Market Overview

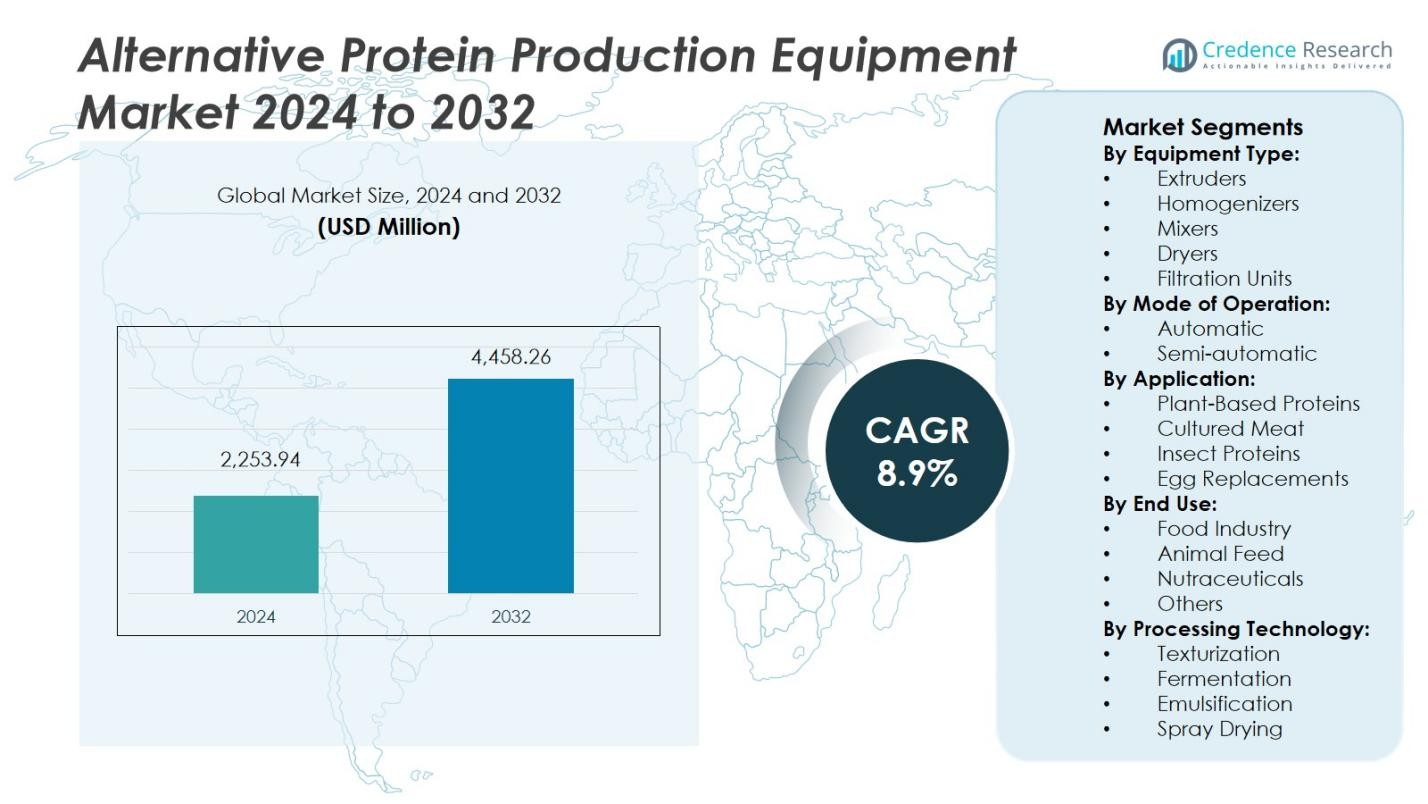

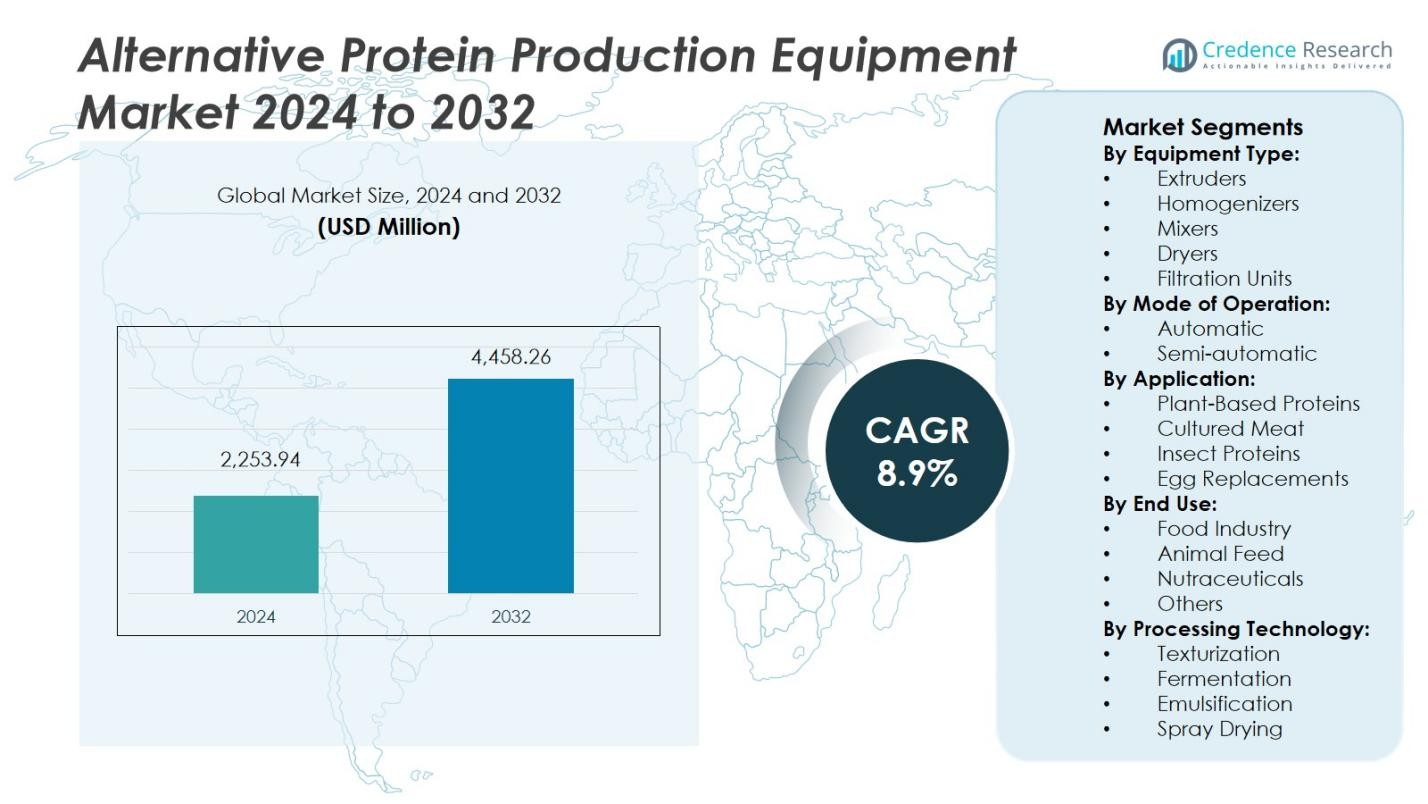

The Alternative Protein Production Equipment Market was valued at USD 2,253.94 million in 2024 and is anticipated to reach USD 4,458.26 million by 2032, growing at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alternative Protein Production Equipment Market Size 2024 |

USD 2,253.94 Million |

| Alternative Protein Production Equipment Market, CAGR |

8.9% |

| Alternative Protein Production Equipment Market Size 2032 |

USD 4,458.26 Million |

The alternative protein production equipment market is led by Bühler AG, GEA Group Aktiengesellschaft, Alfa Laval AB, ANDRITZ AG, Middleby Corporation, JBT Marel Corporation, MULTIVAC Sepp Haggenmüller SE & Co. KG, Bepex International LLC, BAK Food Equipment, and FAM STUMABO. These players compete on high-efficiency extrusion, hygienic separation, modular automation, and digital process control. North America leads with 34% market share, supported by advanced processing infrastructure and strong food-tech investment. Europe holds 29%, driven by sustainability regulations and precision fermentation activity. Asia-Pacific accounts for 24%, propelled by rapid capacity additions in plant-based and cell-based facilities. Vendor strategies focus on scalable, energy-saving systems and end-to-end lines that shorten commissioning time and ensure consistent quality across multiple protein formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Alternative Protein Production Equipment Market was valued at USD 2,253.94 million in 2024 and is projected to reach USD 4,458.26 million by 2032, expanding at a CAGR of 8.9% during the forecast period.

