| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Allergen Free Products Market Size 2024 |

USD 47,989.65 Million |

| Allergen Free Products Market, CAGR |

4.88% |

| Allergen Free Products Market Size 2032 |

USD 72,236.86 Million |

Market Overview

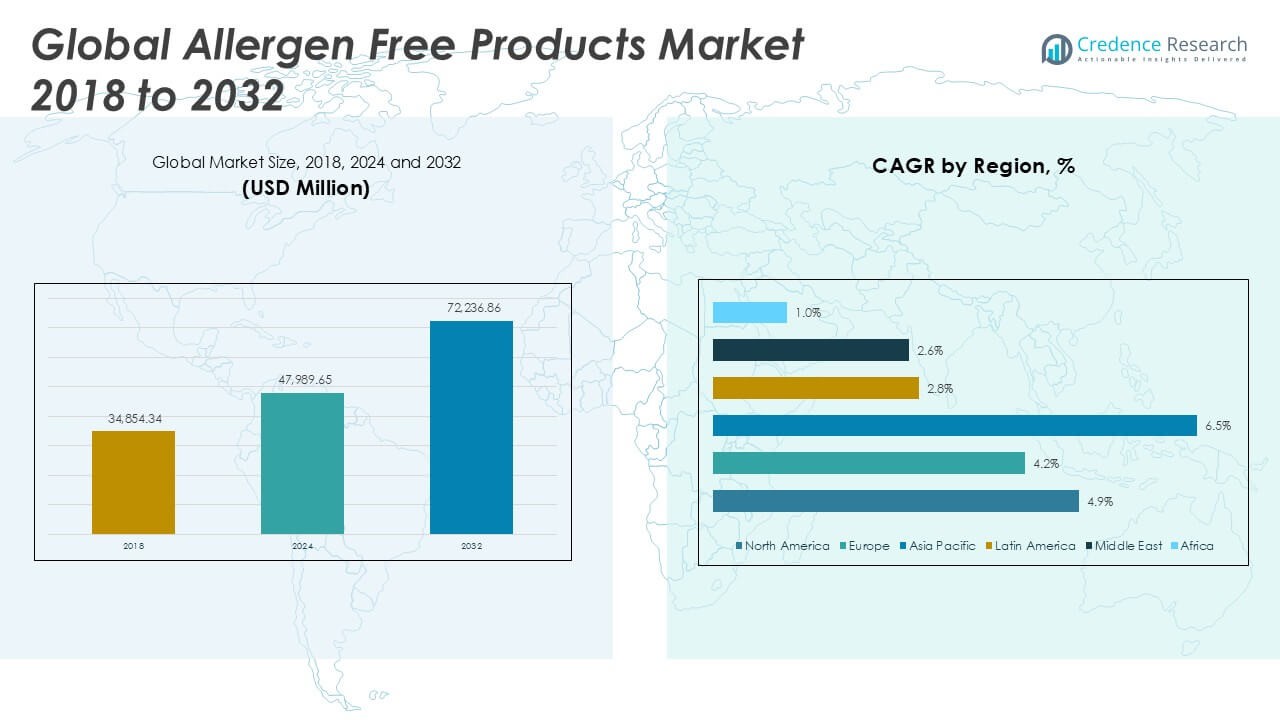

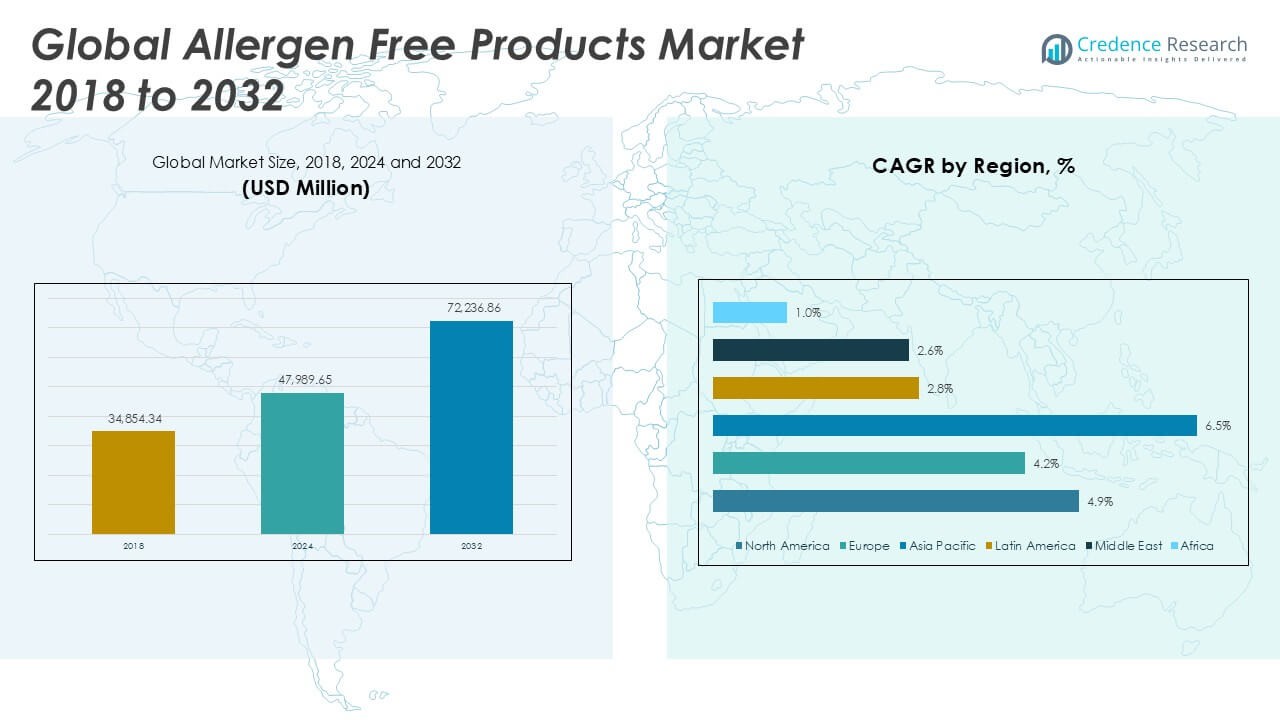

The Allergen Free Products Market size was valued at USD 4,854.34 million in 2018, increased to USD 47,989.65 million in 2024, and is anticipated to reach USD 72,236.86 million by 2032, at a CAGR of 4.88% during the forecast period.

The Allergen Free Products Market is experiencing robust growth, driven by rising consumer awareness of food allergies, intolerances, and the growing demand for clean-label and health-focused products. Increasing incidence of food-related allergies, especially among children and young adults, has prompted manufacturers to innovate and expand allergen-free offerings, including snacks, bakery, beverages, and dairy alternatives. Stricter food safety regulations and improved labeling standards further support market expansion, ensuring transparency and trust among consumers. The rise of veganism, plant-based diets, and the influence of social media on healthy lifestyles also contribute to the growing popularity of allergen-free products. Market trends highlight the adoption of advanced food processing technologies, the use of alternative ingredients such as gluten-free grains, and strategic product launches targeting specific allergy groups. The shift toward sustainable packaging and e-commerce channels enhances market reach, supporting sustained growth across developed and emerging markets.

The Allergen Free Products Market demonstrates diverse geographical growth patterns, with North America, Europe, and Asia Pacific emerging as key regions due to rising awareness of food allergies and increasing demand for safe, health-conscious food choices. North America benefits from strong regulatory frameworks, high consumer awareness, and widespread product availability across retail and online channels. Europe exhibits robust growth fueled by strict food safety regulations and active advocacy from health organizations. Asia Pacific is quickly expanding as urbanization, income growth, and lifestyle changes drive demand for allergen free foods, especially in China, Japan, and Australia. Leading companies shaping the competitive landscape include Enjoy Life Foods, General Mills Inc., and The Hain Celestial Group. These key players focus on continuous product innovation, broad allergen-free portfolios, and global distribution strategies to meet evolving consumer needs in both established and emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Allergen Free Products Market reached USD 47,989.65 million in 2024 and is projected to reach USD 72,236.86 million by 2032, reflecting a CAGR of 4.88% during the forecast period.

