Market Overview

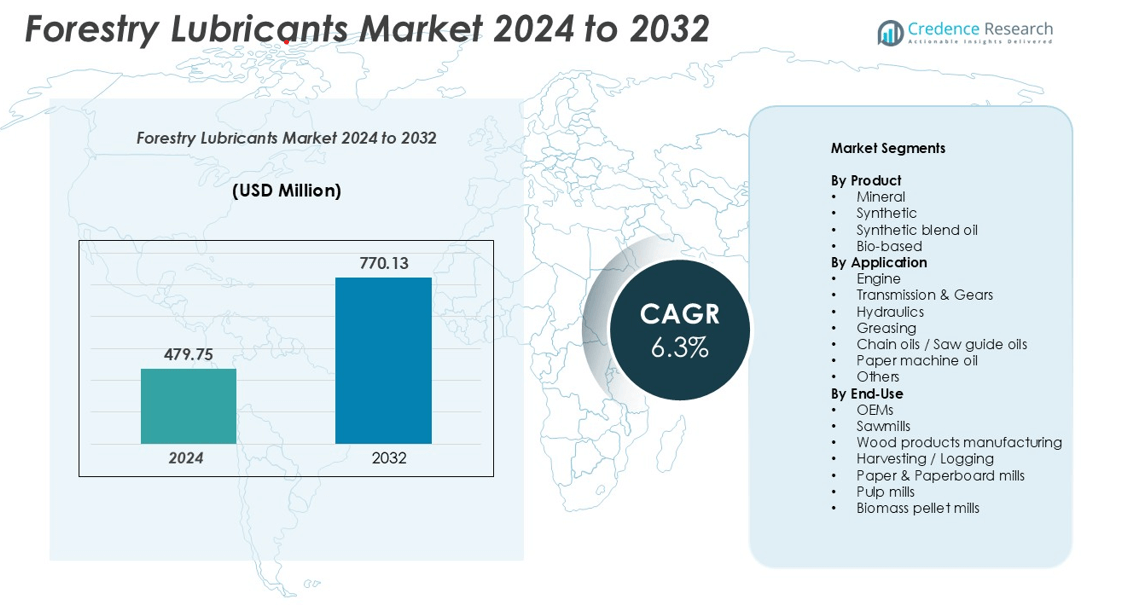

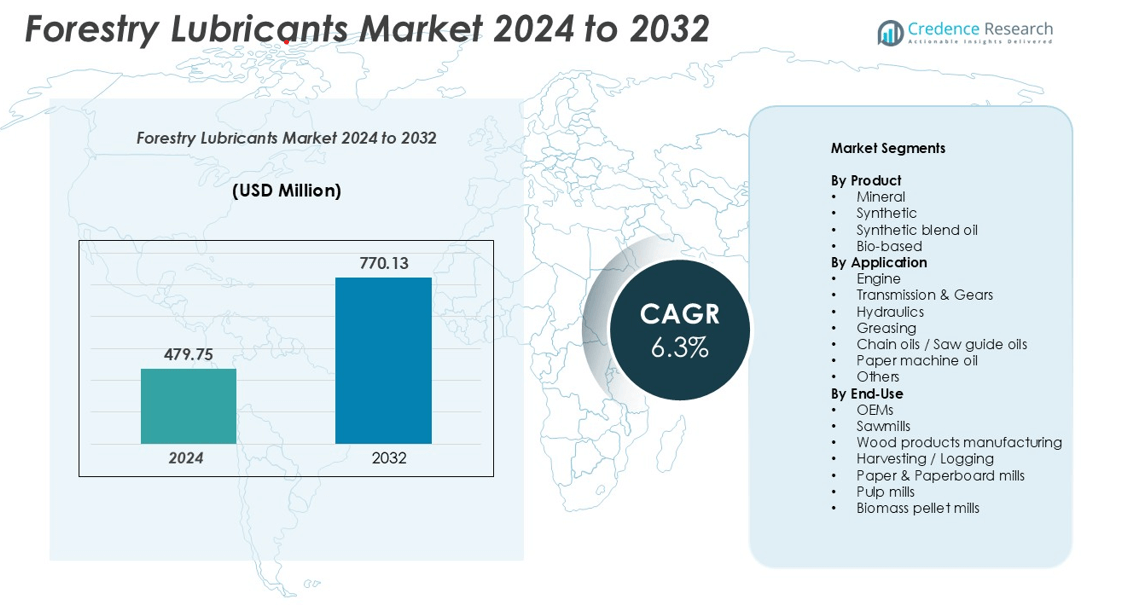

The Forestry Lubricants market size was valued at USD 479.75 million in 2024 and is anticipated to reach USD 770.13 million by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Forestry Lubricants Market Size 2024 |

USD 479.75 million |

| Forestry Lubricants Market CAGR |

6.3% |

| Forestry Lubricants Market Size 2032 |

USD 770.13 million |

The forestry lubricants market is dominated by major players including Exxon Mobil Corporation, Chevron Corporation, Fuchs Petrolub SE, Amsoil Inc., Lubrizol Corporation, Kluber Lubrication, and Bioblend Renewable Resources, which leverage strong R&D, advanced formulations, and strategic OEM partnerships to maintain leadership. North America leads the market with approximately 35% share, driven by mechanized sawmills, logging operations, and strict environmental regulations. Asia-Pacific follows closely with 28% share, fueled by expanding wood processing industries and growing adoption of synthetic and bio-based lubricants. Europe holds around 25% share, supported by established pulp and paper sectors and sustainability-focused operations. The remaining share is distributed across Latin America (8%) and MEA (4%). These regions, combined with continuous product innovation and environmental compliance initiatives, offer significant growth opportunities for market leaders.

Market Insights

- The forestry lubricants market was valued at USD 479.75 million in 2024 and is projected to reach USD 770.13 million by 2032, growing at a CAGR of 6.3%.

- Rising mechanization in logging, sawmills, and wood processing operations is driving demand for engine oils, chain oils, and hydraulic lubricants across global markets.

- Growing adoption of bio-based and synthetic lubricants, along with technological innovations in formulations, is a key trend shaping product development and sustainability initiatives.

- The market is highly competitive, with major players such as Exxon Mobil, Chevron, Fuchs Petrolub, Amsoil, Lubrizol, and Kluber Lubrication focusing on R&D, OEM partnerships, and regional expansions to maintain leadership.