- Growth is driven by rising demand for sustainable, plant-based, and cultured proteins, along with government support for eco-friendly food production.

- Key trends include automation, AI-driven monitoring, and modular equipment designs enhancing production scalability and efficiency.

- The market is moderately consolidated, with major players such as Bühler AG, GEA Group, Alfa Laval, and ANDRITZ AG investing heavily in innovation and R&D.

- Regionally, North America leads with a 34% share, followed by Europe at 29% and Asia-Pacific at 24%, while the extruders segment holds the dominant 36% share within equipment categories.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Equipment Type:

Extruders dominate the alternative protein production equipment market, accounting for 36% share in 2024. Their ability to transform plant-based and insect-derived materials into textured protein structures drives their widespread adoption. Extruders enhance product consistency, scalability, and nutrient retention, making them vital in large-scale production. Mixers and homogenizers follow due to their role in achieving uniform formulations and emulsions, while dryers and filtration units contribute to moisture control and purity. The growing preference for high-efficiency and energy-saving extrusion systems further supports segment growth across plant-based and cultured meat applications.

For instance, Bühler AG leads with its advanced extrusion systems that enable efficient and scalable texturization of plant proteins, integrating digital automation to improve consistency and nutrient retention.

By Mode of Operation:

The automatic segment holds 68% share of the market, driven by the demand for precision, speed, and reduced human intervention in protein processing. Automation enables consistent product quality and lowers operational costs through digital monitoring and process control. Manufacturers are integrating IoT-enabled and AI-driven automation to optimize extrusion, mixing, and drying cycles. Semi-automatic systems retain relevance among small and mid-sized enterprises due to lower capital investment. However, increasing adoption of fully automated lines in large food-tech facilities continues to strengthen this segment’s dominance.

For instance, KNAUER’s automated protein purification systems have been successfully used in biotech applications such as the automated purification of GFP with high precision, demonstrating the widespread adoption of automation in processing biologics.

By Application:

Plant-based proteins lead the market with 54% share, supported by rising consumer demand for sustainable and vegan alternatives. This segment benefits from investments in extrusion, homogenization, and filtration technologies that replicate meat-like texture and flavor. Cultured meat applications are growing rapidly as bioreactor and cell-cultivation equipment improve in efficiency. Insect proteins and egg replacements represent emerging niches, gaining attention for their nutritional density and environmental advantages. Continuous technological innovation and expansion of food-tech manufacturing hubs are further propelling plant-based protein processing equipment demand.

Key Growth Drivers

Rising Demand for Sustainable Protein Sources

Growing global awareness about environmental sustainability and animal welfare is accelerating the shift toward alternative proteins. Consumers are increasingly adopting plant-based, cultured, and insect-derived proteins as substitutes for traditional meat. This demand pushes manufacturers to invest in high-capacity extruders, homogenizers, and dryers for efficient large-scale production. Governments and food-tech companies are also promoting sustainable protein ecosystems through funding and collaborations, further driving demand for advanced production equipment that minimizes waste and energy consumption while improving output efficiency.

For instance, Impossible Foods utilizes advanced biotechnology and biomanufacturing processes that cut water use by 87% and greenhouse gas emissions by 89% versus traditional beef production.

Technological Advancements in Food Processing Equipment

Continuous innovation in automation, AI integration, and precision engineering is reshaping protein production processes. Modern extruders, mixers, and filtration units now deliver higher yield, improved texture, and enhanced product uniformity. Advanced control systems ensure consistent quality and reduced downtime, attracting both startups and established players to upgrade their facilities. Equipment manufacturers are focusing on modular, scalable designs to cater to the evolving needs of food producers, enabling faster adaptation to new protein formulations and diverse raw material sources.

For instance, Bühler Group offers advanced extrusion systems that enable food producers to customize texture and flavor profiles of plant-based proteins, supporting scalable production of meat substitutes with consistent quality.

