Market Overview

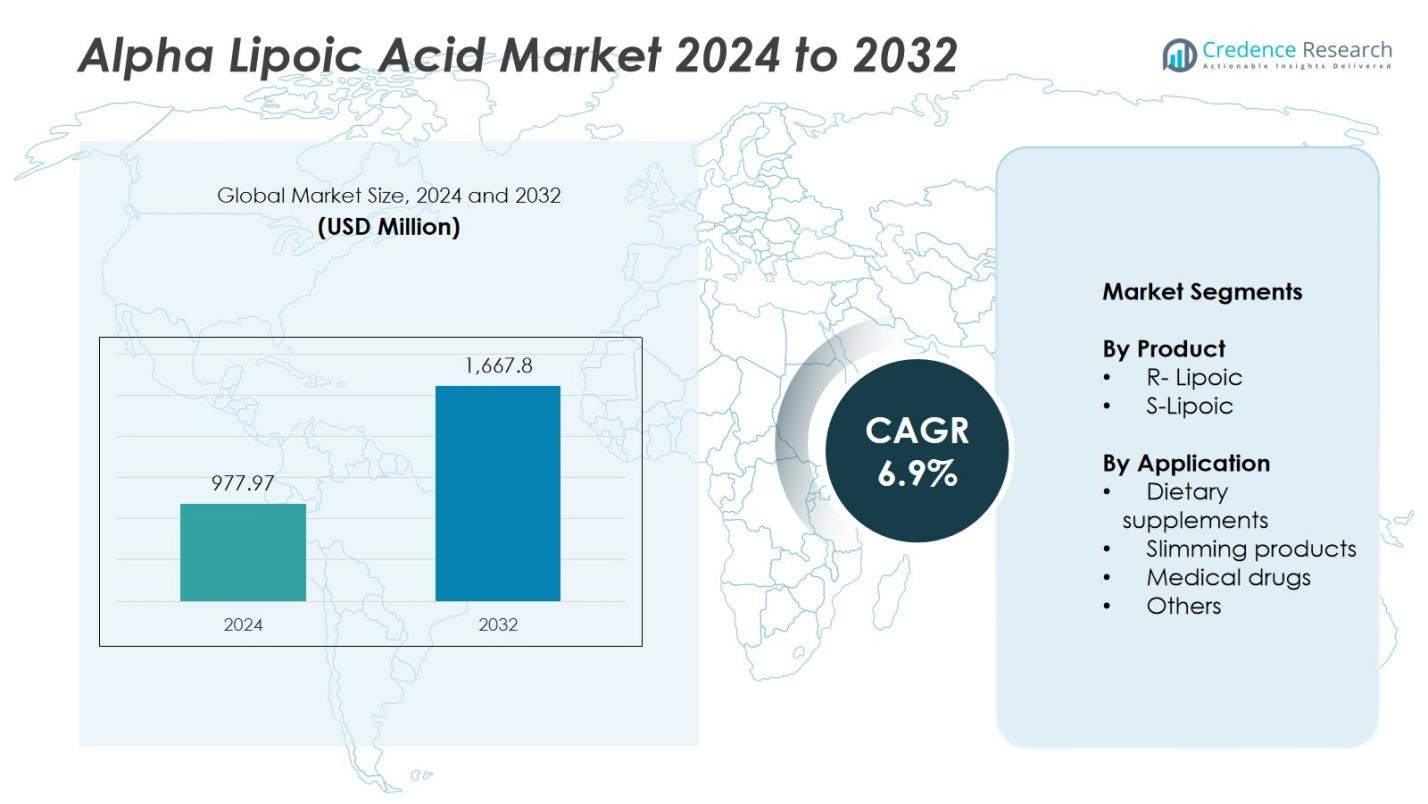

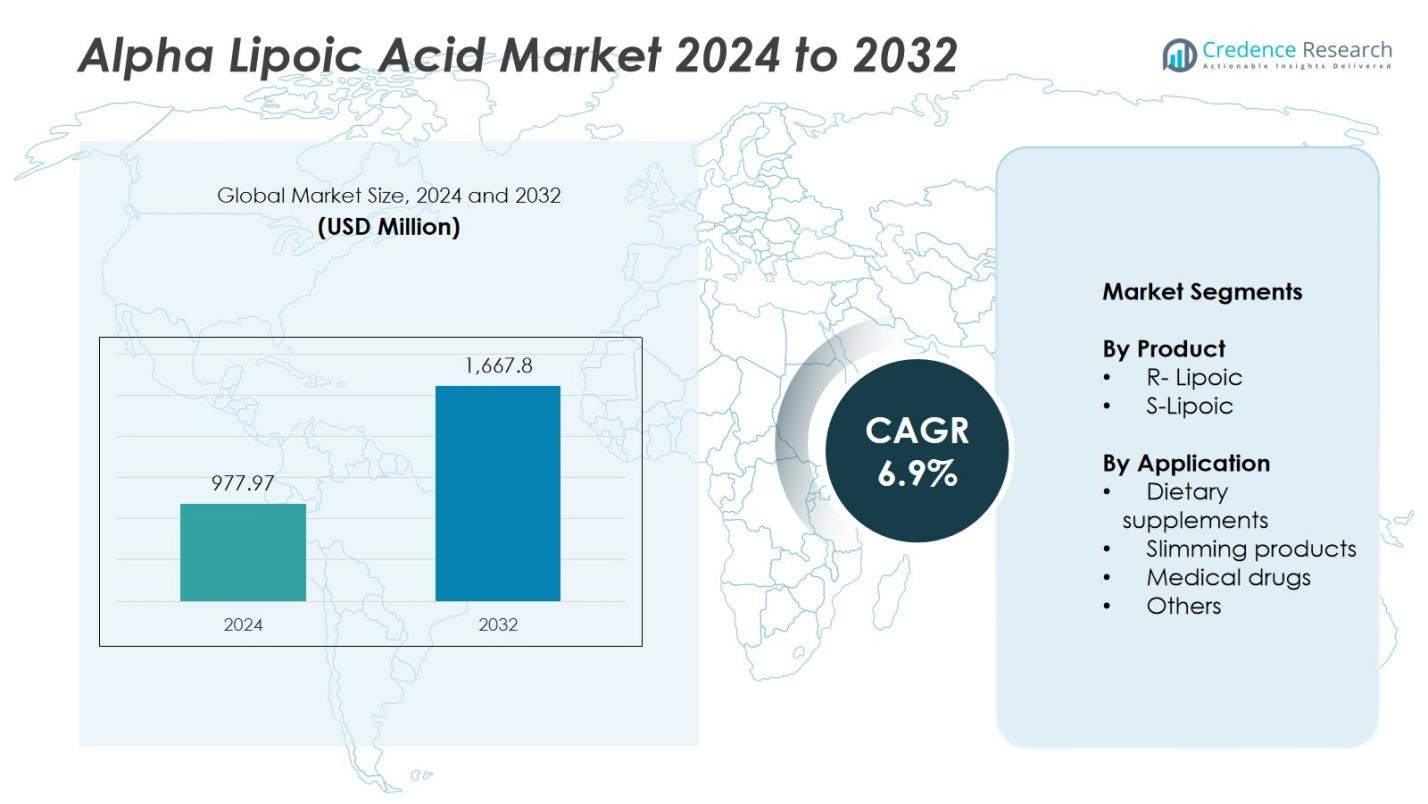

The Alpha Lipoic Acid Market size was valued at USD 977.97 million in 2024 and is anticipated to reach USD 1,667.81 million by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Lipoic Acid Market Size 2024 |