- North America leads with a 35% market share, followed by Asia-Pacific at 28% and Europe at 25%, while Latin America and MEA account for 8% and 4%, respectively; mineral oils dominate the product segment, with engine applications holding the largest share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The Forestry Lubricants market is segmented into mineral, synthetic, synthetic blend oil, and bio-based products. Among these, mineral lubricants hold the dominant share due to their cost-effectiveness and widespread availability across forestry equipment. The growing adoption of heavy machinery in sawmills and logging operations drives demand for reliable and consistent lubrication performance. Meanwhile, synthetic and bio-based oils are gaining traction owing to their superior thermal stability, biodegradability, and reduced environmental impact, particularly in regions with stringent ecological regulations.

- For instance, Shell’s Helix Ultra with PurePlus technology has been shown to provide exceptional engine cleanliness, allowing test vehicles to maintain the same fuel economyand performance as when they were new, even after a 100,000 km fleet trial.

By Application:

Applications of forestry lubricants include engines, transmission & gears, hydraulics, greasing, chain oils/saw guide oils, paper machine oil, and others. Engine oils remain the leading sub-segment, accounting for the largest share due to their critical role in maintaining machinery efficiency and reducing wear in high-performance forestry engines. Increasing mechanization in logging, paper mills, and wood product manufacturing is driving the requirement for specialized lubricants that withstand extreme temperatures and heavy-duty operation. Growing awareness of equipment longevity and operational safety further supports market expansion.

- For instance, Castrol’s Intelligent Lubrication Solutions, which include Castrol SmartOil and Castrol SmartMonitor, were recognized with the 2025 IoT Emerging Technology Award. These solutions utilize advanced sensor-driven technology and real-time monitoring to deliver context-aware insights. This helps customers move from reactive to predictive maintenance, optimizing engine and equipment performance and extending asset life.

