Market Overview

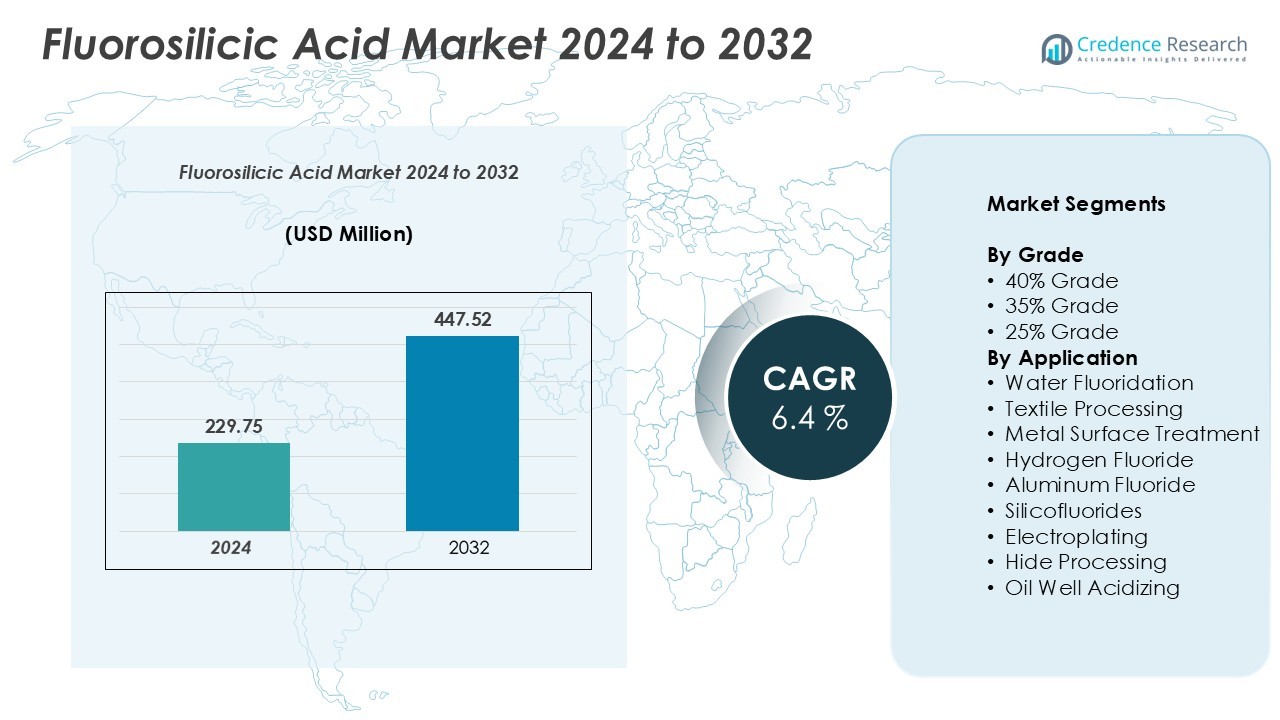

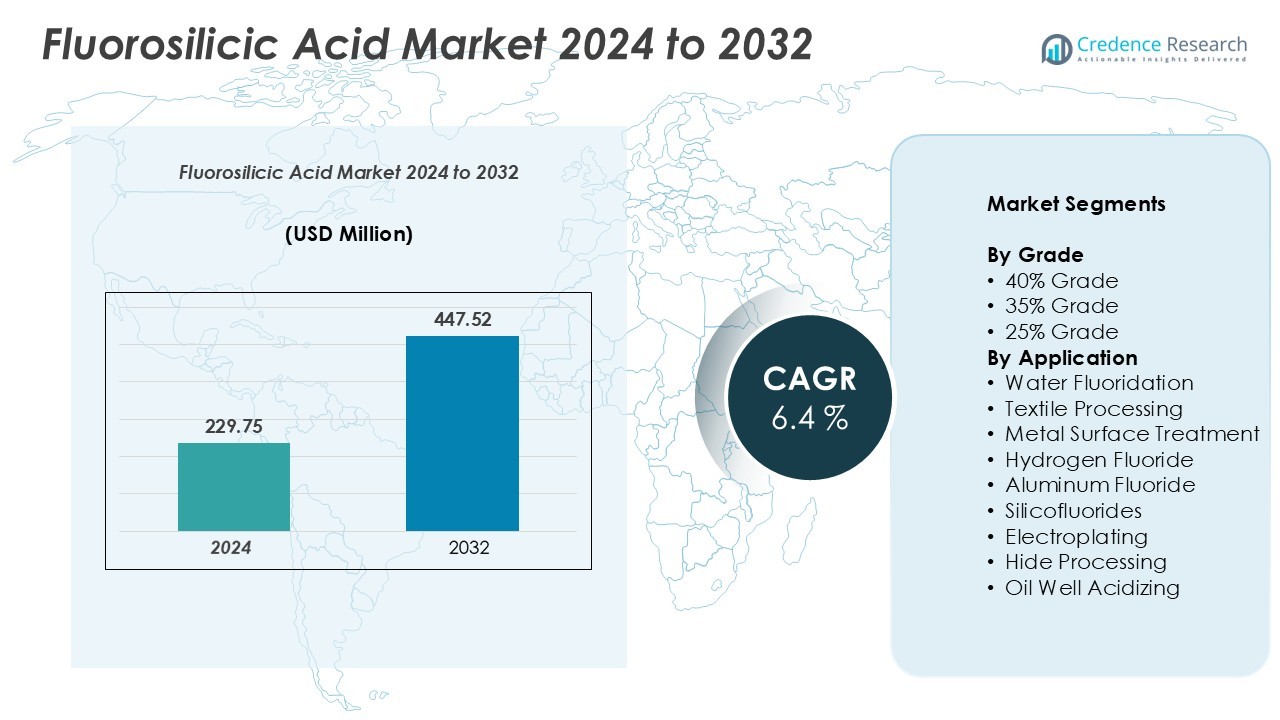

The fluorosilicic acid market size was valued at USD 229.75 million in 2024 and is anticipated to reach USD 447.52 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorosilicic Acid Market Size 2024 |

USD 229.75 Million |

| Fluorosilicic Acid Market, CAGR |

6.4% |

| Fluorosilicic Acid Market Size 2032 |

USD 447.52 Million |

The fluorosilicic acid market is dominated by key players such as Honeywell International, Solvay, American Elements, IXOM, Hydrite Chemical, Gelest, Napco Chemical Company, Foshan Nanhai Shuangfu, Hawkins, and Xinxiang Yellow River Fine Chemicals, who collectively drive innovation, product quality, and regional expansion. These companies leverage advanced production technologies, sustainable manufacturing, and strategic partnerships to maintain a competitive edge. Asia-Pacific leads the global market with a 38% share, driven by strong industrialization, water fluoridation programs, and the aluminum smelting industry in China, India, and Japan. North America follows with a 28% share, supported by established water treatment infrastructure and stringent regulatory frameworks. Europe holds 22%, while Latin America and the Middle East & Africa account for 7% and 5%, respectively. The synergy of technological leadership and strategic regional presence underpins the market dominance of these top players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global fluorosilicic acid market was valued at USD 229.75 million in 2024 and is projected to reach USD 447.52 million by 2032, growing at a CAGR of 6.4%.

- Strong demand for water fluoridation, aluminum fluoride production, and industrial applications drives market growth, supported by government initiatives and expanding industrialization.

- Key trends include the adoption of sustainable production methods, recovery of fluorosilicic acid as a byproduct from phosphate fertilizers, and technological advancements in high-purity and eco-friendly chemical processes.

- The market is competitive, with major players such as Honeywell International, Solvay, American Elements, IXOM, and Hydrite Chemical focusing on product innovation, regional expansion, and strategic partnerships. Restraints include environmental regulations and raw material cost fluctuations affecting production stability.

- Regionally, Asia-Pacific leads with 38% share, followed by North America 28%, Europe 22%, Latin America 7%, and Middle East & Africa 5%; among grades, 40% grade dominates, while water fluoridation remains the largest application segment.

