Market Overview

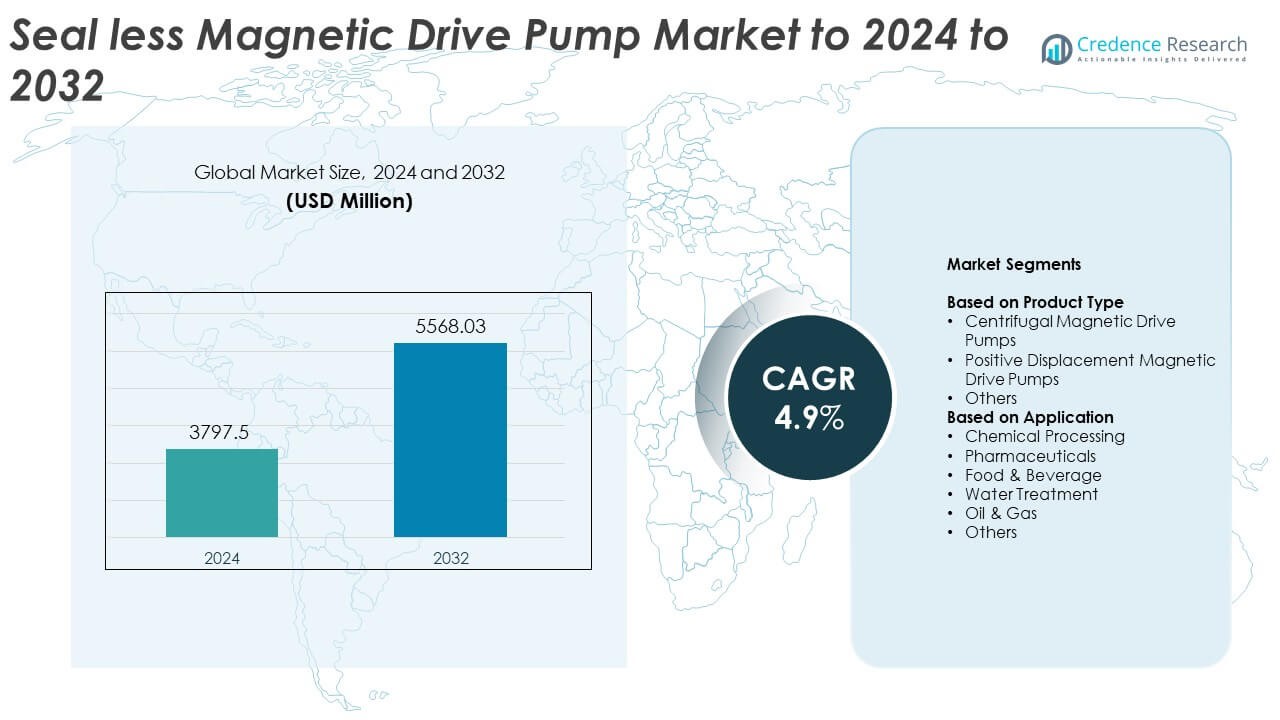

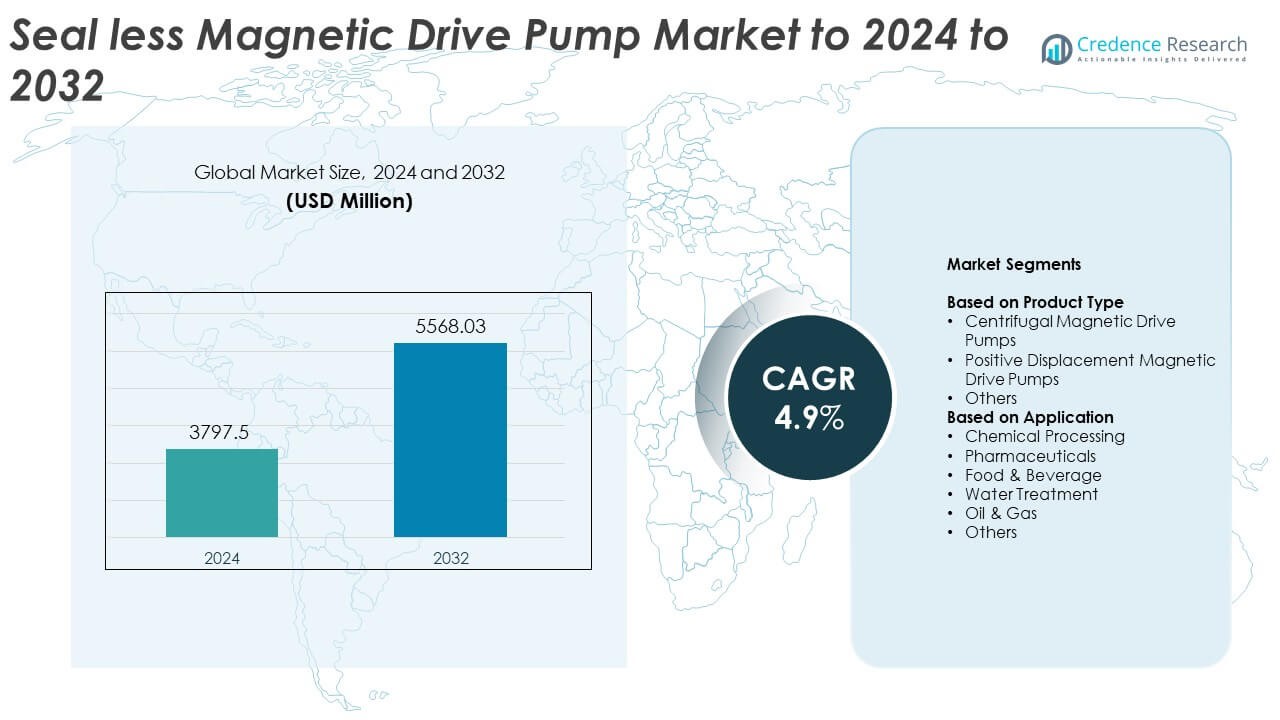

Seal Less Magnetic Drive Pump Market size was valued at USD 3797.5 Million in 2024 and is anticipated to reach USD 5568.03 Million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Seal Less Magnetic Drive Pump Market Size 2024 |

USD 3797.5 Million |

| Seal Less Magnetic Drive Pump Market, CAGR |

4.9% |

| Seal Less Magnetic Drive Pump Market Size 2032 |

USD 5568.03 Million |

The Seal Less Magnetic Drive Pump Market includes major players such as Magnatex Pumps, Inc., Finish Thompson Inc., Iwaki Co., Ltd., CP Pumpen AG, Klaus Union GmbH & Co. KG, ITT Goulds Pumps, Flowserve Corporation, Verder Liquids, Sundyne LLC, and Dickow Pumpen GmbH & Co. KG. These companies compete through advanced corrosion-resistant designs, energy-efficient models, and wider service networks. Asia Pacific leads the market with about 34% share in 2024 due to strong chemical and water treatment expansion. North America follows with nearly 32%, driven by strict safety standards and industrial upgrades, while Europe holds around 28% supported by sustainability mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Seal Less Magnetic Drive Pump Market was valued at USD 3797.5 Million in 2024 and is projected to reach USD 5568.03 Million by 2032, growing at a CAGR of 4.9%.

• Market growth is driven by rising demand for leak-free pumping systems, strict environmental rules, and strong use in chemical processing, which holds the largest application share at about 42% in 2024.

• Key trends include higher adoption of corrosion-resistant materials, energy-efficient pump designs, and wider use in modular process systems across pharmaceuticals and water treatment.