- Strong consumer demand for safe, health-oriented foods drives market growth, supported by rising awareness of allergies and intolerances across all age groups.

- Product innovation and diversification continue, with manufacturers developing gluten-free, dairy-free, nut-free, and soy-free offerings to appeal to broader consumer segments.

- Major players such as Enjoy Life Foods, General Mills Inc., and The Hain Celestial Group invest in extensive allergen-free portfolios, global distribution, and strategic partnerships to strengthen market position.

- High production costs, complex supply chains, and the challenge of achieving appealing taste and texture remain persistent restraints for market players.

- North America, Europe, and Asia Pacific lead the market due to advanced regulatory environments, robust retail networks, and growing health consciousness, while Latin America, Middle East, and Africa show steady but slower adoption.

- Regional expansion, rising online retail, and targeted marketing toward untapped consumer groups offer new opportunities for brands seeking to capitalize on changing dietary habits and regulatory support.

Market Drivers

Rising Prevalence of Food Allergies and Intolerances Drives Demand for Allergen Free Products

A significant driver of the Allergen Free Products Market is the increasing prevalence of food allergies and intolerances globally. Cases of allergic reactions to common ingredients such as gluten, nuts, dairy, and soy continue to rise, prompting consumers and healthcare professionals to seek safer food options. Regulatory bodies and health organizations now emphasize the importance of allergen awareness, leading to heightened consumer scrutiny of food labels and product formulations. Families with children and young adults are especially vigilant, fueling a surge in demand for allergen free products in both retail and foodservice sectors. Food producers respond by reformulating traditional products and introducing new ranges that exclude major allergens. The expanding consumer base extends beyond those with diagnosed allergies, reaching health-conscious individuals seeking preventive dietary choices.

- For instance, Enjoy Life Foods, a leading brand, offers more than 70 certified allergen-free products that exclude 14 major allergens, distributing to over 40,000 retail locations in North America.

Consumer Preferences Shift Toward Clean Label and Transparent Ingredients

Evolving consumer preferences toward clean label products with transparent ingredient sourcing significantly influence the market. Shoppers increasingly prioritize foods that clearly list ingredients, exclude artificial additives, and avoid cross-contamination with allergens. This shift drives manufacturers to adopt strict quality control standards and invest in certified production processes that ensure allergen-free integrity. Transparent communication of allergen-free claims through labeling and marketing campaigns enhances brand credibility and consumer loyalty. The market benefits from strategic collaborations with advocacy groups and regulatory authorities to standardize definitions and practices, supporting widespread adoption of allergen free products.

- For instance, The Hain Celestial Group achieved third-party certification for over 50 of its products as non-GMO and organic, and implemented batch-level ingredient tracking across its manufacturing sites.

Innovation in Alternative Ingredients and Product Formulation Expands Market Offerings

Continuous innovation in food technology and ingredient sourcing broadens the product landscape for allergen free alternatives. Companies invest in research to develop high-quality substitutes for common allergens, such as gluten-free grains, plant-based dairy alternatives, and nut-free spreads. This focus on innovation enhances taste, texture, and nutritional value, helping allergen free products appeal to a broader audience. Advanced food processing and packaging technologies extend shelf life and ensure product safety, making allergen free foods more accessible and appealing. New product launches target specific consumer groups, catering to dietary restrictions while supporting flavor variety and convenience.

Regulatory Support and Market Access Improve Allergen Free Products Availability

Government regulations and industry standards play a crucial role in shaping the Allergen Free Products Market. Stringent labeling requirements and mandatory disclosure of allergen content ensure that consumers make informed choices. Authorities in major markets, including North America and Europe, enforce compliance with food safety protocols and penalize mislabeling, driving producers to maintain high transparency standards. Certification programs and independent verification schemes further instill consumer confidence. Online retail and e-commerce platforms expand product access, enabling small and large brands to reach diverse markets and meet evolving consumer needs.

