Market Overview:

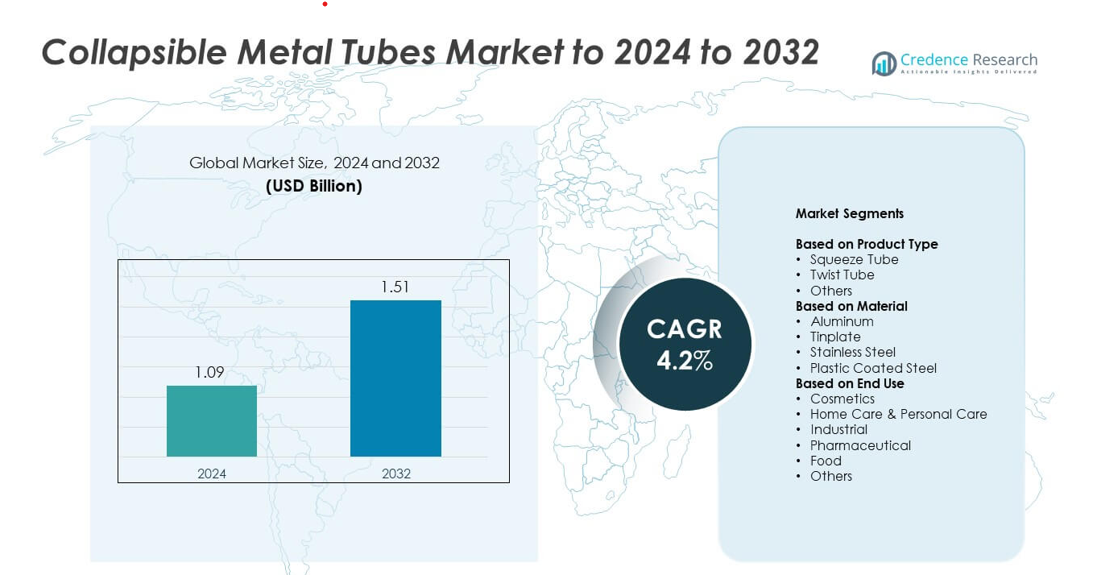

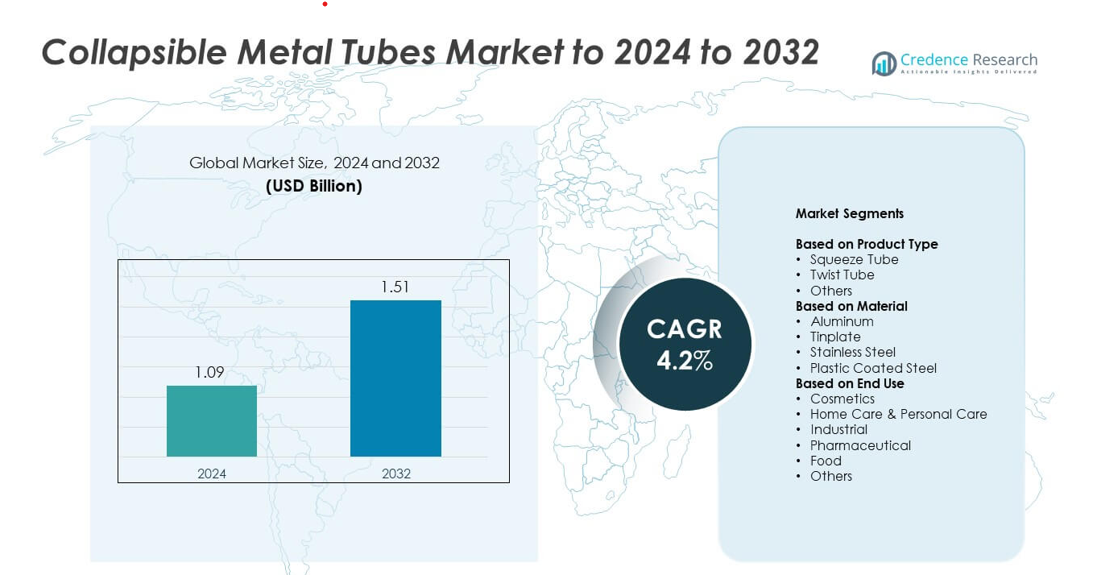

The Collapsible Metal Tubes Market size was valued at USD 1.09 billion in 2024 and is anticipated to reach USD 1.51 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Collapsible Metal Tubes Market Size 2024 |

