Market Overview

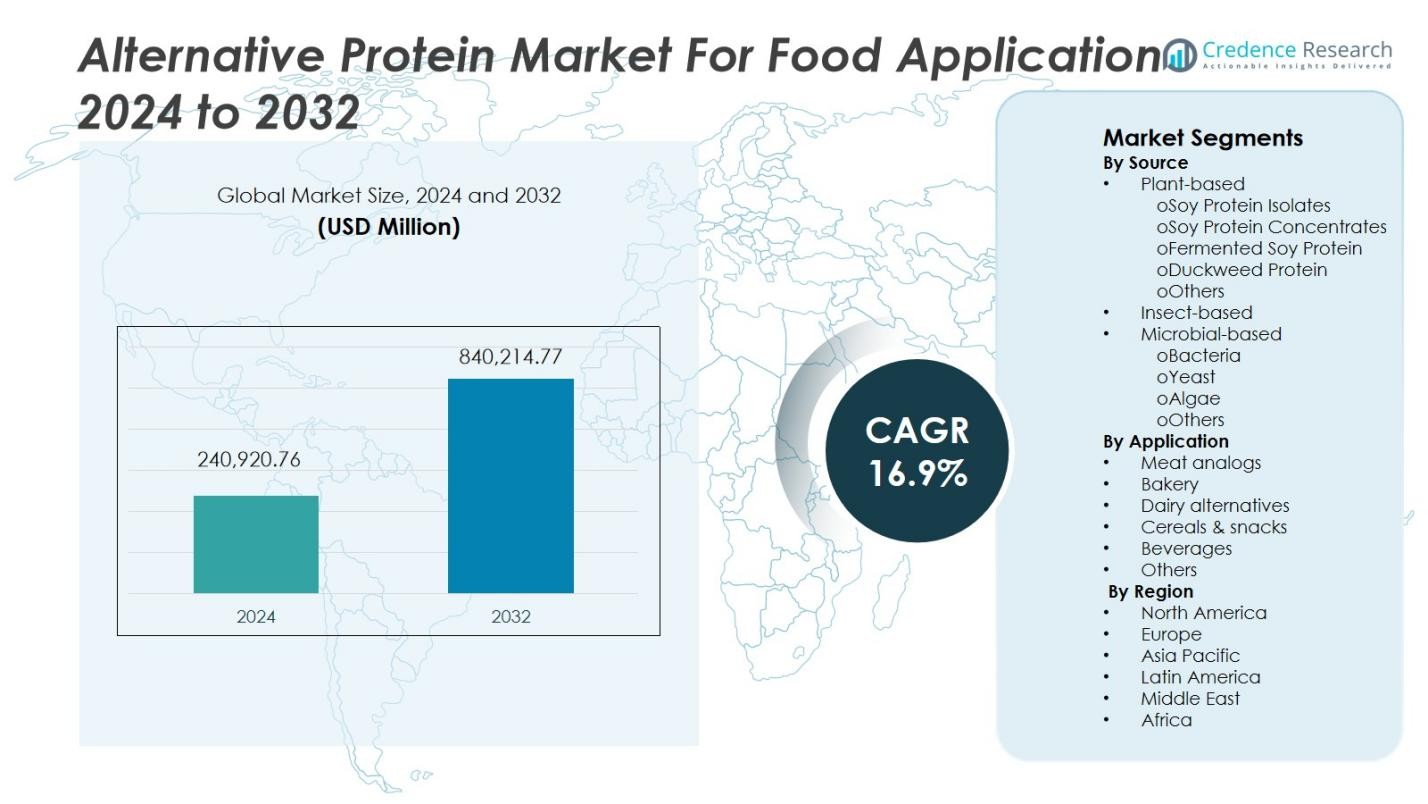

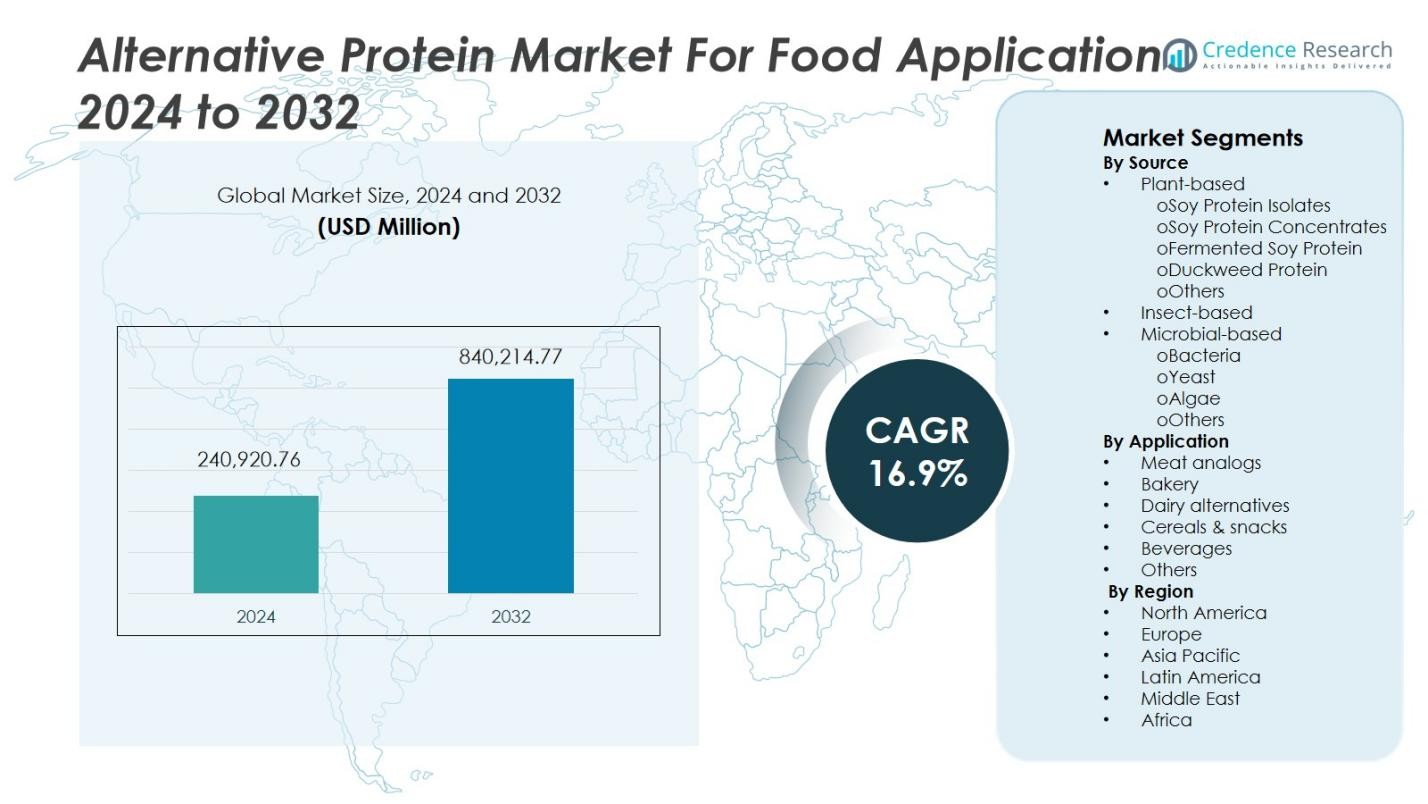

The Alternative Protein Market for Food Application was valued at USD 240,920.76 million in 2024 and is projected to reach USD 840,214.77 million by 2032, registering a CAGR of 16.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alternative Protein Market for Food Application Size 2024 |

USD 240,920.76 Million |

| Alternative Protein Market for Food Application, CAGR |

16.9% |

| Alternative Protein Market for Food Application Size 2032 |

USD 840,214.77 Million |

The Alternative Protein Market for Food Application is dominated by key players such as Cargill Inc., Archer Daniels Midland Company, Ingredion Inc., Kerry Group, DSM NV, The Scoular Company, Lightlife Foods Inc., Impossible Foods Inc., and International Flavors & Fragrances Inc. These companies are driving market growth through technological innovation, sustainable sourcing, and strategic collaborations in plant-based and microbial protein development. North America leads the market with a 34% share, driven by strong consumer demand for plant-based foods and advanced food processing technologies. Europe follows with 29% share, supported by sustainability policies and innovation in clean-label products, while Asia-Pacific, holding 25% share, is emerging as the fastest-growing region fueled by urbanization and evolving dietary preferences.

