Market Overview

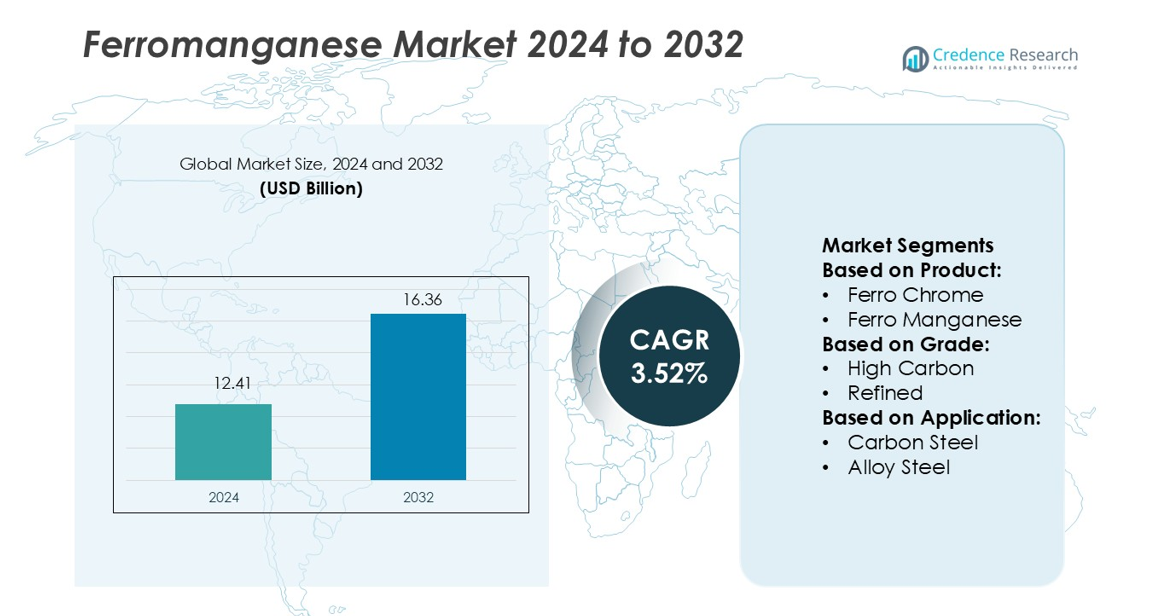

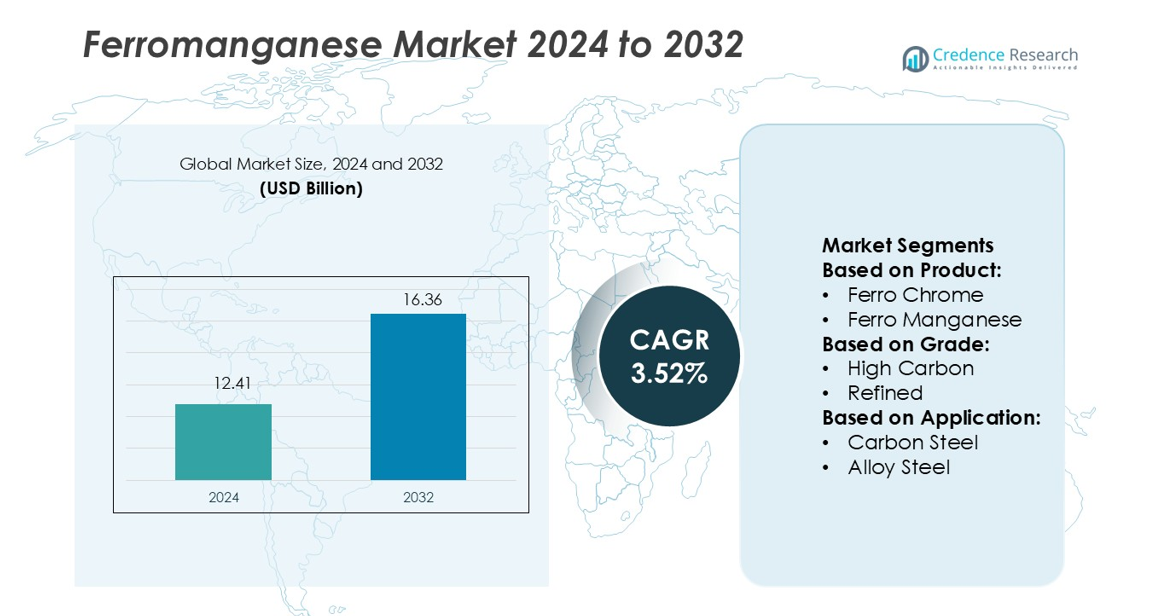

Ferromanganese Market size was valued USD 12.41 billion in 2024 and is anticipated to reach USD 16.36 billion by 2032, at a CAGR of 3.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ferromanganese Market Size 2024 |