Market Trends

Product Innovation and Diversification Enhance Allergen Free Offerings Across Categories

Continuous product innovation and diversification characterize the evolving landscape of the Allergen Free Products Market. Food manufacturers expand their portfolios to include a broader array of allergen free snacks, baked goods, dairy alternatives, and ready-to-eat meals. Companies introduce unique flavors, improved textures, and fortified nutritional profiles to appeal to consumers with allergies and those following health-conscious lifestyles. The adoption of novel ingredients such as ancient grains, seeds, and plant-based proteins supports both functional benefits and product differentiation. Startups and established brands compete through frequent new product launches that cater to changing dietary trends and specific allergy needs. This dynamic environment fosters strong brand recognition and increases consumer engagement with allergen free foods.

- For instance, Daiya Foods launched 12 new plant-based dairy alternatives in a single year and distributed to over 25,000 retail outlets in the United States and Canada by the end of 2022.

Clean Label Movement and Transparency Shape Consumer Preferences and Purchasing Decisions

The growing emphasis on clean label products and ingredient transparency remains a defining trend in the Allergen Free Products Market. Consumers demand clear, straightforward labeling that identifies both the presence and absence of common allergens, artificial additives, and preservatives. Companies prioritize non-GMO, organic, and minimally processed ingredients to build trust and loyalty among increasingly health-aware buyers. Industry players actively pursue third-party certifications and rigorous quality assurance processes to validate their claims and strengthen market credibility. Transparent supply chains and responsible sourcing initiatives further align with the ethical expectations of modern shoppers. Retailers respond by dedicating shelf space and online filters to allergen free and clean label products, streamlining the consumer shopping experience.

- For instance, General Mills Inc. secured non-GMO certification for 90% of its Cheerios line, and began using blockchain-based supply chain verification for over 20 products by 2023.

E-commerce and Direct-to-Consumer Channels Accelerate Market Penetration

The rapid growth of e-commerce and direct-to-consumer distribution channels significantly influences the Allergen Free Products Market. Online platforms provide consumers with easy access to a wide selection of allergen free options, enabling them to compare products, read reviews, and make informed decisions. Digital marketing and subscription-based delivery models expand brand reach while supporting personalized dietary needs and recurring purchases. Small and emerging brands benefit from online exposure, gaining traction without traditional retail barriers. E-commerce analytics offer valuable consumer insights, guiding new product development and targeted marketing campaigns. The convenience of online shopping encourages trial, repeat purchases, and brand loyalty.

Globalization and Cross-Border Market Expansion Drive Wider Adoption

Globalization supports the increased availability and adoption of allergen free products across diverse regions. Major market players enter emerging markets through partnerships, acquisitions, and localized production, making allergen free foods more accessible to varied consumer bases. International regulatory harmonization simplifies product approval processes, reducing barriers to cross-border trade. The influence of global media and social platforms raises awareness about food allergies and healthy living worldwide. Manufacturers tailor product formulations and packaging to reflect cultural preferences and dietary requirements in different regions. This global expansion supports sustained growth and ensures that allergen free products meet the needs of consumers around the world.

Market Challenges Analysis

High Production Costs and Supply Chain Complexities Limit Market Accessibility

High production costs and complex supply chains remain significant challenges for the Allergen Free Products Market. Sourcing specialized raw materials that meet strict allergen-free standards often involves higher procurement expenses and limited supplier options. Manufacturers must invest in dedicated facilities or stringent segregation processes to avoid cross-contamination, increasing operational costs. These factors drive up the final price for consumers, potentially restricting market accessibility, especially in price-sensitive regions. Small and emerging brands face hurdles scaling production and maintaining consistent quality across batches. Supply chain disruptions, such as ingredient shortages or logistic delays, further complicate reliable product availability in the market.

Taste, Texture, and Shelf Life Optimization Present Ongoing Technical Barriers

Ensuring optimal taste, texture, and shelf life poses ongoing technical challenges for manufacturers of allergen free products. Many allergen-free formulations must replace traditional ingredients like wheat, dairy, or nuts, which provide key sensory and functional qualities in foods. Creating appealing alternatives often requires advanced research and innovative food technology, which can increase development timelines and costs. Achieving consumer acceptance hinges on continuous improvement in product quality and sensory experience. The Allergen Free Products Market must address consumer expectations for flavor and convenience without compromising safety or nutritional value. Frequent product reformulation and the need for specialized expertise further strain resources, impacting the speed of innovation.