Market Insights

- The Alternative Protein Market for Food Application was valued at USD 240,920.76 million in 2024 and is projected to reach USD 840,214.77 million by 2032, growing at a CAGR of 16.9%.

- Rising consumer awareness about sustainability, health, and ethical food production is driving strong demand for plant, microbial, and insect-based protein sources.

- Emerging trends include advancements in precision fermentation, hybrid protein products, and the development of allergen-free and clean-label formulations.

- The market is highly competitive with key players such as Cargill Inc., Archer Daniels Midland Company, Kerry Group, DSM NV, and Impossible Foods Inc. focusing on innovation and global partnerships.

- Regionally, North America leads with 34% share, followed by Europe at 29% and Asia-Pacific at 25%, while plant-based proteins dominate with 65% segment share, supported by rapid adoption in meat analogs and dairy alternatives.

Market Segmentation Analysis:

By Source

Plant-based proteins dominate the Alternative Protein Market for Food Applications, capturing 65% of total revenue in 2024. Among these, soy protein isolates lead due to their excellent amino acid composition, digestibility, and versatility in food formulations. The demand for non-GMO and sustainable soy sources strengthens this dominance, while fermented soy and duckweed proteins gain momentum for enhanced flavor and nutritional value. In contrast, microbial-based proteins hold nearly 20% share, led by yeast and algae-based proteins for their high concentration, texture-mimicking ability, and growing use in dairy and meat alternatives. Insect-based proteins, accounting for 15%, are gaining traction in energy bars and snacks due to their eco-efficiency and regulatory support in Europe and Asia.

For instance, duckweed proteins have emerged as a sustainable alternative, with companies like Parabel USA and Hinoman Ltd. innovating advanced processing methods to improve flavor and scalability, addressing growing consumer demand for sustainable protein in Europe and North America.

By Application

The meat analogs segment holds the largest application share at 40% in 2024, driven by the global shift toward flexitarian diets and rising plant-based product innovation. Companies are using soy, pea, and mycoprotein to replicate meat-like texture and flavor. Dairy alternatives follow with a 22% market share, supported by lactose intolerance awareness and vegan consumer demand, with soy and oat proteins leading product formulations. Bakery and cereals & snacks collectively contribute about 28% share, fueled by consumer preference for protein-fortified and functional foods. Meanwhile, protein beverages represent nearly 7% share, growing rapidly with the popularity of ready-to-drink nutritional shakes using algae and yeast-based proteins.

For instance, Quorn Foods utilizes mycoprotein from fungi as a key ingredient in its popular meat analog products worldwide, recognized for high protein and fiber content.

Key Growth Drivers

Rising Demand for Sustainable and Ethical Protein Sources

Consumers are increasingly shifting toward sustainable and ethical food options, driving strong growth in the alternative protein market. Growing awareness of the environmental impact of animal farming, including greenhouse gas emissions and land use, is prompting adoption of plant-, insect-, and microbial-based proteins. Companies are leveraging sustainability claims and transparent sourcing to appeal to eco-conscious consumers. This transition aligns with global climate goals and positions alternative proteins as a core solution for future food security and responsible consumption.

For instance, Oatly has gained recognition for its oat-based dairy alternatives, promoting lower water and land use compared to traditional dairy production.

Advancements in Food Processing and Protein Extraction Technologies

Technological innovation plays a vital role in improving the functionality, flavor, and digestibility of alternative proteins. Modern extraction, fermentation, and texturization methods enhance taste and structure, allowing plant and microbial proteins to mimic traditional animal-based products. Developments in enzymatic hydrolysis and precision fermentation also reduce off-flavors and improve amino acid profiles. These advancements enable large-scale commercialization of meat analogs, dairy alternatives, and beverages, boosting acceptance among mainstream consumers and expanding product diversity.

For instance, Louis Dreyfus Company launched a dedicated R&D center focused on non-GMO plant protein isolates, leveraging advanced protein extraction and formulation technologies to deliver multipurpose products with enhanced taste and nutritional profile.