• Competition intensifies as leading manufacturers expand distribution networks, invest in improved magnetic coupling technology, and enhance product durability to secure larger industrial contracts.

• Asia Pacific leads with nearly 34% share in 2024 due to strong industrial expansion, followed by North America at 32% and Europe at 28%, reflecting high compliance needs and strong uptake of seal-less pump systems.

Market Segmentation Analysis:

By Product Type

Centrifugal Magnetic Drive Pumps dominate this segment with about 64% share in 2024. These pumps lead due to strong suitability for corrosive fluids, lower maintenance needs, and wide use in chemical and water treatment plants. Manufacturers prefer centrifugal designs because they support continuous flow, energy-efficient operation, and reduced leakage risk. Positive displacement magnetic drive pumps grow steadily as industries handle high-viscosity liquids, while the others category expands in niche uses where compact pump designs meet specialized flow requirements.

- For instance, Sundyne confirms in its 2024 ANSIMAG technical datasheet that the ETFE-lined magnetic drive pump casing is engineered to handle process fluids at temperatures up to 121°C, as validated under ANSI/HI 9.6.1 operating limits.

By Application

Chemical Processing holds the largest share in this segment with nearly 42% in 2024. Demand rises as chemical plants prioritize leak-free pumping systems to prevent hazardous emissions and meet stricter environmental standards. Seal-less magnetic drive pumps gain traction because they offer zero mechanical seal failure and strong resistance to acids, solvents, and aggressive compounds. Pharmaceuticals and food and beverage applications grow as facilities adopt hygienic and contamination-free pumping solutions, while oil and gas uses increase with the need to handle volatile and flammable fluids safely.

