation in performance materials. It supports start-ups developing high-purity silicones for electronics and renewable energy systems. Research collaborations shorten time-to-market for new grades. The trend reflects Europe’s strategic goal of maintaining technological leadership in advanced materials.

- For instance, the University of Bayreuth, under EU Horizon Europe initiatives, conducts research in advanced materials and polymer sciences, emphasizing sustainable and high-performance silicone materials. These projects reflect strong academia–industry collaboration aimed at fostering innovation in Europe’s material science ecosystem.

Market Challenges Analysis

High Production Costs and Complex Processing Requirements in Silicone Manufacturing

The Europe Silicone Elastomers Market faces cost challenges due to high raw material and energy expenses. Silicone production involves complex polymerization and compounding processes that require precision control. Limited local sources for key raw materials add to dependency on imports. Energy-intensive curing and molding processes increase overall production costs. Manufacturers must balance product quality with affordability to remain competitive. Technological upgrades are necessary to optimize yields and minimize waste. Maintaining cost efficiency while meeting environmental standards remains a key difficulty for regional producers.

Stringent Regulatory Standards and Competition from Alternative Polymers

European regulatory frameworks impose strict quality and safety standards on silicone elastomers. Compliance with REACH and other certifications increases development time and cost. Producers must ensure formulations are free from restricted substances. Alternative polymers such as thermoplastic elastomers present cost-effective options in some applications. The availability of substitutes challenges silicone’s market share in non-critical uses. Regulatory delays often slow product approvals, affecting commercialization speed. The Europe Silicone Elastomers Market must innovate to sustain relevance under these evolving compliance pressures.

Market Opportunities

Emergence of Electric Mobility and Advanced Electronics Manufacturing

The shift toward electric vehicles and next-generation electronics creates new growth avenues. Silicone elastomers ensure reliable performance under high thermal and electrical stress. Their use in EV batteries, sensors, and connectors is increasing rapidly. European automakers are investing in localized component sourcing, favoring silicone producers. It supports durable and efficient systems for transportation electrification. Expanding semiconductor and electronics assembly industries enhance market potential. The Europe Silicone Elastomers Market gains long-term opportunity from this technology-driven demand cycle.

Growth of Medical Silicone Applications and Sustainable Infrastructure Projects

Medical device production expansion across Europe creates fresh opportunities. Silicone elastomers are vital in catheters, prosthetics, and diagnostic devices due to biocompatibility. Infrastructure modernization encourages the use of silicone sealants and coatings for energy-efficient buildings. The construction sector’s emphasis on green materials strengthens demand for silicone-based insulation. Investments in smart hospitals and healthcare innovation centers boost material consumption. The growing preference for recyclable materials supports ongoing innovation. These developments open profitable and stable market segments for silicone manufacturers.

Market Segmentation Analysis

By Type

Liquid Silicone Rubber (LSR) dominates due to its superior molding precision, high purity, and adaptability for automated manufacturing. It finds extensive use in electronics and healthcare devices where performance consistency is vital. High Consistency Rubber (HCR) maintains a strong presence in automotive and industrial sectors for its resilience and mechanical strength. Fluorosilicone elastomers serve applications demanding fuel and oil resistance, particularly in aerospace. Other specialty silicones address niche requirements such as extreme weather sealing. The Europe Silicone Elastomers Market benefits from balanced adoption across these categories, ensuring diversified demand.

- For instance, Momentive’s Silopren™ LSR 4640 is a medical-grade liquid silicone rubber compliant with USP Class VI and ISO 10993 standards. It supports injection molding for healthcare applications and retains its mechanical properties after ethylene oxide, steam, and gamma sterilization, as confirmed by Momentive’s official product data.

By Application

Electrical and electronics applications lead the market, driven by the need for insulating and protective materials in high-voltage systems. Automotive and transportation sectors follow closely, using silicone elastomers for gaskets, hoses, and heat shields. Industrial machinery relies on silicone components for vibration control and mechanical stability. Consumer goods utilize silicone for flexible kitchenware and personal care products. Construction applications gain traction through sealants and adhesives for energy-efficient buildings. Other applications, including medical and aerospace, expand steadily through material innovation. The segmental diversity sustains long-term market growth across Europe.

- For instance, Wacker Chemie AG’s ELASTOSIL® silicone dampening pads are designed for industrial and machinery applications, delivering verified vibration and noise reduction performance. These products are supported by quality certifications and European supply standards, demonstrating their reliability in demanding mechanical environments.