Market Opportunities

Expansion into Emerging Markets and Untapped Consumer Segments Supports Growth

Expansion into emerging markets and untapped consumer segments presents a significant opportunity for the Allergen Free Products Market. Urbanization, rising incomes, and growing awareness about food allergies increase demand for safer and healthier food options in regions such as Asia Pacific, Latin America, and the Middle East. Market leaders can build brand loyalty by offering affordable and accessible allergen free products tailored to local tastes and dietary needs. Strategic partnerships with regional distributors and retailers help establish a stronger presence and expand reach. Educational initiatives about food safety and allergen management further drive market acceptance. The potential to serve large, underpenetrated populations creates room for sustained market growth.

Innovation in Product Development and Functional Health Benefits Drives Differentiation

Innovation in product development and a focus on functional health benefits provide an opportunity to differentiate offerings within the Allergen Free Products Market. Companies that invest in research and development to create products with improved taste, texture, and nutritional profiles gain a competitive edge. Fortifying allergen free foods with added vitamins, minerals, and plant-based proteins attracts both health-conscious consumers and those with specific dietary needs. Adoption of cutting-edge processing technologies and sustainable packaging solutions appeals to environmentally aware shoppers. Collaborating with nutritionists and healthcare professionals supports credibility and enhances product positioning. Meeting evolving consumer expectations through continuous innovation enables brands to capture new market share and foster customer loyalty.

Market Segmentation Analysis:

By Type:

Gluten-free products hold a significant share, driven by the rising incidence of celiac disease and gluten sensitivities worldwide. Dairy-free items show high demand, supported by increased lactose intolerance and the popularity of plant-based diets. Nut-free, soy-free, and egg-free products appeal to those with severe food allergies, while fish-free and shellfish-free offerings address specific dietary restrictions. The market’s ability to cater to various allergen categories strengthens its appeal among diverse consumer groups.

- For instance, Dr. Schär AG/SPA produces over 120 gluten-free products and operates in more than 100 countries, supplying over 25 million units annually.

By Product Type:

Baked goods represent a substantial segment in the Allergen Free Products Market, with manufacturers investing in the development of bread, cakes, and pastries that exclude major allergens. Snacks and bars attract health-conscious consumers and individuals seeking convenient, safe options for on-the-go consumption. Dairy alternatives, such as plant-based milk, cheese, and yogurt, register robust growth as consumers shift away from traditional dairy. Confectionery and beverages also expand their allergen-free portfolios, offering chocolates, candies, juices, and specialty drinks without common allergens. Baby food emerges as a crucial segment, responding to rising parental concern over early childhood allergies. The ‘others’ category encompasses emerging product formats and specialty items tailored for niche markets.

- For instance, Nestlé SA launched 18 new dairy-free and allergen-free baby food SKUs in 2023, distributing these products across 35 countries in Europe and Asia.

By Distribution Channel:

Supermarkets and hypermarkets dominate sales due to their wide assortment and accessibility, allowing consumers to compare various allergen free brands and products easily. Specialty stores focus on curated selections and personalized service, catering to shoppers with specific dietary requirements. Online retail channels gain traction, providing convenient access to a broad range of allergen free products and supporting the growth of smaller brands through digital marketplaces. Convenience stores enhance market penetration by stocking popular allergen-free items for quick purchases. The ‘others’ segment covers health food outlets and direct-to-consumer delivery models, further diversifying the routes through which consumers access allergen free solutions. This robust segmentation enables the market to address shifting consumer needs while supporting steady expansion across regions and categories.

Segments:

Based on Type:

- Gluten-Free

- Dairy-Free

- Nut-Free

- Soy-Free

- Egg-Free

- Fish-Free

- Shellfish-Free

- Others

Based on Product Type:

- Baked Goods

- Snacks and Bars

- Dairy Alternatives

- Confectionery

- Beverages

- Baby Food

- Others

Based on Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Allergen Free Products Market

North America Allergen Free Products Market grew from USD 14,260.40 million in 2018 to USD 19,416.98 million in 2024 and is projected to reach USD 29,314.28 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.9%. North America is holding a 40% market share. The United States leads the region, supported by Canada and Mexico, with strong consumer awareness and high adoption of allergen free food alternatives. Advanced food labeling regulations, rising incidence of food allergies, and a mature retail infrastructure drive market penetration. U.S. manufacturers set trends through innovation and extensive product ranges across key categories. Growth in e-commerce platforms, health-focused retail, and specialty stores supports diverse purchasing habits. It benefits from robust marketing and significant investments in product development.