Growing Health Awareness and Shift Toward Functional Nutrition

Consumers increasingly view alternative proteins as part of a balanced, health-driven lifestyle. Rising incidences of obesity, lactose intolerance, and cardiovascular diseases have accelerated demand for low-fat, high-protein, and cholesterol-free food options. Plant and microbial proteins provide essential amino acids, fiber, and micronutrients, supporting clean-label and fortified product development. The growing popularity of protein-enriched foods and beverages among athletes, vegans, and aging populations continues to strengthen this driver across developed and emerging markets.

Key Trends & Opportunities

Expansion of Hybrid and Functional Food Products

A growing trend in the market is the development of hybrid foods combining traditional meat with plant or microbial proteins. This approach enhances taste familiarity while reducing environmental impact. Food manufacturers are also introducing fortified products enriched with vitamins, probiotics, and omega-3s to enhance nutritional value. The trend opens opportunities for functional innovation in snacks, cereals, and dairy alternatives, targeting both mainstream and health-conscious consumers who seek balanced and sustainable diets.

For instance, Wilk, a food tech company based in Israel, has developed a hybrid yogurt that blends plant-based ingredients with cultivated milk fat. This innovation aims to address both cost and sensory challenges in the alternative dairy market by offering a product that combines traditional dairy with plant-based components.

Strategic Collaborations and Investment in Fermentation Technology

Strategic partnerships between biotech firms, food manufacturers, and research institutions are accelerating innovation in the alternative protein ecosystem. Increased investment in microbial fermentation and cell-cultured protein platforms is expanding scalable production capabilities. Companies are focusing on precision fermentation for high-yield protein synthesis with superior sensory profiles. These collaborations create opportunities to lower production costs, enhance product functionality, and meet global protein demand sustainably, particularly across Asia-Pacific and North America.

For instance, Ajinomoto Bio-Pharma Services partnered with Olon S.p.A. to leverage microbial strain development and large-scale fermentation capabilities, accelerating the manufacture of high-demand proteins for pharmaceutical and biotech industries using fermenters with over 100,000 liters capacity.

Key Challenges

High Production Costs and Scale-Up Limitations

Despite technological progress, production costs for alternative proteins remain high compared to traditional animal sources. Complex fermentation and purification processes require significant capital investment, limiting scalability and affordability. Many start-ups struggle to achieve price parity with conventional proteins, affecting mass-market penetration. Addressing this challenge demands supply chain optimization, technological standardization, and government support through subsidies and infrastructure development to achieve competitive pricing and widespread consumer access.

Taste, Texture, and Consumer Acceptance Barriers

Replicating the sensory experience of animal-based products remains a significant hurdle for manufacturers. Many alternative proteins still face challenges in achieving the desired flavor, mouthfeel, and aroma that consumers expect. Off-notes in plant proteins and texture inconsistencies in microbial formulations can limit repeat purchases. Overcoming these issues requires continuous innovation in formulation science, flavor masking, and advanced processing technologies to enhance palatability and drive broader consumer acceptance in mainstream food applications.

Regional Analysis

North America

North America holds the leading position in the alternative protein market for food applications, capturing 34% market share in 2024. The region’s dominance stems from high consumer awareness of plant-based diets, strong vegan trends, and advanced food technology infrastructure. The United States drives most of the demand, supported by established players and start-ups developing plant, microbial, and insect-based products. Increasing investment in precision fermentation and government support for sustainable food production strengthen growth. Canada’s expanding vegan food sector and retail innovation also contribute significantly to regional expansion.

Europe

Europe accounts for 29% of the global market share in 2024, driven by strict environmental policies and rising consumer demand for sustainable protein alternatives. Countries such as Germany, the Netherlands, and the United Kingdom lead in plant-based innovation and insect protein approvals under EU Novel Food Regulations. Growing flexitarian lifestyles and strong regulatory backing for clean-label products accelerate adoption. European food manufacturers are integrating fermentation technologies to improve texture and taste, while partnerships with biotechnology firms expand the microbial protein segment’s footprint across the region.

Asia-Pacific

Asia-Pacific represents 25% of the global market share in 2024, emerging as the fastest-growing region due to a rising middle-class population and increasing protein consumption. China, Japan, and India are major contributors, supported by urbanization and growing acceptance of plant-based and algae-derived proteins. Government initiatives promoting food security and sustainable agriculture are also driving investments in alternative protein manufacturing. Rapid retail expansion and the influence of Western diets further support product diversification. The region’s innovation in soy, pea, and insect protein processing continues to strengthen its long-term market potential.