USD 977.97 Million |

| Alpha Lipoic Acid Market, CAGR |

6.9% |

| Alpha Lipoic Acid Market Size 2032 |

USD 1,667.81 Million |

The Alpha Lipoic Acid Market is led by key players such as Shandong Qidu Pharmaceutical, GeroNova Research, Source Naturals, Suzhou Fushilai Pharmaceutical, Jiangsu Tohope Pharmaceutical, Qufu Maidesen Fine Chemical, Shanghai Shyndec (Modern) Pharmaceutical, HiMedia Laboratories, MTC Industries, and Infa Group (Olon S.p.A.). These companies focus on expanding production capacity, enhancing formulation purity, and developing bio-based synthesis methods to meet rising global demand. North America dominates the market with a 38% share in 2024, driven by strong nutraceutical consumption and advanced pharmaceutical manufacturing. Europe follows with a 28% share, supported by regulatory emphasis on high-quality supplements, while Asia-Pacific, holding a 22% share, is emerging as the fastest-growing region due to expanding health awareness and rising local production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Alpha Lipoic Acid Market was valued at USD 977.97 million in 2024 and is expected to reach USD 1,667.81 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Rising consumer awareness of antioxidant benefits and preventive healthcare drives strong demand for alpha lipoic acid supplements and pharmaceutical formulations.

- Growing adoption of bio-based and sustainable production technologies marks a key trend, improving product quality and environmental compliance.

- Leading players such as Shandong Qidu Pharmaceutical and GeroNova Research compete through innovation, purity improvement, and global distribution expansion.

- North America leads the market with 38% share, followed by Europe at 28%, and Asia-Pacific at 22%; the R-lipoic acid segment dominates with 63% share, while dietary supplements hold the largest application share at 48%, driven by preventive health trends.

Market Segmentation Analysis:

By Product:

The R-lipoic acid segment dominates the Alpha Lipoic Acid Market, accounting for around 63% of the total share in 2024. Its superior bioavailability and antioxidant efficiency compared to the S-lipoic form make it the preferred choice in dietary and pharmaceutical formulations. Growing awareness of R-lipoic acid’s role in glucose metabolism and nerve health supports its rising adoption in nutraceuticals and medical applications. The S-lipoic acid segment holds the remaining 37% share, mainly used in blended or synthetic formulations due to lower cost and wider industrial availability.

For instance, GeroNova Research offers Bio-Enhanced® R-Lipoic Acid, which demonstrates 40 times greater plasma concentration stability than standard forms in human studies

By Application:

The dietary supplements segment leads the market with a 48% share in 2024, driven by increasing consumer focus on preventive healthcare and antioxidant-rich products. Rising incidence of diabetes and obesity further boosts demand for alpha lipoic acid supplements that support energy metabolism and insulin sensitivity. The medical drugs segment follows with about 32% share, supported by therapeutic use in neuropathy and liver disorders. Slimming products and other applications collectively hold 20% share, driven by expanding use in weight management and cosmetic formulations.

For instance, NOW Foods markets R-Lipoic Acid 100 mg capsules aimed at enhancing glucose utilization and cellular energy in adults.

Key Growth Drivers

Rising Demand for Antioxidant Supplements

Growing awareness of oxidative stress and its link to chronic diseases has increased the demand for antioxidant supplements. Alpha lipoic acid’s ability to neutralize free radicals and regenerate vitamins C and E makes it a preferred ingredient in health supplements. Consumers seeking anti-aging and metabolic health benefits are fueling sales across pharmacies and online platforms, particularly in North America and Europe, where preventive wellness trends continue to strengthen supplement adoption rates.

For instance, Solgar Inc., a key player in the supplements industry, offers ALA formulations recognized for their ability to neutralize free radicals and regenerate essential vitamins C and E, supporting cellular health and metabolic functions.

Expanding Pharmaceutical Applications

Alpha lipoic acid is gaining traction in pharmaceutical formulations for managing diabetic neuropathy, liver diseases, and cardiovascular disorders. Its role in improving insulin sensitivity and reducing nerve damage makes it a valuable therapeutic compound. Growing research and clinical trials supporting its neuroprotective and anti-inflammatory effects are driving its inclusion in medical drugs. The steady expansion of the global diabetic population further supports sustained demand for pharmaceutical-grade alpha lipoic acid.