Europe Allergen Free Products Market

Europe Allergen Free Products Market grew from USD 11,223.85 million in 2018 to USD 14,962.90 million in 2024 and is projected to reach USD 21,367.25 million by 2032, reflecting a CAGR of 4.2%. Europe is holding a 29% market share. The United Kingdom, Germany, and France drive the region’s performance, supported by growing demand for gluten-free and dairy-free foods. Strict food safety standards and labeling requirements build consumer trust and foster a dynamic innovation environment. Retail chains offer a wide range of allergen free products, both in-store and online. Plant-based trends and the influence of wellness-focused consumers shape market direction. Government initiatives and advocacy by allergy associations contribute to expanding product availability.

Asia Pacific Allergen Free Products Market

Asia Pacific Allergen Free Products Market grew from USD 6,707.29 million in 2018 to USD 10,009.33 million in 2024 and is projected to reach USD 17,063.27 million by 2032, reflecting a CAGR of 6.5%. Asia Pacific is holding a 24% market share. China, Japan, and Australia are the primary contributors to regional expansion, with rising urbanization and health consciousness fueling demand. It benefits from a large base of younger consumers and increased incidence of food allergies in major metropolitan areas. Expansion of modern grocery formats and growing online retail platforms improve product access. Local manufacturers introduce traditional and innovative allergen free options to meet evolving preferences. Strategic collaborations and imports of international brands strengthen market competitiveness.

Latin America Allergen Free Products Market

Latin America Allergen Free Products Market grew from USD 1,279.32 million in 2018 to USD 1,733.27 million in 2024 and is projected to reach USD 2,221.83 million by 2032, reflecting a CAGR of 2.8%. Latin America is holding a 3% market share. Brazil, Mexico, and Argentina lead consumption, with rising awareness of food allergies in urban centers. It faces challenges in affordability and distribution, but increasing interest in health and wellness trends opens new opportunities. Retailers expand allergen free offerings, especially in premium grocery segments. Regulatory updates and nutrition campaigns encourage informed consumer choices. Growth in online retail supports emerging brands targeting specific dietary needs.

Middle East Allergen Free Products Market

Middle East Allergen Free Products Market grew from USD 968.29 million in 2018 to USD 1,217.71 million in 2024 and is projected to reach USD 1,544.02 million by 2032, reflecting a CAGR of 2.6%. The Middle East is holding a 2% market share. Saudi Arabia and the United Arab Emirates are the key markets, driven by increasing expatriate populations and lifestyle changes. Retailers focus on expanding premium and imported allergen free selections, especially in metropolitan areas. It benefits from gradual improvements in food safety standards and consumer education. Product innovation remains limited compared to mature markets, but international brands grow their presence. Online and specialty channels cater to niche consumer segments with tailored offerings.

Africa Allergen Free Products Market

Africa Allergen Free Products Market grew from USD 415.19 million in 2018 to USD 649.46 million in 2024 and is projected to reach USD 726.21 million by 2032, reflecting a CAGR of 1.0%. Africa is holding a 1% market share. South Africa and Nigeria lead the region, but the market remains underdeveloped due to limited awareness and purchasing power. It experiences slow but steady growth in urban centers with increasing exposure to global health trends. Local producers and distributors face barriers related to supply chain infrastructure and regulatory consistency. Allergen free products remain a niche segment, available mainly in specialty and high-end retail outlets. Ongoing efforts by NGOs and health organizations promote food safety and allergen awareness.

Key Player Analysis

- Enjoy Life Foods

- Amy’s Kitchen

- General Mills Inc.

- The Hain Celestial Group

- Nestlé SA

- Daiya Foods Inc.