USD 12.41 billion |

| Ferromanganese Market, CAGR |

3.52% |

| Ferromanganese Market Size 2032 |

USD 16.36 billion |

The ferromanganese market is shaped by prominent players including Eurasian Natural Resources Corporation, Tata Steel, Gulf Ferroalloys, S.C. Feral S.R.L, SAIL, Sakura Ferroalloys, Brahm Group, OM Holdings, Ferroalloy Corporation Limited, and Arcelor Mittal. These companies focus on capacity expansion, advanced smelting technologies, and sustainable production methods to strengthen their global presence. Strategic partnerships and product diversification help them meet growing steel industry demand. Asia Pacific leads the global market with a 45% share, supported by rapid industrialization, strong steel production, and abundant manganese resources. This regional dominance is reinforced by cost advantages, efficient logistics, and expanding export capabilities, positioning it as the key growth hub for the ferromanganese industry.

Market Insights

- The ferromanganese market size was valued at USD 12.41 billion in 2024 and is projected to reach USD 16.36 billion by 2032, growing at a CAGR of 3.52%.

- Rising steel production and infrastructure investments are driving steady demand across construction, automotive, and energy industries.

- Growing focus on low-carbon and refined grades reflects a clear trend toward sustainable and high-performance alloy production.

- The market is competitive, with key players expanding capacities, investing in advanced smelting technologies, and forming strategic partnerships to strengthen their position.

- Asia Pacific leads with a 45% share, supported by strong steel output and resource availability, while North America and Europe remain stable markets with increasing demand for high-quality ferromanganese grades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Ferro Manganese dominates the product segment with a market share of 42%. Its strong position is driven by rising demand in the steel industry due to its high deoxidizing and desulfurizing properties. Ferro Manganese improves steel strength and wear resistance, making it suitable for construction and automotive applications. Ferro Chrome, Ferro Silicon, and Ferro Silicon-Manganese follow, supported by their increasing use in specialty alloys and foundry processes. The growing infrastructure development and rapid industrialization across emerging economies further strengthen the demand for Ferro Manganese in large-scale steel production.

- For instance, Eurasian Natural Resources Corporation (ENRC) operates ferroalloy plants with an annual capacity exceeding 1.5 million metric tons, enabling large-scale production of high-carbon Ferro Manganese.

By Grade

High Carbon grade leads this segment with a 61% market share. The dominance of this grade is supported by its cost-effectiveness and wide application in producing carbon and alloy steel. High Carbon Ferro Manganese offers excellent deoxidizing properties, making it preferred for bulk steelmaking operations. Refined grades are gaining momentum due to their low impurity levels and suitability for specialized steel production. Expanding steel manufacturing capacities and increasing demand from the automotive and construction sectors continue to drive the growth of the High Carbon grade.

- For instance, Tata Steel’s ferro-alloy unit expanded its high-carbon Fe-Mn alloy plant capacity from 0.0504 million t/year to 0.060 million t/year, as noted in its half-yearly compliance report.

By Application

Carbon Steel is the dominant application segment, holding 54% of the market share. The segment benefits from the increasing use of Ferro Manganese as a key additive for enhancing strength, ductility, and wear resistance. High consumption in construction, shipbuilding, and automotive manufacturing contributes to its leadership. Alloy Steel and Stainless Steel segments also show steady growth, driven by technological advancements and demand for high-performance materials. The expansion of infrastructure projects and rising industrial output globally continue to boost Ferro Manganese use in carbon steel production.

Key Growth Drivers

Rising Steel Production Demand

The surge in global steel production is a major growth driver for the ferromanganese market. Ferromanganese improves steel strength, hardness, and wear resistance, making it vital in carbon and alloy steel manufacturing. Expanding infrastructure, automotive, and construction industries are pushing steel consumption, which directly boosts ferromanganese demand. Countries like China and India are increasing their steel output, driving higher consumption of alloying elements. The product’s role as a deoxidizer and desulfurizer further strengthens its position in steelmaking processes, ensuring stable demand across key industries.

- For instance, Gulf Ferro Alloys (Sabayek) achieved an annual output of around 130,000 tons. The company sold 30–40% of its production domestically within the GCC region, while exporting the remainder to international markets, including the US and Europe.