Market Segmentation Analysis:

By Grade

The fluorosilicic acid market, segmented by grade, includes 40% grade, 35% grade, and 25% grade variants. Among these, the 40% grade segment dominates the market, accounting for the largest share owing to its high concentration and efficiency in industrial and water treatment applications. Its superior chemical stability and cost-effectiveness make it the preferred choice for bulk utilization across municipal water fluoridation and chemical synthesis. The demand for 40% grade fluorosilicic acid is further driven by stringent regulations promoting safe fluoridation practices and increasing consumption in metal surface treatment processes.

- For instance, in 2019, the U.S. produced approximately 29 million kilograms (32,000 tons) of fluorosilicic acid (FSA) as a byproduct of processing phosphate rock. A portion of this FSA was then used for water fluoridation. However, water fluoridation is not the primary purpose of its production, as it is a low-cost byproduct of the phosphate fertilizer industry and is also used in other industrial applications.

By Application

In terms of application, water fluoridation represents the dominant sub-segment, capturing a substantial market share due to its extensive use in public water treatment programs worldwide. The segment’s growth is driven by growing health awareness regarding dental hygiene and government initiatives promoting fluoridated water supplies. Beyond this, applications in textile processing and metal surface treatment also contribute significantly, supported by the compound’s role in bleaching, cleaning, and corrosion resistance. Increasing urbanization and municipal infrastructure development continue to reinforce the prominence of water fluoridation as the primary growth driver.

- For instance, in 2001, it was estimated that approximately 63% of fluorosilicic acid was consumed for water fluoridation in the U.S.

Key Growth Drivers

Expanding Demand for Water Fluoridation

A major growth driver for the fluorosilicic acid market is the increasing global emphasis on water fluoridation programs aimed at improving dental health. Municipal and industrial authorities across developed and emerging economies are incorporating fluorosilicic acid into public water treatment systems to prevent tooth decay and enhance oral hygiene. The U.S. Centers for Disease Control and Prevention (CDC) recognizes community water fluoridation as a cost-effective public health measure, leading to widespread adoption. Similarly, countries such as India, China, and Brazil are expanding municipal infrastructure to support large-scale fluoridation projects. The high solubility and efficiency of fluorosilicic acid in water treatment make it a preferred additive, ensuring steady demand across both residential and industrial sectors.

- For instance, in 2019, the United States produced approximately 29 million kilograms (32,000 tons) of fluorosilicic acid as a byproduct of phosphate fertilizer manufacturing. A significant portion of this byproduct was then sold for various uses, including water fluoridation.

Growing Industrial Utilization in Metal Surface Treatment and Textile Processing

Fluorosilicic acid plays a critical role in multiple industrial processes, including metal surface cleaning, textile processing, and electroplating. Its effectiveness in removing oxides and impurities from metals, combined with its compatibility with diverse alloys, drives its usage in automotive, construction, and manufacturing industries. In the textile sector, fluorosilicic acid is utilized for bleaching and fabric finishing applications, ensuring improved product quality and durability. Rapid industrialization in emerging economies and the rising need for precision-treated metals are fueling market growth. Moreover, technological advancements in surface treatment chemicals and eco-friendly formulations are boosting its acceptance across industries seeking high performance with minimal environmental impact.

- For instance, in 2001, it was estimated that approximately 65,200 tons of byproduct fluorosilicic acid were produced by 10 plants owned by 6 companies in the United States.

Rising Demand for Aluminum Fluoride in the Aluminum Smelting Industry

The aluminum industry’s growing need for aluminum fluoride (AlF₃) is significantly driving fluorosilicic acid consumption, as it serves as a primary feedstock in the production process. Aluminum fluoride is essential in reducing the melting point of alumina during electrolytic smelting, thereby improving energy efficiency. With rising global aluminum production—particularly in China, Russia, and the Gulf Cooperation Council (GCC) countries—demand for high-purity fluorosilicic acid continues to expand. Manufacturers are investing in optimized production technologies to ensure consistent quality and sustainable supply. This integration between the fluorosilicic acid and aluminum fluoride industries reinforces supply chain stability and ensures long-term market growth potential.