- Glutino

- Schär AG/SPA

- Bob’s Red Mill Natural Foods

- Earth’s Best Organic

Competitive Analysis

The Allergen Free Products Market features intense competition among leading players, including Enjoy Life Foods, Amy’s Kitchen, General Mills Inc., The Hain Celestial Group, Nestlé SA, Daiya Foods Inc., Glutino, Dr. Schär AG/SPA, Bob’s Red Mill Natural Foods, and Earth’s Best Organic. These companies hold a strong presence through diverse product portfolios that address a wide range of allergen concerns, such as gluten-free, dairy-free, and nut-free options. They invest heavily in research and development to improve product taste, texture, and nutritional value, ensuring continuous innovation and consumer appeal. Strategic mergers, acquisitions, and partnerships enable these brands to strengthen distribution networks and expand global reach. Digital marketing, strong branding, and consumer education campaigns further reinforce their leadership positions. The competitive environment encourages frequent new product launches and adaptation to evolving dietary trends, regulatory requirements, and labeling standards. Key players differentiate themselves by achieving high-quality standards, securing third-party certifications, and leveraging advanced manufacturing capabilities. Their proactive approach to product safety and transparency builds trust and long-term loyalty among health-conscious consumers worldwide.

Recent Developments

- In May 2025, Enjoy Life Foods became the first brand to feature SnackSafely’s allergen transparency badges on all its products, simplifying retail purchasing decisions for allergic consumers.

- In January 2025, Hain Celestial launched Garden Veggie™ Flavor Burst™ tortilla chips, which became the top-selling better-for-you salty snack new product in 2024. These chips feature five vegetables and non-GMO corn and are certified gluten-free. The company also maintains Earth’s Best® as the leading natural and organic toddler snack brand.

- In April 2024, Nestlé SA launched a new line of dairy-free snacks in Europe, expanding its presence in the allergen-free market and catering to the increasing demand for dairy alternatives. This move aligns with the broader trend of rising consumer interest in plant-based and allergen-free food options.

- In April 2024, The Simply Good Foods Company, a developer, marketer and seller of branded nutritional foods and snacking products, and Only What You Need (“OWYN”), a leading plant-based, allergen-free ready-to-drink (“RTD”) protein shake brand, announced that the companies have entered into a definitive agreement under which Simply Good Foods will acquire OWYN for $280 million in cash. Only What You Need is the fastest growing RTD protein shake brand in the market and enhances Simply Good Foods’ portfolio with further diversification and provides the Company with a greater presence within the RTD protein shake segment.

Market Concentration & Characteristics

The Allergen Free Products Market exhibits moderate to high concentration, with a handful of prominent multinational companies driving innovation, product development, and global distribution. It features a competitive mix of established food giants and specialized brands that leverage advanced food technology and strict quality assurance to differentiate their offerings. Market leaders maintain significant influence through extensive portfolios, broad geographic reach, and strong relationships with retailers and distributors. The market is characterized by rapid new product introductions, clear labeling standards, and a focus on transparency and safety to address the needs of consumers with allergies and dietary restrictions. Barriers to entry include stringent regulatory requirements, high production costs, and the need for specialized manufacturing capabilities to prevent cross-contamination. It shows a dynamic landscape where continuous investment in research, marketing, and supply chain resilience is essential for sustaining growth and responding to evolving consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Distribution Channeland Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The allergen free products market will continue to grow due to increasing awareness about food allergies and intolerances.

- Demand for clean-label and transparent ingredient lists will drive the adoption of allergen-free alternatives.

- Rising health consciousness among consumers will encourage the shift toward gluten-free, dairy-free, and nut-free options.

- Regulatory support and clear labeling standards will enhance consumer trust in allergen-free product offerings.

- The expansion of e-commerce platforms will facilitate greater accessibility to niche allergen-free products.

- Manufacturers will increasingly invest in R&D to create innovative allergen-free formulations without compromising taste.

- The foodservice sector will incorporate more allergen-free options in response to customer demand and liability concerns.

- Growing vegan and plant-based trends will support the development of soy-free and dairy-free alternatives.

- Emerging markets will offer new growth opportunities as awareness and disposable incomes rise.

- Strategic partnerships and certifications will become crucial for companies to build brand credibility and market share.