USD 1.09 billion |

| Collapsible Metal Tubes Market, CAGR |

4.2% |

| Collapsible Metal Tubes Market Size 2032 |

USD 1.51 billion |

MettlerToledo International, Somerset Aluminum Tube, Kappa Packaging, Albéa, Essentra Packaging, Allied Tube and Conduit Corporation, TUBEX GmbH, A W Chesterton Company, Mason Packaging and SHK Group form the core competitive set in the collapsible metal tubes market. These companies deploy advanced manufacturing capabilities, global distribution networks and strategic partnerships to serve major end‑use sectors such as cosmetics, pharmaceuticals and food packaging. Regionally, North America leads with over 40 % of the market share in 2024, followed by Europe at around 30 %, while Asia Pacific holds roughly 20 %. Market players must therefore align product innovation and sustainability efforts with strong regional execution to maintain competitive advantage.

Market Insights

- The market was valued at USD 1.09 billion in 2024 and USD1.51 billion in 2032 and it is forecast to grow at a CAGR of 4.2 %.

- Growth is driven by rising demand in the cosmetics, food, and pharmaceutical sectors, along with increasing need for recyclable, sustainable packaging solutions.

- Trends show dominance of the squeeze tube product type with about 42 % share, and aluminum material seizing roughly 50 % share, as well as expansion into emerging‑market food and home‑care applications.

- Competitive activity remains strong with global manufacturers leveraging advanced barrier technologies, regional players offering customized solutions, and consolidation shaping market dynamics.

- Restraints include volatile raw‑material costs and competitive pressure from alternative packaging like plastic tubes and pouches, especially in mature regions.

- Regionally, North America leads with around 40 % market share, Europe holds about 30 %, Asia‑Pacific approximately 20 %, Latin America and Middle East & Africa make up the remaining share combined.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The squeeze tube segment holds about 42 % of the market and remains the leading product type. Its dominance comes from strong use in cosmetics, pharmaceuticals, and personal-care products that need precise and clean dispensing. Rising demand for portable skincare and hygiene items supports this segment, while twist tubes and other formats grow at a slower pace due to limited application flexibility.

- For instance, Ball Corporation reported that global aluminum packaging shipments increased by 4.1% year‑on‑year in Q2 2025.

By Material

Aluminum accounts for roughly 50 % of the material share and leads the Collapsible Metal Tubes Market. Its light weight, strong barrier protection, and high recyclability make it the preferred choice for cosmetics, pharmaceuticals, and food applications. Growing interest in sustainable and durable packaging further strengthens aluminum’s position over tinplate, stainless steel, and plastic-coated steel.

- For instance, Shiseido Co., Ltd. reported net sales of 973,038 million yen for the full year 2023, representing an 8.8% decrease compared to the previous year.

By End Use

The cosmetics segment represents about 35 % of total market share and stands as the largest end-use category. Expanding demand for skincare creams, lotions, and premium personal-care products drives strong adoption of collapsible metal tubes. Their ability to protect sensitive formulations and offer controlled dispensing supports higher usage, while other end-use sectors grow steadily but remain smaller in comparison.

Key Growth Drivers

Rising Demand for Sustainable Packaging

The growing demand for sustainable packaging is a significant growth driver in the Collapsible Metal Tubes Market. As environmental concerns continue to rise, there is an increasing preference for recyclable and eco-friendly packaging materials. Metal tubes, particularly aluminum, are a sustainable alternative to plastic, offering superior recyclability. This shift towards green packaging is being driven by both consumer demand and regulatory pressures on businesses to adopt more sustainable practices, especially in industries like cosmetics, pharmaceuticals, and food, where eco-friendly solutions are in high demand.

- For instance, Ball Corporation aims to grow comparable diluted earnings per share by a range of 12‑15% in 2025, supported by sustainable aluminum‑packaging demand.