Infrastructure and Industrial Expansion

Rapid urbanization and infrastructure development are fueling demand for high-performance steel, supporting ferromanganese market growth. Construction projects, power plants, shipbuilding, and transport networks rely on durable steel components enhanced by ferromanganese. Governments are investing in infrastructure modernization, especially in Asia Pacific and Africa, increasing the use of structural steel. Industrial growth also accelerates alloy steel production for machinery and heavy equipment. The consistent infrastructure push ensures long-term demand stability, making ferromanganese a critical input in large-scale construction and industrial projects worldwide.

- For instance, SAIL signed a pact with ABB India to create digital twins for blast furnaces and steel-melt shops at the Rourkela Steel Plant. The plant produced 4.08 million tons of saleable steel in FY 2024-25, with a target of reaching about 9 million tons by 2030.

Technological Advancements in Production

Advances in smelting and refining technologies are enhancing ferromanganese output and quality. Modern furnaces improve energy efficiency and reduce carbon emissions, aligning with global sustainability goals. Automated systems and process optimization reduce operational costs while increasing manganese recovery rates. These improvements make production more cost-effective, supporting competitiveness in both developed and emerging markets. Upgraded technology also allows better control over carbon content and impurity levels, improving product quality. This technological edge encourages producers to expand capacity and meet rising global steel industry demand.

Key Trends & Opportunities

Shift Toward Low-Carbon Production

Sustainability trends are driving producers to adopt low-carbon manufacturing processes for ferromanganese. Electric arc furnaces and renewable power integration reduce emissions, supporting decarbonization goals. Major producers are investing in cleaner technologies to meet stricter environmental regulations. This shift not only improves environmental performance but also enhances product acceptance in international markets. Low-carbon production methods create competitive advantages and align with green steelmaking initiatives, opening opportunities for long-term growth.

- For instance, Sakura Ferroalloys officially opened its new US$31 million sinter plant after a construction period of 22 months. The plant was commissioned to ensure a consistent and optimized feed for the company’s smelting operations.

Growing Demand from Emerging Economies

Rising industrialization in emerging economies offers strong market expansion opportunities. Rapid construction growth and automotive manufacturing in Asia Pacific, Latin America, and Africa are increasing steel consumption. These regions are also boosting local alloy production to reduce import dependency. Expanding manufacturing capacities and foreign investments in steel plants further increase ferromanganese demand. This trend positions emerging markets as key revenue contributors for producers seeking diversified global footprints.

- For instance, BRAHM Group is establishing an integrated ferro-alloys plant at Barjora in West Bengal with 5 × 11 MVA submerged-arc furnaces, a two-line 500 TPD manganese sinter plant, and a captive power plant of 2 × 30 MW.

Expansion of Value-Added Products

Producers are developing refined ferromanganese grades to meet specialized steel requirements. Low-carbon and medium-carbon variants are gaining traction in high-end applications like automotive and energy equipment. These products improve performance and support cleaner steelmaking processes. Innovation in value-added alloys helps producers tap into niche markets with higher profit margins. The growing demand for customized steel grades accelerates this opportunity, strengthening product diversification strategies.

Key Challenges

Price Volatility of Raw Materials

Fluctuations in manganese ore prices pose a significant challenge to ferromanganese producers. Dependence on limited mining regions and unstable supply chains often drives unpredictable costs. Rising energy expenses further increase production costs, reducing profit margins. Market participants face pressure to maintain pricing stability despite volatile inputs. This uncertainty affects production planning, contract negotiations, and investment strategies.

Stringent Environmental Regulations

Tightening environmental regulations are increasing compliance costs for producers. Ferromanganese smelting emits greenhouse gases and particulate matter, attracting strict monitoring. Producers must invest in pollution control technologies and cleaner production methods, raising capital expenses. Non-compliance can result in penalties, production halts, or export restrictions. These regulatory pressures may limit smaller producers’ competitiveness, reshaping market dynamics toward large, well-capitalized firms.

Regional Analysis

North America

North America holds a market share of 18%, driven by steady steel demand from construction, automotive, and energy industries. The U.S. dominates the region, supported by advanced steel production facilities and increasing adoption of low-carbon alloys. Infrastructure modernization programs and defense manufacturing further boost ferromanganese consumption. Producers focus on efficiency improvements and environmental compliance to meet regulatory standards. The region also benefits from a reliable supply chain and technological innovations in smelting. Growing investments in electric arc furnaces and cleaner production methods position North America as a strong and stable market for ferromanganese.