Key Trends & Opportunities

Technological Advancements and Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities for fluorosilicic acid manufacturers. Rapid urbanization, expanding industrial bases, and increasing demand for clean water systems are accelerating market penetration. Technological innovations in product purity enhancement and process automation are further improving production efficiency and safety. Companies are also establishing localized manufacturing facilities and strategic partnerships to ensure reliable supply and cost competitiveness. This trend aligns with the growing need for high-quality fluorosilicic acid in aluminum smelting, water treatment, and chemical synthesis applications, strengthening the market’s global footprint.

- For instance, in 2015, the United States recovered an estimated 40,000 tons of fluorosilicic acid as a byproduct of processing phosphate rock. This amount was equivalent to about 64,000 tons of 100% fluorspar.

Increasing Shift Toward Sustainable and Low-Emission Manufacturing

A key trend in the fluorosilicic acid market is the transition toward environmentally sustainable production methods. Manufacturers are focusing on reducing emissions and waste generation through advanced recovery systems that extract fluorosilicic acid as a byproduct from phosphate fertilizer production. This circular approach not only minimizes environmental footprint but also enhances cost efficiency. The adoption of cleaner technologies and compliance with stringent environmental regulations are opening opportunities for companies to strengthen their ESG profiles. Furthermore, demand for green chemistry solutions in industrial processing is driving investments in low-carbon production and innovative waste-to-value conversion technologies.

Key Challenges

Environmental and Health Concerns Related to Fluorine Compounds

One of the major challenges confronting the fluorosilicic acid market is the increasing scrutiny over environmental and health risks associated with fluorine-based compounds. Improper handling or disposal can lead to toxic emissions and water contamination, posing hazards to human health and ecosystems. Regulatory agencies across North America and Europe have implemented strict safety standards for production, transportation, and usage, raising operational costs for manufacturers. These compliance requirements often necessitate additional investments in waste management systems and emission controls. The industry’s ability to adopt safer production practices and improve public perception will be critical for sustaining long-term market growth.

Fluctuating Raw Material Availability and Cost Volatility

The availability and pricing of raw materials, particularly phosphate rock and sulfuric acid, significantly affect fluorosilicic acid production costs. Supply chain disruptions, geopolitical instability, and fluctuating energy prices contribute to market uncertainty. Producers relying on byproduct recovery from phosphate fertilizer manufacturing are especially vulnerable to variations in fertilizer production rates. This dependency can lead to inconsistent supply and cost pressures, impacting profitability. To mitigate these risks, manufacturers are diversifying sourcing strategies, optimizing production efficiency, and exploring alternative feedstocks. However, managing these fluctuations remains a key challenge for maintaining stable operations and competitive pricing in the global market.

Regional Analysis

North America

North America holds a significant share of the fluorosilicic acid market, accounting for approximately 28% of the global revenue. The region’s growth is driven by extensive use in municipal water fluoridation programs and strong industrial demand from metal treatment and chemical manufacturing sectors. The United States dominates the regional market due to well-established public health initiatives and stringent water quality regulations. Additionally, increasing adoption in aluminum fluoride and hydrogen fluoride production supports steady consumption. Technological advancements in eco-friendly production processes and regulatory compliance continue to strengthen North America’s leadership in the global fluorosilicic acid market.

Europe

Europe captures around 22% of the global fluorosilicic acid market, supported by strong demand across the water treatment, aluminum, and textile industries. Countries such as Germany, the United Kingdom, and France lead the regional market owing to strict environmental standards and established chemical processing infrastructure. The growing emphasis on sustainable production methods and waste recovery from phosphate fertilizer plants enhances market efficiency. However, the region faces moderate growth due to regulatory scrutiny concerning fluorine-based compounds. Nonetheless, continued investments in clean production technologies and green chemistry are ensuring Europe’s steady presence in the global market landscape.