- For instance, Iwaki’s MX and MX-F series magnetic drive pumps are designed for safe handling of corrosive chemicals and offer various material options, including ETFE-lined casings in the MX-F series. The standard specific gravity limit for the MX-F series is up to approximately 2.0. Depending on the specific model, motor power, and impeller trimming, these pumps can handle liquids with a specific gravity of up to 2.3.

Key Growth Drivers

Rising Focus on Leak-Free and Safe Fluid Handling

Growing safety rules push industries to adopt sealed pumping systems that prevent leakage of hazardous liquids. Seal less magnetic drive pumps support zero-emission handling, which helps chemical, pharmaceutical, and oil facilities reduce environmental risks. Industries choose these pumps to avoid seal failures and meet compliance needs. This factor stands out as the key growth driver in the market.

- For instance, Flowserve produces a range of sealless magnetic drive pumps, such as the HPX-Mag, that are designed to comply with the stringent API 685 standard for centrifugal pumps in the petroleum, petrochemical, and natural gas industries.

Expanding Use in Corrosive and Aggressive Chemical Processes

Chemical producers increasingly rely on magnetic drive pumps because these pumps handle corrosive acids, solvents, and high-purity fluids without mechanical wear. Their durability reduces downtime and lowers long-term costs for plants that run continuous operations. This demand strengthens growth as more companies shift from traditional sealed pumps to corrosion-resistant magnetic drive systems.

- For instance, CP Pump Systems manufactures the MKPL-S, a PFA-lined, self-priming magnetic drive pump designed for highly corrosive, chlorinated, and fluorinated media. This material is widely recognized in chemical compatibility charts for safely handling high concentrations of sulfuric acid (H₂SO₄), including concentrations up to 98%

Rising Investment in Energy-Efficient Industrial Equipment

Industries aim to cut energy use by replacing older pumps with efficient magnetic drive designs. These pumps reduce friction losses and deliver smooth operation, helping plants meet efficiency goals. Higher electricity costs and sustainability mandates push companies to adopt solutions that lower operating expenses while improving performance. This trend drives steady adoption across water treatment and chemical processing.

Key Trends and Opportunities

Adoption of Advanced Materials and Composite Pump Designs

Producers use advanced composites, engineered plastics, and corrosion-resistant metals to boost pump reliability. These materials extend service life in harsh environments and help companies reduce maintenance shutdowns. As industries face more complex fluid-handling needs, material innovation creates strong opportunities for product upgrades and premium pump models.

- For instance, manufacturers like Coron Enterprise design PFA/FEP-lined magnetic drive pumps for demanding chemical applications with structural integrity enhanced by carbon fiber-filled containment shells. These pumps are designed to be robust and resist corrosion and permeation. The ISO 22088 standard generally relates to determining the resistance of thermoplastics to environmental stress cracking (ESC).

Growing Demand from Green Chemistry and Clean Manufacturing

Sustainable production practices increase demand for pumps that prevent leakage, cut waste, and improve safety. Magnetic drive pumps support clean operations by eliminating seal contamination and lowering emissions. Companies adopting eco-friendly processes create new opportunities for pump makers to supply high-efficiency and compliance-focused designs. This remains the key market trend and opportunity.

- For instance, Milton Roy manufactures a range of diaphragm metering pumps designed for precise and safe handling of chemicals in various industries. These pumps feature robust, sealless designs (e.g., using PTFE diaphragms and leak-proof housings) to inherently provide leak-free operation, thereby eliminating fugitive emissions. The design principle aims for zero measurable emissions under standard operating conditions.

Rising Adoption in Modular and Skid-Based Process Systems

Compact industrial systems require pumps that fit into small footprints while offering strong reliability. Magnetic drive pumps meet this need with lightweight materials and flexible installation options. As modular process lines expand in pharmaceuticals and specialty chemicals, pump manufacturers gain opportunities to supply custom, integration-ready units.

Key Challenges

High Initial Cost of Magnetic Drive Systems

These pumps cost more than conventional sealed pumps due to advanced materials and specialized components. Smaller plants struggle to justify the higher upfront investment even though long-term savings are strong. Price sensitivity slows adoption in cost-sensitive industries, making this the key challenge in the market.

Limitations in Handling Solids and High-Viscosity Fluids

Magnetic drive technology performs best with clean and low-viscosity liquids. Industries dealing with slurries or thick fluids face performance issues such as reduced flow and higher heat buildup. These limits restrict use in certain applications and force companies to consider alternatives where solid handling is critical.

Regional Analysis

North America

North America holds about 32% share in the Seal Less Magnetic Drive Pump Market in 2024. Growth rises as chemical processing, pharmaceuticals, and water treatment plants adopt leak-free pumping systems to meet stricter EPA safety rules. Industries favor magnetic drive designs because they cut maintenance costs and improve containment of hazardous liquids. Expanding shale processing and increased investment in energy-efficient industrial equipment support steady demand. Strong presence of pump manufacturers and upgrades across chemical hubs in the U.S. and Canada strengthen the region’s position as a key revenue contributor.

