Market Overview:

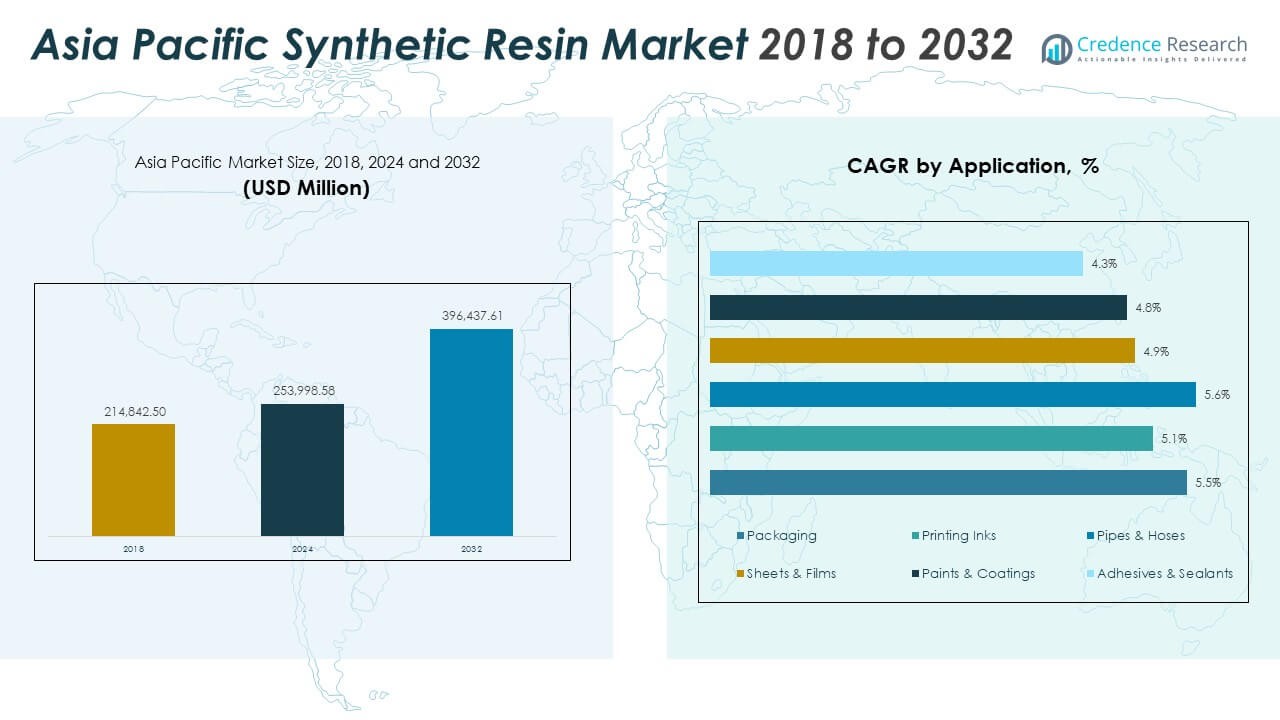

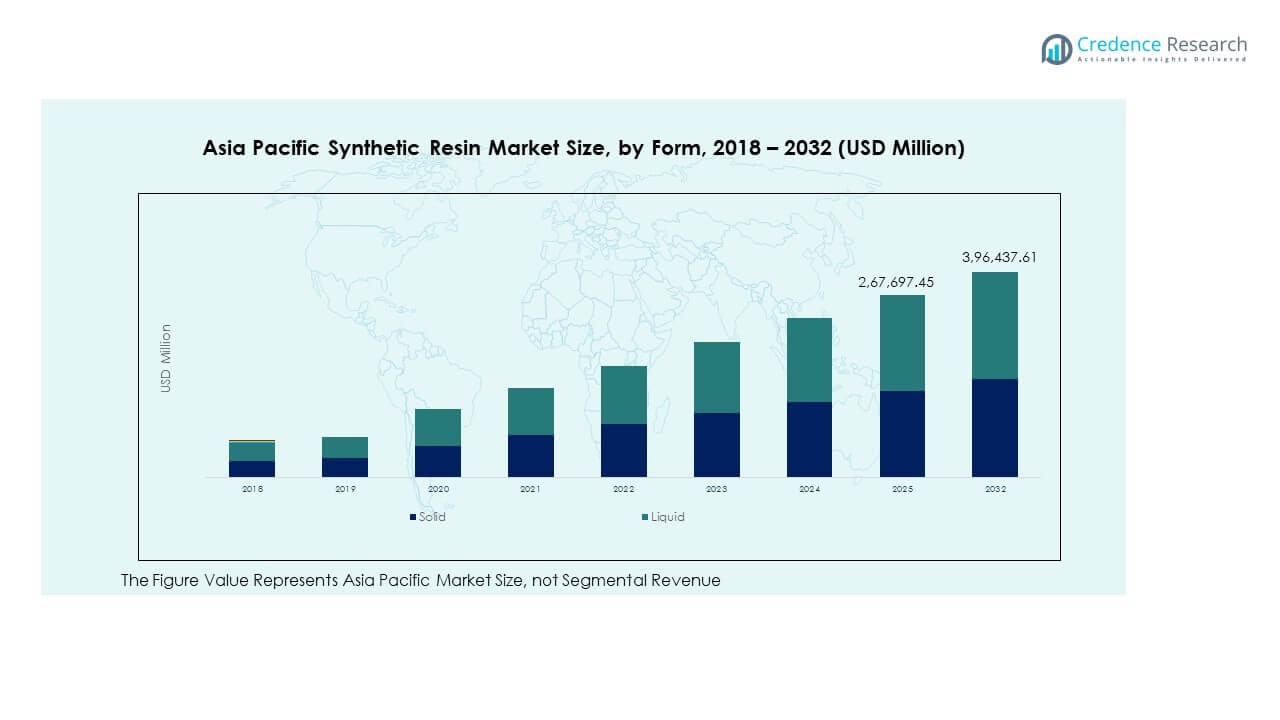

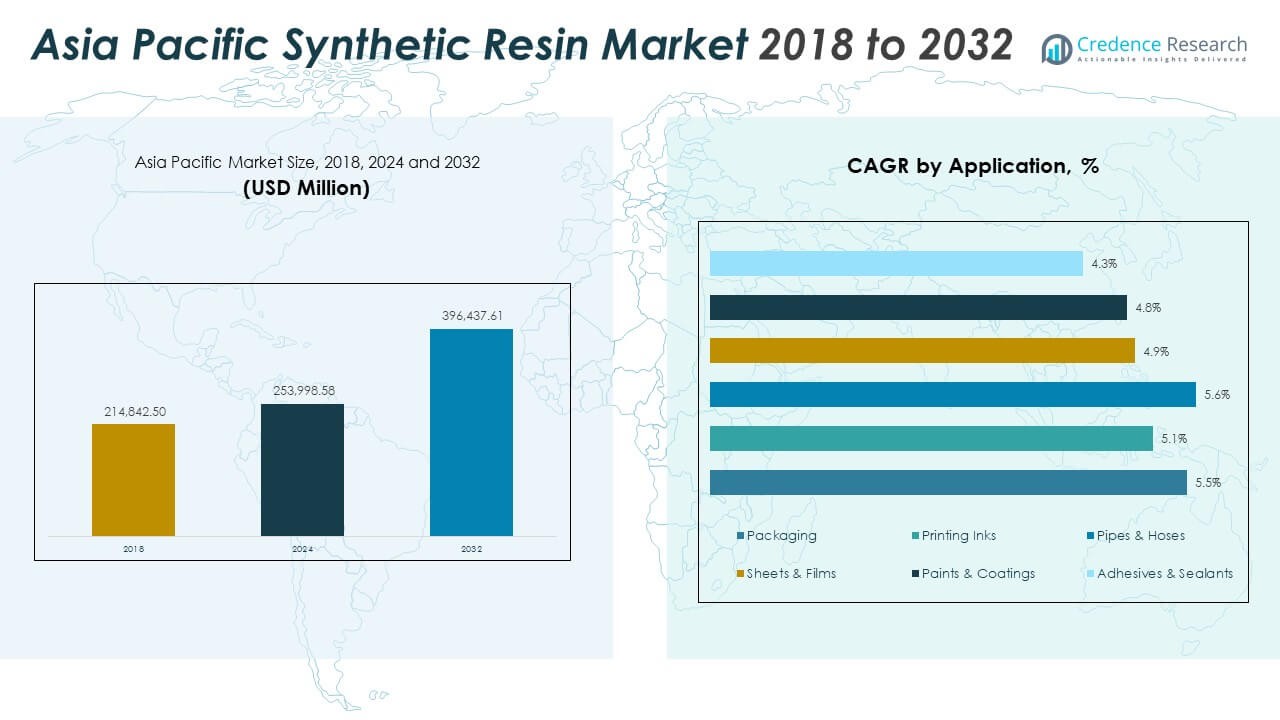

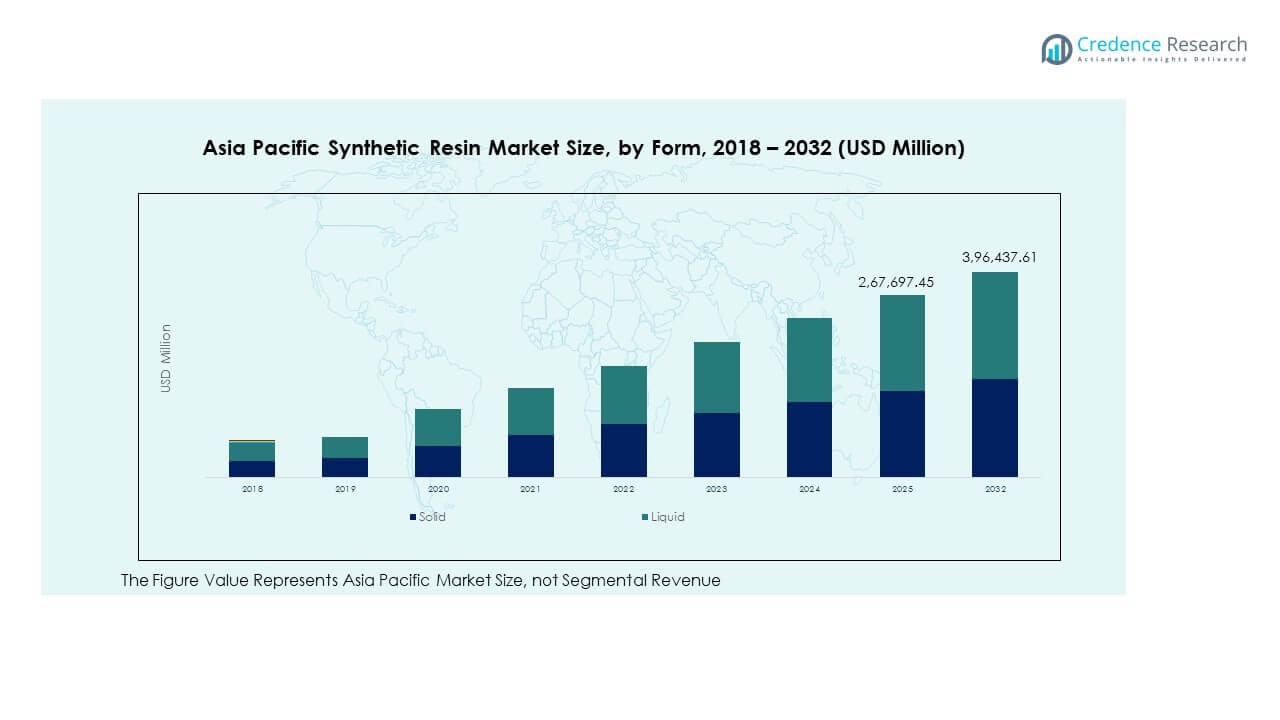

The Asia Pacific Synthetic Resin Market size was valued at USD 214,842.50 million in 2018 to USD 253,998.58 million in 2024 and is anticipated to reach USD 396,437.61 million by 2032, at a CAGR of 5.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Synthetic Resin Market Size 2024 |

USD 253,998.58 Million |

| Asia Pacific Synthetic Resin Market, CAGR |

5.73% |

| Asia Pacific Synthetic Resin Market Size 2032 |

USD 396,437.61 Million |

Strong demand from construction, automotive, and packaging industries is driving the Asia Pacific Synthetic Resin Market. Expanding infrastructure projects, lightweight material integration in vehicles, and growing flexible packaging consumption contribute significantly to rising volumes. Technological innovations improve resin performance, making products more durable and efficient. Government initiatives supporting manufacturing and sustainable production strengthen industry growth. These factors create a stable demand base across multiple sectors and enable producers to scale capacity, invest in R&D, and diversify their applications.

China leads the market with its extensive production capabilities, robust industrial ecosystem, and strong demand across sectors. Japan and South Korea contribute significantly through advanced resin technologies and high-performance applications. India and Southeast Asia are emerging as fast-growing markets supported by urbanization, industrial expansion, and increasing manufacturing investment. Oceania plays a supportive role with stable demand in infrastructure and energy. This geographic diversity ensures balanced market development and positions the region as a major driver of global synthetic resin demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Synthetic Resin Market was valued at USD 214,842.50 million in 2018, reached USD 253,998.58 million in 2024, and is projected to hit USD 396,437.61 million by 2032, growing at a CAGR of 5.73%.

- East Asia holds the largest share at 41%, driven by China’s robust manufacturing base and advanced resin technologies in Japan and South Korea. South and Southeast Asia follow with 33%, supported by urbanization and capacity expansion. Oceania contributes 26%, anchored by stable demand in infrastructure and energy.