For instance, Viatris’ Thioctacid® (alpha-lipoic acid) remains one of the most prescribed therapies for diabetic neuropathy, supported by over 50 clinical trials validating its nerve-protective action.

Increased Use in Weight Management Products

The growing preference for natural ingredients in slimming and fitness products has boosted the use of alpha lipoic acid. Its proven role in enhancing energy metabolism and supporting fat oxidation attracts consumers pursuing weight control solutions. Manufacturers are increasingly integrating the compound into functional beverages, dietary pills, and nutrition bars. This trend aligns with the expanding global market for nutraceuticals, particularly in urban regions where lifestyle-related obesity is on the rise.

Key Trends & Opportunities

Shift Toward Bio-Based and Natural Production

Market players are moving toward bio-fermentation and plant-based synthesis methods to meet the rising demand for clean-label ingredients. This shift not only reduces environmental impact but also enhances product purity, appealing to health-conscious consumers. Companies investing in sustainable production technologies gain a competitive edge through cost efficiency and regulatory compliance, creating new growth opportunities in the nutraceutical and pharmaceutical sectors.

For instance, Perfect Day, Inc. produces animal-free dairy proteins through fermentation, enabling sustainable alternatives for ice cream and cheese without compromising quality.

Rising Penetration in Emerging Economies

The expanding healthcare and supplement industries in Asia-Pacific and Latin America present significant growth opportunities. Increasing disposable income and awareness about preventive healthcare are driving adoption of antioxidant supplements. Local manufacturers are investing in affordable formulations, while global players focus on regional partnerships and distribution networks to strengthen market presence in countries like China, India, and Brazil.

For instance, in China, BeiGene launched its BTK inhibitor Brukinsa, which has seen rapid adoption in the region, highlighting regional focus on innovative oncology therapies.

Key Challenges

High Production Costs and Raw Material Constraints

Manufacturing alpha lipoic acid requires complex chemical synthesis and high-quality raw materials, which raise production costs. Fluctuating prices of precursors and limited local sourcing options in developing regions further strain profit margins. These challenges push manufacturers to explore cost-effective fermentation routes and long-term supplier partnerships to stabilize production and maintain competitiveness in price-sensitive markets.

Regulatory and Quality Compliance Barriers

Strict regulations governing ingredient safety, labeling, and pharmaceutical use pose challenges for market participants. Variations in global regulatory standards complicate international trade and delay product approvals. Companies must maintain consistent quality and meet purity benchmarks to gain consumer trust and certification. Failure to comply with evolving safety norms can lead to product recalls and reputational damage, restraining overall market growth.

Regional Analysis

North America

North America leads the Alpha Lipoic Acid Market with a 38% share in 2024, driven by strong consumer awareness of preventive healthcare and nutritional supplements. The U.S. dominates due to high supplement consumption and the presence of major nutraceutical companies. Expanding applications in diabetic neuropathy treatment and anti-aging formulations further stimulate regional demand. Supportive regulatory frameworks and growing clinical validation of alpha lipoic acid’s therapeutic benefits enhance market penetration across pharmaceutical and dietary supplement sectors.

Europe

Europe accounts for a 28% market share, supported by high adoption of antioxidant supplements and increasing prevalence of metabolic disorders. Countries like Germany, France, and the U.K. are key markets, driven by robust healthcare infrastructure and demand for natural bioactive compounds. Strict quality standards and focus on clean-label ingredients strengthen consumer trust in alpha lipoic acid products. Expanding use in pharmaceutical formulations addressing neuropathy and liver-related diseases further supports regional market growth across both retail and clinical settings.

Asia-Pacific

The Asia-Pacific region holds a 22% share and is expected to be the fastest-growing market through 2032. Rising awareness of health supplements, coupled with increasing disposable incomes in China, India, and Japan, fuels product demand. Expanding pharmaceutical manufacturing capacity and government initiatives promoting preventive healthcare boost regional adoption. Local suppliers in China and South Korea are strengthening supply chains for cost-effective production, driving accessibility. The growing population of diabetic and obese individuals further propels the use of alpha lipoic acid across medical and nutraceutical applications.