Asia-Pacific

Asia-Pacific dominates the global fluorosilicic acid market, holding the largest share of approximately 38%. The region’s leadership is attributed to rapid industrialization, expanding water treatment infrastructure, and the thriving aluminum smelting industry in China, India, and Japan. China remains the largest producer and consumer, supported by large-scale manufacturing and government-led industrial development projects. Growing demand for aluminum fluoride and electroplating applications further propels regional growth. Increasing investments in sustainable chemical production and favorable government policies promoting industrial modernization strengthen Asia-Pacific’s position as the primary growth engine for the global fluorosilicic acid market.

Latin America

Latin America accounts for nearly 7% of the global fluorosilicic acid market, with Brazil and Mexico leading consumption. The market is driven by expanding water fluoridation initiatives, rising industrialization, and growing application in textile and metal processing industries. Government-backed programs for improving public health through water fluoridation are boosting demand. Additionally, the development of local chemical production facilities is enhancing supply chain efficiency. Although the region faces infrastructure limitations, increasing investments in industrial modernization and sustainable manufacturing are expected to support moderate but consistent growth in the Latin American fluorosilicic acid market.

Middle East & Africa

The Middle East & Africa region represents around 5% of the global fluorosilicic acid market, with growth primarily supported by industrial expansion and rising aluminum production in Gulf countries. The United Arab Emirates and Saudi Arabia are investing heavily in aluminum fluoride manufacturing, utilizing fluorosilicic acid as a key input. Additionally, increasing demand for water treatment chemicals in arid regions drives consumption. Africa’s emerging economies are gradually adopting fluoridation practices and expanding industrial applications. Although the market share is relatively small, infrastructure development and new industrial projects are creating promising long-term growth opportunities in the region.

Market Segmentations:

By Grade

- 40% Grade

- 35% Grade

- 25% Grade

By Application

- Water Fluoridation

- Textile Processing

- Metal Surface Treatment

- Hydrogen Fluoride

- Aluminum Fluoride

- Silicofluorides

- Electroplating

- Hide Processing

- Oil Well Acidizing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fluorosilicic acid market is highly competitive, characterized by the presence of global chemical manufacturers and regional producers focusing on water treatment, industrial applications, and aluminum fluoride production. Key players, including Honeywell International, Solvay, American Elements, IXOM, and Hydrite Chemical, leverage advanced production technologies, strategic partnerships, and regional distribution networks to strengthen market presence. Companies are increasingly investing in sustainable and eco-friendly manufacturing processes to comply with stringent environmental regulations and enhance operational efficiency. Competitive strategies also include expansion into emerging markets in Asia-Pacific, Latin America, and the Middle East to capture growing demand. Product innovation, quality consistency, and cost optimization remain critical differentiators, while byproduct recovery from phosphate fertilizer plants provides a reliable supply advantage. Overall, the market is driven by innovation, regulatory compliance, and strategic collaborations, fostering a dynamic landscape where established players and new entrants compete for technological and regional leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International

- Gelest

- IXOM

- American Elements

- Solvay

- Foshan Nanhai Shuangfu

- Hydrite Chemical

- Xinxiang Yellow River Fine Chemicals

- Napco Chemical Company

- Hawkins

Recent Developments

- In May 2022, Hawkins acquired all the assets of C & L Aqua Professionals, Inc and LC Blending, Inc. this is a strategic move with the objective of increasing the company’s water treatment presence in Lousiana.

- In February of 2022, Honeywell International Inc. invented a refurbished process of converting low-grade plastic wastes back to oil suitable for the refinery.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fluorosilicic acid market is expected to grow steadily due to increasing water fluoridation initiatives worldwide.

- Expansion of the aluminum industry will drive higher demand for aluminum fluoride production.

- Industrial applications in metal treatment, textile processing, and electroplating will continue to support market growth.

- Sustainable and eco-friendly production methods will become more prevalent among manufacturers.

- Emerging economies in Asia-Pacific, Latin America, and Africa will offer new growth opportunities.

- Technological advancements will improve product purity, efficiency, and safety standards.

- Strategic partnerships and regional expansions will strengthen market presence for leading companies.

- Regulatory compliance with environmental and safety standards will shape manufacturing practices.

- Byproduct recovery from phosphate fertilizer production will enhance supply chain stability.

- Focus on innovation and cost optimization will remain key to maintaining competitive advantage.