Rising Investment in Food-Tech Startups and R&D

Venture capital funding and corporate investments in alternative protein startups are boosting equipment demand. Companies engaged in cultured meat and plant-based innovations rely heavily on specialized bioreactors, homogenizers, and dryers for product development. R&D initiatives focused on texture enhancement, nutrient retention, and energy-efficient production are expanding rapidly across North America, Europe, and Asia-Pacific. Partnerships between equipment suppliers and food manufacturers are also fostering innovation, leading to the commercialization of next-generation processing systems tailored for alternative protein production.

Key Trends & Opportunities

Automation and Digitalization in Processing Systems

Automation is becoming central to the alternative protein equipment market, enabling greater precision, efficiency, and scalability. Smart sensors, digital controls, and real-time analytics are improving process monitoring and reducing operational costs. Manufacturers are integrating Industry 4.0 technologies to enhance energy efficiency and predictive maintenance. This trend presents major opportunities for companies developing AI-based extrusion and mixing systems, as food producers seek to optimize output while maintaining consistent product quality and sustainability standards.

For instance, Danone Specialized Nutrition successfully transformed its processes with AVEVA’s Manufacturing Execution System (MES), enabling better ingredient tracking, quality control, and recipe management within complex plant-based protein production.

Expansion into Emerging Protein Categories

The market is witnessing growing opportunities in emerging protein segments such as insect-based and fermentation-derived proteins. These categories require customized processing technologies for efficient extraction, drying, and formulation. Equipment makers are adapting to this shift by developing versatile systems compatible with multiple protein types. The rise of functional foods, sports nutrition, and alternative dairy applications further expands the commercial potential, encouraging innovation in compact, flexible, and energy-efficient machinery suitable for new-generation protein production facilities.

For instance, GEA Group introduced its latest separator technology in 2024, designed to optimize the recovery of mycoprotein during fermentation-based protein production for clients in the alternative meat sector.

Key Challenges

High Initial Capital and Operating Costs

Establishing a fully automated alternative protein production facility demands significant upfront investment in advanced machinery, automation, and infrastructure. Small and medium-scale producers often struggle to afford modern extruders and homogenizers due to high procurement and maintenance costs. Additionally, energy consumption and complex cleaning processes add to operational expenses. These financial barriers limit entry for emerging players, slowing overall market penetration and creating a dependency on large corporations with greater capital resources.

Technical Complexity and Regulatory Compliance

The production of alternative proteins involves intricate processes that must meet strict food safety and quality regulations. Maintaining consistency in texture, taste, and nutritional profile requires advanced control systems and expert handling. Regulatory frameworks for novel proteins, such as cultured meat or insect-based foods, differ across regions, increasing compliance challenges. Manufacturers must invest heavily in R&D and quality assurance to align with evolving standards, which can delay commercialization and increase time-to-market for innovative protein products.

Regional Analysis

North America

North America holds the 34% market share in the alternative protein production equipment market, driven by strong demand for plant-based and cultured meat products. The region benefits from advanced food-processing infrastructure, high consumer awareness, and active investments by key players such as Beyond Meat and Impossible Foods. The U.S. leads adoption due to its innovation-focused ecosystem and regulatory support for sustainable protein technologies. Strategic partnerships between equipment manufacturers and food-tech startups are fostering automation and scalability, while Canada’s expanding clean-label protein sector further strengthens regional equipment demand.

Europe

Europe accounts for 29% market share, supported by stringent sustainability regulations and strong consumer inclination toward eco-friendly food production. The region’s focus on reducing carbon emissions has encouraged food producers to adopt efficient and energy-saving extrusion and mixing equipment. Countries such as Germany, the Netherlands, and France are leading in cultured meat research and precision fermentation. The European Union’s funding for green food technology and infrastructure upgrades continues to boost equipment demand. Local manufacturers are emphasizing modular, hygienic designs that comply with evolving EU safety and environmental standards.

Asia-Pacific

Asia-Pacific captures 24% market share and represents the fastest-growing regional market due to rising population, urbanization, and dietary shifts toward sustainable protein sources. China, Japan, and Singapore are at the forefront of alternative protein innovation, with several large-scale investments in plant-based and cell-based meat manufacturing. Governments are promoting local protein technology hubs to enhance food security and reduce import dependency. The region’s expanding food-processing capabilities and adoption of automation in extrusion and drying systems are key growth enablers. Increasing consumer acceptance of meat alternatives continues to drive market expansion.