Europe

Europe accounts for nearly 28% share of the Seal Less Magnetic Drive Pump Market in 2024. Growth is supported by strict environmental rules under REACH and rising replacement of sealed pumps in chemical, food, and specialty manufacturing facilities. Companies prefer magnetic drive systems to reduce emissions, meet efficiency goals, and support sustainable production lines. Industrial modernization in Germany, France, and the U.K. drives higher adoption, while expansion of pharmaceutical and biotechnology plants boosts long-term demand. Manufacturers gain opportunities through advanced materials and energy-optimized pump designs tailored for continuous plant operations.

Asia Pacific

Asia Pacific leads with about 34% share in the Seal Less Magnetic Drive Pump Market in 2024. Strong expansion in chemicals, pharmaceuticals, electronics, and water treatment facilities fuels rapid adoption. China, India, Japan, and South Korea invest in leak-free and corrosion-resistant pumping systems to support high-volume chemical output and rising environmental compliance. Industrial automation and construction of new process plants strengthen demand across diverse end-use sectors. The region benefits from low-cost manufacturing, rising exports, and government-backed initiatives promoting clean and efficient industrial technologies.

Latin America

Latin America represents around 4% share of the Seal Less Magnetic Drive Pump Market in 2024. Growth remains steady as Brazil and Mexico expand chemical, mining, and food manufacturing operations that require safe fluid handling systems. Companies adopt magnetic drive pumps to manage corrosive liquids, reduce downtime, and comply with tightening safety rules. Water treatment upgrades and investments in petrochemical plants improve adoption levels. However, uneven industrial growth, import dependence, and budget constraints limit large-scale replacement of conventional sealed pumps across the region.

Middle East and Africa

Middle East and Africa hold nearly 2% share of the Seal Less Magnetic Drive Pump Market in 2024. Demand grows primarily from oil and gas processing, desalination, and chemical manufacturing facilities that require leakage-free pumping solutions. Countries such as Saudi Arabia, UAE, and South Africa invest in industrial expansion and environmental safety improvements, supporting gradual adoption. The market benefits from rising focus on corrosion-resistant and explosion-safe systems. However, slower industrial diversification and reliance on imported pump technologies restrict broader penetration in several developing markets.

Market Segmentations:

By Product Type

- Centrifugal Magnetic Drive Pumps

- Positive Displacement Magnetic Drive Pumps

- Others

By Application

- Chemical Processing

- Pharmaceuticals

- Food & Beverage

- Water Treatment

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes Magnatex Pumps, Inc., Finish Thompson Inc., Iwaki Co., Ltd., CP Pumpen AG, Klaus Union GmbH & Co. KG, ITT Goulds Pumps, Flowserve Corporation, Verder Liquids, Sundyne LLC, and Dickow Pumpen GmbH & Co. KG. The market features strong rivalry as companies expand product lines and focus on leak-free designs. Many producers invest in new materials that improve pump strength and reduce wear. Firms also enhance energy performance to meet growing efficiency goals in major industries. Several manufacturers strengthen service support to reduce downtime for plants. Many suppliers work on compact designs that suit tight plant layouts. Producers adopt digital tools that help users monitor pump health and prevent failures. Global players widen distribution networks to reach fast-growing regions. Many companies focus on chemical and water treatment sectors due to high demand. The competitive field remains active as firms upgrade technology to hold or gain share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Flowserve launched the INNOMAG TB-MAG Dual Drive Pump, which is the world’s first sealless magnetic drive pump with a double hermetic seal and a secondary independent containment system.

- In 2025, CP Pumpen AG continues to supply its sealless magnetic drive pumps that fulfill stringent demands in chemical, pharmaceutical, and biotech industries.

- In 2024, Iwaki highlighted its ongoing innovation in magnetic drive pumps, emphasizing the development and promotion of products designed for enhanced safety, durability, and operational efficiency.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as industries increase adoption of leak-free pumping systems.

- Chemical processing plants will drive strong demand for corrosion-resistant magnetic drive pumps.

- Energy-efficient pump models will gain traction due to rising operational cost pressure.

- Pharmaceutical and biotech facilities will boost adoption through hygiene and contamination-free needs.

- Water treatment projects will support steady demand across municipal and industrial sectors.

- Advanced materials and composites will enhance pump durability and performance.

- Automation in process industries will increase integration of smart magnetic drive pumps.

- Modular and skid-based systems will create new opportunities for compact pump designs.

- Asia Pacific will strengthen its leadership due to rapid industrial growth and compliance upgrades.

- Higher investment in sustainability will push industries to shift from sealed pumps to seal-less models.