Segmentation

By Type

- Liquid Silicone Rubber (LSR)

- High Consistency Rubber (HCR)

- Fluorosilicone Elastomers

- Others

By Application

- Electrical & Electronics

- Automotive & Transportation

- Industrial Machinery

- Consumer Goods

- Construction

- Others

Regional Analysis

Western Europe

Western Europe holds the dominant share of 58% in the Europe Silicone Elastomers Market. Germany leads the subregion with strong industrial infrastructure and established automotive and electronics sectors. France and the United Kingdom follow with significant adoption across healthcare, aerospace, and construction industries. The presence of leading chemical manufacturers and advanced R&D facilities accelerates product innovation. Growing demand for high-performance materials in electric vehicles and medical devices strengthens regional growth. Strategic collaborations between suppliers and OEMs enhance value chain integration and ensure stable supply across end-use sectors.

Northern and Southern Europe

Northern and Southern Europe collectively account for 27% of the market share. Nordic countries such as Sweden, Denmark, and Finland show rising demand for silicone elastomers in renewable energy and healthcare applications. It benefits from government sustainability programs and technology-driven industries. Southern Europe, led by Italy and Spain, experiences moderate growth due to increased manufacturing activities in consumer goods and industrial equipment. Strong investments in sustainable infrastructure and medical device production are driving local adoption. Expanding export capabilities further improve regional competitiveness within the European landscape.

Eastern Europe

Eastern Europe contributes 15% to the total market share and represents a rapidly growing subregion. Poland, the Czech Republic, and Hungary are emerging as key industrial hubs supported by lower production costs and foreign direct investments. The region’s expanding automotive and electronics manufacturing sectors create strong demand for silicone elastomers. It benefits from government incentives promoting local polymer production and technology transfer from Western partners. Industrial modernization projects and infrastructure development continue to stimulate market opportunities. The increasing establishment of regional distribution centers strengthens market access and export potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow Inc.

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Reiss Manufacturing Inc.

- Mesgo S.p.A.

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Elkem ASA

- KCC Corporation

- Specialty Silicone Products Inc.

- Dow Corning GmbH

- Nusil Technology LLC

Competitive Analysis

The Europe Silicone Elastomers Market is characterized by a strong presence of global and regional manufacturers focusing on innovation, capacity expansion, and sustainability. Leading companies such as Wacker Chemie AG, Dow Inc., Momentive Performance Materials, Elkem ASA, and Shin-Etsu Chemical Co. dominate through extensive product portfolios and technological expertise. It emphasizes advanced grades of liquid silicone rubber and high-consistency rubber to meet industrial demands. Strategic partnerships with automotive, electronics, and healthcare OEMs enhance market penetration. Companies invest in eco-friendly formulations and local production to comply with European environmental standards. Continuous R&D efforts ensure superior product quality, reduced cycle times, and cost efficiency, reinforcing competitive positioning.

Recent Developments

- In September 2025, Safic-Alcan announced the expansion of its partnership with Momentive to distribute silicone elastomers more broadly across Europe, particularly strengthening its portfolio in France and Eastern Europe. This partnership is designed to accelerate innovation in the market and provide customers with wider access to Momentive’s advanced silicone elastomer solutions, reflecting a strong commitment to performance, safety, and sustainability in regional supply chains.

- In June 2025, WACKER introduced a new silicone elastomer product specifically aimed at the power grid and e-mobility sectors, which it showcased at the K 2025 trade fair held in Germany from October 8 to 15. This product is engineered to provide highly reliable insulation for components in these critical applications, reinforcing WACKER’s innovation leadership in the European silicone elastomers market and catering to the rising demand for advanced materials in both energy infrastructure and electric mobility.

Report Coverage

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for silicone elastomers in automotive and healthcare sectors will drive steady market expansion.

- Innovation in liquid silicone rubber formulations will enhance precision molding and product performance.

- Increasing adoption in electric vehicle components will strengthen the material’s relevance in sustainable mobility.

- Advancements in bio-based silicone production will align with Europe’s carbon neutrality goals.

- Growing healthcare infrastructure and medical device manufacturing will expand application scope.

- Strategic investments in automation and smart manufacturing will optimize processing efficiency.

- Expanding demand for high-performance elastomers in electronics will create new revenue opportunities.

- Strong regulatory support for eco-friendly materials will promote sustainable production methods.

- Rising industrial activity in Eastern Europe will transform the region into a significant growth hub.

- Continuous R&D and collaboration among manufacturers will enhance innovation and long-term competitiveness.