Europe

Europe accounts for a market share of 20%, supported by mature steel manufacturing industries in Germany, France, and Italy. The region’s emphasis on decarbonization and sustainable steelmaking drives demand for refined and low-carbon ferromanganese grades. Strict environmental regulations encourage producers to adopt cleaner technologies. Infrastructure renovation, automotive production, and renewable energy projects contribute to stable consumption levels. Import dependence from Africa and Asia ensures diversified supply channels. Ongoing investments in green steel initiatives and high-quality alloy production continue to sustain Europe’s strong position in the global ferromanganese market.

Asia Pacific

Asia Pacific leads the ferromanganese market with a market share of 45%, anchored by China, India, Japan, and South Korea. Rapid urbanization, infrastructure expansion, and steel-intensive industries drive strong regional demand. China remains the largest producer and consumer, supported by integrated steel plants and extensive construction activities. India’s growing steel sector adds further momentum. The region benefits from abundant manganese reserves and competitive production costs. Ongoing capacity expansions and technological upgrades enhance operational efficiency. Asia Pacific’s dominance is reinforced by increasing exports and government-backed industrial development programs, making it the core growth hub for the market.

Latin America

Latin America holds a market share of 7%, supported by growing construction, automotive, and mining industries. Brazil is the leading contributor, leveraging strong manganese ore reserves and expanding steel production capacity. The region is witnessing rising infrastructure investments and industrial development, boosting demand for ferromanganese. Local producers focus on improving production efficiency and expanding export capabilities. Trade agreements and increasing foreign investments strengthen the supply chain. Though smaller in scale compared to Asia Pacific, Latin America shows significant growth potential, especially as downstream industries modernize and create new opportunities for alloy producers.

Middle East & Africa

The Middle East & Africa region captures a market share of 10%, driven by abundant manganese reserves in countries like South Africa and Gabon. The region serves as both a key supplier and a growing consumer due to expanding steel and construction activities. Infrastructure projects, energy sector developments, and industrialization plans boost ferromanganese demand. Producers benefit from resource availability and increasing export opportunities to Europe and Asia. Strategic partnerships and investments in new processing facilities support market expansion. This region’s strong raw material base positions it as a critical pillar in the global ferromanganese supply network.

Market Segmentations:

By Product:

- Ferro Chrome

- Ferro Manganese

By Grade:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ferromanganese market is shaped by leading players such as Eurasian Natural Resources Corporation, Tata Steel, Gulf Ferroalloys, S.C. Feral S.R.L, SAIL, Sakura Ferroalloys, Brahm Group, OM Holdings, Ferroalloy Corporation Limited, and Arcelor Mittal. The ferromanganese market is defined by strong capacity expansions, technological advancements, and strategic collaborations. Producers are focusing on improving smelting efficiency, reducing operational costs, and adopting low-carbon production technologies to meet rising global steel demand. Investments in advanced furnaces, energy recovery systems, and process automation enhance output quality and reduce emissions. Many companies are also entering long-term supply agreements to secure stable raw material sourcing. Product diversification and innovation in alloy grades are key strategies to cater to specialized steel applications. These competitive initiatives strengthen global presence and create sustainable growth opportunities in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Eramet revised its 2024 production targets downward for its manganese activities in Gabon and nickel activities in Indonesia. This was a direct response to challenging market conditions, including a downturn in demand from China for manganese and a lower-than-expected nickel ore sales permit issued by Indonesian authorities.

- In October 2024, OM Holdings announced a collaboration with South32 to initiate a ferroalloy slag repurposing project. This initiative aimed to enhance sustainability in the ferro manganese industry by recycling waste materials from ferroalloy production.

- In September 2023, Indian Metals and Ferro Alloys Ltd. announced the ramping up of the existing ore mining capacity and setting up a new greenfield smelting capacity in Kalinganagar, Odisha. This step has been taken to cater to the rising domestic demand for stainless steel

Report Coverage

The research report offers an in-depth analysis based on Product, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ferromanganese will grow with rising global steel production.

- Low-carbon and refined grades will gain wider adoption in steelmaking.

- Technological advancements in smelting will improve production efficiency.

- Cleaner manufacturing processes will support environmental compliance.

- Emerging economies will play a key role in market expansion.

- Strategic collaborations will strengthen global supply networks.

- Product diversification will drive higher-value applications.

- Increased infrastructure investments will boost long-term consumption.

- Automation and energy-efficient systems will reduce operational costs.

- Sustainability initiatives will shape future production and trade strategies.