Expansion of the Cosmetics Industry

The expanding global cosmetics industry is a key growth driver for the Collapsible Metal Tubes Market. As the demand for skincare, haircare, and beauty products increases, collapsible metal tubes provide an ideal packaging solution due to their portability, ease of use, and ability to protect delicate formulations. The rise of premium beauty products and the growing emphasis on brand differentiation are further boosting the use of metal tubes in packaging. Their ability to offer both functionality and aesthetic appeal makes them highly favored in the cosmetics sector.

- For instance, Shiseido’s external sales, excluding the impacts of foreign exchange and business transfers, grew by +19% in the EMEA region for the full fiscal year 2023.

Increasing Consumer Preference for Convenience

The rising demand for convenience in packaging is another key growth driver. Consumers increasingly favor packaging that is easy to use, portable, and hygienic, and collapsible metal tubes fulfill these needs effectively. These tubes are particularly popular in sectors like cosmetics, pharmaceuticals, and food, where controlled dispensing and convenience are essential. As lifestyles become busier, the demand for practical packaging that supports on-the-go consumption continues to grow, further fueling the market for collapsible metal tubes.

Key Trend

Innovations in Packaging Design

Innovations in packaging design are becoming a prominent trend in the Collapsible Metal Tubes Market. Companies are focusing on enhancing the functionality and aesthetic appeal of their packaging, introducing features such as airless pumps, flip-top caps, and unique shapes. These design innovations help improve user experience, increase convenience, and elevate the product’s visual appeal, particularly in the cosmetics and pharmaceutical industries. As packaging design continues to evolve, it is expected to drive increased demand for metal tubes that offer both form and function.

- For instance, Albéa Group is a leading global manufacturer of cosmetic and personal care packaging with 37 industrial sites and officesworldwide, including production facilities in North America.

Increasing Use in the Food Industry

The use of collapsible metal tubes in the food industry is an emerging trend, particularly for packaging items like sauces, pastes, and condiments. The demand for metal tubes is driven by their ability to preserve the integrity of food products by offering an effective barrier to air, moisture, and light. Additionally, as more food manufacturers look to adopt sustainable and recyclable packaging options, collapsible metal tubes are becoming an attractive choice due to their eco-friendly benefits and ability to extend shelf life.

- For instance, Ball Corporation’s shipments growth shows applicability beyond beverages into packaging sectors like food and personal‑care, supported by its 3.9% shipment increase in Q3 2025.

Growing Demand in Emerging Markets

Emerging markets present significant growth opportunities for the Collapsible Metal Tubes Market. As disposable incomes rise and urbanization increases in regions like Asia-Pacific and Latin America, the demand for premium products in cosmetics, pharmaceuticals, and food is expanding. Consumers in these regions are becoming more aware of the benefits of eco-friendly and aesthetically appealing packaging, which is driving the demand for collapsible metal tubes. As these markets continue to grow, companies have the opportunity to tap into a rapidly expanding consumer base.

Key Challenge

High Production Costs

A key challenge in the Collapsible Metal Tubes Market is the high production costs associated with manufacturing metal tubes. The raw materials used in production, such as aluminum and tinplate, can be expensive, and the specialized production processes involved further add to the cost. This can make collapsible metal tubes less competitive in price-sensitive industries or regions where cost is a primary concern. To overcome this challenge, manufacturers need to find ways to reduce production costs without compromising quality or sustainability.

Limited Consumer Awareness of Recycling Benefits

Despite being recyclable, a major challenge for collapsible metal tubes is the limited consumer awareness regarding their recyclability. Many consumers still perceive metal packaging as non-recyclable or improperly dispose of it, undermining the sustainability benefits. Educating consumers on the recycling process and the environmental advantages of using metal tubes is crucial. Without greater awareness, the full potential of metal tubes as an eco-friendly packaging solution may not be fully realized, hindering the growth of the market.

Regional Analysis

North America

The North America region held approximately 40 % of the global collapsible metal tubes market share in 2024. Strong demand from established cosmetics, pharmaceutical, and food‑packaging industries drives this dominance, supported by stringent packaging regulations and higher consumer awareness around sustainability. The United States and Canada continue to lead consumption, backed by an efficient supply chain and advanced manufacturing capabilities. As brands increasingly adopt recyclable packaging formats, the region is well positioned to maintain its leading status in the market.