By End-Use:

The market is categorized by end-use into OEMs, sawmills, wood products manufacturing, harvesting/logging, paper & paperboard mills, pulp mills, and biomass pellet mills. Sawmills dominate the market, reflecting their high consumption of diverse lubrication products for machinery like saws, conveyors, and planers. Expansion of wood processing industries and modernization of equipment are key drivers, coupled with a shift toward environmentally friendly lubricants in compliance with industry regulations. OEM partnerships for customized lubricant solutions also enhance market penetration and adoption across end-users.

Key Growth Drivers

Rising Mechanization in Forestry Operations

The increasing adoption of advanced machinery in logging, sawmills, and wood processing plants is a primary driver for the forestry lubricants market. Mechanized equipment such as chainsaws, harvesters, and paper machines require specialized lubrication to ensure optimal performance, reduce wear, and extend service life. For instance, high-capacity chainsaws and hydraulic harvesters generate significant heat and friction, necessitating the use of premium engine oils, greases, and chain oils. Additionally, the expansion of wood products manufacturing and paper mills in emerging economies is boosting demand for reliable lubricants. This trend, combined with rising investment in modern forestry infrastructure, continues to push market growth as operators seek oils that enhance operational efficiency and minimize downtime.

- For instance, High-capacity chainsaws and hydraulic harvesters, due to their demanding nature and heavy workload, generate considerable heat and friction. Therefore, premium lubricants—including high-quality engine oils, greases, and chain oils—are essential for their proper function, minimizing wear, and extending the equipment’s lifespan.

Stringent Environmental Regulations

Increasing environmental awareness and strict regulations regarding biodegradability and emission standards are driving the demand for eco-friendly lubricants. Bio-based and biodegradable lubricants are preferred in many regions to reduce soil and water contamination caused by spills during forestry operations. For example, European and North American regulations mandate that chain oils used in sensitive forest areas meet specific biodegradability criteria, promoting the adoption of sustainable lubrication solutions. Companies are investing in research to improve the performance and longevity of bio-based products, offering environmentally responsible alternatives without compromising machinery protection. This regulatory push is creating significant opportunities for manufacturers to innovate and differentiate their product portfolios.

- For instance, Mi240 FORESTER, a readily biodegradable, saturated synthetic ester chain lubricant, is specially formulated for tree harvester chains, chain-driven sawmill conveyors, and chainsaws, providing unparalleled resistance to abrasive dirt and sawdust build-up on chains.

Growth in Wood Processing and Paper Industries

The expansion of the wood processing and paper sectors globally is significantly contributing to the forestry lubricants market. As demand for paper, paperboard, and engineered wood products rises, the need for efficient lubrication of machinery such as paper machines, planers, and saws also increases. OEMs and end-users increasingly prefer high-performance synthetic and blend oils to maintain consistent production quality and reduce maintenance costs. The trend is particularly strong in regions with growing paper exports and industrial wood production, where uninterrupted operations are critical. The increasing focus on operational efficiency and equipment longevity further reinforces the adoption of advanced lubrication solutions.

Key Trends & Opportunities

Shift Toward Bio-Based and Synthetic Lubricants

There is a noticeable shift from conventional mineral oils to bio-based and synthetic lubricants due to their superior thermal stability, reduced environmental impact, and extended service life. Manufacturers are launching innovative solutions that offer improved wear protection and biodegradability. For instance, major companies now provide chain oils with 90–95% biodegradability, making them suitable for environmentally sensitive forest operations. This trend opens opportunities for market players to capture environmentally conscious customers while complying with global sustainability regulations, positioning their products as both performance-oriented and eco-friendly.

- For instance, DGP Pro100 Biodegradable Bar & Chain Oil, made from North American-grown plant oils, boasts a 96% bio-derived content, making it USDA Certified Biobased.