Latin America

Latin America holds a 7% market share, driven by growing awareness of sustainable food practices and the rise of plant-based product startups. Brazil and Mexico are leading contributors, supported by improving industrial infrastructure and access to affordable raw materials such as soy and pea protein. Equipment adoption is rising in mid-sized food companies focusing on product diversification. Despite limited large-scale facilities, partnerships with European and North American equipment suppliers are accelerating modernization. Government initiatives promoting agri-food innovation are expected to further support regional growth in production technologies.

Middle East & Africa

The Middle East & Africa region accounts for 6% market share, with growing interest in sustainable protein alternatives amid increasing food security concerns. The UAE, Israel, and South Africa are emerging as key markets due to their focus on food-tech innovation and investment in plant-based and cultured meat ventures. Equipment demand is increasing as manufacturers modernize facilities to produce protein-rich, halal-compliant alternatives. Rising urban populations, health-conscious consumers, and supportive government initiatives are gradually improving market penetration, though limited manufacturing capacity and higher import costs remain key barriers.

Market Segmentations:

By Equipment Type:

- Extruders

- Homogenizers

- Mixers

- Dryers

- Filtration Units

By Mode of Operation:

By Application:

- Plant-Based Proteins

- Cultured Meat

- Insect Proteins

- Egg Replacements

By End Use:

- Food Industry

- Animal Feed

- Nutraceuticals

- Others

By Processing Technology:

- Texturization

- Fermentation

- Emulsification

- Spray Drying

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the alternative protein production equipment market features major players such as Bühler AG, Alfa Laval AB, ANDRITZ AG, BAK Food Equipment, Bepex International LLC, FAM STUMABO, GEA Group Aktiengesellschaft, JBT Marel Corporation, Middleby Corporation, and MULTIVAC Sepp Haggenmüller SE & Co. KG. These companies are focusing on technological innovation, automation, and sustainable processing solutions to enhance efficiency and reduce energy consumption. Strategic initiatives such as mergers, partnerships, and capacity expansions are common as firms compete to strengthen their market presence. Bühler AG and GEA Group lead in large-scale extrusion and mixing technologies, while Alfa Laval and ANDRITZ excel in separation and filtration systems. Emerging players are targeting niche applications like cultured meat and insect protein production. The market remains moderately consolidated, with top players leveraging global distribution networks, R&D investments, and digitalization strategies to meet growing demand for next-generation protein processing equipment.

Key Player Analysis

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Bepex International LLC

- Alfa Laval AB

- Middleby Corporation

- ANDRITZ AG

- JBT Marel Corporation

- Bühler AG

- FAM STUMABO

- GEA Group Aktiengesellschaft

- BAK Food Equipment

Recent Developments

- In April 2024, Bühler AG, in collaboration with Givaudan and MISTA, launched a cutting-edge extrusion hub at the MISTA Innovation Center in San Francisco to advance plant-based protein production technologies.

- In February 2025, Rockwell Automation partnered with FDA-approved alternative protein manufacturing facilities to integrate advanced automation and digital control systems, enhancing efficiency and scalability across the alternative protein production chain.

- In March 2025, Burcon NutraScience Corporation’s partner, RE ProMan, LLC, acquired a protein processing facility in Galesburg (Illinois) to integrate Burcon’s protein-processing technologies.

- In October 2025, the MBOLD coalition launched the “Protein Catalyst” initiative, teaming up with major food and agriculture companies including Bühler Group to drive collaborative R&D and equipment innovation for plant-based and novel protein processing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Mode of Operation, Application, End Use, Processing Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as global demand for sustainable protein sources rises.

- Equipment innovation will focus on energy efficiency, automation, and digital monitoring systems.

- Manufacturers will invest more in flexible systems to support multiple protein types.

- Cultured meat and fermentation-based protein facilities will create new equipment opportunities.

- Partnerships between food-tech firms and machinery providers will expand production capacity.

- Asia-Pacific will emerge as the fastest-growing region due to rapid industrialization and dietary shifts.

- Adoption of AI and IoT-enabled processing lines will enhance product quality and traceability.

- Small and mid-sized food producers will increasingly adopt semi-automated solutions.

- Stringent food safety regulations will drive demand for hygienic and modular equipment designs.

- Continuous R&D investments will lead to next-generation technologies supporting precision protein manufacturing.

Market Segmentation Analysis:

Market Segmentation Analysis: