Market Overview

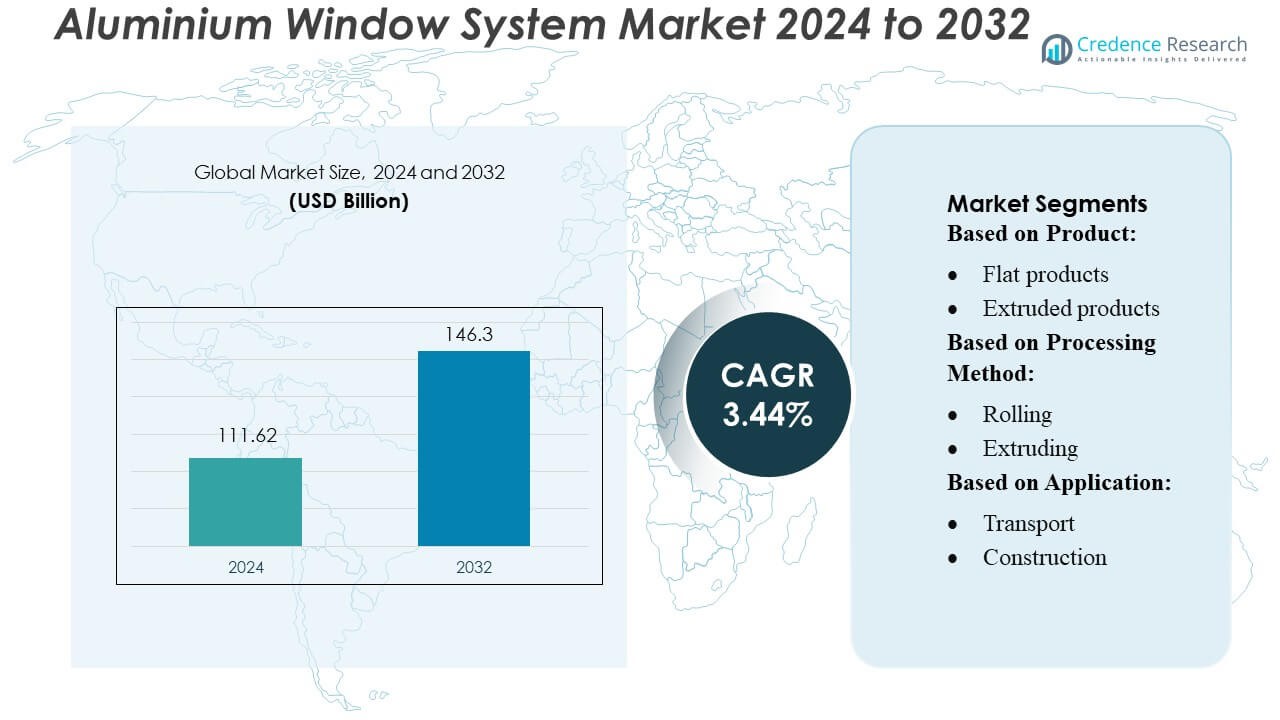

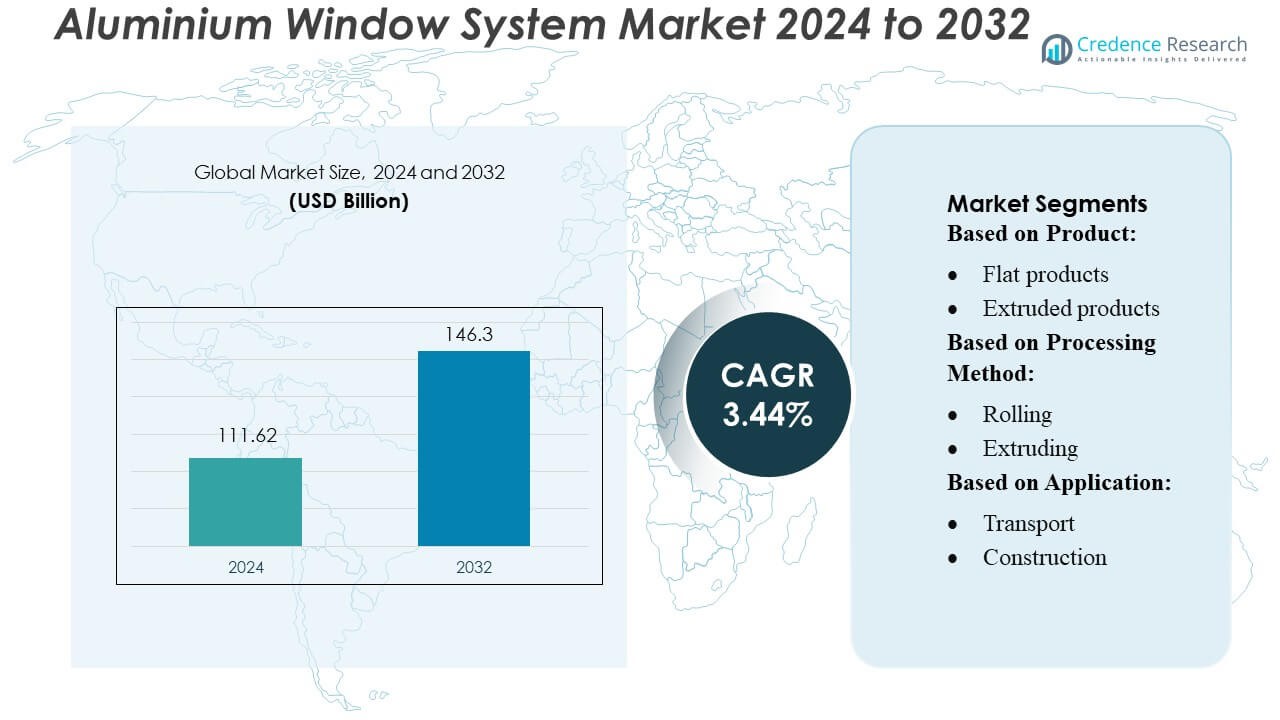

Aluminium Window System Market size was valued USD 111.62 billion in 2024 and is anticipated to reach USD 146.3 billion by 2032, at a CAGR of 3.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Window System Market Size 2024 |

USD 111.62 Billion |

| Aluminium Window System Market, CAGR |

3.44% |

| Aluminium Window System Market Size 2032 |

USD 146.3 Billion |

The aluminium window system market is shaped by major players such as Pella Corporation, ANDERSEN CORPORATION, JELD-WEN, Inc., Masonite, Cornerstone Building Brands, Inc., Marvin, PGT INNOVATIONS, SIERRA PACIFIC WINDOWS, Steves & Sons Inc., and Kömmerling, all of which compete intensely on innovation, energy efficiency, and design flexibility. The region leading the market is Asia-Pacific, commanding approximately 39 % of the global market share, driven by rapid urbanization, large-scale infrastructure development, and strong demand for sustainable building materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aluminium Window System Market was valued at USD 111.62 billion in 2024 and is projected to reach USD 146.3 billion by 2032 at a CAGR of 3.44%, driven by rising construction and renovation activities.

- Increasing demand for energy-efficient building envelopes and lightweight, durable materials drives market expansion, with thermal-break systems and recycled aluminium gaining strong traction.

- Product innovation and design differentiation define competitive dynamics, as leading players focus on slim-profile frames, automation-ready systems, and enhanced performance standards to strengthen market share.

- High initial installation costs, fluctuating raw material prices, and limited awareness in developing regions act as restraints, slowing adoption across price-sensitive segments.

- Asia-Pacific leads with 39% regional share, supported by rapid urban development and infrastructure growth, while the sliding window segment continues to dominate due to its space-efficient design and widespread use across residential and commercial buildings.

Market Segmentation Analysis:

By Product

Flat products dominate the Aluminium Window System Market with an estimated over 35% share, driven by their widespread use in architectural façades, curtain walls, and fenestration systems requiring high surface uniformity and structural strength. Their superior recyclability and compatibility with anodizing and powder-coating processes strengthen adoption in energy-efficient commercial buildings. Extruded products also show strong growth due to demand for complex profile designs, while forged, long, cast, and other product categories serve niche applications with moderate uptake influenced by precision engineering and cost-effectiveness.

- For instance, Pella Corporation leverages its Shenandoah, Iowa facility—one of approximately 20 total manufacturing sites operated by the company—to support high-volume production of wood windows, including all wooden double-hung windows.

By Processing Method

Extruding represents the leading processing method, accounting for around 40% of market share, as it enables the production of lightweight, custom-shaped aluminium profiles used extensively in modern window frames and structural framing systems. Its ability to optimize strength-to-weight ratio and support thermal-break technologies makes it the preferred choice for high-performance window solutions. Rolling and drawn processes follow, primarily supporting sheet-based applications and precision components, while casting and forging remain smaller segments used in heavy-duty structural parts requiring enhanced durability and dimensional stability.

- For instance, Sierra Pacific Windows uses .075-inch thick extruded aluminium in its Multi-Slide Plus doors, providing both structural strength and long-term durability.

By Application

Construction remains the dominant application segment with more than 45% share, propelled by rapid urbanization, rising investments in smart buildings, and increasing adoption of energy-efficient façades and window solutions. Aluminium’s corrosion resistance, formability, and recyclability underpin its growing preference in residential and commercial developments. Transport and electrical & electronics represent expanding segments due to lightweighting initiatives and thermal conductivity needs, while packaging, machinery, consumer durables, foil stock, and other applications contribute steady demand shaped by industrial modernization and sustainability initiatives.

Key Growth Drivers

1. Rising Demand for Energy-Efficient Building Solutions

The Aluminium Window System Market grows strongly as builders prioritize energy-efficient designs aligned with global green building standards. Aluminium frames support high-performance glazing, thermal-break technology, and superior insulation, helping commercial and residential projects achieve better energy ratings. Government incentives promoting sustainable construction further accelerate adoption. Additionally, aluminium’s recyclability and long service life reduce lifecycle costs, making it increasingly favored over traditional materials. This sustainability-driven shift continues to stimulate product innovation and premium system installations across major urban infrastructure projects.

- For instance, Masonite’s 2022 Environmental, Social & Governance report shows the company reduced its Scope 1 and 2 greenhouse gas emissions by 34% since 2019, demonstrating its commitment to lower-carbon operations.

2. Rapid Urbanization and Expansion of Infrastructure Projects

Accelerating urbanization, particularly in Asia-Pacific and the Middle East, drives significant demand for modern aluminium window systems. Large-scale investments in smart cities, commercial towers, mass housing projects, and transportation hubs create substantial opportunities for high-strength, lightweight, and corrosion-resistant window structures. Builders increasingly prefer aluminium for its design flexibility and compatibility with advanced façade systems. The expansion of mixed-use developments and industrial zones strengthens procurement of standardized and custom architectural profiles, thereby sustaining stable volume growth across global construction value chains.

- For instance, JWC8500 series hybrid window, launched in Canada, features a 26% slimmer frame that increases glass area and achieves a U-factor of 0.82 W/m²·°C, helping surpass Canada’s 2030 energy efficiency targets.

3. Advancements in Extrusion Technologies and Fabrication Precision

Technological upgrades in extrusion processes and fabrication equipment contribute directly to market expansion. Modern extrusion lines enable complex profile geometries, improved surface finishing, and enhanced dimensional accuracy for premium window systems. Integration of automation, robotics, and CNC machining ensures better precision, reduced waste, and faster production cycles. Manufacturers also adopt thermal-break extrusion and multi-chamber frame designs, supporting superior insulation performance. These process improvements elevate the quality and performance of aluminium window systems, expanding their use in high-end architectural and energy-sensitive installations.

Key Trends & Opportunities

1. Growing Adoption of Smart and Automated Window Systems

The market benefits from rising adoption of smart window technologies integrated with sensors, automatic shading, and IoT-enabled climate control solutions. Aluminium frames provide structural strength and design flexibility needed to support motorized components and advanced glazing units. Demand for smart homes and commercial buildings further accelerates this trend. Manufacturers explore embedded photovoltaics, self-tinting glass, and intelligent ventilation systems, creating opportunities for premium aluminium window solutions that enhance energy efficiency, occupant comfort, and building automation capabilities.

- For instance, Richmond, Virginia plant is outfitted with “smart press” machines capable of pressing up to 40 doors at once, while 42-inch interactive screens display real-time product images at each workstation to optimize alignment and quality control.

2. Increasing Use of Recycled Aluminium in Window Profiles

Sustainability initiatives encourage the use of recycled aluminium, which requires significantly less energy to produce and aligns with circular economy goals. Manufacturers actively shift toward low-carbon aluminium billets, creating a growing market for eco-friendly window systems. This trend opens opportunities for companies investing in closed-loop recycling, green certifications, and carbon-reduced product lines. As developers prioritize materials with lower environmental footprints, recycled aluminium window systems gain preference in green buildings, public infrastructure, and environmentally regulated construction sectors.

- For instance, Andersen holds SCS Global Services’ Recycled Content certification for its 100 Series windows, Renewal by Andersen® lines, and A-Series windows, confirming verified recycled content in these profiles.

3. Rising Preference for Slimline and Aesthetic Architectural Designs

A notable trend involves the growing preference for slimline frames that offer larger glass areas, improved natural lighting, and modern architectural aesthetics. Aluminium’s inherent strength allows manufacturers to design minimalistic yet durable profiles that support expansive façades and panoramic window installations. This creates opportunities in luxury real estate, commercial towers, and premium residential developments. Demand for custom colors, textured finishes, and seamless corner joining techniques also fuels innovation, allowing suppliers to deliver visually appealing, high-performance window systems.

Key Challenges

1. Fluctuating Aluminium Prices and Supply Chain Volatility

The market faces challenges due to volatility in aluminium prices influenced by global energy costs, geopolitical tensions, and raw material supply disruptions. Sudden price spikes increase the cost of extrusion, fabrication, and final window installations, impacting profitability for manufacturers and contractors. Import-dependent regions face additional risks from logistics delays and tariffs. These fluctuations complicate production planning and contract pricing, forcing companies to adopt hedging strategies, diversify supplier networks, and improve operational efficiency to maintain competitiveness.

2. Competition from Alternative Window Materials

Despite strong market presence, aluminium window systems compete with uPVC, composite, and timber solutions that offer lower upfront costs or better thermal insulation in specific climates. uPVC windows, in particular, gain traction in residential markets due to affordability and low maintenance requirements. This competition pressures aluminium manufacturers to invest in thermal-break technologies, advanced coatings, and value-added customization to differentiate their products. Without continuous innovation, aluminium systems may lose share in cost-sensitive and energy-regulated building segments.

Regional Analysis

North America

North America accounts for around 15% market share, with demand driven by growing renovation activity and energy-efficiency requirements across residential and commercial buildings. The U.S. remains the largest contributor, supported by rising adoption of durable, low-maintenance aluminium frames in high-rise construction. Manufacturers benefit from advanced extrusion technologies that improve precision and performance. Increasing emphasis on green building certifications and stricter thermal performance standards continues to push builders toward upgraded aluminium window systems. Overall, the region maintains steady growth backed by strong construction and retrofit investments.

Asia-Pacific

Asia-Pacific dominates the Aluminium Window System Market with around 50% market share, supported by rapid urbanization, expanding residential construction, and large commercial infrastructure projects. China and India drive most of the demand as developers prefer aluminium for its durability, low maintenance, and design flexibility. Government investments in smart cities and sustainable buildings further strengthen adoption. Growing local extrusion capacity also reduces production costs, enabling wider use of aluminium frames in both premium and mid-range projects. The region’s strong construction pipeline ensures continued leadership in overall market volume.