Technological Advancements in Lubricant Formulations

Advancements in lubricant technology, such as friction modifiers, anti-foaming agents, and enhanced viscosity indices, are driving market growth. These innovations enable lubricants to withstand extreme temperatures, reduce energy consumption, and prolong machinery life. OEM partnerships and in-house R&D have led to customized lubrication solutions for engines, hydraulics, and greasing systems. For example, specialized transmission oils can now sustain high loads for over 1,500 operating hours, enhancing equipment uptime. The adoption of technologically advanced lubricants presents an opportunity for manufacturers to differentiate their products and increase market share.

- For instance, Mi240 FORESTER, a readily biodegradable, saturated synthetic ester chain lubricant, is specially formulated for tree harvester chains, chain-driven sawmill conveyors, and chainsaws. Its unique polar magnetic properties provide unparalleled resistance to abrasive dirt and sawdust build-up on chains.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing rapid growth in forestry and wood-based industries. This expansion drives demand for high-performance lubricants tailored for local machinery and operational conditions. Manufacturers are exploring distribution partnerships and regional production facilities to cater to these markets efficiently. The rising mechanization and modernization of forestry equipment in these regions, coupled with increasing environmental awareness, provide a substantial growth opportunity for both global and local lubricant providers.

Key Challenges

High Cost of Advanced Lubricants

The adoption of synthetic and bio-based lubricants is often limited by their higher cost compared to conventional mineral oils. Small-scale operators, especially in developing regions, may find it difficult to justify the investment despite the long-term benefits of enhanced equipment life and reduced maintenance. This price sensitivity can restrict market penetration and slow the adoption of premium products. Manufacturers face the challenge of balancing performance, sustainability, and affordability to capture a wider customer base while maintaining profitability.

Equipment Compatibility and Operational Constraints

Not all forestry machinery is compatible with advanced lubricant formulations. The transition from mineral to synthetic or bio-based lubricants can pose operational challenges, including seal compatibility issues, changes in viscosity behavior, or the need for equipment adjustments. In some cases, improper lubricant selection can lead to equipment failures or reduced efficiency. This necessitates technical training and guidance for end-users, making it a barrier to seamless adoption. Manufacturers must invest in education and provide robust technical support to overcome these challenges effectively.

Regional Analysis

North America:

North America dominates the forestry lubricants market, holding around 35% share due to a strong presence of sawmills, paper mills, and wood product manufacturing facilities. The U.S. drives the region, fueled by advanced mechanization in harvesting operations and strict environmental regulations promoting bio-based and biodegradable lubricants. Canada contributes significantly through its large-scale logging sector requiring specialized chain oils and engine lubricants. OEM collaborations and rising adoption of synthetic and synthetic blend oils further support growth. Continuous emphasis on operational efficiency, equipment longevity, and regulatory compliance ensures North America remains a key regional market.

Europe:

Europe accounts for approximately 25% of the forestry lubricants market, supported by strict environmental standards and established wood processing industries. Germany, Sweden, and Finland lead the regional share, with mechanized logging and extensive pulp and paper production driving demand. The preference for eco-friendly bio-based lubricants is high, reflecting the region’s sustainability initiatives. Advanced synthetic oils and synthetic blends are increasingly used to enhance machinery life and reduce downtime. OEM partnerships, continuous R&D, and a focus on reducing carbon footprint in forestry operations strengthen Europe’s position as a mature and significant market.

Asia-Pacific:

Asia-Pacific represents around 28% of the market, emerging as a high-growth region due to industrial expansion, mechanization of forestry operations, and growing paper and wood product sectors. China, Japan, and India dominate the regional share, with China leading because of large-scale sawmills and paper mills. Rising awareness of lubricant performance, coupled with environmental compliance, is driving demand for synthetic and bio-based products. Infrastructure growth and modernization of forestry equipment create strong market opportunities. The adoption of OEM-specified lubricants and technical training programs further strengthens the region’s growth trajectory.

Latin America:

Latin America holds an estimated 8% market share, with Brazil and Chile as primary contributors due to extensive logging and wood processing industries. Mechanization in harvesting and investments in pulp and paper mills increase demand for engine oils and chain saw lubricants. Adoption of synthetic and bio-based lubricants is rising, driven by evolving environmental regulations. Partnerships between global manufacturers and local OEMs enhance market reach and product accessibility. Despite moderate penetration, ongoing modernization and mechanization in forestry operations present considerable growth potential for lubricant suppliers in the region.

Middle East & Africa:

The MEA region accounts for approximately 4% of the forestry lubricants market. South Africa, Egypt, and Morocco lead regional consumption, primarily using mineral oils for wood product manufacturing and sawmill operations. Awareness of bio-based and synthetic lubricants is gradually growing. Mechanized harvesting, logging projects, and infrastructure development support market demand. Limited local production and reliance on imports present challenges; however, partnerships with global manufacturers and increasing environmental regulations create opportunities for expansion. Over the forecast period, MEA is expected to experience steady growth in forestry lubricant adoption.

Market Segmentations:

By Product

- Mineral

- Synthetic

- Synthetic blend oil

- Bio-based

By Application

- Engine

- Transmission & Gears

- Hydraulics

- Greasing

- Chain oils / Saw guide oils

- Paper machine oil

- Others

By End-Use

- OEMs

- Sawmills

- Wood products manufacturing

- Harvesting / Logging

- Paper & Paperboard mills

- Pulp mills

- Biomass pellet mills

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The forestry lubricants market is highly competitive, featuring a mix of global oil majors, specialized lubricant manufacturers, and regional players. Leading companies such as Exxon Mobil Corporation, Chevron Corporation, Fuchs Petrolub SE, Amsoil Inc., Lubrizol Corporation, and Kluber Lubrication leverage strong R&D capabilities to develop advanced synthetic, bio-based, and biodegradable lubricants that meet stringent environmental and performance standards. Strategic initiatives, including mergers and acquisitions, partnerships with OEMs, and regional expansions, allow these players to strengthen market presence and distribution networks. Mid-sized and regional companies, such as Bioblend Renewable Resources, Elba Lubrication Inc., and Klondike Lubricants Corporation, focus on niche segments, sustainable products, and custom formulations to compete effectively. Continuous product innovation, growing emphasis on eco-friendly solutions, and OEM collaborations remain critical strategies for maintaining market leadership and capturing emerging opportunities in North America, Europe, and Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amsoil Inc.

- Bioblend Renewable Resources

- Chevron Corporation

- China Petroleum & Chemical Corporation (Sinopec Corp)

- Elba Lubrication Inc.

- Exxon Mobil Corporation

- Frontier Performance Lubricants

- Fuchs Petrolub SE

- Klondike Lubricants Corporation

- Kluber Lubrication

- Lubrizol Corporation

- Penine Lubricants

- Petro Canada Lubricants

Recent Developments

- In August 2024, EnviOn Oy launched Lube-En, a fully biodegradable synthetic lubricant for chainsaw and harvester use.

- In July 2024, TYGRIS announced the launch of its ONOS line, the company’s first-ever range of biodegradable lubricants. This innovative development marks a significant milestone in TYGRIS’ commitment to sustainability and signifies a major leap forward for the industrial lubrication industry.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and biodegradable lubricants will increase due to stricter environmental regulations.

- Adoption of synthetic and synthetic blend oils will grow across sawmills, paper mills, and wood processing facilities.

- Mechanization in harvesting and logging operations will continue to drive lubricant consumption globally.

- Emerging markets in Asia-Pacific and Latin America will present significant growth opportunities.

- OEM partnerships will play a crucial role in the development and adoption of specialized lubricant formulations.

- Technological advancements will focus on enhancing lubricant performance, reducing wear, and extending equipment life.

- Increased awareness of operational efficiency and maintenance optimization will boost lubricant usage.

- Growth in the paper, pulp, and biomass industries will sustain consistent demand for diverse lubricant types.

- Market players will invest in R&D to develop sustainable and high-performance products.

- Strategic expansions, mergers, and regional collaborations will strengthen the competitive landscape.