- South and Southeast Asia represent the fastest-growing subregion with 33% share, supported by rapid industrialization, infrastructure growth, and packaging demand expansion across India and ASEAN economies.

- Solid resins represent the dominant form segment, capturing 58% share in 2024, supported by strong demand in packaging, construction, and automotive industries.

- Liquid resins account for 42% share, gaining traction in paints, coatings, and adhesive applications, aligning with manufacturing modernization across the region.

Market Drivers

Rising Demand from Construction and Infrastructure Development Across Emerging Economies

The strong growth in the construction and infrastructure sector is creating consistent demand for synthetic resins across Asia Pacific. Expanding residential, commercial, and industrial building activities are driving consumption in insulation, adhesives, sealants, and coatings. The construction sector benefits from the resin’s durability, weather resistance, and cost efficiency. Large-scale urbanization projects in China and India support significant material requirements. The Asia Pacific Synthetic Resin Market benefits from this rapid infrastructure growth across major economies. It is witnessing increased use of high-performance resins in pipes, panels, and insulation systems. Government investments in smart cities and transportation networks strengthen this growth. These factors establish construction as a major demand center for the market.

- For instance, in June 2025, BASF introduced its Ultramid® Advanced N3U42G6 polyphthalamide resin for high-voltage connectors in construction and infrastructure projects, achieving a heat distortion temperature of 265°Cand low moisture uptake, which ensures dimensional stability and prevents blistering during surface mount technology (SMT) processing, reducing waste and costs in connector manufacturing.

Expanding Packaging Industry and Shifting Consumer Preferences Toward Flexible Materials

The packaging industry is driving resin demand through increased consumption of flexible and lightweight materials. Rising e-commerce activity and growing food and beverage packaging needs accelerate market momentum. Flexible packaging enhances shelf life, reduces material costs, and improves logistics efficiency. Key manufacturers are focusing on developing advanced polymer resins to support diverse packaging formats. The Asia Pacific Synthetic Resin Market benefits from evolving consumer preferences toward sustainable and lightweight packaging. It is experiencing wider adoption across sectors such as retail, healthcare, and FMCG. Improved sealing properties and design flexibility strengthen its usage. This packaging expansion continues to be a key demand generator for resin producers.

Technological Advancements Enhancing Performance and Process Efficiency in Resin Applications

Innovations in polymer processing and formulation technologies are enabling improved resin performance across industries. New grades offer better thermal stability, chemical resistance, and mechanical strength for advanced applications. These improvements drive adoption in high-performance industries such as automotive and electronics. Automation in production facilities enhances output quality and lowers costs. The Asia Pacific Synthetic Resin Market is gaining momentum through these technological upgrades. It is enabling manufacturers to meet specialized application requirements and tighter performance standards. Growing R&D investments from major producers support this transformation. These innovations enhance competitiveness and strengthen the industry base in the region.

- For instance, Mitsubishi Chemical’s DURABIO™ bio-based polycarbonate resin, derived from plant-based isosorbide, offers outstanding UV resistance (retains high surface hardness after 1000 hours exposure), excellent scratch resistance, and impact strength comparable to conventional PC resin, making it suitable for automotive and electronics applications requiring durability and optical clarity.

Rising Automotive Production and Lightweight Material Integration Supporting Resin Demand

Automotive manufacturers are integrating lightweight and high-strength materials to improve efficiency and reduce emissions. Synthetic resins are used in interior components, coatings, adhesives, and exterior parts. Increasing vehicle production volumes in China, India, and ASEAN countries strengthen demand. It enables manufacturers to balance performance, cost, and weight requirements in modern vehicle design. The Asia Pacific Synthetic Resin Market is gaining strong traction from the automotive sector’s structural evolution. It supports the industry’s move toward electric and fuel-efficient vehicles. Resin-based materials offer durability, design flexibility, and lower production costs. This dynamic positions automotive manufacturing as a critical growth driver.

Market Trends

Accelerating Shift Toward Bio-Based and Sustainable Resin Alternatives in Industrial Applications

Companies are increasing focus on bio-based and eco-friendly resins to reduce carbon footprints. This shift supports regulatory goals and aligns with rising consumer awareness of environmental impacts. Green chemistry and renewable feedstocks are gaining momentum in production lines. The Asia Pacific Synthetic Resin Market is undergoing a visible transition toward sustainable formulations. It reflects changing industry priorities toward circular economy models. Major players are scaling investments in biopolymer development to meet new standards. End users are adopting eco-friendly solutions to align with sustainability targets. This movement is reshaping the material landscape across packaging, automotive, and construction sectors.