Latin America

Latin America captures a 7% market share, with Brazil and Mexico leading due to growing demand for dietary supplements and weight management products. Increasing health awareness and expanding retail distribution networks support sales of alpha lipoic acid supplements. Local pharmaceutical firms are integrating the compound into formulations targeting neuropathy and metabolic health. Government efforts to improve access to nutraceuticals and affordable healthcare options enhance long-term market potential across the region.

Middle East & Africa

The Middle East & Africa region represents a 5% market share, primarily driven by increasing urbanization and rising investment in healthcare infrastructure. Gulf countries like Saudi Arabia and the UAE are witnessing growing consumer interest in dietary supplements and functional products. Limited local production capacity prompts imports from Asia and Europe, ensuring product availability. The gradual shift toward preventive wellness and awareness of antioxidant therapies supports steady market expansion in both clinical and retail channels across the region.

Market Segmentations:

By Product

By Application

- Dietary supplements

- Slimming products

- Medical drugs

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Alpha Lipoic Acid Market is characterized by the presence of key players such as Shandong Qidu Pharmaceutical, GeroNova Research, Source Naturals, Suzhou Fushilai Pharmaceutical, Jiangsu Tohope Pharmaceutical, Qufu Maidesen Fine Chemical, Shanghai Shyndec (Modern) Pharmaceutical, HiMedia Laboratories, MTC Industries, and Infa Group (Olon S.p.A.). These companies compete through innovation in production technology, product purity, and application diversification. Market leaders focus on expanding their nutraceutical and pharmaceutical portfolios, emphasizing bioavailable and high-quality formulations. Strategic alliances, supply chain optimization, and investment in sustainable synthesis methods are key trends among leading firms. Growing collaborations with healthcare and dietary supplement brands strengthen distribution reach, particularly in emerging markets. Continuous research into the therapeutic and metabolic benefits of alpha lipoic acid supports competitive differentiation, while regulatory compliance and cost-efficient manufacturing remain critical success factors shaping long-term market leadership.

Key Player Analysis

- Shandong Qidu Pharmaceutical

- GeroNova Research

- Source Naturals

- Suzhou Fushilai Pharmaceutical

- Jiangsu Tohope Pharmaceutical

- Qufu Maidesen Fine Chemical

- Shanghai Shyndec (Modern) Pharmaceutical

- HiMedia Laboratories

- MTC Industries

- Infa Group (Olon S.p.A.)

Recent Developments

- In January 2023, Indena launched ALA Pure, a new ultra-purified alpha lipoic acid supplement derived from sunflower seeds. This innovation highlights Indena’s expertise in plant-based active ingredients, offering enhanced purity and bioavailability for improved health benefits.

- On May 2, 2023, HiMedia Laboratories (India) announced an expansion of its nutraceutical ingredient offerings, adding α-lipoic acid to support export demand.

- On May 22, 2024, Maypro partnered with HITLAB to integrate digital health platforms with novel ingredient development, including ALA-based wellness solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for antioxidant supplements.

- Expanding use of alpha lipoic acid in diabetic neuropathy treatments will strengthen pharmaceutical demand.

- Increasing consumer focus on preventive healthcare will boost dietary supplement adoption.

- Manufacturers will shift toward bio-based and sustainable production methods for purity and safety.

- Asia-Pacific will emerge as the fastest-growing region due to rising health awareness and local production.

- Partnerships between nutraceutical and pharmaceutical firms will expand product reach globally.

- Growing application in weight management and anti-aging formulations will support market diversification.

- Technological advancements will enhance synthesis efficiency and lower production costs.

- Regulatory harmonization across regions will improve product standardization and market entry.

- Continuous clinical research will expand medical uses, enhancing long-term market potential.