Latin America

Latin America holds 7% of the market share in 2024, supported by rising consumer interest in sustainable food options and evolving dietary patterns. Brazil and Mexico lead adoption due to the increasing availability of plant-based meat and dairy alternatives. Local manufacturers are expanding product lines to include soy, chia, and quinoa-based proteins, catering to health-conscious consumers. Expanding supermarket distribution and partnerships with international plant-based brands are accelerating growth. However, limited production capacity and fluctuating raw material costs remain key constraints for market scalability across the region.

Middle East & Africa

The Middle East & Africa account for 5% of the market share in 2024, reflecting gradual adoption driven by growing awareness of health, sustainability, and food security concerns. The United Arab Emirates and South Africa are leading markets, supported by rising vegan communities and retail diversification. Increasing reliance on imported plant-based products from Europe and Asia is driving regional collaborations. Investment in local food tech start-ups and expansion of food processing facilities are helping reduce dependency on imports, paving the way for steady market development over the coming years.

Market Segmentations:

By Source

- Plant-based

- Soy Protein Isolates

- Soy Protein Concentrates

- Fermented Soy Protein

- Duckweed Protein

- Others

- Insect-based

- Microbial-based

-

- Bacteria

- Yeast

- Algae

- Others

By Application

- Meat analogs

- Bakery

- Dairy alternatives

- Cereals & snacks

- Beverages

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Alternative Protein Market for Food Application includes major players such as Cargill Inc., Archer Daniels Midland Company, Ingredion Inc., Kerry Group, DSM NV, The Scoular Company, Lightlife Foods Inc., Impossible Foods Inc., and International Flavors & Fragrances Inc. These companies compete through innovation, partnerships, and product diversification to meet growing global demand for sustainable and high-protein food solutions. Strategic investments in plant-based, microbial, and fermentation-based protein technologies are driving differentiation. Leading firms focus on expanding production capacity, improving texture and taste profiles, and securing sustainable raw material sourcing. Collaborations with food manufacturers and research institutes are strengthening R&D capabilities, while mergers and acquisitions support global footprint expansion. Continuous advancements in processing efficiency and ingredient formulation are helping companies achieve competitive pricing and enhance consumer appeal, positioning them as key players in shaping the future of the alternative protein industry.

Key Player Analysis

- Cargill Inc.

- Lightlife Foods, Inc.

- The Scoular Company

- Archer Daniels Midland Company

- DSM NV

- Kerry Group

- Impossible Foods Inc.

- Ingredion Inc.

- International Flavors & Fragrances, Inc.

Recent Developments

- In July 2025, GEA Group opened a New Food Application and Technology Center in Janesville, Wisconsin, investing USD 20 million to advance precision fermentation, cell cultivation, and plant-based protein scale-up.

- In August 2024, Corbion NV acquired the bread improver business of Novotech Food Ingredients to strengthen its alternative protein and plant-based ingredient portfolio across the Asia-Pacific region.

- In August 2025, v2food formed a strategic partnership with Ajinomoto Co., Inc. to develop next-generation clean protein products, including a new frozen meal range.

- In October 2025, AB Technologies launched a hybrid cheese called “From Up” at the trade fair, combining about 60% real cheese with potato and grapeseed oil as sustainable ingredients.

Report Coverage

The research report offers an in-depth analysis based on Source, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong expansion due to rising consumer preference for sustainable food sources.

- Plant-based proteins will continue to dominate, supported by innovation in texture and flavor improvement.

- Microbial and fermentation-derived proteins will gain popularity for their nutritional quality and scalability.

- Insect-based proteins will find broader acceptance in functional foods and sports nutrition.

- Investments in precision fermentation and biomanufacturing will lower production costs.

- Strategic partnerships between food tech firms and manufacturers will accelerate product diversification.

- Clean-label and allergen-free protein formulations will attract health-conscious consumers.

- Regulatory support for novel protein sources will encourage faster commercialization.

- Asia-Pacific will emerge as a key growth hub driven by urbanization and dietary shifts.

- Continuous R&D will enhance the sensory appeal and affordability of alternative protein products worldwide.