- For instance, Covestro began commercial supply of mass-balanced waterborne polyurethane dispersions from its Shanghai integrated site in Q1 2024. The products use up to 80% alternative raw materials and are ISCC PLUS certified, supporting low-carbon applications in coatings and adhesives across Asia Pacific.

Integration of Smart Manufacturing Technologies to Enhance Operational Efficiency

Digital manufacturing tools are enabling higher productivity and better process control in resin production. Automation, AI, and predictive maintenance improve consistency and lower operational costs. Real-time data monitoring enhances quality assurance and shortens production cycles. The Asia Pacific Synthetic Resin Market is experiencing greater adoption of Industry 4.0 technologies. It is helping producers increase flexibility and respond faster to demand shifts. Smart systems also reduce waste and improve energy efficiency. Major chemical companies are investing in advanced infrastructure to stay competitive. This trend is modernizing production networks and creating stronger value chains.

- For instance, BASF’s Caojing plant in Shanghai expanded polyester and polyurethane resin capacity from 8,000 tons to 18,800 tons per year in March 2025, utilizing process optimization and advanced automation to double output capabilities; further upgrades include predictive analytics planned for 2026, supporting the automotive coatings supply chain.

Growing Preference for High-Performance and Specialty Resins in Advanced Applications

Industrial users are shifting to high-performance and specialty resins for critical applications. These materials offer superior resistance, durability, and thermal stability compared to conventional resins. Demand is rising from sectors such as aerospace, electronics, and automotive. The Asia Pacific Synthetic Resin Market is adapting to these changing requirements with new product lines. It is driving innovation in resin formulation to meet performance standards. Manufacturers are focusing on niche markets with strong growth potential. Specialty resins support the region’s shift toward advanced manufacturing industries. This preference is expanding opportunities for differentiated product portfolios.

Strong Expansion of Downstream Processing and Conversion Capabilities in the Region

Countries are investing heavily in downstream processing to capture higher value in the resin value chain. Converting base polymers into films, sheets, and composites creates more revenue streams. This growth is encouraging investments in new plants and expansion projects. The Asia Pacific Synthetic Resin Market is benefiting from these infrastructure advancements. It strengthens domestic production capabilities and reduces import dependency. Local converters gain access to better technologies and skilled labor. This expansion supports diverse end-use sectors and accelerates supply chain efficiency. Downstream growth enhances regional competitiveness and supports sustained demand.

Market Challenges Analysis

Rising Environmental Regulations and Restrictions Impacting Resin Manufacturing Processes

Tightening environmental regulations are imposing significant constraints on conventional resin production. Governments are enforcing stricter controls on volatile organic compounds and non-recyclable materials. Compliance with these norms requires high investment in cleaner technologies and waste treatment systems. Smaller manufacturers face pressure due to higher operational costs and technology upgrades. The Asia Pacific Synthetic Resin Market faces ongoing challenges in aligning production with evolving environmental policies. It is witnessing a shift toward sustainable solutions, but the transition remains complex and costly. Regulatory uncertainty across countries creates further planning challenges. This evolving regulatory climate demands stronger adaptation strategies.

Volatility in Raw Material Prices and Supply Chain Disruptions Affecting Cost Structures

Fluctuations in crude oil and natural gas prices directly impact resin production costs. Dependence on petrochemical feedstocks exposes the industry to high market uncertainty. Supply chain disruptions from geopolitical events and transportation constraints intensify the problem. It limits profit margins and increases pricing pressure across end-use sectors. The Asia Pacific Synthetic Resin Market faces persistent challenges in stabilizing cost structures. It is experiencing higher competition as producers seek to manage raw material volatility. Rising energy costs further compound operational challenges. This volatility forces companies to optimize sourcing and improve production resilience.

Market Opportunities

Rising Investment in Recycling Technologies and Circular Economy Initiatives

Recycling infrastructure expansion is unlocking new opportunities for resin producers. Advanced mechanical and chemical recycling methods can improve material recovery rates. Governments are promoting circular economy initiatives through incentives and regulatory support. The Asia Pacific Synthetic Resin Market is positioned to benefit from this shift toward resource efficiency. It can enable producers to reduce waste, lower carbon emissions, and meet sustainability targets. Strategic collaborations between resin manufacturers and recyclers are strengthening this opportunity. The increasing emphasis on closed-loop systems supports long-term market growth potential.