Europe

In 2024, Europe accounted for around 30 % of the global collapsible metal tubes market. The region’s share is underpinned by high consumer penetration of premium beauty and personal‑care products, growing adoption of eco‑friendly packaging, and comprehensive regulatory frameworks aimed at reducing plastic waste. Key markets such as Germany, France and the UK drive regional growth through innovation in material and design. Europe remains a strong environment for packaged‑metal tube formats due to its mix of sustainability focus and mature industry infrastructure.

Asia Pacific

The Asia Pacific region captured about 20 % of the global collapsible metal tubes market in 2024. Rapid urbanisation, rising disposable income and a growing middle class in countries like China and India are boosting demand for personal‑care and packaged food products. Additionally, local manufacturing cost advantages and increasing brand launches in the region support market growth. As sustainability awareness improves and premium product consumption expands, Asia Pacific offers significant upside potential for the metal‑tube packaging segment.

Latin America

Latin America held an estimated 7 % share of the global collapsible metal tubes market in 2024. Growth in the region is driven by rising urban population, increasing adoption of mid‑to‑premium personal‐care brands, and expanding food‑and‑beverage packaging activities. However, price sensitivity and relatively limited manufacturing infrastructure present headwinds. With improved supply‑chain logistics and shifting consumer preferences toward better packaging formats, Latin America presents a valid growth frontier for market participants.

Middle East & Africa

The Middle East & Africa region contributed roughly 3 % of the global collapsible metal tubes market in 2024. The market here benefits from increasing industrialisation, growing demand for packaged personal‑care and intimate‑care products, and a gradual shift toward sustainable packaging. However, investment and infrastructure constraints alongside volatile raw‑material costs restrict faster growth. With rising regulatory focus on recyclability and eco‑packaging, this region holds potential to expand its market presence in the coming years.

Market Segmentations:

By Product Type

- Squeeze Tube

- Twist Tube

- Others

By Material

- Aluminum

- Tinplate

- Stainless Steel

- Plastic Coated Steel

By End Use

- Cosmetics

- Home Care & Personal Care

- Industrial

- Pharmaceutical

- Food

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

MettlerToledo International, Somerset Aluminum Tube, Kappa Packaging, Albéa, Essentra Packaging, Allied Tube and Conduit Corporation, TUBEX GmbH, A W Chesterton Company, Mason Packaging, SHK Group operate in a competitive landscape defined by global scale, technology leadership, and strategic supply‑chain execution. The leading firms utilise broad manufacturing footprints across multiple regions, advanced R&D capabilities to improve barrier and material performance, and extensive brand partnerships in cosmetics, pharmaceuticals, and food sectors to maintain strong positions. Other participants differentiate through niche product customization, regional responsiveness, and agile production models. These dynamics intensify competition around cost efficiency, sustainability credentials, and throughput capabilities, while also raising barriers for smaller entrants seeking to scale globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Albéa expanded the production of its existing high-barrier, recyclable laminate tube films (like the Greenleaf technology) to its North American facility in Brampton, a move that protects products while streamlining the supply chain and supporting local recycling capabilities.

- In 2023, TUBEX GmbH launched the MonoRefill, a mono-material aluminum tube made from 100% recycled aluminum (95% post-consumer recycled) designed for product refills with a snap-off integrated closure

- In 2023, Adelphi invested in new manufacturing equipment, including a robotic filling system, to increase production for its pharmaceutical and cosmetic client

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable and lightweight materials will drive greater adoption of collapsible metal tubes.

- Growing premiumisation in cosmetics and personal care will increase usage of metallic packaging formats.

- Manufacturers will invest in advanced barrier coatings to extend product shelf‑life and protect sensitive formulations.

- Emerging markets will offer high growth potential as disposable incomes rise and packaging standards evolve.

- Supply chain localisation and cost‑efficient production will become key for market competitiveness.

- Brands will emphasise sustainable packaging claims, boosting appeal of metal tubes over plastics.

- Digital printing and decoration technologies will enhance design flexibility and brand differentiation.

- Integration of smart packaging features, such as QR codes and anti‑tamper seals, will gain traction.

- Raw material cost fluctuations will continue to challenge margin stability for producers.

- Collaboration between packaging manufacturers, brands and recyclers will strengthen circular economy initiatives.