Europe

Europe holds about 20% market share, driven by strict building energy regulations and widespread use of thermally efficient window systems. Countries such as Germany, the U.K., and France lead demand due to strong renovation activity and high emphasis on sustainable architectural designs. Aluminium windows gain preference for their superior insulation when paired with thermal-break technology and advanced glazing. Rising adoption of slim-frame and modern façade solutions also supports market expansion. The region’s mature construction sector ensures stable, high-value demand, especially in commercial and institutional buildings.

Latin America

Latin America represents around 8–10% market share, driven by expanding urban housing demand and increasing use of aluminium frames in mid-rise and commercial construction. Brazil and Mexico lead the region, supported by infrastructure upgrades and rising preference for cost-efficient, lightweight window systems. Although the market is price-sensitive, aluminium’s long lifespan and low maintenance requirements strengthen adoption. Gradual growth in industrial facilities and public-sector projects further supports demand. As construction activity stabilizes and modernization initiatives continue, the region exhibits steady and improving market potential.

Middle East & Africa

The Middle East & Africa region holds about 5% market share, supported by large-scale commercial projects, luxury residential developments, and government-led infrastructure expansion. Aluminium windows are widely preferred due to their corrosion resistance and suitability for harsh climatic conditions. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption as they invest in modern architectural façades and energy-efficient building designs. Growing interest in high-performance window systems with improved insulation and custom aesthetics contributes to gradual but consistent market growth across the region.

Market Segmentations:

By Product:

- Flat products

- Extruded products

By Processing Method:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Aluminium Window System Market features a competitive landscape led by major players such as Pella Corporation, SIERRA PACIFIC WINDOWS, Masonite, Cornerstone Building Brands, Inc., JELD-WEN, Inc., Steves & Sons Inc., ANDERSEN CORPORATION, Marvin, PGT INNOVATIONS, and Kömmerling. The Aluminium Window System Market remains highly competitive, driven by continuous advancements in design efficiency, durability, and energy performance. Manufacturers focus on integrating thermal insulation technologies, corrosion-resistant alloys, and slim-frame aesthetics to meet evolving building standards and customer preferences. The market benefits from growing construction activity, with companies strengthening their portfolios through automated fabrication, precision engineering, and modular system development. Sustainability remains a major competitive factor, encouraging adoption of recyclable materials and low-carbon production processes. Firms also enhance competitiveness through strategic distribution expansions, digital configurators, and customized architectural solutions, enabling them to cater to diverse residential, commercial, and industrial applications while maintaining strong market differentiation.

Key Player Analysis

Recent Developments

- In August 2024, Home Electrification and Appliance Rebates (HEAR) program was launched by Arizona which is designed to help low- and middle-income households save on energy-efficient HVAC equipment and other appliances.

- In April 2024, Andersen Corporation announced the expansion of its retractable screen portfolio by launching a retractable screen for Andersen patio doors. This new product focuses on offering seamless access to fresh air and unobstructed views while keeping insects out by combining form with function for enhanced functionality and comfort.

- In February 2024, Pella Corporation introduced the Steady Set Interior Installation System at the International Builders’ Show (IBS) in Las Vegas. The new system is recognized for its speed, efficiency, and safety, allowing for most of the window installation to be completed from inside the home.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Processing Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will adopt more energy-efficient aluminium systems to meet stricter building performance standards.

- Manufacturers will increase the use of recyclable and low-carbon aluminium to support sustainability goals.

- Demand will grow for slim-profile and minimalist frame designs in modern residential and commercial projects.

- Automation and digital fabrication technologies will enhance production accuracy and reduce lead times.

- Smart window systems with integrated sensors and automated controls will gain wider acceptance.

- Thermal-break technologies will continue to advance, improving insulation and reducing heat transfer.

- Urbanization and infrastructure development will boost demand for durable aluminium window solutions.

- Companies will expand customization options to meet diverse architectural and aesthetic requirements.

- Strategic collaborations with builders, architects, and façade specialists will strengthen market presence.

- Growth in renovation and retrofit activities will increase adoption of high-performance aluminium window upgrades.