Emerging Demand from High-Growth Sectors Including Renewable Energy and Electronics

The rapid expansion of renewable energy and electronic manufacturing is creating new resin applications. Resins provide strong structural and insulation properties needed in components and devices. This creates opportunities for specialized product development targeting advanced industries. The Asia Pacific Synthetic Resin Market is poised to benefit from this expanding industrial base. It can support high-performance solutions in wind energy, solar panels, circuit boards, and semiconductors. Local players are increasing focus on capacity expansion and product innovation. This evolving demand landscape strengthens the region’s role in advanced material supply chains.

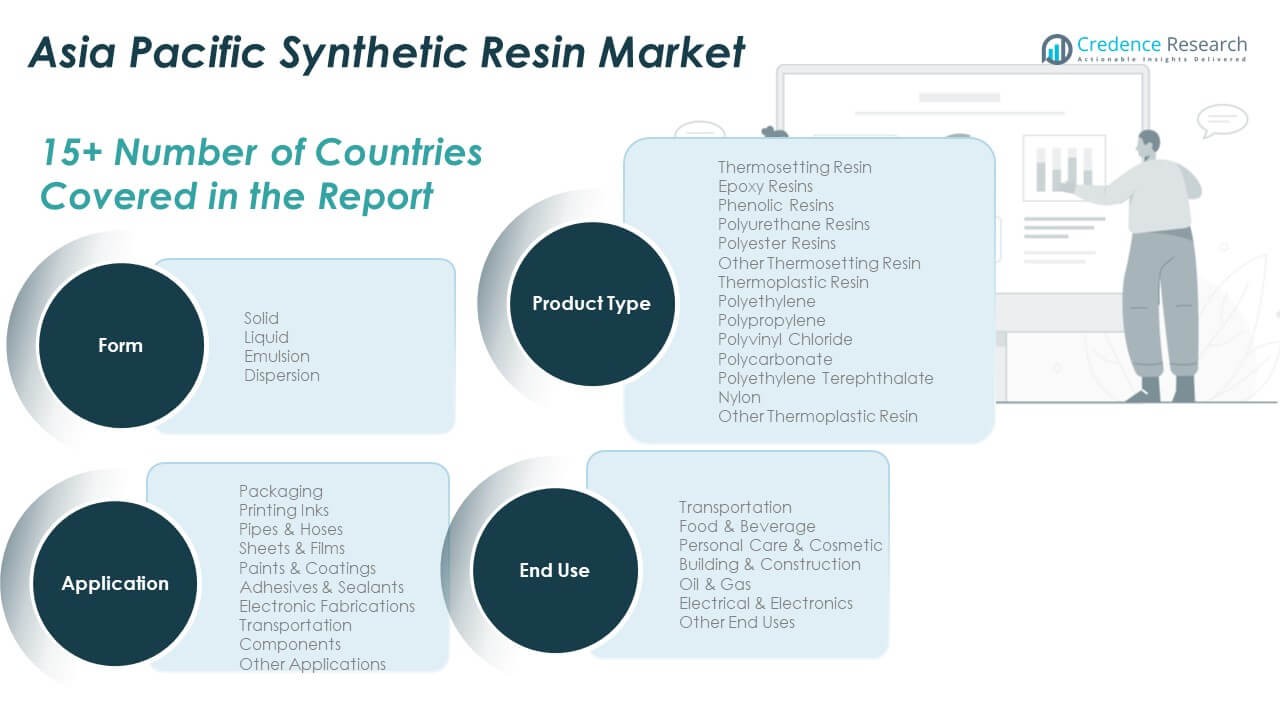

Market Segmentation Analysis

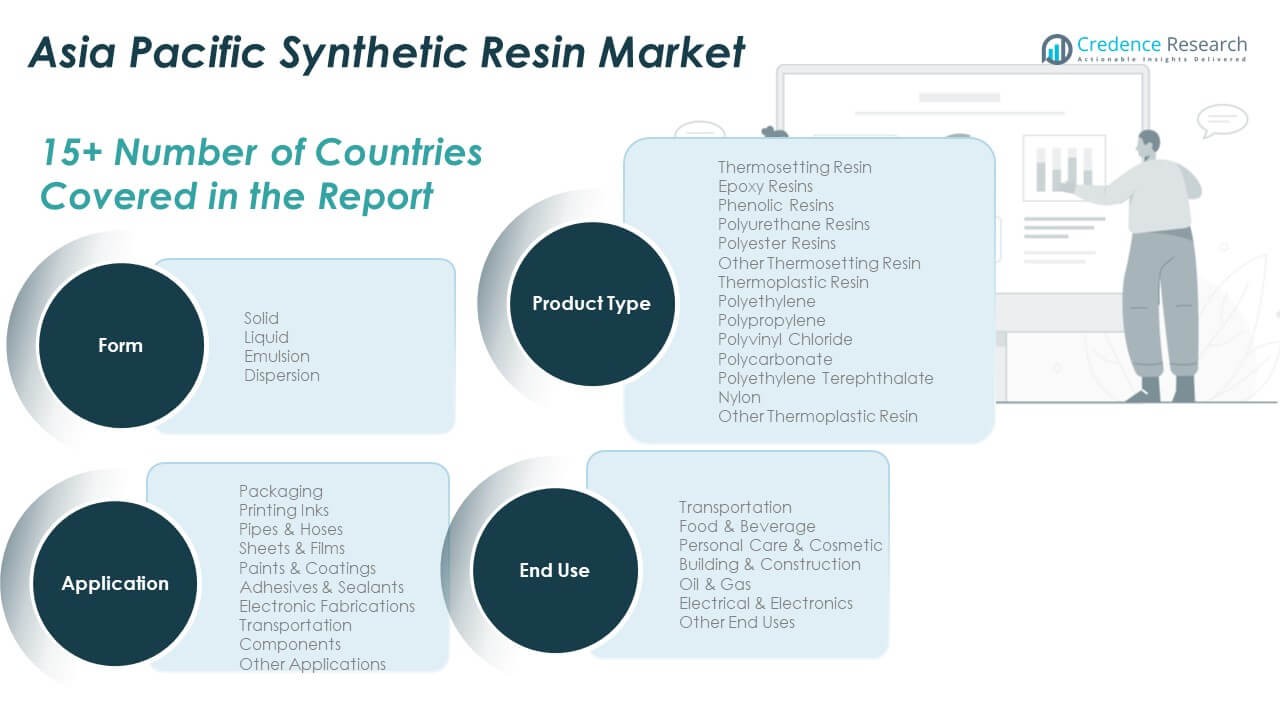

By Form

Solid resins dominate the market due to their extensive use in construction, packaging, and automotive industries. Their strong mechanical strength, heat resistance, and durability support broad applications in structural components. Liquid resins are gaining traction in coatings and adhesives because of their ease of processing and fast curing properties. Emulsion and dispersion forms support niche applications, including specialty coatings and electronics. The Asia Pacific Synthetic Resin Market benefits from this balanced product mix, enabling industries to select materials based on performance and processing needs.

- For instance, Henkel launched new photopolymer Loctite 3D IND249 resin in April 2023, specifically designed for high industrial throughput; this resin is validated on commercial printers and delivers high-temperature stability combined with fine feature resolution for end-use medical and electronic applications. Emulsion and dispersion resins are vital for next-generation printed electronics.

By Application

Packaging leads the application segment, driven by high demand for lightweight, durable, and cost-effective materials. Sheets and films follow closely, supported by strong growth in retail, e-commerce, and flexible packaging. Paints and coatings are also key consumers, reflecting rising infrastructure activity. Adhesives, sealants, and electronic fabrications contribute to niche but fast-growing applications. Transportation components further expand the use of advanced polymers across mobility solutions. This diverse demand base supports stable market growth.

- For example, DIC Corporation offers waterborne coating resins with advanced sustainability profiles, including VOC emissions below international benchmarks for green construction, as incorporated for Indian and Southeast Asian public infrastructure during 2024-25.

By End Use

Transportation remains a major end-use segment, driven by lightweighting trends and rising vehicle production. Building and construction also hold a strong position due to infrastructure investments. Food and beverage packaging maintains steady demand, while personal care and cosmetics add high-value applications. Electrical and electronics provide growth opportunities through insulation and structural components. Oil and gas rely on specialized resins for pipes, coatings, and safety applications.

By Product Type

Thermoplastic resins hold a large share, led by polyethylene, polypropylene, and PVC, favored for their versatility and cost efficiency. PET and polycarbonate support applications needing clarity and strength. Thermosetting resins such as epoxy, phenolic, and polyurethane serve high-performance sectors like automotive, construction, and electronics. Their chemical resistance and structural integrity strengthen market penetration across critical applications.

Segmentation

By Form

- Solid

- Liquid

- Emulsion

- Dispersion

By Application

- Packaging

- Printing Inks

- Pipes & Hoses

- Sheets & Films

- Paints & Coatings

- Adhesives & Sealants

- Electronic Fabrications

- Transportation Components

- Other Applications

By End Use

- Transportation

- Food & Beverage

- Personal Care & Cosmetic

- Building & Construction

- Oil & Gas

- Electrical & Electronics

- Other End Uses

By Product Type

· Thermosetting Resin

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Other Thermosetting Resin

· Thermoplastic Resin

- Polyethylene

- Polypropylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Nylon

- Other Thermoplastic Resin

Regional Analysis

East Asia

East Asia holds the largest share of 41% in the Asia Pacific Synthetic Resin Market. China dominates this subregion with its extensive manufacturing capacity, strong infrastructure investments, and a robust packaging sector. It benefits from large-scale production of thermoplastic and thermosetting resins, supported by high domestic consumption. Japan and South Korea strengthen the region through innovation in specialty resins and high-performance applications. These countries focus on advanced material technologies for automotive, electronics, and construction sectors. The presence of major resin producers and downstream converters enhances production efficiency. It establishes East Asia as the strategic center of resin manufacturing and export in the region.

South Asia and Southeast Asia

South Asia and Southeast Asia together account for 33% of the regional market. India leads this subregion with strong growth in packaging, infrastructure, and automotive industries. Rapid urbanization and expansion of industrial manufacturing boost demand for polyethylene, polypropylene, and PVC. ASEAN countries, including Thailand, Indonesia, and Vietnam, contribute through rising foreign investments and capacity expansion projects. These countries are building competitive downstream industries in films, pipes, and coatings. The Asia Pacific Synthetic Resin Market gains resilience from this subregion’s diversified end-use base and growing processing capabilities. It positions South and Southeast Asia as key emerging growth hubs.

Oceania

Oceania captures a 26% share of the market, supported mainly by Australia’s advanced infrastructure and energy industries. The region has a stable demand base in construction, oil and gas, and transportation sectors. Its resin consumption is driven by high-quality standards and reliance on imports from East Asia. Domestic processing capabilities remain moderate but are expanding through strategic investments. Resin use in energy-efficient building materials and packaging is increasing steadily. It plays a supportive but growing role in the overall regional market structure. This subregion contributes to balanced demand and supply flows within Asia Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

- Dow Inc.

- DuPont de Nemours, Inc.

Competitive Analysis

The Asia Pacific Synthetic Resin Market is characterized by strong competition among global and regional producers. Key players include BASF SE, Dow Inc., SABIC, LyondellBasell Industries, Formosa Plastics Corporation, Mitsui Chemicals, Toray Industries, LG Chem, Sinopec, and Reliance Industries. These companies focus on product innovation, capacity expansion, and downstream integration to strengthen their market positions. Strategic collaborations and investments in sustainable resin technologies help build long-term competitiveness. It maintains a steady pace of technological advancements and market penetration across multiple industries. Players leverage regional production hubs to improve logistics efficiency and serve high-demand sectors. This competitive structure supports rapid scaling, stronger customer relationships, and broader application reach across the region.

Recent Developments

- In September 2025, Covestro AG expanded advanced production technology for its NIA-PFAS super-durable flexible powder coating resins (Uralac® Premium P 8000 and P 9000) at its Pingtung Site in Taiwan. This enables supply of PFAS-free powder coating polyester resins to Asia Pacific’s building materials and heavy machinery sectors, while reducing supply chain carbon emissions in the region.

- In June 2025, Mitsubishi Chemical Group unveiled new-generation food packaging and additive solutions at ProPak Asia 2025 in Bangkok, focusing on improved barrier performance and recyclability for food packaging applications. The launch demonstrates the group’s commitment to advancing sustainable technologies for safety and shelf life in Asia Pacific’s food processing sector.

- In March 2025, Westlake Corporation announced the launch of its new EpoVIVE portfolio through its Westlake Epoxy division, introducing a line of epoxy phenolic resins aimed at boosting performance in coatings and other applications across the Asia Pacific synthetic resin market.

- In November 2025, SABIC officially launched its new $170 million Ultem resin manufacturing facility in Singapore. This strategic opening marks SABIC’s first advanced specialty chemical plant in the region, increasing global Ultem resin capacity by 50% to serve high-tech sectors such as aerospace, healthcare, electronics, and electric vehicles across Asia Pacific.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End Use and Product Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising urbanization will increase demand for lightweight and durable resin products in packaging and construction sectors.

- Growth in electric vehicle manufacturing will drive wider resin adoption in automotive components.

- Expansion of flexible packaging production will create stronger downstream opportunities for resin converters.

- Shift toward sustainable formulations will accelerate investments in bio-based and recyclable resin technologies.

- Digital transformation of production facilities will improve process control and cost efficiency.

- Technological advancements will enable high-performance resin grades with improved heat and chemical resistance.

- Regional trade integration will strengthen supply chain efficiency and enhance cross-border resin flows.

- Expanding electronics manufacturing will boost demand for specialty resins in insulation and structural applications.

- Rising infrastructure projects will sustain high consumption levels in pipes, coatings, and building materials.

- Ongoing R&D investment will support market diversification into emerging industrial applications across Asia Pacific.